La crème à fouetter est un produit laitier riche en matières grasses, contenant généralement entre 30 et 40 % de matières grasses laitières, spécialement conçu pour être fouetté et obtenir une texture légère et aérée. Fabriquée à partir de lait de vache ou d'autres animaux laitiers, elle se caractérise par sa consistance riche et onctueuse, idéale pour des applications culinaires telles que le nappage de desserts, la création de garnitures et l'enrichissement de sauces. Sa teneur élevée en matières grasses lui permet d'incorporer de l'air lorsqu'elle est fouettée, produisant ainsi une mousse stable et indéformable. C'est un ingrédient populaire dans les cuisines familiales et professionnelles pour créer une variété de plats délicieux et visuellement attrayants.

Le marché européen de la crème fouettée désigne le segment de l'industrie laitière qui englobe la production, la distribution et la vente de crèmes fouettées dans les pays européens. Ce marché comprend à la fois les segments industriels et grand public, s'adressant à divers utilisateurs finaux tels que les ménages, les restaurants, les boulangeries et les fabricants de produits alimentaires. Caractérisé par une gamme diversifiée de produits, aux teneurs en matières grasses, aux saveurs et aux emballages variés, ce marché est porté par la demande des consommateurs pour des ingrédients polyvalents adaptés aux applications culinaires et de fouettage, ainsi que par les tendances en matière de praticité et de qualité dans la préparation des aliments. Les normes réglementaires, les exigences de sécurité alimentaire et l'évolution des préférences des consommateurs pour des produits naturels et durables influencent considérablement la dynamique du marché de la crème fouettée en Europe.

Accéder au rapport complet sur https://www.databridgemarketresearch.com/reports/europe-whipping-cream-market

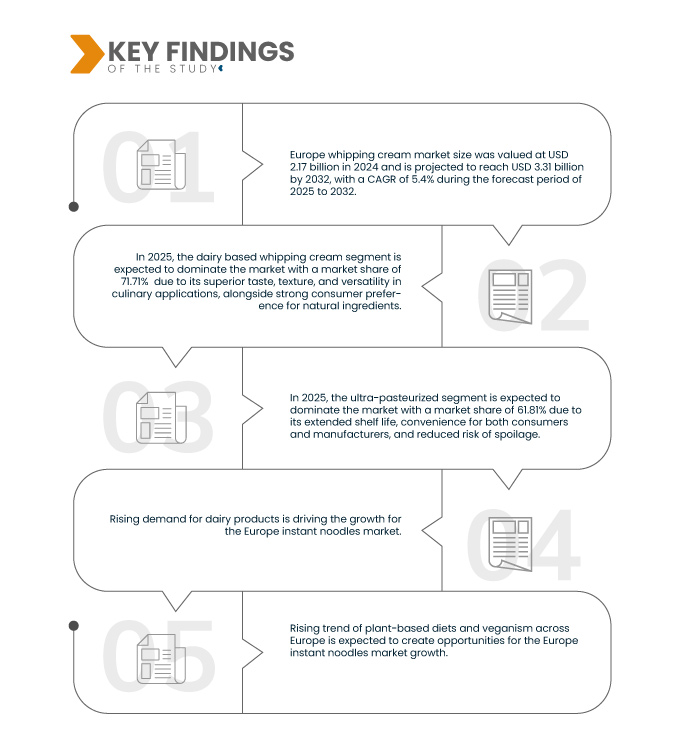

Data Bridge Market Research analyse que la taille du marché européen de la crème à fouetter était évaluée à 2,17 milliards USD en 2024 et devrait atteindre 3,31 milliards USD d'ici 2032, avec un TCAC de 5,4 % au cours de la période de prévision de 2025 à 2032.

Principales conclusions de l'étude

L'essor du secteur de la restauration

L'essor de la restauration en Europe joue un rôle crucial dans le développement du marché de la crème fleurette. Les restaurants, cafés et traiteurs l'intègrent de plus en plus à leur offre culinaire. Avec la popularité croissante des restaurants et la diversification des cuisines, les établissements de restauration recherchent constamment des ingrédients de qualité pour sublimer la saveur et la présentation de leurs plats. La crème fleurette est un ingrédient essentiel dans de nombreuses recettes, des desserts gourmands comme les mousses et les cheesecakes aux sauces et soupes savoureuses, ce qui la rend indispensable dans les restaurants gastronomiques comme dans les restaurants décontractés. Son utilisation croissante dans la préparation des aliments contribue directement à la demande croissante de crème fleurette en vrac, les restaurateurs privilégiant la qualité et le goût dans leurs offres.

Portée du rapport et segmentation du marché

Rapport métrique

|

Détails

|

Période de prévision

|

2025 à 2032

|

Année de base

|

2024

|

Années historiques

|

2023 (Personnalisable 2013-2018)

|

Unités quantitatives

|

Chiffre d'affaires en milliards USD

|

Segments couverts

|

Produit (crème fouettée à base de produits laitiers et non laitiers), type (ultra-pasteurisé et pasteurisé), forme (semi-liquide, liquide et poudre), formulation (sucré et non sucré), emballage (Tetra Pack, en bouteille, en gobelets et en canettes), poids (101 g - 400 g, moins de 100 g, 401 g - 800 g, 800 g - 1 kg et plus de 1 kg), application (secteur de la restauration et ménages), canal de distribution (direct et indirect)

|

Pays couverts

|

Allemagne, France, Royaume-Uni, Italie, Espagne, Russie, Pays-Bas, Belgique, Suisse, Turquie et reste de l'Europe

|

Acteurs du marché couverts

|

Fonterra Co-operative Group (qui fait partie de Fonterra Co-operative Group Limited) (Nouvelle-Zélande), Arla Foods amba (Danemark), Lactlis McLelland Ltd. (Angleterre), Nestlé (Suisse), FrieslandCampina (Debic fait partie de FrieslandCampina Professional) (Pays-Bas), cremio (Bulgarie), Califia Farms, LLC (États-Unis), DANA DAIRY GROUP (France), Emborg (Europe), Granarolo SpA (Italie), Hochwald Foods GmbH (Allemagne), IFFCO ITALIA SRL (Italie), Kraft Heinz (qui fait partie de The Kraft Heinz Company) (États-Unis) et Rich's (États-Unis), entre autres

|

Points de données couverts dans le rapport

|

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research incluent également une analyse approfondie par des experts, une épidémiologie des patients, une analyse du pipeline et un cadre réglementaire.

|

Analyse des segments

Le marché européen de la crème à fouetter est segmenté en huit segments notables en fonction du produit, du type, de la forme, de la formulation, de l'emballage, du poids, de l'application et du canal de distribution.

- Sur la base du produit, le marché européen de la crème à fouetter est segmenté en crème à fouetter à base de produits laitiers et en crème à fouetter à base de produits non laitiers.

En 2025, le segment de la crème à fouetter à base de produits laitiers devrait dominer le marché européen de la crème à fouetter

En 2025, le segment de la crème à fouetter à base de produits laitiers devrait dominer le marché avec une part de marché de 71,71 % en raison de son goût supérieur, de sa texture et de sa polyvalence dans les applications culinaires, ainsi que de la forte préférence des consommateurs pour les ingrédients naturels.

- Sur la base du type, le marché européen de la crème à fouetter est segmenté en ultra-pasteurisée et pasteurisée

En 2025, le segment ultra-pasteurisé devrait dominer le marché européen de la crème à fouetter

En 2025, le segment ultra-pasteurisé devrait dominer le marché avec une part de marché de 61,81 % en raison de sa durée de conservation prolongée, de sa commodité pour les consommateurs et les fabricants et de son risque réduit de détérioration.

- En termes de forme, le marché européen de la crème à fouetter est segmenté en crème semi-liquide, liquide et en poudre. En 2025, le segment semi-liquide devrait dominer le marché avec une part de marché de 46,68 %.

- En fonction de sa formulation, le marché européen de la crème à fouetter est segmenté en crème sucrée et non sucrée. En 2025, le segment sucré devrait dominer le marché avec une part de marché de 61,15 %.

- En termes de conditionnement, le marché européen de la crème à fouetter est segmenté en Tetra Pack, en bouteille, en pot et en canette. En 2025, le segment Tetra Pack devrait dominer le marché avec une part de marché de 41,48 %.

- En fonction du poids, le marché européen de la crème à fouetter est segmenté en 101 g - 400 g, moins de 100 g, 401 g - 800 g, 800 g - 1 kg et plus de 1 kg. En 2025, le segment 101 g - 400 g devrait dominer le marché avec une part de marché de 41,43 %.

- En fonction des applications, le marché européen de la crème fouettée est segmenté entre la restauration et les produits ménagers. En 2025, le secteur de la restauration devrait dominer le marché avec une part de marché de 63,42 %.

- En fonction des canaux de distribution, le marché européen de la crème à fouetter est segmenté en distribution directe et indirecte. En 2025, le segment direct devrait dominer le marché avec une part de marché de 59,60 %.

Acteurs majeurs

Data Bridge Market Research analyse NISSIN FOODS HOLDINGS CO., LTD (Japon), Nestlé (Suisse), PT INDOFOOD CBP SUKSES MAKMUR TBK (Indonésie), Unilever (Royaume-Uni) et Ajinomoto Co., Inc. (Japon) entre autres comme les principaux acteurs du marché européen de la crème à fouetter.

Évolution du marché

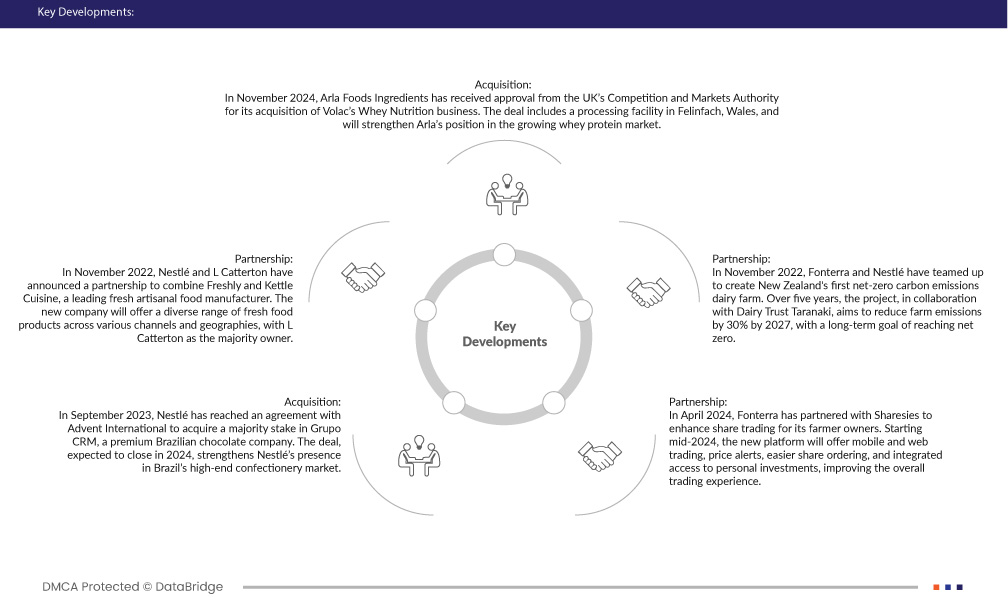

- En novembre 2024, Arla Foods Ingredients a reçu l'approbation de l'Autorité britannique de la concurrence et des marchés pour l'acquisition de l'activité Whey Nutrition de Volac. L'accord comprend une usine de transformation à Felinfach, au Pays de Galles, et renforcera la position d'Arla sur le marché en pleine croissance des protéines de lactosérum.

- En septembre 2023, Nestlé a conclu un accord avec Advent International pour acquérir une participation majoritaire dans Grupo CRM, une entreprise brésilienne de chocolat haut de gamme. Cet accord, dont la finalisation est prévue en 2024, renforce la présence de Nestlé sur le marché brésilien de la confiserie haut de gamme.

- En novembre 2022, Nestlé et L Catterton ont annoncé un partenariat visant à fusionner Freshly et Kettle Cuisine, un leader de la fabrication artisanale de produits frais. La nouvelle entreprise proposera une gamme diversifiée de produits frais sur différents canaux et dans différentes zones géographiques, avec L Catterton comme actionnaire majoritaire.

- En avril 2024, Fonterra s'est associé à Sharesies pour améliorer la négociation d'actions pour ses propriétaires-exploitants agricoles. Dès mi-2024, la nouvelle plateforme offrira des services de négociation mobile et web, des alertes de prix, une commande d'actions simplifiée et un accès intégré aux investissements personnels, améliorant ainsi l'expérience de trading globale.

- En novembre 2022, Fonterra et Nestlé se sont associés pour créer la première ferme laitière à émissions nettes de carbone de Nouvelle-Zélande. Sur cinq ans, le projet, mené en collaboration avec Dairy Trust Taranaki, vise à réduire les émissions agricoles de 30 % d'ici 2027, avec pour objectif à long terme d'atteindre la neutralité carbone.

Analyse régionale

Géographiquement, les pays couverts par le rapport sur le marché européen de la crème à fouetter sont l'Allemagne, la France, le Royaume-Uni, l'Italie, l'Espagne, la Russie, les Pays-Bas, la Belgique, la Suisse, la Turquie et le reste de l'Europe.

Selon l'analyse de Data Bridge Market Research :

L'Allemagne devrait dominer la région sur le marché européen de la crème à fouetter

L'Allemagne devrait dominer le marché en raison de sa forte industrie laitière, de sa forte demande de produits à base de crème traditionnels et végétaux et de son secteur de transformation alimentaire robuste.

L'Allemagne devrait être le pays qui connaîtra la croissance la plus rapide sur le marché européen de la crème fouettée

L'Allemagne devrait être le pays connaissant la croissance la plus rapide en raison de sa forte industrie laitière, de sa forte demande de produits à base de crème traditionnels et végétaux, de son secteur de transformation alimentaire robuste et de la préférence des consommateurs pour les ingrédients laitiers de haute qualité, ainsi que de son rôle central sur les marchés européens de la restauration et de la vente au détail.

Pour plus d'informations sur le marché européen de la crème à fouetter, cliquez ici : https://www.databridgemarketresearch.com/reports/europe-whipping-cream-market