Asia Pacific Medical Imaging Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

23.60 Billion

USD

36.22 Billion

2024

2032

USD

23.60 Billion

USD

36.22 Billion

2024

2032

| 2025 –2032 | |

| USD 23.60 Billion | |

| USD 36.22 Billion | |

|

|

|

Segmentación del mercado de imágenes médicas de Asia y el Pacífico, por tipo (servicios y productos), modalidad (estacionaria y portátil), procedimiento (tomografía computarizada (TC), imágenes por rayos X, imágenes por resonancia magnética (IRM), ultrasonido, imágenes nucleares (SPECT/PET) y otros), tecnología (radiología digital directa y radiología computarizada), edad del paciente (adultos y pediátricos), aplicación (cardiología, pélvica y abdominal, oncología, mamografía, ginecología, neurología, urología, musculoesquelético, dental y otros), usuarios finales (hospitales, centros de diagnóstico, centros de imágenes, clínicas especializadas, centros quirúrgicos ambulatorios, institutos académicos y de investigación y otros) – Tendencias de la industria y pronóstico hasta 2032

Análisis del mercado de imágenes médicas

La imagenología médica se refiere a las técnicas y procesos utilizados para generar imágenes del cuerpo humano (o partes de él) para una variedad de aplicaciones clínicas, incluidas las operaciones médicas y el diagnóstico, así como la ciencia médica, que incluye el estudio de la anatomía y el funcionamiento normales. Es un subconjunto de la imagenología biológica que incluye la radiografía, la endoscopia, la termografía, la fotografía médica y la microscopía en un sentido más amplio. Las técnicas de medición y registro como la electroencefalografía (EEG) y la magnetoencefalografía (MEG) son ejemplos de imagenología médica, ya que crean datos que se pueden representar como mapas en lugar de imágenes.

Tamaño del mercado de imágenes médicas

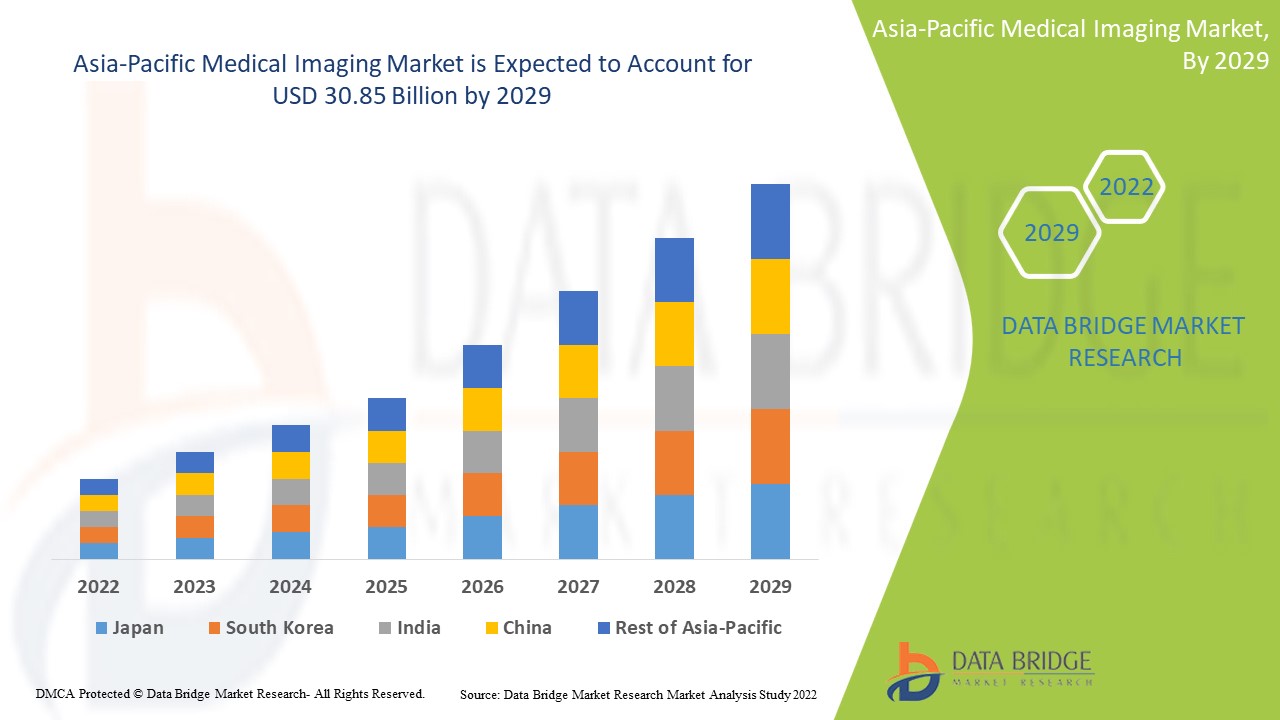

El tamaño del mercado de imágenes médicas de Asia y el Pacífico se valoró en USD 23,60 mil millones en 2024 y se proyecta que alcance los USD 36,22 mil millones para 2032, con una CAGR del 5,50% durante el período de pronóstico de 2025 a 2032.

Alcance del informe y segmentación del mercado

|

Atributos |

Perspectivas clave del mercado de imágenes médicas |

|

Segmentación |

|

|

Países cubiertos |

China, Japón, India, Corea del Sur, Singapur, Malasia, Australia, Tailandia, Indonesia, Filipinas, Resto de Asia-Pacífico (APAC) en Asia-Pacífico (APAC) |

|

Actores clave del mercado |

Koninklijke Philips NV (Países Bajos), RamSoft, Inc. (Canadá), InHealth Group (Reino Unido), Radiology Reports online (EE. UU.), Siemens (Alemania), Sonic Healthcare Limited (Australia), RadNet, Inc. (EE. UU.), General Electric (EE. UU.), Akumin Inc. (EE. UU.), Hologic Inc. (EE. UU.), Shimadzu Corporation (Japón), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China), CANON MEDICAL SYSTEMS CORPORATION (Japón), Carl Zeiss Ag (Alemania), FUJIFILM Corporation (Japón), Hitachi, Ltd. (Japón), MEDNAX Services, Inc. (EE. UU.), Carestream Health (EE. UU.), Teleradiology Solutions (EE. UU.), UNILABS (Suiza), ONRAD, Inc. (EE. UU.) |

|

Oportunidades de mercado |

|

Definición del mercado de imágenes médicas

La imagenología médica es una técnica que permite generar diversas imágenes internas del cuerpo para el diagnóstico y el tratamiento de enfermedades. Esta técnica es muy importante para mejorar la salud de las personas en todo el mundo, ya que puede ayudar a detectar de forma temprana ciertas enfermedades internas y a tratarlas adecuadamente. También es posible analizar lo que ya se ha diagnosticado y tratado.

Dinámica del mercado de imágenes médicas

Conductores

- Demanda creciente de modalidades de imágenes innovadoras

La industria está siendo impulsada por la integración de trajes quirúrgicos con tecnología de imágenes. Sin embargo, el número de nuevos hospitales en los países en desarrollo de Asia Pacífico ha aumentado drásticamente. La entrada de proveedores de servicios de salud globales es la culpable de esto. Los actores privados dominan el sector de la salud en estos países. Las modalidades de imágenes suelen tener un espacio específico en los nuevos hospitales. En los próximos años, es probable que la creciente competencia y la mayor demanda de servicios de salud de clase mundial impulsen la expansión del segmento.

- Aumento de casos de enfermedades crónicas

El mercado de reactivos para diagnóstico por imágenes de Asia y el Pacífico está impulsado por factores como el cáncer y las enfermedades cardiovasculares, los avances técnicos, el desarrollo de reactivos para diagnóstico por imágenes y la gran demanda insatisfecha de procedimientos médicos y de diagnóstico por imágenes. Los trastornos cardiovasculares, por ejemplo, son una de las principales causas de muerte en todo el mundo. Además, debido a que las personas mayores tienen más probabilidades de desarrollar enfermedades crónicas, se prevé que el creciente crecimiento de la población geriátrica aumente la demanda de reactivos para diagnóstico por imágenes.

- Evolución de la demanda de reactivos para imágenes médicas

El creciente número de pacientes con cáncer que requieren técnicas avanzadas de diagnóstico por imagen, como la imagen fotoacústica y los reactivos de diagnóstico por imagen para un mejor diagnóstico, también contribuye a la expansión del mercado. Además, es probable que la creciente población de ancianos, el aumento del gasto en atención médica y la creciente demanda de procedimientos efectivos y medicamentos seguros impulsen el mercado de reactivos de diagnóstico por imagen.

Oportunidades

Se prevé que los avances tecnológicos, combinados con inversiones y dinero gubernamentales, contribuyan a la expansión del mercado, en particular en países en desarrollo como India y China. En enero de 2020, Allengers, por ejemplo, presentó el primer escáner de TC de 32 cortes fabricado localmente en India. Canon Medical Systems colaboró en la creación del sistema.

Se prevé que los centros de enseñanza, los hospitales y las universidades aumenten su necesidad de modalidades de imagenología de última generación para proporcionar formación en tecnología avanzada, lo que tendrá un impacto sustancial en el crecimiento del mercado en los próximos años. Esta tendencia, que antes se limitaba a los países ricos, se está extendiendo cada vez más a los países en desarrollo. Por ejemplo, el único equipo de resonancia magnética (MRI) de 7T certificado, el MAGNETOM Terra de Siemens Healthineers, se ha instalado únicamente en Estados Unidos.

Restricciones/Desafíos

Sin embargo, es probable que la expansión del mercado se vea obstaculizada por la escasez de personal médico experimentado, los altos costos de los equipos, la falta de proveedores de reactivos para imágenes y las rigurosas regulaciones gubernamentales.

Este informe sobre el mercado de imágenes médicas proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado por categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de imágenes médicas, comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Alcance del mercado de imágenes médicas

El mercado de imágenes médicas está segmentado en función del tipo, modalidad, procedimiento, tecnología, edad del paciente, aplicación y usuario final. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Servicios

- Producto

Modalidad

- Estacionario

- Portátil

Procedimiento

- Tomografía computarizada (TC)

- Imágenes de rayos X

- Imágenes por resonancia magnética (IRM)

- Ultrasonido, imágenes nucleares (SPECT/PET)

- Otros

Tecnología

- Radiología digital directa

- Radiología computarizada

Edad del paciente

- Adultos

- Pediátrico

Solicitud

- Cardiología

- Pélvico y abdominal

- Oncología

- Mamografía

- Ginecología

- Neurología

- Urología

- Músculoesquelético

- Dental

- Otros

Usuarios finales

- Hospitales

- Centros de diagnóstico

- Centros de imágenes

- Clínicas de especialidades

- Centros de cirugía ambulatoria

- Institutos académicos y de investigación

- Otros

Análisis regional del mercado de imágenes médicas

Se analiza el mercado de imágenes médicas y se proporcionan información y tendencias del tamaño del mercado por país, tipo, modalidad, procedimiento, tecnología, edad del paciente, aplicación y usuario final como se menciona anteriormente.

Los países cubiertos en el informe del mercado de imágenes médicas son China, Japón, India, Corea del Sur, Singapur, Malasia, Australia, Tailandia, Indonesia, Filipinas, Resto de Asia-Pacífico (APAC) en Asia-Pacífico (APAC).

La región de Asia y el Pacífico está creciendo a la tasa más alta, debido al creciente número de geriátricos y al aumento del gasto en atención médica. Debido a la avanzada infraestructura de atención médica del país, la industria de imágenes médicas de Japón es dominante. Los servicios de imágenes médicas tienen una gran demanda en Japón debido al envejecimiento de la población del país y a las enfermedades crónicas.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Puntos de datos como análisis de la cadena de valor aguas abajo y aguas arriba, tendencias técnicas y análisis de las cinco fuerzas de Porter, estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Cuota de mercado de imágenes médicas

El panorama competitivo del mercado de imágenes médicas proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de imágenes médicas.

Los líderes del mercado de imágenes médicas que operan en el mercado son:

- Koninklijke Philips NV (Países Bajos)

- RamSoft, Inc. (Canadá)

- Grupo InHealth (Reino Unido)

- Informes de radiología en línea (EE. UU.)

- Siemens (Alemania)

- Sonic Healthcare Limited (Australia)

- RadNet, Inc. (Estados Unidos)

- General Electric (Estados Unidos)

- Akumin Inc. (Estados Unidos)

- Hologic Inc. (Estados Unidos)

- Corporación Shimadzu (Japón)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- CORPORACIÓN CANON MEDICAL SYSTEMS (Japón)

- Carl Zeiss Ag (Alemania)

- FUJIFILM Corporation (Japón)

- Hitachi, Ltd. (Japón)

- MEDNAX Services, Inc. (EE. UU.),

- Carestream Health (Estados Unidos)

- Soluciones de teleradiología (EE. UU.)

- UNILABS (Suiza)

- ONRAD, Inc. (Estados Unidos)

Últimos avances en el mercado de imágenes médicas

- En marzo de 2021, Vscan AirTM es un ecógrafo de bolsillo inalámbrico de última generación de GE Healthcare que ofrece a los médicos una calidad de imagen nítida, capacidades de escaneo de cuerpo completo y un software intuitivo.

- En enero de 2021, Esaote North America lanzó en Canadá el sistema de ultrasonido MyLab X8. MyLab X8 es un sistema de imágenes premium con todas las funciones que integra las tecnologías más nuevas y ofrece una mayor calidad de imagen sin comprometer el flujo de trabajo ni la eficiencia. Anteriormente fue autorizado por la FDA en los EE. UU.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.