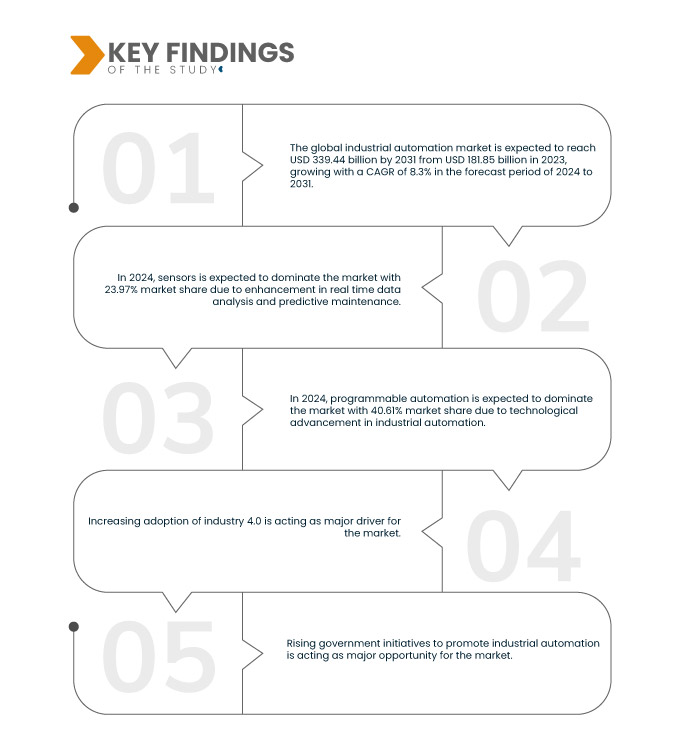

The increasing adoption of industry 4.0 principles is serving as a significant driving force for the global industrial automation market. Industry 4.0, also acknowledged as the fourth industrial revolution, emphasizes the integration of digital technologies with traditional manufacturing processes to enhance efficiency, productivity, and flexibility. One of the key components of industry 4.0 is the implementation of advanced automation solutions, such as robotics, advanced sensors, and cloud computing, across various industries. These technologies allow seamless communication and collaboration between machines, systems, and humans, leading to streamlined operations and improved decision-making processes.

Access full Report @ https://www.databridgemarketresearch.com/reports/global-industrial-automation-market

Data Bridge Market Research analyses that the Global Industrial Automation Market is expected to reach a value of USD 339.44 billion by 2031 from 181.85 billion in 2023, growing at a CAGR of 8.3% during the forecast period of 2024 to 2031.

Key Findings of the Study

Growing Demand of Automation for Reliable and Efficient Manufacturing

The global industrial automation market is experiencing a significant surge in demand, primarily driven by the need for reliable and efficient manufacturing processes. Automation technologies have become increasingly sophisticated, offering manufacturers the ability to streamline operations, improve productivity, and reduce costs. One of the key driving factors behind this trend is the growing demand for automation solutions that can address the challenges of modern manufacturing, such as the need for precision, flexibility, and scalability.

In today's highly competitive business landscape, manufacturers are under pressure to improve their efficiency and productivity while maintaining high standards of quality. Automation technologies offer a solution by automating repetitive tasks, optimizing workflows, and minimizing the risk of errors. This not only leads to higher output and better quality products but also allows companies to allocate resources more effectively, leading to cost savings and improved profitability.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016-2021)

|

|

Quantitative Units

|

Revenue in USD Billion

|

|

Segments Covered

|

Components (Sensors, Industrial Robots, Industrial PC, Machine Vision, Industrial 3D Printing, Human-Machine Interface (HMI), Field Instruments, Control Valves, and Others), Mode of Automation (Semi-Automation and Fully-Automation), Systems (PID, Model Based Control, and Others), Solution (Programmable Logic Controller (PLC), Distributed Control System (DCS), Supervisory Control and Data Acquisition (SCADA), Enterprise Level Controls, Programmable Automation Control (PAC), Plant Asset Management (PAM), Digitalization, Functional Safety, Emission Control), Type (Programmable Automation, Fixed or Hard Automation, Integrated Automation, and Flexible or Soft Automation), End User (Process Industries and Discrete Industries)

|

|

Countries Covered

|

U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Sweden, Denmark, Poland, Norway, Finland, Turkey, Rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, New Zealand, Taiwan, Vietnam, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Qatar, Bahrain, Kuwait, Oman, Rest of Middle East and Africa, Brazil, Argentina and Rest of South America

|

|

Market Players Covered

|

Siemens (Germany), Analog Devices, Inc. (U.S.), Schneider Electric (France), General Electric Company (U.S.), Mitsubishi Electric Corporation (Japan), FANUC America Corporation (U.S.), Honeywell International Inc. (U.S.), AMETEK Inc. (U.S.), ABB (Switzerland), KEYENCE CORPORATION (Japan), Hitachi Vantara LLC (U.S.), Rockwell Automation (U.S.), Emerson Electric Co (U.S.), Yokogawa Electric Corporation (Japan), Delta Electronics, Inc. (Taiwan), Fuji Electric Co., Ltd. (Japan), Endress+Hauser Group Services AG (Switzerland), OMRON Corporation (Japan), KUKA AG (Germany), Bosch Rexroth Corporation (Germany), Concept Systems (U.S.), and MachineMetrics (U.S.), among others

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand

|

Segment Analysis

The global industrial automation market is segmented into six notable segments, which are based on components, mode of automation, systems, solution, type and end user.

- On the basis of components, the global industrial automation market is segmented into sensors, industrial robots, industrial PC, machine vision, industrial 3D printing, Human-Machine Interface (HMI), field instruments, control valves and others

In 2024, sensors segment is expected to dominate the Global Industrial Automation Market

In 2024, sensors segment is expected to dominate the global industrial automation market with 23.97% market share due to growing demand of automation for reliable and efficient manufacturing.

- On the basis of mode of automation, the global industrial automation market is segmented into semi-automation and fully-automation. In 2024, semi-automation segment is expected to dominate the market with 64.06% market share

- On the basis of systems, the global industrial automation market is segmented into PID, model based control and others. In 2024, PID segment is expected to dominate the market with 72.56% market share

- On the basis of solution, the global industrial automation market is segmented into Programmable Logic Controller (PLC), Distributed Control System (DCS), Supervisory Control and Data Acquisition (SCADA), enterprise level controls, Programmable Automation Control (PAC), Plant Asset Management (PAM), digitalization, functional safety and emission control. In 2024, Programmable Logic Controller (PLC) segment is expected to dominate the market with 27.92% market share

- On the basis of type, the global industrial automation market is segmented into programmable automation, fixed or hard automation, integrated automation and flexible or soft automation

In 2024, programmable automation segment is expected to dominate the Global Industrial Automation Market

In 2024, programmable automation segment is expected to dominate the market with 40.61% market share due to technological advancement in industrial automation.

- On the basis of end user, the global industrial automation market is segmented into process industries and discrete industries. In 2024, process industries segment is expected to dominate the market with 71.28% market share

Major Players

Data Bridge Market Research analyzes Siemens (Germany), Schneider Electric (France), General Electric (U.S.), FANUC America Corporation (U.S.), Mitsubishi Electric Corporation (Japan) as the major players operating in global industrial automation market.

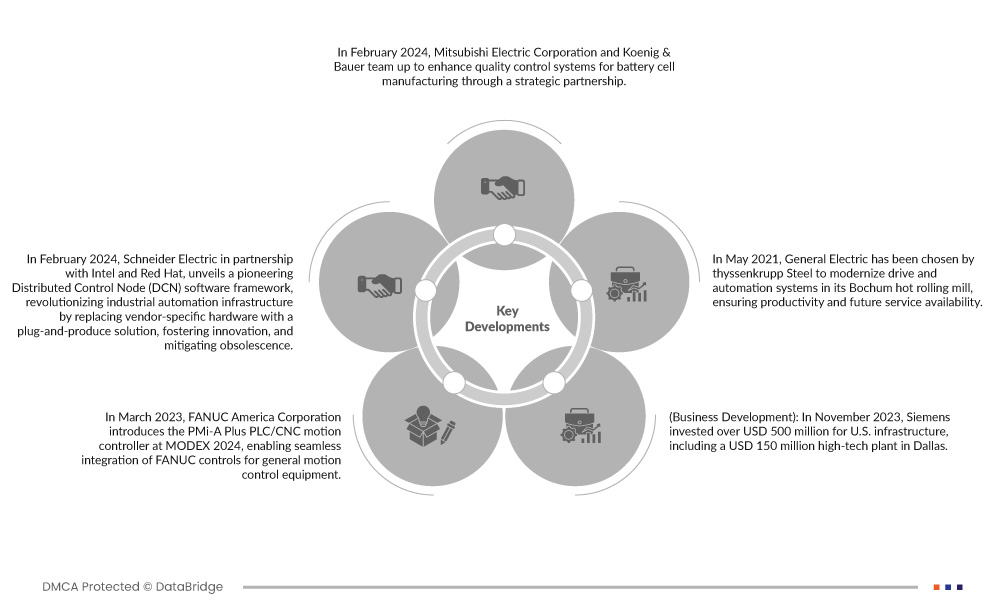

Market Development

- In February 2024, Mitsubishi Electric Corporation and Koenig & Bauer team up to enhance quality control systems for battery cell manufacturing through a strategic partnership. Leveraging Mitsubishi Electric's CIS expertise and Koenig & Bauer's inline machine vision systems, the collaboration aims to streamline electrode foil production for improved efficiency and reliability in battery manufacturing

- In February 2024, Schneider Electric in partnership with Intel and Red Hat, unveils a pioneering Distributed Control Node (DCN) software framework, revolutionizing industrial automation infrastructure by replacing vendor-specific hardware with a plug-and-produce solution, fostering innovation, and mitigating obsolescence. This collaborative effort embodies a forward-looking vision, aligning with the Open Process Automation Forum's objectives, to empower industrial businesses with interoperable, portable technology, shaping the future of industrial control systems

- In March 2023, FANUC America Corporation introduces the PMi-A Plus PLC/CNC motion controller at MODEX 2024, enabling seamless integration of FANUC controls for general motion control equipment. This demonstration showcases the synergy between FANUC's factory automation and cobot product lines, offering a comprehensive automated warehouse solution for the supply chain industry

- In November 2023, Siemens invested over USD 500 million for U.S. infrastructure, including a USD 150 million high-tech plant in Dallas. The investment will support American data centers and critical infrastructure, meeting rising demand fueled by generative AI adoption. Roland Busch, CEO of Siemens AG, underscores the move's significance for economic backbone support and decarbonization progress

- In May 2021, General Electric has been chosen by thyssenkrupp Steel to modernize drive and automation systems in its Bochum hot rolling mill, ensuring productivity and future service availability. With a project spanning three stages, including the replacement of drive converters and control systems, the upgrade will enhance efficiency and minimize downtime, crucial for maintaining production integrity and reducing delays

Regional Analysis

Geographically, the countries covered in the global industrial automation market report are U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Sweden, Denmark, Poland, Norway, Finland, Turkey, rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, New Zealand, Taiwan, Vietnam, rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Qatar, Bahrain, Kuwait, Oman, rest of Middle East and Africa, Brazil, Argentina and rest of South America.

As per Data Bridge Market Research analysis:

Asia-Pacific is expected to be the dominant and fastest growing region in the Global Industrial Automation Market

Asia-Pacific is expected to be the dominant and fastest growing region in the industrial automation market due to its rapidly expanding manufacturing sector, technological advancements, and increasing adoption of automation solutions. This dominance is further fueled by government initiatives promoting Industry 4.0, fostering a conducive environment for automation adoption across various sectors, solidifying Asia-Pacific's position as a key player in the global industrial automation landscape.

For more detailed information about global industrial automation market report, click here – https://www.databridgemarketresearch.com/reports/global-industrial-automation-market