Serbia Romania And Bulgaria Cng Compressed Natural Gas Fuel Market

市场规模(十亿美元)

CAGR :

%

USD

563.98 Million

USD

749.83 Million

2023

2035

USD

563.98 Million

USD

749.83 Million

2023

2035

| 2024 –2035 | |

| USD 563.98 Million | |

| USD 749.83 Million | |

|

|

|

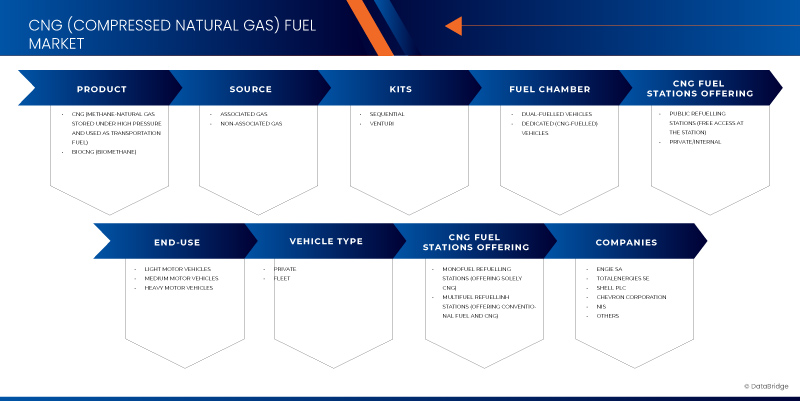

塞尔维亚、罗马尼亚和保加利亚CNG(压缩天然气)燃料市场细分,按产品(CNG(高压储存并用作运输燃料的甲烷 - 天然气)和 BioCNG(生物甲烷))、来源(伴生气和非伴生气)、套件(顺序和文丘里)、燃料室(双燃料车辆和专用(CNG 燃料)车辆)、车辆类型(私人和车队)、CNG 燃料站提供(单一燃料加油站(仅提供 CNG)和多燃料加油站(提供传统燃料和 CNG)、CNG 燃料站实体(公共加油站(车站免费使用)和私人/内部)、最终用途(轻型机动车、中型机动车和重型机动车)– 行业趋势和预测到 2035 年。

CNG(压缩天然气)燃料市场分析

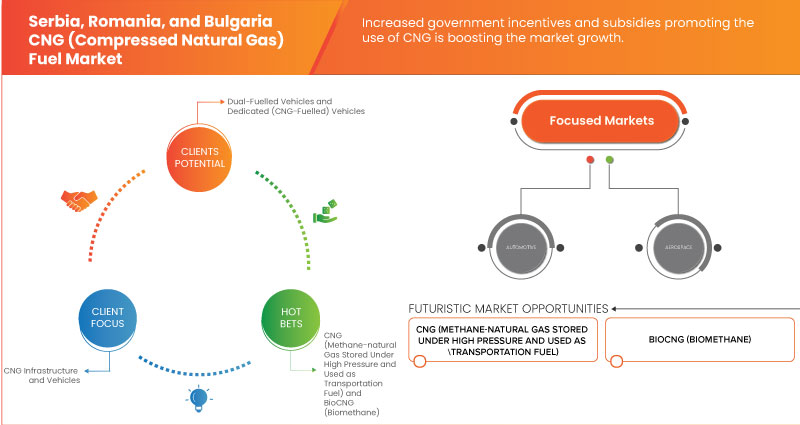

塞尔维亚、罗马尼亚和保加利亚 CNG(压缩天然气)燃料市场政府政策和激励措施通过支持更清洁的能源解决方案和鼓励使用 CNG 作为替代燃料来推动 CNG 的采用。塞尔维亚、罗马尼亚和保加利亚 CNG(压缩天然气)燃料市场的技术进步提高了性能和效率,使其更具竞争力并推动进一步的市场采用。日益增强的环保意识正在推动这两个市场采用可持续的做法和环保材料。从而推动全球市场增长。

CNG(压缩天然气)燃料市场规模

塞尔维亚、罗马尼亚和保加利亚 CNG(压缩天然气)燃料市场规模在 2023 年价值 5.6398 亿美元,预计到 2035 年将达到 7.4983 亿美元,在 2024 年至 2035 年的预测期内复合年增长率为 2.4%。除了对市场价值、增长率、细分、地理覆盖范围和主要参与者等市场情景的见解外,Data Bridge Market Research 策划的市场报告还包括深度专家分析、患者流行病学、管道分析、定价分析和监管框架。

CNG(压缩天然气)燃料市场趋势

“塞尔维亚、罗马尼亚和保加利亚日益严格的环境政策和减排目标支持采用 CNG”

在塞尔维亚、罗马尼亚和保加利亚,严格的环境法规和减排目标正在增加压缩天然气作为传统燃料(如煤炭、石油、丙烷等)的清洁替代品的采用。塞尔维亚正在通过实施旨在减少空气污染和温室气体排放的政策来与欧盟标准保持一致。政府通过为 CNG 车辆提供奖励并投资扩建加油基础设施来支持这一转变。

例如,罗马尼亚积极主动地将 CNG 纳入其能源和交通部门。该国的政策侧重于减少城市空气污染和实现欧盟排放目标。罗马尼亚为 CNG 车辆提供补贴和补助,从而扩大了 CNG 车辆的使用范围,尤其是在公共交通和车队运营中。在政府举措的支持下,CNG 加油网络的发展进一步加速了这一转变。

报告范围和市场细分

|

属性 |

CNG(压缩天然气)燃料关键市场洞察 |

|

涵盖的领域 |

副产品:CNG(甲烷 - 高压储存并用作运输燃料的天然气)和 BioCNG(生物甲烷) 按来源分类:伴生气和非伴生气 按 套件分类:顺序和文丘里 按 燃料室分类:双燃料汽车和专用(CNG 燃料)汽车 按 车辆类型:私家车和车队 按 CNG 燃料站提供:单一燃料加气站(仅提供 CNG)和多燃料加气站(提供传统燃料和 CNG) 按 CNG 加油站实体:(公共加油站(免费)在站内使用)和(私人/内部) 按 最终用途分类:轻型机动车、中型机动车和重型机动车 |

|

覆盖国家 |

保加利亚、塞尔维亚、罗马尼亚 |

|

主要市场参与者 |

NIS(德国)、KryoGas(欧洲)、Engie SA(法国)、Total Energies SE(法国)、雪佛龙公司(美国)和壳牌公司(英国) |

|

市场机会 |

· 将现有公共和私人交通工具转换为 CNG 具有巨大潜力 · 塞尔维亚、罗马尼亚和保加利亚在开发跨境 CNG 基础设施方面开展合作 |

|

增值数据信息集 |

除了对市场价值、增长率、细分、地理覆盖范围和主要参与者等市场情景的见解之外,Data Bridge Market Research 策划的市场报告还包括深入的专家分析、定价分析、品牌份额分析、消费者调查、人口分析、供应链分析、价值链分析、原材料/消耗品概述、供应商选择标准、PESTLE 分析、波特分析和监管框架。 |

CNG(压缩天然气)燃料市场定义

塞尔维亚、罗马尼亚和保加利亚的 CNG 燃料市场涵盖了压缩天然气作为运输燃料的整个生命周期,从生产、分销到消费。它涉及建设加油站等基础设施、推进 CNG 车辆技术以及实施支持清洁能源的法规。其目的是减少排放并减少对传统燃料的依赖,同时探索每个国家独特的经济和环境优势。

CNG(压缩天然气)燃料市场动态

驱动程序

- 塞尔维亚、罗马尼亚和保加利亚日益严格的环境政策和减排目标支持采用 CNG

在塞尔维亚、罗马尼亚和保加利亚,严格的环境法规和减排目标正在增加压缩天然气作为煤炭、石油、丙烷等传统燃料的清洁替代品的采用。塞尔维亚正在实施旨在减少空气污染和温室气体排放的政策,以符合欧盟标准。政府通过为 CNG 汽车提供奖励和投资扩建加油基础设施来支持这一转变。罗马尼亚采取积极主动的方式将 CNG 纳入其能源和运输部门。该国的政策侧重于减少城市空气污染和实现欧盟排放目标。罗马尼亚为 CNG 汽车提供补贴和补助,从而扩大了 CNG 的使用范围,尤其是在公共交通和车队运营中。在政府举措的支持下,CNG 加油网络的增长进一步加速了这一转变。

例如,

- 2021 年,根据联合国欧洲经济委员会的报告,保加利亚以煤炭为主的能源结构限制了 BEV 的采用,但现有的 NGV 基础设施提供了潜力。为了推动 NGV 的使用,保加利亚正在扩建 CNG/LNG 加气站和配套设施,评估需求,并评估投资、社会经济和环境影响

使用 CNG 的经济效益不断提高

压缩天然气具有显著的经济优势,使其成为汽油和柴油等传统燃料的有力替代品。CNG 的一个主要优势是成本效益;它通常比汽油和柴油便宜,从而降低了消费者和企业的燃料成本。这对商用车队尤其有利,因为燃料费用的减少可以转化为大量的财务节省。CNG 车辆通常由于燃烧更清洁而产生较低的维护成本,这减少了发动机磨损以及频繁维修和换油的需要。这可以延长车辆的使用寿命并节省更多费用。与价格波动较大的石油基燃料相比,CNG 的另一个经济优势是其价格稳定,从而提供更可预测和可管理的燃料成本。

例如,

- 据太平洋煤气电力公司发表的文章称,天然气是一种清洁燃料,泄漏后会迅速消散,避免水污染,产生的温室气体更少,与其他燃料相比,有助于减少全球变暖

机会

- 将现有公共和私人交通工具转换为 CNG 具有巨大潜力

将现有的公共和私人交通车队改用压缩天然气 (CNG) 可带来显著的经济、环境和运营效益。从经济角度来看,CNG 是一种经济高效的汽油和柴油替代品,可降低燃料成本并为车队运营商节省大量资金。这对于大型车队尤其有利,例如公共交通和物流中使用的车队,因为燃料费用占运营预算的很大一部分。CNG 车辆通常维护成本较低,因为它们的燃烧更清洁,从而减少了发动机磨损和维修频率。这可以延长车辆使用寿命并增加节省。从环境角度来看,与传统燃料相比,CNG 是一种更清洁的燃料,可显著减少氮氧化物 (NOx)、颗粒物和二氧化碳 (CO2) 的排放。污染物的减少有助于改善空气质量、遵守严格的排放法规并有益于公众健康。

- 塞尔维亚、罗马尼亚和保加利亚合作开发跨境 CNG 基础设施

塞尔维亚、罗马尼亚和保加利亚在开发跨境压缩天然气 (CNG) 基础设施方面的合作,是加强区域能源安全和促进可持续交通的重要进步。这些国家认识到互联互通的 CNG 网络对双方都有利,因此正在共同努力,打造一个跨越国界的广泛而综合的加油基础设施。此次合作的一个核心方面是开发跨境加油站,旨在为在这些国家之间行驶的车辆提供不间断的 CNG 服务。通过在主要交通路线沿线建立战略位置的加油站网络,塞尔维亚、罗马尼亚和保加利亚旨在促进 CNG 车辆的广泛采用,并简化商业和公共交通车队的跨境流动。

例如,

- 根据 Vignette Bulgariia 发布的博客,塞尔维亚和保加利亚有着历史关系,这种关系由冲突和合作时期塑造而成。自 1990 年代南斯拉夫解体以来,两国已建立了目前国际公认的边界,并制定了货物、人员和相互安全的双边规定,包括保加利亚 Vignette

限制/挑战

- 替代燃料的竞争日益激烈

电动汽车 (EV)、氢能和生物燃料等替代燃料的兴起对 CNG 构成了直接竞争。尤其是电动汽车,由于电池技术的进步和充电基础设施投资的增加而受到广泛关注。人们还正在探索氢燃料电池提供零排放运输解决方案的潜力。这些替代方案通常受益于旨在减少碳排放的政府大力支持和补贴。电动汽车和氢能等替代燃料加油基础设施的开发和扩建可能会掩盖对 CNG 站的投资。政府和私人投资者越来越关注这些新技术,这可能会分散资源和注意力,使其无法建设强大的 CNG 网络。

例如

- 2024 年 4 月,根据绿色论坛发布的消息,罗马尼亚正面临充电站短缺的问题,但电动汽车 (EV) 的普及凸显了需求的不断增长。为了促进向电动汽车的过渡并支持可持续交通,罗马尼亚需要加强其基础设施并实施有利的法规。安永罗马尼亚合伙人 Mihai Drăghici 在接受 Green 采访时强调,罗马尼亚预计电动汽车销量的年增长率为 20-25%,预计到 2024 年市场份额将达到近 30%,到 2027 年可能超过 50%

严格的安全和监管标准增加了复杂性和成本

严格的安全和监管标准大大增加了各行业的复杂性和成本,带来了显著的挑战。这些标准虽然对于确保产品和流程的安全性、可靠性和环境可持续性至关重要,但在合规和实施方面却带来了层层复杂性。满足严格的安全和监管要求通常需要大量的文档、测试和认证流程。对于制造商来说,这意味着投资全面的测试设施和程序,以确保其产品符合要求的标准。这不仅增加了运营成本,还延长了开发时间,从而可能延迟进入市场并影响竞争定位。

本市场报告详细介绍了最新发展、贸易法规、进出口分析、生产分析、价值链优化、市场份额、国内和本地市场参与者的影响,分析了新兴收入领域的机会、市场法规的变化、战略市场增长分析、市场规模、类别市场增长、应用领域和主导地位、产品批准、产品发布、地域扩展、市场技术创新。如需获取更多市场信息,请联系 Data Bridge Market Research 获取分析师简报,我们的团队将帮助您做出明智的市场决策,实现市场增长。

气候变化情景

CNG(压缩天然气)燃料市场通常被定位为汽油和柴油等传统化石燃料的更清洁替代品。然而,环境问题仍然存在,特别是在开采、运输和使用过程中的甲烷泄漏,这可能会抵消 CNG 的碳减排效益。甲烷是一种强效温室气体,其全球变暖潜能值远高于二氧化碳,因此其管理对于 CNG 的环境可行性至关重要。此外,虽然 CNG 燃烧比其他化石燃料更清洁,但它仍然是一种不可再生资源,其在脱碳经济中的长期作用存在争议。

监管框架内容

法规在塞尔维亚、罗马尼亚和保加利亚 CNG(压缩天然气)燃料市场中发挥着至关重要的作用,确保整个制造过程中的产品质量、安全和环境合规性。

- 下表显示了管理市场的各种法规:

塞尔维亚共和国矿业和能源部:矿业和能源部为天然气行业引入了新的监管框架。该框架要求部长为各种天然气基础设施项目颁发许可证,并设立新的运输和分销实体,以增强市场功能。

联合国法规:联合国第110号法规对使用压缩天然气(CNG)和液化天然气(LNG)作为动力的零部件和车辆的批准进行了规范,确保了统一的安装和安全标准。

保加利亚部长理事会:保加利亚的替代燃料国家政策旨在通过发展 CNG 和 LNG 基础设施来与欧盟标准保持一致。其中包括降低消费税、特殊停车和采购奖金。该计划将在 2030 年前分阶段将基础设施从交通走廊扩展到区域网络。

生产成本情景

制造商的平均生产成本并不是恒定的,它取决于或受各种因素影响。根据我们的分析,2023 年 CNG(压缩天然气)燃料的平均产量为 458,708.69 吨,预计 2024 年将达到 460,447.76 吨。2023 年的平均消耗量为 421,507.42 吨,预计 2024 年将达到 427,111.35 吨。

原材料短缺和运输延误的影响和当前市场状况

Data Bridge Market Research 提供高水平的市场分析,并通过考虑原材料短缺和运输延误的影响和当前市场环境来提供信息。这意味着评估战略可能性、制定有效的行动计划并协助企业做出重要决策。

除了标准报告外,我们还提供从预测的运输延迟、按区域划分的分销商映射、商品分析、生产分析、价格映射趋势、采购、类别绩效分析、供应链风险管理解决方案、高级基准测试等角度对采购层面的深入分析,以及其他采购和战略支持服务。

经济放缓对产品定价和供应的预期影响

当经济活动放缓时,行业开始受到影响。DBMR 提供的市场洞察报告和情报服务考虑了经济衰退对产品定价和可获得性的预测影响。借助这些,我们的客户通常可以领先竞争对手一步,预测他们的销售额和收入,并估算他们的盈亏支出。

CNG(压缩天然气)燃料市场范围

市场根据产品、来源、套件、燃料室、车辆类型、CNG 加油站供应、CNG 加油站实体和最终用途进行细分。这些细分市场之间的增长将帮助您分析行业中微弱的增长细分市场,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

产品

- CNG(甲烷 - 高压储存并用作运输燃料的天然气)

- 生物压缩天然气 (生物甲烷)

来源

- 伴生气

- 非伴生气

套件

- 顺序

- 文丘里管

燃油室

- 双燃料汽车

- 专用(CNG 燃料)车辆

车辆类型

- 私人的

- 舰队

- 出租车/巴士

- 警察

- 送货

- 其他的

CNG 加油站提供

- 单一燃料加气站(仅提供 CNG)

- 多燃料加油站(提供传统燃料和 CNG)

CNG 加油站实体

- 公共加油站(站内免费使用)

- 私人/内部

最终用途

- 轻型机动车

- 汽车

- SUV

- 小型无人驾驶汽车

- 掀背车

- 轿车

- 轿跑车

- 敞篷车

- 其他的

- 吉普车

- 小型货车

- 其他的

- 汽车

中型机动车

- 公共汽车

- 速度

- 微型货车

重型机动车

- 卡车

- 预告片

- 容器

- 多轴客车

- 其他的

CNG(压缩天然气)燃料市场区域分析

对市场进行分析,并按国家、产品、来源、套件、燃料室、车辆类型、 CNG 加油站供应、 CNG 加油站实体和最终用途提供市场规模洞察和趋势,如上所述。

市场覆盖的国家包括保加利亚、塞尔维亚和罗马尼亚。

随着越来越多的人认识到罗马尼亚较低的排放和成本,预计罗马尼亚将因其环境效益和成本效益而占据主导地位。

报告的国家部分还提供了影响单个市场因素和国内市场监管变化,这些因素和变化影响了市场的当前和未来趋势。下游和上游价值链分析、技术趋势和波特五力分析、案例研究等数据点是用于预测单个国家市场情景的一些指标。此外,在提供国家数据的预测分析时,还考虑了区域品牌的存在和可用性以及它们因来自本地和国内品牌的激烈或稀缺竞争而面临的挑战、国内关税和贸易路线的影响。

CNG(压缩天然气)燃料市场份额

市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、产生的收入、市场潜力、研发投资、新市场计划、全球影响力、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度、应用主导地位。以上提供的数据点仅与公司对市场的关注有关。

在市场上运营的 CNG(压缩天然气)燃料市场领导者是:

- NIS(德国)

- KryoGas(欧洲)

- Engie SA(法国)

- 道达尔能源 SE(法国)

- 雪佛龙公司(美国)

- 壳牌有限公司 (英国)

CNG(压缩天然气)燃料市场的最新发展

- 2023年11月,根据Djordje Jajcanin的文章,塞尔维亚能源部长Dubravka Djedovic Handanovic表示,塞尔维亚将于11月底完成塞尔维亚-保加利亚天然气互联互通部分。该管道每年将输送18亿立方米的天然气,目前已接近投入运营。塞尔维亚最近还与阿塞拜疆签署了一项进口4亿立方米天然气的协议,使其能源来源多样化

- 2 月,壳牌集团完成了对可再生天然气 (RNG) 领先生产商 Nature Energy 的收购。这一战略举措标志着壳牌在低碳燃料领域的能力大幅扩张,强化了其加速能源转型的承诺。Nature Energy 专门通过厌氧消化生产沼气,将有机废物转化为可再生天然气 (RNG)。此次收购增强了壳牌在 RNG 市场的地位,为交通、工业和供暖提供了可持续的化石燃料替代品

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 CURRENCY AND PRICING

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELING

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 MARKET END-USE COVERAGE GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 BARGAINING POWER OF SUPPLIERS

4.2.4 BARGAINING POWER OF BUYERS

4.2.5 COMPETITIVE RIVALRY

4.3 PRODUCTION CONSUMPTION ANALYSIS

4.4 VENDOR SELECTION CRITERIA

4.5 BIO-CNG LEGISLATION

4.6 CNG OPERATING COMPANIES

4.7 ESTIMATION OF RETAIL CNG SALES PER OPERATING COMPANY

4.8 ESTIMATION OF TOTAL MOTOR FUELS RETAIL MARKET AND CNG RETAIL MARKET

4.9 NUMBER OF CNG REFUELING STATIONS

4.1 PRICE ANALYSIS

4.10.1 AVERAGE CNG PRICE PER COUNTRY IN EUR/KG – HISTORY AND FORECAST

4.10.2 PRICE STRUCTURE: INDUSTRIAL CNG PRICE/VAT/EXCISE DUTY PER COUNTRY IN EUR/KG – HISTORY & FORECAST

4.11 ANALYSIS OF TOTAL NUMBER OF REFUELING STATIONS (OFFERING ALL TYPES OF FUEL)

4.11.1 CURRENT DISTRIBUTION AND TRENDS

4.11.2 IMPLICATIONS AND FUTURE OUTLOOK

4.12 CLIMATE CHANGE SCENARIO

4.12.1 ENVIRONMENTAL CONCERNS

4.12.2 INDUSTRY RESPONSE

4.12.3 GOVERNMENT'S ROLE

4.12.4 ANALYST'S RECOMMENDATIONS

4.13 CNG REFUELLING INFRASTRUCTURE ANALYSIS

4.13.1 SERBIA

4.13.1.1 CURRENT STATE OF INFRASTRUCTURE

4.13.1.2 CHALLENGES

4.13.1.3 OPPORTUNITIES:

4.13.2 ROMANIA:

4.13.2.1 CURRENT STATE OF INFRASTRUCTURE:

4.13.2.2 CHALLENGES:

4.13.2.3 OPPORTUNITIES:

4.13.3 BULGARIA:

4.13.3.1 CURRENT STATE OF INFRASTRUCTURE:

4.13.3.2 CHALLENGES:

4.13.3.3 OPPORTUNITIES:

4.13.4 COMPARATIVE SUMMARY:

4.14 ESTIMATION OF TOTAL MOTOR FUELS RETAIL MARKET AND CNG RETAIL MARKET

4.14.1 INFRASTRUCTURE DEVELOPMENT:

4.14.2 GOVERNMENT POLICIES:

4.14.3 ENVIRONMENTAL CONCERNS:

4.14.4 MARKET SHARE DYNAMICS

4.15 GOVERNMENT AND LOCAL PERMITTING PROCESS FOR CNG INFRASTRUCTURE

4.15.1 INSTALLATION OF CNG EQUIPMENT

4.15.1.1 SERBIA:

4.15.1.2 ROMANIA:

4.15.1.3 BULGARIA:

4.15.2 FILLING OF STATIONARY CONTAINERS

4.15.2.1 SERBIA:

4.15.2.2 ROMANIA:

4.15.2.3 BULGARIA:

4.15.3 BUILDING REFUELING FACILITIES

4.15.3.1 SERBIA:

4.15.3.2 ROMANIA:

4.15.3.3 BULGARIA:

4.15.4 ADDITIONAL CONSIDERATIONS

4.15.4.1 SERBIA:

4.15.4.2 ROMANIA:

4.15.4.3 BULGARIA:

4.16 MARKET ANALYSIS ON VEHICLE TYPE: PASSENGER CARS VS. LDV (LIGHT DUTY BUSUES<5T AND LIGHT DUTY TRUCKS <3,5T) VS. HDV (HEAVY DUTY BUSES>5T AND HEAVY-DUTY VEHICLES>3,5T)

4.16.1 PASSENGER CARS

4.16.2 LIGHT DUTY VEHICLES (LDVS)

4.16.3 HEAVY DUTY VEHICLES (HDVS)

4.17 NATIONAL PROGRAM AND STRATEGIES FOR INCREASING CNG CONSUMPTION

4.17.1 SERBIA

4.17.2 ROMANIA

4.17.3 BULGARIA

4.18 NUMBER OF CNG REFUELING STATIONS AND THEIR SHARE

4.19 RAW MATERIAL COVERAGE

4.19.1 NATURAL GAS

4.19.2 SOURCES AND SUPPLY CHAIN

4.19.3 MARKET DYNAMICS

4.19.4 RECENT DEVELOPMENT

4.2 STANDARDS, TECHNICAL, AND SAFETY SPECIFICATIONS FOR CNG INFRASTRUCTURE

4.20.1 CNG CONTAINERS FOR STORAGE

4.20.1.1 MATERIAL STANDARDS

4.20.1.2 CERTIFICATION

4.20.1.3 INSPECTION AND TESTING

4.20.1.4 SAFETY FEATURES

4.20.2 COMPRESSION PLANTS

4.20.2.1 DESIGN STANDARDS

4.20.2.2 SAFETY PROTOCOLS

4.20.2.3 OPERATIONAL SAFETY

4.20.3 COMPRESSORS INSTALLATIONS

4.20.3.1 TECHNICAL SPECIFICATIONS

4.20.3.2 INSTALLATION REQUIREMENTS

4.20.3.3 SAFETY MEASURES

4.20.4 DISPENSING INSTALLATIONS

4.20.4.1 DISPENSER DESIGN

4.20.4.2 METERING ACCURACY

4.20.4.3 USER SAFETY

4.20.5 PIPING AND FITTINGS

4.20.5.1 MATERIAL SPECIFICATIONS

4.20.5.2 INSTALLATION STANDARDS

4.20.5.3 LEAK PREVENTION

4.20.6 SUPPLEMENTARY ELEMENTS

4.20.6.1 VALVES AND REGULATORS

4.20.6.2 CONTROL SYSTEMS

4.20.6.3 EMERGENCY SYSTEMS

4.20.7 COMPLIANCE AND CERTIFICATION

4.20.7.1 NATIONAL AND INTERNATIONAL STANDARDS

4.20.7.2 CERTIFICATION REQUIREMENTS

4.20.7.3 REGULAR AUDITS AND INSPECTIONS

4.21 SUPPLY CHAIN ANALYSIS

4.21.1 OVERVIEW

4.21.2 LOGISTIC COST SCENARIO

4.21.2.1 FUEL TRANSPORTATION COSTS

4.21.2.2 INFRASTRUCTURE-RELATED COSTS

4.21.2.3 ECONOMIES OF SCALE

4.21.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.21.3.1 SPECIALIZED KNOWLEDGE AND CAPABILITIES

4.21.3.2 NETWORK AND INFRASTRUCTUR

4.21.3.3 CROSS-BORDER COORDINATION

4.21.3.4 COST OPTIMIZATION

4.21.3.5 RISK MANAGEMENT

4.21.4 CONCLUSION

4.22 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.22.1 ADVANCED COMPRESSION TECHNOLOGY

4.22.2 IMPROVED STORAGE SOLUTIONS

4.22.3 INFRASTRUCTURE EXPANSION TECHNOLOGIES

4.22.4 DIGITAL MONITORING AND CONTROL SYSTEMS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING STRINGENT ENVIRONMENTAL POLICIES AND EMISSION REDUCTION TARGETS IN SERBIA, ROMANIA, AND BULGARIA SUPPORT THE ADOPTION OF CNG

6.1.2 RISING ECONOMIC BENEFITS OF USING CNG

6.1.3 INCREASED GOVERNMENT INCENTIVES AND SUBSIDIES PROMOTING THE USE OF CNG

6.2 RESTRAINTS

6.2.1 HIGH INITIAL COSTS ASSOCIATED WITH DEVELOPING CNG STATIONS AND INFRASTRUCTURE

6.2.2 LACK OF COMPREHENSIVE CNG REFUELLING INFRASTRUCTURE

6.3 OPPORTUNITIES

6.3.1 SUBSTANTIAL POTENTIAL IN CONVERTING EXISTING FLEETS OF PUBLIC AND PRIVATE TRANSPORTATION TO CNG

6.3.2 COLLABORATIVE EFFORTS BETWEEN SERBIA, ROMANIA, AND BULGARIA IN DEVELOPING CROSS-BORDER CNG INFRASTRUCTURE

6.4 CHALLENGES

6.4.1 INCREASING COMPETITION WITH ALTERNATIVE FUELS

6.4.2 STRICT SAFETY AND REGULATORY STANDARDS HEIGHTEN COMPLEXITY AND COSTS

7 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY PRODUCTS

7.1 OVERVIEW

7.2 CNG (METHANE-NATURAL GAS STORED UNDER HIGH PRESSURE AND USED AS TRANSPORTATION FUEL)

7.3 BIOCNG (BIOMETHANE)

8 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY SOURCE

8.1 OVERVIEW

8.2 ASSOCIATED GAS

8.2.1 NON-ASSOCIATED GAS

9 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY KITS

9.1 OVERVIEW

9.2 SEQUENTIAL

9.3 VENTURI

10 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY FUEL CHAMBER

10.1 OVERVIEW

10.2 DUAL-FUELLED VEHICLES

10.3 DEDICATED (CNG-FUELLED) VEHICLES

11 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY VEHICLE TYPE

11.1 OVERVIEW

11.2 PRIVATE

11.3 FLEET

12 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CNG FUEL STATIONS OFFERING

12.1 OVERVIEW

12.2 MONOFUEL REFUELLING STATIONS (OFFERING SOLELY CNG)

12.3 MULTIFUEL REFUELLING STATIONS (OFFERING CONVENTIONAL FUELS AND CNG)

13 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CNG FUEL STATIONS ENTITY

13.1 OVERVIEW

13.2 PUBLIC REFUELLING STATIONS (FREE ACCESS AT THE STATION)

13.3 PRIVATE/INTERNAL

14 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY END USE

14.1 OVERVIEW

14.2 LIGHT MOTOR VEHICLES

14.3 MEDIUM MOTOR VEHICLES

14.4 HEAVY MOTOR VEHICLES

15 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY COUNTRY

15.1 ROMANIA

15.2 BULGARIA

15.3 SERBIA

16 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: SERBIA

16.2 COMPANY SHARE ANALYSIS: ROMANIA

16.3 COMPANY SHARE ANALYSIS: BULGARIA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 ENGIE SA

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT UPDATES

18.2 TOTALENERGIES SE

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT UPDATES

18.3 SHELL PLC

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT UPDATES

18.4 CHEVRON CORPORATION

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT UPDATES

18.5 KRYOGAS

18.5.1 COMPANY SNAPSHOT

18.5.2 PRODUCT PORTFOLIO

18.5.3 RECENT DEVELOPMENTS

18.6 NIS

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

表格列表

TABLE 1 ESTIMATION OF RETAIL CNG SALES PER OPERATING COMPANY, TONS & SHARE

TABLE 2 SERBIA, ROMANIA, AND BULGARIA CNG FUEL RETAIL MARKET (TONS)

TABLE 3 SERBIA, ROMANIA, AND BULGARIA GASOLINE RETAIL MARKET (TONS)

TABLE 4 NUMBER OF CNG STATIONS AND AVERAGE PRICES IN EUROE, BY COUNTRY

TABLE 5 NATURAL GAS VEHICLES

TABLE 6 REGULATION COVERAGE

TABLE 7 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY PRODUCTS, 2020-2035 (USD THOUSAND)

TABLE 8 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY PRODUCTS, 2020-2035 (TONS)

TABLE 9 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY SOURCE, 2020-2035 (USD THOUSAND)

TABLE 10 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY SOURCE, 2020-2035 (TONS)

TABLE 11 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY KITS, 2020-2035 (USD THOUSAND)

TABLE 12 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY FUEL CHAMBER, 2020-2035 (USD THOUSAND)

TABLE 13 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY VEHICLE TYPE, 2020-2035 (USD THOUSAND)

TABLE 14 SERBIA, ROMANIA, AND BULGARIA FLEET IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY VEHICLE TYPE, 2020-2035 (USD THOUSAND)

TABLE 15 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CNG FUEL STATIONS OFFERING, 2020-2035 (USD THOUSAND)

TABLE 16 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CNG FUEL STATIONS ENTITY, 2020-2035 (USD THOUSAND)

TABLE 17 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY END USE, 2020-2035 (USD THOUSAND)

TABLE 18 SERBIA, ROMANIA, AND BULGARIA LIGHT MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

TABLE 19 SERBIA, ROMANIA, AND BULGARIA CARS IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CATEGORY, 2020-2035 (USD THOUSAND)

TABLE 20 SERBIA, ROMANIA, AND BULGARIA MEDIUM MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

TABLE 21 SERBIA, ROMANIA, AND BULGARIA HEAVY MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

TABLE 22 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY COUNTRY, 2020-2035 (USD THOUSAND)

TABLE 23 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY COUNTRY, 2020-2035 (TONS)

TABLE 24 ROMANIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY PRODUCTS, 2020-2035 (USD THOUSAND)

TABLE 25 ROMANIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY PRODUCTS, 2020-2035 (TONS)

TABLE 26 ROMANIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY SOURCE, 2020-2035 (USD THOUSAND)

TABLE 27 ROMANIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY SOURCE, 2020-2035 (TONS)

TABLE 28 ROMANIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY KITS, 2020-2035 (USD THOUSAND)

TABLE 29 ROMANIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY FUEL CHAMBER, 2020-2035 (USD THOUSAND)

TABLE 30 ROMANIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY VEHICLE TYPE, 2020-2035 (USD THOUSAND)

TABLE 31 ROMANIA FLEET IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY VEHICLE TYPE, 2020-2035 (USD THOUSAND)

TABLE 32 ROMANIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CNG FUEL STATIONS OFFERING, 2020-2035 (USD THOUSAND)

TABLE 33 ROMANIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CNG FUEL STATIONS ENTITY, 2020-2035 (USD THOUSAND)

TABLE 34 ROMANIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY END USE, 2020-2035 (USD THOUSAND)

TABLE 35 ROMANIA LIGHT MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

TABLE 36 ROMANIA CARS IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CATEGORY, 2020-2035 (USD THOUSAND)

TABLE 37 ROMANIA MEDIUM MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

TABLE 38 ROMANIA HEAVY MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

TABLE 39 BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY PRODUCTS, 2020-2035 (USD THOUSAND)

TABLE 40 BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY PRODUCTS, 2020-2035 (TONS)

TABLE 41 BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY SOURCE, 2020-2035 (USD THOUSAND)

TABLE 42 BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY SOURCE, 2020-2035 (TONS)

TABLE 43 BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY KITS, 2020-2035 (USD THOUSAND)

TABLE 44 BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY FUEL CHAMBER, 2020-2035 (USD THOUSAND)

TABLE 45 BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY VEHICLE TYPE, 2020-2035 (USD THOUSAND)

TABLE 46 BULGARIA FLEET IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY VEHICLE TYPE, 2020-2035 (USD THOUSAND)

TABLE 47 BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CNG FUEL STATIONS OFFERING, 2020-2035 (USD THOUSAND)

TABLE 48 BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CNG FUEL STATIONS ENTITY, 2020-2035 (USD THOUSAND)

TABLE 49 BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY END USE, 2020-2035 (USD THOUSAND)

TABLE 50 BULGARIA LIGHT MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

TABLE 51 BULGARIA CARS IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CATEGORY, 2020-2035 (USD THOUSAND)

TABLE 52 BULGARIA MEDIUM MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

TABLE 53 BULGARIA HEAVY MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

TABLE 54 SERBIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY PRODUCTS, 2020-2035 (USD THOUSAND)

TABLE 55 SERBIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY PRODUCTS, 2020-2035 (TONS)

TABLE 56 SERBIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY SOURCE, 2020-2035 (USD THOUSAND)

TABLE 57 SERBIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY SOURCE, 2020-2035 (TONS)

TABLE 58 SERBIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY KITS, 2020-2035 (USD THOUSAND)

TABLE 59 SERBIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY FUEL CHAMBER, 2020-2035 (USD THOUSAND)

TABLE 60 SERBIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY VEHICLE TYPE, 2020-2035 (USD THOUSAND)

TABLE 61 SERBIA FLEET IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY VEHICLE TYPE, 2020-2035 (USD THOUSAND)

TABLE 62 SERBIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CNG FUEL STATIONS OFFERING, 2020-2035 (USD THOUSAND)

TABLE 63 SERBIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CNG FUEL STATIONS ENTITY, 2020-2035 (USD THOUSAND)

TABLE 64 SERBIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY END USE, 2020-2035 (USD THOUSAND)

TABLE 65 SERBIA LIGHT MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

TABLE 66 SERBIA CARS IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CATEGORY, 2020-2035 (USD THOUSAND)

TABLE 67 SERBIA MEDIUM MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

TABLE 68 SERBIA HEAVY MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

图片列表

FIGURE 1 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET

FIGURE 2 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: DATA TRIANGULATION

FIGURE 3 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: DROC ANALYSIS

FIGURE 4 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: MULTIVARIATE MODELLING

FIGURE 7 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: DBMR MARKET POSITION GRID

FIGURE 9 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: MARKET END-USE COVERAGE GRID

FIGURE 10 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: SEGMENTATION

FIGURE 12 TWO SEGMENTS COMPRISE THE SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY PRODUCTS

FIGURE 13 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: OVERVIEW

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 RISING ECONOMIC BENEFITS OF USING CNG IS EXPECTED TO DRIVE THE SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET IN THE FORECAST PERIOD

FIGURE 16 THE CNG (METHANE-NATURAL GAS STORED UNDER HIGH PRESSURE AND USED AS TRANSPORTATION FUEL) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET IN 2024 AND 2031

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES

FIGURE 19 PRODUCTION CONSUMPTION ANALYSIS: SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET

FIGURE 20 VENDOR SELECTION CRITERIA

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET

FIGURE 22 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, PRODUCTS, 2023

FIGURE 23 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, SOURCE, 2023

FIGURE 24 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, KITS, 2023

FIGURE 25 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, FUEL CHAMBER, 2023

FIGURE 26 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, VEHICLE TYPE, 2023

FIGURE 27 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, CNG FUEL STATIONS OFFERING, 2023

FIGURE 28 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, CNG FUEL STATIONS ENTITY, 2023

FIGURE 29 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, END USE, 2023

FIGURE 30 SERBIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: COMPANY SHARE 2023 (%)

FIGURE 31 ROMANIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: COMPANY SHARE 2023 (%)

FIGURE 32 BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: COMPANY SHARE 2023 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。