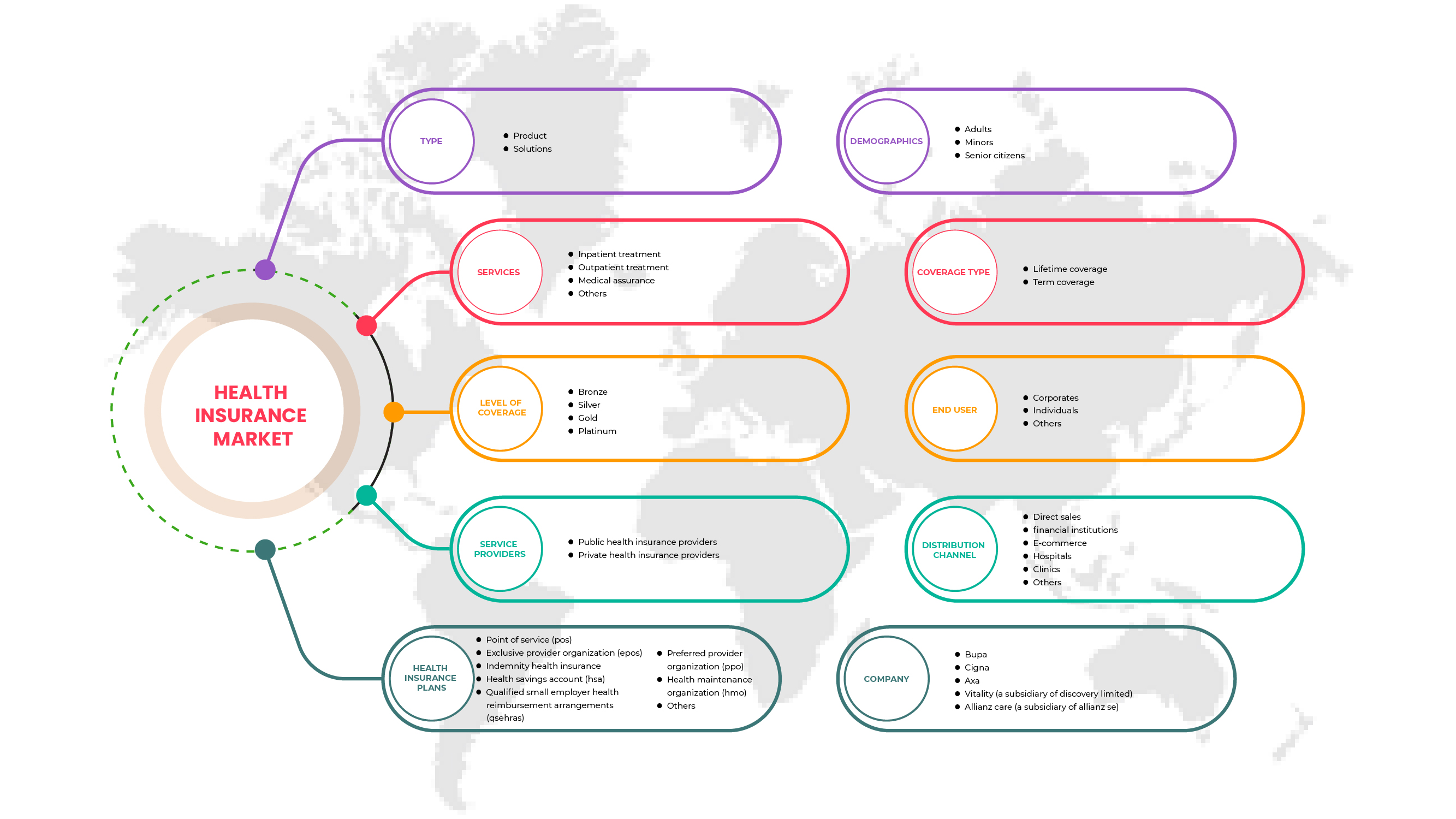

英国健康保险市场,按类型(产品和解决方案)、服务(住院治疗、门诊治疗、医疗保险等)、覆盖级别(铜牌、银牌、金牌和白金)、服务提供商(公共健康保险提供商、私人健康保险提供商)、健康保险计划(服务点 (POS)、独家提供商组织 (EPOS)、赔偿健康保险、健康储蓄账户 (HSA)、合格小型雇主健康报销安排 (QSEHRAS)、首选提供商组织 (PPO)、健康维护组织 (HMO) 等)、人口统计(成人、未成年人和老年人)、覆盖类型(终身覆盖、定期覆盖)、最终用户(企业、个人等)分销渠道(直销、金融机构、电子商务、医院、诊所等)、行业趋势和预测到 2029 年。

英国健康保险市场分析和规模

健康保险政策包含多种功能和福利。它为投保人提供针对某些治疗的财务保障。健康保险政策提供的优势包括无现金住院、住院前和住院后保险、报销和各种附加服务。英国健康保险市场报告提供了市场份额、新发展和产品渠道分析的详细信息、国内和本地市场参与者的影响,分析了新兴收入来源、市场法规变化、产品批准、战略决策、产品发布、地域扩张和市场技术创新方面的机会。

Data Bridge Market Research 分析,预计到 2029 年,英国健康保险市场价值将达到 1343.7664 亿美元,预测期内复合年增长率为 4.7%。产品部分是英国健康保险市场最大的产品部分。英国健康保险市场报告还深入介绍了定价分析、专利分析和技术进步。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制至 2019 - 2014) |

|

定量单位 |

收入(百万美元)、销量(单位)、定价(美元) |

|

涵盖的领域 |

按类型(产品和解决方案)、服务(住院治疗、门诊治疗、医疗保险等)、覆盖级别(青铜、白银、黄金和白金)、服务提供商(公共健康保险提供商、私人健康保险提供商)、健康保险计划(服务点 (POS)、独家提供商组织 (EPOS)、赔偿健康保险、健康储蓄账户 (HSA)、合格小型雇主健康报销安排 (QSEHRAS)、首选提供商组织 (PPO)、健康维护组织 (HMO) 等)、人口统计(成人、未成年人和老年人)、覆盖类型(终身覆盖、定期覆盖)、最终用户(企业、个人等)分销渠道(直销、金融机构、电子商务、医院、诊所等)。 |

|

覆盖国家 |

英国 |

|

涵盖的市场参与者 |

Bupa、Cigna、AXA、Vitality(Discovery Limited 的子公司)、Allianz Care(Allianz SE 的子公司)、Aviva、AIA Group Limited、Saga、Exeter Friendly Society Limited、Pru Life UK、Freedom Health Insurance、General and Medical Finance Ltd 和美国国际集团。 |

市场定义

健康保险是一种保险,承保各种手术费用以及因疾病或受伤而产生的医疗费用。它适用于全面或有限范围的医疗服务,承保特定服务的全部或部分费用。它为投保人提供财务支持,因为它承保投保人住院治疗时的所有医疗费用。它还承保住院前和住院后的费用。

在健康保险计划中,有几种类型的保险可供选择,即无现金或报销索赔。当保单持有人在保险公司的网络医院接受治疗时,可享受无现金福利。如果保单持有人在不在名单网络内的医院接受治疗,在这种情况下,保单持有人将承担所有医疗费用,然后通过提交所有医疗账单向保险公司索取报销。

英国健康保险市场动态

本节旨在了解市场驱动因素、优势、机遇、限制和挑战。以下内容将详细讨论所有这些内容:

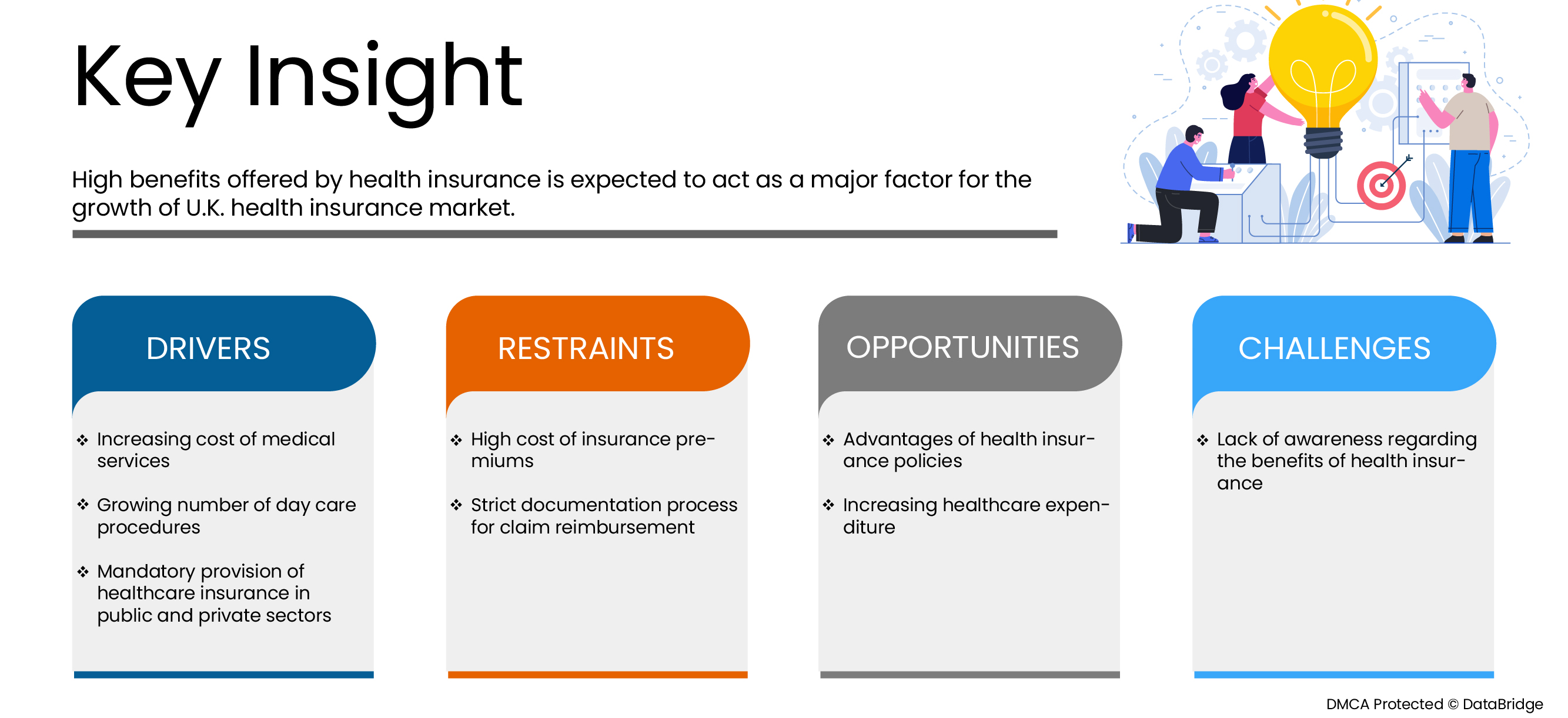

驱动程序

-

医疗服务成本不断上涨

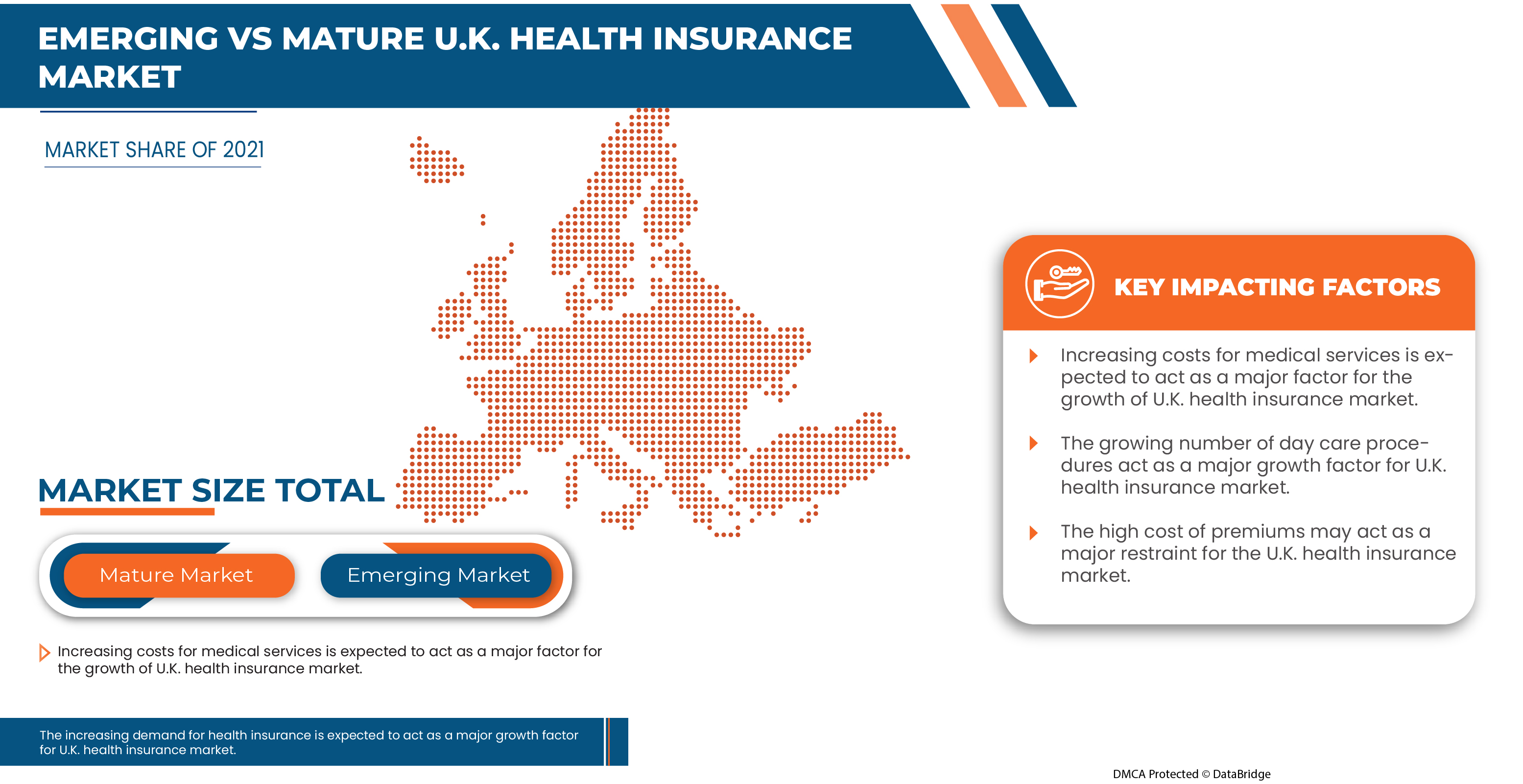

全球及英国医疗服务成本的上涨预计将成为英国健康保险市场的一个推动力。这使得许多消费者在消费者健康或其家人需要医疗时可以购买人寿保险来支付医疗费用。

-

日托程序数量不断增加

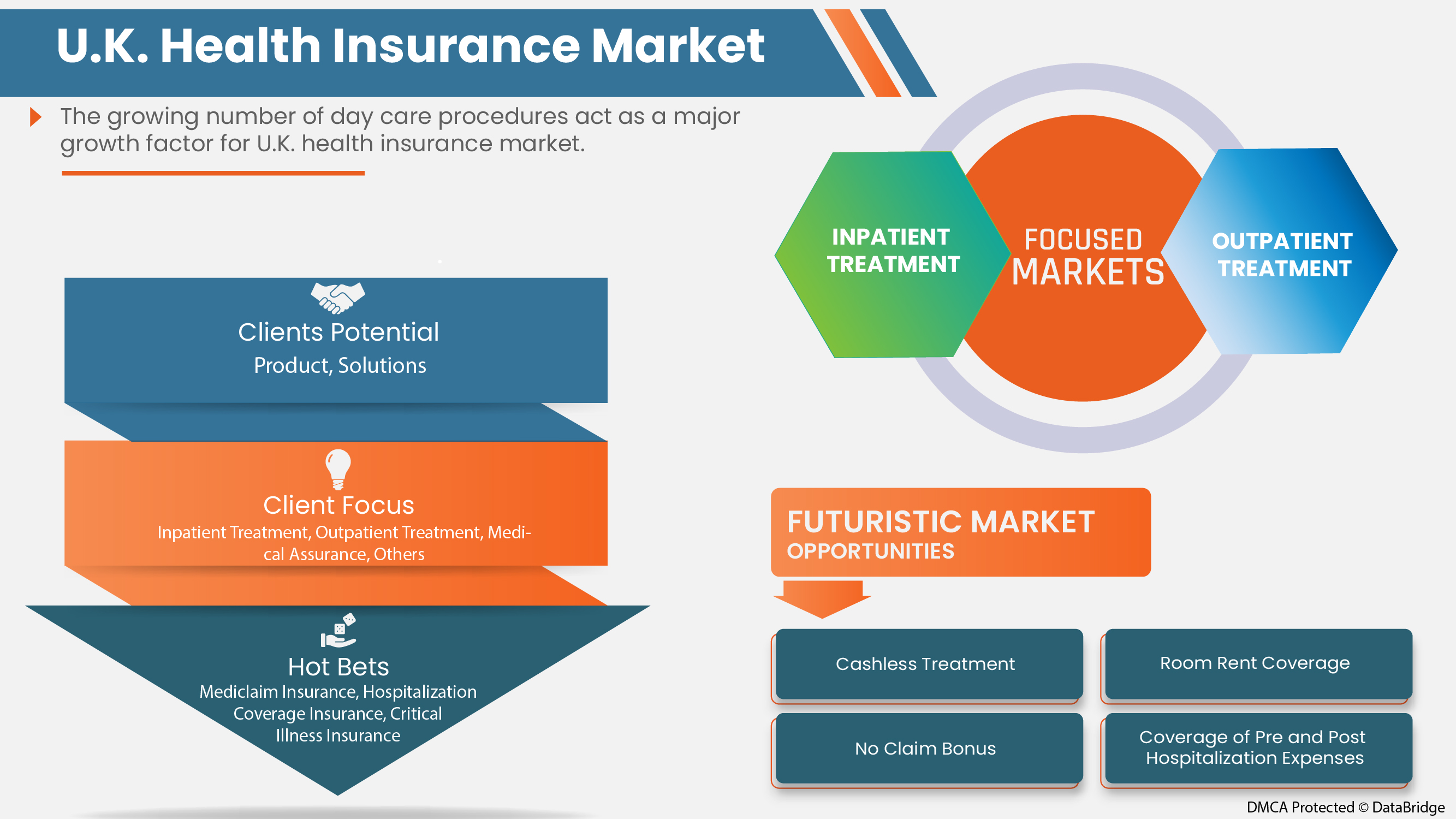

如今,大多数健康保险公司都将日间护理程序纳入保险计划。对于此类手术的理赔,无需住院 24 小时,而住院时间是理赔的最低住院时间。这使得日间护理程序数量的不断增长推动了英国健康保险市场的增长。

机会

-

健康保险政策的优势

在健康保险计划中,投保人可以获得医疗费用报销,例如住院、手术和受伤引起的治疗。健康保险单是投保人与保险公司之间的一种协议,保险公司同意在未来发生医疗问题时保证支付治疗费用,而投保人同意根据保险计划支付保费。因此,健康保险单日益增加的优势有望成为市场增长的机会。

克制/挑战

- 保险费用高昂

健康保险涵盖所有类型的医疗费用。它为投保人提供财务支持,因为它涵盖投保人住院治疗时的所有医疗费用。健康保险还涵盖住院前和住院后的费用。要购买健康保险,投保人必须定期支付保险费以保持健康保险单有效。在大多数情况下,保险费用根据保险计划而定,较高,这可能会阻碍市场的增长。

COVID-19 对英国健康保险市场的影响

COVID-19 严重影响了各行各业,因为几乎每个国家都选择关闭除经营必需品的设施以外的所有设施。政府采取了一些严格的措施,例如关闭设施和销售非必需品、阻止国际贸易等,以防止 COVID-19 的传播。这提振了英国医疗保险市场,因为消费者正在购买保险,以避免在有医疗需求时在医院支付巨额资本金。因此,COVID-19 对英国医疗保险市场产生了积极影响。

最新动态

- 2020 年 8 月,国际医疗集团 (IMG) 增强了其产品服务,以支持组织进行安全国际旅行所需的规划和研究。该公司独特的新援助服务旨在支持客户制定 2020 年及以后的计划。这一发展帮助该公司在疫情中维持并蓬勃发展。

- 2019 年 2 月,Now Health International 宣布已在国际市场推出其 SimpleCare 计划。SimpleCare 的新计划旨在为注重成本的人士提供负担得起的国际健康保险。通过推出新产品,该公司增强了其在英国等国际市场的业务,并创造了更多收入。

英国健康保险市场范围

英国健康保险市场根据类型、服务、覆盖范围、服务提供商、健康保险计划、人口统计、覆盖类型、最终用户和分销渠道进行细分。这些细分市场之间的增长将帮助您分析行业中增长微弱的细分市场,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

英国健康保险市场,按类型

- 产品

- 解决方案

根据类型,市场分为产品和解决方案。

英国健康保险市场(按服务分类)

- 住院治疗

- 门诊治疗

- 医疗保障

- 其他的

根据服务,市场分为住院治疗、门诊治疗、医疗保障和其他。

英国健康保险市场,按覆盖范围划分

- 青铜

- 银

- 金子

- 铂

根据覆盖范围,市场分为青铜、白银、黄金和白金。

英国健康保险市场(按服务提供商划分)

- 私人健康保险提供商

- 公共健康保险提供者

根据服务提供商,市场分为私人医疗保险提供商和公共医疗保险提供商。

英国健康保险市场,按健康保险计划

- 服务点 (POS)

- 独家供应商组织 (EPOS)

- 赔偿健康保险

- 健康储蓄账户(HSA)

- 合格小型雇主健康报销安排(QSEHRAS)

- 首选医疗机构 (PPO)

- 健康维护组织(HMO)

- 其他的

根据健康保险计划,市场分为服务点(POS)、独家医疗提供商组织(EPOS)、补偿性健康保险、健康储蓄账户(HSA)、合格小型雇主健康报销安排(QSEHRAS)、优先医疗提供商组织(PPO)、健康维护组织(HMO)等。

按人口统计

- 成年人

- 未成年人

- 长者

根据人口统计数据,英国健康保险市场分为成年人、未成年人和老年人。

按保险类型

- 终身保障

- 期限覆盖

根据保险类型,英国健康保险市场分为终身保险和定期保险。

按最终用户

- 企业

- 个人

- 其他的

根据最终用户,英国健康保险市场分为企业、个人和其他。

按分销渠道

- 直销

- 金融机构

- 电子商务

- 医院

- 诊所

- 其他的

根据分销渠道,英国健康保险市场分为直销、金融机构、电子商务、医院、诊所和其他。

英国健康保险市场区域分析/见解

如上所述,英国健康保险市场基于类型、服务、覆盖范围、服务提供商、健康保险计划、人口统计、覆盖类型、最终用户和分销渠道。

2022年,由于健康保险政策优势和医疗支出增加等因素,英国健康保险市场预计将实现增长。

报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和市场监管变化。下游和上游价值链分析、技术趋势和波特五力分析、案例研究等数据点是用于预测各个国家市场情景的一些指标。此外,在提供国家数据的预测分析时,还考虑了英国品牌的存在和可用性以及由于来自本地和国内品牌的大量或稀缺竞争而面临的挑战、国内关税的影响和贸易路线。

竞争格局和英国健康保险市场份额分析

分析实验室服务市场竞争格局按竞争对手提供详细信息。详细信息包括公司概况、公司财务状况、产生的收入、市场潜力、研发投资、新市场计划、英国业务、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度以及应用主导地位。以上提供的数据点仅与公司对英国健康保险市场的关注有关。

英国健康保险市场提供保险服务的一些主要公司包括 Bupa、Cigna、AXA、Vitality(Discovery Limited 的子公司)、Allianz Care(Allianz SE 的子公司)、Aviva、AIA Group Limited、Saga、Exeter Friendly Society Limited、Pru Life UK、Freedom Health Insurance、general and medical finance ltd、American International Group, Inc. 等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.K. HEALTH INSURANCE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 MARKET END-USER COVERAGE GRID

2.9 DBMR MARKET CHALLENGE MATRIX

2.1 TYPE LIFE LINE CURVE

2.11 MULTIVARIATE MODELING

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING COST OF MEDICAL SERVICES

5.1.2 GROWING NUMBER OF DAYCARE PROCEDURES

5.1.3 MANDATORY PROVISION OF HEALTHCARE INSURANCE IN PUBLIC AND PRIVATE SECTORS

5.2 RESTRAINTS

5.2.1 HIGH COST OF INSURANCE PREMIUMS

5.2.2 STRICT DOCUMENTATION PROCESS FOR CLAIM REIMBURSEMENT

5.3 OPPORTUNITIES

5.3.1 ADVANTAGES OF HEALTH INSURANCE POLICIES

5.3.2 INCREASING HEALTHCARE EXPENDITURE

5.4 CHALLENGE

5.4.1 LACK OF AWARENESS REGARDING THE BENEFITS OF HEALTH INSURANCE

6 U.K. HEALTH INSURANCE MARKET, BY TYPE

6.1 OVERVIEW

6.2 PRODUCT

6.2.1 MEDICLAIM INSURANCE

6.2.2 INDIVIDUAL COVERAGE INSURANCE

6.2.3 FAMILY FLOATER COVERAGE INSURANCE

6.2.4 HOSPITALIZATION COVERAGE INSURANCE

6.2.5 SENIOR CITIZEN COVERAGE INSURANCE

6.2.6 CRITICAL ILLNESS INSURANCE

6.2.7 UNIT LINKED HEALTH PLANS

6.2.8 PERMANENT HEALTH INSURANCE

6.3 SOLUTIONS

6.3.1 LEAD GENERATIONS SOLUTIONS

6.3.2 REVENUE MANAGEMENT & BILLING SOLUTIONS

6.3.3 ROBOTIC PROCESS AUTOMATION

6.3.4 INSURANCE CLOUD SOLUTIONS

6.3.5 CLAIMS ADMINISTRATION CLOUD SOLUTIONS

6.3.6 VALUE-BASED PAYMENTS SOLUTIONS

6.3.7 ARTIFICIAL INTELLIGENCE & BLOCK CHAIN SOLUTIONS

6.3.8 INTELLIGENT CASE MANAGEMENT SOLUTIONS

6.3.9 OTHERS

7 U.K. HEALTH INSURANCE MARKET, BY SERVICES

7.1 OVERVIEW

7.2 INPATIENT TREATMENT

7.3 OUTPATIENT TREATMENT

7.4 MEDICAL ASSURANCE

7.5 OTHERS

8 U.K. HEALTH INSURANCE MARKET, BY LEVEL OF COVERAGE

8.1 OVERVIEW

8.2 BRONZE

8.3 SILVER

8.4 GOLD

8.5 PLATINUM

9 U.K. HEALTH INSURANCE MARKET, BY SERVICE PROVIDERS

9.1 OVERVIEW

9.2 PUBLIC HEALTH INSURANCE PROVIDERS

9.3 PRIVATE HEALTH INSURANCE PROVIDERS

10 U.K. HEALTH INSURANCE MARKET, BY HEALTH INSURANCE PLANS

10.1 OVERVIEW

10.2 POINT OF SERVICE (POS)

10.3 EXCLUSIVE PROVIDER ORGANIZATION (EPOS)

10.4 PREFERRED PROVIDER ORGANIZATION (PPO)

10.5 INDEMNITY HEALTH INSURANCE

10.6 HEALTH MAINTENANCE ORGANIZATION (HMO)

10.7 HEALTH SAVINGS ACCOUNT (HSA)

10.8 QUALIFIED SMALL EMPLOYER HEALTH REIMBURSEMENT ARRANGEMENTS (QSEHRAS)

10.9 OTHERS

11 U.K. HEALTH INSURANCE MARKET, BY DEMOGRAPHICS

11.1 OVERVIEW

11.2 ADULTS

11.3 MINORS

11.4 SENIOR CITIZENS

12 U.K. HEALTH INSURANCE MARKET, BY COVERAGE TYPE

12.1 OVERVIEW

12.2 LIFETIME COVERAGE

12.3 TERM COVERAGE

13 U.K. HEALTH INSURANCE MARKET, BY END-USER

13.1 OVERVIEW

13.2 CORPORATES

13.3 INDIVIDUALS

13.4 OTHERS

14 U.K. HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 DIRECT SALES

14.3 FINANCIAL INSTITUTIONS

14.4 E-COMMERCE

14.5 HOSPITALS

14.6 CLINICS

14.7 OTHERS

15 U.K. HEALTH INSURANCE MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: U.K.

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 CIGNA

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT UPDATE

17.2 AVIVA

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT UPDATES

17.3 ALLIANZ CARE (A SUBSIDIARY OF ALLIANZ)

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT UPDATE

17.4 AXA

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT UPDATES

17.5 BUPA

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT UPDATES

17.6 AMERICAN INTERNATIONAL GROUP, INC. (2021)

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 EXETER FRIENDLY SOCIETY LIMITED

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 FREEDOM HEALTH INSURANCE

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 GENERAL AND MEDICAL FINANCE LTD

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 PRU LIFE UK

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 SAGA (2021)

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 VITALITY (A SUBSIDIARY OF DISCOVERY LTD)

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT UPDATES

18 QUESTIONNAIRE

19 RELATED REPORTS

表格列表

TABLE 1 AVERAGE COSTS FOR COMMON SURGERIES

TABLE 2 LIST OF DAYCARE PROCEDURES

TABLE 3 AVERAGE EMPLOYEE PREMIUMS IN U.S. (2020)

TABLE 4 U.K. HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 U.K. PRODUCT IN HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 U.K. SOLUTIONS IN HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 U.K. HEALTH INSURANCE MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 8 U.K. HEALTH INSURANCE MARKET, BY LEVEL OF COVERAGE, 2020-2029 (USD MILLION)

TABLE 9 U.K. HEALTH INSURANCE MARKET, BY SERVICE PROVIDERS, 2020-2029 (USD MILLION)

TABLE 10 U.K. HEALTH INSURANCE MARKET, BY HEALTH INSURANCE PLANS, 2020-2029 (USD MILLION)

TABLE 11 U.K. HEALTH INSURANCE MARKET, BY DEMOGRAPHICS, 2020-2029 (USD MILLION)

TABLE 12 U.K. HEALTH INSURANCE MARKET, BY COVERAGE TYPE, 2020-2029 (USD MILLION)

TABLE 13 U.K. HEALTH INSURANCE MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 14 U.K. HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 U.K. HEALTH INSURANCE MARKET: SEGMENTATION

FIGURE 2 U.K. HEALTH INSURANCE MARKET: DATA TRIANGULATION

FIGURE 3 U.K. HEALTH INSURANCE MARKET: DROC ANALYSIS

FIGURE 4 U.K. HEALTH INSURANCE MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 U.K. HEALTH INSURANCE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.K. HEALTH INSURANCE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.K. HEALTH INSURANCE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 U.K. HEALTH INSURANCE MARKET: END-USER COVERAGE GRID

FIGURE 9 U.K. HEALTH INSURANCE MARKET: CHALLENGE MATRIX

FIGURE 10 U.K. HEALTH INSURANCE MARKET: TYPE LIFE LINE CURVE

FIGURE 11 U.K. HEALTH INSURANCE MARKET: MULTIVARIATE MODELLING

FIGURE 12 U.K. HEALTH INSURANCE MARKET: SEGMENTATION

FIGURE 13 INCREASING COST OF MEDICAL SERVICES IS EXPECTED TO DRIVE THE U.K. HEALTH INSURANCE MARKET GROWTH IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.K. HEALTH INSURANCE MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE U.K. HEALTH INSURANCE MARKET

FIGURE 16 HEALTH INSURANCE COVERAGE

FIGURE 17 U.K. HEALTH INSURANCE MARKET: BY TYPE, 2021

FIGURE 18 U.K. HEALTH INSURANCE MARKET: BY SERVICES, 2021

FIGURE 19 U.K. HEALTH INSURANCE MARKET: BY LEVEL OF COVERAGE, 2021

FIGURE 20 U.K. HEALTH INSURANCE MARKET: BY SERVICE PROVIDERS, 2021

FIGURE 21 U.K. HEALTH INSURANCE MARKET: BY HEALTH INSURANCE PLANS, 2021

FIGURE 22 U.K. HEALTH INSURANCE MARKET: BY DEMOGRAPHICS, 2021

FIGURE 23 U.K. HEALTH INSURANCE MARKET: BY COVERAGE TYPE, 2021

FIGURE 24 U.K. HEALTH INSURANCE MARKET: BY END-USER, 2021

FIGURE 25 U.K. HEALTH INSURANCE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 26 U.K. HEALTH INSURANCE MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。