Global Biodegradable Mulch Film Market

Market Size in USD Billion

CAGR :

%

USD

65.38 Billion

USD

114.35 Billion

2024

2032

USD

65.38 Billion

USD

114.35 Billion

2024

2032

| 2025 –2032 | |

| USD 65.38 Billion | |

| USD 114.35 Billion | |

|

|

|

Biodegradable Mulch Film Market Analysis

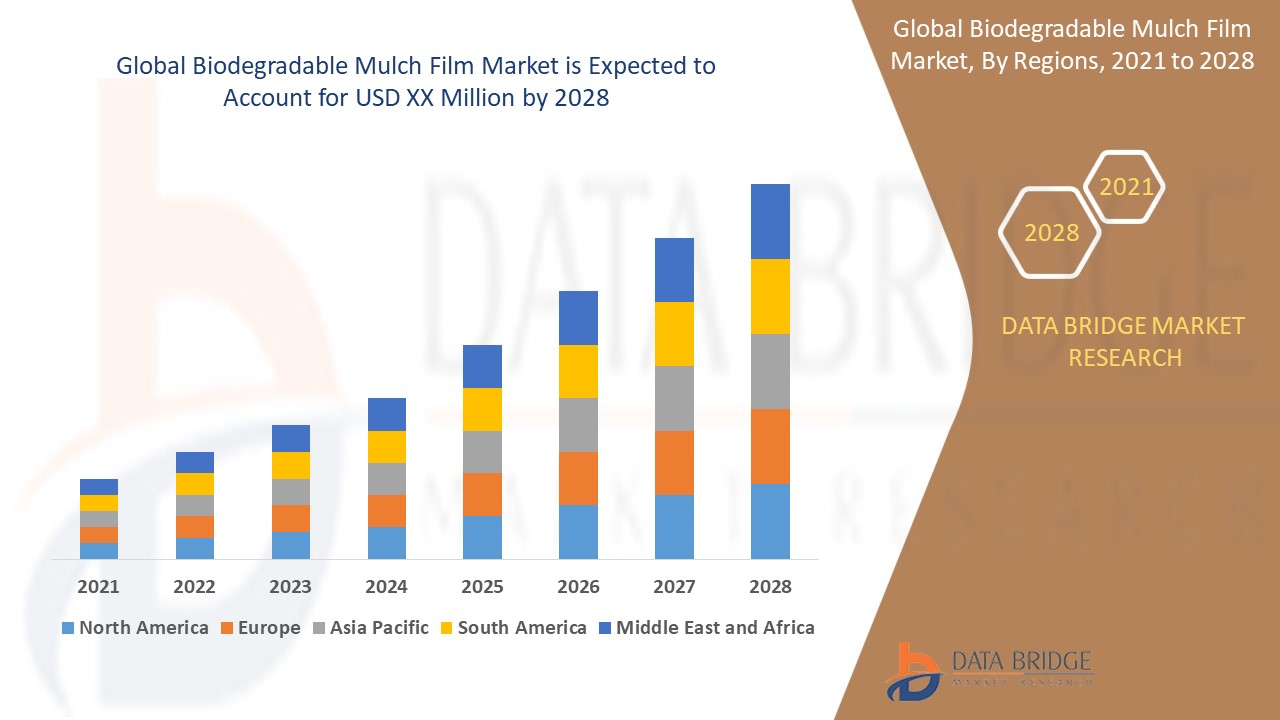

The global biodegradable mulch film market is witnessing robust growth owing to increasing environmental concerns and sustainable agricultural practices. With a shift towards eco-friendly solutions, biodegradable mulch films are gaining traction due to their ability to degrade naturally, reducing soil pollution. Advancements in biopolymer technology and government initiatives supporting sustainable agriculture further propel market expansion. North America and Europe dominate the market due to stringent environmental regulations and widespread adoption of sustainable farming methods. Asia-Pacific is emerging as a lucrative market due to rising awareness and government initiatives promoting biodegradable alternatives. Key players in the market are focusing on research and development to enhance product efficiency and expand their market presence. The market is anticipated to continue its upward trajectory driven by growing environmental consciousness and the need for sustainable farming practices globally.

Biodegradable Mulch Film Market Size

The biodegradable mulch film market size was valued at USD 65.38 billion in 2024 and is projected to reach USD 114.35 billion by 2032, with a CAGR of 7.24% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Report Scope and Biodegradable Mulch Film Segmentation

|

Attributes |

Biodegradable Mulch Film Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

BASF SE, Groupe Barbier, Dubois Agrinovation Inc., Coverfields, PolyExpert, SWAMISAMARTH AGRO BIOTECH LLP, Smurfit Kappa, PLASTIKA KRITIS, CAPTAIN POLYPLAST LTD., Novamont S.p.A, ARMANDO ÁLVAREZ, S.A, FILMORGANIC, BioBag International AS, Fujian Greenjoy Biomaterial Co., Ltd, Tilak Polypack , SUKI CREATIONS PVT. LTD, SPR PACKAGING, LLC, Chennai Polypack Private Limited, Shivam Polymers, and Reya Pack |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Biodegradable Mulch Film Market Definition

Biodegradable mulch film is a type of agricultural film that is designed to break down naturally in the soil after use, avoiding the need for removal and disposal. These films are typically made from biodegradable materials such as bioplastics or natural fibers, which can be broken down by microorganisms in the soil. Biodegradable mulch films offer several advantages over traditional plastic mulch films, including reducing plastic waste in the environment, improving soil health by adding organic matter, and reducing the need for chemical herbicides.

Biodegradable Mulch Film Market Dynamics

Drivers

- Growing Demand of Biodegradable Alternatives

Mulch films are a vital component in modern agriculture, employed to enhance crop yield, conserve soil moisture, regulate soil temperature, and suppress weed growth. These films are typically laid over the soil around plants to create a favourable microenvironment for plant growth. Traditionally, plastic mulch films have dominated the mulch film market due to their effectiveness and cost-efficiency. However, their environmental impact has raised significant concerns among farmers, leading to a growing interest in biodegradable alternatives.

- Government Rules and Regulation for Reducing Plastic Waste

The global environmental crisis caused by plastic pollution has become a major concern for governments worldwide. The alarming accumulation of plastic waste in oceans, landfills, and natural habitats has prompted regulatory bodies to implement stringent rules and regulations aimed at reducing plastic usage. These measures are designed to mitigate the adverse environmental impacts of plastic waste, promote sustainable practices, and encourage the adoption of eco-friendly alternatives. The agricultural sector, in particular, has seen increased regulation, with a significant focus on plastic mulch films, which are widely used for crop production but pose serious disposal challenges.

Opportunities

- Ongoing Research and Development in Biodegradable Materials

The mulch film market has evolved significantly since the first mulch films were introduced in the 1950s. These films, initially designed to conserve soil moisture, reduce weed growth, and improve crop yields, have become an essential tool in modern agriculture. Traditional mulch films, typically made from polyethylene, posed significant environmental challenges due to their non-biodegradable nature, leading to soil contamination and disposal issues. To address these concerns, Research and Development (RandD) efforts have increasingly focused on creating biodegradable alternatives that align with sustainability goals.

- Expanding Adoption of Biodegradable Mulch Films in the Emerging Economies

The growing population in emerging economies is driving an increased demand for food production, necessitating the adoption of modern farming practices. As these regions experience significant population growth, the pressure on agricultural systems intensifies, pushing for more efficient and sustainable farming methods. Modern practices, such as the use of biodegradable mulch films, offer numerous benefits including improved crop yields, soil conservation, and reduced environmental impact. This shift farmer’s attention towards advanced agricultural techniques is essential to meet the rising food demands and ensure food security in these rapidly developing regions.

Restraints/Challenges

- Uncertainty Regarding the Performance of Biodegradable Mulch Films

Biodegradable mulch films offer several advantages over traditional plastic films, including reduced environmental impact and the ability to degrade into non-toxic by-products. However, concerns have been raised about their performance compared to conventional plastic films. Factors such as durability, effectiveness in weed control, and consistency of degradation rates pose uncertainties for farmers and stakeholders.

- Higher Cost than Traditional Plastic Films

Biodegradable mulch films, designed to decompose naturally in the soil, offer an eco-friendly alternative to traditional plastic mulching films. However, the higher cost associated with biodegradable mulch films compared to their non-biodegradable counterpart’s poses a significant restraint to their widespread adoption. Farmers and agricultural businesses often weigh the benefits against the expenses, and the cost disparity can be a decisive factor, limiting the market growth of biodegradable mulch films.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an analyst brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Biodegradable Mulch Film Market Scope

The market is segmented on the basis of material, thickness, form, category, % of surface area covered, crop duration, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Material

- Polylactic Acid (PLA)

- Starch

- Poly (Butylene-Adipate-Co-Terephthalate) (PBAT)

- Polyhydroxyalkanoates (PHA)

- Cellulose

- Poly (Butylene Succinate) (PBS)

- Fossil-Sourced Polyesters

- Poly (Butylene Succinate-Co-Adipate) (PBSA)

- Others

Thickness

- 15 Microns

- 20 Microns

- 25 Microns

- 30 Microns

- 32 Microns

- 50 Microns

- 100 Microns

- Others

Form

- Non-Transparent

- Transparent

Category

- Weed Barrier Mulch

- UV Stabilized Mulch

- Solarization Mulch

- Pesticide barrier mulch

- Insect Repellent Mulch

- Herbicidal Release Mulch

- Fumigation Barrier Mulch

- Others

% of Surface Area Covered

- 70-80%

- 40-60%

- 40-45%

- 90-100%

- 20-25%

Crop Duration

- Short Duration Crops

- Medium Duration Crops

- Long Duration Crops

- Others

Application

- Vegetables

- Fruits

- Cereals and Grains

- Oilseeds and pulses

- Turf and Ornaments

- Floriculture

- Others

Biodegradable Mulch Film Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, material, thickness, form, category, % of surface area covered, crop duration, and application as referenced above.

The countries covered in the market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia and New Zealand, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, United Arab Emirate, Saudi Arabia, Egypt, Israel, South Africa, Rest of Middle East and Africa

Asia-Pacific is expected to dominate global biodegradable mulch film market due to rising adoption of sustainable practice in horticulture and agriculture crops. India is expected to dominate Asia-Pacific biodegradable mulch film market due to government rules and regulation for reducing plastic waste. Russia is expected to dominate Europe biodegradable mulch film market due to growing demand of biodegradable alternatives. U.S. is expected to dominate North America biodegradable mulch film market due to expanding adoption of biodegradable mulch films in the emerging economies.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Biodegradable Mulch Film Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Biodegradable Mulch Film Market Leaders Operating in the Market Are:

- BASF SE

- Groupe Barbier

- Dubois Agrinovation Inc.

- Coverfields

- PolyExpert

- SWAMISAMARTH AGRO BIOTECH LLP

- Smurfit Kappa

- PLASTIKA KRITIS

- CAPTAIN POLYPLAST LTD.

- Novamont S.p.A

- ARMANDO ÁLVAREZ, S.A

- FILMORGANIC

- BioBag International AS

- Fujian Greenjoy Biomaterial Co., Ltd

- Tilak Polypack

- SUKI CREATIONS PVT. LTD

- SPR PACKAGING, LLC

- Chennai Polypack Private Limited

- Shivam Polymers

- Reya Pack

Latest Developments in Biodegradable Mulch Film Market

- In October 2023, according to ABA, each year, Australian agriculture used 200,000 kilometres of plastic mulch film. Disposing of it posed a major issue, with an estimated 40,000 tonnes being stockpiled, buried, or burned annually due to limited recycling options. Conventional OXO-degradable plastics fractured into micro-plastics when left to degrade, causing long-lasting soil contamination and potential entry into the food chain

- In April 2024, European Commission urged a global ban on certain plastic products to combat pollution. They advocated for a comprehensive lifecycle approach to plastics, including bans and enhanced product design. Over 4,000 participants from various sectors met in Canada to negotiate a legally binding treaty to end plastic pollution by 2024. The proposed treaty emphasized obligatory elimination and restrictions on problematic plastics to reduce environmental and health risks

- In October 2023, BioBag International AS. (BioBag World Australia) developed a soil biodegradable agricultural mulch film, easing disposal for growers without harming soil quality. Verified by the Australasian Bioplastics Association to meet ISO 23517: 2021, it became Australia's sole producer with this accreditation, offering an eco-friendly alternative, reducing disposal costs, and enhancing soil health

- In October 2022, according to the research published by ABC Publication, the American Chemical Society faced three main disadvantages regarding Polylactic Acid (PLA) biodegradable mulch film: low ductility, high cost compared to LDPE, and slow biodegradability in soil. With an elongation at break of around 5%, it was over twice as expensive as LDPE and degraded rapidly only in industrial composting conditions at 58°C

- In February 2020, according to the research paper published by ResearchGate GmbH, biodegradable mulch films, primarily made from Polylactic Acid (PLA), cost over 4000 USD per metric ton, significantly higher than conventional polymers, which range from 1000 to 1500 USD per metric ton. Consequently, biodegradable mulch films were found to be 1.5 to 1.8 times more expensive than traditional plastic mulches

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Biodegradable Mulch Film Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Biodegradable Mulch Film Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Biodegradable Mulch Film Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.