北美减肥和肥胖管理市场,按产品类型(膳食补充剂和代餐)、产品形式(软凝胶、片剂、胶囊、粉末、软糖和果冻、预混料、液体等)、性质(常规和清洁标签)、类别(处方药和非处方药 (OTC))、最终用户人口统计(18 岁以下、18 至 35 岁、35 至 50 岁和 50 岁以上)、分销渠道(基于商店和非商店)、国家(美国、墨西哥和加拿大)行业趋势和预测到 2029 年。

市场分析和见解:北美减肥和肥胖管理市场

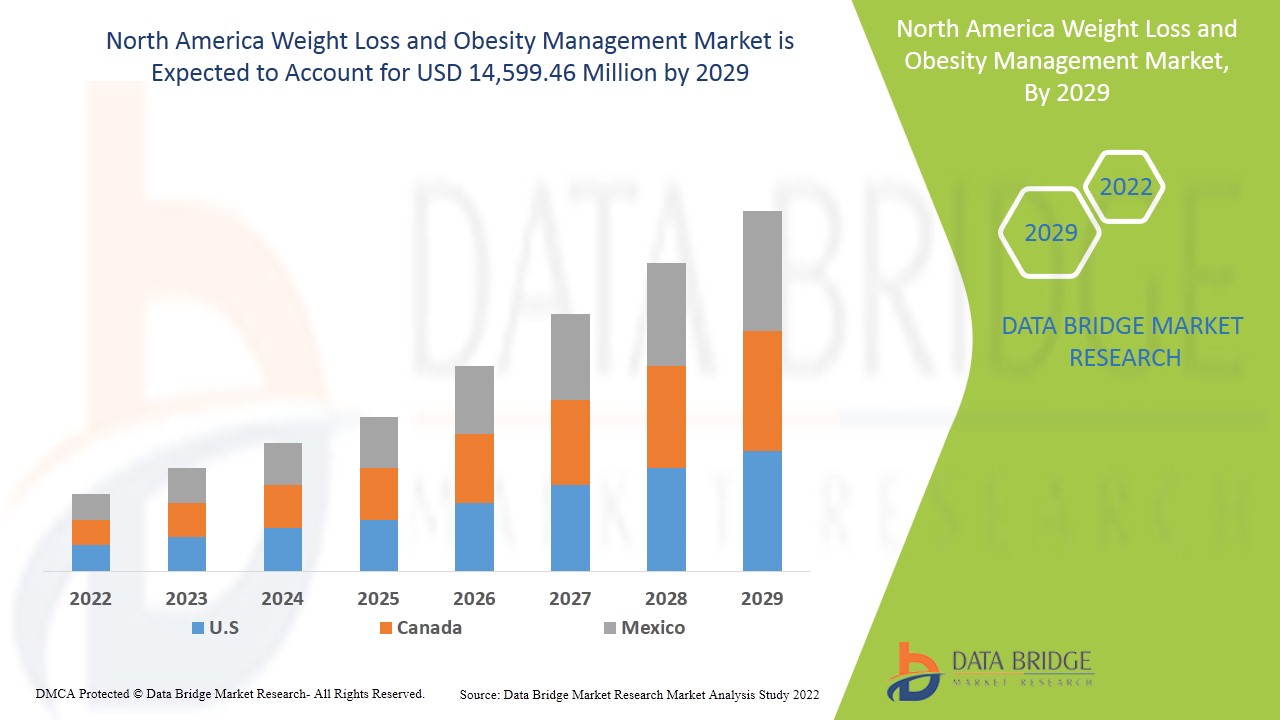

北美减肥和肥胖管理市场预计将在 2022 年至 2029 年的预测期内获得显着增长。Data Bridge Market Research 分析称,在 2022 年至 2029 年的预测期内,该市场的复合年增长率为 9.5%,预计到 2029 年将达到 145.9946 亿美元。

北美人口肥胖病例数量的激增预计将推动减肥和肥胖管理市场的增长。由于不健康和久坐的生活方式的增加,高血压和糖尿病等慢性病的患病率增加,以及减肥手术数量的激增,预计将加速减肥和肥胖管理市场的增长。

- 此外,人们对垃圾食品的偏爱增加、缺乏运动、忙碌的日常生活和日益增加的压力导致人们消费快餐,这将进一步影响减肥和肥胖管理市场的增长。此外,越来越多的人采用在线减肥和体重管理计划、政府提高认识的举措以及发展中经济体可支配收入的增加将对减肥和肥胖管理市场的增长产生积极影响。此外,儿童肥胖率的上升和新兴国家的崛起为减肥和肥胖管理市场带来了盈利机会。

然而,低热量饮食的高成本以及欺骗性营销行为的问题预计将阻碍减肥和肥胖管理市场的增长。严格的法规和规范的实施预计将进一步挑战市场的增长。

北美减肥和肥胖管理市场报告提供了市场份额、新发展和产品线分析、国内和本地市场参与者的影响的详细信息,分析了新兴收入领域、市场法规变化、产品审批、战略决策、产品发布、地域扩张和市场技术创新方面的机会。要了解分析和市场情况,请联系我们获取分析师简报,我们的团队将帮助您创建收入影响解决方案,以实现您的预期目标。

北美减肥和肥胖管理市场范围和市场规模

北美减肥和肥胖管理市场根据产品类型、产品形式、性质、类别、最终用户人口统计和分销渠道分为六个显著的部分。

- 根据产品类型,北美减肥和肥胖管理市场分为膳食补充剂和代餐。由于发展中经济体肥胖人口不断增加,消费者对低热量食品和饮料的认识不断提高,预计到 2022 年,膳食补充剂将占据市场主导地位。

- 根据产品形式,北美减肥和肥胖管理市场细分为软凝胶、片剂、胶囊、粉末、软糖和果冻、预混料、液体等。与其他形式的减肥和肥胖管理相比,粉末形式易于使用,预计 2022 年粉末部分将占据市场主导地位。

- 根据自然性,北美减肥和肥胖管理市场分为传统和清洁标签。到 2022 年,由于对有机、天然种植产品的需求不断增长,传统市场预计将占据市场主导地位。

- 根据类别,北美减肥和肥胖管理市场分为处方药和非处方药 (OTC)。2022 年,非处方药 (OTC) 市场预计将占据市场主导地位,因为减肥和肥胖管理用非处方药越来越受欢迎。

- 根据最终用户,北美减肥和肥胖管理市场细分为 18 岁以下、18 至 35 岁、35 至 50 岁和 50 岁以上。到 2022 年,由于儿童肥胖率上升,预计 18 至 35 岁人群将占据市场主导地位。

- 根据分销渠道,北美减肥和肥胖管理市场分为实体店和非实体店。由于新冠疫情的出现,预计 2022 年非实体店市场将占据市场主导地位。

减肥和肥胖管理市场国家级分析

对北美减肥和肥胖管理市场进行了分析,并根据产品类型、产品形式、性质、类别、最终用户人口统计和分销渠道提供了市场规模信息。

据报道,该地区减肥和肥胖管理市场涵盖的国家包括美国、加拿大和墨西哥

由于主要工业家正专注于开发减肥产品以满足消费者的需求,预计北美将在 2022 年至 2029 年的预测期内以最有希望的增长率增长。

减肥和肥胖管理需求不断增长

北美减肥和肥胖管理市场还为您提供每个国家/地区行业增长的详细市场分析,包括销售额、零部件销售额以及持续发布和监管情景变化对市场的支持的影响。数据涵盖 2022 年至 2029 年的历史时期。

竞争格局及减肥和肥胖管理份额分析

北美减肥和肥胖管理市场竞争格局按竞争对手提供详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、北美业务、生产基地和设施、公司优势和劣势、产品发布、产品试验渠道、产品批准、专利、产品宽度和广度、应用主导地位以及技术生命线曲线。以上提供的数据点仅与公司对南美减肥和肥胖管理市场的关注有关。

减肥和肥胖管理市场的一些主要参与者包括 Herbalife International of America, Inc.、ABH Pharma Inc.、Vitaco、Amway Corp.、Stepan Company、GNC Holdings, LLC、GlaxoSmithKline plc.、Glanbia PLC、Abbott、Shaklee Corporation、Nu Skin Enterprises、Atlantic Multipower UK Ltd.、Nature's Sunshine Products, Inc.、Ajinomoto Co., Inc.、Bionova、DSM、American Health、Omega Protein Corporation、Integrated BioPharma, Inc.、Bio-Tech Pharmacal、The Himalaya Drug Company、Pharmavite、Ricola、BLACKMORES 等。

世界各地的公司也发起了各种产品的开发,这也加速了减肥和肥胖管理市场的增长。

例如,

- 2020 年 10 月,据 GlobeNewswire, Inc. 报道,Meticore 推出了针对男性和女性的新型减肥补充剂。该补充剂有助于促进新陈代谢,因为它有助于提高内部细胞的温度,从而促进新陈代谢再生。该配方采用六种优质植物营养素和草药提取物以及 Meticore 药丸制成。

合作、合资和其他战略通过扩大覆盖范围和存在感来提高公司的市场份额。通过扩大规模范围,组织还可以改善其减肥和肥胖管理产品的供应。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 COMPARATIVE ANALYSIS (HERBAL SUPPLEMENTS VS SYNTHETIC SUPPLEMENTS)

4.2 PRICING ANALYSIS FOR WEIGHT LOSS & OBESITY MANAGEMENT SUPPLEMENTS-

4.3 VALUE CHAIN FOR NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET

4.4 SUPPLY CHAIN OF NORTH AMERICA WEIGHT LOSS & OBESITY MANAGEMENT MARKET

4.5 BRAND COMPARATIVE ANALYSIS

4.6 CLEAN LABELED PRODUCT LAUNCHES

4.7 CONSUMER TRENDS

4.8 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET- GROWTH STRATEGIES ADOPTED BY KEY PLAYERS

4.9 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET- INDUSTRY TRENDS AND FUTURE PERSPECTIVES

5 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET- REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING RATES IN CHRONIC DISEASES

6.1.2 INCREASING PREVALENCE OF OBESITY

6.1.3 INCREASE IN GERIATRIC POPULATION

6.1.4 INCREASING BARIATRIC SURGERIES

6.2 RESTRAINTS

6.2.1 STRINGENT RULES & REGULATIONS

6.2.2 HIGH COST ASSOCIATED WITH THE LOW-CALORIE DIETS

6.3 OPPORTUNITIES

6.3.1 RISING DISPOSABLE INCOME ENHANCING THE PURCHASING POWER OF RELATED WEIGHT LOSS PRODUCTS

6.3.2 GROWING CONSUMPTION OF PROCESSED FOOD

6.3.3 RISE IN STRATEGIC INITIATIVES BY MARKET PLAYERS

6.4 CHALLENGES

6.4.1 LACK OF AWARENESS IN LOWER INCOME COUNTRIES

6.4.2 INCREASE IN PRODUCT RECALL

7 IMPACT OF COVID-19 ON THE NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET

7.1 AFTERMATH OF COVID-19

7.2 IMPACT ON DEMAND AND SUPPLY CHAIN

7.3 IMPACT ON PRICE

7.4 CONCLUSION

8 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 DIETARY SUPPLEMENTS

8.2.1 SUPPLEMENT TYPE

8.2.1.1 Herbal/Natural

8.2.1.2 Synthetic

8.2.2 ACTIVE INGREDIENT TYPE

8.2.2.1 Green Tea Extract

8.2.2.2 Chitosan

8.2.2.3 Pyruvate

8.2.2.4 Probiotics

8.2.2.5 Conjugated Linoleic Acid

8.2.2.6 Green Coffee Bean Extract

8.2.2.7 Caffeine

8.2.2.8 Chromium

8.2.2.9 Bitter Orange (Citrus Aurantium L.)

8.2.2.10 Carnitine

8.2.2.11 African Mango (Irvingia Gabonensis)

8.2.2.12 White Kidney Bean (Phaseolus Vulgaris)

8.2.2.13 Others

8.3 MEAL REPLACEMENTS

8.3.1 POWDERED MIXES

8.3.2 READY TO DRINK BEVERAGES/SHAKES

8.3.3 PROTEIN BARS

8.3.4 OTHERS

9 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM

9.1 OVERVIEW

9.2 POWDERS

9.3 CAPSULE

9.4 LIQUIDS

9.5 TABLETS

9.6 PREMIXES

9.7 SOFT GELS

9.8 GUMMIES & JELLIES

9.9 OTHERS

10 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 STORE BASED

10.2.1 PHARMACIES

10.2.2 SPECIALTY STORES

10.2.3 HEALTH AND BEAUTY STORES

10.2.4 CONVENIENCE STORE

10.2.5 SUPERMARKET/HYPERMARKET

10.2.6 OTHERS

10.3 NON STORED BASED

10.3.1 ONLINE (THIRD PARTY ONLINE RETAILERS)

10.3.2 COMPANY OWNED WEBSITE

11 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY

11.1 OVERVIEW

11.2 TO 35 YEARS

11.3 TO 50 YEARS

11.4 ABOVE 50 YEARS

11.5 UNDER 18 YEARS

12 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 MEXICO

12.1.3 CANADA

13 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 QUESTIONNAIRE

15 RELATED REPORTS

表格列表

TABLE 1 MOST OBESE COUNTRIES OF ASIA-PACIFIC 2020

TABLE 2 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA POWDERS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA CAPSULE IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA LIQUIDS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA TABLETS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA PREMIXES IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA SOFT GELS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA GUMMIES & JELLIES IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA OTHERS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION))

TABLE 18 NORTH AMERICA STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA 18 TO 35 YEARS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA 35 TO 50 YEARS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA ABOVE 50 YEARS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA UNDER 18 YEARS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 36 NORTH AMERICA NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 37 U.S. WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 38 U.S. DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 39 U.S. DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 40 U.S. MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 41 U.S. WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 42 U.S. WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 43 U.S. WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 44 U.S. STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 45 U.S. NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 46 MEXICO WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 47 MEXICO DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 48 MEXICO DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 49 MEXICO MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 50 MEXICO WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 51 MEXICO WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 52 MEXICO WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 53 MEXICO STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 54 MEXICO NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 55 CANADA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 56 CANADA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 57 CANADA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 58 CANADA MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 59 CANADA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 60 CANADA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 61 CANADA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 62 CANADA STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 63 CANADA NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

图片列表

FIGURE 1 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET : DROC ANALYSIS

FIGURE 4 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA REGION IS EXPECTED TO DOMINATE THE NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET WHEREAS ASIA-PACIFIC IS GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 INCREASE IN OBESE POPULATION IS DRIVING THE GROWTH OF NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 DIETARY SUPPLEMENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS THE FASTEST-GROWING MARKET FOR WEIGHT LOSS AND OBESITY MANAGEMENT MANUFACTURERS IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 SUPPLY CHAIN OF WEIGHT LOSS & OBESITY MANAGEMENT MARKET

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET

FIGURE 16 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY PRODUCT TYPE, 2021

FIGURE 17 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY PRODUCT FORM, 2021

FIGURE 18 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 19 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2021

FIGURE 20 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: SNAPSHOT (2021)

FIGURE 21 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY COUNTRY (2021)

FIGURE 22 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 25 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。