Global Biosurgery Market

市场规模(十亿美元)

CAGR :

%

USD

14.61 Billion

USD

23.64 Billion

2024

2032

USD

14.61 Billion

USD

23.64 Billion

2024

2032

| 2025 –2032 | |

| USD 14.61 Billion | |

| USD 23.64 Billion | |

|

|

|

|

Global Biosurgery Market Segmentation, By Product (Bone-Graft Substitutes, Soft-Tissue Attachments, Hemostatic Agents,Surgical Sealants and Adhesives, Adhesion Barriers, and Staple-Line Reinforcement Agents), Application (General Surgery, Cardiovascular Surgery, Orthopaedic Surgery, Neurological Surgery, Reconstructive Surgery, Gynaecological Surgery, Thoracic Surgery, and Urological Surgery), End-User (Hospitals, Clinics, and Others) - Industry Trends and Forecast to 2032

Biosurgery Market Size

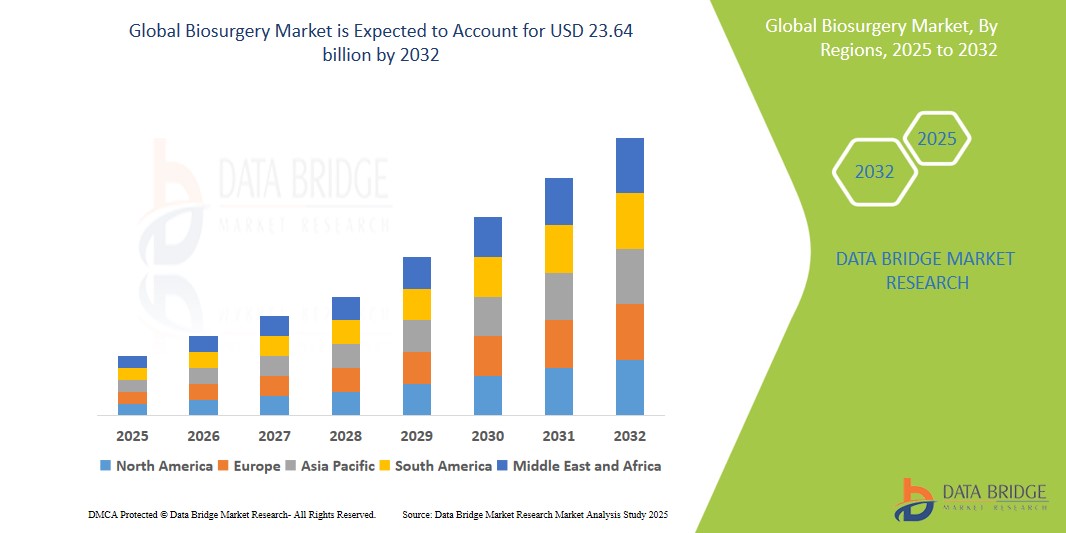

- The global biosurgery market size was valued atUSD 14.61 billion in 2024 and is expected to reachUSD 23.64 billion by 2032, at aCAGR of 6.20%during the forecast period

- This growth is driven by rise in the cases of surgeries

Biosurgery Market Analysis

- Biosurgery systems are critical medical devices utilized during surgical procedures to provide real-time visualization of anatomical structures, improving surgical precision, minimizing complications, and enhancing patient outcomes. These technologies include intraoperativeMRI, CT, and ultrasound, providing essential guidance for intricate surgeries

- The growing demand for biosurgery is primarily driven by the increasing number of complex surgical procedures, the rising preference for minimally invasive surgeries, and advancements in technology that deliver higher image resolution, quicker processing, and improved integration with surgical navigation systems.

- North America is expected to dominate the biosurgery market with the largest market share of 51.54%, driven by its advanced healthcare infrastructure, widespread adoption of cutting-edge surgical technologies, favorable reimbursement policies, and the presence of leading market players in the region

- Asia-Pacific is projected to register the highest growth rate in the biosurgery market during the forecast period, fueled by rapid healthcare infrastructure improvements, growing investments in surgical care, increasing awareness of image-guided surgeries, and heightened healthcare spending in emerging markets such as China and India

- The surgical sealants and adhesives segment is anticipated to capture the largest market share of 27.69%, due to increasing number of surgeries being conducted for various reasons has led to the use of surgical sealants, which act as a barrier to prevent the leakage of fluids, blood, urine, and air

Report Scope and Biosurgery Market Segmentation

|

Attributes |

Biosurgery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Biosurgery Market Trends

“Advancements in Robotic-Assisted Surgery for Biosurgery”

- A significant trend in the biosurgery market is the increasing adoption of robotic-assisted surgical systems, which enhance precision and control during surgeries. These systems allow for minimally invasive procedures with better accuracy, contributing to improved patient outcomes

- Robotic-assisted surgeries provide high-definition imaging, enhanced dexterity, and real-time feedback, enabling surgeons to perform complex procedures with greater confidence and precision

- The trend is also being supported by the integration of advanced robotic systems in major hospitals, improving the efficiency of surgeries and reducing the risk of human error

- For instance, in 2023, the Mayo Clinic expanded its robotic surgery capabilities by adding the da Vinci Surgical System to perform a wide range of minimally invasive procedures

- The increasing reliance on robotic-assisted surgeries is transforming the biosurgery landscape, driving faster recovery times and reducing complications in complex surgeries

Biosurgery Market Dynamics

Driver

“Rising Focus on Surgical Precision and Real-Time Visualization”

- A key driver in the biosurgery market is the growing focus on surgical precision, as modern medical practices emphasize minimizing human error and enhancing real-time visualization during complex procedures

- Advanced imaging technologies such as intraoperative MRI, CT, and ultrasound are becoming indispensable for real-time monitoring, offering high-resolution images that allow surgeons to make informed decisions during critical procedures

- These imaging technologies enable a clearer view of anatomical structures, improving precision and reducing complications in high-stakes surgeries

- For instance, a 2023 study published by the American College of Surgeons revealed that the use of intraoperative MRI in brain surgeries resulted in a 15% increase in tumor removal accuracy

- The drive for precision in surgeries is accelerating the demand for advanced biosurgical imaging systems, fueling market growth

Opportunity

“Increasing Adoption of Personalized Medicine in Biosurgery”

- A significant opportunity for the biosurgery market is the increasing adoption of personalized medicine, which tailors surgical procedures and treatment plans to individual patient needs

- Personalized medicine relies on advanced imaging systems to assess a patient’s unique anatomy and condition, ensuring that surgeries are as effective and precise as possible

- As healthcare providers strive to offer more customized treatments, the demand for sophisticated imaging technologies that support personalized surgery is expected to grow significantly

- For instance, in 2023, a major U.S. hospital network introduced personalized treatment plans for orthopedic surgeries, using 3D imaging and patient-specific surgical models to optimize outcomes

- The integration of personalized medicine in surgery represents a growing opportunity for biosurgical companies to offer innovative solutions tailored to individual patients, driving market expansion

Restraint/Challenge

“Regulatory and Compliance Challenges in Biosurgery Technology Adoption”

- A major challenge in the biosurgery market is the complex regulatory landscape surrounding the approval and adoption of new biosurgery technologies, particularly in emerging markets

- Stringent regulations and lengthy approval processes can delay the availability of new products, hindering market growth, especially for companies looking to introduce innovative biosurgical system

- Compliance with local and international regulatory standards adds significant complexity and costs to the development and distribution of biosurgery systems, limiting market access in some regions

- For instance, in 2023, a major biosurgery firm faced delays in launching a new intraoperative CT system in the European Union due to extended approval timelines

- The regulatory hurdles faced by companies can slow the pace of innovation and adoption, presenting a barrier to wider market penetration

Biosurgery Market Scope

The market is segmented on the basis of product, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Application |

|

|

By End User |

|

In 2025, the surgical sealants and adhesives is projected to dominate the market with a largest share in product segment

The surgical sealants and adhesives segment is expected to dominate the biosurgery market with the largest market share of 27.69% in 2025 due to increasing number of surgeries being conducted for various reasons has led to the use of surgical sealants, which act as a barrier to prevent the leakage of fluids, blood, urine, and air. Common types of surgical sealants include fibrin, cyanoacrylates, glutaraldehyde-albumin, and polyethylene-glycol-based sealants.

The adults is expected to account for the largest share during the forecast period in application segment

In 2025, the adults segment is expected to dominate the market with the largest market share of 54.14% due to the high volume of surgical procedures performed on adults, particularly in areas such as orthopedic, cardiovascular, and general surgeries.

Biosurgery Market Regional Analysis

“North America Holds the Largest Share in the Biosurgery Market”

- North America dominates the biosurgery market with the largest market share of 51.54%, driven by the strong presence of key industry players, highly developed healthcare infrastructure, increasing adoption of advanced surgical imaging technologies, and supportive reimbursement policies for intraoperative procedures

- The U.S. holds the largest share within the region due to the widespread use of intraoperative MRI, CT, and ultrasound systems, the rising number of complex surgical procedures, and continuous innovation in imaging modalities tailored for real-time surgical navigation

- Increasing investments in neurosurgery, orthopedic surgery, and oncology applications, coupled with favorable regulatory approvals and growing demand for precision surgeries, are expected to further strengthen North America's leadership in the global biosurgery market

“Asia-Pacific is Projected to Register the Highest CAGR in the Biosurgery Market”

- Asia-Pacific is expected to witness the highest growth rate in the biosurgery market, fueled by rapid improvements in healthcare infrastructure, rising surgical volumes, growing awareness of advanced surgical imaging technologies, and expanding access to healthcare services in emerging economies

- Countries such as China, India, and Japan are key contributors to regional growth, supported by government initiatives for healthcare modernization, increasing investments in hospital facilities, and the growing burden of chronic diseases requiring surgical intervention

- Japan, known for its technological leadership and high healthcare standards, is actively adopting cutting-edge biosurgery solutions, while China and India are witnessing a surge in demand due to healthcare reforms, public-private partnerships, and increased training of medical professionals in image-guided surgeries

Biosurgery Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Baxter (U.S.)

- BD (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Medtronic (U.S.)

- Sanofi (France)

- B. Braun AG (Germany)

- CryoLife, Inc. (U.S.)

- Stryker (U.S.)

- Hemostasis, LLC (U.S.)

- Integra LifeSciences Corporation (U.S.)

- Pfizer Inc. (U.S.)

- CSL Limited (Australia)

- Exactech, Inc. (U.S.)

- RTI Surgical (U.S.)

- Getinge (Sweden)

- Samyang Holdings Corporation (U.S.)

- TELA Bio, Inc. (U.S.)

- Tissue Regenix (U.K.)

- Osiris Therapeutics, Inc. (U.S.)

Latest Developments in Global Biosurgery Market

- In May 2024, Sanofi announced an investment of over USD 1.10 billion in biomanufacturing in France, in addition to the USD 2.74 billion already allocated for major projects, reinforcing the company’s strategic commitment to enhancing health sovereignty. This investment aims to bolster Sanofi's biomanufacturing capabilities within France, positioning the company for future growth in biosurgery and healthcare innovation

- In November 2023, Johnson & Johnson MedTech’s Ethicon received approval for its ETHIZIA Hemostatic Sealing Patch, designed to effectively manage and stop disruptive bleeding during surgical procedures. This addition strengthens Ethicon's extensive biosurgery portfolio, meeting urgent needs in controlling surgical bleeding with enhanced precision and reliability

- In October 2023, Stryker launched a new catalog of advanced wound care products that utilize unique bioengineered materials, aimed at accelerating the healing process and reducing the risk of infection in surgical and traumatic injuries. This launch reflects Stryker’s dedication to providing advanced biosurgical solutions for improving patient recovery outcomes

- In September 2023, Medtronic announced that it had received FDA approval for a new bioactive tissue adhesive for soft tissue repair procedures, featuring enhanced bond strength and elasticity. This product allows surgeons to perform advanced techniques with greater ease, enhancing surgical precision and patient safety in biosurgery

- In August 2023, Ethicon, a Johnson & Johnson company, introduced a new surgical mesh for hernia repairs, advancing bioengineering to improve tissue integration and reduce complications and healing times post-surgery. This innovation further strengthens Ethicon’s ongoing commitment to enhancing surgical outcomes and biosurgical solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。