Les additifs pour fluides de travail des métaux sont des composants essentiels à la formation de fluides destinés aux applications industrielles. Ils prolongent la durée de vie des machines et des outils, réduisent les frottements, préviennent la corrosion et l'adhérence, et dissipent efficacement la chaleur pendant l'usinage. Ces additifs offrent des avantages significatifs, tels qu'une amélioration des pressions extrêmes grâce à leur masse moléculaire élevée, une réduction de la volatilité et des odeurs des huiles étrangères, et une meilleure visibilité des pièces. Les émulsifiants assurent la stabilité des émulsions fluides, quelle que soit la dureté de l'eau, tandis que les additifs lubrifiants sans métal ni chlore améliorent la réduction des frottements et les propriétés d'émulsification. Les additifs de trempe améliorent les performances de trempe, notamment dans les fluides à base d'huile minérale, avec un contrôle exceptionnel des dépôts et de l'oxydation.

Accéder au rapport complet sur https://www.databridgemarketresearch.com/reports/north-america-metalworking-fluid-additives-market

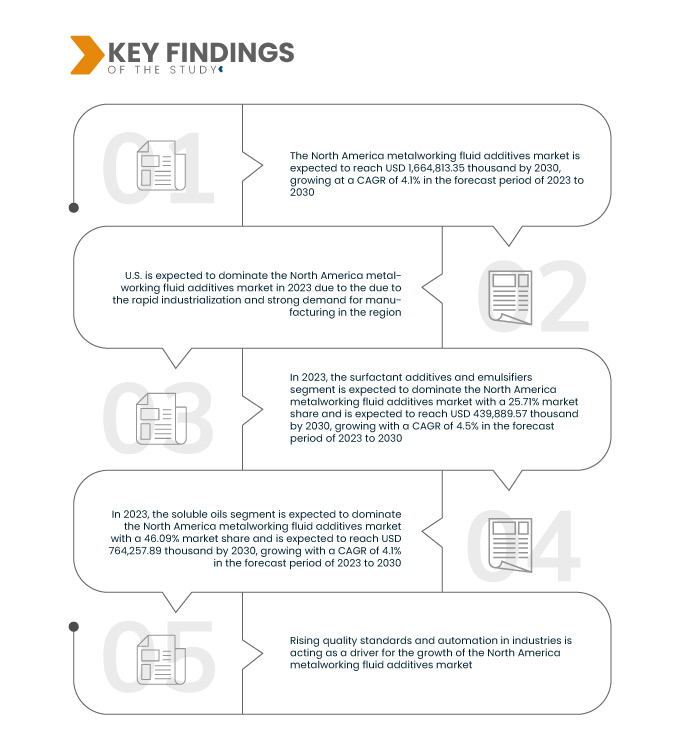

Data Bridge Market Research analyse que le marché nord-américain des additifs pour fluides de travail des métaux devrait croître avec un TCAC de 4,1 % de 2023 à 2030 et devrait atteindre 1 664 813,35 milliers USD d'ici 2030.

Principales conclusions de l'étude

L'expansion des secteurs de l'automobile, de l'aérospatiale et des machines devrait stimuler la croissance du marché

Sur le marché nord-américain, la demande d'additifs pour fluides de travail des métaux est stimulée par la croissance et l'expansion rapides de secteurs industriels importants, notamment l'automobile, l'aéronautique et les machines. Ces industries représentent l'industrie manufacturière moderne dans son ensemble, repoussant sans cesse les limites de l'innovation et du développement technique.

Couvrant une grande variété de produits, l'industrie des machines englobe des équipements industriels lourds et des appareils électroniques complexes. À l'ère de l'Industrie 4.0 et de la fabrication intelligente, des solutions additives adaptées aux différents procédés de fabrication deviennent essentielles. Les additifs pour fluides de travail des métaux permettent au secteur des machines d'améliorer l'efficacité, de prolonger la durée de vie des outils et d'obtenir des finitions de surface impeccables, favorisant ainsi la création de machines de pointe.

L'expansion de ces industries est intrinsèquement liée à la hausse des exigences de production, aux exigences de précision et à la quête incessante d'excellence opérationnelle. Cette croissance collective alimente la demande d'additifs pour fluides de travail des métaux qui optimisent les processus d'usinage, augmentent la longévité des outils et affinent la qualité de surface. Par conséquent, le marché nord-américain des additifs pour fluides de travail des métaux est florissant, sa progression étant étroitement liée à l'évolution de ces secteurs industriels vitaux. Des secteurs en expansion tels que l'automobile, l'aérospatiale et la machinerie devraient stimuler la croissance du marché.

Portée du rapport et segmentation du marché

Rapport métrique

|

Détails

|

Période de prévision

|

2023 à 2030

|

Année de base

|

2022

|

Années historiques

|

2021 (personnalisable de 2015 à 2020)

|

Unités quantitatives

|

Chiffre d'affaires en milliers de dollars américains

|

Segments couverts

|

Type d'additif (additifs tensioactifs et émulsifiants , inhibiteurs de corrosion, additifs extrême pression, stabilisants, antimousses, alcanolamines, agents antibuée, colorants/teintures et autres), application (huiles solubles, huiles pures, fluides semi-synthétiques et fluides synthétiques), activité de travail des métaux (fraisage, perçage, meulage, rodage, taraudage et autres), utilisation finale (automobile, aérospatiale, fabrication de machines et d'équipements, énergie et électricité, marine et autres)

|

Pays couverts

|

États-Unis, Canada et Mexique

|

Acteurs du marché couverts

|

Lubrizol Corporation (États-Unis), Dow (États-Unis), Evonik Industries AG (Allemagne), FUCHS (Allemagne), Solvay (Belgique), LANXESS (Allemagne), BP plc (Royaume-Uni), CLARIANT (Allemagne), Ingevity et ses entités liées (États-Unis), Ashland (États-Unis), Italmatch Chemicals SpA (Italie), Kao Corporation (Japon), Umicore (Belgique), Colonial Chemical (États-Unis), Biosynthetic Technologies (États-Unis), DOVER CHEMICAL CORPORATION (États-Unis), Emery Oleochemicals (États-Unis), Pilot Chemical Corp. (États-Unis), RT Vanderbilt Holding Company, Inc. (États-Unis) et ZSCHIMMER & SCHWARZ, INC. (Allemagne), entre autres

|

Points de données couverts dans le rapport

|

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une production et une capacité géographiquement représentées par entreprise, des configurations de réseau de distributeurs et de partenaires, une analyse détaillée et mise à jour des tendances des prix et une analyse des déficits de la chaîne d'approvisionnement et de la demande.

|

Analyse des segments

Le marché nord-américain des additifs pour fluides de travail des métaux est segmenté en quatre segments notables en fonction du type d'additif, de l'application, de l'activité de travail des métaux et de l'utilisation finale.

- Sur la base du type d'additif, le marché est segmenté en additifs tensioactifs et émulsifiants, inhibiteurs de corrosion , additifs extrême pression, stabilisants, antimousses, alcanolamines, agents antibuée, colorants/colorants et autres.

En 2023, le segment des additifs tensioactifs et des émulsifiants devrait dominer le marché.

En 2023, le segment des additifs tensioactifs et des émulsifiants devrait dominer le marché avec une part de marché de 25,71 % en raison de leur rôle crucial dans l'amélioration de la lubrification, du refroidissement et de la stabilité en réduisant la friction et en améliorant la dispersion des fluides à base d'huile et d'eau dans les processus d'usinage.

- Sur la base de l'application, le marché est segmenté en huiles solubles, huiles pures, fluides semi-synthétiques et fluides synthétiques

- Sur la base de l'activité de travail des métaux, le marché est segmenté en fraisage, perçage, meulage, rodage, taraudage et autres

En 2023, le segment du fraisage de l’activité métallurgique devrait dominer le marché.

En 2023, le segment du fraisage devrait dominer le marché avec une part de marché de 24,91 % en raison de son utilisation généralisée dans l'usinage de précision, qui nécessite une lubrification et un refroidissement efficaces.

- Sur la base de l'utilisation finale, le marché est segmenté en automobile, aérospatiale, fabrication de machines et d'équipements, électricité et énergie, marine et autres

Acteurs majeurs

Data Bridge Market Research analyse The Lubrizol Corporation (États-Unis), Dow (États-Unis), Evonik Industries AG (Allemagne), FUCHS (Allemagne) et Solvay (Belgique) comme les principaux acteurs du marché nord-américain des additifs pour fluides de travail des métaux.

Évolution du marché

- En août 2023, Colonial Chemical a reçu le prix de la Grande Entreprise de l'Année (plus de 100 employés) décerné par la Chambre de commerce du comté de Marion. C'est la sixième fois depuis 2014 que l'entreprise est récompensée pour ses réalisations. Sa croissance s'étend à l'international, avec une expansion notable de son siège social de New Hope, dans le Tennessee. L'entreprise a également été saluée par divers groupes industriels, l'Agence de protection de l'environnement (EPA) et des organisations civiques.

- En avril 2023, LANXESS a dévoilé une innovation majeure dans le domaine des additifs pour fluides de travail des métaux avec ses nouveaux vecteurs soufrés clairs et durables, commercialisés sous le label Scopeblue. Ces additifs innovants, tels que les Additin RC 2315, RC 2317, RC 2410, RC 2415, RC 2418 et RC 2515, sont fabriqués à partir de matériaux renouvelables d'origine locale. Ces additifs offrent des performances supérieures dans les procédés modernes de travail des métaux. Ils réduisent efficacement l'usure et empêchent le soudage à froid des surfaces métalliques, même sous haute pression.

- En septembre 2022, CLARIANT a mis en place une gamme complète d'additifs pour créer des fluides de travail des métaux entièrement synthétiques et hautement lubrifiants. La gamme complète d'additifs multifonctionnels peu moussants et les conseils de formulation sont désormais accessibles en ligne pour une utilisation sans huile minérale. Ces fluides hydrosolubles, plus biorésistants, améliorent l'efficacité d'usinage, la productivité et la protection avec moins de composants. L'entreprise peut ainsi attirer davantage de clients, car ils peuvent pleinement comprendre les propriétés de chaque ingrédient sur le site web.

- En avril 2022, Univar Solutions et Dow ont renforcé leur partenariat mondial grâce à un accord L&MF en Chine continentale et à Hong Kong. Univar affirme que cette relation stratégique avec Dow lui permet d'offrir à ses clients un accès à un portefeuille complet de composants de produits industriels. Univar est le plus grand distributeur d'ingrédients pour lubrifiants et fluides de travail des métaux de Dow.

- En janvier 2022, Biosynthetic Technologies, pionnier des composés synthétiques biosourcés, a acquis Innoleo, distributeur de dérivés du ricin. Cette opération stratégique renforce le portefeuille technologique Estolide de Biosynthetic avec une gamme complète de dérivés du ricin et d'oléo-dérivés. Parmi ceux-ci, on compte l'huile de ricin, l'huile de ricin hydrogénée et l'acide 12-hydroxy stéarique 12HSA, destinés aux applications dans les graisses, les lubrifiants, les revêtements et les soins personnels. Cette collaboration élargit leur portée et leur offre de produits, leur permettant de proposer des lubrifiants respectueux de l'environnement et diverses solutions oléo-dérivées à un marché mondial.

Analyse régionale

Géographiquement, les pays couverts par le rapport sur le marché des additifs pour fluides de travail des métaux en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

Selon l'analyse de Data Bridge Market Research :

Les États-Unis sont la région dominante sur le marché nord-américain des additifs pour fluides de travail des métaux.

Les États-Unis devraient dominer le marché en raison de scénarios favorables pour les additifs pour fluides de travail des métaux, d’une industrialisation rapide et d’une forte demande de fabrication dans la région.

On estime que les États-Unis sont la région qui connaît la croissance la plus rapide sur le marché.

Les États-Unis devraient connaître une croissance économique entre 2023 et 2030, grâce à la forte production et à la forte consommation dans la région. De plus, diverses avancées technologiques dans les technologies de production et l'expansion des installations de production dans la région sont également attendues.

Pour plus d'informations sur le marché nord-américain des additifs pour fluides de travail des métaux, cliquez ici : https://www.databridgemarketresearch.com/reports/north-america-metalworking-fluid-additives-market