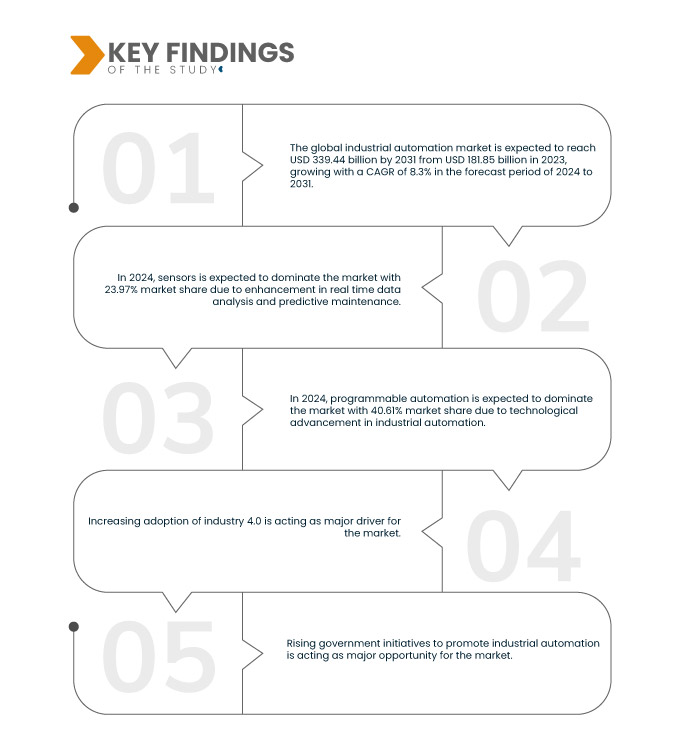

L’adoption croissante des principes de l’industrie 4.0 constitue un moteur important pour le marché mondial de l’automatisation industrielle. L'Industrie 4.0, également reconnue comme la quatrième révolution industrielle, met l'accent sur l'intégration des technologies numériques aux processus de fabrication traditionnels pour améliorer l'efficacité, la productivité et la flexibilité. L'un des éléments clés de l'industrie 4.0 est la mise en œuvre de solutions d'automatisation avancées, telles que la robotique, les technologies avancées. capteurset le cloud computing, dans divers secteurs. Ces technologies permettent une communication et une collaboration transparentes entre les machines, les systèmes et les humains, conduisant à des opérations rationalisées et à des processus décisionnels améliorés.

Accéder au rapport complet @https://www.databridgemarketresearch.com/reports/global-industrial-automation-market

Data Bridge Market Research analyse que le Marché mondial de l’automatisation industrielle devrait atteindre une valeur de 339,44 milliards USD d’ici 2031, contre 181,85 milliards en 2023, avec une croissance à un TCAC de 8,3 % au cours de la période de prévision de 2024 à 2031.

Principales conclusions de l'étude

Demande croissante d’automatisation pour une fabrication fiable et efficace

L'industrie mondiale automatisation Le marché connaît une augmentation significative de la demande, principalement motivée par le besoin de processus de fabrication fiables et efficaces. Les technologies d'automatisation sont devenues de plus en plus sophistiquées, offrant aux fabricants la possibilité de rationaliser leurs opérations, d'améliorer leur productivité et de réduire leurs coûts. L’un des principaux facteurs à l’origine de cette tendance est la demande croissante de solutions d’automatisation capables de relever les défis de la fabrication moderne, tels que le besoin de précision, de flexibilité et d’évolutivité.

Dans le paysage commercial hautement concurrentiel d'aujourd'hui, les fabricants sont contraints d'améliorer leur efficacité et leur productivité tout en maintenant des normes de qualité élevées. Les technologies d'automatisation offrent une solution en automatisant les tâches répétitives, en optimisant les flux de travail et en minimisant le risque d'erreurs. Cela conduit non seulement à une production plus élevée et à des produits de meilleure qualité, mais permet également aux entreprises d'allouer les ressources plus efficacement, ce qui entraîne des économies de coûts et une meilleure rentabilité.

Portée du rapport et segmentation du marché

|

Mesure du rapport

|

Détails

|

|

Période de prévision

|

2024 à 2031

|

|

Année de référence

|

2023

|

|

Années historiques

|

2022 (personnalisable jusqu'en 2016-2021)

|

|

Unités quantitatives

|

Chiffre d’affaires en milliards USD

|

|

Segments couverts

|

Composants (capteurs, robots industriels, PC industriels, vision industrielle, impression 3D industrielle, interface homme-machine (IHM), instruments de terrain, vannes de contrôle et autres), mode d'automatisation (semi-automatisation et entièrement automatisation), systèmes ( PID, contrôle basé sur un modèle et autres), solution (automate programmable (PLC), système de contrôle distribué (DCS), contrôle de supervision et acquisition de données (SCADA), contrôles de niveau entreprise, contrôle d'automatisation programmable (PAC), gestion des actifs de l'usine ( PAM), numérisation, sécurité fonctionnelle, contrôle des émissions), type (automatisation programmable, automatisation fixe ou matérielle, automatisation intégrée et automatisation flexible ou douce), utilisateur final (industries de transformation et industries discrètes)

|

|

Pays couverts

|

États-Unis, Canada, Mexique, Allemagne, France, Royaume-Uni, Pays-Bas, Suisse, Belgique, Russie, Italie, Espagne, Suède, Danemark, Pologne, Norvège, Finlande, Turquie, Reste de l'Europe, Chine, Japon, Inde, Corée du Sud, Singapour , Malaisie, Australie, Thaïlande, Indonésie, Philippines, Nouvelle-Zélande, Taïwan, Vietnam, reste de l'Asie-Pacifique, Arabie saoudite, Émirats arabes unis, Afrique du Sud, Égypte, Israël, Qatar, Bahreïn, Koweït, Oman, reste du Moyen-Orient et d'Afrique. , Brésil, Argentine et reste de l'Amérique du Sud

|

|

Acteurs du marché couverts

|

Siemens (Allemagne), Analog Devices, Inc. (États-Unis), Schneider Electric (France), General Electric Company (États-Unis), Mitsubishi Electric Corporation (Japon), FANUC America Corporation (États-Unis), Honeywell International Inc. (États-Unis), AMETEK Inc. (États-Unis), ABB (Suisse), KEYENCE CORPORATION (Japon), Hitachi Vantara LLC (États-Unis), Rockwell Automation (États-Unis), Emerson Electric Co (États-Unis), Yokogawa Electric Corporation (Japon), Delta Electronics, Inc. ( Taiwan), Fuji Electric Co., Ltd. (Japon), Endress+Hauser Group Services AG (Suisse), OMRON Corporation (Japon), KUKA AG (Allemagne), Bosch Rexroth Corporation (Allemagne), Concept Systems (États-Unis) et MachineMetrics (États-Unis), entre autres

|

|

Points de données couverts dans le rapport

|

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie d'experts, une production géographiquement représentée par l'entreprise et capacité, configuration du réseau de distributeurs et de partenaires, analyse détaillée et mise à jour des tendances des prix et analyse des déficits de la chaîne d'approvisionnement et de la demande

|

Analyse sectorielle

Le marché mondial de l’automatisation industrielle est segmenté en six segments notables, basés sur les composants, le mode d’automatisation, les systèmes, la solution, le type et l’utilisateur final.

- Sur la base des composants, le marché mondial de l'automatisation industrielle est segmenté en capteurs, robots industriels, PC industriels, vision industrielle, impression 3D industrielle, interface homme-machine (IHM), instruments de terrain, vannes de régulation et autres.

En 2024, des capteurs le segment devrait dominer le marché mondial de l’automatisation industrielle

En 2024, le segment des capteurs devrait dominer le marché mondial de l’automatisation industrielle avec une part de marché de 23,97 % en raison de la demande croissante d’automatisation pour une fabrication fiable et efficace.

- Sur la base du mode d’automatisation, le marché mondial de l’automatisation industrielle est segmenté en semi-automatisation et entièrement automatisation. En 2024, le segment de la semi-automatisation devrait dominer le marché avec 64,06 % de part de marché.

- Sur la base des systèmes, le marché mondial de l’automatisation industrielle est segmenté en PID, contrôle basé sur un modèle et autres. En 2024, le segment PID devrait dominer le marché avec une part de marché de 72,56 %

- Sur la base de la solution, le marché mondial de l'automatisation industrielle est segmenté en contrôleur logique programmable (PLC), système de contrôle distribué (DCS), contrôle de supervision et acquisition de données (SCADA), contrôles au niveau de l'entreprise, contrôle d'automatisation programmable (PAC), actifs d'usine. Gestion (PAM), numérisation, sécurité fonctionnelle et contrôle des émissions. En 2024, le segment des contrôleurs logiques programmables (PLC) devrait dominer le marché avec 27,92 % de part de marché.

- Sur la base du type, le marché mondial de l’automatisation industrielle est segmenté en automatisation programmable, automatisation fixe ou matérielle, automatisation intégrée et automatisation flexible ou douce.

En 2024, le segment de l’automatisation programmable devrait dominer le marché mondial de l’automatisation industrielle.

En 2024, le segment de l’automatisation programmable devrait dominer le marché avec une part de marché de 40,61 % en raison des progrès technologiques en matière d’automatisation industrielle.

- Sur la base de l’utilisateur final, le marché mondial de l’automatisation industrielle est segmenté en industries de transformation et industries discrètes. En 2024, le segment des industries de transformation devrait dominer le marché avec une part de marché de 71,28 %.

Acteurs majeurs

Data Bridge Market Research analyse Siemens (Allemagne), Schneider Electric (France), General Electric (États-Unis), FANUC America Corporation (États-Unis), Mitsubishi Electric Corporation (Japon) comme les principaux acteurs opérant sur le marché mondial de l’automatisation industrielle.

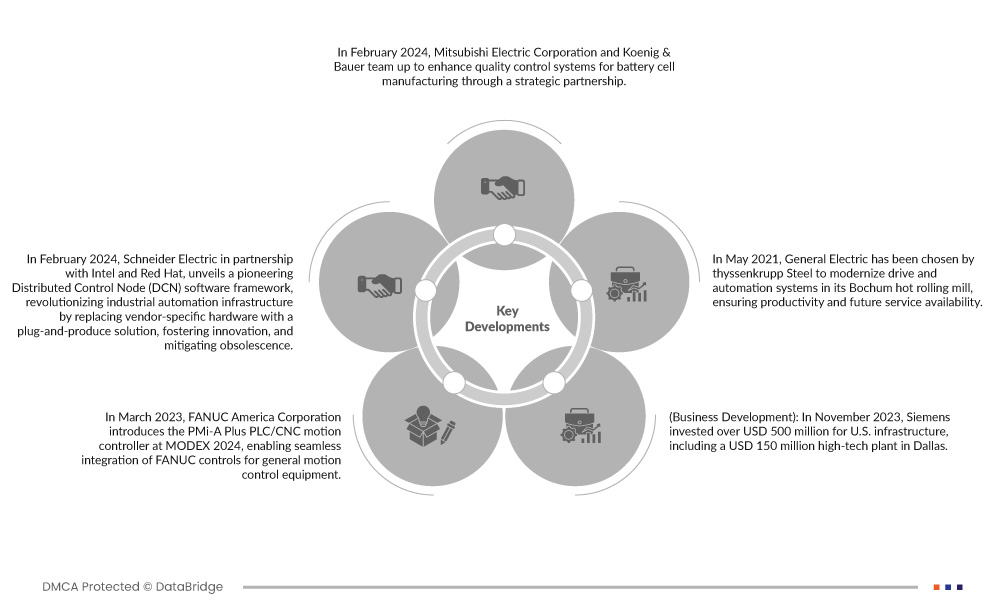

Développement du marché

- En février 2024, Mitsubishi Electric Corporation et Koenig & Bauer s'associent pour améliorer les systèmes de contrôle qualité pour la fabrication de cellules de batterie grâce à un partenariat stratégique. Tirant parti de l'expertise CIS de Mitsubishi Electric et des systèmes de vision industrielle en ligne de Koenig & Bauer, la collaboration vise à rationaliser la production de feuilles d'électrode pour améliorer l'efficacité et la fiabilité de la fabrication de batteries.

- En février 2024, Schneider Electric, en partenariat avec Intel et Red Hat, dévoile un cadre logiciel pionnier de nœud de contrôle distribué (DCN), révolutionnant l'infrastructure d'automatisation industrielle en remplaçant le matériel spécifique du fournisseur par une solution plug-and-product, favorisant l'innovation et atténuant obsolescence. Cet effort de collaboration incarne une vision avant-gardiste, alignée sur les objectifs de l'Open Process Automation Forum, visant à doter les entreprises industrielles d'une technologie interopérable et portable, façonnant l'avenir des systèmes de contrôle industriels.

- En mars 2023, FANUC America Corporation présente le contrôleur de mouvement PLC/CNC PMi-A Plus au MODEX 2024, permettant une intégration transparente des commandes FANUC pour les équipements généraux de contrôle de mouvement. Cette démonstration met en valeur la synergie entre les gammes de produits d'automatisation industrielle et de cobot de FANUC, offrant une solution complète d'entrepôt automatisé pour l'industrie de la chaîne d'approvisionnement.

- En novembre 2023, Siemens a investi plus de 500 millions de dollars dans les infrastructures américaines, dont une usine de haute technologie de 150 millions de dollars à Dallas. L'investissement soutiendra l'Amérique centres de données et les infrastructures critiques, répondant à la demande croissante alimentée par l’adoption de l’IA générative. Roland Busch, PDG de Siemens AG, souligne l'importance de cette décision pour le soutien de l'économie et les progrès de la décarbonation.

- En mai 2021, General Electric a été choisi par thyssenkrupp Steel pour moderniser les systèmes d'entraînement et d'automatisation de son laminoir à chaud de Bochum, garantissant ainsi la productivité et la disponibilité future des services. Avec un projet en trois étapes, y compris le remplacement des convertisseurs de vitesse et des systèmes de contrôle, la mise à niveau améliorera l'efficacité et minimisera les temps d'arrêt, ce qui est crucial pour maintenir l'intégrité de la production et réduire les retards.

Analyse régionale

Géographiquement, les pays couverts dans le rapport sur le marché mondial de l’automatisation industrielle sont les États-Unis, le Canada, le Mexique, l’Allemagne, la France, le Royaume-Uni, les Pays-Bas, la Suisse, la Belgique, la Russie, l’Italie, l’Espagne, la Suède, le Danemark, la Pologne, la Norvège, la Finlande, la Turquie et le reste. pays d'Europe, Chine, Japon, Inde, Corée du Sud, Singapour, Malaisie, Australie, Thaïlande, Indonésie, Philippines, Nouvelle-Zélande, Taïwan, Vietnam, reste de l'Asie-Pacifique, Arabie Saoudite, Émirats arabes unis, Afrique du Sud, Égypte, Israël, Qatar , Bahreïn, le Koweït, Oman, le reste du Moyen-Orient et l'Afrique, le Brésil, l'Argentine et le reste de l'Amérique du Sud.

Selon l’analyse de l’étude de marché Data Bridge :

L’Asie-Pacifique devrait être la région dominante et à la croissance la plus rapide sur le marché mondial de l’automatisation industrielle.

L’Asie-Pacifique devrait être la région dominante et à la croissance la plus rapide en le marché de l'automatisation industrielle en raison de son secteur manufacturier en expansion rapide, des progrès technologiques et de l'adoption croissante de solutions d'automatisation. Cette domination est en outre alimentée par les initiatives gouvernementales promouvant l'Industrie 4.0, favorisant un environnement propice à l'adoption de l'automatisation dans divers secteurs, renforçant ainsi la position de l'Asie-Pacifique en tant qu'acteur clé dans le paysage mondial de l'automatisation industrielle.

Pour des informations plus détaillées sur le marché mondial de l’automatisation industrielle rapport, cliquez ici –https://www.databridgemarketresearch.com/reports/global-industrial-automation-market