美国巧克力市场的麦芽糖醇,按形式(粉末、糖浆和晶体)、应用(巧克力产品和巧克力内含物)、分销渠道(直接和间接)划分 - 行业趋势和 2030 年预测。

美国麦芽糖醇巧克力市场分析与洞察

麦芽糖醇是从水果、蔬菜和淀粉等各种原料中提取的糖醇。淀粉中的麦芽糖是麦芽糖醇的来源,它被用作各种食品和饮料产品中的低热量甜味剂,如无糖巧克力、硬糖、烘焙食品、巧克力涂层和口香糖。随着人们越来越注重健康,全球糖尿病患者人数也在增加,全球对低热量甜味剂的需求也在增加。因此,全球对低热量巧克力和无糖巧克力中麦芽糖醇的需求也在增加。

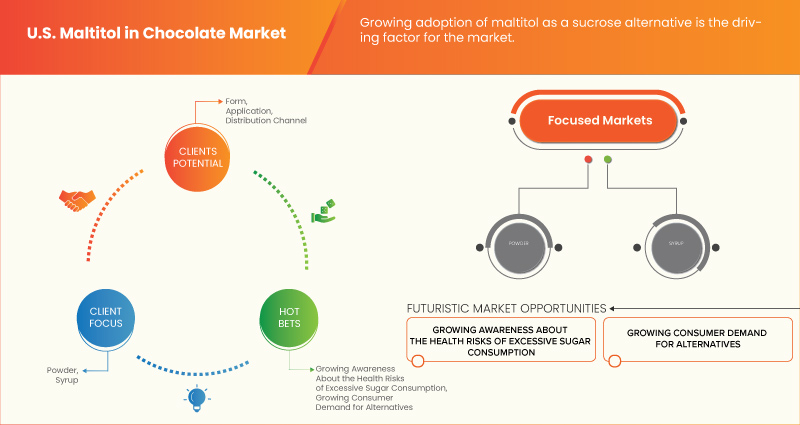

推动市场增长的因素包括低热量和无糖巧克力产品的需求不断增长、常规糖成分引起的健康问题越来越多、麦芽糖醇作为蔗糖替代品的采用日益广泛以及原材料来源丰富。制约市场增长的因素包括麦芽糖醇的副作用、与其他甜味剂相比麦芽糖醇的高成本以及市场上可用的替代品数量。许多公司正在扩大其生产设施,以满足对含麦芽糖醇巧克力的更高需求。Data Bridge Market Research 分析称,美国巧克力市场中的麦芽糖醇预计将在 2030 年达到 6810 万美元的价值,预测期内的复合年增长率为 6.5%。

|

报告指标 |

细节 |

|

预测期 |

2023 至 2030 年 |

|

基准年 |

2022 |

|

历史岁月 |

2021 (可定制为 2015-2020) |

|

定量单位 |

收入(百万美元)、销量(单位)和定价(美元) |

|

涵盖的领域 |

形式(粉末、糖浆和晶体)、应用(巧克力产品和巧克力内含物)、分销渠道(直接和间接) |

|

覆盖国家 |

我们 |

|

涵盖的市场参与者 |

谷物加工公司(美国)、罗盖特公司(法国)、宜瑞安公司(美国)、嘉吉公司(美国)、ADM(美国)、丰益国际有限公司(新加坡)、默克公司(德国)和 Nutra Food Ingredients(美国)等 |

美国麦芽糖醇在巧克力市场的定义

麦芽糖醇是一种糖的替代品,常用于生产巧克力和其他糖果产品。它属于一类被称为多元醇或糖醇的甜味剂。麦芽糖醇来源于麦芽糖,麦芽糖是一种存在于大麦等谷物中的糖。就其化学结构而言,麦芽糖醇是一种由两个糖分子、葡萄糖和山梨糖醇组成的二糖醇。它的味道和甜度与糖相似,但热量更低。麦芽糖醇通常用作巧克力和其他甜食中的糖的替代品,以提供甜味和质地,同时降低总糖含量。

美国麦芽糖醇巧克力市场动态

本节旨在了解市场驱动因素、机遇、限制因素和挑战。下文将详细讨论所有这些内容:

驱动程序

- 因食用常规糖类成分而导致的健康问题普遍存在

巧克力、蛋糕、糖果、冰淇淋、松饼和饼干等各种食品中普通糖的消费量不断增加,这是导致美国人口健康问题的主要因素。与日常过量摄入糖有关的健康问题包括肥胖、蛀牙和糖尿病。世界卫生组织 (WHO) 限制了添加糖的食品和饮料的消费。此举是为了改善美国公众健康。

因此,肥胖或超重人口的增加预计将增加巧克力等食品中对麦芽糖醇等低热量甜味剂的需求。因此,由于食用普通糖成分而导致的健康问题普遍存在,预计将推动市场增长。

- 消费者对无糖和低热量巧克力产品的需求不断增长

麦芽糖醇是一种被称为糖醇的甜味剂。它不致龋,卡路里含量极低,只有普通糖的一半,每克含 2.1 卡路里,而普通糖每克含 4.0 卡路里。因此,美国低卡路里和无糖巧克力对麦芽糖醇的需求正在增加。低卡路里食品趋势背后的主要原因是美国各地越来越注重健康的人群

根据 Gama Compass 的数据,拉丁美洲已在美国推出了 15.8% 的新型低热量食品,每 100 克/毫升仅含 50-150 千卡热量。因此,消费者对无糖和低热量巧克力产品(包括巧克力)的需求不断增长,预计将在未来几年推动美国巧克力行业对麦芽糖醇的需求。

克制

- 麦芽糖醇的副作用

麦芽糖醇是普通糖的替代甜味剂,天然存在于一些水果和蔬菜中。食用麦芽糖醇有多种好处,它是一种低热量甜味剂,有助于预防龋齿,但过量食用麦芽糖醇对健康有害,因为食用麦芽糖醇会产生多种副作用。

因此,预计过量消费麦芽糖醇所产生的副作用将抑制市场的增长。

机会

- 麦芽糖醇是巧克力中预防牙齿问题的关键成分

糖的消费量增加导致各种负面健康问题,如龋齿和糖尿病。因此,医疗专业人士和牙科专业人士正在宣传用麦芽糖醇等替代甜味剂代替普通糖,这可能是麦芽糖醇作为无热量甜味剂用于巧克力产品以预防儿童龋齿的机会。

因此,由于麦芽糖醇对口腔健康有益,而且人们在口腔健康方面的支出也越来越多,因此在巧克力产品中使用麦芽糖醇对市场来说是一个绝佳的机会。因此,预计这将为市场增长创造机会。

挑战

- 市场上可用的替代品数量

麦芽糖醇是普通糖的替代甜味剂,因为普通糖存在各种健康危害。糖尿病、高血糖、肥胖、高血压和牙齿损伤是与普通糖有关的最常见问题。对低热量和无糖产品的需求不断增长,推动了对麦芽糖醇等低热量甜味剂的需求。

用作麦芽糖醇替代品的多元醇具有与麦芽糖醇相似的特性,并且都是低热量甜味剂,可以轻松被麦芽糖醇取代。因此,它将影响麦芽糖醇的增长。因此,预计它将挑战市场增长。

最新动态

- 2023 年 3 月,ADM 再次被 Ethisphere 评为 2023 年全球最具商业道德企业之一。Ethisphere 是推动商业道德实践标准的全球领导者。这是 ADM 连续第四年获得这一认可,该奖项旨在表彰那些理解领导的重要性、优先考虑道德业务表现并表现出对诚信整体承诺的公司。

- 2022 年 7 月,KENT Corporation 家族企业成员之一谷物加工公司 (GPC) 宣布已完成对 Natural Products, Inc. (NPI) 业务的收购。

美国麦芽糖醇在巧克力中的市场范围

美国巧克力麦芽糖醇市场根据形式、应用和分销渠道分为三个显著的细分市场。细分市场之间的增长有助于您分析利基增长领域和进入市场的策略,并确定您的核心应用领域和目标市场的差异。

形式

- 粉末

- 糖浆

- 水晶

根据形式,市场分为粉末、糖浆和晶体。

应用

- 巧克力产品

- 巧克力配料

根据应用,市场分为巧克力产品和巧克力夹心。

分销渠道

- 直接的

- 间接

根据分销渠道,市场分为直接分销和间接分销。

美国麦芽糖醇巧克力市场分析/见解

美国巧克力中的麦芽糖醇市场根据形式、应用和分销渠道分为三个显著的部分。

本市场报告涵盖的国家是美国

巧克力市场竞争格局及美国麦芽糖醇份额分析

美国麦芽糖醇在巧克力市场的竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、产生的收入、市场潜力、研发投资、新市场计划、生产基地和设施、公司优势和劣势、产品发布、产品批准、产品宽度和广度、应用优势和产品类型生命线曲线。以上提供的数据点仅与公司对美国麦芽糖醇在巧克力市场的关注有关。

美国巧克力市场麦芽糖醇的主要参与者包括谷物加工公司、罗盖特公司、宜瑞安公司、嘉吉公司、ADM、丰益国际有限公司、默克公司和 Nutra Food Ingredients 等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET TESTING TYPE COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 VALUE CHAIN ANALYSIS

4.3 SUPPLY CHAIN ANALYSIS

4.4 IMPORT-EXPORT ANALYSIS

4.5 RAW MATERIAL SOURCING ANALYSIS

4.6 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.7 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.8 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.9 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

4.1 BRAND OUTLOOK

4.11 IMPACT OF ECONOMIC SLOWDOWN ON MARKET

4.12 PRICING INDEX (PRICE AT B2B END & PRICES AT FOB)

4.13 PRODUCTION CAPACITY OF KEY MANUFACTURERS

5 REGULATORY FRAMEWORK

6 REGIONAL WRITE-UP (U.S.)

6.1 OVERVIEW

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 PREVALENCE OF HEALTH ISSUES DUE TO CONSUMPTION OF REGULAR SUGAR INGREDIENTS

7.1.2 RISING CONSUMER DEMAND FOR SUGAR-FREE AND LOW-CALORIE CHOCOLATE GOODS

7.1.3 GROWING ADOPTION OF MALTITOL AS A SUCROSE ALTERNATIVE

7.1.4 ABUNDANT RAW MATERIAL SOURCES

7.2 RESTRAINTS

7.2.1 SIDE EFFECTS OF MALTITOL

7.2.2 HIGH COST OF MALTITOL

7.3 OPPORTUNITIES

7.3.1 MALTITOL IS A KEY COMPONENT IN CHOCOLATES TO PREVENT DENTAL ISSUES

7.3.2 CONSUMPTION OF MALTITOL AND ITS ASSOCIATED HEALTH BENEFITS

7.4 CHALLENGES

7.4.1 NUMBER OF ACCESSIBLE ALTERNATIVES ON THE MARKET

7.4.2 STRINGENT REGULATORY FRAMEWORK

8 U.S. MALTITOL IN CHOCOLATE MARKET, BY FORM

8.1 OVERVIEW

8.2 CRYSTALS

8.3 POWDER

8.4 SYRUP

8.4.1 HIGH MALTOSE SYRUP

8.4.2 EXTRA HIGH-MALTOSE SYRUP

9 U.S. MALTITOL IN CHOCOLATE MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 CHOCOLATE PRODUCTS

9.2.1 CHOCOLATE BARS

9.2.2 CHOCOLATE BITES

9.2.3 CHOCOLATE WAFERS

9.2.4 CHOCOLATE COOKIES

9.2.5 ASSORTMENT CHOCOLATES

9.2.6 CHOCOLATE CAKES & PASTRIES

9.2.7 CHOCOLATE DONUTS & BROWNIES

9.2.8 CHOCOLATE CANDIES

9.2.9 OTHERS

9.2.9.1 WHITE CHOCOLATE

9.2.9.2 MILK CHOCOLATE

9.2.9.3 DARK CHOCOLATE

9.2.9.3.1 POWDER

9.2.9.3.2 SYRUP

9.2.9.3.3 CRYSTAL

9.3 CHOCOLATE INCLUSION

9.3.1 CHOCOLATE SHAPES

9.3.2 JIMMIES

9.3.3 DRAGEES

9.3.3.1 OVAL DRAGEES

9.3.3.2 PEARL DRAGEES

9.3.4 CHOCOLATE SYRUPS

9.3.5 CHOCOLATE FLAKES

9.3.6 QUINS

9.3.7 NONPAREILS

9.3.8 CHOCOLATE CHUNKS

9.3.9 CHOCOLATE SHELLS

9.3.10 CHOCOLATE CUPS

9.3.11 OTHERS

9.3.11.1 MILK CHOCOLATE

9.3.11.2 WHITE CHOCOLATE

9.3.11.3 DARK CHOCOLATE

9.3.11.3.1 POWDER

9.3.11.3.2 SYRUP

9.3.11.3.3 CRYSTAL

10 U.S. MALTITOL IN CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 DIRECT

10.3 INDIRECT

11 U.S. MALTITOL IN CHOCOLATE MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: SWITZERLAND

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 ADM

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENTS

13.2 GRAIN PROCESSING CORPORATION

13.2.1 COMPANY SNAPSHOT

13.2.2 PRODUCT PORTFOLIO

13.2.3 RECENT DEVELOPMENT

13.3 INGREDION INCORPORATED (2022)

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENTS

13.4 CARGILL, INCORPORATED

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 MERCK KGAA (2022)

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENT

13.6 NUTRA FOOD INGREDIENTS

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 . RECENT DEVELOPMENT

13.7 ROQUETTE FRÈRES

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 WILMAR INTERNATIONAL LTD. (2022)

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

表格列表

TABLE 1 COMPANIES WITH THEIR MALTILOL BRANDS

TABLE 2 COMPARISON OF SOME PHYSICO-CHEMICAL PROPERTIES FOR SUCROSE AND MALTITOL

TABLE 3 FREQUENCY AND MEAN SCORE OF INTOLERANCE SYMPTOMS INTENSITY AFTER REGULAR CONSUMPTION OF INCREASING DOSES OF MALTITOL IN 12 HEALTHY VOLUNTEERS

TABLE 4 PRICES INDICATION OF DIFFERENT SWEETENERS

TABLE 5 ALTERNATIVE FORMULATIONS

TABLE 6 U.S. MALTITOL IN CHOCOLATE MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 7 U.S. MALTITOL IN CHOCOLATE MARKET, BY FORM, 2021-2030 (TONS)

TABLE 8 U.S. MALTITOL IN CHOCOLATE MARKET, BY FORM, 2021-2030 (ASP)

TABLE 9 U.S. SYRUP IN MALTITOL IN CHOCOLATE MARKET, BY SYRUP TYPE, 2021-2030 (USD MILLION)

TABLE 10 U.S. MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 11 U.S. CHOCOLATE PRODUCTS IN MALTITOL IN CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 U.S. CHOCOLATE PRODUCTS IN MALTITOL IN CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 13 U.S. CHOCOLATE PRODUCTS IN MALTITOL IN CHOCOLATE MARKET, BY MALTITOL FORM, 2021-2030 (USD MILLION)

TABLE 14 U.S. CHOCOLATE INCLUSIONS IN MALTITOL IN CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 U.S. DRAGEES IN MALTITOL IN CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 16 U.S. CHOCOLATE INCLUSIONS IN MALTITOL IN CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 17 U.S. CHOCOLATE INCLUSIONS IN MALTITOL IN CHOCOLATE MARKET, BY MALTITOL FORM, 2021-2030 (USD MILLION)

TABLE 18 U.S. MALTITOL IN CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

图片列表

FIGURE 1 U.S. MALTITOL IN CHOCOLATE MARKET: SEGMENTATION

FIGURE 2 U.S. MALTITOL IN CHOCOLATE MARKET: DATA TRIANGULATION

FIGURE 3 U.S. MALTITOL IN CHOCOLATE MARKET: DROC ANALYSIS

FIGURE 4 U.S. MALTITOL IN CHOCOLATE MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 U.S. MALTITOL IN CHOCOLATE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. MALTITOL IN CHOCOLATE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.S. MALTITOL IN CHOCOLATE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 U.S. MALTITOL IN CHOCOLATE MARKET: END USER COVERAGE GRID

FIGURE 9 U.S. MALTITOL IN CHOCOLATE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 U.S. MALTITOL IN CHOCOLATE MARKET: SEGMENTATION

FIGURE 11 THE PREVALENCE OF HEALTH ISSUES DUE TO THE CONSUMPTION OF REGULAR SUGAR INGREDIENTS IS EXPECTED TO DRIVE THE U.S. MALTITOL IN CHOCOLATE MARKET IN THE FORECAST PERIOD

FIGURE 12 CRYSTALS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. MALTITOL IN CHOCOLATE MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE U.S. MALTITOL IN CHOCOLATE MARKET

FIGURE 14 U.S. MALTITOL IN CHOCOLATE MARKET: BY FORM, 2022

FIGURE 15 U.S. MALTITOL IN CHOCOLATE MARKET: BY FORM, 2023-2030 (USD MILLION)

FIGURE 16 U.S. MALTITOL IN CHOCOLATE MARKET: BY FORM, CAGR (2023-2030)

FIGURE 17 U.S. MALTITOL IN CHOCOLATE MARKET: BY FORM, LIFELINE CURVE

FIGURE 18 U.S. MALTITOL IN CHOCOLATE MARKET: BY APPLICATION, 2022

FIGURE 19 U.S. MALTITOL IN CHOCOLATE MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 20 U.S. MALTITOL IN CHOCOLATE MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 21 U.S. MALTITOL IN CHOCOLATE MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 22 U.S. MALTITOL IN CHOCOLATE MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 23 U.S. MALTITOL IN CHOCOLATE MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 24 U.S. MALTITOL IN CHOCOLATE MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 25 U.S. MALTITOL IN CHOCOLATE MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 26 U.S. MALTITOL IN CHOCOLATE MARKET: COMPANY SHARE 2022 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。