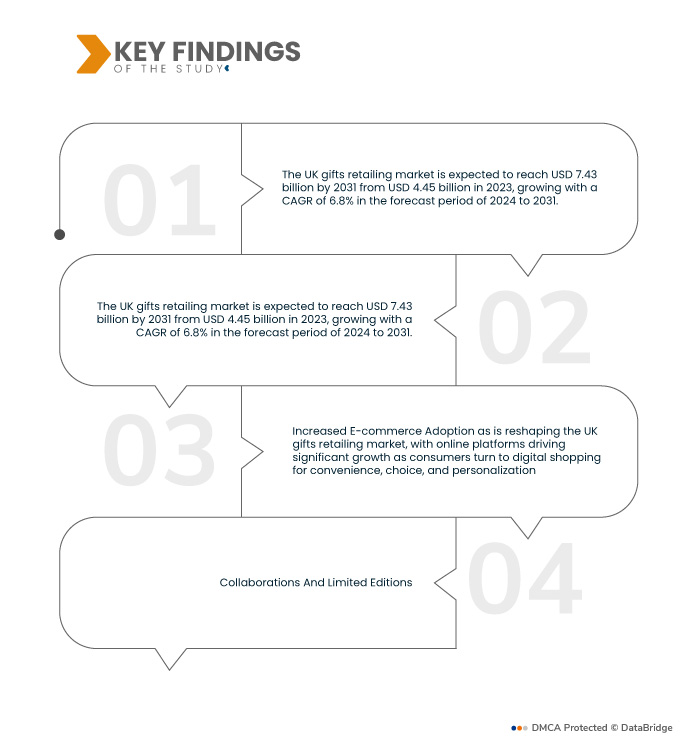

Die zunehmende Nutzung des E-Commerce verändert den britischen Geschenkartikelmarkt. Online-Plattformen sorgen für ein deutliches Wachstum, da Verbraucher aufgrund ihrer Bequemlichkeit, Auswahl und Personalisierung auf digitales Einkaufen setzen. Die Pandemie hat diesen Trend beschleunigt, und angesichts der gestiegenen Verbrauchererwartungen investieren immer mehr Einzelhändler in verbesserte Online-Erlebnisse, optimierte Zahlungsoptionen und schnellere Lieferservices. Dieser Wandel ermöglicht es kleineren und Nischenmarken, ein breiteres Publikum zu erreichen und einen wettbewerbsintensiven Markt zu schaffen, in dem Verbraucher kuratierte und einzigartige Geschenkoptionen jenseits des traditionellen Angebots im Einzelhandel entdecken können. Infolgedessen erlebt der britische Geschenkartikelmarkt eine stärkere digitale Transformation, die zu höheren Umsätzen und einer stärkeren Kundenbindung im Internet führt.

Zugriff auf den vollständigen Bericht unter https://www.databridgemarketresearch.com/reports/uk-gifts-retailing-market

Laut einer Analyse von Data Bridge Market Research dürfte der britische Markt für Geschenkartikel im Einzelhandel von 4,45 Milliarden US-Dollar im Jahr 2023 auf 7,43 Milliarden US-Dollar im Jahr 2031 anwachsen und im Prognosezeitraum von 2024 bis 2031 eine durchschnittliche jährliche Wachstumsrate (CAGR) von 6,8 % aufweisen.

Wichtigste Ergebnisse der Studie

Steigende Nachfrage nach Firmengeschenken

Der britische Geschenkartikelmarkt verzeichnet eine steigende Nachfrage nach Firmengeschenken. Unternehmen suchen personalisierte und hochwertige Geschenke, um Kundenbeziehungen zu stärken und die Leistungen ihrer Mitarbeiter zu würdigen. Da Remote- und Hybridarbeit die Arbeitswelt verändert, sind Firmengeschenke zu einem effektiven Instrument geworden, um Engagement und Loyalität zu erhalten, die Markenwahrnehmung zu stärken und das Wohlwollen zu fördern. Diese Nachfrage unterstützt das Wachstum im E-Commerce, wo Einzelhändler eine breite Palette an individualisierbaren, luxuriösen und nachhaltigen Geschenkoptionen anbieten, um die spezifischen Bedürfnisse von Firmenkunden zu erfüllen. Dadurch wird der britische Geschenkartikelmarkt zu einem wichtigen Akteur in Strategien zum Aufbau von Unternehmensbeziehungen .

Berichtsumfang und Marktsegmentierung

Berichtsmetrik

|

Details

|

Prognosezeitraum

|

2024 bis 2031

|

Basisjahr

|

2023

|

Historische Jahre

|

2022 (Anpassbar von 2016–2022)

|

Quantitative Einheiten

|

Umsatz in Milliarden USD

|

Abgedeckte Segmente

|

Produkt (Geschenkgutscheine, personalisierte Geschenke , Lebensmittel- und Getränkekörbe, Spielzeug und Spiele, Blumen und Schokolade, Kosmetik und Düfte, Elektronik und Gadgets, Bekleidung und Accessoires, Wohndekor und Möbel, Schmuck, Bücher und Schreibwaren, Wellness- und Spa-Produkte, Souvenirs und Neuheiten, saisonale Dekorationen, Schreibtischaccessoires, Geschenkartikel, Grußkarten), anlassspezifische Geschenke (Geburtstagsgeschenke, Feiertagsgeschenke, Jubiläumsgeschenke, Festivalgeschenke, Valentinstagsgeschenke, Abschlussgeschenke, Muttertags- und Vatertagsgeschenke), Preisspanne (Masse, Premium), empfängerspezifische Geschenke (Geschenke für Sie/Ihn, Firmengeschenke, Geschenke für Kinder), Geschenkkarten und Gutscheine (digitale Geschenkkarten, Erlebnisgutscheine), Spezialgeschenke (Abo-Boxen, Gourmet- und Lebensmittelgeschenke), ethische und nachhaltige Geschenke (Fair-Trade-Produkte, umweltfreundliche und nachhaltige Geschenke), Personalisierungstrends (individuelle Verpackungen, Gravuren und Stickereien), Technologieintegration (E-Gifting-Plattformen, Augmented und Virtual Reality), Vertriebskanal (Online, Offline)

|

Abgedeckte Marktteilnehmer

|

Amazon (USA), Card Factory plc. (Großbritannien), Alibaba Group Holding Limited (China), Walmart (USA), Beyond, Inc. (USA), AGC, LLC. (USA), Williams-Sonoma, Inc. (USA), Macy's (USA), Disney (USA), Enesco, LLC. (USA), MARKS & SPENCER (Großbritannien), Hallmark Licensing, LLC (USA), Etsy, Inc. (Irland), Cimpress (Irland), Getting Personal (Großbritannien), Zazzle Inc (USA), Pinnacle Promotions (USA), Redbubble (Australien), AG Custom Gifts (USA), funkypigeon.com Limited (Großbritannien), Fat Brain Toy Co. (USA) und Cafepress Inc. (USA)

|

Im Bericht behandelte Datenpunkte

|

Zusätzlich zu den Markteinblicken wie Marktwert, Wachstumsrate, Marktsegmenten, geografischer Abdeckung, Marktteilnehmern und Marktszenario enthält der vom Data Bridge Market Research-Team kuratierte Marktbericht eine eingehende Expertenanalyse, Import-/Exportanalyse, Preisanalyse, Produktionsverbrauchsanalyse und PESTLE-Analyse.

|

Segmentanalyse

Der britische Markt für Geschenkartikel ist in zehn wichtige Segmente unterteilt, basierend auf Produkt, anlassspezifischen Geschenken, Preisspanne, empfängerspezifischen Geschenken, Geschenkkarten und Gutscheinen, Spezialgeschenken, ethischen und nachhaltigen Geschenken, Personalisierungstrends, Technologieintegration und Vertriebskanal.

- Auf der Grundlage der Produkte ist der britische Markt für Geschenkartikel in die Segmente Geschenkgutscheine, personalisierte Geschenke, Lebensmittel- und Getränkekörbe, Spielsachen und Spiele, Blumen und Schokolade, Kosmetika und Parfüms, Elektronik und Gadgets, Bekleidung und Accessoires, Wohndekor und Möbel, Schmuck, Bücher und Schreibwaren, Wellness- und Spa-Produkte, Souvenirs und Neuheiten, saisonale Dekorationen, Schreibtischzubehör, Geschenkartikel, Grußkarten und mehr unterteilt.

Im Jahr 2024 wird das Segment der Geschenkgutscheine voraussichtlich mit einem Marktanteil von 14,67 % den Markt dominieren

Im Jahr 2024 wird das Segment der Geschenkgutscheine voraussichtlich mit einem Marktanteil von 14,67 % den Markt dominieren , da sie vielseitig einsetzbar und praktisch sind und den Empfängern die Möglichkeit bieten, ihre Geschenke selbst auszuwählen.

- Auf der Grundlage anlassspezifischer Geschenke ist der britische Geschenkeinzelhandelsmarkt in Geburtstagsgeschenke, Feiertagsgeschenke, Jubiläumsgeschenke, Festgeschenke, Valentinstagsgeschenke, Schulabschlussgeschenke, Muttertags- und Vatertagsgeschenke und andere unterteilt.

Im Jahr 2024 wird das Segment Geburtstagsgeschenke voraussichtlich den Markt mit einem Marktanteil von 31,60 % dominieren

Im Jahr 2024 wird das Segment der Geburtstagsgeschenke voraussichtlich mit einem Marktanteil von 31,60 % den Markt dominieren, da Geburtstage weltweit gefeiert werden und eine konstant hohe Nachfrage nach Geschenkkäufen besteht.

- Auf der Grundlage der Preisspanne ist der britische Geschenkeinzelhandelsmarkt in Massen- und Premiumprodukte segmentiert. Im Jahr 2024 wird erwartet, dass Massenprodukte den Markt mit einem Marktanteil von 72,32 % dominieren werden.

- Der britische Geschenkeinzelhandelsmarkt ist auf der Grundlage empfängerspezifischer Geschenke in Geschenke für ihn/sie, Firmengeschenke, Geschenke für Kinder und andere unterteilt. Im Jahr 2024 werden Geschenke für ihn/sie voraussichtlich mit einem Marktanteil von 53,06 % den Markt dominieren.

- Der britische Markt für Geschenkkarten und Gutscheine ist in digitale Geschenkkarten und Erlebnisgutscheine unterteilt. Im Jahr 2024 wird das Segment der digitalen Geschenkkarten voraussichtlich mit einem Marktanteil von 70,42 % dominieren.

- Der britische Geschenkartikelmarkt ist nach Spezialgeschenken in Abo-Boxen sowie Gourmet- und Lebensmittelgeschenke segmentiert. Im Jahr 2024 werden Abo-Boxen voraussichtlich mit einem Marktanteil von 73,44 % den Markt dominieren.

- Auf der Grundlage ethischer und nachhaltiger Geschenke ist der britische Geschenkeinzelhandelsmarkt in Fair-Trade-Produkte und umweltfreundliche und nachhaltige Geschenke segmentiert. Im Jahr 2024 werden Fair-Trade-Produkte voraussichtlich mit einem Marktanteil von 66,63 % den Markt dominieren.

- Basierend auf Personalisierungstrends ist der britische Geschenkartikelmarkt in individuelle Verpackungen sowie Gravuren und Stickereien segmentiert. Im Jahr 2024 werden individuelle Verpackungen voraussichtlich den Markt mit einem Marktanteil von 55,53 % dominieren.

- Der britische Geschenkartikelmarkt ist aufgrund der Technologieintegration in E-Gifting-Plattformen sowie Augmented und Virtual Reality segmentiert. Im Jahr 2024 werden E-Gifting-Plattformen voraussichtlich den Markt mit einem Marktanteil von 84,16 % dominieren.

- Der britische Geschenkartikelmarkt ist nach Vertriebskanälen in Online- und Offline-Markt segmentiert. Im Jahr 2024 werden Online-Plattformen voraussichtlich den Markt mit einem Marktanteil von 64,89 % dominieren.

Hauptakteure

Data Bridge Market Research analysiert Amazon (USA), Card Factory plc. (Großbritannien), Alibaba Group Holding Limited (China), Walmart (USA) und Beyond, Inc. (USA) als die wichtigsten Unternehmen, die auf dem britischen Geschenkartikel-Einzelhandelsmarkt tätig sind.

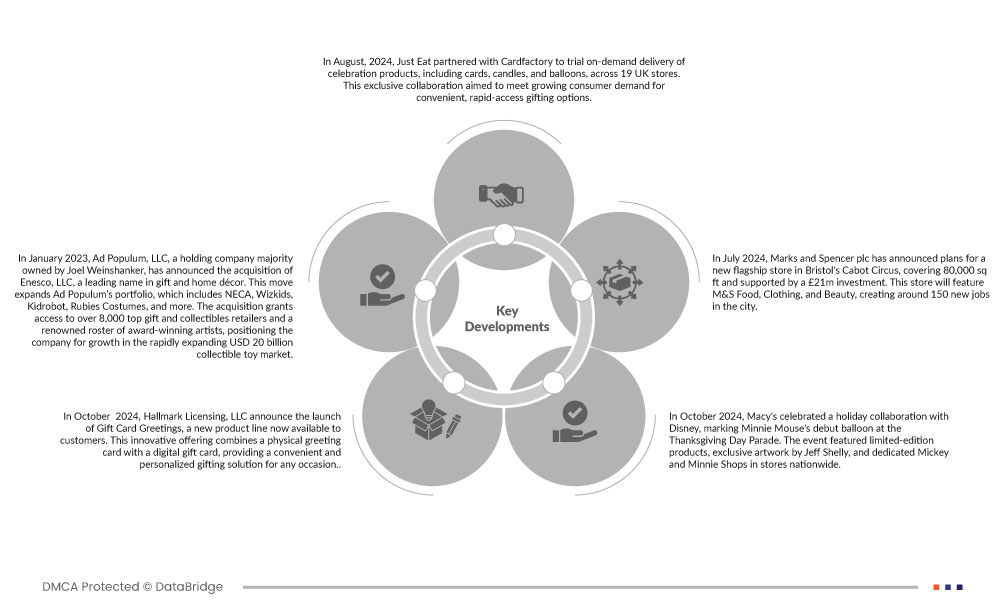

Marktentwicklung

- Im August 2024 testete Just Eat gemeinsam mit Cardfactory die On-Demand-Lieferung von Festartikeln wie Karten, Kerzen und Luftballons in 19 britischen Filialen. Diese exklusive Zusammenarbeit zielte darauf ab, die wachsende Nachfrage der Verbraucher nach bequemen und schnell zugänglichen Geschenkoptionen zu befriedigen.

- Im Januar 2023 gab Ad Populum, LLC, eine Holdinggesellschaft im Mehrheitsbesitz von Joel Weinshanker, die Übernahme von Enesco, LLC, einem führenden Anbieter von Geschenkartikeln und Wohndeko, bekannt. Dieser Schritt erweitert das Portfolio von Ad Populum, das unter anderem NECA, Wizkids, Kidrobot und Rubies Costumes umfasst. Die Übernahme ermöglicht den Zugang zu über 8.000 führenden Geschenkartikel- und Sammlerhändlern sowie einer renommierten Liste preisgekrönter Künstler und positioniert das Unternehmen damit für Wachstum im schnell wachsenden Markt für Sammlerspielzeug im Wert von 20 Milliarden US-Dollar.

- Im Oktober 2024 kündigt Hallmark Licensing, LLC die Einführung von Gift Card Greetings an, einer neuen Produktlinie, die ab sofort für Kunden erhältlich ist. Dieses innovative Angebot kombiniert eine physische Grußkarte mit einer digitalen Geschenkkarte und bietet so eine praktische und personalisierte Geschenklösung für jeden Anlass.

- Im Mai 2024 feierte Macy's im Oktober eine Weihnachtskooperation mit Disney und feierte den Debütballon von Minnie Maus bei der Thanksgiving Day Parade. Die Veranstaltung umfasste limitierte Produkte, exklusive Kunstwerke von Jeff Shelly und spezielle Mickey- und Minnie-Shops in den Filialen im ganzen Land.

- Im Juli 2024 kündigte Marks and Spencer plc Pläne für einen neuen Flagship-Store im Cabot Circus in Bristol an. Der Store soll eine Fläche von 7.400 Quadratmetern umfassen und mit einer Investition von 21 Millionen Pfund finanziert werden. In diesem Store werden Lebensmittel, Bekleidung und Kosmetik von M&S angeboten, wodurch rund 150 neue Arbeitsplätze in der Stadt entstehen.

Laut Marktforschungsanalyse von Data Bridge:

Im britischen Geschenkartikel-Einzelhandel dominiert Großbritannien dank seines fortschrittlichen Fertigungssektors und erheblicher Investitionen in Technologie und Forschung und Entwicklung. Die Präsenz großer Industrieunternehmen und strenge Qualitätskontrollvorschriften treiben die Nachfrage nach präzisen Messlösungen in verschiedenen Branchen voran.

Für detailliertere Informationen zum britischen Geschenkartikel-Einzelhandelsmarkt klicken Sie hier – https://www.databridgemarketresearch.com/reports/uk-gifts-retailing-market