Asia Pacific Medical Imaging Market

Taille du marché en milliards USD

TCAC :

%

USD

23.60 Billion

USD

36.22 Billion

2024

2032

USD

23.60 Billion

USD

36.22 Billion

2024

2032

| 2025 –2032 | |

| USD 23.60 Billion | |

| USD 36.22 Billion | |

|

|

|

Segmentation du marché de l'imagerie médicale en Asie-Pacifique, par type (services et produits), modalité (stationnaire et portable), procédure (tomodensitométrie (CT), imagerie par rayons X, imagerie par résonance magnétique (IRM), échographie, imagerie nucléaire (SPECT/PET) et autres), technologie (radiologie numérique directe et radiologie informatisée), âge du patient (adultes et enfants), application (cardiologie, pelvienne et abdominale, oncologie, mammographie, gynécologie, neurologie, urologie, musculo-squelettique, dentaire et autres), utilisateurs finaux (hôpitaux, centres de diagnostic, centres d'imagerie, cliniques spécialisées, centres de chirurgie ambulatoire, instituts universitaires et de recherche et autres) - Tendances et prévisions de l'industrie jusqu'en 2032

Analyse du marché de l'imagerie médicale

L'imagerie médicale désigne les techniques et les processus utilisés pour réaliser des images du corps humain (ou de parties de celui-ci) pour diverses applications cliniques, notamment les opérations médicales et le diagnostic, ainsi que la science médicale, qui comprend l'étude de l'anatomie et des fonctions normales. Il s'agit d'un sous-ensemble de l'imagerie biologique qui comprend la radiographie, l'endoscopie, la thermographie, la photographie médicale et la microscopie au sens large. Les techniques de mesure et d'enregistrement telles que l'électroencéphalographie (EEG) et la magnétoencéphalographie (MEG) sont des exemples d'imagerie médicale car elles créent des données qui peuvent être représentées sous forme de cartes plutôt que d'images.

Taille du marché de l'imagerie médicale

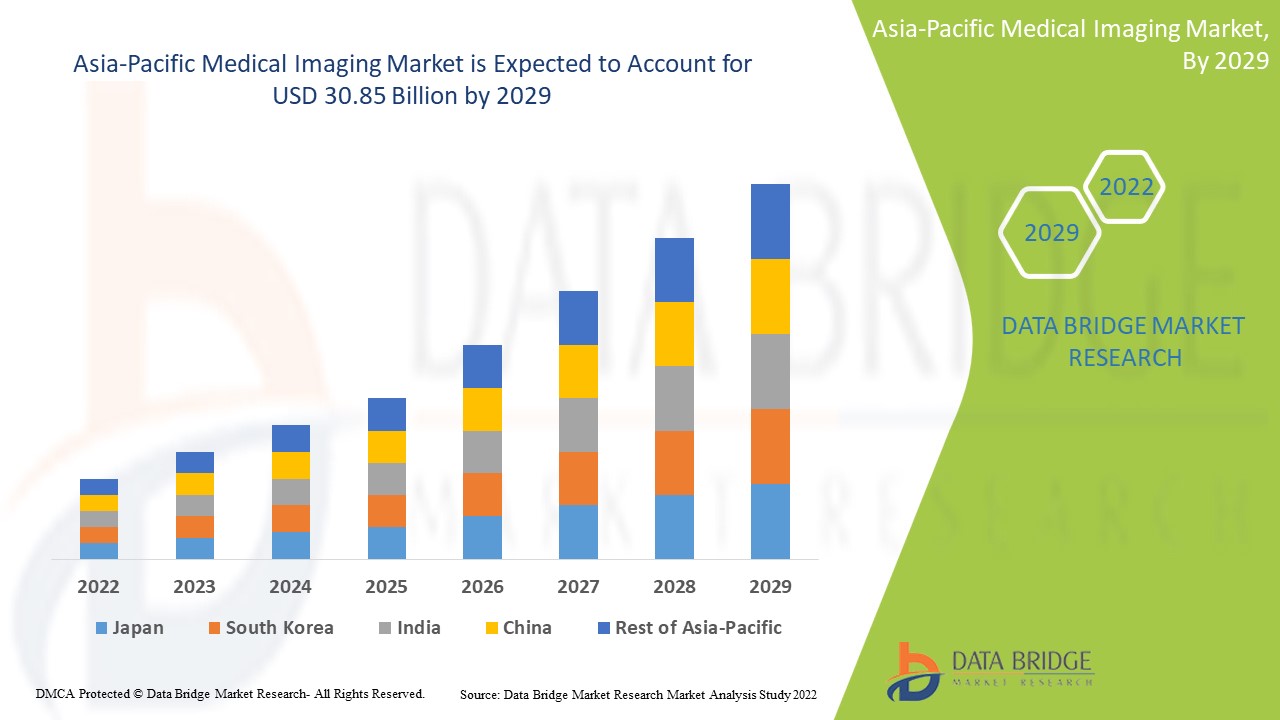

La taille du marché de l'imagerie médicale en Asie-Pacifique était évaluée à 23,60 milliards USD en 2024 et devrait atteindre 36,22 milliards USD d'ici 2032, avec un TCAC de 5,50 % au cours de la période de prévision de 2025 à 2032.

Portée du rapport et segmentation du marché

|

Attributs |

Informations clés sur le marché de l'imagerie médicale |

|

Segmentation |

|

|

Pays couverts |

Chine, Japon, Inde, Corée du Sud, Singapour, Malaisie, Australie, Thaïlande, Indonésie, Philippines, Reste de l'Asie-Pacifique (APAC) dans la région Asie-Pacifique (APAC) |

|

Principaux acteurs du marché |

Koninklijke Philips NV (Pays-Bas), RamSoft, Inc. (Canada), InHealth Group (Royaume-Uni), Radiology Reports online (États-Unis), Siemens (Allemagne), Sonic Healthcare Limited (Australie), RadNet, Inc. (États-Unis), General Electric (États-Unis), Akumin Inc. (États-Unis), Hologic Inc. (États-Unis), Shimadzu Corporation (Japon), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (Chine), CANON MEDICAL SYSTEMS CORPORATION (Japon), Carl Zeiss Ag (Allemagne), FUJIFILM Corporation (Japon), Hitachi, Ltd. (Japon), MEDNAX Services, Inc. (États-Unis), Carestream Health (États-Unis), Teleradiology Solutions (États-Unis), UNILABS (Suisse), ONRAD, Inc. (États-Unis) |

|

Opportunités de marché |

|

Définition du marché de l'imagerie médicale

L'imagerie médicale est une technique permettant de générer diverses images de l'intérieur du corps à des fins de diagnostic et de traitement des maladies. Cette technique est particulièrement importante pour améliorer la santé des personnes dans le monde entier, car elle peut aider à la détection précoce de certaines maladies internes et au traitement approprié de ces troubles. Il est également possible d'examiner ce qui a déjà été diagnostiqué et traité.

Dynamique du marché de l'imagerie médicale

Conducteurs

- Demande croissante de modalités d'imagerie innovantes

L'industrie est portée par l'intégration des combinaisons chirurgicales à la technologie d'imagerie. Cependant, le nombre de nouveaux hôpitaux dans les pays en développement de la région Asie-Pacifique a augmenté de façon spectaculaire. L'arrivée de prestataires de services de santé mondiaux en est la cause. Les acteurs privés dominent le secteur de la santé dans ces pays. Les modalités d'imagerie occupent généralement une place spécifique dans les nouveaux hôpitaux. Dans les années à venir, la concurrence croissante et la demande accrue de services de santé de classe mondiale devraient stimuler l'expansion du secteur.

- Augmentation des cas de maladies chroniques

Le marché des réactifs d'imagerie médicale en Asie-Pacifique est influencé par des facteurs tels que le cancer et les maladies cardiovasculaires, les avancées techniques, le développement des réactifs d'imagerie médicale et les demandes élevées non satisfaites en matière de procédures d'imagerie médicale et diagnostique. Les troubles cardiovasculaires, par exemple, sont l'une des principales causes de décès dans le monde. De plus, comme les personnes âgées sont plus susceptibles de développer des maladies chroniques, la croissance croissante de la population gériatrique devrait augmenter la demande de réactifs d'imagerie médicale.

- Évolution de la demande en réactifs d'imagerie médicale

Le nombre croissant de patients atteints de cancer qui ont besoin de techniques d'imagerie diagnostique avancées telles que l'imagerie photoacoustique et les réactifs d'imagerie pour un meilleur diagnostic contribue également à l'expansion du marché. En outre, la population vieillissante, l'augmentation des dépenses de santé et la demande croissante de procédures efficaces et de médicaments sûrs sont susceptibles de faire progresser le marché des réactifs d'imagerie médicale.

Opportunités

Les avancées technologiques, combinées aux investissements et aux fonds publics, devraient contribuer à l'expansion du marché, en particulier dans les pays en développement comme l'Inde et la Chine. En janvier 2020, Allengers, par exemple, a dévoilé le premier scanner CT 32 coupes fabriqué localement en Inde. Canon Medical Systems a participé à la création du système.

Les établissements d'enseignement, les hôpitaux et les universités devraient accroître leurs besoins en matière de modalités d'imagerie de pointe afin de proposer une formation aux technologies avancées, ce qui aura un impact considérable sur la croissance du marché dans les années à venir. Cette tendance, qui était auparavant limitée aux pays riches, s'étend de plus en plus aux pays en développement. Par exemple, le seul équipement d'imagerie par résonance magnétique (IRM) 7T certifié, le MAGNETOM Terra de Siemens Healthineers, n'a été installé qu'aux États-Unis.

Contraintes/Défis

Toutefois, l’expansion du marché risque d’être entravée par une pénurie de personnel médical expérimenté, des coûts d’équipement élevés, un manque de fournisseurs de réactifs d’imagerie et des réglementations gouvernementales rigoureuses.

Ce rapport sur le marché de l'imagerie médicale fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et local, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché de l'imagerie médicale, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Portée du marché de l'imagerie médicale

Le marché de l'imagerie médicale est segmenté en fonction du type, de la modalité, de la procédure, de la technologie, de l'âge du patient, de l'application et de l'utilisateur final. La croissance de ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Services

- Produit

Modalité

- Stationnaire

- Portable

Procédure

- Tomodensitométrie (TDM)

- Imagerie à rayons X

- Imagerie par résonance magnétique (IRM)

- Échographie, imagerie nucléaire (SPECT/PET)

- Autres

Technologie

- Radiologie numérique directe

- Radiologie informatisée

Âge du patient

- Adultes

- Pédiatrique

Application

- Cardiologie

- Pelvien et abdominal

- Oncologie

- Mammographie

- Gynécologie

- Neurologie

- Urologie

- Musculosquelettique

- Dentaire

- Autres

Utilisateurs finaux

- Hôpitaux

- Centres de diagnostic

- Centres d'imagerie

- Cliniques spécialisées

- Centres de chirurgie ambulatoire

- Instituts universitaires et de recherche

- Autres

Analyse régionale du marché de l'imagerie médicale

Le marché de l’imagerie médicale est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, type, modalité, procédure, technologie, âge du patient, application et utilisateur final, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché de l'imagerie médicale sont la Chine, le Japon, l'Inde, la Corée du Sud, Singapour, la Malaisie, l'Australie, la Thaïlande, l'Indonésie, les Philippines et le reste de l'Asie-Pacifique (APAC).

L'Asie-Pacifique connaît le taux de croissance le plus élevé, en raison du nombre croissant de personnes âgées et de l'augmentation des dépenses de santé. En raison de l'infrastructure de santé avancée du pays, le secteur japonais de l'imagerie médicale domine. Les services d'imagerie médicale sont très demandés au Japon en raison du vieillissement de la population et des maladies chroniques du pays.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces de Porter, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Part de marché de l'imagerie médicale

Le paysage concurrentiel du marché de l'imagerie médicale fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché de l'imagerie médicale.

Les leaders du marché de l'imagerie médicale opérant sur le marché sont :

- Koninklijke Philips NV (Pays-Bas)

- RamSoft, Inc. (Canada)

- Groupe InHealth (Royaume-Uni)

- Rapports de radiologie en ligne (États-Unis)

- Siemens (Allemagne)

- Sonic Healthcare Limited (Australie)

- RadNet, Inc. (États-Unis)

- General Electric (États-Unis)

- Akumin Inc. (États-Unis)

- Hologic Inc. (États-Unis)

- Société Shimadzu (Japon)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (Chine)

- CANON MEDICAL SYSTEMS CORPORATION (Japon)

- Carl Zeiss AG (Allemagne)

- FUJIFILM Corporation (Japon)

- Hitachi, Ltd. (Japon)

- MEDNAX Services, Inc. (États-Unis),

- Carestream Health (États-Unis)

- Solutions de téléradiologie (États-Unis)

- UNILABS (Suisse)

- ONRAD, Inc. (États-Unis)

Dernières évolutions du marché de l'imagerie médicale

- En mars 2021, Vscan AirTM est un échographe de poche sans fil de pointe de GE Healthcare qui offre aux médecins une qualité d'image cristalline, des capacités d'analyse du corps entier et un logiciel intuitif

- En janvier 2021, au Canada, Esaote North America a lancé le système d'échographie MyLab X8. MyLab X8 est un système d'imagerie haut de gamme complet qui intègre les technologies les plus récentes et offre une meilleure qualité d'image sans compromettre le flux de travail ou l'efficacité. Il a été précédemment autorisé par la FDA aux États-Unis

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.