Die steigende Nachfrage nach Lösungen für die Präzisionslandwirtschaft treibt den Markt für Farmmanagement-Software maßgeblich voran. Präzisionslandwirtschaft nutzt Technologie zur Überwachung und Steuerung der Feldvariabilität und optimiert so den Einsatz von Betriebsmitteln wie Wasser, Dünger und Pestiziden. Mithilfe von Farmmanagement-Software können Landwirte detaillierte Daten über Bodenbeschaffenheit, Pflanzengesundheit und Wetterlagen sammeln und so fundierte Entscheidungen treffen, die Ernteerträge und Ressourceneffizienz steigern. Diese detaillierte Datenanalyse trägt dazu bei, Abfall zu reduzieren, Kosten zu senken und die Gesamtproduktivität des Betriebs zu steigern, was Präzisionslandwirtschaft zu einer attraktiven Option für moderne Landwirte macht.

Lösungen für die Präzisionslandwirtschaft ermöglichen die Echtzeitüberwachung und -steuerung von landwirtschaftlichen Betrieben, was für rechtzeitige Eingriffe und Maßnahmen entscheidend ist. Farmmanagement-Software liefert Echtzeit-Einblicke durch die Integration von Sensoren, Drohnen und IoT-Geräten, die kontinuierlich Daten erfassen und übertragen. Diese Echtzeit-Einblicke helfen Landwirten, Probleme wie Schädlingsbefall oder Bewässerungsprobleme frühzeitig zu erkennen und umgehend Gegenmaßnahmen zu ergreifen. Die Möglichkeit, auf Echtzeitdaten zu reagieren, verbessert nicht nur die Gesundheit und Erträge der Pflanzen, sondern gewährleistet auch eine effiziente Ressourcennutzung und trägt so zur Nachhaltigkeit landwirtschaftlicher Praktiken bei.

Vollständigen Bericht abrufen unter https://www.databridgemarketresearch.com/reports/global-farm-management-software-market

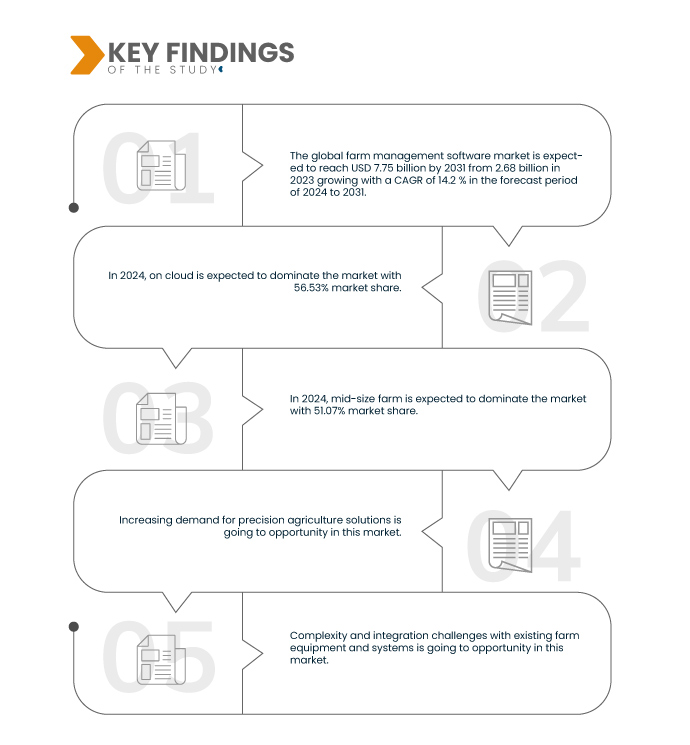

Data Bridge Market Research analysiert, dass der globale Markt für Farm-Management-Software voraussichtlich einen Wert von 7,75 Milliarden US-Dollar bis 2031 erreichen wird, von 2,68 Milliarden US-Dollar im Jahr 2023, und im Prognosezeitraum von 2024 bis 2031 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 14,2 % wachsen wird.

Wichtigste Ergebnisse der Studie

Staatliche Initiativen und Subventionen für die digitale Landwirtschaft

Regierungen weltweit erkennen zunehmend das Potenzial der digitalen Landwirtschaft zur Steigerung der landwirtschaftlichen Produktivität und Nachhaltigkeit. Mit Initiativen und Subventionen wollen sie Landwirte zum Einsatz fortschrittlicher Technologien wie Farmmanagement-Software ermutigen, die ein effizientes Ressourcenmanagement und Echtzeit-Entscheidungen ermöglicht. Diese staatlichen Maßnahmen umfassen häufig finanzielle Anreize, Zuschüsse und Schulungsprogramme, um Landwirten zu helfen, die anfänglichen Kostenhürden bei der Einführung neuer Technologien zu überwinden. Infolgedessen integrieren immer mehr Landwirte digitale Tools in ihre Betriebe und treiben so das Wachstum des Marktes für Farmmanagement-Software voran.

Berichtsumfang und Marktsegmentierung

Berichtsmetrik

|

Details

|

Prognosezeitraum

|

2024 bis 2031

|

Basisjahr

|

2023

|

Historische Jahre

|

2022 (Anpassbar auf 2016–2021)

|

Quantitative Einheiten

|

Umsatz in Milliarden USD

|

Abgedeckte Segmente

|

Bereitstellungsmodus (On-Cloud und On-Premise), Betriebsgröße (mittelgroßer Betrieb, großer Betrieb und kleiner Betrieb), Anwendung (Präzisionslandwirtschaft, Präzisionsviehhaltung, Präzisionsforstwirtschaft , Präzisionsaquakultur, intelligentes Gewächshaus und andere), landwirtschaftliche Produktion (Vorproduktionsplanung, Produktionsplanung und Nachproduktionsplanung), Betriebssystem (Windows, Android, MAC, iOS, Linux und andere), Preiskategorie (abonnementbasiert, kostenlos/werbebasiert und einmalige Lizenz), Benutzertyp (Landwirte und Agrarunternehmen)

|

Abgedeckte Länder

|

USA, Kanada, China, Australien, Südkorea, Indien, Neuseeland, Taiwan, Singapur, Malaysia, Thailand, Vietnam, Indonesien, Philippinen, Restlicher Asien-Pazifik-Raum, Brasilien, Argentinien, Mexiko, Restliches Lateinamerika, Saudi-Arabien, Südafrika, Ägypten, Bahrain, Oman, Israel, Kuwait, Katar, Vereinigte Arabische Emirate, Restlicher Naher Osten und Afrika, Frankreich, Spanien, Polen, Deutschland, Italien, Rumänien, Portugal, Griechenland, Ungarn, Kroatien, Bulgarien, Litauen, Irland, Österreich, Slowenien, Lettland, Schweden, Niederlande, Finnland, Dänemark, Belgien, Zypern, Tschechien, Slowakei, Estland, Luxemburg, Malta, Nicht-EU-Europa

|

Abgedeckte Marktteilnehmer

|

Farmbrite (USA), Ruumi (Großbritannien), Shivrai Technologies Pvt. Ltd (Indien), Gatec (Brasilien), PickApp (Israel), EasyKeeper Herd Manager (USA), Bushel Inc. (USA), AnimalSoft Kft. (Ungarn), Field Margin Ltd. (Großbritannien), AGRIVI (Kroatien), Raven Industries, Inc. (USA), Trimble Inc. (USA), Deere & Company (USA), PigCHAMP, Inc. (USA), Topcon (Japan), AgJunction LLC (USA), Agworld Pty Ltd (USA/Australien), Farmers Edge Inc. (Kanada), Climate LLC (USA), ABACO SPA (Italien), GEA Group Aktiengesellschaft (Deutschland), Afimilk Ltd. (Israel), TELUS (Kanada), CropX Inc. (USA), Cropin Technology Solution (Indien), Conservis (USA), Ag Leader Technology (USA) und IBM (USA) unter anderem

|

Im Bericht behandelte Datenpunkte

|

Zusätzlich zu den Markteinblicken wie Marktwert, Wachstumsrate, Marktsegmenten, geografischer Abdeckung, Marktteilnehmern und Marktszenario enthält der vom Data Bridge Market Research-Team kuratierte Marktbericht eine eingehende Expertenanalyse, Import-/Exportanalyse, Preisanalyse, Produktionsverbrauchsanalyse und PESTLE-Analyse.

|

Segmentanalyse

Der globale Markt für Farmmanagementsoftware ist in sieben wichtige Segmente unterteilt, die auf Bereitstellungsmodus, Farmgröße, Anwendung, Farmproduktion, Betriebssystem, Preiskategorie und Benutzertyp basieren.

- Auf der Grundlage des Bereitstellungsmodus ist der Markt in On-Cloud und On-Premise segmentiert

Im Jahr 2024 wird erwartet, dass On-Cloud den globalen Markt für Farm-Management-Software dominieren wird

- Im Jahr 2024 wird On-Cloud voraussichtlich den Markt mit einem Marktanteil von 56,53 % dominieren, da die Nachfrage nach Lösungen für die Präzisionslandwirtschaft steigt.

- Auf der Grundlage der Betriebsgröße ist der Markt in mittelgroße, große und kleine Betriebe unterteilt.

Im Jahr 2024 wird erwartet, dass mittelgroße landwirtschaftliche Betriebe den globalen Markt für Farm-Management-Software dominieren werden

- Im Jahr 2024 wird erwartet, dass mittelgroße landwirtschaftliche Betriebe aufgrund staatlicher Initiativen und Subventionen für die digitale Landwirtschaft mit einem Marktanteil von 51,07 % den Markt dominieren werden.

- Der Markt ist je nach Anwendung in Präzisionslandwirtschaft, Präzisionsviehhaltung, Präzisionsforstwirtschaft, Präzisionsaquakultur, intelligente Gewächshäuser und weitere Bereiche unterteilt. Im Jahr 2024 wird die Präzisionslandwirtschaft voraussichtlich mit einem Marktanteil von 43,17 % den Markt dominieren.

- Auf der Grundlage der landwirtschaftlichen Produktion ist der Markt in Vorproduktionsplanung, Produktionsplanung und Nachproduktionsplanung segmentiert. Im Jahr 2024 wird die Vorproduktionsplanung voraussichtlich mit einem Marktanteil von 41,79 % den Markt dominieren.

- Auf der Grundlage des Betriebssystems ist der Markt in Windows, Android, MAC, IOS, Linux und andere segmentiert. Im Jahr 2024 wird das Windows-Segment voraussichtlich mit einem Marktanteil von 39,94 % den Markt dominieren.

- Basierend auf der Preiskategorie ist der Markt in Abonnements, kostenlose/AdBsed-Angebote und Einmallizenzen unterteilt. Im Jahr 2024 wird das Abonnementsegment voraussichtlich mit einem Marktanteil von 55,50 % den Markt dominieren.

- Auf der Grundlage des Nutzertyps wird der Markt in Landwirte und landwirtschaftliche Unternehmen segmentiert. Im Jahr 2024 wird das Segment der Landwirte voraussichtlich mit einem Marktanteil von 64,34 % den Markt dominieren.

Hauptakteure

Data Bridge Market Research analysiert GEA Group Aktiengesellschaft (Deutschland), IBM (USA), Deere & Company (USA), Trimble Inc. (USA), Trimble Inc. (USA) als wichtige Marktteilnehmer in diesem Markt.

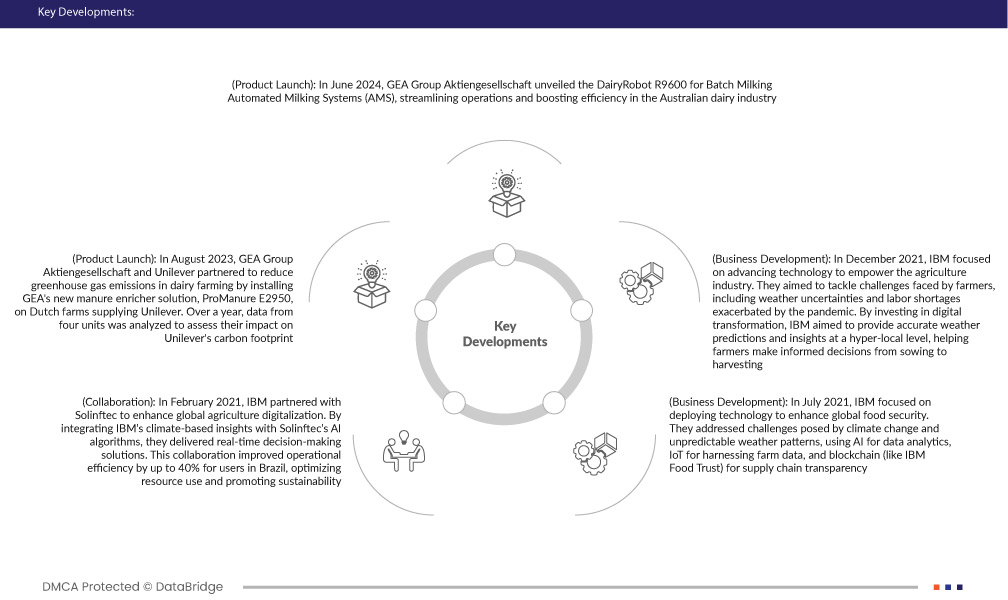

Marktentwicklung

- Im Juni 2024 stellte die GEA Group Aktiengesellschaft den DairyRobot R9600 für Batch-Melksysteme (AMS) vor. Er optimiert die Abläufe und steigert die Effizienz in der australischen Milchwirtschaft. Diese Innovation adressiert Herausforderungen im Fütterungsmanagement und in den täglichen Abläufen und macht AMS für größere Betriebe zugänglicher. Dank seines kompakten Designs und seines geringen Ressourcenverbrauchs verbessert der DairyRobot R9600 das Kuhwohl und die Betriebseffizienz. GEA profitiert davon, indem es seine Marktpräsenz ausbaut und nachhaltiges Wachstum unterstützt.

- Im August 2023 haben die GEA Group Aktiengesellschaft und Unilever eine Partnerschaft zur Reduzierung der Treibhausgasemissionen in der Milchviehhaltung geschlossen. Dazu installierten sie GEAs neue Gülleanreicherungslösung ProManure E2950 auf niederländischen Unilever-Lieferantenbetrieben. Über ein Jahr hinweg wurden Daten von vier Betrieben analysiert, um deren Auswirkungen auf den CO2-Fußabdruck von Unilever zu bewerten. Diese Zusammenarbeit stärkte GEAs Ruf als führender Anbieter nachhaltiger Agrarlösungen deutlich, stärkte ihre Marktpräsenz und eröffnete neue Geschäftsmöglichkeiten.

- Im Februar 2021 ging IBM eine Partnerschaft mit Solinftec ein, um die globale Digitalisierung der Landwirtschaft voranzutreiben. Durch die Integration klimabasierter Erkenntnisse von IBM mit den KI-Algorithmen von Solinftec lieferten sie Lösungen für die Entscheidungsfindung in Echtzeit. Diese Zusammenarbeit steigerte die Betriebseffizienz für Nutzer in Brasilien um bis zu 40 %, optimierte die Ressourcennutzung und förderte die Nachhaltigkeit. IBMs fortschrittliche Wetterdaten ermöglichten ein besseres Agrarmanagement, förderten Innovationen und unterstützten die Agrarindustrie weltweit. Diese Partnerschaft unterstreicht IBMs Engagement, Technologie für Umweltschutz und landwirtschaftliche Weiterentwicklung weltweit einzusetzen.

- Im Juli 2021 konzentrierte sich IBM auf den Einsatz von Technologien zur Verbesserung der globalen Ernährungssicherheit. Das Unternehmen begegnete den Herausforderungen des Klimawandels und unvorhersehbarer Wetterlagen mit KI für die Datenanalyse, IoT für die Nutzung landwirtschaftlicher Daten und Blockchain (wie IBM Food Trust) für Transparenz in der Lieferkette. Diese Innovationen kommen Landwirten weltweit zugute und ermöglichen bessere Entscheidungen, nachhaltigere Anbaumethoden und eine verbesserte Marktwettbewerbsfähigkeit. Die Initiativen von IBM zielen darauf ab, die Nahrungsmittelproduktion zu stabilisieren, Kleinbauern zu unterstützen und die UN-Ziele für nachhaltige Entwicklung zu erreichen, um eine sicherere und widerstandsfähigere globale Nahrungsmittelversorgung zu fördern.

- Im Dezember 2021 konzentrierte sich IBM auf die Weiterentwicklung von Technologien zur Stärkung der Landwirtschaft. Ziel war es, die Herausforderungen der Landwirte zu bewältigen, darunter Wetterunsicherheiten und Arbeitskräftemangel, die durch die Pandemie verschärft wurden. Durch Investitionen in die digitale Transformation wollte IBM präzise Wettervorhersagen und Erkenntnisse auf hyperlokaler Ebene bereitstellen und Landwirten so helfen, fundierte Entscheidungen von der Aussaat bis zur Ernte zu treffen.

Regionale Analyse

Geografisch gesehen sind die folgenden Länder vom globalen Markt für Farmmanagementsoftware abgedeckt: USA, Kanada, Mexiko, Europa, Deutschland, Großbritannien, Frankreich, Spanien, Italien, Türkei, Russland, Belgien, Niederlande, Schweiz, Dänemark, Schweden, Norwegen, Finnland, Polen und übriges Europa, China, Japan, Südkorea, Australien, Malaysia, Neuseeland, Singapur, Indien, Thailand, Indonesien, Philippinen, Taiwan, Vietnam, übriger asiatisch-pazifischer Raum, Vereinigte Arabische Emirate, Saudi-Arabien, Ägypten, Israel, Südafrika, Oman, Bahrain, Kuwait, Katar, übriger Naher Osten und Afrika, Brasilien, Argentinien und übriges Südamerika.

Laut Marktforschungsanalyse von Data Bridge:

Es wird erwartet, dass Nordamerika den globalen Markt für Farmmanagement-Software dominieren und die am schnellsten wachsende Region sein wird

Nordamerika wird voraussichtlich den Markt für Farmmanagement-Software dominieren. Grund dafür sind die technologisch fortschrittlichen Farmen, die weitreichende Infrastruktur und die unterstützende Regierungspolitik. Die Region profitiert von der frühen Einführung von Präzisionslandwirtschaft und Automatisierungstechnologien, die durch erhebliche Investitionen in Forschung und Entwicklung im Bereich Agrartechnologie sowie die Präsenz wichtiger Marktteilnehmer unterstützt werden.

Für detailliertere Informationen zum globalen Marktbericht für Farmmanagement-Software klicken Sie hier – https://www.databridgemarketresearch.com/reports/global-farm-management-software-market