南美冷冻渔船市场,按系统(空气冷冻、板冷冻、盐水、IQF(单独速冻))、类型(商业渔船、手工渔船和休闲渔船)、船长(小于 20 米、21 米至 30 米、40 米以上和 31 米至 40 米)、冷冻能力(50 吨至 150 吨、150 吨至 300 吨、小于 50 吨和超过 300 吨)– 行业趋势和预测到 2029 年

市场分析和规模

渔船是一种浮桥或船只,用于在海洋、湖泊或溪流中捕鱼。各种渔船都用于商业、休闲捕鱼和手工捕鱼。水产资源的采集和生产是在野外或受控条件下进行的水产养殖。对海鲜产品的需求不断增长,也增加了市场对冷冻渔船解决方案的需求。南美冷冻渔船市场正在迅速增长,因为海鲜对健康有益,而且对产量要求更高。这些公司甚至推出了新产品来获得更大的市场份额。

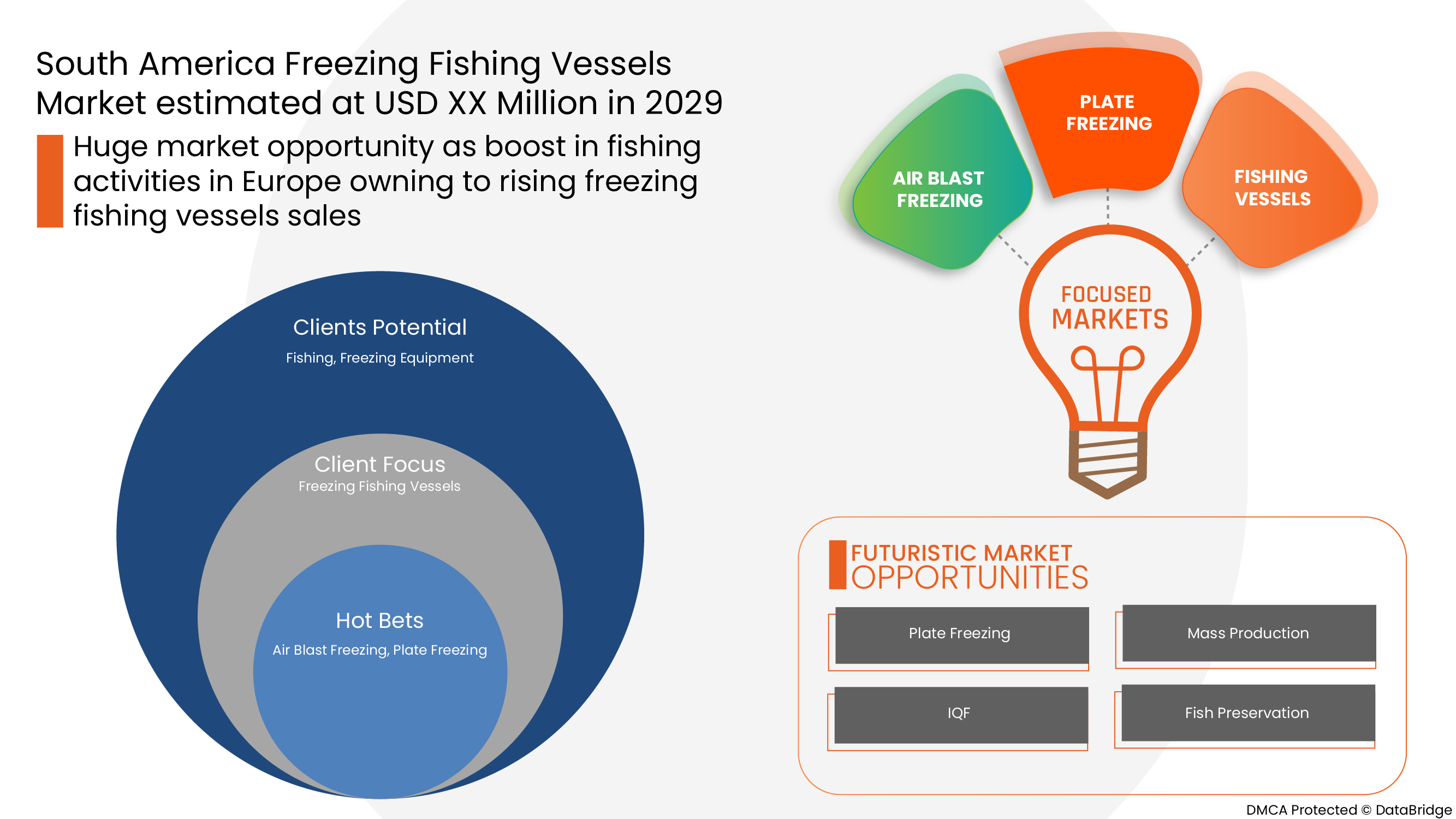

Data Bridge Market Research 分析,南美冷冻渔船市场预计到 2029 年将达到 30.1381 亿美元的价值,预测期内的复合年增长率为 3.9%。“气流冷冻”占冷冻渔船市场最大的系统部分。冷冻渔船市场报告还深入介绍了定价分析、专利分析和技术进步。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020 |

|

定量单位 |

百万美元 |

|

涵盖的领域 |

按系统(气流冷冻、平板冷冻、盐水、IQF(单独速冻))、按类型(商业渔船、手工渔船和休闲渔船)、按船只长度(小于 20 米、21 米 - 30 米、40 米以上和 31 米 - 40 米)、按冷冻能力(50 吨至 150 吨、150 吨至 300 吨、小于 50 吨和大于 300 吨) |

|

覆盖国家 |

秘鲁、智利、厄瓜多尔和南美洲其他地区 |

|

涵盖的市场参与者 |

Nordic Wildfish、Lerøy Havfisk、Nichols Bros Boat Builders、Master Boat Builders, Inc.、Chantier de constructions navales Martinez、Astilleros Armon、Karstensens Skibsværft A/S、Green Yard Kleven、Ulstein Group ASA、HEINEN & HOPMAN、Marefsol BV、Integrated Marine Systems, Inc.、MMC FIRST PROCESS AS.、Teknotherm、Damen Shipyards Group、Damen Shipyards Group、Wärtsilä、Kongsberg Gruppen ASA、Thoma-Sea Ship Builders, LLC、Rolls-Royce plc、MAURICE、ELLIOTT BAY DESIGN GROUP、Aresa Shipyard 等 |

市场定义

渔船是一种浮桥或船只,用于在海洋、湖泊或溪流中捕鱼。商业、休闲捕鱼和手工捕鱼中使用各种类型的渔船。水产资源的收集和生产是在野外或受控条件下进行的。两者都采用了从独特到高度工业化的大量创新组合,包括船舶和设备以及捕鱼设备和方法。对于捕捞渔业和水产养殖,使用渔船和工程细丝、液压设备和鱼类处理等创新技术是渔船市场的当前趋势。此外,渔船上的鱼类收获还包括用于鱼类发现的设备、用于路线和通信的卫星创新、安装维护和可拆卸电机的广泛使用。渔业技术中对捕鱼设备的需求不断增长,预计将推动全球渔船市场的发展。

南美冷冻渔船市场动态

本节旨在了解市场驱动因素、优势、机遇、限制和挑战。以下内容将详细讨论所有这些内容:

- 娱乐活动日益流行

全球范围内,钓鱼和划船等休闲活动日益增多,导致对渔船的需求增加。渔船提供的先进功能,如长保质期、耐用性、定制性和环保性,进一步吸引了更多客户。因此,预计在预测期内对渔船的需求将进一步增加。

- 人们对海鲜健康益处的认识不断提高

全球对捕鱼的需求增加,人们对金枪鱼、底栖鱼和鲑鱼等海鲜的健康益处的认识不断提高,对产品的需求也随之增加。户外活动的参与以及对海鲜的需求极大地刺激了渔船市场,预计在预测期内将进一步增长。

- 可持续发展的需求

阻碍这一市场增长的因素可能是对可持续发展的需求不断增长。渔船从水体中捕捞的鱼往往比短时间内能够补充的鱼多,导致鱼类库存迅速减少。但这种影响可以通过在全球范围内实施严格的捕鱼和海事法规来缓解,以确保鱼类的稳定供应。

- 初期投资成本高

冷冻渔船市场提供了多种有利因素,例如健康益处、容量增加,但所有这些都伴随着高昂的投资成本。造船业是一项成本密集型产业,项目可能跨越数年。这可能会抑制冷冻渔船市场的增长。

COVID-19 对冷冻渔船市场的影响

COVID-19 对冷冻渔船市场产生了重大影响,因为几乎每个国家都选择关闭除生产必需品的工厂以外的所有生产设施。政府采取了一些严格的措施,例如停止非必需品的生产和销售、封锁国际贸易等,以防止 COVID-19 的传播。在这种大流行情况下,唯一能开展业务的是获准开放和运行流程的基本服务。

由于政府出台了促进 COVID-19 后国际贸易的政策,冷冻渔船市场的增长正在上升。此外,冷冻渔船市场为渔业市场和海鲜需求带来的好处正在增加市场对冷冻渔船市场的需求。然而,贸易路线拥堵和一些国家之间的贸易限制等因素正在抑制市场的增长。疫情期间生产设施的关闭对市场产生了重大影响。

制造商正在制定各种战略决策,以在 COVID-19 后实现复苏。参与者正在进行多项研发活动,以改进冷冻渔船市场所涉及的技术。借助此,公司将为市场带来先进而精准的解决方案。此外,政府促进国际贸易的举措也推动了市场的增长。

最新动态

- 2021 年 8 月,瓦锡兰为船舶制造商 Karstensens Shipyard 提供了渔船推进解决方案。该推进系统的主要特点是 NOx Reducer 减排系统、减速器、可调螺距螺旋桨和 ProTouch 推进遥控系统。该解决方案的推出帮助该公司扩大了市场。

- 2019 年 6 月,劳斯莱斯公司获得了为 Engenes fiskeriselskap AS 建造 70 米长船尾拖网渔船的合同。该公司提供船舶设计和广泛的设备,如动力和推进、甲板机械、电气和自动化系统。通过这家公司,公司扩大了市场和全球影响力。

南美冷冻渔船市场范围

南美冷冻渔船市场根据系统、类型、船长和冷冻能力进行细分。这些细分市场之间的增长情况将帮助您分析行业中增长缓慢的细分市场,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

按系统

- 气流冷冻

- 平板冷冻

- 盐水

- IQF(单独速冻)

根据系统,北美、欧洲、亚太和南美冷冻渔船市场分为风冷冷冻、板冻冷冻、盐水冷冻和IQF(单独速冻)。

按类型

- 商业渔船

- 手工捕鱼船

- 休闲渔船

根据类型,北美、欧洲、亚太和南美冷冻渔船市场分为商业渔船、手工渔船和休闲渔船。

按船舶长度

- 少于 20 米

- 21男-30男

- 40米以上

- 31男-40男

根据船舶长度,北美、欧洲、亚太和南美冷冻渔船市场细分为少于 20 米、21 米至 30 米、40 米以上和 31 米至 40 米。

通过冻结产能

- 50吨至150吨

- 150吨至300吨

- 少于 50 吨

- 300吨以上

根据冷冻能力,北美、欧洲、亚太和南美冷冻渔船市场细分为50吨至150吨、150吨至300吨、少于50吨和超过300吨。

冷冻渔船市场区域分析/见解

对南美冷冻渔船市场进行了分析,并按国家、系统、类型、船长和冷冻能力提供了市场规模见解和趋势。

冷冻渔船市场报告涉及的国家包括秘鲁、智利、厄瓜多尔和南美洲其他地区。

秘鲁在南美冷冻渔船市场占据主导地位。秘鲁可能是增长最快的南美冷冻渔船市场。秘鲁、智利和厄瓜多尔等新兴国家的基础设施、商业和工业发展不断增强,是该市场占据主导地位的原因。由于政府的举措和金枪鱼捕捞活动,秘鲁在南美地区占据主导地位。

报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和市场监管变化。下游和上游价值链分析、技术趋势和波特五力分析、案例研究等数据点是用于预测各个国家市场情景的一些指标。此外,在提供国家数据的预测分析时,还考虑了南美品牌的存在和可用性以及它们因来自本地和国内品牌的激烈或稀缺竞争而面临的挑战、国内关税和贸易路线的影响。

竞争格局和冷冻渔船市场份额分析

南美冷冻渔船市场竞争格局按竞争对手提供详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、南美业务、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度、应用主导地位。以上提供的数据点仅与公司对冷冻渔船市场的关注有关。

冷冻渔船市场的一些主要参与者包括:

Nordic Wildfish、Lerøy Havfisk、Nichols Bros Boat Builders、Master Boat Builders, Inc.、Chantier de constructions navales Martinez、Astilleros Armon、Karstensens Skibsværft A/S、Green Yard Kleven、Ulstein Group ASA、HEINEN & HOPMAN、Marefsol BV、Integrated Marine Systems, Inc.、MMC FIRST PROCESS AS.、Teknotherm、Damen Shipyards Group、Damen Shipyards Group、Wärtsilä、Kongsberg Gruppen ASA、Thoma-Sea Ship Builders, LLC、Rolls-Royce plc、MAURICE、ELLIOTT BAY DESIGN GROUP 和 Aresa Shipyard 等等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF SOUTH AMERICA FREEZING FISHING VESSELS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 PREMIUM INSIGHTS:

2.1 FISHING VESSEL CONSTRUCTION

2.2 OTHER DETAILS REGARDING FISHING VESSEL

2.2.1 FISHING VESSEL AVERAGE OPERATIONAL YEARS

2.2.2 TOTAL NUMBER OF FISHING VESSEL

3 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY SYSTEM

3.1 OVERVIEW

3.2 AIR BLAST FREEZING

3.3 PLATE FREEZING

3.3.1 VERTICAL PLATE FREEZING

3.3.2 HORIZONTAL PLATE FREEZING

3.4 BRINE

3.5 IQF (INDIVIDUAL QUICK FROZEN)

4 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY TYPE

4.1 OVERVIEW

4.2 COMMERCIAL FISHING VESSELS

4.3 ARTISANAL FISHING VESSELS

4.4 RECREATIONAL FISHING VESSELS

5 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY VESSEL LENGTH

5.1 OVERVIEW

5.2 LESS THAN 20 M

5.3 21 M-30 M

5.4 ABOVE 40 M

5.5 31 M-40 M

6 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY FREEZING CAPACITY

6.1 OVERVIEW

6.2 50 TONS TO 150 TONS

6.3 150 TONS TO 300 TONS

6.4 LESS THAN 50 TONS

6.5 MORE THAN 300 TONS

7 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY REGION

7.1 SOUTH AMERICA

7.1.1 PERU

7.1.2 CHILE

7.1.3 ECUADOR

7.1.4 REST OF SOUTH AMERICA

8 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, COMPANY LANDSCAPE

8.1 COMPANY SHARE ANALYSIS: SOUTH AMERICA

9 SWOT ANALYSIS

10 COMPANY PROFILE

10.1 ROLLS-ROYCE PLC

10.1.1 COMPANY SNAPSHOT

10.1.2 REVENUE ANALYSIS

10.1.3 COMPANY SHARE ANALYSIS

10.1.4 PRODUCTS PORTFOLIO

10.1.5 RECENT DEVELOPMENTS

10.2 WÄRTSILÄ

10.2.1 COMPANY SNAPSHOT

10.2.2 REVENUE ANALYSIS

10.2.3 COMPANY SAHRE ANALYSIS

10.2.4 PRODUCTS PORTFOLIO

10.2.5 RECENT DEVELOPMENTS

10.3 DAMEN SHIPYARDS GROUP

10.3.1 COMPANY SNAPSHOT

10.3.2 COMPANY SHARE ANALYSIS

10.3.3 PRODUCTS PORTFOLIO

10.3.4 RECENT DEVELOPMENT

10.4 ULSTEIN GROUP ASA

10.4.1 COMPANY SNAPSHOT

10.4.2 COMPANY SHARE ANALYSIS

10.4.3 PRODUCTS PORTFOLIO

10.4.4 RECENT DEVELOPMENTS

10.5 KONGSBERG GRUPPEN ASA

10.5.1 COMPANY SNAPSHOT

10.5.2 REVENUE ANALYSIS

10.5.3 COMPANY SHARE ANALYSIS

10.5.4 PRODUCTS PORTFOLIO

10.5.5 RECENT DEVELOPMENTS

10.6 ARESA SHIPYARD

10.6.1 COMPANY SNAPSHOT

10.6.2 PRODUCTS PORTFOLIO

10.6.3 RECENT DEVELOPMENTS

10.7 ASTILLEROS ARMON

10.7.1 COMPANY SNAPSHOT

10.7.2 PRODUCTS PORTFOLIO

10.7.3 RECENT DEVELOPMENTS

10.8 CHANTIER DE CONSTRUCTIONS NAVALES MARTINEZ

10.8.1 COMPANY SNAPSHOT

10.8.2 PRODUCTS PORTFOLIO

10.8.3 RECENT DEVELOPMENTS

10.9 ELLIOTT BAY DESIGN GROUP

10.9.1 COMPANY SNAPSHOT

10.9.2 PRODUCTS PORTFOLIO

10.9.3 RECENT DEVELOPMENTS

10.1 GREEN YARD KLEVEN

10.10.1 COMPANY SNAPSHOT

10.10.2 SERVICES PORTFOLIO

10.10.3 RECENT DEVELOPMENTS

10.11 HEINEN & HOPMAN

10.11.1 COMPANY SNAPSHOT

10.11.2 PRODUCTS PORTFOLIO

10.11.3 RECENT DEVELOPMENTS

10.12 INTEGRATED MARINE SYSTEMS, INC.

10.12.1 COMPANY SNAPSHOT

10.12.2 PRODUCTS PORTFOLIO

10.12.3 RECENT DEVELOPMENTS

10.13 KARSTENSENS SKIBSVÆRFT A/S

10.13.1 COMPANY SNAPSHOT

10.13.2 PRODUCTS PORTFOLIO

10.13.3 RECENT DEVELOPMENTS

10.14 LERØY HAVFISK

10.14.1 COMPANY SNAPSHOT

10.14.2 PRODUCTS PORTFOLIO

10.14.3 RECENT DEVELOPMENTS

10.15 MAREFSOL B.V.

10.15.1 COMPANY SNAPSHOT

10.15.2 PRODUCTS PORTFOLIO

10.15.3 RECENT DEVELOPMENTS

10.16 MASTER BOAT BUILDERS, INC.

10.16.1 COMPANY SNAPSHOT

10.16.2 PRODUCTS PORTFOLIO

10.16.3 RECENT DEVELOPMENTS

10.17 MAURICE

10.17.1 COMPANY SNAPSHOT

10.17.2 PRODUCTS PORTFOLIO

10.17.3 RECENT DEVELOPMENTS

10.18 MMC FIRST PROCESS AS.

10.18.1 COMPANY SNAPSHOT

10.18.2 PRODUCTS PORTFOLIO

10.18.3 RECENT DEVELOPMENT

10.19 NICHOLS BROS BOAT BUILDERS

10.19.1 COMPANY SNAPSHOT

10.19.2 PRODUCTS PORTFOLIO

10.19.3 RECENT DEVELOPMENTS

10.2 NORDIC WILDFISH

10.20.1 COMPANY SNAPSHOT

10.20.2 PRODUCTS PORTFOLIO

10.20.3 RECENT DEVELOPMENTS

10.21 TEKNOTHERM

10.21.1 COMPANY SNAPSHOT

10.21.2 PRODUCTS PORTFOLIO

10.21.3 RECENT DEVELOPMENTS

10.22 THOMA-SEA SHIP BUILDERS, LLC

10.22.1 COMPANY SNAPSHOT

10.22.2 PRODUCTS PORTFOLIO

10.22.3 RECENT DEVELOPMENTS

11 QUESTIONNAIRE

12 RELATED REPORTS

表格列表

TABLE 1 FISHING VESSEL CONSTRUCTION DETAILS

TABLE 2 FISHING VESSEL AVERAGE OPERATIONAL YEARS WITH RESPECT TO THE TYPE

TABLE 3 FISHING VESSEL OWNERS REQUIRING FREEZING SYSTEMS

TABLE 4 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 5 SOUTH AMERICA AIR BLAST FREEZING IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 SOUTH AMERICA PLATE FREEZING IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 SOUTH AMERICA PLATE FREEZING IN FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 SOUTH AMERICA BRINE IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 SOUTH AMERICA IQF (INDIVIDUAL QUICK FROZEN) IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 SOUTH AMERICA COMMERCIAL FISHING VESSELS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 SOUTH AMERICA ARTISANAL FISHING VESSELS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 SOUTH AMERICA RECREATIONAL FISHING VESSELS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY VESSEL LENGTH, 2020-2029 (USD MILLION)

TABLE 15 SOUTH AMERICA LESS THAN 20 M IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 SOUTH AMERICA 21 M-30 M IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 SOUTH AMERICA ABOVE 40 M IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 SOUTH AMERICA 31 M-40 M IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY FREEZING CAPACITY, 2020-2029 (USD MILLION)

TABLE 20 SOUTH AMERICA 50 TONS TO 150 TONS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 SOUTH AMERICA 150 TONS TO 300 TONS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 SOUTH AMERICA LESS THAN 50 TONS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 SOUTH AMERICA MORE THAN 300 TONS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 25 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 26 SOUTH AMERICA PLATE FREEZING IN FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY VESSEL LENGTH, 2020-2029 (USD MILLION)

TABLE 29 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY FREEZING CAPACITY, 2020-2029 (USD MILLION)

TABLE 30 PERU FREEZING FISHING VESSELS MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 31 PERU PLATE FREEZING IN FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 PERU FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 PERU FREEZING FISHING VESSELS MARKET, BY VESSEL LENGTH, 2020-2029 (USD MILLION)

TABLE 34 PERU FREEZING FISHING VESSELS MARKET, BY FREEZING CAPACITY, 2020-2029 (USD MILLION)

TABLE 35 CHILE FREEZING FISHING VESSELS MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 36 CHILE PLATE FREEZING IN FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 CHILE FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 CHILE FREEZING FISHING VESSELS MARKET, BY VESSEL LENGTH, 2020-2029 (USD MILLION)

TABLE 39 CHILE FREEZING FISHING VESSELS MARKET, BY FREEZING CAPACITY, 2020-2029 (USD MILLION)

TABLE 40 ECUADOR FREEZING FISHING VESSELS MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 41 ECUADOR PLATE FREEZING IN FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 ECUADOR FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 ECUADOR FREEZING FISHING VESSELS MARKET, BY VESSEL LENGTH, 2020-2029 (USD MILLION)

TABLE 44 ECUADOR FREEZING FISHING VESSELS MARKET, BY FREEZING CAPACITY, 2020-2029 (USD MILLION)

TABLE 45 REST OF SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 SOUTH AMERICA FREEZING FISHING VESSELS MARKET: BY SYSTEM, 2021

FIGURE 2 SOUTH AMERICA FREEZING FISHING VESSELS MARKET: BY TYPE, 2021

FIGURE 3 SOUTH AMERICA FREEZING FISHING VESSELS MARKET: BY VESSEL LENGTH, 2021

FIGURE 4 SOUTH AMERICA FREEZING FISHING VESSELS MARKET: BY FREEZING CAPACITY, 2021

FIGURE 5 SOUTH AMERICA FREEZING FISHING VESSELS MARKET: SNAPSHOT (2021)

FIGURE 6 SOUTH AMERICA FREEZING FISHING VESSELS MARKET: BY COUNTRY (2021)

FIGURE 7 SOUTH AMERICA FREEZING FISHING VESSELS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 8 SOUTH AMERICA FREEZING FISHING VESSELS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 9 SOUTH AMERICA FREEZING FISHING VESSELS MARKET: BY SYSTEM (2022-2029)

FIGURE 10 SOUTH AMERICA FREEZING FISHING VESSELS MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。