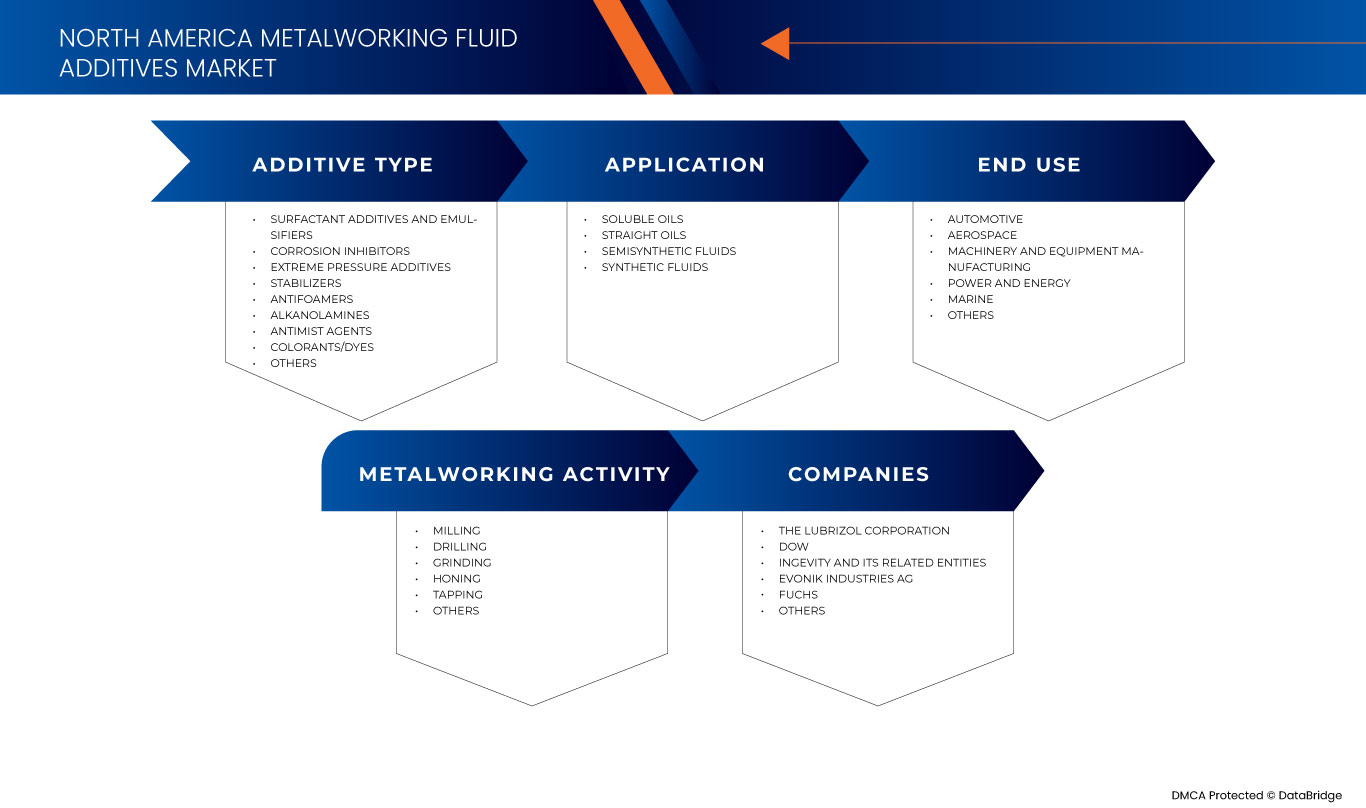

Marché nord-américain des additifs pour fluides de travail des métaux, par type d'additif (additifs tensioactifs et émulsifiants, inhibiteurs de corrosion, additifs extrême pression, stabilisants, antimousses, alcanolamines, agents antibuée, colorants/teintures et autres), application (huiles solubles, huiles pures, fluides semi-synthétiques et fluides synthétiques), activité de travail des métaux (fraisage, perçage, meulage, rodage, taraudage et autres), utilisation finale (automobile, aérospatiale, fabrication de machines et d'équipements, électricité et énergie, marine et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché des additifs pour fluides de travail des métaux en Amérique du Nord

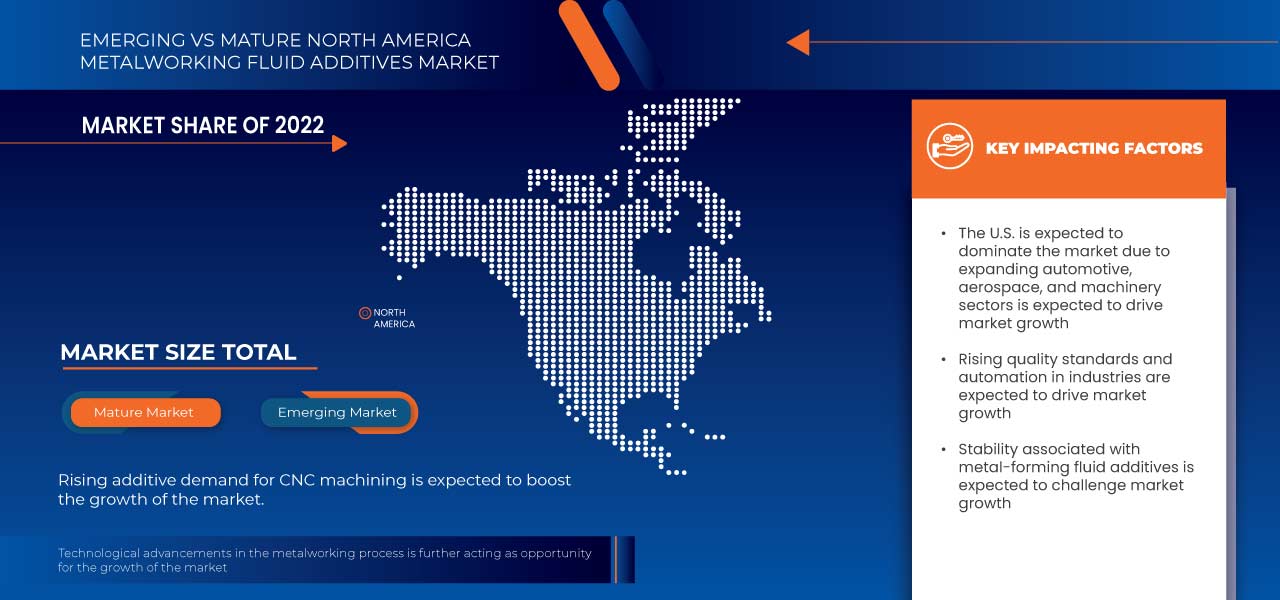

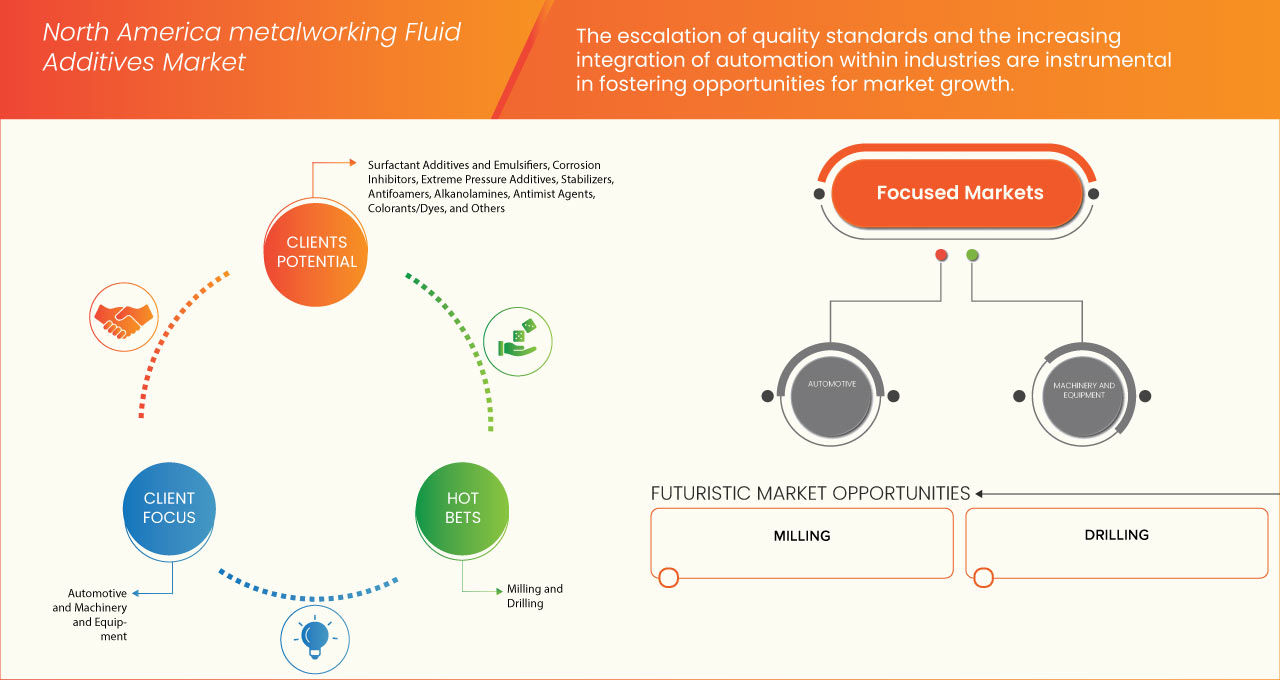

L'expansion des secteurs de l'automobile, de l'aéronautique et de la machinerie est le facteur clé de l'expansion du marché. L'escalade des normes de qualité et l'intégration croissante de l'automatisation au sein des industries contribuent à favoriser les opportunités de croissance du marché.

L'adoption croissante de l'usinage à sec dans les industries constitue un frein important au marché. En outre, les fluctuations des prix et de la disponibilité des matières premières représentent un défi de taille pour la croissance du marché. L'évolution vers des additifs respectueux de l'environnement semble être une opportunité croissante qui a le potentiel de conduire à la croissance du marché.

Le rapport sur le marché des additifs pour fluides de travail des métaux en Amérique du Nord fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Le marché nord-américain des additifs pour fluides de travail des métaux devrait stimuler la croissance du marché au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît à un TCAC de 4,1 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 1 664 813,35 milliers de dollars d'ici 2030. La demande croissante d'additifs pour l'usinage CNC est le facteur moteur qui devrait propulser la croissance du marché.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Par type d'additif (additifs tensioactifs et émulsifiants, inhibiteurs de corrosion , additifs extrême pression, stabilisants, antimousses, alcanolamines, agents antibuée, colorants/teintures et autres), application (huiles solubles, huiles pures, fluides semi-synthétiques et fluides synthétiques), activité de travail des métaux (fraisage, perçage, meulage, rodage, taraudage et autres), utilisation finale (automobile, aérospatiale, fabrication de machines et d'équipements, électricité et énergie, marine et autres) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

Lubrizol Corporation (États-Unis), Dow (États-Unis), Evonik Industries AG Ingevity et ses entités liées (États-Unis), Ashland (États-Unis), Italmatch Chemicals Sp. z o.o.), Colonial Chemical (États-Unis), Biosynthetic Technologies (États-Unis), DOVER CHEMICAL CORPORATION (États-Unis), Emery Oleochemicals (États-Unis), Pilot Chemical Corp. (États-Unis) et RT Vanderbilt Holding Company, Inc. (États-Unis) entre autres |

Dynamique du marché des additifs pour fluides de travail des métaux en Amérique du Nord

Conducteurs

- Expansion des secteurs de l'automobile, de l'aérospatiale et des machines

La demande d'additifs pour fluides de travail des métaux est stimulée par la croissance et l'expansion rapides de secteurs industriels importants, notamment l'automobile, l'aéronautique et les machines. Ces industries représentent une fabrication moderne en repoussant continuellement les limites de l'innovation et du développement technique.

Le secteur automobile, pilier des économies mondiales, est constamment à la recherche de moyens pour accroître les performances, la sécurité et l'efficacité des véhicules. Pour produire des composants de précision, cette activité nécessite des procédures d'usinage complexes. Les additifs pour fluides de travail des métaux jouent un rôle crucial pour garantir le bon fonctionnement et permettre la production de pièces automobiles de haute qualité en offrant des fonctions de lubrification, de refroidissement et d'élimination des copeaux.

- Normes de qualité en hausse et automatisation dans les industries

L’intensification des normes de qualité et l’intégration croissante de l’automatisation au sein des industries contribuent à favoriser les opportunités de croissance du marché. Ces deux facteurs, combinés, ont initié un changement de paradigme dans les pratiques de fabrication et remodèlent la dynamique de la demande en additifs pour fluides de travail des métaux. Des normes de qualité élevées sont devenues primordiales dans les processus de fabrication modernes.

Les industries sont contraintes de maintenir la précision, la cohérence et le respect de spécifications strictes pour garantir l'intégrité et les performances des produits. Les additifs pour fluides de travail des métaux jouent un rôle essentiel dans la réalisation de ces objectifs. Les additifs qui améliorent les propriétés de lubrification, de refroidissement et d'anticorrosion sont devenus impératifs pour optimiser les processus d'usinage, améliorer la longévité des outils et obtenir des finitions de produits supérieures. La demande d'additifs avancés pour fluides de travail des métaux est appelée à augmenter à mesure que les industries de tous les secteurs s'efforcent d'atteindre ou de dépasser ces normes de qualité, stimulant ainsi la croissance du marché.

Opportunités

- Progrès technologiques dans le processus de travail des métaux

Les progrès technologiques sont devenus un moteur essentiel de la croissance du marché. Ces développements technologiques ont considérablement influencé la formulation, l'application et les performances des additifs pour fluides de travail des métaux, créant ainsi une multitude d'opportunités d'expansion du marché.

L’un des principaux domaines d’avancée technologique est le perfectionnement des formulations additives. Les fabricants s’appuient sur des recherches et des innovations de pointe pour développer des additifs offrant des propriétés supérieures de lubrification, de protection contre la corrosion et de refroidissement. Ces additifs conçus avec précision améliorent les processus d’usinage, prolongent la durée de vie des outils et contribuent à la qualité supérieure des produits finis. Ce niveau d’optimisation des performances crée une proposition de valeur convaincante pour les utilisateurs finaux, ce qui stimule la demande d’additifs pour fluides de travail des métaux. En outre, les progrès de la nanotechnologie ont ouvert de nouvelles voies pour améliorer l’efficacité des additifs pour fluides de travail des métaux. Les nanoparticules peuvent conférer aux fluides de travail des métaux des caractéristiques améliorées de lubrification, de transfert de chaleur et d’anti-usure en raison de leurs propriétés uniques.

- Vers des additifs respectueux de l'environnement

Le marché connaît actuellement une transformation profonde, portée par l'importance croissante accordée à la durabilité environnementale. Alors que les industries s'efforcent de réduire leur empreinte écologique, l'adoption d'additifs respectueux de l'environnement dans les processus de travail des métaux est devenue un moteur essentiel de la croissance du marché.

Le marché des additifs pour fluides de travail des métaux a longtemps été dominé par des formulations contenant des composés et des additifs à base de pétrole présentant des risques potentiels pour la santé et l'environnement. Cependant, la prise de conscience croissante de ces dangers, les réglementations strictes et la demande croissante des consommateurs pour des produits durables ont marqué le début d'un changement de paradigme vers des alternatives plus respectueuses de l'environnement.

Contraintes / Défis

- Les industries se tournent vers l'usinage à sec traditionnel

L’adoption croissante de l’usinage à sec dans les industries constitue une contrainte notable qui affecte le marché. L’usinage à sec, une technique dans laquelle peu ou pas de liquide de refroidissement ou de lubrifiant est utilisé pendant le processus d’usinage, a gagné du terrain en raison de son potentiel de réduction des coûts, de ses avantages environnementaux et de l’amélioration des conditions de travail. Cette transition n’est pas difficile et son impact se répercute sur l’ensemble du marché.

L’un des principaux facteurs qui motivent le passage à l’usinage à sec est le potentiel d’économies de coûts. Les fluides de travail des métaux traditionnels, ainsi que les additifs associés, nécessitent des efforts d’approvisionnement, de maintenance et d’élimination. L’usinage à sec élimine ces coûts, ce qui en fait une option intéressante pour les industries soucieuses des coûts. De plus, l’usinage à sec réduit la production de déchets, rationalise l’élimination des déchets et contribue à un processus de fabrication plus efficace.

- Fluctuation des prix des matières premières

Ce facteur, étroitement lié à la dynamique économique, géopolitique et de la chaîne d'approvisionnement, a un impact direct sur les coûts de production, les prix et la stabilité globale du marché. Les additifs pour fluides de travail des métaux sont formulés à l'aide de matières premières clés, notamment des huiles de base, des packages d'additifs comprenant des agents de pression extrême, des composés anti-usure, des agents anti-mousse, des inhibiteurs de corrosion et des produits chimiques spéciaux tels que des émulsifiants, des biocides et des solvants .

Ces composants améliorent collectivement la lubrification, le refroidissement, la résistance à la corrosion et les performances globales des fluides de travail des métaux, ce qui a un impact crucial sur les processus d'usinage. La composition de la formulation est adaptée à des applications et des exigences d'usinage spécifiques, ce qui en fait une solution polyvalente pour une gamme d'opérations de travail des métaux. Nous pouvons en déduire que les matières premières, telles que les huiles de base, les additifs et les produits chimiques spéciaux , constituent une part importante de la structure de coût des additifs pour fluides de travail des métaux. La sensibilité du marché aux fluctuations de prix de ces matières premières résulte de facteurs tels que les tensions géopolitiques, les changements dans la dynamique de l'offre et de la demande et les perturbations des routes commerciales en Amérique du Nord. Les variations rapides des prix peuvent entraîner des augmentations de coûts imprévisibles pour les fabricants, exerçant une pression sur les marges bénéficiaires. Une telle volatilité augmente non seulement les incertitudes opérationnelles, mais entrave également la capacité à offrir des prix compétitifs aux utilisateurs finaux.

- Réglementations environnementales et facteurs de durabilité impliqués

Les réglementations environnementales et les facteurs de durabilité sont devenus des défis importants qui ont un impact sur la trajectoire de croissance du marché. Ces facteurs découlent de l'accent croissant mis en Amérique du Nord sur la réduction de l'empreinte environnementale des processus industriels et l'alignement sur des pratiques durables. Les réglementations environnementales et les facteurs de durabilité présentent des défis complexes pour le marché. L'évolution du paysage réglementaire, la nécessité de s'aligner sur les objectifs de durabilité, la demande d'emballages respectueux de l'environnement et l'émergence de concepts d'économie circulaire constituent collectivement un défi pour les fabricants en matière de conformité, de formulation, de coût et d'innovation. Pour relever avec succès ces défis, il faudra une adaptation stratégique et une concentration sur des solutions respectueuses de l'environnement, qui devraient remettre en cause la croissance du marché.

Développements récents

- En août 2023, Boecore a choisi Colorado Springs pour son expansion, motivée par son expertise en cybersécurité. Les incitations à la croissance et l'écosystème aérospatial renforcent l'attrait du Colorado au milieu des considérations sur Huntsville, en Alabama, et le comté de Weber, dans l'Utah

- En juillet 2023, Godrej Aerospace a joué un rôle crucial dans les missions spatiales indiennes, en fournissant des composants pour Chandrayaan-3. L'expertise de l'entreprise témoigne de son engagement en faveur du progrès et de l'innovation aérospatiale, en soutenant à la fois l'exploration spatiale et les industries de l'aviation commerciale

- En juin 2023, selon la BBC, l'OPEP contrôle près de 40 % des réserves mondiales de pétrole. En plus de la réduction de la production d'avril 2003, l'Arabie saoudite et d'autres producteurs de pétrole de l'OPEP+ ont annoncé de nouvelles réductions de la production de pétrole d'environ 1,16 million de barils par jour. L'OPEP peut avoir un impact sur l'approvisionnement en pétrole de l'Amérique du Nord et, par conséquent, influencer les prix du pétrole et du gaz dans le monde entier, ce qui aura finalement un impact sur le coût des produits qui utilisent le pétrole brut comme matière première.

- En juillet 2023, selon un article publié par LNG, l'Agence européenne des produits chimiques propose une période de transition de sept ans pour les paraffines chlorées à chaîne moyenne et d'autres substances contenant des chloroalcanes dont la longueur de chaîne carbonée varie de C14 à C17. Cette restriction vise à évaluer les risques potentiels pour la santé humaine ou l'environnement liés à la fabrication, à l'utilisation ou au commerce de ces substances. La paraffine chlorée à chaîne moyenne est utilisée dans les fluides de travail des métaux comme agent extrême pression pour les opérations difficiles, protégeant les outils et les composants contre les frottements, l'usure et la surchauffe à des vitesses et des pressions élevées.

Portée du marché des additifs pour fluides de travail des métaux en Amérique du Nord

Le marché nord-américain des additifs pour fluides de travail des métaux est segmenté en quatre segments notables en fonction du type d'additif, de l'application, de l'activité de travail des métaux et de l'utilisation finale. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Type d'additif

- Additifs tensioactifs et émulsifiants

- Inhibiteurs de corrosion

- Additifs pour pression extrême

- Stabilisateurs

- Antimousses

- Alcanolamines

- Agents antibuée

- Colorants/Teintures

- Autres

Sur la base du type d'additif, le marché est segmenté en additifs tensioactifs et émulsifiants, inhibiteurs de corrosion, additifs extrême pression, stabilisateurs, antimousses, alcanolamines, agents antibuée, colorants/colorants et autres.

Application

- Huiles solubles

- Huiles pures

- Fluides semi-synthétiques

- Fluides synthétiques

Sur la base de l’application, le marché est segmenté en huiles solubles, huiles pures, fluides semi-synthétiques et fluides synthétiques.

Activité métallurgique

- Fraisage

- Forage

- Affûtage

- Honing

- Tapotement

- Autres

Sur la base de l'activité de travail des métaux, le marché est segmenté en fraisage, perçage, meulage, rodage, taraudage et autres.

Utilisation finale

- Automobile

- Aérospatial

- Fabrication de machines et d'équipements

- Pouvoir et énergie

- Marin

- Autres

Sur la base de l'utilisation finale, le marché est segmenté en automobile, aérospatiale, fabrication de machines et d'équipements, électricité et énergie, marine et autres.

Marché des additifs pour fluides de travail des métaux en Amérique du Nord : analyse régionale

Le marché nord-américain des additifs pour fluides de travail des métaux est analysé et des informations sur la taille du marché sont fournies par type d’additif, application, activité de travail des métaux et utilisation finale, comme référencé ci-dessus.

Les pays couverts dans ce rapport de marché sont les États-Unis, le Canada et le Mexique.

Les États-Unis devraient dominer le marché en raison de l’industrialisation rapide et de la forte demande de produits manufacturés dans la région.

La section du rapport sur les pays fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs douaniers d'import-export sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché : marché nord-américain des additifs pour fluides de travail des métaux

Le paysage concurrentiel du marché des additifs pour fluides de travail des métaux en Amérique du Nord fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais cliniques, l'analyse de la marque, les approbations de produits, les brevets, la largeur et l'ampleur du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise par rapport au marché.

Certains des principaux acteurs couverts dans ce rapport sont The Lubrizol Corporation (États-Unis), Dow (États-Unis), Evonik Industries AG Ingevity et ses entités liées (États-Unis), Ashland (États-Unis), Italmatch Chemicals Sp. z o.o.), Colonial Chemical (États-Unis), Biosynthetic Technologies (États-Unis), DOVER CHEMICAL CORPORATION (États-Unis), Emery Oleochemicals (États-Unis), Pilot Chemical Corp. (États-Unis) et RT Vanderbilt Holding Company, Inc. (États-Unis), entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 REMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 EXPANDING AUTOMOTIVE, AEROSPACE, AND MACHINERY SECTORS

5.1.2 RISING QUALITY STANDARDS AND AUTOMATION IN INDUSTRIES

5.1.3 RISING ADDITIVE DEMAND IN CNC MACHINING

5.2 RESTRAINTS

5.2.1 SUPPLY CHAIN DISRUPTIONS IN THE METALWORKING FLUID ADDITIVES MARKET

5.2.2 INDUSTRIES SHIFTING TO TRADITIONAL DRY MACHINING

5.2.3 FLUCTUATION IN RAW MATERIAL PRICES

5.3 OPPORTUNITIES

5.3.1 TECHNOLOGICAL ADVANCEMENTS IN THE METALWORKING PROCESS

5.3.2 SHIFT TOWARDS ECO-FRIENDLY ADDITIVES

5.3.3 RISING PRODUCT INNOVATIONS IN METALWORKING FLUID ADDITIVES

5.4 CHALLENGES

5.4.1 ENVIRONMENTAL REGULATIONS AND SUSTAINABILITY FACTORS INVOLVED

5.4.2 STABILITY ASSOCIATED WITH METAL FORMING FLUID ADDITIVES

6 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET, BY ADDITIVE TYPE

6.1 OVERVIEW

6.2 SURFACTANT ADDITIVES AND EMULSIFIERS

6.2.1 SURFACTANT ADDITIVES AND EMULSIFIERS, BY CHEMICAL COMPOUNDS

6.2.1.1 ETHOXYLATED ALCOHOL

6.2.1.2 SULFONATES

6.2.1.3 ETHOXYLATED FATTY ACIDS AND ESTERS

6.2.1.4 AMINES

6.2.1.5 PHOSPHATE ESTERS

6.2.1.6 SORBITAN ESTERS

6.2.1.7 BIODEGRADABLE SURFACTANTS

6.2.1.8 POLYMERIC SURFACTANTS

6.2.1.9 OTHERS

6.3 CORROSION INHIBITORS

6.3.1 CORROSION INHIBITORS, BY CHEMICAL COMPOUNDS

6.3.1.1 AMINES

6.3.1.2 AZOLES

6.3.1.3 PHOSPHATES

6.3.1.4 NITRITES

6.3.1.5 PHOSPHONATES

6.3.1.6 CARBOXYLIC ACIDS

6.3.1.7 SULFONATES

6.3.1.8 OTHER COMPOUNDS

6.4 EXTREME PRESSURE ADDITIVES

6.4.1 EXTREME PRESSURE ADDITIVES, BY CHEMICAL COMPOUNDS

6.4.1.1 MOLYBDENUM DISULFIDE (MOS2)

6.4.1.2 GRAPHITE

6.4.1.3 PHOSPHORUS-CONTAINING COMPOUNDS

6.4.1.4 SULFUR-CONTAINING COMPOUNDS

6.4.1.5 SULFUR-PHOSPHORUS COMPOUNDS

6.4.1.6 CHLORINATED COMPOUNDS

6.4.1.7 BORON COMPOUNDS

6.4.1.8 POLYMERS

6.4.1.9 OTHERS

6.5 STABILIZERS

6.5.1 STABILIZERS, BY CHEMICAL COMPOUNDS

6.5.1.1 BIOCIDES

6.5.1.2 ANTIOXIDANTS

6.5.1.3 RUST INHIBITORS

6.5.1.4 DISPERSANTS

6.5.1.4.1 DISPERSANTS, BY TYPE

6.5.1.4.1.1 POLYMERIC DISPERSANTS

6.5.1.4.1.2 SURFACTANT-BASED DISPERSANTS

6.5.1.4.1.3 ORGANIC ACID DISPERSANTS

6.5.1.5 METAL DEACTIVATORS

6.5.1.6 OTHERS

6.6 ANTIFOAMERS

6.6.1 ANTIFOAMERS, BY CHEMICAL COMPOUNDS

6.6.1.1 SILICON-BASED ANTIFOAMERS

6.6.1.2 MINERAL OIL BASED ANTIFOAMERS

6.6.1.3 FATTY ACID ESTERS

6.6.1.4 POLYMER-BASED ANTIFOAMERS

6.6.1.5 HYDROPHOBIC SILICA

6.6.1.6 OTHERS

6.7 ALKANOLAMINES

6.7.1 ALKANOLAMINES, BY CHEMICAL COMPOUNDS

6.7.1.1 TRIETHANOLAMINE (TEA)

6.7.1.2 DIETHANOLAMINE (DEA)

6.7.1.3 MONOETHANOLAMINE (MEA)

6.7.1.4 METHYLDIETHANOLAMINE (MDEA)

6.7.1.5 DIISOPROPANOLAMINE (DIPA)

6.7.1.6 OTHERS

6.8 ANTIMIST AGENTS

6.8.1 ANTIMIST AGENTS, BY CHEMICAL COMPOUNDS

6.8.1.1 SILICON-BASED COMPOUNDS

6.8.1.2 FATTY ACID ETHOXYLATES

6.8.1.3 POLYMERIC ANTI-MIST AGENTS

6.8.1.4 AMINE DERIVATIVES

6.8.1.5 OTHERS

6.9 COLORANTS/DYES

6.1 OTHERS

7 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 SOLUBLE OILS

7.3 STRAIGHT OILS

7.4 SEMISYNTHETIC FLUIDS

7.5 SYNTHETIC FLUIDS

8 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET, BY METALWORKING ACTIVITY

8.1 OVERVIEW

8.2 MILLING

8.3 DRILLING

8.4 GRINDING

8.5 HONING

8.6 TAPPING

8.7 OTHERS

9 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET, BY END USE

9.1 OVERVIEW

9.2 AUTOMOTIVE

9.3 AEROSPACE

9.4 MACHINERY AND EQUIPMENT MANUFACTURING

9.5 POWER AND ENERGY

9.6 MARINE

9.7 OTHERS

10 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: BY COUNTRY

10.1 U.S.

10.2 CANADA

10.3 MEXICO

11 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.2 PARTNERSHIPS & CONTRACTS

11.3 EVENT

11.4 AWARD

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 THE LUBRIZOL CORPORATION (BERKSHIRE HATHAWAY INC.)

13.1.1 COMPANY SNAPSHOT

13.1.2 PRODUCT PORTFOLIO

13.1.3 RECENT DEVELOPMENT

13.2 DOW

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENT

13.3 INGEVITY AND ITS RELATED ENTITIES

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENT

13.4 EVONIK INDUSTRIES AG

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 FUCHS

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENT

13.6 ASHLAND

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 BIOSYNTHETIC TECHNOLOGIES

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 BP P.L.C.

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENT

13.9 COLONIAL CHEMICAL

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 CLARIANT

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENT

13.11 DOVER CHEMICAL CORPORATION

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 EMERY OLEOCHEMICALS

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 ITALMATCH CHEMICALS S.P.A

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.14 KAO CORPORATION

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENT

13.15 LANXESS

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENT

13.16 PILOT CHEMICAL

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENT

13.17 R.T. VANDERBILT HOLDING COMPANY, INC.

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 SOLVAY

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT DEVELOPMENT

13.19 UMICORE

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT DEVELOPMENT

13.2 ZSCHIMMER & SCHWARZ, INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET, BY ADDITIVE TYPE, 2021-2030 (USD THOUSAND)

TABLE 2 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET, BY ADDITIVE TYPE, 2021-2030 (TONS)

TABLE 3 NORTH AMERICA SURFACTANT ADDITIVES AND EMULSIFIERS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA CORROSION INHIBITORS IN METALWORKING FLUID ADDITIVS MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA EXTREME PRESSURE ADDITIVES IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA STABILIZERS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA DISPERSANTS IN METALWORKING FLUID ADDITIVES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA ANTIFOAMERS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA ALKANOLAMINES IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA ANTIMIST AGENTS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET, BY METALWORKING ACTIVITY, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 16 U.S. METALWORKING FLUID ADDITIVES MARKET, BY ADDITIVE TYPE, 2021-2030 (USD THOUSAND)

TABLE 17 U.S. METALWORKING FLUID ADDITIVES MARKET, BY ADDITIVE TYPE, 2021-2030 (TONS)

TABLE 18 U.S. SURFACTANT ADDITIVES AND EMULSIFIERS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 19 U.S. CORROSION INHIBITORS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 20 U.S. EXTREME PRESSURE ADDITIVES IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 21 U.S. STABILIZERS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 22 U.S. DISPERSANTS IN METALWORKING FLUID ADDITIVES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 U.S. ANTIFOAMERS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 24 U.S. ALKANOLAMINES IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 25 U.S. ANTIMIST AGENTS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 26 U.S. METALWORKING FLUID ADDITIVES MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 27 U.S. METALWORKING FLUID ADDITIVES MARKET, BY METALWORKING ACTIVITY, 2021-2030 (USD THOUSAND)

TABLE 28 U.S. METALWORKING FLUID ADDITIVES MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 29 CANADA METALWORKING FLUID ADDITIVES MARKET, BY ADDITIVE TYPE, 2021-2030 (USD THOUSAND)

TABLE 30 CANADA METALWORKING FLUID ADDITIVES MARKET, BY ADDITIVE TYPE, 2021-2030 (TONS)

TABLE 31 CANADA SURFACTANT ADDITIVES AND EMULSIFIERS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 32 CANADA CORROSION INHIBITORS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 33 CANADA EXTREME PRESSURE ADDITIVES IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 34 CANADA STABILIZERS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 35 CANADA DISPERSANTS IN METALWORKING FLUID ADDITIVES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 CANADA ANTIFOAMERS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 37 CANADA ALKANOLAMINES IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 38 CANADA ANTIMIST AGENTS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 39 CANADA METALWORKING FLUID ADDITIVES MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 40 CANADA METALWORKING FLUID ADDITIVES MARKET, BY METALWORKING ACTIVITY, 2021-2030 (USD THOUSAND)

TABLE 41 CANADA METALWORKING FLUID ADDITIVES MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 42 MEXICO METALWORKING FLUID ADDITIVES MARKET, BY ADDITIVE TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 MEXICO METALWORKING FLUID ADDITIVES MARKET, BY ADDITIVE TYPE, 2021-2030 (TONS)

TABLE 44 MEXICO SURFACTANT ADDITIVES AND EMULSIFIERS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 45 MEXICO CORROSION INHIBITORS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 46 MEXICO EXTREME PRESSURE ADDITIVES IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 47 MEXICO STABILIZERS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 48 MEXICO DISPERSANTS IN METALWORKING FLUID ADDITIVES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 MEXICO ANTIFOAMERS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 50 MEXICO ALKANOLAMINES IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 51 MEXICO ANTIMIST AGENTS IN METALWORKING FLUID ADDITIVES MARKET, BY CHEMICAL COMPOUNDS, 2021-2030 (USD THOUSAND)

TABLE 52 MEXICO METALWORKING FLUID ADDITIVES MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 53 MEXICO METALWORKING FLUID ADDITIVES MARKET, BY METALWORKING ACTIVITY, 2021-2030 (USD THOUSAND)

TABLE 54 MEXICO METALWORKING FLUID ADDITIVES MARKET, BY END USE, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: NORTH AMERICA VS GLOBAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: SEGMENTATION

FIGURE 10 RISING ADDITIVE DEMAND IN CNC MACHINING IS DRIVING THE GROWTH OF THE NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET IN THE FORECAST PERIOD

FIGURE 11 THE SURFACTANT ADDITIVES AND EMULSIFIERS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET IN 2023 AND 2030

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET

FIGURE 13 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: BY ADDITIVE TYPE, 2022

FIGURE 14 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: BY APPLICATION, 2022

FIGURE 15 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: BY METALWORKING ACTIVITY, 2022

FIGURE 16 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: BY END USE, 2022

FIGURE 17 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: SNAPSHOT (2022)

FIGURE 18 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.