Global Sugar Based Excipients Market

市场规模(十亿美元)

CAGR :

%

USD

7.36 Billion

USD

12.12 Billion

2024

2032

USD

7.36 Billion

USD

12.12 Billion

2024

2032

| 2025 –2032 | |

| USD 7.36 Billion | |

| USD 12.12 Billion | |

|

|

|

|

Global Sugar Based Excipients Market Segmentation, By Product (Actual Sugar, Sugar Alcohol and Artificial Sweeteners), Type (Powders, Compression Sugars, Crystals and Syrups), Application (Fillers, Diluents, Tonicity Agents and Flavoring Agents), Formulation (Oral, Topical, Parenteral) - Industry Trends and Forecast to 2032

Sugar Based Excipients Market Size

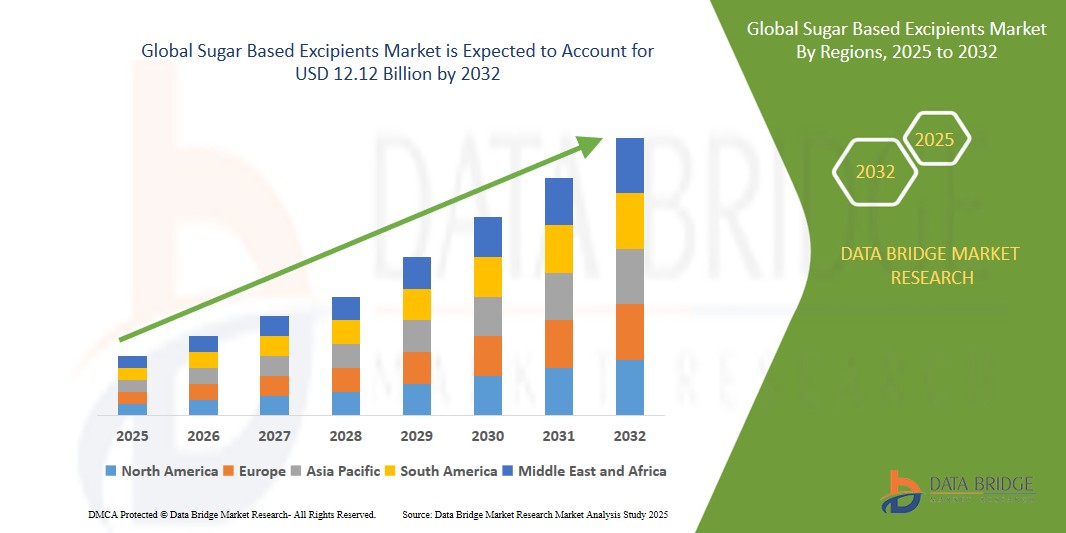

- The global Sugar Based Excipients market was valued atUSD 7.36 billion in 2024 and is expected to reachUSD 12.12 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at aCAGR of 6.4%, primarily driven by the increasing demand for orally disintegrating tablets (ODTs)

- This growth is driven by sugar-based excipients, such as mannitol and sorbitol, are effective in masking the bitter taste of APIs, enhancing the palatability of ODTs and making them more acceptable to patients.

Sugar Based Excipients Market Analysis

- The growing preference for oral solid dosage forms, such as tablets and capsules, is driving the demand for sugar-based excipients.

- These excipients enhance drug stability, bioavailability, and patient compliance through improved taste masking and ease of swallowing.

- The pharmaceutical industry is increasingly adopting co-processed excipients to improve the functionality of drug formulations.

- These excipients offer enhanced properties like better flowability, compressibility, and solubility, leading to more efficient and patient-friendly drug delivery systems.

Report Scope and Sugar Based Excipients Market Segmentation

|

Attributes |

Sugar Based Excipients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sugar Based Excipients Market Trends

“The Rising Adoption of Co-Processed Excipients”

- Co-processed excipients combine multiple excipients to improve flowability, compressibility, and stability, enhancing drug formulation efficiency.

- The pharmaceutical sector increasingly seeks multifunctional excipients to streamline manufacturing processes and improve product performance.

- The popularity of tablets and capsules boosts demand for co-processed excipients that facilitate better taste masking and bioavailability.

- As generic drug manufacturing expands, co-processed excipients help maintain consistent quality and efficacy across products

- For instance, Roquette launched PEARLITOL Flash, a co-processed excipient based on mannitol (a sugar alcohol) and starch for fast-dissolving tablets, improving patient compliance and product performance.

- The integration of co-processed excipients addresses multiple formulation challenges, positioning them as a key driver in the evolution of sugar-based excipients within the pharmaceutical industry.

Sugar Based Excipients Market Dynamics

Driver

“Increasing Demand for Orally Disintegrating Tablets (ODTs)”

- ODTs eliminate the need for swallowing pills, making medication intake easier for patients with swallowing difficulties, thereby improving adherence to prescribed treatments.

- The rapid dissolution of ODTs facilitates faster absorption of active pharmaceutical ingredients (APIs), leading to improved bioavailability and quicker therapeutic effects.

- Sugar-based excipients, such as mannitol and sorbitol, are effective in masking the bitter taste of APIs, enhancing the palatability of ODTs and making them more acceptable to patients.

- The use of sugar-based excipients in ODTs can reduce production costs due to their multifunctional properties, including serving as fillers, binders, and sweeteners, streamlining the formulation process.

For instance,

- A study explored the use of erythritol, a sugar alcohol, as an excipient in ODTs. The MADG method was employed to enhance tablet ability and achieve rapid disintegration while maintaining tablet hardness. This approach addressed challenges associated with erythritol's low compressibility, offering a promising strategy for ODT formulation.

- The growing preference for ODTs, driven by their patient-friendly attributes and the functional benefits of sugar-based excipients, is significantly contributing to the expansion of the sugar-based excipients market.

Opportunity

“Expansion of Sugar-Based Excipients in Pediatric and Geriatric Drug Formulations”

- The increasing global pediatric and geriatric populations necessitate medications that are palatable and easy to administer. Sugar-based excipients enhance taste and solubility, making them ideal for these age groups.

- There's a growing demand for natural, non-toxic excipients in pharmaceuticals. Sugar-based excipients, derived from natural sources, align with this trend, offering safety and efficacy.

- Innovations in drug formulations, such as orally disintegrating tablets, benefit from sugar-based excipients due to their binding properties and ability to improve drug stability.

- Emerging markets, particularly in Asia-Pacific, are witnessing a surge in pharmaceutical manufacturing, driving the demand for sugar-based excipients.

For instance,

- Mannitol, a sugar alcohol, is frequently used by Merck in formulations for elderly patients due to its sweetness, low glycemic index, and smooth mouthfeel

- The convergence of demographic shifts, consumer preferences, and pharmaceutical innovations positions sugar-based excipients as a pivotal component in developing age-appropriate drug formulations, presenting significant growth opportunities in the global market.

Restraint/Challenge

“Stringent Regulatory Compliance”

- Regulatory bodies like the FDA and EMA require detailed justification for the inclusion of excipients in pharmaceutical formulations. This includes demonstrating safety, efficacy, and necessity, which can be time-consuming and resource-intensive for manufacturers.

- The rigorous standards set by regulatory agencies have led to a shortage of FDA-approved manufacturing sites for sugar-based excipients.

- This limitation restricts production capacity and can delay the introduction of new products to the market.

- Manufacturers must adhere to strict quality control procedures to ensure product consistency and safety. These demands can increase operational costs and require significant investment in quality assurance infrastructure.

- Navigating the complex regulatory landscape is a major challenge for the sugar-based excipients market. While these regulations are essential for ensuring product safety and efficacy, they can also impede market growth and innovation.

Sugar Based Excipients Market Scope

The market is segmented on the basis of product, type, application, and formulation.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Type |

|

|

By Application |

|

|

By Formulation |

|

Sugar Based Excipients Market Regional Analysis

“Europe is the Dominant Region in the Sugar Based Excipients Market”

- Europe dominates the Sugar Based Excipients market, driven by significant demand for sugar-based excipients used in oral formulations, including pediatric and geriatric medications

- Germany holds a significant share due to contribute significantly to demand, driven by presence of major excipient producers such as Roquette Group (France), DFE Pharma (Germany), and BASF SE (Germany) enhances Europe's market position through advanced research and development capabilities

- Supportive initiatives and substantial investments in drug development and generic drug production across Europe further bolster the region's dominance in the sugar-based excipients market.

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific region is expected to witness the highest growth rate in the Sugar Based Excipients market, driven by increasing pharmaceutical manufacturing activities

- China is growing with highest CAGR in the region due to growing population, rising healthcare expenditure, and expanding pharmaceutical industries contribute to the demand for sugar-based excipients.

- In addition, regulatory reforms, technological advancements, and strategic collaborations in the pharmaceutical sector further support market growth in the Asia Pacific region

Sugar Based Excipients Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Roquette Frères (France)

- DFE Pharma (Germany)

- BASF SE (Germany)

- Ashland Inc. (U.S.)

- Archer Daniels Midland Company (U.S.)

- MEGGLE AG (Germany)

- Associated British Foods Plc (U.K.)

- Cargill, Inc. (U.S.)

- Colorcon, Inc. (U.S.)

- FMC Corporation (U.S.)

- The Lubrizol Corporation (U.S.)

- MB Sugars & Pharmaceuticals (India)

- Citron Scientific (India)

- Harshad Agencies (India)

- Emilio Castelli (Italy)

- New Zealand Pharmaceuticals Limited (New Zealand)

- IMCD Pharma (Netherlands)

- Pfanstiehl, Inc. (U.S.)

Latest Developments in Global Sugar Based Excipients Market

- In In October 2022, MB Sugars showcased its Rich Specialty Sugars for the festive season. The brand embraced the celebratory spirit, recognizing that India's Diwali festivities are traditionally centered around sweets and delicacies. Sweets also play a vital role in Indian weddings and festivals.

- In January 2022, Cargill inaugurated its first Food Innovation Center in India to cater to the growing demand for nutritious food. Located in Gurugram, Haryana, the Cargill Innovation Center was established to respond to evolving trends in the food and beverage (F&B) market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。