Le marché européen des soins de santé à domicile englobe une gamme de services médicaux et non médicaux fournis aux individus dans le confort de leur foyer. Il propose divers services de santé, notamment des soins infirmiers qualifiés, des thérapies par perfusion à domicile et des aides-soignants à domicile. Les services infirmiers et thérapeutiques qualifiés constituent des segments dominants, répondant aux besoins post-hospitalisation et à la gestion des maladies chroniques. Ces services permettent aux patients de récupérer et de gérer leurs conditions dans le confort de leur foyer, réduisant ainsi les séjours à l'hôpital. Le marché était caractérisé par des entreprises et des startups établies proposant des solutions innovantes pour répondre à la demande croissante de services de soins de santé à domicile.

Accédez au rapport complet sur https://www.databridgemarketresearch.com/reports/europe-home-healthcare-market

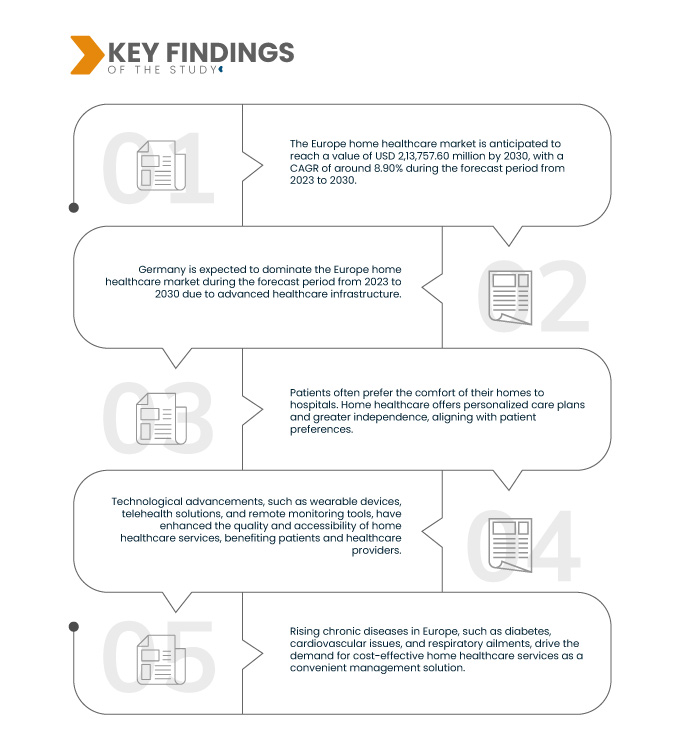

Data Bridge Market Research analyse que le Marché européen des soins de santé à domicile devrait croître à un TCAC de 8,90 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 2 13 757,60 millions de dollars d'ici 2030, contre 1 08 068,35 millions de dollars en 2022. Le vieillissement de la population européenne est lié à l'augmentation des maladies chroniques et des maladies chroniques à long terme. -les besoins en soins de longue durée, stimulant la demande de services de soins de santé à domicile. Ce changement démographique alimente la croissance du marché des soins à domicile.

Principales conclusions de l'étude

La large disponibilité des politiques de remboursement devrait stimuler le taux de croissance du marché

Le marché européen des soins de santé à domicile bénéficie de la large disponibilité des politiques de remboursement. Les programmes de financement obligatoires financés par le gouvernement couvrent plus de 75 % des coûts des soins ambulatoires, encourageant ainsi le passage des soins hospitaliers aux soins ambulatoires. Dans de nombreux pays européens, les services ambulatoires spécialisés et les services de soins primaires sont essentiellement gratuits au point d'utilisation, ce qui facilite un meilleur accès et un meilleur prix pour les patients. Ces politiques de remboursement favorables sont des moteurs clés de la croissance du marché.

Portée du rapport et segmentation du marché

|

Mesure du rapport

|

Détails

|

|

Période de prévision

|

2023 à 2030

|

|

Année de référence

|

2022

|

|

Années historiques

|

2021 (personnalisable jusqu'en 2015-2020)

|

|

Unités quantitatives

|

Chiffre d'affaires en millions USD, volumes en unités, prix en USD

|

|

Segments couverts

|

Type (appareils, services, logiciels), maladie (maladies cardiaques,Hypertension, Maladies des os et des articulations, diabète, maladies pulmonaires obstructives chroniques, obésité, démence/maladie d'Alzheimer, maladies infectieuses (VIH/SIDA), Maladies de Parkinson, Tabagisme, Asthme, Dépression), Canal de distribution (Appels d'offres directs, Vente au détail)

|

|

Pays couverts

|

Allemagne, France, Royaume-Uni, Pays-Bas, Suisse, Belgique, Russie, Italie, Espagne, Turquie, Reste de l'Europe en Europe.

|

|

Acteurs du marché couverts

|

Koninklijke Philips NV (États-Unis), Omron Healthcare, Inc. (Japon), Air Liquide (France), B. Braun Melsungen AG (Allemagne), Medtronic (Irlande), DaVita Inc. (États-Unis), Cardinal Health (États-Unis), Sunrise Medical (États-Unis), General Electric (États-Unis), A&D Company, Limited (Japon), BAYADA Home Health Care (États-Unis), Invacare Corporation (États-Unis), GE Healthcare (Royaume-Uni), Baxter (États-Unis), F. Hoffmann-La Roche Ltd (Suisse), Bupa Home Healthcare, Ltd (Royaume-Uni), Healthcare at Home (Royaume-Uni) et Linde plc (Allemagne)

|

|

Points de données couverts dans le rapport

|

En plus des informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie d'experts, l'épidémiologie des patients, une analyse du pipeline, une analyse des prix, et le cadre réglementaire.

|

Analyse sectorielle :

Le marché européen des soins de santé à domicile est segmenté en fonction du type, de la maladie et du canal de distribution.

- Sur la base du type, le marché européen des soins de santé à domicile est segmenté en appareils, services et logiciels.

- Sur la base des maladies, le marché européen des soins de santé à domicile est segmenté en maladies cardiaques, hypertension, maladies des os et des articulations, diabète, maladies pulmonaires obstructives chroniques, obésité, démence/maladie d'Alzheimer, maladies infectieuses (VIH/sida), maladies de Parkinson, tabagisme. , l'asthme et la dépression.

- Sur la base du canal de distribution, le marché européen des soins de santé à domicile est segmenté en appels d'offres directs et ventes au détail.

Acteurs majeurs

Data Bridge Market Research reconnaît les sociétés suivantes comme les principaux acteurs du marché européen des soins de santé à domicile : BAYADA Home Health Care (États-Unis), Invacare Corporation (États-Unis), GE Healthcare (Royaume-Uni), Baxter (États-Unis), F. Hoffmann. -La Roche Ltd (Suisse), Bupa Home Healthcare, Ltd (Royaume-Uni), Healthcare at Home (Royaume-Uni) et Linde plc (Allemagne).

Développements du marché

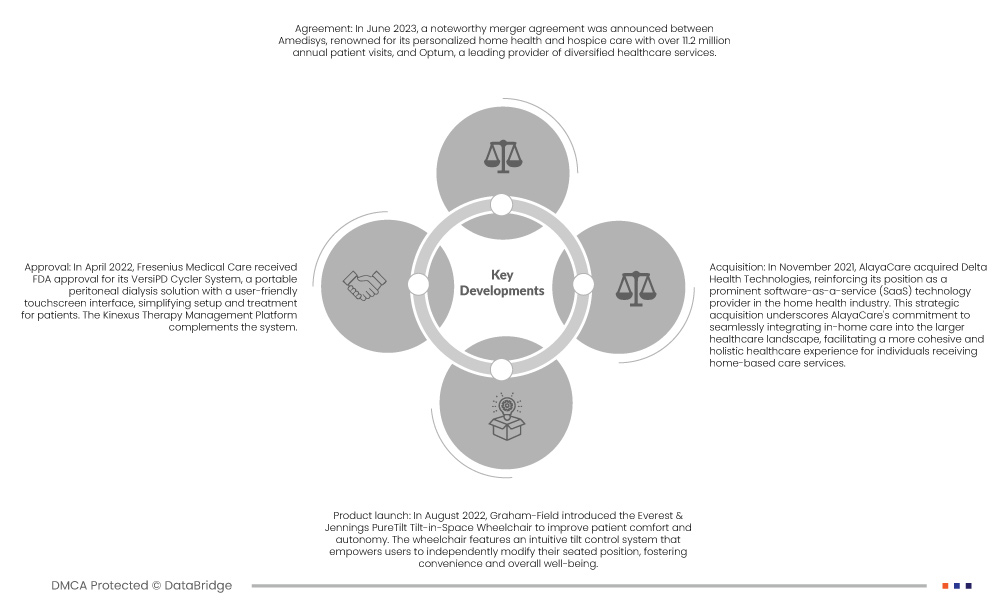

- En juin 2023, un accord de fusion remarquable a été annoncé entre Amedisys, réputé pour ses soins personnalisés à domicile et ses soins palliatifs avec plus de 11,2 millions de visites annuelles de patients, et Optum, l'un des principaux fournisseurs de services de santé diversifiés. Cette fusion marque une étape majeure dans le secteur de la santé, unissant deux entités de premier plan pour offrir une gamme élargie de solutions et de services de santé, promettant des avancées significatives dans l'industrie.

- En août 2022, Graham-Field a présenté le fauteuil roulant inclinable dans l'espace Everest & Jennings PureTilt pour améliorer le confort et l'autonomie des patients. Le fauteuil roulant est doté d'un système de contrôle d'inclinaison intuitif qui permet aux utilisateurs de modifier indépendamment leur position assise, favorisant ainsi la commodité et le bien-être général. Cette innovation améliore la mobilité et la qualité de vie des personnes à mobilité réduite.

- En avril 2022, Fresenius Medical Care a reçu l'approbation de la FDA pour son système VersiPD Cycler, une solution de dialyse péritonéale portable dotée d'une interface à écran tactile conviviale, simplifiant l'installation et le traitement pour les patients. La plateforme de gestion de thérapie Kinexus complète le système. Ce système de santé intégré exploite la connectivité et la gestion des données pour améliorer les soins aux patients, faisant ainsi progresser considérablement le traitement par dialyse.

- En novembre 2021, AlayaCare a acquis Delta Health Technologies, renforçant ainsi sa position de fournisseur de premier plan de technologie Software-as-a-Service (SaaS) dans le secteur de la santé à domicile. Cette acquisition stratégique souligne l'engagement d'AlayaCare à intégrer de manière transparente les soins à domicile dans le paysage plus large des soins de santé, facilitant ainsi une expérience de soins de santé plus cohérente et holistique pour les personnes recevant des services de soins à domicile.

Analyse régionale

Géographiquement, les pays couverts dans le rapport sur le marché européen des soins de santé à domicile sont l’Allemagne, la France, le Royaume-Uni, les Pays-Bas, la Suisse, la Belgique, la Russie, l’Italie, l’Espagne, la Turquie et le reste de l’Europe en Europe.

Selon l’analyse de l’étude de marché Data Bridge :

L’Allemagne devrait dominer le marché Marché européen des soins de santé à domicile au cours de la période de prévision 2023-2030

Le marché allemand des soins de santé à domicile est prêt à croître, porté par une population âgée importante, des infrastructures de santé avancées et des revenus disponibles plus élevés. Les initiatives gouvernementales visant à réduire les dépenses de santé grâce à des services de soins de santé à domicile améliorés ont encore stimulé le marché, ce qui a donné lieu à une part de marché importante pour les entreprises opérant dans le secteur.

Pour des informations plus détaillées sur le Rapport sur le marché européen des soins de santé à domicile, cliquez ici –https://www.databridgemarketresearch.com/reports/europe-home-healthcare-market