Schwefelsäure, auch bekannt als Vitriolöl, ist eine vielseitige und unverzichtbare Chemikalie mit zahlreichen positiven Anwendungen. Als starke Säure dient sie als wichtiges Reagenz in Industrie und Labor in verschiedenen Prozessen. Ihre farb- und geruchlose sowie viskose Beschaffenheit erhöht die Sicherheit in der Handhabung. Die hohe Wasserlöslichkeit von Schwefelsäure gewährleistet eine effiziente Anwendung in verschiedenen Konzentrationen. Mit der Summenformel H₂SO₄ weist sie stark säurehaltige Eigenschaften auf und findet Anwendung in verschiedenen Branchen, darunter der Metallverarbeitung, der chemischen Herstellung und der Düngemittelproduktion, und trägt so zur globalen industriellen Entwicklung und Innovation bei.

Vollständigen Bericht abrufen unter https://www.databridgemarketresearch.com/reports/europe-sulfuric-acid-market

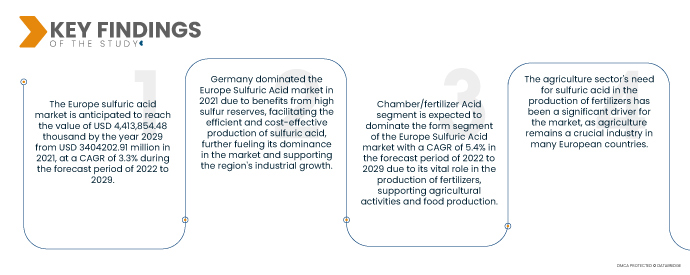

Data Bridge Market Research analysiert, dass der europäische Schwefelsäuremarkt voraussichtlich einen Wert von 4.413.854,48 Tausend US-Dollar im Jahr 2029 erreichen wird, von 3.404.202,91 Millionen US-Dollar im Jahr 2021, bei einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 3,3 % im Prognosezeitraum 2022 bis 2029. Schwefelsäure ist eine grundlegende Chemikalie, die in einer Vielzahl von industriellen Prozessen wie der Metallverarbeitung, Erdölraffination und der chemischen Herstellung verwendet wird und für eine konstante Nachfrage in Europa sorgt.

Wichtigste Ergebnisse der Studie

Die chemische Produktion dürfte das Marktwachstum antreiben

In der chemischen Produktion spielt Schwefelsäure als grundlegender Rohstoff eine zentrale Rolle für die Herstellung einer Vielzahl wichtiger Chemikalien. Sie findet Anwendung in der Düngemittelproduktion, wo sie nährstoffreiche Düngemittel für die Landwirtschaft liefert. Darüber hinaus spielt Schwefelsäure eine Schlüsselrolle bei der Synthese synthetischer Farbstoffe und trägt so zur dynamischen Textil- und Farbenindustrie bei. Darüber hinaus trägt ihr Einsatz in der Waschmittelproduktion zur Herstellung wirksamer Reinigungsprodukte bei und unterstützt so das Wachstum und die Entwicklung der chemischen Industrie in Europa.

Berichtsumfang und Marktsegmentierung

Berichtsmetrik

|

Details

|

Prognosezeitraum

|

2022 bis 2029

|

Basisjahr

|

2021

|

Historische Jahre

|

2020 (Anpassbar auf 2014 – 2019)

|

Quantitative Einheiten

|

Umsatz in Tausend USD, Mengen in Tausend, Preise in USD

|

Abgedeckte Segmente

|

Rohstoffe (Nichtedelmetallhütten, elementarer Schwefel, Pyriterz und andere), Form (konzentriert, 66-Grad-Baume-Schwefelsäure, Turm-/Glover-Säure, Kammer-/Düngemittelsäure, Batteriesäure und verdünnte Schwefelsäure), Herstellungsverfahren (Kontaktverfahren, Bleikammerverfahren, Nassschwefelsäureverfahren, Metabisulfitverfahren und andere), Vertriebskanal (offline und online), Anwendung (Düngemittel, chemische Herstellung, Erdölraffination, Metallverarbeitung, Automobil-, Textil-, Arzneimittelherstellung, Zellstoff und Papier , Industrie und andere)

|

Abgedecktes Land

|

Deutschland, Großbritannien, Italien, Frankreich, Spanien, Russland, Schweiz, Türkei, Belgien, Niederlande und Restliches Europa

|

Abgedeckte Marktteilnehmer

|

LANXESS (Deutschland), Brenntag GmbH (eine Tochtergesellschaft der Brenntag SE) (Deutschland), Boliden Group (Schweden), Adisseo (Frankreich), Veolia (Frankreich), Univar Solutions Inc (USA), NORAM Engineering & Construction Ltd. (Kanada), Nouryon (Niederlande), International Raw Materials LTD (USA), Eti Bakir (Türkei), ACIDEKA SA (Spanien), Airedale Chemical Company Limited (Großbritannien), BASF SE (Ludwigshafen, Deutschland), Aguachem Ltd (Großbritannien), Feralco AB (Großbritannien), Fluorsid (Italien), Aurubis AG (Deutschland), Nyrstar (Niederlande), Merck KGaA (Deutschland) und Shrieve (USA)

|

Im Bericht behandelte Datenpunkte

|

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, geografisch dargestellte Produktion und Kapazität nach Unternehmen, Netzwerklayouts von Distributoren und Partnern, detaillierte und aktuelle Preistrendanalysen und Defizitanalysen der Lieferkette und Nachfrage.

|

Segmentanalyse:

Der europäische Schwefelsäuremarkt ist nach Rohstoff, Form, Herstellungsverfahren, Vertriebskanal und Anwendung segmentiert.

- Auf der Grundlage der Rohstoffe ist der Markt in Nichtedelmetallhütten, elementaren Schwefel, Pyriterz und andere segmentiert. Es wird erwartet, dass das Segment des elementaren Schwefels den Rohstoffmarkt aufgrund der reichlichen Verfügbarkeit und der Kosteneffizienz bei der Herstellung von Schwefelsäure im Kontaktverfahren mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 5,1 % im Prognosezeitraum 2022 bis 2029 dominieren wird.

Im Jahr 2022 wird das Segment elementarer Schwefel voraussichtlich den Rohstoff des europäischen Schwefelsäuremarktes dominieren

Im Jahr 2022 wird das Segment elementarer Schwefel voraussichtlich den Rohstoffmarkt dominieren, da es als Primärrohstoff im Kontaktverfahren zur Schwefelsäureproduktion weit verbreitet und kostengünstig ist und im Prognosezeitraum von 2022 bis 2029 eine durchschnittliche jährliche Wachstumsrate (CAGR) von 5,1 % aufweisen wird.

- Der Markt ist nach Form segmentiert in konzentrierte, 66-Grad-Baume-Schwefelsäure, Turm-/Glover-Säure, Kammer-/Düngemittelsäure, Batteriesäure und verdünnte Schwefelsäure. Das Kammer-/Düngemittelsäure-Segment wird voraussichtlich das Formsegment des europäischen Schwefelsäuremarktes mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 5,4 % im Prognosezeitraum 2022 bis 2029 dominieren, da es eine wichtige Rolle bei der Düngemittelproduktion, der Unterstützung landwirtschaftlicher Aktivitäten und der Lebensmittelproduktion spielt.

- Der Markt wird nach Herstellungsverfahren in Kontaktverfahren, Bleikammerverfahren, Nassschwefelsäureverfahren, Metabisulfitverfahren und weitere unterteilt. Das Kontaktverfahren wird voraussichtlich aufgrund seiner hohen Effizienz und Wirtschaftlichkeit im Prognosezeitraum 2022 bis 2029 mit einer durchschnittlichen jährlichen Wachstumsrate von 5,3 % das Segment der Herstellungsverfahren auf dem europäischen Schwefelsäuremarkt dominieren. Dabei wird Schwefeldioxid oxidiert, um Schwefeltrioxid zu erzeugen, das anschließend zu Schwefelsäure hydratisiert wird. Daher ist es ein in der Industrie weit verbreitetes Verfahren.

Im Jahr 2022 wird das Kontaktverfahren voraussichtlich das Herstellungsprozesssegment des europäischen Schwefelsäuremarktes dominieren

Im Jahr 2022 wird das Kontaktverfahren voraussichtlich das Herstellungsverfahrensegment des europäischen Schwefelsäuremarktes dominieren, da es Schwefeldioxid hocheffizient in Schwefeltrioxid umwandelt, einem entscheidenden Schritt für die Produktion von Schwefelsäure in großen Mengen, und die Skalierbarkeit der Branche mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 5,3 % im Prognosezeitraum von 2022 bis 2029 sicherstellt.

- Der europäische Schwefelsäuremarkt ist nach Vertriebskanälen in Offline und Online unterteilt. Offline wird voraussichtlich im Prognosezeitraum 2022 bis 2029 mit einer durchschnittlichen jährlichen Wachstumsrate von 5,1 % das Vertriebskanalsegment des europäischen Schwefelsäuremarktes dominieren, da Kunden persönlichen Service und Produktprüfungen vor dem Kauf bevorzugen. Einzelhandelsgeschäfte und Händler bieten Komfort und direkte Interaktion und stärken so das Vertrauen und die Zufriedenheit der Verbraucher.

- Der Markt ist nach Anwendungsbereichen segmentiert in Düngemittel, Chemieproduktion, Erdölraffination, Metallverarbeitung, Automobilindustrie, Textilindustrie, Arzneimittelherstellung, Zellstoff- und Papierindustrie, Industrie und weitere. Düngemittel werden voraussichtlich das Anwendungssegment des europäischen Schwefelsäuremarktes mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 5,2 % im Prognosezeitraum 2022 bis 2029 dominieren, da Schwefelsäure im Agrarsektor für die nährstoffreiche Bodenaufbereitung, das Pflanzenwachstum und die Lebensmittelproduktion unerlässlich ist und zur globalen Lebensmittelversorgungskette beiträgt.

Hauptakteure

Data Bridge Market Research erkennt die folgenden Unternehmen als die wichtigsten Akteure auf dem europäischen Schwefelsäuremarkt an: BASF SE (Deutschland), Aguachem Ltd (Großbritannien), Feralco AB (Großbritannien), Fluorsid (Italien), Aurubis AG (Deutschland) und Nyrstar (Niederlande).

Marktentwicklungen

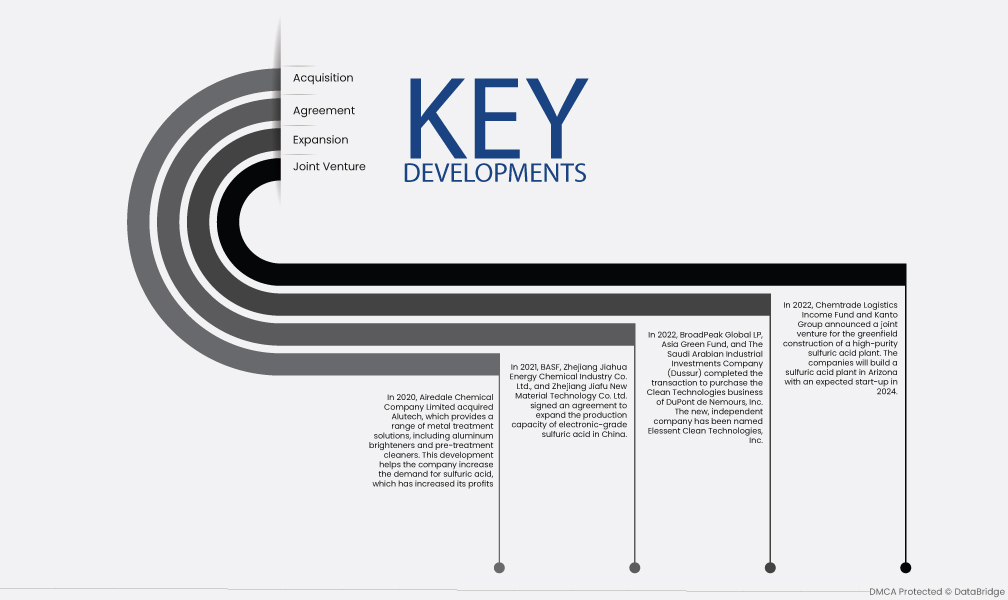

- Im Jahr 2022 gaben der Chemtrade Logistics Income Fund und die Kanto Group ein Joint Venture für den Neubau einer Anlage zur Herstellung hochreiner Schwefelsäure bekannt. Die beiden Unternehmen werden in Arizona eine Schwefelsäureanlage errichten, deren Inbetriebnahme für 2024 geplant ist.

- Im Jahr 2022 schlossen BroadPeak Global LP, Asia Green Fund und The Saudi Arabian Industrial Investments Company (Dussur) die Transaktion zum Kauf des Geschäftsbereichs Clean Technologies von DuPont de Nemours, Inc. ab. Das neue, unabhängige Unternehmen erhielt den Namen Elessent Clean Technologies, Inc.

- Im Jahr 2021 unterzeichneten BASF, Zhejiang Jiahua Energy Chemical Industry Co. Ltd. und Zhejiang Jiafu New Material Technology Co. Ltd. eine Vereinbarung zur Erweiterung der Produktionskapazität von Schwefelsäure in Elektronikqualität in China.

- Im Jahr 2020 übernahm die Airedale Chemical Company Limited Alutech, ein Anbieter von Lösungen zur Metallbehandlung, darunter Aluminiumaufheller und Vorbehandlungsreiniger. Diese Entwicklung trägt dazu bei, die Nachfrage nach Schwefelsäure zu steigern, was wiederum zu höheren Gewinnen führte.

Regionale Analyse

Geografisch betrachtet sind die im europäischen Schwefelsäuremarktbericht abgedeckten Länder Deutschland, Großbritannien, Italien, Frankreich, Spanien, Russland, die Schweiz, die Türkei, Belgien, die Niederlande und das übrige Europa

Laut Marktforschungsanalyse von Data Bridge:

Deutschland ist die dominierende Region auf dem europäischen Schwefelsäuremarkt im Prognosezeitraum 2022-2029

Deutschlands führende Position auf dem Schwefelsäuremarkt ist auf die starke Industrialisierung zurückzuführen, die eine starke Nachfrage nach der Chemikalie für verschiedene Anwendungen schafft. Die florierende Chemieindustrie des Landes ist in hohem Maße auf Schwefelsäure als wichtigen Rohstoff für die Herstellung von Düngemitteln, synthetischen Farbstoffen und Reinigungsmitteln angewiesen. Darüber hinaus profitiert Deutschland von hohen Schwefelreserven, die eine effiziente und kostengünstige Produktion von Schwefelsäure ermöglichen, die Marktführerschaft weiter stärken und das industrielle Wachstum der Region fördern.

Für detailliertere Informationen zum europäischen Schwefelsäuremarktbericht klicken Sie hier – https://www.databridgemarketresearch.com/reports/europe-sulfuric-acid-market