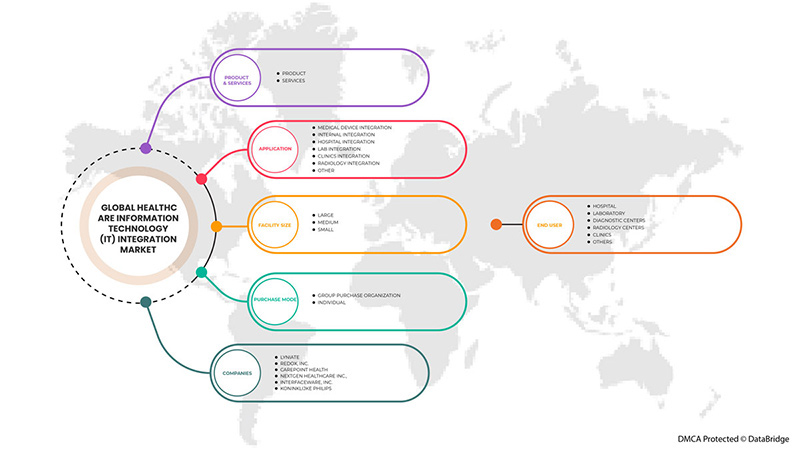

North America Healthcare Information Technology (IT) Integration Market, By Product & Services (Product, and Services), Application (Medical Device Integration, Internal Integration, Hospital Integration, Lab Integration, Clinics Integration, and Radiology Integration), Facility Size (Large, Medium, and Small), Purchase Mode (Group Purchase Organization, and Individual), End User (Hospitals, Laboratory, Diagnostic Centers, Radiology Centers, and Clinics), Industry Trends and Forecast to 2029.

North America Healthcare Information Technology (IT) Integration Market Analysis and Insights

Healthcare IT integration enables it for healthcare systems to gather data, exchange it with the cloud, and communicate with one another, allowing for the rapid and correct analysis of that data. The Internet of Things (IoT) combines sensor output with communications to provide tasks that were until recently thought of as notional, from monitoring and diagnosis to delivery methods. The sensors can be incorporated into a device, cloud-based, or wearable. With the developments of such sensors and ICT, the healthcare sector now possesses a dynamic collection of patient data that can be used to support diagnostics and preventive care and to assess the likely success of preventive treatment.

In addition, Integration initiatives are often limited in scope. They integrate only a small portion of patient data available because it is difficult to move information among disparate clinical and business software applications within and beyond healthcare enterprise borders. It requires a thorough understanding of data governance, expert health messaging standards, access to sophisticated technology, and expertise in systems integration, including service-oriented architecture (SOA) and enterprise architecture management (EAM). CGI’s HIIF defines and describes all the parameters necessary to achieve the integration that healthcare organizations require.

However, the higher costs associated with integrated IT solutions and issues associated with interoperability are anticipated to restrain the market growth.

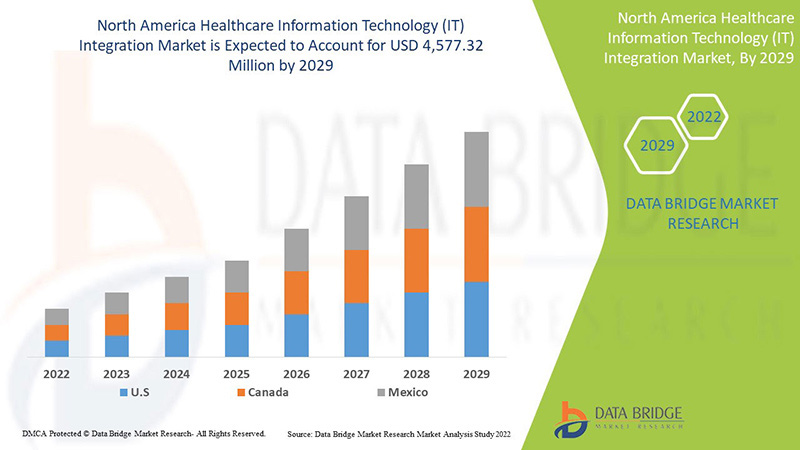

Data Bridge Market Research analyzes that the North America healthcare information technology (IT) integration market is expected to reach a value of USD 4,577.32 million by 2029, at a CAGR of 13.4% during the forecast period. Product and services account for the largest type segment in the market due to the rapid demand for IT solutions and services in North America. This market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

收入(百万美元)、销量(单位)、定价(美元) |

|

涵盖的领域 |

按产品和服务(产品和服务)、应用(医疗设备集成、内部集成、医院集成、实验室集成、诊所集成和放射科集成)、设施规模(大、中、小)、购买模式(团购组织和个人)、最终用户(医院、实验室、诊断中心、放射中心和诊所)。 |

|

覆盖国家 |

美国、加拿大和墨西哥。 |

|

涵盖的市场参与者 |

Lyniate、Redox, Inc.、carepoint health、Nextgen Healthcare Inc.、Interfaceware, Inc. Koninklijke Philips、Oracle、AVI-SPL, INC.、Allscripts Healthcare solutions, Inc、Epic systems corporation、Qualcomm life Inc.、Capsule technologies Inc. Orion health、Quality syetems, Inc.、Cerner corporation、Intersystems corporation、Infor Inc.、GE Healthcare、MCKESSON Corporation 和 Meditech 等。 |

北美医疗保健信息技术 (IT) 集成市场定义

健康 IT 集成(健康信息技术)是 IT 领域的一部分,涉及为医疗保健行业设计、开发、创建、使用和维护信息系统。自动化和可互操作的医疗保健信息系统将继续改善医疗保健和公共卫生、降低成本、提高效率、减少错误和提高患者满意度,并优化门诊和住院医疗保健提供者的报销。健康 IT 的重要性源于不断发展的技术和不断变化的政府政策的结合,这些政策影响着患者护理的质量。一些医疗保健信息技术 (IT) 集成产品包括接口/集成引擎、医疗设备集成软件和媒体集成解决方案,服务包括实施和集成、支持和维护、培训和教育以及咨询。健康 IT 使医疗保健提供者能够通过安全地使用和共享健康信息来更好地管理患者护理。通过为大多数美国人开发安全和私密的电子健康记录,并在需要的时间和地点以电子方式提供健康信息,健康 IT 可以提高护理质量,甚至使医疗保健更具成本效益。借助医疗 IT,医疗保健提供者将拥有:准确、完整的患者健康信息。这样,提供者就可以提供尽可能好的护理,无论是在例行就诊还是医疗紧急情况下,能够更好地协调所提供的护理。如果患者患有严重的疾病,这一点尤其重要。对于选择这种便利的患者来说,这是一种通过互联网与患者及其家庭护理人员安全共享信息的方式。

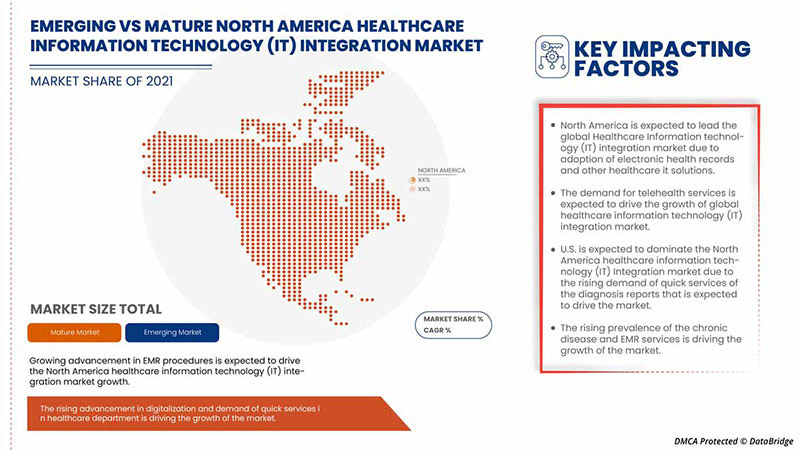

此外,电子病历和其他医疗 IT 解决方案的快速普及是市场影响力巨大的驱动因素之一。此外,将患者数据集成到医疗系统的迫切需求以及政府的优惠政策、资助计划和部署医疗 IT 集成解决方案的举措是市场增长的主要驱动因素。

北美医疗信息技术 (IT) 集成市场动态

本节旨在了解市场驱动因素、机遇、限制因素和挑战。下文将详细讨论所有这些内容:

驱动程序

- 电子健康记录和其他医疗 IT 解决方案的快速采用

患者数据复杂、保密,而且通常不是结构化的。将这些信息纳入医疗保健交付流程是一项挑战,必须应对这一挑战才能抓住机会改善患者护理。尽管电子健康记录 (HER) 已经使用了十多年,但由于各国政府采取措施提高患者数据安全性,该市场最近才开始加速发展。

HITECH 施加的监管要求刺激了 EHR 和 EMR 的采用。推动市场增长的另一个重要因素是责任医疗组织 (ACO) 的数量不断增加,从而增加了对 EHR 和 EMR 的需求。

丹麦、瑞典、法国和加拿大等其他国家的政府也在鼓励采用 EHR,并强制要求有效使用 EHR 来控制医疗保健成本。

此外,IT 服务有助于整合整个医疗保健系统中的各种最终用户,包括医院、护理部门、药房和健康保险公司。然而,整合这些数据及其实时可用性对于医疗保健专业人员确保有效决策至关重要。因此,随着未来几年 EHR 系统的预期增长,医院将重点关注通过将不同的医院系统与 EHR 集成来提高其能力,从而为医疗保健信息技术 (IT) 集成市场创造发展机会。

- 远程医疗服务和远程患者监控解决方案的需求不断增长

目前,远程医疗服务被用于监测和咨询目的。医疗保健解决方案的进步有助于提供教育内容并确保患者和医疗保健提供者之间的不间断沟通。远程患者监测解决方案的成功运行取决于医疗和信息和通信技术 (ICT) 设备的成功集成,这些设备能够实现远距离医疗服务。

由于医生和护士在医院工作时大部分时间都没有电脑,他们很难随身携带病历。因此,许多市场参与者已开始提供移动平台,例如移动应用程序,用于医疗 IT 解决方案。

计算技术的进步提供了越来越多的选择,例如先进的宽带、移动和网络、远程患者监控、高清视频会议和 EHR。这为解决方案提供商整合医疗信息技术创造了重大机遇。通过由互联医疗设备组成的物联网医疗网络,可以远程监控家中患者的生命体征,例如血压水平、体重、血糖水平、心电图和体温,因为患者数据会自动发送给护士或医生。

联网医疗环境允许医生远程监控和调整患者的病情。联网医疗技术涉及智能传感器技术、高级连接、界面增强和数据分析。这些进步有助于通过提高患者接受度和减少就诊次数来降低医疗成本。此外,虽然实施成本可能很高,但这些技术有助于加快许多企业的运营速度。

随着技术的进步,这些解决方案在改善远程监控和患者依从性以及随后的生活质量方面发挥着重要作用。因此,对远程监控解决方案和远程设备日益增长的需求预计将在未来几年推动北美医疗信息技术 (IT) 集成解决方案提供商的增长。

克制

- 与互操作性相关的问题

医疗信息系统的异构性对成功实施和使用医疗信息解决方案构成了重大挑战。许多国家没有用于存储和交换数据的特定 IT 标准,这导致了互操作性问题。虽然存在许多不同的数据存储、传输和安全标准,但实施和集成这些互操作性标准对护理提供者以及医疗和医疗 IT 解决方案提供者来说是一个重大挑战。由于缺乏单一的医疗信息系统来满足主要医疗保健提供者的所有行政、临床、技术和实验室要求,互操作性要求和互操作性标准变得非常重要。由于对定义的标准了解不足或缺乏技术知识,供应商也遵循不同的数据格式和标准,这使得与合作伙伴系统共享实时数据变得困难,从而增加了医疗 IT 集成的成本。数据质量和完整性问题、不符合既定标准、缺乏合格的专业人员以及医疗保健提供者之间的正常运行时间差异是实施完全可互操作的医疗 IT 基础设施的主要障碍。这些因素预计将抑制市场的增长。

机遇/ 挑战

- 数据集成相关的挑战

不同部门创建了与患者相关的信息。在医疗保健组织内的所有治疗点,使其成为一个信息密集程度更高的行业,并且可靠的患者记录是必不可少的,但是,必须通过结合大量数据来提供可靠的信息,以生成全面而可信的患者记录,因为医疗保健系统中使用各种医疗设备和诊断仪器,并且越来越需要连接所有这些系统,以协助医疗保健从业者在各个护理提供点快速响应。

许多医疗机构都投资了多种信息管理应用程序,包括资产管理系统、影像系统、电子邮件管理系统、表格管理系统、临床信息系统、劳动力管理系统、数据库管理系统、内容管理系统、收入周期管理系统、临床和非临床工作流系统以及客户关系管理系统。随着医疗机构越来越多地采用各种医疗 IT 系统,将不同类型的 IT 系统集成到组织的 IT 架构中的需求也越来越大,以确保这些系统得到最佳利用并有助于做出准确的决策。医疗 IT 系统与其他系统的成功结合是医疗机构 IT 基础设施开发项目的重点。

因此,医疗保健中的每个组织都使用不同的系统,并且由于数据集成而导致误诊和报告检查不当的可能性很高,从而破坏了医疗保健信息技术的使用,这对市场增长构成了挑战。

COVID-19 对北美医疗信息技术 (IT) 集成市场的影响

COVID-19 疫情对北美医疗保健产生了巨大影响,英国是受影响最严重的国家之一。由于 COVID-19 疫情,所有医疗诊所都承受着巨大的压力,全球医疗机构每天都有大量患者就诊,人满为患。冠状病毒疾病的不断流行推动了全球多个国家对准确诊断和治疗设备的需求。在这方面,联网护理技术已被证明非常有用。它们允许医疗保健提供者使用数字连接的无创设备(例如家用血压监测仪和脉搏血氧仪)监测患者。此外,这种疾病在北美的迅速蔓延导致医院病床和医护人员短缺。因此,联网医疗设备越来越多地被采用来监测生命体征,未来几年可能会出现类似的趋势

制造商正在制定各种战略决策,以在新冠疫情后实现复苏。参与者正在进行多项研发活动和产品发布,并建立战略合作伙伴关系,以改进药物基因组学检测市场所涉及的技术和检测结果。

最新动态

- 2022 年 8 月,Cognizant 宣布被 AXA UK & Ireland 选为技术合作伙伴,帮助其整合、现代化和管理部分 IT 运营。AXA UK & Ireland 正在改造其技术生态系统,以创建一个更加数字化、现代化和敏捷的 IT 环境,该环境数据丰富、安全、可持续且总体成本更低。Cognizant 将提供综合 IT 服务,涵盖服务台支持和维护、终端用户计算、应用程序开发和维护、云运营和 IT 基础设施管理。这有助于该公司扩大业务。

- 2022 年 7 月,NXGN Management, LLC 在 7 月 28 日至 31 日于奥兰多举行的美国足病医学协会 (APMA) 年度会议上展示了其屡获殊荣的 NextGen Office,这是唯一集成到该协会注册中心的电子健康记录 (EHR)。NextGen Healthcare 是 APMA 注册中心的创始合作伙伴,为 NextGen Healthcare 客户提供临床相关见解。这有助于该公司在 APMA 展示其产品并获得认可。

北美医疗信息技术 (IT) 集成市场范围

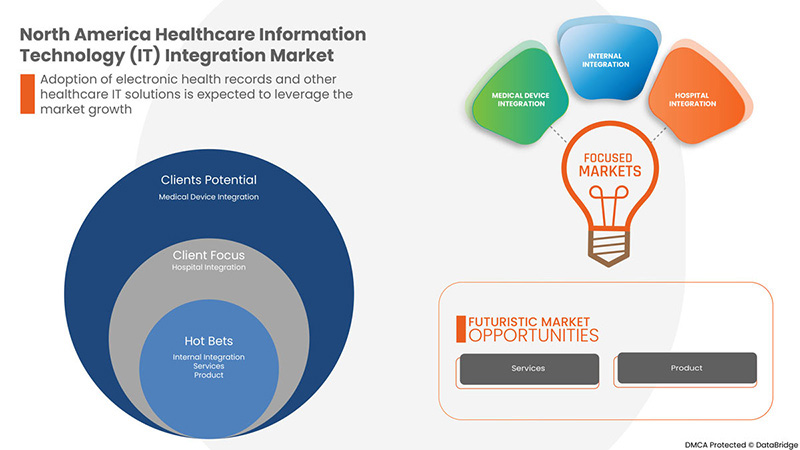

北美医疗保健信息技术 (IT) 集成市场细分为产品和服务、应用、设施规模、购买模式和最终用户。细分市场之间的增长有助于您分析利基增长领域和进入市场的策略,并确定您的核心应用领域和目标市场的差异。

按产品和服务

- 产品

- 服务

根据产品和服务,北美医疗保健信息技术 (IT) 集成市场分为产品和服务。

按应用

- 医疗器械集成

- 内部整合

- 医院整合

- 实验室整合

- 诊所整合

- 放射科整合

- 其他

根据应用,北美医疗保健信息技术 (IT) 集成市场细分为医疗设备集成、内部集成、医院集成、实验室集成、诊所集成、放射学集成和其他。

按设施规模

- 大的

- 中等的

- 小的

根据设施规模,北美医疗保健信息技术 (IT) 集成市场分为大型、中型和小型。

按购买方式

- 团购组织

- 个人

根据购买模式,北美医疗保健信息技术(IT)集成市场分为团体购买和个人购买。

按最终用户

- 医院

- 实验室

- 诊断中心

- 放射科中心

- 诊所

- 其他的

根据最终用户,北美医疗保健信息技术 (IT) 集成市场分为医院、实验室、诊断中心、放射中心、诊所和其他。

北美医疗保健信息技术 (IT) 集成市场区域分析/见解

对北美医疗保健信息技术 (IT 集成市场进行分析,并按产品和服务、应用、设施规模、购买模式和最终用户提供市场规模信息。

本市场报告涵盖的国家包括美国、加拿大和墨西哥。

2022 年,北美将占据主导地位,因为北美是最大的消费市场,GDP 较高,拥有主要市场参与者。由于医疗 IT 技术进步的提升,美国预计将实现增长。

报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和国内市场监管变化。新销售、替代销售、国家人口统计、监管法案和进出口关税等数据点是用于预测各个国家市场情景的一些主要指标。此外,在对国家数据进行预测分析时,还考虑了北美品牌的存在和可用性以及它们因来自本地和国内品牌的激烈或稀缺竞争而面临的挑战,以及销售渠道的影响。

Competitive Landscape and North America Healthcare Information Technology (IT) Integration Market Share Analysis

North America healthcare information technology (IT) integration market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points are only related to the company’s focus on the North America healthcare information technology (IT) integration market.

Some of the major players operating in the North America healthcare information technology (IT) integration market are Lyniate, Redox, Inc., carepoint health, Nextgen Healthcare Inc., Interfaceware, Inc., Koninklijke Philips, Oracle, AVI-SPL, INC., Allscripts Healthcare solutions Inc., Epic systems corporation, Qualcomm life Inc., Capsule technologies Inc., Orion health, Quality syetems, Inc., Cerner corporation, Intersystems corporation, Infor Inc., GE Healthcare, MCKESSON Corporatio, and Meditech, among others.

Research Methodology: North America Healthcare Information Technology (IT) Integration Market

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include the Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, North America vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT AND SERVICES LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 POTENTIAL HEALTHCARE IT TECHNOLOGIES

4.1.1 EHR

4.1.2 EMR

4.1.3 ARTIFICIAL INTELLIGENCE

4.1.4 TELEMEDICINE

5 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET SHARE ANALYSIS-

6 REGULATIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RAPID ADOPTION OF ELECTRONIC HEALTH RECORDS AND OTHER HEALTHCARE IT SOLUTIONS

7.1.2 GROWING DEMAND FOR TELEHEALTH SERVICES AND REMOTE PATIENT MONITORING SOLUTIONS

7.1.3 GROWING REQUIREMENT OF TELEHEALTH SERVICES ACROSS HEALTHCARE SECTOR

7.2 RESTRAINS

7.2.1 ISSUES ASSOCIATED WITH INTEROPERABILITY

7.2.2 HIGH COSTS ASSOCIATED WITH INTEGRATED IT SOLUTIONS

7.3 OPPORTUNITIES

7.3.1 EARLY MEDICAL DECISIONS AND CLINICAL DECISION SUPPORT

7.3.2 DATA UNIFORMITY AND STANDARDIZED DATA EXCHANGE

7.3.3 INCREASING AWARENESS AMONG PEOPLE

7.4 CHALLENGES

7.4.1 DATA INTEGRATION RELATED CHALLENGES

7.4.2 RISING HEALTHCARE FRAUDS

8 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT AND SERVICES

8.1 OVERVIEW

8.2 SERVICES

8.2.1 SUPPORT & MAINTENANCE

8.2.2 IMPLEMENTATION & INTEGRATION

8.2.3 TRAINING & EDUCATION

8.2.4 CONSULTING

8.3 PRODUCT

8.3.1 INTERFACE/INTEGRATION ENGINES

8.3.1.1 GROUP PURCHASE ORGANIZATION

8.3.1.2 INDIVIDUAL

8.3.2 MEDICAL DEVICE INTEGRATION SOFTWARE

8.3.2.1 GROUP PURCHASE ORGANIZATION

8.3.2.2 INDIVIDUAL

8.3.3 MEDIA INTEGRATION SOLUTIONS

8.3.3.1 GROUP PURCHASE ORGANIZATION

8.3.3.2 INDIVIDUAL

8.3.4 OTHER INTEGRATION TOOLS

9 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 MEDICAL DEVICE INTEGRATION

9.3 HOSPITAL INTEGRATION

9.4 INTERNAL INTEGRATION

9.5 RADIOLOGY INTEGRATION

9.6 LAB INTEGRATION

9.7 CLINICS INTEGRATION

9.8 OTHERS

10 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE

10.1 OVERVIEW

10.2 LARGE

10.3 MEDIUM

10.4 SMALL

11 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE

11.1 OVERVIEW

11.2 GROUP PURCHASE ORGANIZATION

11.3 INDIVIDUAL

12 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITAL

12.3 DIAGNOSTIC CENTERS

12.4 RADIOLOGY CENTERS

12.5 LABORATORY

12.6 CLINICS

12.7 OTHERS

13 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 EMR PROVIDERS

16.2 ALLSCRIPTS HEALTHCARE, LLC AND/OR ITS AFFILIATES.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 NXGN MANAGEMENT, LLC

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 EPIC SYSTEMS CORPORATION

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 MEDICAL INFORMATION TECHNOLOGY, INC.

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENTS

16.6 TEGRATION PROVIDERS

16.7 INFOR.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 LYNIATE

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 QVERA

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 INTERSYSTEM CORPORATION

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 GENERAL ELECTRIC HEALTHCARE

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 COMPANY SHARE ANALYSIS

16.11.4 PRODUCT PORTFOLIO

16.11.5 RECENT DEVELOPMENTS

16.12 INTERFACEWARE INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 ORION HEALTH GROUP

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 IBM (2021)

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 COMPANY SHARE ANALYSIS

16.14.4 PRODUCT PORTFOLIO

16.14.5 RECENT DEVELOPMENTS

16.15 SUMMIT HEALTHCARE SERVICES, INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 MASIMO (2021)

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENT

16.17 MDI SOLUTIONS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 COGNIZANT

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 SIEMENS HEALTHCARE GMBH

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 COMPANY SHARE ANALYSIS

16.19.4 PRODUCT PORTFOLIO

16.19.5 RECENT DEVELOPMENTS

16.2 REDOX, INC.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 BOTH PROVIDERS

16.22 ORACLE (2021)

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 COMPANY SHARE ANALYSIS

16.22.4 PRODUCT PORTFOLIO

16.22.5 RECENT DEVELOPMENTS

16.23 KONNKLIJKE PHILIPS N.V. (2021)

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

表格列表

TABLE 1 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA MEDICAL DEVICE INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA HOSPITAL INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA INTERNAL INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA RADIOLOGY INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA LAB INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA CLINICS INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA OTHERS INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA LARGE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA MEDIUM IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA SMALL IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA GROUP PURCHASE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA INDIVIDUAL IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA HOSPITAL IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA DIAGNOSTIC CENTRES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA RADIOLOGY CENTRES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA LABORATORY IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA CLINICS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA OTHERS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION))

TABLE 39 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 42 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 43 U.S. SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 44 U.S. PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 45 U.S. INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 46 U.S. MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 47 U.S. MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 48 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION))

TABLE 49 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 50 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 51 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 52 CANADA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 53 CANADA SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 54 CANADA PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 55 CANADA INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 56 CANADA MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 57 CANADA MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 58 CANADA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION))

TABLE 59 CANADA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 60 CANADA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 61 CANADA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 62 MEXICO HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 63 MEXICO SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 64 MEXICO PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 65 MEXICO INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 66 MEXICO MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 67 MEXICO MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 68 MEXICO HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION))

TABLE 69 MEXICO HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 70 MEXICO HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 71 MEXICO HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: SEGMENTATION

FIGURE 11 GROWING DEMAND FOR HEALTHCARE IT SOLUTION, TELEHEALTH SERVICES AND REMOTE PATIENT MONITORING SOLUTIONS ARE EXPECTED TO DRIVE THE NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET

FIGURE 14 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT AND SERVICES, 2021

FIGURE 15 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT AND SERVICES, 2022-2029 (USD MILLION)

FIGURE 16 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT AND SERVICES, CAGR (2022-2029)

FIGURE 17 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT AND SERVICES, LIFELINE CURVE

FIGURE 18 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY APPLICATION, 2021

FIGURE 19 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY APPLICATION, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY APPLICATION, LIFELINE CURVE

FIGURE 22 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY FACILITY SIZE, 2021

FIGURE 23 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY FACILITY SIZE, 2022-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY FACILITY SIZE, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY FACILITY SIZE, LIFELINE CURVE

FIGURE 26 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY PURCHASE MODE, 2021

FIGURE 27 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY PURCHASE MODE, 2022-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY PURCHASE MODE, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY PURCHASE MODE, LIFELINE CURVE

FIGURE 30 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY END USER, 2021

FIGURE 31 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY END USER, 2022-2029 (USD MILLION)

FIGURE 32 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY END USER, CAGR (2022-2029)

FIGURE 33 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY END USER, LIFELINE CURVE

FIGURE 34 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: SNAPSHOT (2021)

FIGURE 35 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY COUNTRY (2021)

FIGURE 36 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 37 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 38 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT & SERVICES (2022-2029)

FIGURE 39 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。