North America Wearable Conferencing Technology Market, By Offering (Hardware, Software, and Services), Conferencing Type (Audio Conferencing and Video Conferencing), Deployment Mode (On-Premise and Cloud), Organization Size (Small & Medium Organization and Large Organization), Application (Consumer and Enterprise), End Use (Corporate, Education, Healthcare, Government and Defense, Banking, Financial Services and Insurance (BSFI), Media and Entertainment and Other), Country (U.S., Canada and Mexico) Industry Trends and Forecast to 2029

Market Analysis and Insights: North America Wearable Conferencing Technology Market

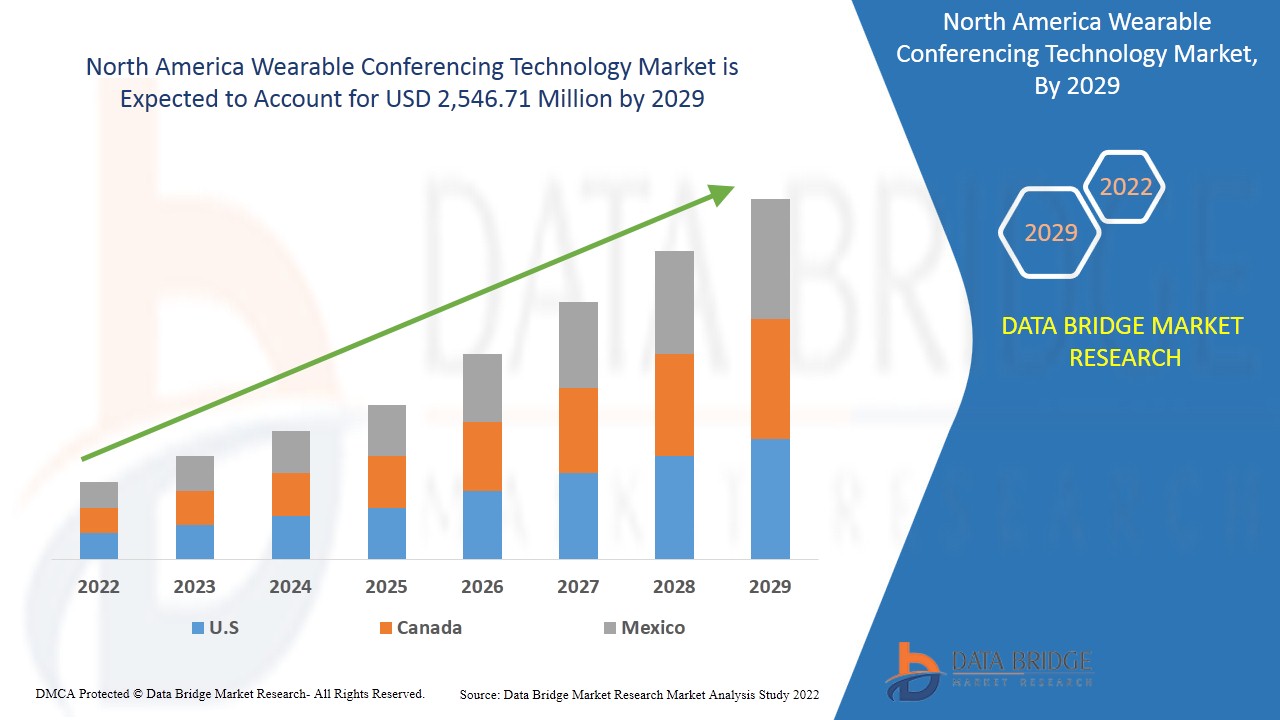

North America wearable conferencing technology market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 13.6% in the forecast period of 2022 to 2029 and is expected to reach USD 2,546.71 million by 2029. Surging focus and adoption of remote working culture is boosting the North America wearable conferencing technology market.

Wearable technology, often known as "wearables," is a class of electronic devices that can be worn on the body. The gadgets are hands-free devices with practical applications that are powered by microprocessors and have the ability to send and receive data via the Internet. Real-time cooperation between several devices is possible with conferencing solutions. Participants can join a single digital place using their mobile devices, laptops, or personal computers (PCs) using a conferencing platform. Users can use an Internet connection to access conferencing technologies that are supplied as software as a service (SaaS). A web conferencing platform can also be supplied on-premises, utilizing an organization's data center capabilities. Thus, it is a technology, which is used in the devices such as Google Glasses or Microsoft HoloLens for the application of conferencing and collaborating via audio or video medium. Currently this market has wide applications in the corporate world for professional collaborations and in educational and training sectors.

The surging focus and adoption of remote working culture acts as a driver in the North America wearable conferencing technology market. The intermittent nature of wind energy prove to be a challenge. However, increase in various strategic decisions such as partnerships are expected to provide opportunities for the North America wearable conferencing technology market. The high cost of conferencing infrastructure can prove to be a restrain for the market.

The North America wearable conferencing technology market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the North America Wearable conferencing technology market scenario, contact Data Bridge Market Research for an Analyst Brief; our team will help you create a revenue impact solution to achieve your desired goal.

North America Wearable Conferencing Technology Market Scope and Market Size

The North America wearable conferencing technology market is segmented based on offering, conferencing type, deployment mode, organization size, application and end use. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- Based on offering, the North America wearable conferencing technology market is segmented into hardware, software and services. Hardware is further sub-segmented into camera, microphone and others. In addition, services is further sub-segmented into managed services and professional services. In 2022, hardware is expected to dominate the North America wearable conferencing technology market as it generates more revenue and more research and development in hardware by large organizations.

- Based on conferencing type, the North America wearable conferencing technology market is segmented into audio conferencing and video conferencing. In 2022, the video conferencing segment is expected to dominate as it facilitates virtual meetings and collaboration on digital documents and shared presentations by connecting individuals in real time.

- Based on deployment mode, the North America wearable conferencing technology market is segmented into on-premise and cloud. In 2022, on-premise segment is anticipated to dominate the market as it help to provide security and privacy of the infrastructure as it is locally situated. The deployment of this type is cheaper compared to cloud.

- Based on organization size, the North America wearable conferencing technology market is segmented into small & medium organization and large organization. In 2022, large organization segment is anticipated to dominate the market as the solution requires higher capital investment and the cost is justified by the companies higher revenue generation by the deployment of this technology.

- Based on application, the North America wearable conferencing technology market is segmented into consumer and enterprise. In 2022, enterprise segment is anticipated to dominate the market as it the solution help the employees to working remotely with ease and efficiency.

- Based on end use, the North America wearable conferencing technology market is segmented into corporate, education, healthcare, government and defense, banking, financial services and insurance (BSFI), media and entertainment and other. In 2022, corporate segment is anticipated to dominate the market as conferencing solutions help the employees to collaborate and work on shared documents together in real time or through screen sharing.

North America Wearable Conferencing Technology Market Country Level Analysis

The North America Wearable conferencing technology market is analyzed, and market size offering, conferencing type, deployment mode, organization size, application and end use as referenced above.

The countries covered in the North America wearable conferencing technology market report are U.S., Canada and Mexico. U.S. dominates the North America Wearable conferencing technology market due to the key players’ presence from the wearable devices as well as the conferencing software providers. Canada holds the second place as the country is seeing development in the AR & MR market with research facilities of small companies and demand from healthcare industry.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Increasing penetration of smart devices and internet services is boosting the market growth of North America wearable conferencing technology market

The North America wearable conferencing technology market also provides you with a detailed market analysis for every country's growth in a particular market. Additionally, it provides detailed information regarding the market players’ strategy and their geographical presence. The data is available for the historical period 2011 to 2020.

Competitive Landscape and North America Wearable Conferencing Technology Market Share Analysis

The North America wearable conferencing technology market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width, and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to the North America wearable conferencing technology market.

The major companies which are dealing in the North America wearable conferencing technology are Logitech, Vuzix Corporation, Vidyo, Inc., Ricoh, Zoom Video Communications, Inc., Microsoft, LogMeIn, Inc., RealWear, Inc., DIALPAD, INC., Google (a subsidiary of Alphabet Inc.), Chironix, Seiko Epson Corporation, Iristick, Robert Bosch GmbH, ezTalks, HTC Corporation, Sony Corporation, Lenovo, EON Reality, TeamViewer among others in domestic players. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many contracts and agreements are also initiated by the companies worldwide, which accelerates the North America wearable conferencing technology market.

For instances,

- In October 2021, LogMeIn, Inc. has released GoToConnect Legal, a new version of its unified communications as a service (UCaaS) platform. The platform is designed to meet the demands of legal professionals by facilitating collaboration with clients and colleagues in order to maximize billable hours. The solution will allow minimizing unbilled time, maximizing revenue, managing regulations from governing bodies, and maintaining high security in their practice. Thus, the company will help to deliver high quality and easily billable services to their clients.

- In December 2021, Vidyo, Inc. unveiled new VidyoRoom Solutions interfaces, including three new in-office video conferencing experiences tailored to deliver the best collaboration environment for hybrid teams. New interfaces for huddle rooms, meeting rooms, and boardrooms, including conference controls and support for immersive experiences, will become increasingly vital as employees try to return to the office following the pandemic, while others continue to work remotely. With this company will be able to provide user-friendly experience to its clients.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SURGING FOCUS AND ADOPTION OF REMOTE WORKING CULTURE

5.1.2 INCREASING PENETRATION OF SMART DEVICES AND INTERNET SERVICES

5.1.3 RISE IN ADOPTION OF CONFERENCING TECHNOLOGY BY EDUCATIONAL INSTITUTES

5.2 RESTRAINTS

5.2.1 HIGH COST OF CONFERENCING INFRASTRUCTURE

5.2.2 LOSS OF DATA AND PRIVACY

5.3 OPPORTUNITIES

5.3.1 INCREASE IN VARIOUS STRATEGIC DECISIONS SUCH AS PARTNERSHIP AND ACQUISITION

5.3.2 RISE IN INITIATIVES BY GOVERNMENT

5.4 CHALLENGES

5.4.1 NORTH AMERICA ECONOMIC SLOWDOWN LIMITS

5.4.2 ELECTRONIC COMPONENTS ARE PUSHING SMART GLASSES BOUNDARIES

6 IMPACT ANALYSIS OF COVID-19 ON NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 STRATEGIC DECISION BY MANUFACTURERS AND GOVERNMENT INITIATIVES AFTER COVID-19

6.3 IMPACT ON DEMAND

6.4 PRICE IMPACT

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY OFFERING

7.1 OVERVIEW

7.2 HARDWARE

7.2.1 CAMERA

7.2.2 MICROPHONE

7.2.3 OTHERS

7.3 SOFTWARE

7.4 SERVICES

7.4.1 MANAGED SERVICES

7.4.2 PROFESSIONAL SERVICES

8 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY CONFERENCING TYPE

8.1 OVERVIEW

8.2 VIDEO CONFERENCING

8.3 AUDIO CONFERENCING

9 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE

9.1 OVERVIEW

9.2 ON-PREMISE

9.3 CLOUD

10 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE

10.1 OVERVIEW

10.2 LARGE ORGANIZATION

10.3 SMALL & MEDIUM ORGANIZATION

11 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 ENTERPRISE

11.3 CONSUMER

12 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY END USE

12.1 OVERVIEW

12.2 CORPORATE

12.2.1 MARKET BY DEPLOYMENT MODE

12.2.1.1 ON-PREMISE

12.2.1.2 CLOUD

12.2.2 MARKET BY ORGANIZATION SIZE

12.2.2.1 LARGE ORGANIZATION

12.2.2.2 SMALL & MEDIUM ORGANIZATION

12.3 EDUCATION

12.3.1 MARKET BY DEPLOYMENT MODE

12.3.1.1 ON-PREMISE

12.3.1.2 CLOUD

12.3.2 MARKET BY ORGANIZATION SIZE

12.3.2.1 LARGE ORGANIZATION

12.3.2.2 SMALL & MEDIUM ORGANIZATION

12.4 HEALTHCARE

12.4.1 MARKET BY DEPLOYMENT MODE

12.4.1.1 ON-PREMISE

12.4.1.2 CLOUD

12.4.2 MARKET BY ORGANIZATION SIZE

12.4.2.1 LARGE ORGANIZATION

12.4.2.2 SMALL & MEDIUM ORGANIZATION

12.5 GOVERNMENT AND DEFENSE

12.5.1 MARKET BY DEPLOYMENT MODE

12.5.1.1 ON-PREMISE

12.5.1.2 CLOUD

12.5.2 MARKET BY ORGANIZATION SIZE

12.5.2.1 LARGE ORGANIZATION

12.5.2.2 SMALL & MEDIUM ORGANIZATION

12.6 MEDIA AND ENTERTAINMENT

12.6.1 MARKET BY DEPLOYMENT MODE

12.6.1.1 ON-PREMISE

12.6.1.2 CLOUD

12.6.2 MARKET BY ORGANIZATION SIZE

12.6.2.1 LARGE ORGANIZATION

12.6.2.2 SMALL & MEDIUM ORGANIZATION

12.7 BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI)

12.7.1 MARKET BY DEPLOYMENT MODE

12.7.1.1 ON-PREMISE

12.7.1.2 CLOUD

12.7.2 MARKET BY ORGANIZATION SIZE

12.7.2.1 LARGE ORGANIZATION

12.7.2.2 SMALL & MEDIUM ORGANIZATION

12.8 OTHER

12.8.1 MARKET BY DEPLOYMENT MODE

12.8.1.1 ON-PREMISE

12.8.1.2 CLOUD

12.8.2 MARKET BY ORGANIZATION SIZE

12.8.2.1 LARGE ORGANIZATION

12.8.2.2 SMALL & MEDIUM ORGANIZATION

13 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 GOOGLE (A SUBSIDIARY OF ALPHABET INC.)

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 MICROSOFT

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 LENEVO

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 RICOH

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 SEIKO EPSON CORPORATION

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 CHIRONIX

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 DIALPAD, INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 EON REALITY

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 EZTALKS

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 HTC CORPORATION

16.10.1 COMPANY PROFILE

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

16.11 IRISTICK

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 LOGITECH

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 LOGMEIN, INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 REALWEAR, INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 ROBERT BOSCH GMBH

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENT

16.16 SONY CORPORATION

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 TEAMVIEWER

16.17.1 COMPANY SNAPSHOT

16.17.2 REVNUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENTS

16.18 VIDYO, INC.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 VUZIX CORPORATION

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENT

16.2 ZOOM VIDEO COMMUNICATIONS, INC.

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 COMPANY SHARE ANALYSIS

16.20.4 PRODUCT PORTFOLIO

16.20.5 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

表格列表

TABLE 1 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA HARDWARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA HARDWARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA SOFTWARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA SERVICES IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA SERVICES IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY CONFERENCING TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA VIDEO CONFERENCING IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA AUDIO CONFERENCING IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA ON-PREMISE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA CLOUD IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA LARGE ORGANIZATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA SMALL & MEDIUM ORGANIZATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA ENTERPRISE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA CONSUMER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA HARDWARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA SERVICES IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY CONFERENCING TYPE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 64 U.S. WEARABLE CONFERENCING TECHNOLOGY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 65 U.S. HARDWARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 U.S. SERVICES IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 U.S. WEARABLE CONFERENCING TECHNOLOGY MARKET, BY CONFERENCING TYPE, 2020-2029 (USD MILLION)

TABLE 68 U.S. WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 69 U.S. WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 70 U.S. WEARABLE CONFERENCING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 U.S. WEARABLE CONFERENCING TECHNOLOGY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 72 U.S. CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 73 U.S. CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 74 U.S. EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 75 U.S. EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 76 U.S. HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 77 U.S. HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 78 U.S. GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 79 U.S. GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 80 U.S. MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 81 U.S. MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 82 U.S. BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 83 U.S. BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 84 U.S. OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 85 U.S. OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 86 CANADA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 87 CANADA HARDWARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 CANADA SERVICES IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 CANADA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY CONFERENCING TYPE, 2020-2029 (USD MILLION)

TABLE 90 CANADA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 91 CANADA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 92 CANADA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 93 CANADA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 94 CANADA CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 95 CANADA CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 96 CANADA EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 97 CANADA EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 98 CANADA HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 99 CANADA HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 100 CANADA GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 101 CANADA GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 102 CANADA MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 103 CANADA MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 104 CANADA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 105 CANADA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 106 CANADA OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 107 CANADA OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 108 MEXICO WEARABLE CONFERENCING TECHNOLOGY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 109 MEXICO HARDWARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 MEXICO SERVICES IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 MEXICO WEARABLE CONFERENCING TECHNOLOGY MARKET, BY CONFERENCING TYPE, 2020-2029 (USD MILLION)

TABLE 112 MEXICO WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 113 MEXICO WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 114 MEXICO WEARABLE CONFERENCING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 115 MEXICO WEARABLE CONFERENCING TECHNOLOGY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 116 MEXICO CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 117 MEXICO CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 118 MEXICO EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 119 MEXICO EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 120 MEXICO HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 121 MEXICO HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 122 MEXICO GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 123 MEXICO GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 124 MEXICO MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 125 MEXICO MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 126 MEXICO BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 127 MEXICO BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 128 MEXICO OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 129 MEXICO OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: SEGMENTATION

FIGURE 11 RISING PREFERENCE FOR REMOTE WORKING IS EXPECTED TO DRIVE NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKETIN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKETIN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET

FIGURE 14 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY OFFERING, 2021

FIGURE 15 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY CONFERENCING TYPE, 2021

FIGURE 16 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY DEPLOYMENT MODE, 2021

FIGURE 17 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 18 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY APPLICATION, 2021

FIGURE 19 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY END USE, 2021

FIGURE 20 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: SNAPSHOT (2021)

FIGURE 21 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY COUNTRY (2021)

FIGURE 22 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY OFFERING (2022-2029)

FIGURE 25 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。