Global Gear Oils Market

市场规模(十亿美元)

CAGR :

%

USD

8.77 Billion

USD

10.69 Billion

2024

2032

USD

8.77 Billion

USD

10.69 Billion

2024

2032

| 2025 –2032 | |

| USD 8.77 Billion | |

| USD 10.69 Billion | |

|

|

|

|

Global Gear Oils Market Segmentation, By Base Oil (Mineral Oil, Synthetic Oil, Semi-Synthetic Oil and Bio-Based Oil), Product Type (Transportation and Industrial), Application (Worm Gearboxes, Spur and Helical Gearboxes, Bevel and Hypoid Gearboxes, Planetary Gearboxes, Spiral Bevel Gearboxes, and Parallel Shaft Gearboxes) and End-use (Manufacturing, Mining, Construction and Heavy Equipment, Agriculture, Metallurgy and Metalworking, Oil and Gas, Power Generation, Transport and Others) - Industry Trends and Forecast to 2032

Gear Oils Market Size

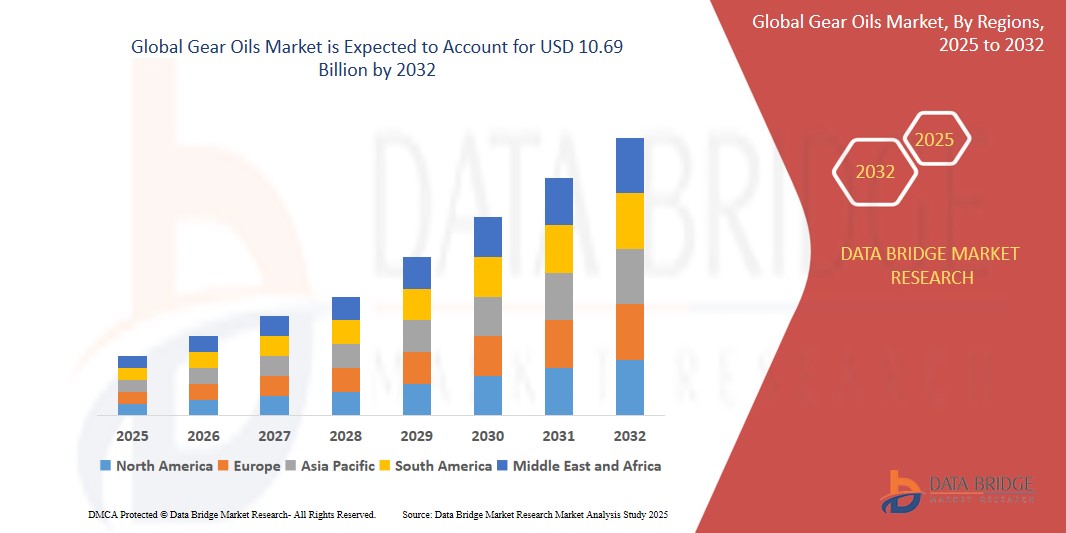

- The global gear oils market was valued atUSD 8.77 billion in 2024 and is expected to reachUSD 10.69 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at aCAGR of 2.5%, primarily driven by the rising industrialization and machinery usage

- This growth is driven by ongoing infrastructure projects demand construction equipment and machinery—another key user of industrial gear oils, reinforcing consistent market growth

Gear Oils Market Analysis

- Growing environmental concerns and stringent regulations are driving the development and adoption of biodegradable and non-toxic gear oils.

- These eco-friendly formulations offer reduced environmental impact while maintaining high performance, aligning with the industry's shift towards sustainability.

- Innovations in gear oil formulations, such as the incorporation of advanced additives and synthetic base oils, are enhancing lubrication efficiency.

- These advancements lead to improved wear protection, thermal stability, and extended service life of machinery, catering to the demands of modern industrial applications.

Report Scope and Gear Oils Market Segmentation

|

Attributes |

Gear Oils Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Gear Oils Market Trends

“Shift Toward Bio-Based and Environmentally Friendly Gear Oils”

- Governments and environmental bodies worldwide are enforcing stricter regulations on lubricant disposal and emissions, encouraging the use of biodegradable, non-toxic gear oils.

- Automotive, marine, and industrial sectors are aligning with sustainability targets by adopting bio-based gear oils that reduce carbon footprint and ecological impact.

- Innovations in ester-based and synthetic bio-lubricants are enhancing performance, oxidation stability, and lifespan—making them competitive with conventional mineral oils.

- Original Equipment Manufacturers (OEMs) are increasingly recommending or mandating eco-friendly lubricants, driving wider adoption across end-user industries.

- For instance, FUCHS offers a range of biodegradable lubricants called PLANTO that includes gear oils. These products are designed for environmentally sensitive applications, such as forestry and marine, where minimizing environmental impact is crucial.

- Increased awareness among consumers and industries about environmental protection is leading to higher demand for green alternatives in maintenance and operations.

Gear Oils Market Dynamics

Driver

“Rising Industrialization and Machinery Usage”

- As global industrialization accelerates—especially in emerging economies—there is a growing need for machinery that requires gear oils for smooth and efficient operation.

- Sectors like mining, steel, cement, and power generation extensively use heavy-duty gearboxes and require high-performance gear oils to minimize wear and downtime.

- Rising vehicle production globally boosts the use of gear oils in transmissions and differentials, particularly in commercial and off-road vehicles.

- Industries are increasingly investing in high-quality gear oils to reduce maintenance costs, extend machinery life, and improve energy efficiency.

- Ongoing infrastructure projects demand construction equipment and machinery—another key user of industrial gear oils, reinforcing consistent market growth.

- For instance, According to an article by JUSDA Supply Chain Management International Co., Ltd., the shift of manufacturing bases to Southeast Asia has led to greater use of industrial machinery, increasing the need for reliable gear oils to support continuous operations.

- The rising pace of industrialization and expanding machinery usage continue to be primary catalysts for gear oil demand across multiple sectors. This trend is expected to sustain market growth as industries prioritize operational efficiency and equipment longevity.

Opportunity

“Growth in Wind Energy Installations”

- The global push for renewable energy is driving rapid expansion of wind farms, particularly in Asia-Pacific, Europe, and North America.

- Wind turbine gearboxes require high-performance gear oils to handle extreme pressures and temperature variations, ensuring operational reliability.

- Wind gearboxes need synthetic gear oils with extended service life, presenting opportunities for manufacturers offering premium, long-lasting lubricants.

- Partnerships with turbine manufacturers (e.g., Siemens Gamesa, Vestas) open doors for long-term supply contracts and co-development of application-specific oils.

- For instance, Shell developed its Omala S5 Wind 320 synthetic gear oil specifically for wind turbines, offering extended oil drain intervals and superior protection. Shell has partnerships with major turbine OEMs and operates in over 30,000 wind turbines globally.

- Growing installed base of turbines increases demand for maintenance, offering recurring revenue through oil changes, condition monitoring, and technical support, making it a key growth opportunity in the Gear Oils market.

Restraint/Challenge

“Fluctuating Raw Material Prices”

- Gear oils are primarily derived from base oils (mineral, synthetic), which are directly linked to crude oil prices. Volatility in crude oil markets significantly impacts production costs.

- Frequent price changes make it difficult for manufacturers to maintain stable profit margins, especially when cost increases cannot be fully passed on to customers.

- Unpredictable prices often lead to disruptions in the procurement and inventory planning of raw materials, affecting consistent product availability.

- In price-sensitive markets, companies may hesitate to adjust product prices in response to cost increases, leading to intense price competition and reduced profitability.

- Unstable input costs can divert funds away from research and development, slowing innovation in high-performance or eco-friendly gear oil formulations.

Gear Oils Market Scope

The market is segmented on the basis of base oil, product type, and application.

|

Segmentation |

Sub-Segmentation |

|

By Base Oil |

|

|

By Product Type |

|

|

By Application |

|

|

By End-use |

|

Gear Oils Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Gear Oils Market”

- Asia-Pacific dominates the Gear Oils market, driven its large automotive and industrial sectors, rapid urbanization, and growing manufacturing industries

- China holds a significant share due to contribute significantly to demand, driven by expanding automotive production, industrial machinery usage, and increasing infrastructure development in the region

“India is Projected To Register the Highest Growth Rate as a country”

- India is growing with highest CAGR in the region due to increasing adoption of automation and advanced manufacturing technologies further fuels the demand for high-performance lubricants in the region.

- Government initiatives to promote industrial growth and sustainable development are expected to create new opportunities for market players

Gear Oils Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Global Gear Oil Market Are:

- Shell group of companies (Netherlands)

- China Petrochemical Corporation (China)

- Exxon Mobil Corporation (U.S.)

- Chevron Corporation (U.S.)

- bp p.l.c. (U.K.)

- FUCHS (Germany)

- Total (France)

- Phillips 66 Company (U.S.)

- Saudi Arabian Oil Co. (Saudi Arabia)

- LUKOIL (Russia)

- Idemitsu Kosan Co., Ltd. (Japan)

- CASTROL LIMITED (U.K.)

- LIQUI MOLY GmbH (Germany)

- Calumet Specialty Products Partners, L.P. (U.S.)

- Morris Lubricants (U.K.)

- Penrite Oil (Australia)

- Carl Bechem GmbH (Germany)

- Valvoline Inc. (U.S.)

- Peak Lubricants Pty Ltd (Australia)

- Indian Oil Corporation (India)

Latest Developments in Global Gear Oils Market

- In January 2023, Goodyear Lubricants introduced new BS-6-compliant lubricants in Haryana for the Indian market. The company launched a new line of car lubricant oils for distribution in South and Southeast Asia, as well as New Zealand. The goal of the new product line was to reduce carbon footprint while complying with current EURO 6 and BS-6 regulations. Goodyear worked with Assurance International Limited to develop a range of environmentally friendly and sustainable products.

- In October 2023, HPCL and Chevron Brands International LLC, a division of Chevron Corporation, reached a long-term agreement in which Chevron's lubricant products, including its exclusive Havoline and Delo brands, were licensed, produced, distributed, and marketed under the Caltex brand.

- In August 2022, Exol unveiled Optifarm HP, a high-performance gear oil specifically designed for JCB use. This product launch demonstrated Exol's commitment to offering a wide range of performance oil solutions to meet the market's evolving demands. Made with premium quality, thermally stable base oils and advanced additive chemistry, Optifarm HP was a specialized, high-performance gear oil. It helped reduce chatter and squawk in oil-immersed braking systems while offering exceptional component protection to extend equipment life. Other benefits of Optifarm HP included reduced foaming, outstanding anti-wear properties, superior oxidation stability, and enhanced anti-squawk performance in brake systems.

- In May 2022, German lubricant specialist LIQUI MOLY launched Top Tec Gear EV 510 gear oil, designed specifically for high-torque electric motors and meeting the strict manufacturer requirements of Tesla. LIQUI MOLY's research and development team also worked on low-conductivity coolants for electric vehicle batteries. As e-mobility became more prevalent in Europe, the US, and Asia, LIQUI MOLY prepared for the future by offering specialized lubricants for all types of vehicles.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。