Der globale Markt für biologisch abbaubare Mulchfolien verzeichnet ein starkes Wachstum, da Umweltbedenken die Nachfrage nach nachhaltigen landwirtschaftlichen Praktiken ankurbeln. Landwirte suchen zunehmend nach Alternativen zu herkömmlichen Kunststoffmulchfolien und entscheiden sich für biologisch abbaubare Optionen, die sich natürlich zersetzen und so die Plastikverschmutzung und Bodenkontamination reduzieren. Dieser Trend zu umweltfreundlichen Lösungen entspricht dem Verbraucherwunsch nach umweltverträglichen Produkten und fördert einen Markt, der reif für Innovation und Expansion ist. Da biologisch abbaubare Mulchfolien eine vergleichbare Leistung wie ihre konventionellen Pendants bieten und gleichzeitig die Umweltbelastung minimieren, werden sie weltweit zunehmend eingesetzt und treiben das Wachstum des globalen Marktes für biologisch abbaubare Mulchfolien voran.

Vollständigen Bericht abrufen unter https://www.databridgemarketresearch.com/reports/global-biodegradable-mulch-film-market

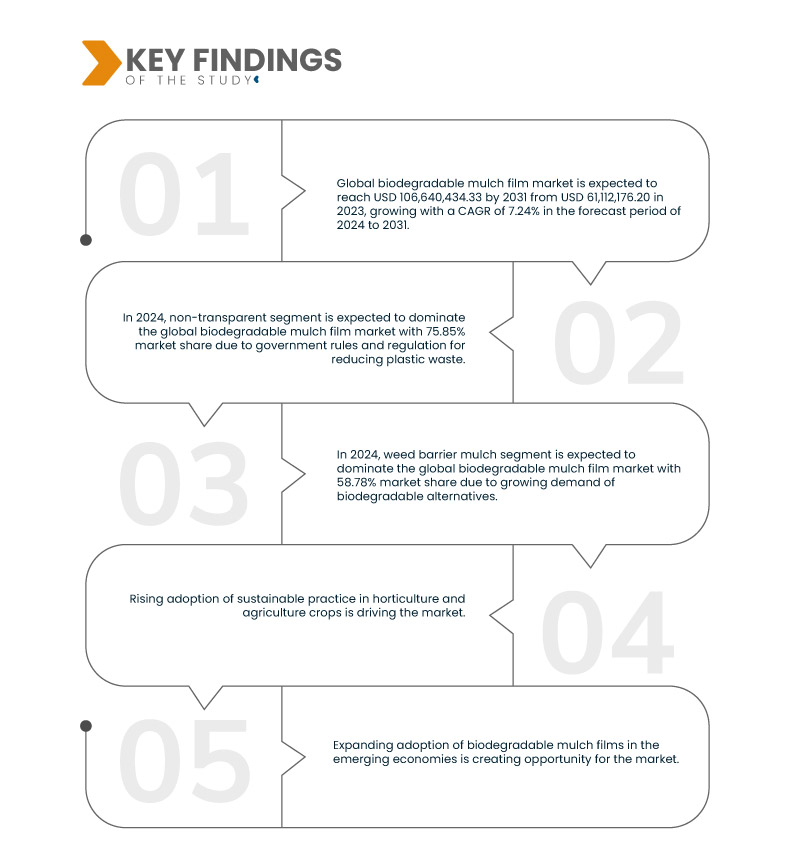

Data Bridge Market Research geht davon aus, dass der globale Markt für biologisch abbaubare Mulchfolien bis 2031 voraussichtlich auf 106.640.434,33 USD anwachsen wird, ausgehend von 61.112.176,20 USD im Jahr 2023. Dies entspricht einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 7,24 % im Prognosezeitraum 2024 bis 2031. Die steigende Nachfrage ist auf den wachsenden Öl- und Gassektor zurückzuführen. Dies ist auf die Notwendigkeit hochauflösender Lösungen zur Optimierung der Betriebseffizienz und zur Gewährleistung der Sicherheit in industriellen Prozessen zurückzuführen. Daher investieren Unternehmen verschiedener Branchen zunehmend in Lösungen für biologisch abbaubare Mulchfolien, um ihre Produktionsanlagen zu modernisieren und sich einen Wettbewerbsvorteil zu sichern.

Wichtigste Ergebnisse der Studie

Staatliche Vorschriften und Regelungen zur Reduzierung von Plastikmüll

Der Markt für biologisch abbaubare Mulchfolien wird maßgeblich von staatlichen Vorschriften zur Kunststoffabfallbewirtschaftung bestimmt, die einen wesentlichen Treiber für den Markt für biologisch abbaubare Mulchfolien darstellen. Da die Behörden strengere Vorschriften zur Reduzierung der Kunststoffverschmutzung und zur Förderung umweltfreundlicher Alternativen erlassen, steigt die Nachfrage nach biologisch abbaubaren Mulchfolien. Diese Vorschriften beinhalten oft Verbote oder Einschränkungen herkömmlicher Kunststoffmulchfolien und schaffen Anreize für Landwirte, auf biologisch abbaubare Alternativen umzusteigen, um die Vorschriften einzuhalten und zu einer nachhaltigen Landwirtschaft beizutragen. Daher spielen staatliche Initiativen eine entscheidende Rolle bei der Beschleunigung der Einführung biologisch abbaubarer Mulchfolien und der Gestaltung der Marktwachstumskurve.

Im heutigen Markt sind gesetzliche Vorschriften zur Kunststoffabfallbewirtschaftung ein wichtiger Treiber für die Branche der biologisch abbaubaren Mulchfolien. Der Bedarf an effizienten, biologisch abbaubaren Mulchfoliensystemen steigt aufgrund des wachsenden Branchenwissens und des regulatorischen Drucks zur Emissionsreduzierung. Unternehmen investieren erheblich in Spitzentechnologien, um die Einhaltung der Vorschriften zu gewährleisten und ihre Umweltauswirkungen zu reduzieren. Diese Motivation fördert nicht nur Innovationen im Bereich der biologisch abbaubaren Mulchfolien, sondern eröffnet auch profitable Perspektiven für Anbieter umweltfreundlicher Lösungen. Die Bedeutung dieses Faktors für die Branche der biologisch abbaubaren Mulchfolien nimmt stetig zu, da Nachhaltigkeit zunehmend an Bedeutung gewinnt.

Berichtsumfang und Marktsegmentierung

Berichtsmetrik

|

Details

|

Prognosezeitraum

|

2024 bis 2031

|

Basisjahr

|

2023

|

Historische Jahre

|

2022 (Anpassbar auf 2016–2021)

|

Quantitative Einheiten

|

Umsatz in USD

|

Abgedeckte Segmente

|

Material ( Polymilchsäure (PLA) , Stärke, Poly(butylenadipat-co-terephthalat) (PBAT), Polyhydroxyalkanoate (PHA) , Zellulose, Poly(butylensuccinat) (PBS), Polyester fossilen Ursprungs, Poly(butylensuccinat-co-adipat) (PBSA) und andere), Dicke (15 Mikrometer, 20 Mikrometer, 25 Mikrometer, 30 Mikrometer, 32 Mikrometer, 50 Mikrometer, 100 Mikrometer und andere), Form (nicht transparent und transparent), Kategorie (Unkrautbarrieremulch, UV-stabilisierter Mulch, Solarisationsmulch, Pestizidbarrieremulch, Insektenschutzmulch, Herbizidfreisetzungsmulch, Begasungsbarrieremulch und andere), Prozentsatz der bedeckten Oberfläche (70–80 %, 40–60 %, 40–45 %, 90–100 % und 20–25 %), Kulturdauer (Kurzzeitkulturen, Mittelzeitkulturen, Langzeitkulturen und andere), Anwendung (Gemüse, Obst, Getreide und Körner, Ölsaaten und Hülsenfrüchte, Rasen und Zierpflanzen, Blumenzucht und andere)

|

Abgedeckte Länder

|

USA, Kanada, Mexiko, Brasilien, Argentinien, Restliches Südamerika, Deutschland, Italien, Großbritannien, Frankreich, Spanien, Niederlande, Belgien, Schweiz, Türkei, Russland, Polen, Norwegen, Schweden, Dänemark, Finnland, Restliches Europa, Japan, China, Indien, Vietnam, Taiwan, Neuseeland, Südkorea, Australien, Singapur, Malaysia, Thailand, Indonesien, Philippinen, Restlicher Asien-Pazifik-Raum, Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Oman, Katar, Kuwait, Bahrain und Restlicher Naher Osten und Afrika

|

Abgedeckte Marktteilnehmer

|

Base SE (Deutschland), Novamont SPA (Italien), Groupe Barbier (Frankreich), Polyexpert (Kanada), SPR Packaging LLC. (USA), Dubois Agrinovation Inc. (Kanada), PolyExpert (Kanada), Novamont SpA (Italien), ARMANDO ÁLVAREZ, SA (Spanien), FILMORGANIC (Kanada), BioBag International AS (Norwegen), Fujian Greenjoy Biomaterial Co., Ltd (China), Tilak Polypack (Indien), SUKI CREATIONS PVT. LTD (Indien), SPR PACKAGING, LLC (USA), Chennai Polypack Private Limited (Indien), Shivam Polymers (Indien) und Reya Pack (Indien) unter anderem

|

Im Bericht behandelte Datenpunkte

|

Neben den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch eingehende Expertenanalysen, geografisch dargestellte Produktion und Kapazität nach Unternehmen, Netzwerklayouts von Distributoren und Partnern, detaillierte und aktualisierte Preistrendanalysen und Defizitanalysen der Lieferkette und der Nachfrage

|

Segmentanalyse

Der globale Markt für biologisch abbaubare Mulchfolien ist in sieben wichtige Segmente unterteilt, die auf Material, Dicke, Form, Kategorie, Prozentsatz der bedeckten Oberfläche, Erntedauer und Anwendung basieren.

- Auf der Grundlage der Materialien ist der Markt in Polymilchsäure (PLA), Stärke, Poly (Butylen-Adipat-Co-Terephthalat) (PBAT), Polyhydroxyalkanoate (PHA), Zellulose, Poly (Butylensuccinat) (PBS), Polyester aus fossilen Quellen, Poly (Butylensuccinat-Co-Adipat) (PBSA) und andere unterteilt.

Im Jahr 2024 wird erwartet, dass das Segment Polymilchsäure (PLA) den globalen Markt für biologisch abbaubare Mulchfolien dominieren wird

Im Jahr 2024 wird das Segment Polymilchsäure (PLA) aufgrund seiner branchenübergreifenden hohen Effizienz und Produktivität voraussichtlich mit einem Marktanteil von 44,65 % den Markt dominieren.

- Auf der Grundlage der Dicke ist der globale Markt für biologisch abbaubare Mulchfolien in 15 Mikrometer, 20 Mikrometer, 25 Mikrometer, 30 Mikrometer, 32 Mikrometer, 50 Mikrometer, 100 Mikrometer und andere unterteilt

Im Jahr 2024 wird das 15-Mikron-Segment voraussichtlich den globalen Markt für biologisch abbaubare Mulchfolien dominieren

Im Jahr 2024 wird das 15-Mikron-Segment aufgrund der Kosteneffizienz und Benutzerfreundlichkeit voraussichtlich den globalen Markt für biologisch abbaubare Mulchfolien mit einem Anteil von 26,58 % dominieren.

- Der globale Markt für biologisch abbaubare Mulchfolien ist in transparente und nicht transparente Folien unterteilt. Im Jahr 2024 wird das nicht transparente Segment voraussichtlich mit einem Marktanteil von 75,85 % den globalen Markt für biologisch abbaubare Mulchfolien dominieren.

- Der globale Markt für biologisch abbaubare Mulchfolien ist nach Kategorien unterteilt in Unkrautschutzmulch, UV-stabilisierten Mulch, Solarisationsmulch, Pestizidschutzmulch, Insektenschutzmulch, Herbizidschutzmulch, Begasungsschutzmulch und weitere. Im Jahr 2024 wird das Segment Unkrautschutzmulch voraussichtlich den globalen Markt für biologisch abbaubare Mulchfolien mit einem Marktanteil von 58,78 % dominieren.

- Der globale Markt für biologisch abbaubare Mulchfolien ist nach Flächenanteil in 70–80 %, 40–60 %, 40–45 %, 90–100 % und 20–25 % unterteilt. Im Jahr 2024 wird das Segment 70–80 % voraussichtlich mit einem Marktanteil von 38,32 % den globalen Markt für biologisch abbaubare Mulchfolien dominieren.

- Basierend auf der Erntedauer wird der globale Markt für biologisch abbaubare Mulchfolien in kurzzeitige , mittelzeitige und langfristige Ernten unterteilt. Im Jahr 2024 wird das Segment der kurzzeitigen Ernten voraussichtlich mit einem Marktanteil von 67,81 % den globalen Markt für biologisch abbaubare Mulchfolien dominieren.

- Basierend auf der Anwendung wird die globale biologisch abbaubare Mulchfolie in Gemüse, Obst, Getreide, Ölsaaten und Hülsenfrüchte, Rasen und Zierpflanzen, Blumenzucht und andere segmentiert. Im Jahr 2024 wird das Gemüsesegment voraussichtlich mit einem Marktanteil von 52,88 % den globalen Markt für biologisch abbaubare Mulchfolie dominieren.

Hauptakteure

- Data Bridge Market Research analysierte Base SE (Deutschland), Novamont SpA (Italien), Groupe Barbier (Frankreich), Polyexpert (Kanada) und SPR Packaging LLC (Tochtergesellschaft der Almando Alvarez Group) (USA) als die wichtigsten Akteure auf dem Markt.

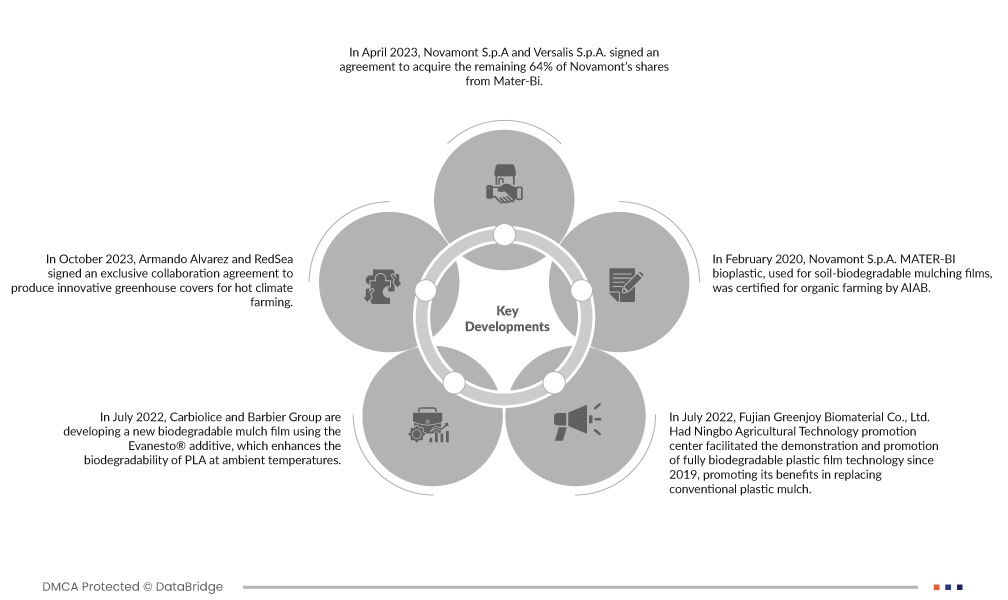

Marktentwicklung

- Laut ABA verbrauchte die australische Landwirtschaft im Oktober 2023 jährlich 200.000 Kilometer Kunststoffmulchfolie. Die Entsorgung stellte ein großes Problem dar: Schätzungsweise 40.000 Tonnen wurden jährlich aufgrund eingeschränkter Recyclingmöglichkeiten gelagert, vergraben oder verbrannt. Herkömmliche OXO-abbaubare Kunststoffe zerfielen beim Abbau in Mikroplastik, was zu einer dauerhaften Bodenkontamination und einem möglichen Eintrag in die Nahrungskette führte.

- Im April 2024 drängte die Europäische Kommission auf ein weltweites Verbot bestimmter Kunststoffprodukte, um die Umweltverschmutzung zu bekämpfen. Sie plädierte für einen umfassenden Lebenszyklusansatz für Kunststoffe, einschließlich Verboten und verbessertem Produktdesign. Über 4.000 Teilnehmer aus verschiedenen Sektoren trafen sich in Kanada, um einen rechtsverbindlichen Vertrag zur Beendigung der Plastikverschmutzung bis 2024 auszuhandeln. Der vorgeschlagene Vertrag betonte die obligatorische Beseitigung und Beschränkung problematischer Kunststoffe, um Umwelt- und Gesundheitsrisiken zu reduzieren.

- Im Oktober 2023 entwickelte BioBag International AS (BioBag World Australia) eine biologisch abbaubare Mulchfolie für die Landwirtschaft, die Landwirten die Entsorgung erleichtert, ohne die Bodenqualität zu beeinträchtigen. Das von der Australasian Bioplastics Association zertifizierte Unternehmen erfüllt die ISO 23517:2021 und ist damit Australiens einziger Hersteller mit dieser Zertifizierung. Es bietet eine umweltfreundliche Alternative, senkt die Entsorgungskosten und verbessert die Bodengesundheit.

- Im Oktober 2022 stellte die American Chemical Society laut einer von ABC Publication veröffentlichten Studie drei Hauptnachteile der biologisch abbaubaren Mulchfolie aus Polymilchsäure (PLA) fest: geringe Duktilität, hohe Kosten im Vergleich zu LDPE und langsame biologische Abbaubarkeit im Boden. Mit einer Bruchdehnung von etwa 5 % war PLA mehr als doppelt so teuer wie LDPE und zersetzte sich nur unter industriellen Kompostierungsbedingungen bei 58 °C schnell.

- Laut einer im Februar 2020 von der ResearchGate GmbH veröffentlichten Studie kosteten biologisch abbaubare Mulchfolien, die hauptsächlich aus Polymilchsäure (PLA) hergestellt werden, über 4000 US-Dollar pro Tonne und damit deutlich mehr als herkömmliche Polymere, die zwischen 1000 und 1500 US-Dollar pro Tonne kosten. Biologisch abbaubare Mulchfolien waren demnach 1,5- bis 1,8-mal teurer als herkömmliche Kunststoffmulche.

Regionale Analyse

Geografisch betrachtet sind dies die folgenden Länder, die im globalen Marktbericht für biologisch abbaubare Mulchfolien abgedeckt sind: USA, Kanada, Mexiko, Brasilien, Argentinien, übriges Südamerika, Deutschland, Italien, Großbritannien, Frankreich, Spanien, Niederlande, Belgien, Schweiz, Türkei, Russland, Polen, Norwegen, Schweden, Dänemark, Finnland, übriges Europa, Japan, China, Indien, Vietnam, Taiwan, Neuseeland, Südkorea, Australien, Singapur, Malaysia, Thailand, Indonesien, Philippinen, übriger asiatisch-pazifischer Raum, Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Oman, Katar, Kuwait, Bahrain sowie der Rest des Nahen Ostens und Afrikas.

Laut Marktforschungsanalyse von Data Bridge:

Der asiatisch-pazifische Raum dürfte die dominierende und am schnellsten wachsende Region auf dem globalen Markt für biologisch abbaubare Mulchfolien sein

Aufgrund der starken Präsenz wichtiger Akteure, des robusten technologischen Fortschritts, der zunehmenden industriellen Aktivität und der strengen Umweltvorschriften dürfte der asiatisch-pazifische Raum die dominierende und am schnellsten wachsende Region auf dem globalen Markt für biologisch abbaubare Mulchfolien sein.

Für detailliertere Informationen zum globalen Marktbericht für biologisch abbaubare Mulchfilme klicken Sie hier – https://www.databridgemarketresearch.com/reports/global-biodegradable-mulch-film-market