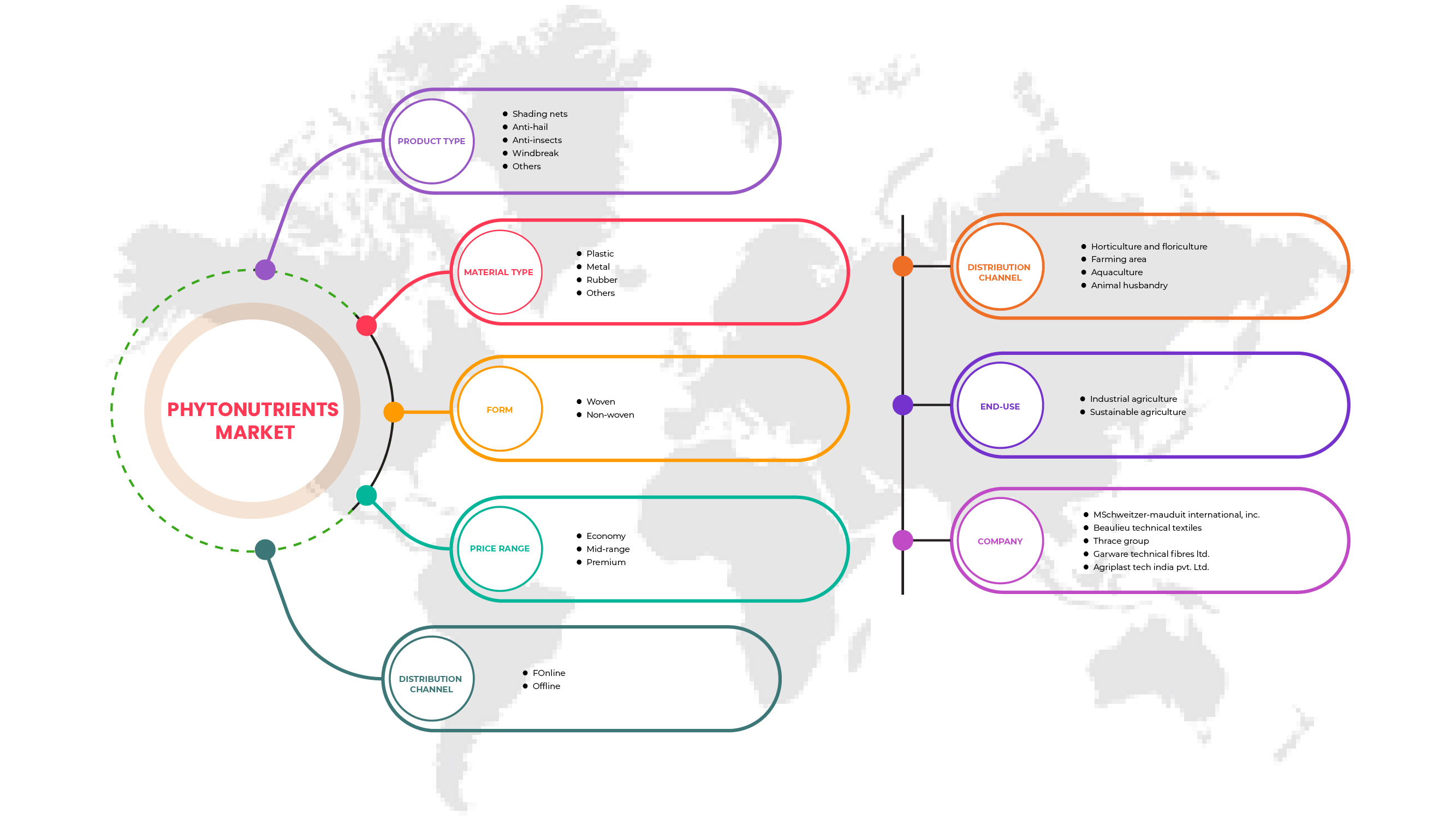

北美农业用网市场,按产品类型(遮阳网、防冰雹网、防虫网、防风网等)、材料类型(塑料、橡胶、金属等)、形式(编织和非编织)、价格范围(经济型、中档和高档)、分销渠道(线下和线上)、应用(园艺和花卉栽培、农业区、畜牧业和水产养殖)、最终用途(工业农业和可持续农业)划分,行业趋势和预测至 2029 年

北美农业网络市场分析与洞察

北美农业网市场本质上是分散的,因为它由许多参与者组成,例如 Garware Technical Fibres Limited 和 Thrace Group。这些公司为农民和其他区域和国际用户生产各种用途的最佳农业网产品。这些农业网制造商和供应商提供具有各种特点的适合所有预算范围的产品。

该地区不断增加的粮食安全举措以及园艺和花卉栽培中农业网的使用量不断增加,推动了北美农业网市场的发展,因为这些网使农民能够生产出更多的农产品。然而,农业塑料污染的增加和对使用塑料农业网的环境担忧预计将成为市场增长的制约因素。但是,各国政府增加的农业补贴以及露台或屋顶农业的不断增加预计将为扩大农业网的应用和使用提供机会。

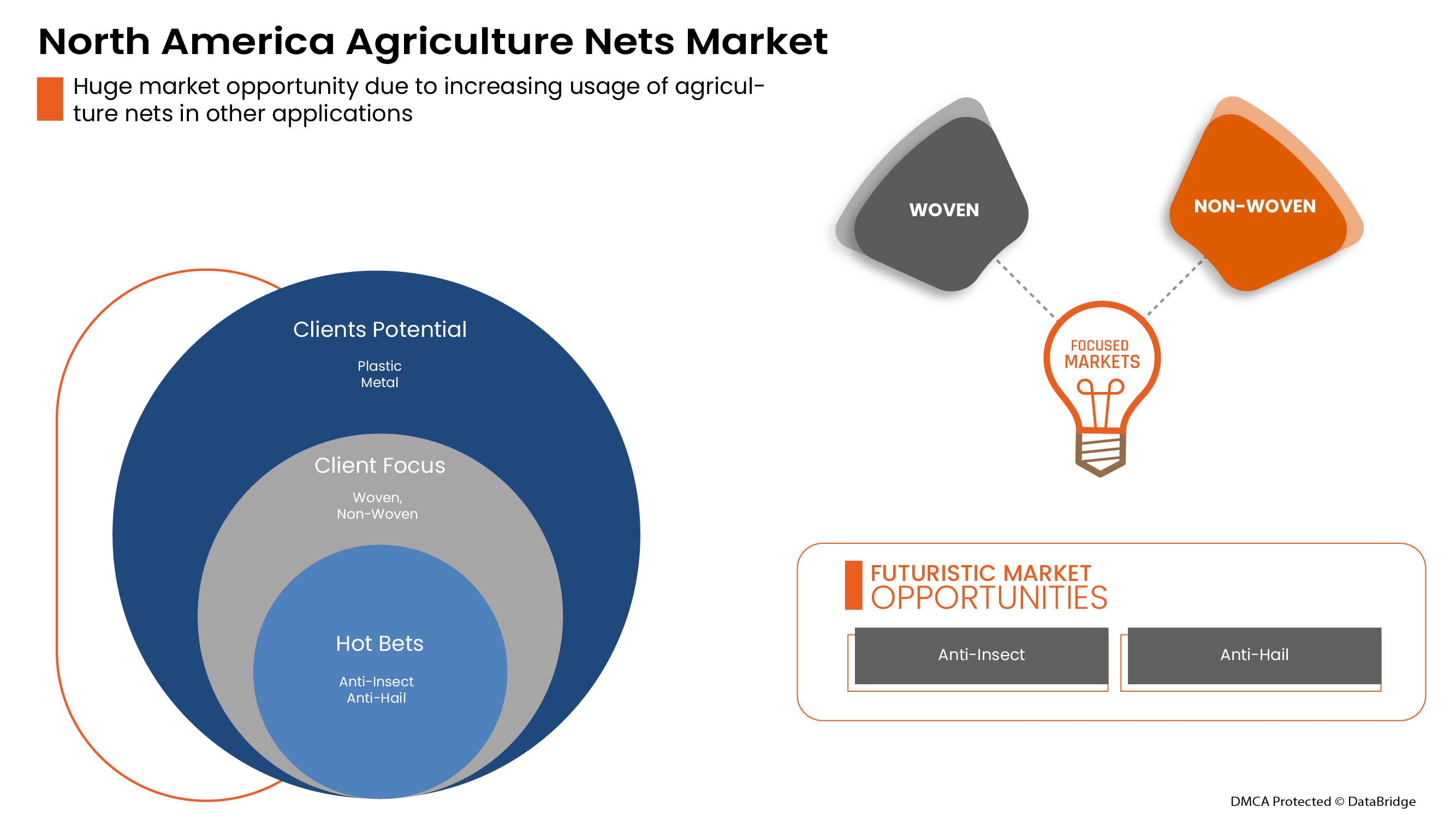

此外,农业纺织品的发展和农业网在林业等其他应用中的不断使用,预计将在未来推动北美农业网市场的增长。

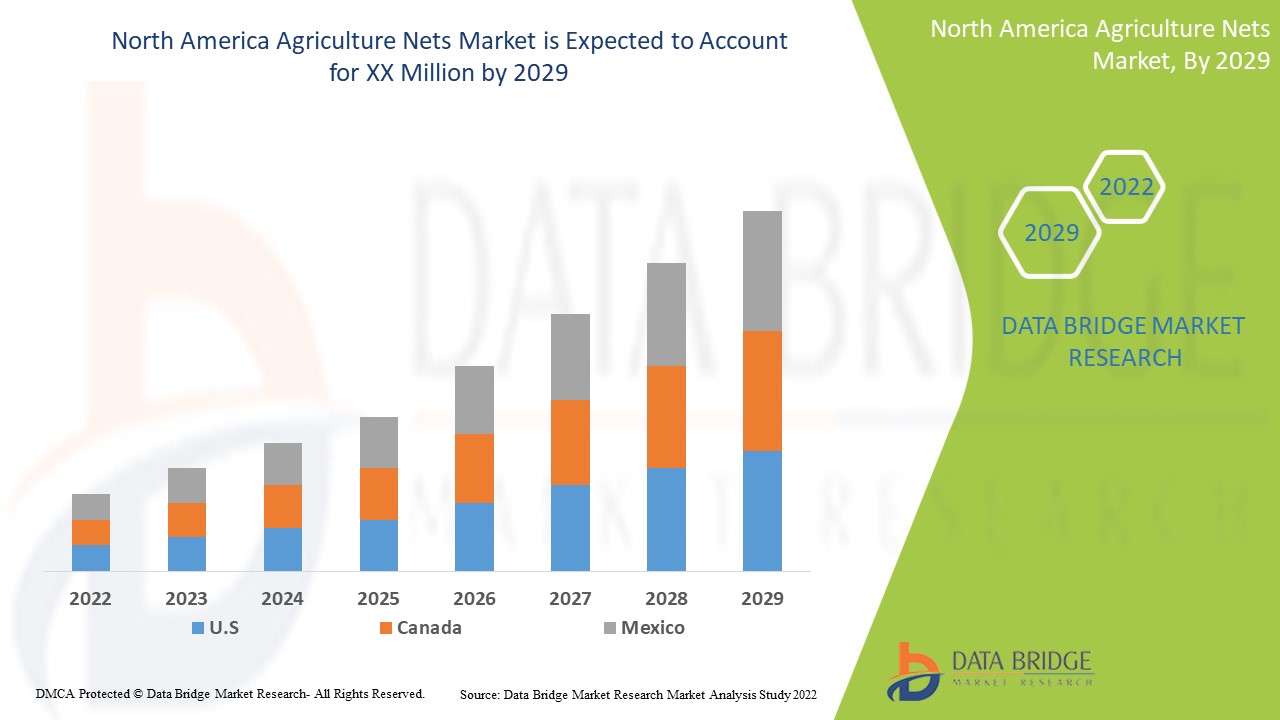

Data Bridge Market Research 分析称,2022 年至 2029 年的预测期内,北美农业网市场将以 6.1% 的复合年增长率增长。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制至 2019 - 2015) |

|

定量单位 |

收入(百万美元),定价(美元) |

|

涵盖的领域 |

按产品类型(遮阳网、防冰雹网、防虫网、防风网等)、材料类型(塑料、橡胶、金属等)、形式(编织和非编织)、价格范围(经济型、中档和高档)、分销渠道(线下和线上)、应用(园艺和花卉栽培、农业面积、畜牧业和水产养殖)、最终用途(工业化农业和可持续农业) |

|

覆盖国家 |

美国、加拿大和墨西哥 |

|

涵盖的市场参与者 |

Belton Industries.、Smart Net Systems Ltd.、Diatex、Garware Technical Fibres Limited、Thrace Group、US Netting, Inc.、Schweitzer-Mauduit International, Inc、中山市鸿骏无纺布有限公司、Beaulieu Technical Textiles |

市场定义

农业用网由橡胶、金属、织物或高密度聚乙烯(也称为 HDPE)等材料制成。农业用网主要用于农业,保护植物免受太阳辐射、紫外线和恶劣天气条件的影响。农业用网的主要优点是防紫外线和为农作物创造微环境的能力。它们以无纺布和编织形式使用。除了农业,这些网还用于花卉栽培、园艺和畜牧业。它们广泛应用于家庭和商业领域,用于建造临时围栏、停车场、渔网、窗棚和脚手架。网的长度和宽度从 1 米到 20 米和 25 米到 300 米不等,具体取决于应用。这些网在农业和相关行业以及建筑、家庭等其他领域的应用越来越多,正在推动北美农业用网市场的发展。

北美农业网络市场动态

驱动程序

- 园艺和花卉栽培中农业网的使用日益增多

农业网在园艺中变得越来越有用和重要,因为它们为农作物提供遮荫并防止农作物过热。防冰雹网还有助于防止农作物遭受冰雹袭击并改善微环境,从而提高种植的生产力和产量。农业网在园艺和花卉栽培领域用于许多应用和功能,例如辐射散射、光选择性。园艺部门的生产力高度依赖于实践中使用的遮阳和网,使农业网成为实践中必不可少的组成部分之一。

因此,随着该地区园艺和花卉栽培实践的增多,农业网的需求正在迅速增加,这成为北美农业网市场增长的驱动力。

- 该地区不断增加的粮食安全举措

当今时代,自绿色革命以来,北美地区政府一直在努力通过各种举措提高国家粮食自给率和粮食安全。此外,在过去的几十年里,随着人口的增加和粮食需求的增加,各国都更加关注国家粮食安全。这成为北美农业网市场的驱动因素,因为这些举措侧重于提高农业产量以及当地农民实现这一目标的方式,因此对农业网的需求有所增加。

机会

-

增加梯田或屋顶农业的实践

屋顶农业实践正在迅速增加,尤其是在城市地区,因为人们利用屋顶的空白空间来种植新鲜蔬菜、香草、水果和可食用花卉。高产的绿色屋顶将粮食生产与生态可持续性相结合,例如减少雨水径流,提供温度效益,例如可能减少供暖和制冷需求(从而减少排放),提高美学价值和空气质量。梯田农业实践的增加导致北美各地对遮阳网、防虫网和防风网的需求增加,为北美农业网市场提供了增长机会。

克制/挑战

- 关于使用农业网的环境问题

农业网在农业、园艺、水产养殖和畜牧业中有多种用途。农业网用于保护种植的农作物免受鸟类、昆虫、小动物以及紫外线辐射和恶劣天气条件等其他因素的影响。这些农业网主要由塑料、橡胶和金属制成。由于塑料网相对于其他材料成本较低,因此可以大规模生产。塑料网的可持续性引起了环境问题,因为生物基塑料网易于生物降解,但高密度聚乙烯 (HDPE)、聚乙烯 (PE) 和聚氯乙烯等传统塑料网并不环保。因此,农业网的非环保特性可能会阻碍市场的增长。

新冠肺炎疫情对北美农业网市场的影响

COVID-19 疫情严重影响了北美农业网市场。COVID-19 持续较长时间,供应链中断,难以向制造商供应原材料,最初降低了农业网的生产率。然而,在 COVID-19 疫情之后,由于人们对农业网好处的认识提高以及园艺和花卉产业的兴起,对农业网的需求大幅增加。消费者正试图使用农业网来提高产量,并从农业和相关行业中获利。因此,由于整个地区粮食安全举措的增加以及农业网在其他应用中的使用增加,COVID-19 疫情之后,北美农业网市场预计将蓬勃发展。

近期发展

- 2022 年 5 月,Schweitzer-Mauduit International, Inc. 和 Neenah, Inc. 宣布建立合作伙伴关系,两家公司将组建一个团队,共同开发未来产品。此举旨在利用两家公司在纺织行业生产技术产品的潜力。该公司旨在通过此次合作,在北美农业网市场推出新的、技术先进的产品

北美农业网络市场范围

北美农业网市场根据产品类型、材料类型、形式、价格范围、分销渠道、应用和最终用途进行细分。这些细分市场之间的增长将帮助您分析行业中的主要增长细分市场,并为用户提供有价值的市场概览和市场洞察,以便做出战略决策,确定核心市场应用。

产品类型

- 遮阳网

- 防冰雹

- 防虫

- 防风林

- 其他的

根据产品类型,北美农业网市场分为遮阳网、防冰雹网、防虫网、防风网和其他网。

材质类型

- 塑料

- 金属

- 橡皮

- 其他的

根据材料类型,北美农业网市场分为塑料、橡胶、金属和其他。

形式

- 编织

- 无纺布

根据形式,北美农业网市场分为编织网和非编织网。

价格范围

- 经济

- 中档

- 优质的

根据价格范围,北美农业网市场分为经济型、中档和高档。

分销渠道

- 在线的

- 离线

根据分销渠道,北美农业网络市场分为线下和线上。

应用

- 园艺与花卉栽培

- 耕作面积

- 畜牧业

- 水产养殖

根据应用,北美农业网市场细分为园艺和花卉栽培、农业区、畜牧业和水产养殖。

最终用途

- 工业农业

- 可持续农业

根据最终用途,北美农业网市场分为工业农业和可持续农业。

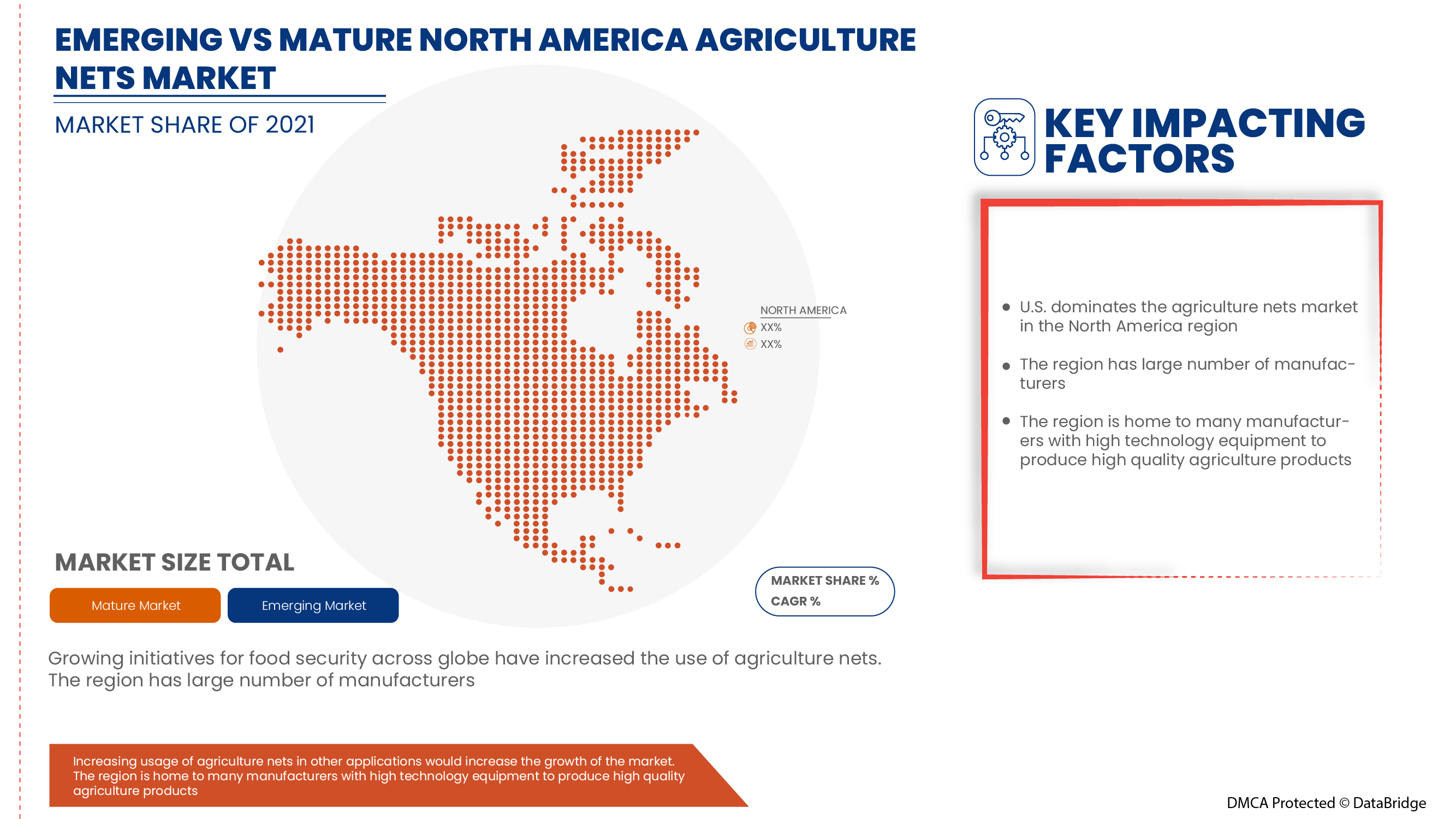

北美农业网络市场区域分析/见解

对北美农业网市场进行了分析,并按国家、产品类型、材料类型、形式、价格范围、分销渠道、应用和最终用途提供了市场规模洞察和趋势。

北美农业网市场报告涵盖的国家包括美国、加拿大和墨西哥。

预计美国将在市场份额和收入方面主导北美农业网市场。由于园艺和花卉栽培的兴起趋势,预计美国将在预测期内保持主导地位。

报告的区域部分还提供了影响单个市场因素和市场法规变化,这些因素和变化会影响市场的当前和未来趋势。新旧销售、国家人口统计、疾病流行病学和进出口关税等数据点是预测单个国家市场情景的一些主要指标。此外,在对国家数据进行预测分析时,还考虑了全球品牌的存在和可用性以及它们因来自本地和国内品牌的激烈竞争而面临的挑战以及销售渠道的影响。

竞争格局和北美农业网络市场份额分析

北美农业网市场竞争格局详细介绍了竞争对手。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、北美业务、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度以及应用主导地位。以上数据点仅与公司对北美农业网市场的关注有关。

北美农业网市场的一些主要参与者包括 Belton Industries.、Diatex、Garware Technical Fibres Limited、Thrace Group、US、Schweitzer-Mauduit International, Inc、中山市鸿骏无纺布有限公司、Beaulieu Technical Textiles 等。

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析以及主要(行业专家)验证。除此之外,数据模型还包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、公司市场份额分析、测量标准、全球与区域以及供应商份额分析。如有进一步询问,请要求分析师致电。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA AGRICULTURE NETS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 PRODUCT TYPE CURVE

2.11 CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PRODUCTION-CONSUMPTION ANALYSIS

4.2 IMPORT EXPORT SCENARIO

4.3 PRICE TREND ANALYSIS

4.4 RAW MATERIAL PRODUCTION COVERAGE

4.5 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.6 LIST OF KEY BUYERS

4.7 PORTER’S FIVE FORCE ANALYSIS

4.8 VENDOR SELECTION CRITERIA

4.9 PESTEL ANALYSIS

4.1 REGULATIONS COVERAGE

5 SUPPLY CHAIN ANALYSIS

5.1 OVERVIEW

5.2 LOGISTIC COST SCENARIO

5.3 IMPORTANCE OF LOGISTIC SERVICE PROVIDERS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING INITIATIVES FOR FOOD SECURITY ACROSS GLOBE

6.1.2 RISING DEMAND FOR AGRICULTURE NETS DUE TO INCREASING INTEREST IN GARDENING

6.1.3 USE OF AGRICULTURE NETS IN AQUACULTURE AND ANIMAL HUSBANDRY

6.1.4 INCREASING USAGE OF AGRICULTURE NET IN HORTICULTURE AND FLORICULTURE

6.2 RESTRAINTS

6.2.1 LESS LIFE SPAN OF NETS

6.2.2 ENVIRONMENTAL CONCERNS REGARDING THE USE OF AGRICULTURE NETS

6.2.3 INCREASING AGRICULTURE PLASTIC POLLUTION

6.3 OPPORTUNITIES

6.3.1 THE DEVELOPMENT OF THE AGRO TEXTILE

6.3.2 NORTH AMERICALY INCREASING PRACTICE OF TERRACE OR ROOFTOP AGRICULTURE

6.3.3 INCREASING USAGE OF AGRICULTURE NETS IN OTHER APPLICATIONS

6.3.4 INCREASING AGRICULTURE SUBSIDIES BY VARIOUS NATION GOVERNMENTS

6.4 CHALLENGES

6.4.1 THE VARYING COSTS OF THE RAW MATERIALS USED IN AGRO-TEXTILE

6.4.2 GEOGRAPHICAL SHORTCOMING OF AGRICULTURE NETS

7 NORTH AMERICA AGRICULTURE NETS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 SHADING NETS

7.3 WINDBREAK

7.4 ANTI-INSECT

7.5 ANTI-HAIL

7.6 OTHERS

8 NORTH AMERICA AGRICULTURE NETS MARKET, BY MATERIAL TYPE

8.1 OVERVIEW

8.2 PLASTIC

8.3 METAL

8.4 RUBBER

8.5 OTHERS

9 NORTH AMERICA AGRICULTURE NETS MARKET, BY PRICE RANGE

9.1 OVERVIEW

9.2 ECONOMY

9.3 MID-RANGE

9.4 PREMIUM

10 NORTH AMERICA AGRICULTURE NETS MARKET, BY FORM

10.1 OVERVIEW

10.2 WOVEN

10.3 NON-WOVEN

11 NORTH AMERICA AGRICULTURE NETS MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 OFFLINE

11.3 ONLINE

12 NORTH AMERICA AGRICULTURE NETS MARKET , BY APPLICATION

12.1 OVERVIEW

12.2 HORTICULTURE AND FLORICULTURE

12.3 FARMING AREA

12.4 AQUACULTURE

12.5 ANIMAL HUSBANDRY

13 NORTH AMERICA AGRICULTURE NETS MARKET, BY END USE

13.1 OVERVIEW

13.1.1 INDUSTRIAL AGRICULTURE

13.1.1.1 SHADING NETS

13.1.1.2 WINDBREAK

13.1.1.3 ANTI-INSECTS

13.1.1.4 ANTI-HAIL

13.1.1.5 OTHERS

13.1.2 SUSTAINABLE AGRICULTURE

13.1.2.1 SHADING NETS

13.1.2.2 WINDBREAK

13.1.2.3 ANTI-INSECTS

13.1.2.4 ANTI-HAIL

13.1.2.5 OTHERS

14 NORTH AMERICA AGRICULTURE NETS MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA AGRICULTURE NETS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 SCHWEITZER-MAUDUIT INTERNATIONAL, INC. (2021)

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 BEAULIEU TECHNICAL TEXTILES

17.2.1 COMPANY SNAPSHOT

17.2.2 PRODUCT PORTFOLIO

17.2.3 RECENT DEVELOPMENT

17.3 THRACE GROUP

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.4 GARWARE TECHNICAL FIBRES LIMITED (2021)

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 AGRIPLAST TECH INDIA PVT. L.T.D.

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT DEVELOPMENTS

17.6 ALPHATEX

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 B&V AGRO IRRIGATION CO.

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 BELTON INDUSTRIES.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 CITTADINI S.P.A

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 DIATEX

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 FIBERWEBINDIA LTD. (2021)

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 NETKING

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 SHAKTI POLYWEAVE PVT. LTD

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 SHREE TARPAULIN INDUSTRIES

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 SMART NET SYSTEMS LTD.

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 SUNSAFE AGROTEXTILES PVT. L.T.D.

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 TUFLEX INDIA.

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 U.S. NETTING, I.N.C.

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 WELLCOINDUSTRIES

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 ZHONGSHAN HONGJUN NONWOVENS CO., LTD.

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

表格列表

TABLE 1 DIFFERENT TYPES OF AGRO-TEXTILE PRODUCTS WITH CONSTITUENT FIBER

TABLE 2 COST VARIATION AS PER MATERIAL USED

TABLE 3 SET OF ITALIAN STANDARD REGARDING AGRICULTURAL NETS

TABLE 4 CLASSIFICATION OF AGRO-TEXTILES PRODUCT WITH THE FABRIC TYPE

TABLE 5 ROOFTOP FARMS ACROSS THE GLOBE

TABLE 6 INSTANCES OF SUITABLE PLANTS FOR DIFFERENT ROOFTOP AGRICULTURE SYSTEMS

TABLE 7 LIGHT SCATTERING UNDER COLORED SHADE NETS COMPARED WITH NO NET

TABLE 8 NORTH AMERICA AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 9 NORTH AMERICA SHADING NETS IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 NORTH AMERICA WINDBREAK IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 NORTH AMERICA ANTI-INSECT IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 NORTH AMERICA ANTI-HAIL IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 NORTH AMERICA OTHERS IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 NORTH AMERICA AGRICULTURE NETS MARKET, BY MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 15 NORTH AMERICA PLASTIC IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 NORTH AMERICA METAL IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 NORTH AMERICA RUBBER IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 NORTH AMERICA OTHERS IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 NORTH AMERICA AGRICULTURE NETS MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 20 NORTH AMERICA ECONOMY IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA MID-RANGE IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 NORTH AMERICA PREMIUM IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 NORTH AMERICA AGRICULTURE NETS MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 24 NORTH AMERICA WOVEN IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 NORTH AMERICA NON-WOVEN IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 NORTH AMERICA AGRICULTURE NETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA OFFLINE IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 NORTH AMERICA ONLINE IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 NORTH AMERICA AGRICULTURE NETS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND))

TABLE 30 NORTH AMERICA HORTICULTURE AND FLORICULTURE IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 NORTH AMERICA FARMING AREA IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 NORTH AMERICA AQUACULTURE IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 NORTH AMERICA ANIMAL HUSBANDRY IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 NORTH AMERICA AGRICULTURE NETS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA INDUSTRIAL AGRICULTURE IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 NORTH AMERICA INDUSTRIAL AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA SUSTAINABLE AGRICULTURE IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 NORTH AMERICA SUSTAINABLE AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 39 NORTH AMERICA AGRICULTURE NETS MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 40 NORTH AMERICA AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 41 NORTH AMERICA AGRICULTURE NETS MARKET, BY MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 42 NORTH AMERICA AGRICULTURE NETS MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 43 NORTH AMERICA AGRICULTURE NETS MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 44 NORTH AMERICA AGRICULTURE NETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 45 NORTH AMERICA AGRICULTURE NETS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 46 NORTH AMERICA AGRICULTURE NETS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 47 NORTH AMERICA INDUSTRIAL AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 NORTH AMERICA SUSTAINABLE AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 49 U.S. AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 50 U.S. AGRICULTURE NETS MARKET, BY MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 51 U.S. AGRICULTURE NETS MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 52 U.S. AGRICULTURE NETS MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 53 U.S. AGRICULTURE NETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 54 U.S. AGRICULTURE NETS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 55 U.S. AGRICULTURE NETS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 56 U.S. INDUSTRIAL AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 U.S. SUSTAINABLE AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 CANADA AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 CANADA AGRICULTURE NETS MARKET, BY MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 60 CANADA AGRICULTURE NETS MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 61 CANADA AGRICULTURE NETS MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 62 CANADA AGRICULTURE NETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 63 CANADA AGRICULTURE NETS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 64 CANADA AGRICULTURE NETS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 65 CANADA INDUSTRIAL AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 CANADA SUSTAINABLE AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 MEXICO AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 68 MEXICO AGRICULTURE NETS MARKET, BY MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 MEXICO AGRICULTURE NETS MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 70 MEXICO AGRICULTURE NETS MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 71 MEXICO AGRICULTURE NETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 72 MEXICO AGRICULTURE NETS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 73 MEXICO AGRICULTURE NETS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 74 MEXICO INDUSTRIAL AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 MEXICO SUSTAINABLE AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

图片列表

FIGURE 1 NORTH AMERICA AGRICULTURE NETS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA AGRICULTURE NETS MARKET : DATA TRIANGULATION

FIGURE 3 NORTH AMERICA AGRICULTURE NETS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA AGRICULTURE NETS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA AGRICULTURE NETS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA AGRICULTURE NETS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA AGRICULTURE NETS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA AGRICULTURE NETS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA AGRICULTURE NETS MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 NORTH AMERICA AGRICULTURE NETS MARKET: SEGMENTATION

FIGURE 11 GROWING INITIATIVES FOR FOOD SECURITY ACROSS THE GLOBE IS EXPECTED TO DRIVE THE NORTH AMERICA AGRICULTURE NETS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SHADING NETS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA AGRICULTURE NETS MARKET IN 2022 TO 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA AGRICULTURE NETS MARKET

FIGURE 14 NORTH AMERICA AGRICULTURE NETS MARKET : BY PRODUCT TYPE, 2021

FIGURE 15 NORTH AMERICA AGRICULTURE NETS MARKET : BY MATERIAL TYPE, 2021

FIGURE 16 NORTH AMERICA AGRICULTURE NETS MARKET : BY PRICE RANGE, 2021

FIGURE 17 NORTH AMERICA AGRICULTURE NETS MARKET: BY FORM, 2021

FIGURE 18 NORTH AMERICA AGRICULTURE NETS MARKET : BY DISTRIBUTION CHANNEL, 2021

FIGURE 19 NORTH AMERICA AGRICULTURE NETS MARKET : BY APPLICATION, 2021

FIGURE 20 NORTH AMERICA AGRICULTURE NETS MARKET : BY END USE, 2021

FIGURE 21 NORTH AMERICA AGRICULTURE NETS MARKET: SNAPSHOT (2021)

FIGURE 22 NORTH AMERICA AGRICULTURE NETS MARKET: BY COUNTRY (2021)

FIGURE 23 NORTH AMERICA AGRICULTURE NETS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 NORTH AMERICA AGRICULTURE NETS MARKET : BY COUNTRY (2021 & 2029)

FIGURE 25 NORTH AMERICA AGRICULTURE NETS MARKET : BY PRODUCT TYPE (2022-2029)

FIGURE 26 NORTH AMERICA AGRICULTURE NETS MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。