Le secteur de la vente au détail aux États-Unis a connu une profonde transformation numérique, portée par des avancées technologiques rapides. Des technologies telles que l'intelligence artificielle (IA) et l'Internet des objets (IoT) révolutionnent la façon dont les détaillants opèrent, coopèrent avec leurs clients et gèrent leurs activités. Ces avancées technologiques constituent un moteur important pour le marché américain des services de vente au détail, notamment dans les domaines du conseil et de la formation, de l'installation et de l'intégration, ainsi que du support et de la maintenance. L'écosystème IoT du commerce de détail comprend des appareils et des capteurs interconnectés intégrés à des objets physiques tels que des produits, des rayons et même des vêtements. Ces appareils collectent des données en temps réel sur les préférences des clients, les niveaux de stock et l'état des magasins. La technologie IoT permet aux détaillants de créer des expériences d'achat immersives, de suivre les stocks en temps réel et de mettre en œuvre des solutions de magasinage intelligentes telles que des systèmes de caisse automatisés et des rayons intelligents.

Accéder au rapport complet : https://www.databridgemarketresearch.com/reports/us-retail-service-market

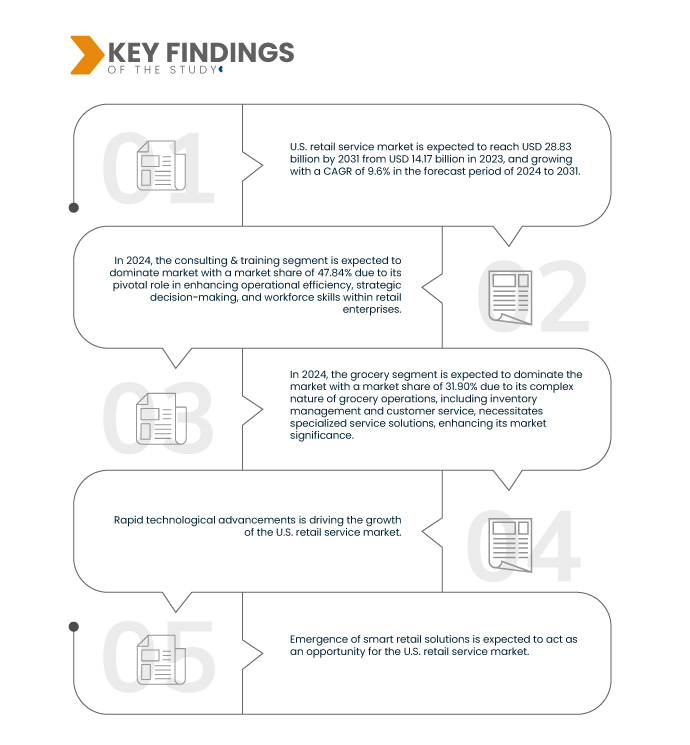

Data Bridge Market Research analyse que le marché américain des services de détail devrait atteindre une valeur de 28,83 milliards USD d'ici 2031, contre 14,17 milliards USD en 2023, à un TCAC de 9,6 % au cours de la période de prévision de 2024 à 2031.

Principales conclusions de l'étude

Complexité croissante des opérations de vente au détail

L'une des principales tendances contribuant à cette évolution est la complexité croissante des opérations de vente au détail. Cette complexité découle de l'adoption de stratégies omnicanales et de l'intégration des canaux de vente en ligne et hors ligne. Alors que les détaillants s'efforcent d'offrir des expériences d'achat fluides via différents points de contact, ils sont confrontés à de nombreuses difficultés pour gérer efficacement leurs opérations. Cette complexité croissante stimule la demande de services, notamment de conseil, de formation, d'installation, d'intégration, d'assistance et de maintenance.

Les détaillants adoptent des stratégies omnicanales pour répondre aux attentes des consommateurs modernes, qui exigent praticité, flexibilité et cohérence sur tous les canaux d'achat. La vente omnicanale implique l'intégration de différents canaux de vente, notamment les magasins physiques, les sites e-commerce, les applications mobiles, les réseaux sociaux, etc., afin de créer une expérience d'achat unifiée. Cependant, la mise en œuvre et la gestion des opérations omnicanales représentent des défis majeurs pour les détaillants, notamment en matière de synchronisation des stocks, de traitement des commandes, de cohérence des prix et de gestion des données clients. Des services de conseil spécialisés sont essentiels pour aider les détaillants à gérer ces enjeux et à développer des stratégies d'optimisation de leurs opérations omnicanales.

Portée du rapport et segmentation du marché

Rapport métrique

|

Détails

|

Période de prévision

|

2024 à 2031

|

Année de base

|

2023

|

Années historiques

|

2022 (personnalisable pour 2016-2021)

|

Unités quantitatives

|

Chiffre d'affaires en milliards USD

|

Segments couverts

|

Services (conseil et formation, installation et intégration, et support et maintenance), applications (épicerie, marchandises générales, mode/spécialité, carburant et commodités, hôtellerie, restauration, voyages, divertissement et autres)

|

Acteurs du marché couverts

|

NCR Voyix Corporation (États-Unis), HCL Technologies Limited (Inde), ExlService Holdings, Inc. (États-Unis), Wipro (Inde), Aspire Systems (Inde), Fujitsu (Japon), Infosys Limited (Inde), CGI Inc. (Canada), Diebold Nixdorf, Incorporated (États-Unis), Oracle (États-Unis), Retail Services Group (États-Unis), Deloitte (Royaume-Uni) et Accenture (Irlande), entre autres

|

Points de données couverts dans le rapport

|

Outre les informations sur le marché telles que la valeur marchande, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché organisé par l'équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse du pilon.

|

Analyse des segments

Le marché américain des services de détail est segmenté en deux segments notables basés sur les services et les applications.

- Sur la base des services, le marché américain des services de détail est segmenté en conseil et formation, installation et intégration, et support et maintenance.

En 2024, le segment du conseil et de la formation devrait dominer le marché américain des services de détail

En 2024, le secteur du conseil et de la formation devrait dominer le marché américain des services de vente au détail avec une part de marché de 47,84 %, grâce à son rôle essentiel dans l'amélioration de l'efficacité opérationnelle, de la prise de décision stratégique et des compétences des équipes au sein des entreprises de vente au détail. En proposant des conseils et des formations sur mesure, ce secteur répond à la complexité croissante des opérations de vente au détail et favorise une approche centrée sur le client, générant ainsi une croissance durable et un avantage concurrentiel dans un secteur de la vente au détail en constante évolution.

- Sur la base des applications, le marché américain des services de détail est segmenté en épicerie, marchandises générales, mode/spécialité, carburant et commodités, hôtellerie, restauration, voyages, divertissement et autres.

En 2024, le segment de l'épicerie devrait dominer le marché américain des services de détail

En 2024, le segment de l'épicerie devrait dominer le marché des services de détail aux États-Unis avec une part de marché de 31,90 % en raison de la nature complexe des opérations d'épicerie, y compris la gestion des stocks et le service client, qui nécessitent des solutions de service spécialisées, renforçant ainsi son importance sur le marché.

Acteurs majeurs

Data Bridge Market Research analyse HCL Technologies Limited (Inde), Wipro (Inde), Aspire Systems (Inde), Infosys Limited (Inde) et Deloitte (Royaume-Uni) comme les principales entreprises opérant sur le marché des services de détail aux États-Unis.

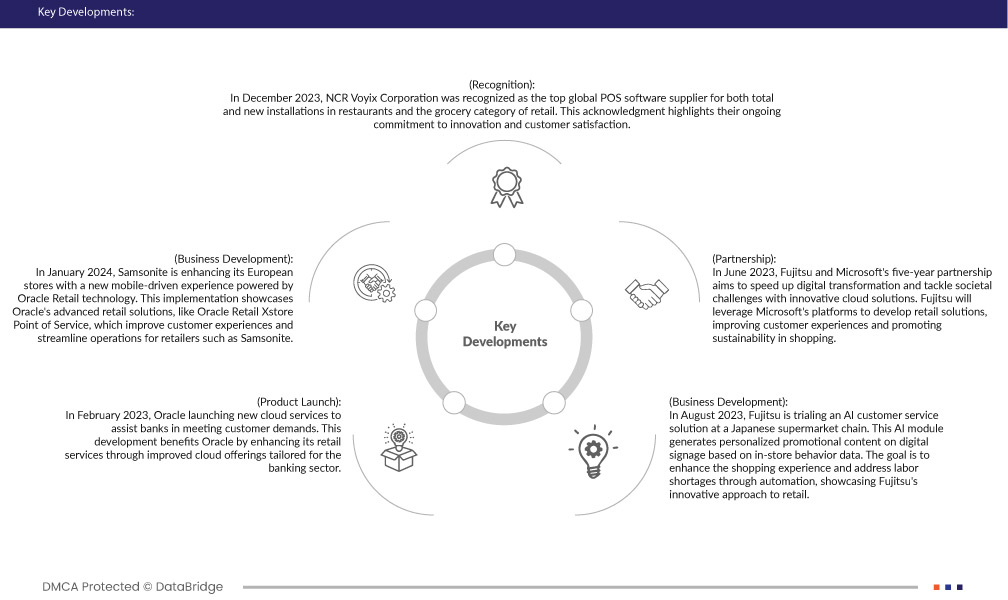

Évolution du marché

- En décembre 2023, NCR Voyix Corporation a été reconnue comme le premier fournisseur mondial de logiciels de point de vente (POS), tant pour les installations complètes que pour les nouvelles installations, dans la restauration et le secteur de l'alimentation. Cette reconnaissance souligne son engagement constant en faveur de l'innovation et de la satisfaction client.

- En janvier 2024, Samsonite enrichit ses magasins européens avec une nouvelle expérience mobile optimisée par la technologie Oracle Retail. Cette implémentation met en avant les solutions de vente au détail avancées d'Oracle, comme Oracle Retail Xstore Point of Service, qui améliorent l'expérience client et rationalisent les opérations des commerçants comme Samsonite.

- En février 2023, Oracle a lancé de nouveaux services cloud pour aider les banques à répondre aux demandes de leurs clients. Ce développement profite à Oracle en améliorant ses services de détail grâce à des offres cloud optimisées, adaptées au secteur bancaire.

- En août 2023, Fujitsu teste une solution de service client basée sur l'IA dans une chaîne de supermarchés japonaise. Ce module d'IA génère du contenu promotionnel personnalisé sur l'affichage dynamique à partir des données comportementales en magasin. L'objectif est d'améliorer l'expérience d'achat et de pallier la pénurie de main-d'œuvre grâce à l'automatisation, illustrant ainsi l'approche innovante de Fujitsu en matière de vente au détail.

- En juin 2023, Fujitsu et Microsoft signent un partenariat de cinq ans visant à accélérer la transformation numérique et à relever les défis sociétaux grâce à des solutions cloud innovantes. Fujitsu s'appuiera sur les plateformes Microsoft pour développer des solutions de vente au détail, améliorer l'expérience client et promouvoir le développement durable dans les achats.

Selon l'analyse de Data Bridge Market Research : pour plus d'informations sur le rapport sur le marché des services de détail aux États-Unis, cliquez ici : https://www.databridgemarketresearch.com/reports/us-retail-service-market