Singapore China Hong Kong And Taiwan Third Party Logistics Market

市场规模(十亿美元)

CAGR :

%

USD

265,902.06 Million

USD

462,107.01 Million

2022

2030

USD

265,902.06 Million

USD

462,107.01 Million

2022

2030

| 2023 –2030 | |

| USD 265,902.06 Million | |

| USD 462,107.01 Million | |

|

|

|

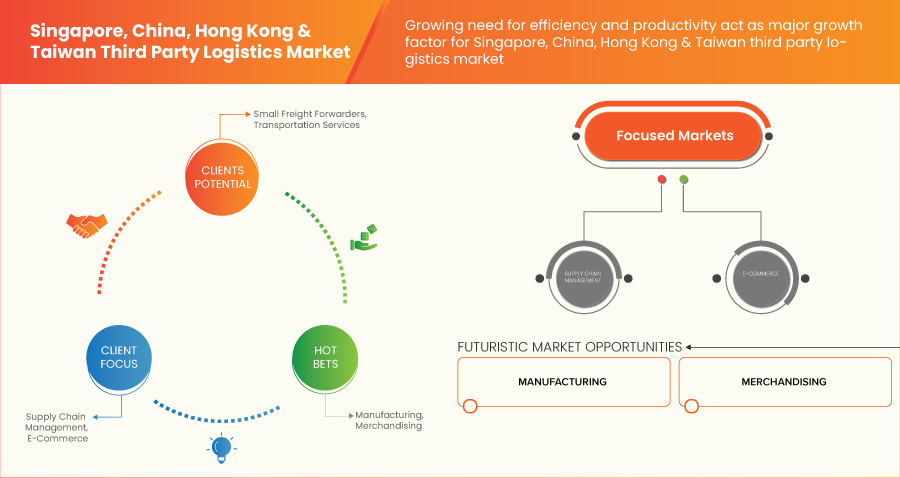

新加坡、中国、香港和台湾第三方物流市场,按服务(供应链管理、国际运输管理 (ITM)、国内运输管理 (DTM)、仓储、履行和配送 (W&D)、专用合同运输 (DCC)/货运代理、增值物流服务 (VALS))、产品(空运、海运、陆运、合同物流、其他)、提供商(整合和提供分包物流的公司、快递公司、小型货运代理、运输服务)、应用(运输、接收、退货、包装)、业务(B2B、B2C)、功能(供应链管理、客户管理、店内运营、战略与规划、商品推销)、垂直(电子商务、零售、制造、消费电子、医疗保健、汽车、半导体/太阳能、航空航天与国防)、零售规模(中、小、大)– 行业趋势与预测到 2030 年。

新加坡、中国、香港和台湾第三方物流市场分析及规模

这些公司将第三方物流服务外包,以专注于其主要业务,例如汽车公司的制造。仓储、运输、转运和维护库存的所有运营物流都外包给市场上的第三方物流参与者。使用第三方物流供应商处理物流以及包装、仓储和订单履行货物配送的主要优势是节省价格——例如,公司不再拥有仓库或团队或工人来展示供应链运营。文档工作和供应链运营的整个流程都由第三方物流参与者负责。

第三方物流包括各种服务,如供应链管理、国内运输管理 (DTM)、仓储、履行和配送 (W&D)、增值服务、国际运输管理以及专用运输或货运代理。供应链管理服务涉及供应链活动的管理,以最大化客户价值并获得可持续的竞争优势。它基于两个核心理念 - 首先,到达最终用户的每件产品都代表着多个组织的累积努力,第二个理念是供应链已经存在很长时间,这是第三方物流行业中最重要的因素。全球贸易的增长和贸易流量的增加导致了对第三方物流的需求,以使贸易流动更加方便和快捷,从而推动了新加坡、中国、香港和台湾第三方物流市场的增长。

Data Bridge Market Research 分析,中国第三方物流市场规模预计将从 2022 年的 2659.0206 亿美元增至 2030 年的 4621.0701 亿美元,在 2023 年至 2030 年的预测期内,复合年增长率为 7.2%。台湾第三方物流市场规模预计将从 2022 年的 76.3055 亿美元增至 2030 年的 103.4933 亿美元,在 2023 年至 2030 年的预测期内,复合年增长率为 3.9%。新加坡第三方物流市场规模预计将从 2022 年的 40.4196 亿美元增至 2030 年的 61.4833 亿美元,在 2023 年至 2030 年的预测期内,复合年增长率为 5.4%。香港第三方物流市场规模预计将从 2022 年的 40.4196 亿美元增至 2030 年的 61.4833 亿美元,在 2023 年至 2030 年的预测期内,复合年增长率为 5.到 2030 年,该数字将从 2022 年的 37.5294 亿美元增至 47.9197 亿美元,在 2023 年至 2030 年的预测期内,复合年增长率为 3.1%。第三方物流 (3PL) 服务提供商拥有丰富的供应链管理专业知识、经验和资源,并且这些数量多年来一直在增加。

|

报告指标 |

细节 |

|

预测期 |

2023 至 2030 年 |

|

基准年 |

2022 |

|

历史岁月 |

2021 (可剪切至 2015-2020) |

|

定量单位 |

收入(百万美元)、定价(美元)、销量(吨) |

|

涵盖的领域 |

服务(供应链管理、国际运输管理(ITM)、国内运输管理(DTM)、仓储、履行和配送(W&D)、专用合同运输(DCC)/货运代理、增值物流服务(VALS))、产品(空运、海运、陆运、合同物流、其他)、提供商(集成和提供分包物流的公司、快递公司、小型货运代理、运输服务)、应用(运输、接收、退货、包装)、业务(B2B、B2C)、功能(供应链管理、客户管理、店内运营、战略与规划、营销)、垂直(电子商务、零售、制造、消费电子、医疗保健、汽车、半导体/太阳能、航空航天与国防)、零售规模(中型、小型、大型)– |

|

覆盖国家 |

新加坡、中国、香港和台湾 |

|

涵盖的市场参与者 |

DHL(德国)、日本通运株式会社(日本)、联邦快递(美国)、日本邮船(日本)、CJ Logistics Corporation(韩国)、CH Robinson Worldwide, Inc.(美国)、DB Schenker(德国)、DSV(丹麦)、KERRY LOGISTICS NETWORK LIMITED(香港)、Kuehne+Nagel(瑞士)、Samudera Shipping Line Ltd(新加坡)、中国外运有限公司(中国)、联合包裹服务公司(美国)、XPO, Inc.(美国)、中远海运物流供应链有限公司(中国)、中远物流国际控股有限公司(香港)、北美物流集团(香港)等。 |

市场定义

第三方物流 (3PL) 是一种服务,允许将仓储到交付的运营物流外包,最终使企业能够专注于业务的主要核心部分。第三方物流公司提供与供应链物流相关的多种服务,包括运输、仓储、拣货和包装、库存预测、订单履行和货运代理。第三方物流服务的主要优势(如包装、仓储和运输)可以降低公司的运营成本,使企业能够专注于其主要业务。第三方物流服务可能会在运输产品等方面提供更好的表现,并帮助企业在不同国家建立强大的影响力。假设任何公司都在国际上销售其产品。在这种情况下,第三方物流可以处理边境出现的文件、海关、关税和其他问题,这些问题可能会延迟发货,如果处理不彻底,则会导致高昂的成本。

新加坡、中国、香港和台湾第三方物流市场动态

本节涉及了解市场应用、供应链、采购类型和类型。所有这些都将在下面详细讨论:

司机

- 第三方物流带来的高效益

第三方物流基本上是从仓储到交付的运营物流外包,包括提供供应链中的多项服务,如货运、包装、订单履行、库存预测、拣货和包装、仓储和运输。第三方物流提供广泛的好处,因为它可以帮助企业主将更多精力放在业务的其他方面,如产品开发、营销和销售。因此,第三方物流提供的高额收益是推动新加坡、中国、香港和台湾第三方物流市场增长的主要因素。第三方物流提供多种好处:-

专业知识和资源:第三方物流 (3PL) 服务提供商拥有丰富的供应链管理专业知识、经验和资源。他们精通法规、行业最佳实践和技术进步。企业可以利用他们的专业知识,从高效且优化的物流运营中受益。

节省成本:通过将物流外包给第三方物流供应商,企业可以节省大量资金。第三方物流供应商通常与运输公司、仓储设施和其他服务提供商建立了网络和关系。他们可以利用这些网络协商更优惠的价格、整合货物并优化路线,从而降低运输成本。

可扩展性和灵活性:使用 3PL 供应商的重要优势之一是能够根据业务需求扩展策略和任务。第三方物流 (3PL) 解决方案提供商提供灵活的选项,可以应对需求变化、季节性变化和市场趋势。根据数量需求,他们拥有快速扩大或缩小规模的基础设施和资源。

更好地关注核心竞争力:企业可以通过将物流功能外包给第三方物流供应商来释放内部资源并专注于核心竞争力。公司现在可以投入更多时间、精力和资源进行战略规划、产品开发、客户服务和营销

- 跨境贸易和全球化不断增长

全球化是指技术、商品和服务的跨境贸易以及人员、投资和信息的流动,使世界经济、人口和文化相互依存。如今,大多数国家的经济高度依赖于各国之间的商品买卖。亚太地区一直是全球贸易的主要参与者,贸易流量大,这增加了对第三方物流的需求,使贸易流通更加便捷和迅速,从而推动了新加坡、中国、香港和台湾第三方物流市场的增长。

机会

- 电子商务日益增长

数字化的发展推动了电子商务行业的增长,大量货物被运送到消费者家门口。亚马逊是电子商务公司中最大的公司,以更快的速度交付产品。消费者现在依赖于快速交付货物,而不会出现产品不匹配的情况。这增加了通过广泛的分销商网络进行更快交付的需求,而第三方物流公司正在提供这种服务,从而为新加坡、中国、香港和台湾的第三方物流市场创造了新的增长机会。以下是这种增长如何为 3PL 行业带来机遇的解释。

限制/挑战

- 与贸易路线相关的拥堵

随着公路和水路交通量和拥堵情况的增加,货运和运输服务运营商在保持可靠时刻表方面面临越来越大的挑战。这会影响供应链和依赖卡车的业务,而这两者对于公共覆盖和私人区域运营商都具有越来越重要的意义。此外,道路上发生的多起事故或海上漏油事件可能会给第三方物流带来意想不到的挑战。以下是有关拥堵如何影响 3PL 行业的解释

新加坡、中国、香港及台湾第三方物流市场范围

全球第三方物流市场分为八个显著的细分市场,包括服务、产品、供应商、应用、业务类型、功能、垂直和零售规模。这些细分市场之间的增长将帮助您分析行业中微弱的增长细分市场,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

服务

- 供应链管理

- 国际运输管理(ITM)

- 国内运输管理(DTM)

- 仓储、履行和配送 (W&D)

- 专用合同运输(DCC)/货运代理

- 增值物流服务(VALS)

产品

- 空运

- 海运

- 陆路交通

- 合同物流

- 其他的

提供者

- 小型货运代理

- 快递公司

- 整合和提供分包物流的公司

- 运输服务

应用

- 接收

- 采摘

- 船运

- 返回

业务类型

- B2B

- B2C

功能

- 供应链管理

- 商品推销

- 店内运营

- 战略与规划

- 客户管理

垂直的

- 电子商务

- 零售

- 卫生保健

- 汽车

- 制造业

- 航空航天和国防

- 消费电子产品

- 半导体/太阳能

- 其他的

零售尺寸

- 小的

- 中等的

- 大的

新加坡、中国、香港和台湾第三方物流市场区域分析/洞察

对新加坡、中国、香港和台湾的第三方物流市场进行了分析,并按上述地区、服务、产品、供应商、应用、业务类型、功能、垂直和零售规模提供了市场规模洞察和趋势。

新加坡、中国、香港和台湾的第三方物流市场预计将实现丰厚的增长,因为 3PL 先进功能的采用热潮预计将推动新加坡、中国、香港和台湾的第三方物流市场的发展。

报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和市场监管变化。下游和上游价值链分析、技术趋势和波特五力分析、案例研究等数据点是用于预测各个国家市场情景的一些指标。此外,在提供区域数据的预测分析时,还考虑了全球品牌的存在和可用性以及由于来自本地和国内品牌的激烈或稀缺竞争而面临的挑战、国内关税的影响和贸易路线。

竞争格局及新加坡、中国、香港和台湾第三方物流市场份额分析

新加坡、中国、香港和台湾第三方物流市场竞争格局提供竞争对手的详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、全球影响力、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度、应用主导地位。以上提供的数据点仅与公司对新加坡、中国、香港和台湾第三方物流市场的关注有关。

在新加坡、中国、香港和台湾第三方物流市场运营的一些主要参与者包括 DHL(德国)、日本通运株式会社(日本)、联邦快递(美国)、日本邮船(日本)、希杰物流株式会社(韩国)、CH Robinson Worldwide, Inc.(美国)、DB Schenker(德国)、DSV(丹麦)、嘉里物流网络有限公司(香港)、Kuehne+Nagel(瑞士)、Samudera Shipping Line Ltd(新加坡)、中国外运有限公司(中国)、联合包裹服务公司(美国)、XPO, Inc.(美国)、中远海运物流供应链有限公司(中国)、中远物流国际控股有限公司(香港)、北美物流集团(香港)等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF SINGAPORE, CHINA, HONG KONG & TAIWAN THIRD PARTY LOGISTICS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 VENDOR SHARE ANALYSIS

2.9 MULTIVARIATE MODELING

2.1 SERVICE TIMELINE CURVE

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BENEFITS OF THIRD PARTY LOGISTICS

4.2 ECONOMIES OF SCALES

4.3 COMPETITIVE EDGE

4.4 WAREHOUSE RENT AND OVERHEADS

4.5 CUSTOMER SATISFACTION AND BRAND LOYALTY

4.6 TRENDS IN RETAIL LOGISTICS

4.6.1 ELASTIC LOGISTICS

4.6.2 BLOCKCHAIN

4.6.3 ARTIFICIAL INTELLIGENCE

4.6.4 IOT (INTERNET OF THINGS)

4.7 THIRD-PARTY LOGISTICS (3PL) COST MODEL

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 HIGH BENEFITS OFFERED BY THIRD-PARTY LOGISTICS

5.1.2 RISING GROWTH IN CROSS-BORDER TRADE AND GLOBALIZATION

5.1.3 SURGING NUMBER OF MANUFACTURING FACILITIES LEADING TO HIGHER NEED OF LOGISTICS

5.1.4 INCREASING GROWTH OF LOGISTICS THROUGH AIRWAYS AND WATER WAYS

5.2 RESTRAINT

5.2.1 CONGESTION ASSOCIATED WITH TRADE ROUTES

5.3 OPPORTUNITIES

5.3.1 INCREASING GROWTH IN E-COMMERCE

5.3.2 GROWING INCLINATION TOWARDS DIGITALIZATION

5.3.3 INCREASING GROWTH IN INVESTMENTS AND EXPANSIONS MADE BY THE MARKET PLAYERS

5.3.4 THE EMERGENCE OF NEW ADVANCED TECHNOLOGIES

5.4 CHALLENGES

5.4.1 SEVERAL GOVERNMENT REGULATIONS AND RESTRICTIONS

5.4.2 LACK OF TRAINING AND EDUCATION

6 SINGAPORE, CHINA, HONG KONG & TAIWAN THIRD PARTY LOGISTICS MARKET, BY SERVICE

6.1 OVERVIEW

6.2 SUPPLY CHAIN MANAGEMENT

6.3 INTERNATIONAL TRANSPORTATION MANAGEMENT (ITM)

6.4 DOMESTIC TRANSPORTATION MANAGEMENT (DTM)

6.5 WAREHOUSING, FULFILMENT & DISTRIBUTION (W&D)

6.5.1 INVENTORY

6.5.2 SHIPPING

6.5.3 TRACKING

6.5.4 PACKING

6.6 DEDICATED CONTRACT CARRIAGE (DCC)/ FREIGHT FORWARDING

6.7 VALUE-ADDED LOGISTICS SERVICES (VALS)

7 SINGAPORE, CHINA, HONG KONG & TAIWAN THIRD PARTY LOGISTICS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 AIR FREIGHT

7.2.1 SUPPLY CHAIN MANAGEMENT

7.2.2 INTERNATIONAL TRANSPORTATION MANAGEMENT (ITM)

7.2.3 DOMESTIC TRANSPORTATION MANAGEMENT (DTM)

7.2.4 WAREHOUSING, FULFILMENT & DISTRIBUTION (W&D)

7.2.5 DEDICATED CONTRACT CARRIAGE (DCC)/ FREIGHT FORWARDING

7.2.6 VALUE-ADDED LOGISTICS SERVICES (VALS)

7.3 OCEAN FREIGHT

7.3.1 SUPPLY CHAIN MANAGEMENT

7.3.2 INTERNATIONAL TRANSPORTATION MANAGEMENT (ITM)

7.3.3 WAREHOUSING, FULFILMENT & DISTRIBUTION (W&D)

7.3.4 DEDICATED CONTRACT CARRIAGE (DCC)/ FREIGHT FORWARDING

7.3.5 VALUE-ADDED LOGISTICS SERVICES (VALS)

7.3.6 DOMESTIC TRANSPORTATION MANAGEMENT (DTM)

7.4 LAND TRANSPORT

7.4.1 SUPPLY CHAIN MANAGEMENT

7.4.2 DOMESTIC TRANSPORTATION MANAGEMENT (DTM)

7.4.3 WAREHOUSING, FULFILMENT & DISTRIBUTION (W&D)

7.4.4 INTERNATIONAL TRANSPORTATION MANAGEMENT (ITM)

7.4.5 DEDICATED CONTRACT CARRIAGE (DCC)/ FREIGHT FORWARDING

7.4.6 VALUE-ADDED LOGISTICS SERVICES (VALS)

7.5 CONTRACT LOGISTICS

7.5.1 SUPPLY CHAIN MANAGEMENT

7.5.2 WAREHOUSING, FULFILMENT & DISTRIBUTION (W&D)

7.5.3 DOMESTIC TRANSPORTATION MANAGEMENT (DTM)

7.5.4 INTERNATIONAL TRANSPORTATION MANAGEMENT (ITM)

7.5.5 DEDICATED CONTRACT CARRIAGE (DCC)/ FREIGHT FORWARDING

7.5.6 VALUE-ADDED LOGISTICS SERVICES (VALS)

7.6 OTHERS

8 SINGAPORE, CHINA, HONG KONG & TAIWAN THIRD PARTY LOGISTICS MARKET, BY PROVIDERS

8.1 OVERVIEW

8.2 COMPANIES INTEGRATING & OFFERING SUBCONTRACTED LOGISTICS

8.3 COURIER COMPANIES

8.4 SMALL FREIGHT FORWARDERS

8.5 TRANSPORTATION SERVICES

9 SINGAPORE, CHINA, HONG KONG & TAIWAN THIRD PARTY LOGISTICS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 SHIPPING

9.3 RECEIVING

9.4 RETURNS

9.5 PACKING

9.5.1 UNBRANDED BOXES

9.5.2 BUBBLE MAILERS

9.5.3 POLY BAGS

9.5.4 PACKING TAPE

9.5.5 DUNNAGE

9.5.6 PAPER BASED DUNNAGE

10 SINGAPORE, CHINA, HONG KONG & TAIWAN THIRD PARTY LOGISTICS MARKET, BY BUSINESS TYPE

10.1 OVERVIEW

10.2 B2C

10.3 B2B

11 SINGAPORE, CHINA, HONG KONG & TAIWAN THIRD PARTY LOGISTICS MARKET, BY FUNCTION

11.1 OVERVIEW

11.2 SUPPLY CHAIN MANAGEMENT

11.3 CUSTOMER MANAGEMENT

11.4 IN-STORE OPERATIONS

11.5 STRATEGY & PLANNING

11.6 MERCHANDISING

12 SINGAPORE, CHINA, HONG KONG & TAIWAN THIRD PARTY LOGISTICS MARKET, BY VERTICAL

12.1 OVERVIEW

12.2 ECOMMERCE

12.2.1 SUPPLY CHAIN MANAGEMENT

12.2.2 CUSTOMER MANAGEMENT

12.2.3 IN-STORE OPERATIONS

12.2.4 STRATEGY & PLANNING

12.2.5 MERCHANDISING

12.3 RETAIL

12.3.1 SUPPLY CHAIN MANAGEMENT

12.3.2 CUSTOMER MANAGEMENT

12.3.3 IN-STORE OPERATIONS

12.3.4 STRATEGY & PLANNING

12.3.5 MERCHANDISING

12.4 MANUFACTURING

12.4.1 SUPPLY CHAIN MANAGEMENT

12.4.2 CUSTOMER MANAGEMENT

12.4.3 IN-STORE OPERATIONS

12.4.4 STRATEGY & PLANNING

12.4.5 MERCHANDISING

12.5 CONSUMER ELECTRONICS

12.5.1 SUPPLY CHAIN MANAGEMENT

12.5.2 CUSTOMER MANAGEMENT

12.5.3 IN-STORE OPERATIONS

12.5.4 STRATEGY & PLANNING

12.5.5 MERCHANDISING

12.6 HEALTHCARE

12.6.1 SUPPLY CHAIN MANAGEMENT

12.6.2 CUSTOMER MANAGEMENT

12.6.3 IN-STORE OPERATIONS

12.6.4 STRATEGY & PLANNING

12.6.5 MERCHANDISING

12.7 AUTOMOTIVE

12.7.1 SUPPLY CHAIN MANAGEMENT

12.7.2 CUSTOMER MANAGEMENT

12.7.3 IN-STORE OPERATIONS

12.7.4 STRATEGY & PLANNING

12.7.5 MERCHANDISING

12.8 SEMICON/SOLAR

12.8.1 SUPPLY CHAIN MANAGEMENT

12.8.2 CUSTOMER MANAGEMENT

12.8.3 IN-STORE OPERATIONS

12.8.4 STRATEGY & PLANNING

12.8.5 MERCHANDISING

12.9 AEROSPACE & DEFENCE

12.9.1 SUPPLY CHAIN MANAGEMENT

12.9.2 CUSTOMER MANAGEMENT

12.9.3 IN-STORE OPERATIONS

12.9.4 STRATEGY & PLANNING

12.9.5 MERCHANDISING

12.1 OTHERS

12.10.1 SUPPLY CHAIN MANAGEMENT

12.10.2 CUSTOMER MANAGEMENT

12.10.3 IN-STORE OPERATIONS

12.10.4 STRATEGY & PLANNING

12.10.5 MERCHANDISING

13 SINGAPORE, CHINA, HONG KONG & TAIWAN THIRD PARTY LOGISTICS MARKET, BY RETAIL SIZE

13.1 OVERVIEW

13.2 MEDIUM

13.3 SMALL

13.4 LARGE

14 CHINA THIRD PARTY LOGISTICS MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: CHINA

14.2 COMPANY SHARE ANALYSIS: TAIWAN

14.3 COMPANY SHARE ANALYSIS: SINGAPORE

14.4 COMPANY SHARE ANALYSIS: HONG KONG

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 FEDEX

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 SERVICE PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 DHL

16.2.1 COMPANY SNAPSHOT

16.2.2 1.2.2 REVENUE ANALYSIS

16.2.3 SERVICE PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 COSCO SHIPPING LOGISTICS SUPPLY CHAIN CO., LTD.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 SERVICE PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 KUEHNE+NAGEL

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 SERVICE PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 DSV

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 SERVICE PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 C.H. ROBINSON WORLDWIDE, INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 SERVICE PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 CJ LOGISTICS CORPORATION

16.7.1 COMPANY SNAPSHOT

16.7.2 SERVICE PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 CN LOGISTICS INTERNATIONAL HOLDINGS LIMITED

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 SERVICE PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 DB SCHENKER

16.9.1 COMPANY SNAPSHOT

16.9.2 SERVICE PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 KERRY LOGISTICS NETWORK LIMITED

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 SERVICE PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

16.11 NAF LOGISTICS GROUP

16.11.1 COMPANY SNAPSHOT

16.11.2 SERVICE PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 NIPPON EXPRESS CO., LTD.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 SERVICE PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 NYK LINE

16.13.1 COMPANY SNAPSHOT

16.13.2 SERVICE PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 SAMUDERA SHIPPING LINE LTD

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 SERVICE PORTFOLIO

16.14.4 RECENT DEVELOPMENTS

16.15 SINOTRANS LIMITED

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 SERVICE PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 TOLL HOLDINGS LIMITED (A SUBSIDIARY OF JAPAN POST HOLDINGS CO., LTD.)

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 SERVICE PORTFOLIO

16.16.4 RECENT DEVELOPMENT

16.17 UNITED PARCEL SERVICE OF AMERICA, INC.

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 SERVICE PORTFOLIO

16.17.4 RECENT DEVELOPMENTS

16.18 XIAMEN XIANGYU GROUP CO., LTD

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 SERVICE PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 XPO, INC.

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 SERVICE PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

16.2 YUNDA LTD

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 SERVICE PORTFOLIO

16.20.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

表格列表

TABLE 1 WAREHOUSE RENT IN HONG KONG

TABLE 2 CHINA THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 3 TAIWAN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 4 SINGAPORE THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 5 HONG KONG THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 6 CHINA WAREHOUSING, FULFILLMENT& DISTRIBUTION (W&D) IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 7 TAIWAN WAREHOUSING, FULFILLMENT& DISTRIBUTION (W&D) IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 8 SINGAPORE WAREHOUSING, FULFILLMENT& DISTRIBUTION (W&D) IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 9 HONG KONG WAREHOUSING, FULFILLMENT& DISTRIBUTION (W&D) IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 10 CHINA THIRD PARTY LOGISTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 11 TAIWAN THIRD PARTY LOGISTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 12 SINGAPORE THIRD PARTY LOGISTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 13 HONG KONG THIRD PARTY LOGISTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 14 CHINA AIR FREIGHT IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 15 TAIWAN AIR FREIGHT IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 16 SINGAPORE AIR FREIGHT IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 17 HONG KONG AIR FREIGHT IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 18 CHINA OCEAN FREIGHT IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 19 TAIWAN OCEAN FREIGHT IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 20 SINGAPORE OCEAN FREIGHT IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 21 HONG KONG OCEAN FREIGHT IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 22 CHINA LAND TRANSPORT IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 23 TAIWAN LAND TRANSPORT IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 24 SINGAPORE LAND TRANSPORT IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 25 HONG KONG LAND TRANSPORT IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 26 CHINA CONTRACT LOGISTICS IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 27 TAIWAN CONTRACT LOGISTICS IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 28 SINGAPORE CONTRACT LOGISTICS IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 29 HONG KONG CONTRACT LOGISTICS IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 30 CHINA THIRD PARTY LOGISTICS MARKET, BY PROVIDERS, 2021-2030 (USD MILLION)

TABLE 31 TAIWAN THIRD PARTY LOGISTICS MARKET, BY PROVIDERS, 2021-2030 (USD MILLION)

TABLE 32 SINGAPORE THIRD PARTY LOGISTICS MARKET, BY PROVIDERS, 2021-2030 (USD MILLION)

TABLE 33 HONG KONG THIRD PARTY LOGISTICS MARKET, BY PROVIDERS, 2021-2030 (USD MILLION)

TABLE 34 CHINA THIRD PARTY LOGISTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 35 TAIWAN THIRD PARTY LOGISTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 36 SINGAPORE THIRD PARTY LOGISTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 37 HONG KONG THIRD PARTY LOGISTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 38 CHINA PACKING IN THIRD PARTY LOGISTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 39 TAIWAN PACKING IN THIRD PARTY LOGISTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 40 SINGAPORE PACKING IN THIRD PARTY LOGISTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 41 HONG KONG PACKING IN THIRD PARTY LOGISTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 42 CHINA THIRD PARTY LOGISTICS MARKET, BY BUSINESS TYPE, 2021-2030 (USD MILLION)

TABLE 43 TAIWAN THIRD PARTY LOGISTICS MARKET, BY BUSINESS TYPE, 2021-2030 (USD MILLION)

TABLE 44 SINGAPORE THIRD PARTY LOGISTICS MARKET, BY BUSINESS TYPE, 2021-2030 (USD MILLION)

TABLE 45 HONG KONG THIRD PARTY LOGISTICS MARKET, BY BUSINESS TYPE, 2021-2030 (USD MILLION)

TABLE 46 CHINA THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 47 TAIWAN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 48 SINGAPORE THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 49 HONG KONG THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 50 CHINA THIRD PARTY LOGISTICS MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 51 TAIWAN THIRD PARTY LOGISTICS MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 52 SINGAPORE THIRD PARTY LOGISTICS MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 53 HONG KONG THIRD PARTY LOGISTICS MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 54 CHINA ECOMMERCE IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 55 TAIWAN ECOMMERCE IN THIRD PARTY LOGISTICS MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 56 SINGAPORE ECOMMERCE IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 57 HONG KONG ECOMMERCE IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 58 CHINA RETAIL IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 59 TAIWAN RETAIL IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 60 SINGAPORE RETAIL IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 61 HONG KONG RETAIL IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 62 CHINA MANUFACTURING IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 63 TAIWAN MANUFACTURING IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 64 SINGAPORE MANUFACTURING IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 65 HONG KONG MANUFACTURING IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 66 CHINA CONSUMER ELECTRONICS IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 67 TAIWAN CONSUMER ELECTRONICS IN THIRD PARTY LOGISTICS MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 68 SINGAPORE CONSUMER ELECTRONICS IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 69 HONG KONG CONSUMER ELECTRONICS IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 70 CHINA HEALTHCARE IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 71 TAIWAN HEALTHCARE IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 72 SINGAPORE HEALTHCARE IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 73 HONG KONG HEALTHCARE IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 74 CHINA AUTOMOTIVE IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 75 TAIWAN AUTOMOTIVE IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 76 SINGAPORE AUTOMOTIVE IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 77 HONG KONG AUTOMOTIVE IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 78 CHINA SEMICON/SOLAR IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 79 TAIWAN SEMICON/SOLAR IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 80 SINGAPORE SEMICON/SOLAR IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 81 HONG KONG SEMICON/SOLAR IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 82 CHINA AEROSPACE & DEFENCE IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 83 TAIWAN AEROSPACE & DEFENCE IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 84 SINGAPORE AEROSPACE & DEFENCE IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 85 HONG KONG AEROSPACE & DEFENCE IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 86 CHINA OTHERS IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 87 TAIWAN OTHERS IN THIRD PARTY LOGISTICS MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 88 SINGAPORE OTHERS IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 89 HONG KONG OTHERS IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 90 CHINA THIRD PARTY LOGISTICS MARKET, BY RETAIL SIZE, 2021-2030 (USD MILLION)

TABLE 91 TAIWAN THIRD PARTY LOGISTICS MARKET, BY RETAIL SIZE, 2021-2030 (USD MILLION)

TABLE 92 SINGAPORE THIRD PARTY LOGISTICS MARKET, BY RETAIL SIZE, 2021-2030 (USD MILLION)

TABLE 93 HONG KONG THIRD PARTY LOGISTICS MARKET, BY RETAIL SIZE, 2021-2030 (USD MILLION)

图片列表

FIGURE 1 SINGAPORE, CHINA, HONG KONG & TAIWAN THIRD PARTY LOGISTICS MARKET: SEGMENTATION

FIGURE 2 SINGAPORE, CHINA, HONG KONG & TAIWAN THIRD PARTY LOGISTICS MARKET: DATA TRIANGULATION

FIGURE 3 SINGAPORE, CHINA, HONG KONG & TAIWAN THIRD PARTY LOGISTICS MARKET: DROC ANALYSIS

FIGURE 4 CHINA THIRD PARTY LOGISTICS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 TAIWAN THIRD PARTY LOGISTICS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 6 SINGAPORE THIRD PARTY LOGISTICS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 7 HONG KONG THIRD PARTY LOGISTICS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 8 CHINA THIRD PARTY LOGISTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 9 TAIWAN THIRD PARTY LOGISTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 10 SINGAPORE THIRD PARTY LOGISTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 11 HONG KONG THIRD PARTY LOGISTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 12 SINGAPORE, CHINA, HONG KONG & TAIWAN THIRD PARTY LOGISTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 13 CHINA THIRD PARTY LOGISTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 14 TAIWAN THIRD PARTY LOGISTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 15 SINGAPORE THIRD PARTY LOGISTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 16 HONG KONG THIRD PARTY LOGISTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 17 CHINA THIRD PARTY LOGISTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 18 TAIWAN THIRD PARTY LOGISTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 19 SINGAPORE THIRD PARTY LOGISTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 20 HONG KONG THIRD PARTY LOGISTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 21 SINGAPORE, CHINA, HONG KONG & TAIWAN THIRD PARTY LOGISTICS MARKET: MULTIVARIATE MODELLING

FIGURE 22 CHINA THIRD PARTY LOGISTICS MARKET: SERVICE CURVE

FIGURE 23 TAIWAN THIRD PARTY LOGISTICS MARKET: SERVICE CURVE

FIGURE 24 SINGAPORE THIRD PARTY LOGISTICS MARKET: SERVICE CURVE

FIGURE 25 HONG KONG THIRD PARTY LOGISTICS MARKET: SERVICE CURVE

FIGURE 26 CHINA THIRD PARTY LOGISTICS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 27 SINGAPORE THIRD PARTY LOGISTICS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 28 SINGAPORE THIRD PARTY LOGISTICS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 29 HONG KONG THIRD PARTY LOGISTICS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 30 SINGAPORE, CHINA, HONG KONG & TAIWAN THIRD PARTY LOGISTICS MARKET: SEGMENTATION

FIGURE 31 HIGH BENEFITS OFFERED BY THIRD PARTY LOGISTICS ARE EXPECTED TO DRIVE CHINA THIRD PARTY LOGISTICS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 32 RISING GROWTH IN CROSS-BORDER TRADE AND GLOBALIZATION IS EXPECTED TO DRIVE TAIWAN THIRD PARTY LOGISTICS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 33 THE SURGING NUMBER OF MANUFACTURING FACILITIES LEADING TO HIGHER NEED OF LOGISTICS IS EXPECTED TO DRIVE SINGAPORE THIRD PARTY LOGISTICS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 34 INCREASING GROWTH OF LOGISTICS THROUGH AIRWAYS AND WATER WAYS IS EXPECTED TO DRIVE HONG KONG THIRD PARTY LOGISTICS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 35 SUPPLY CHAIN MANAGEMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF CHINA THIRD PARTY LOGISTICS MARKET IN 2021 & 2030

FIGURE 36 SUPPLY CHAIN MANAGEMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF TAIWAN THIRD PARTY LOGISTICS MARKET IN 2021 & 2030

FIGURE 37 SUPPLY CHAIN MANAGEMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF SINGAPORE THIRD PARTY LOGISTICS MARKET IN 2021 & 2030

FIGURE 38 SUPPLY CHAIN MANAGEMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF HONG KONG THIRD PARTY LOGISTICS MARKET IN 2021 & 2030

FIGURE 39 DRIVERS, RESTRAINT, OPPORTUNITIES, AND CHALLENGES OF SINGAPORE, CHINA, HONG KONG & TAIWAN THIRD PARTY LOGISTICS MARKET

FIGURE 40 LOGISTICS PERFORMANCE INDEX: OVERALL (1=LOW TO 5=HIGH) - SINGAPORE

FIGURE 41 MANUFACTURING, VALUE ADDED (CONSTANT LCU) - SINGAPORE

FIGURE 42 CONTAINER PORT TRAFFIC BY REGION

FIGURE 43 SINGAPORE THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 44 CHINA THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 45 HONG KONG THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 46 TAIWAN THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 47 SINGAPORE THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 48 CHINA THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 49 HONG KONG THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 50 TAIWAN THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 51 SINGAPORE THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 52 CHINA THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 53 HONG KONG THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 54 TAIWAN THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 55 SINGAPORE THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 56 CHINA THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 57 HONG KONG THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 58 TAIWAN THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 59 SINGAPORE THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 60 CHINA THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 61 HONG KONG THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 62 TAIWAN THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 63 SINGAPORE THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 64 CHINA THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 65 HONG KONG THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 66 TAIWAN THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 67 SINGAPORE THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 68 CHINA THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 69 HONG KONG THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 70 TAIWAN THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 71 SINGAPORE THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 72 CHINA THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 73 HONG KONG THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 74 TAIWAN THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 75 CHINA THIRD PARTY LOGISTICS MARKET: COMPANY SHARE 2022(%)

FIGURE 76 TAIWAN THIRD PARTY LOGISTICS MARKET: COMPANY SHARE 2022 (%)

FIGURE 77 SINGAPORE THIRD PARTY LOGISTICS MARKET: COMPANY SHARE 2022 (%)

FIGURE 78 HONG KONG THIRD PARTY LOGISTICS MARKET: COMPANY SHARE 2022 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。