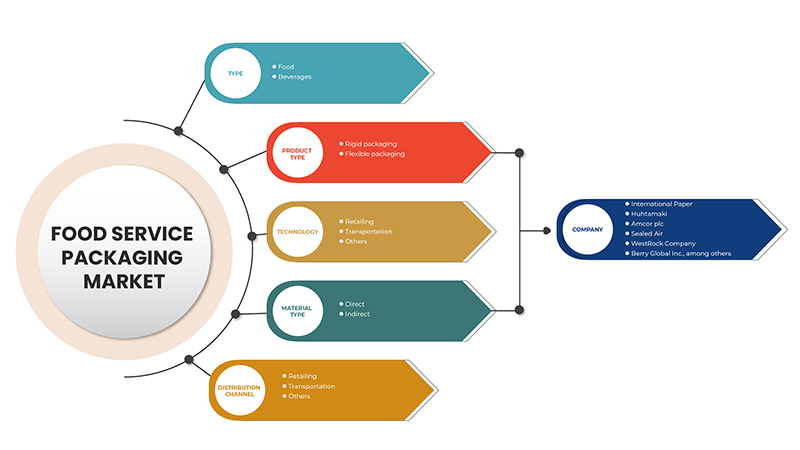

美国食品服务包装市场,按类型(食品和饮料)、材料类型(塑料、纸张、模制纤维/纸浆、木材、玻璃和其他)、产品类型(硬质包装、软包装)、应用(零售、运输和其他)、分销渠道(直接和间接)划分 - 行业趋势和预测到 2029 年。

市场分析和见解

食品包装广泛用于包装加工食品和半加工食品。食品包装有助于保持卫生和质量,提高食品的安全性。食品包装的最终用户是餐馆、餐饮服务、快餐店等。食品包装还有助于延长食品的保质期,并有助于使食品和饮料产品保持更长时间的新鲜。食品包装使用不同的材料,包括塑料、纸、木浆、玻璃等。

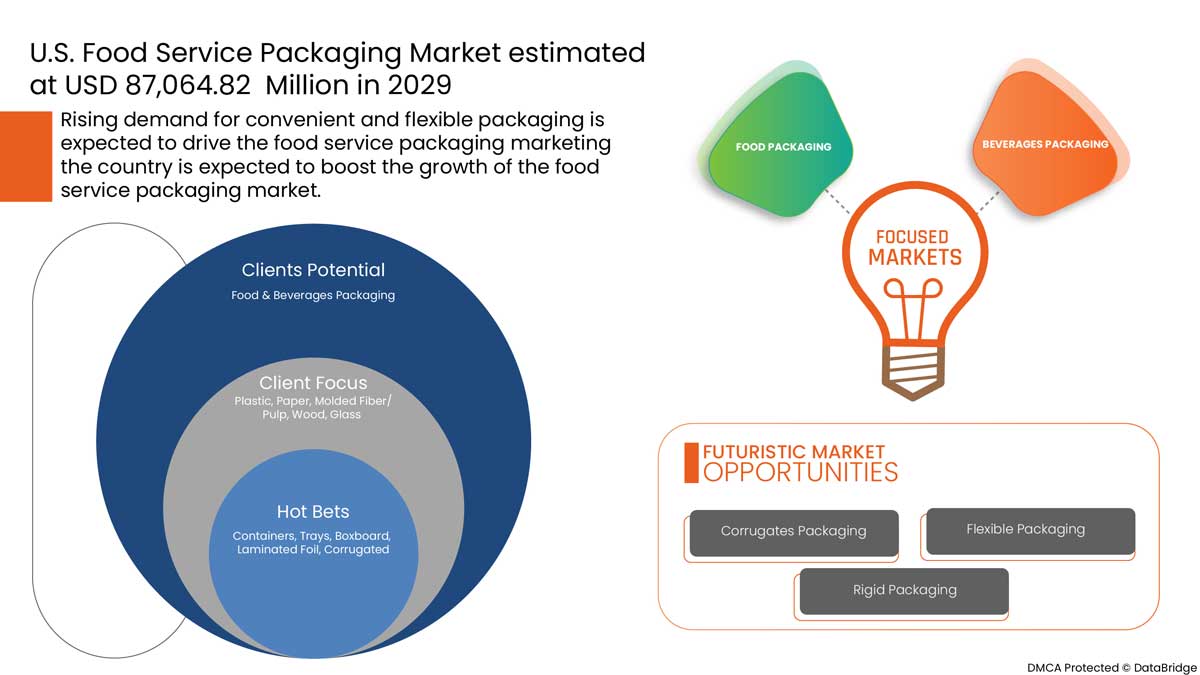

用木材、塑料、纸张等制成的袋子、容器和盒子广泛用于包装食品和饮料产品。对方便灵活包装的需求不断增长,极大地影响了食品服务包装市场的扩张。与此相符的是,越来越多地采用环保和可生物降解的产品有望推动市场的增长。然而,政府机构对包装材料制定的严格规定可能会成为食品服务包装市场增长的主要制约因素。

对可持续包装解决方案的需求不断增长,加上包装行业越来越多地采用现代技术,将为食品服务包装市场创造更多未来机会。然而,在预测期内,保持包装产品的标准质量可能会对食品服务包装市场的增长构成挑战。

Data Bridge Market Research分析,2022年至2029年的预测期内,美国食品服务包装市场将以5.2%的复合年增长率增长。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制至 2019 - 2014) |

|

定量单位 |

收入(百万美元)、销量(百万单位)、定价(美元) |

|

涵盖的领域 |

按类型(食品和饮料)、材料类型(塑料、纸张、模塑纤维/纸浆、木材、玻璃等)、产品类型(硬包装、软包装)、应用(零售、运输等)、分销渠道(直接和间接) |

|

覆盖国家 |

我们 |

|

涵盖的市场参与者 |

国际纸业、Huhtamaki、Amcor plc、Sealed Air、WestRock Company、Berry Global Inc.、Fabri-Kal、Sabert Corporation、Genpak, LLC、Dart Container Corporation |

市场定义

食品包装广泛用于包装加工食品和半加工食品。它有助于保持卫生和质量,并提高食品的安全性。食品包装的最终用户包括餐馆、餐饮服务、快餐店等。食品包装还有助于延长食品的保质期,并有助于使食品和饮料产品保持更长时间的新鲜。食品包装使用不同的材料,包括塑料、纸、木浆、玻璃等。

美国食品服务包装市场动态

驱动程序

-

对便捷、灵活包装的需求不断增长

食品和饮料制造商对方便、灵活的包装的需求日益增加,以取代玻璃罐、金属罐等传统包装。对软包装的需求不断增加,是因为其可持续性,因为它消耗更少的能源和更少的自然资源,产生更少的二氧化碳排放;导致更高的产品与包装比率;并且需要更少的卡车进行运输,消耗更少的燃料并产生更少的排放。上述因素预计将推动市场的增长。此外,软包装更方便、易于储存、可回收、易于打开或携带,并有助于延长产品的保质期,从而增加了食品服务提供商对它的需求。

-

越来越多地采用环保和可生物降解的包装

包装起着重要作用,因为食品包装可以保护食品免受环境、化学和物理因素的影响,如果包装不当,这些因素可能会污染所有食品。包装的基本作用是保护产品在运输过程中免受损坏。食品服务提供商使用不同类型的包装来提供食品和饮料产品,包括纸、塑料、模塑纤维/纸浆、玻璃、木材等。最近,由于环保和可生物降解包装的生产成本低,可以重复使用和回收,因此对环保和可生物降解包装的需求正在增加,从而降低了制造商的废物产生量。此外,人们越来越担心包装对环境的有害影响,这推动了对环保和可生物降解包装的需求。此外,人们对塑料包装和其他包装的废物、环境污染和有害影响的认识不断提高,对易于回收或更快降解的包装的需求也在增加。

机会

-

重视包装行业的现代技术

食品服务供应商对可持续、可靠、环保包装的需求日益增长,这促使制造商引入新颖的现代技术来制造包装产品。食品和饮料对可持续、高质量和有吸引力的包装材料的需求正在增加,这将为食品服务包装制造商创造巨大的机会。现代技术提供高质量和坚固的包装产品,吸引了食品服务制造商。食品服务行业对可靠和创新包装解决方案的需求不断增长,这促使制造商引入现代技术来制造包装解决方案。

克制/挑战

- 食品包装中使用有害的防水/防油添加剂

包装添加剂是天然或化学产品,可以添加到材料中以改善产品的性能。食品包装、储存和加工中使用的合成化学品可能对人体健康造成长期危害,给消费者带来严重的健康问题,因为这些物质大部分都不是惰性的,可能会渗入食品或饮料产品中。

PFAS(多氟烷基物质)化学物质通常被添加到甘蔗渣或模制纤维食品包装中,因为它可以使包装具有更强的防潮、防油和防油脂能力。但是,接触 PFAS 可能会对健康产生不利影响,包括肝损伤、甲状腺疾病、生育能力下降、高胆固醇、肥胖、激素抑制和癌症。这些化学物质很容易迁移到空气、灰尘、食物、土壤和水中,对环境造成有害影响。

此外,包括铝罐在内的多种包装产品内衬通常含有双酚 A (BPA),这是一种内分泌干扰物。包装公司已自愿停止在婴儿配方奶粉和奶瓶包装中使用 BPA,但水瓶和食品包装中仍然存在 BPA。内分泌干扰物与乳腺癌、前列腺癌、不孕症和代谢紊乱等健康问题有关。

COVID-19 对美国食品服务包装市场的影响

COVID-19 在一定程度上影响了市场。由于封锁,食品和饮料行业面临重大危机,这最初减少了对食品服务包装的需求。疫情后,由于对包装和预制食品的需求增加,对食品服务包装的需求有所增加。此外,饮食习惯的改变和对便携食品和饮料产品的更多倾向正在增加食品服务行业对便捷包装的需求。

最新动态

- 2022 年 1 月,国际纸业宣布在美国宾夕法尼亚州建设新的瓦楞包装工厂,旨在扩大其在美国东北部的工业包装足迹

美国食品服务包装市场范围

美国食品服务包装市场根据类型、材料类型、产品类型、应用和分销渠道进行细分。这些细分市场之间的增长将帮助您分析行业中的主要增长细分市场,并为用户提供有价值的市场概览和市场洞察,以便做出战略决策,确定核心市场应用。

类型

- 食物

- 饮料

根据类型,美国食品服务包装市场分为食品和饮料。

材质类型

- 塑料

- 纸

- 模塑纤维/纸浆

- 木头

- 玻璃

- 其他的

根据材料类型,美国食品服务包装市场分为塑料、纸张、模制纤维/纸浆、木材、玻璃和其他。

产品类型

- 硬包装

- 软包装

根据产品类型,美国食品服务包装市场分为硬质包装和软包装。

应用

- 零售

- 运输

- 其他的

根据应用,美国食品服务包装市场分为零售、运输和其他。

分销渠道

- 直接的

- 间接

根据分销渠道,美国食品服务包装市场分为直接细分和间接细分。

竞争格局和美国食品服务包装市场份额分析

美国食品服务包装市场竞争格局详细介绍了竞争对手。详细信息包括公司概况、公司财务状况、产生的收入、市场潜力、研发投资、新市场计划、美国业务、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度以及应用主导地位。以上数据点仅与公司对美国食品服务包装市场的关注有关。

美国食品服务包装市场的一些主要参与者包括 International Paper、Huhtamaki、Amcor plc、Sealed Air、WestRock Company、Berry Global Inc.、Fabri-Kal、Sabert Corporation、Genpak, LLC、Dart Container Corporation 等。

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析以及主要(行业专家)验证。除此之外,数据模型还包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、公司市场份额分析、测量标准、美国供应商份额分析。如有进一步询问,请要求分析师致电。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.S. FOOD SERVICE PACKAGING MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 LABELING AND CLAIMS

4.2 MARKET SHARE OF MOLDED FIBER VS OTHER SUBSTRATES AND ITS PROJECTION

4.3 NEW PRODUCT LAUNCH STRATEGY

4.3.1 OVERVIEW

4.3.2 NUMBER OF PRODUCT LAUNCHES

4.3.2.1 LINE EXTENSION

4.3.2.2 NEW PACKAGING

4.3.2.3 RE-LAUNCHED

4.3.2.4 NEW FORMULATION

4.3.3 DIFFERENTIAL PRODUCT OFFERING

4.3.4 MEETING CONSUMER REQUIREMENT

4.3.5 PACKAGE DESIGNING

4.3.6 PRODUCT POSITIONING

4.3.7 CONCLUSION

4.4 TOP SUPPLIERS INFORMATION

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVES

4.5.1 FUTURE PERSPECTIVE

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 RAW MATERIAL

4.6.2 PACKAGING TYPE (PROCESSING METHOD)

4.6.2.1 PAPER PACKAGING MANUFACTURING PROCESS

4.6.3 DISTRIBUTION

4.6.4 END-USERS

4.7 VALUE CHAIN ANALYSIS

5 REGULATORY FRAMEWORK AND GUIDELINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR CONVENIENT AND FLEXIBLE PACKAGING

6.1.2 INCREASING ADOPTION OF ECO-FRIENDLY AND BIODEGRADABLE PACKAGING

6.1.3 ON-THE-GO LIFESTYLE IS INCREASING THE DEMAND FOR FOODSERVICE PACKAGING

6.1.4 RISING DEMAND FOR CONVENIENCE AND PREPARED FOOD

6.2 RESTRAINTS

6.2.1 STRINGENT GOVERNMENT REGULATIONS ON PACKAGING MATERIALS

6.2.2 USE OF HARMFUL ADDITIVES FOR WATER/OIL RESISTANCE IN FOOD PACKAGING

6.3 OPPORTUNITIES

6.3.1 GROWING DEMAND FOR SUSTAINABLE PACKAGING SOLUTIONS

6.3.2 EMPHASIS ON MODERN TECHNOLOGIES IN THE PACKAGING INDUSTRY

6.4 CHALLENGES

6.4.1 MANAGING PACKAGING WASTE IS DIFFICULT

6.4.2 MAINTAINING THE STANDARD QUALITY OF PACKAGING PRODUCT

7 U.S. FOOD SERVICE PACKAGING MARKET, BY TYPE

7.1 OVERVIEW

7.2 FOOD

7.2.1 CONFECTIONERY PRODUCTS

7.2.2 BAKERY PRODUCTS

7.2.3 DAIRY PRODUCTS

7.2.4 MEAT & POULTRY

7.2.5 FRUITS & VEGETABLES

7.2.6 OTHERS

7.3 BEVERAGES

7.3.1 NON-ALCOHOLIC BEVERAGES

7.3.2 ALCOHOLIC BEVERAGES

8 U.S. FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE

8.1 OVERVIEW

8.2 PAPER

8.3 PLASTIC

8.3.1 POLYETHYLENE TEREPHTHALATE

8.3.2 POLYPROPYLENE (PP)

8.3.3 POLY-VINYL CHLORIDE (PVC)

8.3.4 POLYSTYRENE

8.3.5 ETHYL VINYL ACETATE (EVA)

8.3.6 OTHERS

8.4 MOLDED FIBER / PULP

8.4.1 CARDBOARD

8.4.2 RECYCLED PAPER

8.4.3 NATURAL FIBER

8.4.3.1 SUGARCANE

8.4.3.2 BAMBOO

8.4.3.3 WHEAT STRAW

8.4.3.4 OTHERS

8.4.4 OTHERS

8.5 WOOD

8.6 GLASS

8.7 OTHERS

9 U.S. FOOD SERVICE PACKAGING MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 RIGID PACKAGING

9.2.1 BOXBOARD

9.2.2 CONTAINERS

9.2.3 TRAYS

9.2.4 OTHERS

9.3 FLEXIBLE PACKAGING

9.3.1 CORRUGATED

9.3.2 LAMINATED FOIL

9.3.3 OTHERS

10 U.S. FOOD SERVICE PACKAGING MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 TRANSPORTATION

10.2.1 TRANSPORTATION, BY MATERIAL TYPE

10.2.1.1 PLASTIC

10.2.1.2 PAPER

10.2.1.3 MOLDED FIBER/PULP

10.2.1.3.1 MOLDED FIBER/PULP, BY MATERIAL TYPE

10.2.1.3.1.1 RECYCLED PAPER

10.2.1.3.1.2 NATURAL FIBER

10.2.1.3.1.2.1 NATURAL FIBER, BY MATERIAL TYPE

10.2.1.3.1.2.1.1 SUGARCANE

10.2.1.3.1.2.1.2 BAMBOO

10.2.1.3.1.2.1.3 WHEAT STRAW

10.2.1.3.1.2.1.4 OTHERS

10.2.1.4 OTHERS

10.3 RETAILING

10.3.1 RETAILING, BY MATERIAL TYPE

10.3.1.1 PAPER

10.3.1.2 PLASTIC

10.3.1.3 MOLDED FIBER/PULP

10.3.1.3.1 MOLDED FIBER/PULP, BY MATERIAL TYPE

10.3.1.3.1.1 RECYCLED PAPER

10.3.1.3.1.2 NATURAL FIBER

10.3.1.3.1.2.1 NATURAL FIBER, BY MATERIAL TYPE

10.3.1.3.1.2.1.1 BAMBOO

10.3.1.3.1.2.1.2 WHEAT STRAW

10.3.1.3.1.2.1.3 SUGARCANE

10.3.1.3.1.2.1.4 OTHERS

10.3.1.4 OTHERS

10.4 OTHERS

11 U.S. FOOD SERVICE PACKAGING MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT

11.3 INDIRECT

12 U.S. FOOD SERVICE PACKAGING MARKET, COUNTRY ANALYSIS

12.1 U.S.

13 COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: U.S.

14 SWOT ANALYSIS

15 COMPANY SHARE ANALYSIS

15.1 WESTROCK COMPANY

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 INTERNATIONAL PAPER

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 DART CONTAINER CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 PRODUCT PORTFOLIO

15.3.3 RECENT DEVELOPMENT

15.4 BERRY GLOBAL INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 SABERT CORPORATION

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 AMCOR PLC

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 FABRI-KAL

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 GENPACK, LLC

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 HUHTAMAKI

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 SEALED AIR

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

16 QUESTIONNAIRES

17 RELATED REPORTS

表格列表

TABLE 1 MARKET SHARE OF MOLDED FIBER VS. OTHER SUBSTRATES

TABLE 2 REVENUE OF SUPPLIERS (USD MILLION) (2021)

TABLE 3 TOP SUPPLIERS INFORMATION (2020)

TABLE 4 U.S. FOOD SERVICE PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 U.S. FOOD IN FOOD SERVICE PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 U.S. BEVERAGES IN FOOD SERVICE PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 U.S. FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 8 U.S. FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (MILLION UNITS)

TABLE 9 U.S. PLASTIC IN FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 10 U.S. MOLDED FIBER / PULP IN FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 11 U.S. NATURAL FIBER IN FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 12 U.S. FOOD SERVICE PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 13 U.S. RIGID PACKAGING IN FOOD SERVICE PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 14 U.S. FLEXIBLE PACKAGING IN FOOD SERVICE PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 15 U.S. FOOD SERVICE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 16 U.S. TRANSPORTATION IN FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 17 U.S. MOLDED FIBER / PULP IN FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 18 U.S. NATURAL FIBER IN FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 19 U.S. RETAILING IN FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 20 U.S. MOLDED FIBER / PULP IN FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 21 U.S. NATURAL FIBER IN FOOD SERVICE PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 22 U.S. FOOD SERVICE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 U.S. FOOD SERVICE PACKAGING MARKET: SEGMENTATION

FIGURE 2 U.S. FOOD SERVICE PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 U.S. FOOD SERVICE PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 U.S. FOOD SERVICE PACKAGING MARKET: U.S. VS. REGIONAL MARKET ANALYSIS

FIGURE 5 U.S. FOOD SERVICE PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. FOOD SERVICE PACKAGING MARKET: MULTIVARIATE MODELLING

FIGURE 7 U.S. FOOD SERVICE PACKAGING MARKET

FIGURE 8 U.S. FOOD SERVICE PACKAGING MARKET

FIGURE 9 U.S. FOOD SERVICE PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 10 U.S. FOOD SERVICE PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 11 U.S. FOOD SERVICE PACKAGING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 12 U.S. FOOD SERVICE PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 U.S. FOOD SERVICE PACKAGING MARKET: SEGMENTATION

FIGURE 14 INCREASING ADOPTION OF ECO-FRIENDLY AND BIODEGRADABLE PACKAGING IS EXPECTED TO DRIVE THE U.S. FOOD SERVICE PACKAGING MARKET IN THE FORECAST PERIOD OF 2021 TO 2029

FIGURE 15 ON-THE-GO LIFESTYLE IS INCREASING THE DEMAND FOR FOOD SERVICE PACKAGING IS EXPECTED TO DRIVE THE U.S. FOOD SERVICE PACKAGING MARKET IN THE FORECAST PERIOD OF 2021 TO 2029

FIGURE 16 FOOD IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. FOOD SERVICE PACKAGING MARKET IN 2022 & 2029

FIGURE 17 FOOD IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. FOOD SERVICE PACKAGING MARKET IN 2022 & 2029

FIGURE 18 U.S. FOOD SERVICE PACKAGING MARKET: FACTORS AFFECTING NEW PRODUCT LAUNCHES STRATEGY

FIGURE 19 SUPPLY CHAIN OF U.S. FOOD SERVICE PACKAGING MARKET

FIGURE 20 VALUE CHAIN OF U.S. FOOD SERVICE PACKAGING MARKET

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE U.S. FOOD SERVICE PACKAGING MARKET

FIGURE 22 U.S. FOOD SERVICE PACKAGING MARKET: BY TYPE, 2021

FIGURE 23 U.S. FOOD SERVICE PACKAGING MARKET: BY MATERIAL TYPE, 2021

FIGURE 24 U.S. FOOD SERVICE PACKAGING MARKET: BY PRODUCT TYPE, 2021

FIGURE 25 U.S. FOOD SERVICE PACKAGING MARKET: BY APPLICATION, 2021

FIGURE 26 U.S. FOOD SERVICE PACKAGING MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 27 U.S. FOODSERVICE PACKAGING MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。