北美粘液补充剂市场,按来源(动物来源和非动物来源)、年龄组(老年人和成年人)、注射(单次注射、三次注射和五次注射)、分子量(中等分子量、低分子量和高分子量)、最终用户(医院、骨科诊所、门诊护理中心等)、分销渠道(直接招标和零售销售)划分 - 行业趋势和预测到 2029 年。

北美粘液补充市场分析与洞察

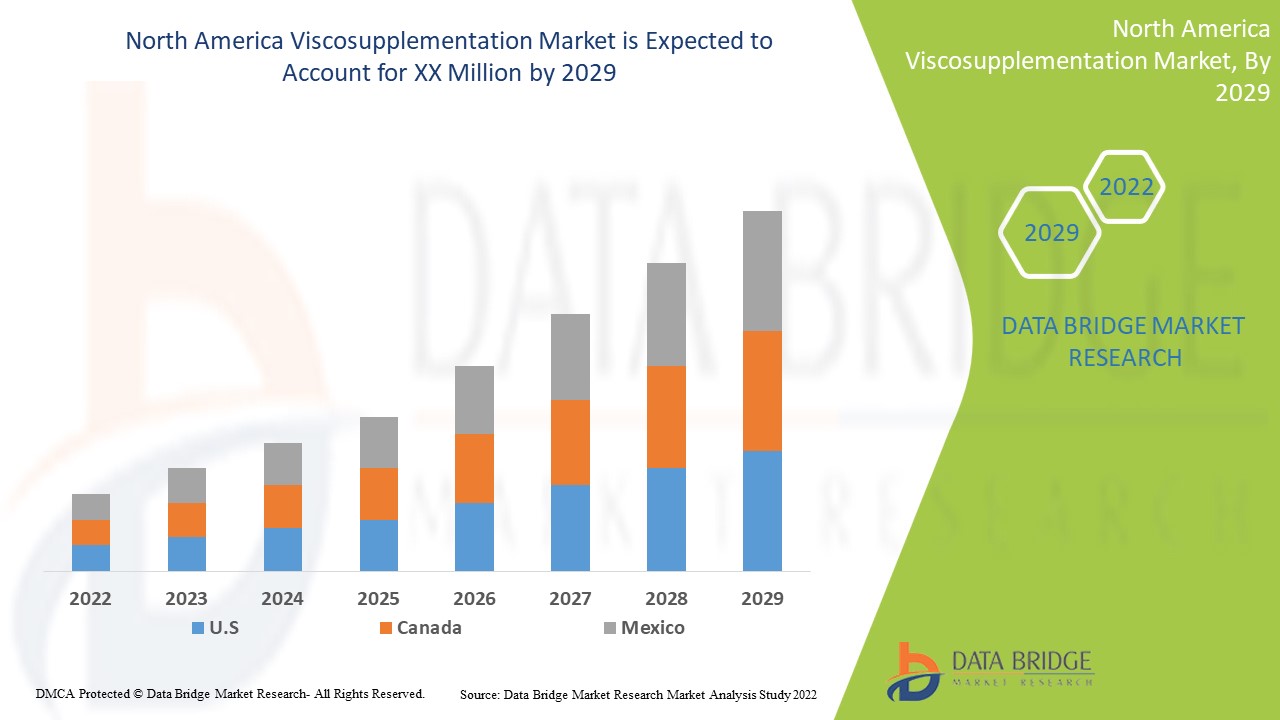

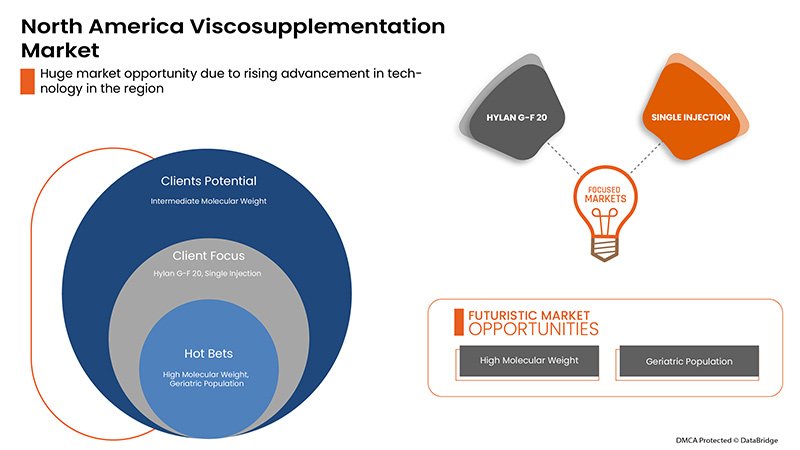

预计北美粘液补充市场将在 2022 年至 2029 年的预测期内增长。Data Bridge Market Research 分析,在 2022 年至 2029 年的预测期内,该市场的复合年增长率为 8.7%。北美医疗保健领域粘液补充治疗的技术进步是推动北美粘液补充市场在预测期内增长的另一个因素。

然而,治疗费用高昂,以及暂时注射、部位疼痛、肿胀、发热和红肿等副作用将限制市场的增长。主要市场参与者建立合作伙伴关系和收购等战略联盟,为北美粘弹性补充市场的增长提供了机会。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020 |

|

定量单位 |

收入(百万美元) 销量(台数)、定价(美元) |

|

涵盖的领域 |

按来源(动物来源和非动物来源)、年龄组(老年人和成年人)、注射(单次注射、三次注射和五次注射)、分子量(中等分子量、低分子量和高分子量)、最终用户(医院、骨科诊所、门诊护理中心等)、分销渠道(直接招标和零售) |

|

覆盖国家 |

美国、加拿大、墨西哥、巴拿马、牙买加和多米尼加共和国 |

|

涵盖的市场参与者 |

北美粘稠补充剂市场的一些主要参与者包括 Anika Therapeutics, Inc.、SEIKAGAKU CORPORATION、Bioventus、Fidia Farmaceutici SPA、Ferring BV、sanofi-aventis US LLC、Zimmer Biomet、OrthogenRx, Inc.(AVNS 的子公司) 、APTISSEN、Johnson & Johnson Services, Inc.、LG Chem.、Viatris Inc.、IBSA Institut Biochimique SA、Ortobrand International、TRB CHEMEDICA SA、Teva Pharmaceutical Industries Ltd.、Lifecore(Landec Corporation 的子公司)、VIRCHOW BIOTECH、Zuventus HealthCare Ltd.(Emcure Pharmaceuticals 的子公司)等。 |

市场定义

治疗模式粘弹性补充疗法的开发是为了长期缓解患有骨关节炎或创伤性关节炎的人和动物关节的疼痛,其基础是发现在关节炎情况下,透明质酸的平均分子量和浓度会降低。因此,滑液的弹性粘度会显著降低。粘弹性补充疗法是一种治疗过程,通过关节穿刺术从关节中取出病理性滑液或积液,并用高度纯化的透明质酸溶液代替,该溶液的浓度是病理性关节液的 16 至 30 倍,是健康滑液中透明质酸浓度的 2 至 5 倍。在当今用于治疗目的的某些透明质酸制剂中,流变性质(粘度和弹性)较低。因此,液体的弹性粘度与从关节炎关节中取出的液体的弹性粘度相似。另一种可供全球患者使用的制剂由透明质酸衍生物 (hylans) 组成,其弹性粘度远高于透明质酸溶液。其流变特性与年轻健康个体体内的液体相当。粘弹性补充剂的临床益处是可以长期缓解关节炎关节的疼痛。

此外,对骨关节炎非手术治疗的需求不断增加、生活方式引起的疾病的普遍性以及基于透明质酸的疗法的开发进步是预计推动市场发展的一些因素。

市场动态

驱动程序

- 老年人口不断增加

随着年龄的增长,因致命创伤而入院的老年患者数量也相应增加。膝关节骨关节炎疾病的患病率不断上升,导致对诊断和治疗的需求不断增加。随着人口的增长,医疗保健系统的压力也在增加。对适当治疗的需求不断增加,这相应地也增加了对预防和治疗膝关节骨关节炎疾病(如肌肉减少症、骨质疏松症、骨质减少症和其他并发症)的护理、服务和技术的需求。老年人更容易患上这些疾病,导致骨骼和关节脆弱。对于这类患者,在治疗过程中使用粘弹性补充疗法,为他们的身体带来即时有效的益处。

随着年龄的增长和骨关节炎患病率的上升,对疾病早期诊断的需求也在增加。因此,全球医疗保健系统对粘弹性补充治疗的需求正在上升。

- 增加骨质疏松症和骨关节炎的风险

骨质疏松症是一种骨骼疾病,其发展原因是骨矿物质密度和骨量较低,或骨骼质量或结构发生变化。骨质疏松症会增加骨折的风险,导致骨骼强度下降,从而导致骨折。与男性相比,女性患骨质疏松症的可能性更大。经后女性经常因骨质疏松症而骨折,因为这种疾病没有症状,通常没有症状。老年人更容易患骨质疏松症。骨关节炎是一种关节疾病,即关节和周围组织的炎症。当出现这种情况时,人的活动能力会受到影响。

骨质疏松症和骨关节炎等隐性疾病没有任何症状,会削弱人体骨骼,导致脊柱畸形、骨折、突然跌倒或骨折等重大死亡。因此,这些疾病的风险增加直接增加了治疗这些疾病导致的畸形所需的粘弹性补充剂的需求。因此,骨质疏松症和骨关节炎风险的增加预计将推动北美粘弹性补充剂市场的增长。

克制

- 缺乏技术专业知识

寻找、吸引和聘用人才也是建立专业工程师和技术人员队伍的第一步。即使在最好的情况下,这个过程也是具有挑战性的。制造业现有的劳动力正在迅速老化和退休。在医疗行业,STEM(科学、技术、工程和数学)技能人才稀缺。尽管制造业对熟练技工(技术人员)和本科/研究生技能(工程师)的需求仍然强劲,但拥有必要技能的人数却越来越少。只有经过培训的专业人员才能进行粘液补充,但由于这些程序很复杂,因此在全球范围内,这个数字要少得多。

然而,组建一支优秀的增材制造 (AM) 员工队伍不仅仅需要寻找和招募合格的候选人。随着技术的转变和发展,员工必须具备与时俱进的资格并保持所需的技能。即使接受了 STEM 重点教育,新晋工程师也肯定需要在职接受 AM 技术培训,这是招聘和聘用他们的主要挑战之一。事实上,许多本科工程课程很少提供 AM 专项教育,因此,许多毕业生可能缺乏雇主所寻求的 AM 技能。

因此,缺乏技术专业知识可能会成为市场增长的制约因素。

机会

- 关节内注射透明质酸 (IAHA) 的安全性和有效性

有几种类型的透明质酸注射剂(也称为粘弹性补充剂)可用于治疗膝关节骨关节炎。它们由公鸡或鸡冠制成,或来自细菌,直接注射到关节中。关节内透明质酸是美国食品和药物管理局批准的膝关节骨关节炎 (OA) 治疗方法。关节内透明质酸 (IAHA) 注射是一种替代的局部治疗选择,可提供对症治疗,而不会产生与 IA 皮质类固醇相关的全身不良反应。许多 RCT 和荟萃分析试图评估 IAHA 的疗效和安全性,结果和结论不一。IAHA 被证明对疼痛和关节功能有积极影响。越来越多的数据表明,多个疗程的 IAHA 可以影响长期结果,包括减少同时使用的镇痛药和延迟全膝关节置换手术的需要。

挑战

- 政府对粘弹性补充剂的使用制定了严格的政策

各主要市场参与者在全球范围内将粘弹性补充剂商业化,得益于遵守全球许多国家制定的监管框架。各种医疗器械的上市前批准因国家而异。美国《食品、药品和化妆品法案》(“FD&C 法案”)对美国的医疗器械进行分类,欧盟 (EU) 则对欧洲的医疗器械进行监管。然而,亚太地区和欧洲、中东和非洲地区的隐私政策和法规正在迅速发展,包括印度、俄罗斯、中国、韩国、新加坡、香港和澳大利亚。

粘液补充疗法受到一系列广泛而复杂的法律、法规和规章的管制,以防止其用于任何潜在的有害治疗。

粘弹性补充疗法可替代骨关节炎或运动事故中受损、受伤或感染的身体部位,同时维持患者对良好身体活动的需求。然而,任何误导都会影响患者的安全和身体结构。

因此,对粘液补充剂使用的严格规则和规定可能会对市场的增长构成挑战。

后 COVID-19 对北美粘液补充市场的影响

COVID-19 导致医护人员和公众对医疗用品的需求大幅增加,以采取预防措施。这些产品的制造商有机会通过确保市场上个人防护设备的稳定供应来利用医疗用品需求的增长。预计 COVID-19 将对北美粘弹性补充剂市场产生巨大影响。

北美粘液补充市场范围和市场规模

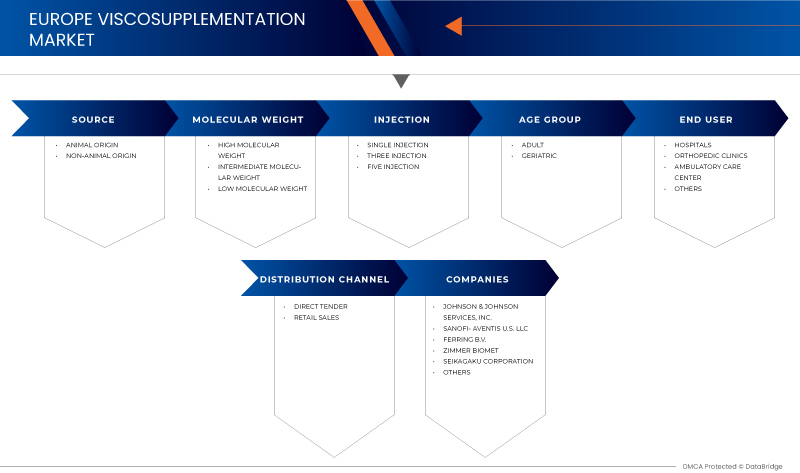

北美粘弹性补充剂市场根据来源、年龄组、分子量、注射剂、最终用户和分销渠道进行细分。细分市场之间的增长有助于您分析利基增长领域和进入市场的策略,并确定您的核心应用领域和目标市场的差异。

来源

- 动物来源

- 非动物来源

根据来源,粘液补充剂市场分为动物来源和非动物来源。

按分子量

- 高分子量

- 低分子量

- 中等分子量

根据分子量,粘液补充剂市场分为中等分子量、低分子量和高分子量。

注射

- 单次注射

- 三次注射

- 五次注射

根据注射方式,粘液补充市场分为单次注射、三次注射和五次注射。

按年龄组

- 成年人

- 老年医学

根据年龄组,粘液补充市场分为老年人和成年人。

终端用户

- 医院

- 骨科诊所

- 家庭医疗保健

- 其他的

根据最终用户,粘液补充市场分为医院、骨科诊所、门诊护理中心和其他。

按分销渠道

- 直接招标

- 零售销售

根据分销渠道,粘液补充剂市场分为直接招标和零售。

粘液补充剂市场国家层面分析

对粘液补充剂市场进行了分析,并按来源、年龄组、分子量、注射剂、最终用户和分销渠道提供了市场规模信息。

北美粘液补充市场报告涵盖的国家包括美国、加拿大、墨西哥、巴拿马、牙买加和多米尼加共和国。

2022 年,美国将占据主导地位,因为越来越多的人选择使用替代皮质类固醇作为关节疼痛管理治疗方案。由于药物治疗技术的进步,美国预计将实现增长。

报告的国家部分还提供了影响单个市场因素和国内市场监管变化,这些因素和变化会影响市场的当前和未来趋势。新销售、替代销售、国家人口统计、监管法案和进出口关税等数据点是用于预测单个国家市场情景的一些主要指标。此外,在对国家数据进行预测分析时,还考虑了北美品牌的存在和可用性以及由于来自本地和国内品牌的激烈或稀少的竞争对销售渠道的影响而面临的挑战。

North America viscosupplementation market also provides you with a detailed market analysis of every country growth in the healthcare industry. Moreover, it provides detailed information regarding healthcare services and treatments, the impact of regulatory scenarios, and trending parameters regarding the North America viscosupplementation market.

Competitive Landscape and North America Viscosupplementation Market Share Analysis

North America Viscosupplementation market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to viscosupplementation treatments.

The major companies which are dealing in the viscosupplementation market are Anika Therapeutics, Inc., SEIKAGAKU CORPORATION, Bioventus, Fidia Farmaceutici S.P.A, Ferring B.V, sanofi-aventis U.S. LLC, Zimmer Biomet, OrthogenRx, Inc. (a subsidiary of AVNS), APTISSEN, Johnson & Johnson Services, Inc., LG Chem., Viatris Inc., IBSA Institut Biochimique SA, Ortobrand International, TRB CHEMEDICA SA, Teva Pharmaceutical Industries Ltd., Lifecore (a subsidiary of Landec Corporation), VIRCHOW BIOTECH, Zuventus HealthCare Ltd. (a subsidiary of Emcure Pharmaceuticals), among others

Strategic alliances like mergers, acquisitions, and agreements by the key market players are further expected to accelerate the growth of viscosupplementation treatments.

For instance,

- In May, 2022, Fidia Farmaceutici S.p.A. harnesses the regenerative power of hyaluronic acid with its innovative portfolio launched in Spain

Fidia Farmaceutici S.p.A. presented its Aesthetic Care portfolio with a scientific symposium on its innovative ACP (Auto-Crosslinked Polymer) technology at the 20th Aesthetic & Anti-aging Medicine World Congress 2022 (AMWC) in Monte Carlo. The company has launched its complete Hyal System and Hy-Tissue portfolio in Spain. This has helped the company to showcase its research for hyaluronic acid

- In June 2022, Johnson & Johnson announced new data from Phase 3 studies demonstrating patients treated with medicine achieved consistent, long-term efficacy through two years across the domains of active psoriatic arthritis (PsA) – including joint, skin, enthesitis, a dactylitis,b spinal pain, and disease severityc endpoints – irrespective of baseline characteristics. This has helped company to showcase its progress

- 2021 年 11 月,LG 化学启动了新一代骨关节炎治疗药物的临床开发。LG 化学宣布,基于骨关节炎治疗新药候选药物 LG00034053 的临床前阳性结果,该公司已获得韩国食品药品安全部 1b/2 期临床试验的批准。LG 化学计划通过设计连接 1 期和 2 期的临床试验来加速新药的开发。

这有助于该公司开发治疗骨关节炎的新药

- 2020 年 11 月,Viatris Inc. 成功整合了迈兰公司 (Mylan NV) 和辉瑞公司 (Pfizer) 的 Upjohn 业务。通过整合这两家互补的传统公司,Viatris 拥有科学、制造和分销专业知识,以及经过验证的监管、医疗和北美商业能力,可为 165 多个国家和地区的患者提供高质量的药品。这有助于该公司扩大业务。

市场参与者的合作、产品发布、业务扩展、奖励和认可、合资企业和其他策略正在增强公司在北美粘液补充市场的影响力,这也有利于该组织的利润增长。

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析以及主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、公司市场份额分析、测量标准、北美与地区以及供应商份额分析。如有进一步询问,请要求分析师致电。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA VISCOSUPPLEMENTATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

5 EPIDEMIOLOGY

6 INDUSTRIAL INSIGHTS

7 PIPELINE ANALYSIS FOR NORTH AMERICA VISCOSUPPLEMENTATION MARKET

8 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: REGULATIONS

9 MARKET OVERVIEW

9.1 DRIVERS

9.1.1 RISING GERIATRIC POPULATION

9.1.2 INCREASING RISK OF OSTEOPOROSIS AND OSTEOARTHRITIS

9.1.3 TECHNOLOGICAL ADVANCEMENT IN VISCOSUPPLEMENTATION

9.1.4 LOW PRODUCTION COST OF VISCOSUPPLEMENTATION PRODUCTS

9.2 RESTRAINTS

9.2.1 LACK OF TECHNICAL EXPERTISE

9.2.2 PRODUCT RECALL PROCEDURES

9.2.3 LIMITED APPLICATIONS OF VISCOSUPPLEMENTATION

9.3 OPPORTUNITIES

9.3.1 SAFETY AND EFFECTIVENESS OF INTRA-ARTICULAR HYALURONIC ACID (IAHA)

9.3.2 RISING HEALTHCARE INFRASTRUCTURE

9.3.3 INCREASE IN DEMAND FOR MINIMALLY INVASIVE PROCEDURES

9.3.4 INCREASING NUMBER OF JOINT REPLACEMENTS AND SPORTS ACCIDENT

9.4 CHALLENGES

9.4.1 STRINGENT GOVERNMENT POLICIES FOR THE USE OF VISCOSUPPLEMENTATION

9.4.2 SIDE-EFFECTS OF VISCOSUPPLEMENTATION

10 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY SOURCE

10.1 OVERVIEW

10.2 NON-ANIMAL ORIGIN

10.2.1 ORTHOVISC

10.2.2 EUFLEXXA

10.2.3 MONOVISC

10.2.4 DUROLANE

10.2.5 GEL-ONE

10.2.6 SUPARTZ

10.2.7 GELSYN-3

10.2.8 CINGAL

10.2.9 SULPLASYN

10.2.10 VISCOSEAL

10.2.11 OSTEONIL

10.2.12 OTHERS

10.3 ANIMAL ORIGIN

10.3.1 HYLAN G-F 20

10.3.2 SYNVIC ONE

10.3.3 SYNVIC

10.3.4 OTHERS

10.3.5 HYALURONANS

10.3.6 HYALGAN

10.3.7 OTHERS

11 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT

11.1 OVERVIEW

11.2 INTERMEDIATE MOLECULAR WEIGHT

11.2.1 ORTHOVISC

11.2.2 EUFLEXXA

11.2.3 MONOVISC

11.2.4 DUROLANE

11.2.5 VISCOSEAL

11.2.6 OSTEONIL

11.2.7 OTHERS

11.3 LOW MOLECULAR WEIGHT

11.3.1 HYLAGAN

11.3.2 SUPARTZ

11.3.3 GELSYN-3

11.3.4 CINGAL

11.3.5 SULPLASYN

11.3.6 OTHERS

11.4 HIGH MOLECULAR WEIGHT

11.4.1 SYNVIC ONE

11.4.2 SYNVIC

11.4.3 OTHERS

12 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY INJECTION

12.1 OVERVIEW

12.2 SINGLE INJECTION

12.3 THREE INJECTION

12.4 FIVE INJECTION

13 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY AGE GROUP

13.1 OVERVIEW

13.2 ADULTS

13.3 GERIATRIC

14 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY END USER

14.1 OVERVIEW

14.2 HOSPITALS

14.3 ORTHOPEDIC CLINICS

14.4 AMBULATORY CARE CENTERS

14.5 OTHERS

15 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 RETAIL SALES

15.3 DIRECT TENDER

16 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY REGION

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

16.1.4 PANAMA

16.1.5 JAMAICA

16.1.6 DOMINICAN REPUBLIC

17 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 JOHNSON & JOHNSON SERVICES, INC.

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENTS

19.2 BIOVENTUS

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENTS

19.3 FERRING B.V.

19.3.1 COMPANY SNAPSHOT

19.3.2 COMPANY SHARE ANALYSIS

19.3.3 PRODUCT PORTFOLIO

19.3.4 RECENT DEVELOPMENT

19.4 SANOFI-AVENTIS U.S. LLC

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIS

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 ZIMMER BIOMET

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENTS

19.6 SEIKAGAKU CORPORATION

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUE ANALYSIS

19.6.3 PRODUCT PORTFOLIO

19.6.4 RECENT DEVELOPMENTS

19.7 ANIKA THERAPEUTICS, INC.

19.7.1 COMPANY SNAPSHOT

19.7.2 REVENUE ANALYSIS

19.7.3 PRODUCT PORTFOLIO

19.7.4 RECENT DEVELOPMENTS

19.8 FIDIA FARMACEUTICI S.P.A

19.8.1 COMPANY SNAPSHOT

19.8.2 REVENUE ANALYSIS

19.8.3 PRODUCT PORTFOLIO

19.8.4 RECENT DEVELOPMENT

19.9 APTISSEN

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENT

19.1 IBSA INSTITUT BIOCHIMIQUE SA

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENT

19.11 LG CHEM.

19.11.1 COMPANY SNAPSHOT

19.11.2 REVENUE ANALYSIS

19.11.3 PRODUCT PORTFOLIO

19.11.4 RECENT DEVELOPMENTS

19.12 LIFECORE (A SUBSIDIARY OF LANDEC CORPORATION)

19.12.1 COMPANY SNAPSHOT

19.12.2 REVENUE ANALYSIS

19.12.3 PRODUCT PORTFOLIO

19.12.4 RECENT DEVELOPMENTS

19.13 ORTHOGENRX, INC. (A SUBSIDIARY OF AVNS)

19.13.1 COMPANY SNAPSHOT

19.13.2 REVENUE ANALYSIS

19.13.3 PRODUCT PORTFOLIO

19.13.4 RECENT DEVELOPMENTS

19.14 ORTOBRAND INTERNATIONAL

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENT

19.15 TEVA PHARMACEUTICAL INDUSTRIES LTD.

19.15.1 COMPANY SNAPSHOT

19.15.2 REVENUE ANALYSIS

19.15.3 PRODUCT PORTFOLIO

19.15.4 RECENT DEVELOPMENTS

19.16 TRB CHEMEDICA SA

19.16.1 COMPANY SNAPSHOT

19.16.2 PRODUCT PORTFOLIO

19.16.3 RECENT DEVELOPMENTS

19.17 VIATRIS INC.

19.17.1 COMPANY SNAPSHOT

19.17.2 REVENUE ANALYSIS

19.17.3 PRODUCT PORTFOLIO

19.17.4 RECENT DEVELOPMENTS

19.18 VIRCHOW BIOTECH

19.18.1 COMPANY SNAPSHOT

19.18.2 PRODUCT PORTFOLIO

19.18.3 RECENT DEVELOPMENT

19.19 ZUVENTUS HEALTHCARE LTD. (A SUBSIDIARY OF EMCURE PHARMACEUTICALS)

19.19.1 COMPANY SNAPSHOT

19.19.2 REVENUE ANALYSIS

19.19.3 PRODUCT PORTFOLIO

19.19.4 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

表格列表

TABLE 1 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA NON-ANIMAL IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 5 NORTH AMERICA ANIMAL IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 9 NORTH AMERICA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 11 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA SINGLE INJECTION IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA THREE INJECTION IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA FIVE INJECTION IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA ADULT IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA GERIATRIC IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA HOSPITALS IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA ORTHOPEADIC CLINICS IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA AMBULATORY CARE CENTERS IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA OTHERS IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA RETAIL SALES IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA DIRECT TENDER IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 37 NORTH AMERICA ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 40 NORTH AMERICA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 42 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 50 U.S. VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 51 U.S. NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 52 U.S. NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 53 U.S. NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 54 U.S. ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 U.S. HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 56 U.S. HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 57 U.S. HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 58 U.S. VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 59 U.S. INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 60 U.S. LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 61 U.S. HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 62 U.S. VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 63 U.S. VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 64 U.S. VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 65 U.S. VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 66 CANADA VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 67 CANADA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 68 CANADA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 69 CANADA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 70 CANADA ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 CANADA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 72 CANADA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 73 CANADA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 74 CANADA VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 75 CANADA INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 76 CANADA LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 77 CANADA HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 78 CANADA VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 79 CANADA VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 80 CANADA VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 81 CANADA VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 82 MEXICO VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 83 MEXICO NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 84 MEXICO NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 85 MEXICO NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 86 MEXICO ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 MEXICO HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 88 MEXICO HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 89 MEXICO HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 90 MEXICO HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 91 MEXICO HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 92 MEXICO HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 93 MEXICO VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 94 MEXICO INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 95 MEXICO LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 96 MEXICO HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 97 MEXICO VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 98 MEXICO VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 99 MEXICO VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 100 MEXICO VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 101 PANAMA VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 102 PANAMA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 103 PANAMA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 104 PANAMA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 105 PANAMA ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 PANAMA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 107 PANAMA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 108 PANAMA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 109 PANAMA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 110 PANAMA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 111 PANAMA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 112 PANAMA VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 113 PANAMA INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 114 PANAMA LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 115 PANAMA HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 116 PANAMA VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 117 PANAMA VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 118 PANAMA VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 119 PANAMA VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 120 JAMAICA VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 121 JAMAICA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 122 JAMAICA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 123 JAMAICA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 124 JAMAICA ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 JAMAICA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 126 JAMAICA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 127 JAMAICA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 128 JAMAICA VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 129 JAMAICA INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 130 JAMAICA HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 131 JAMAICA VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 132 JAMAICA VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 133 JAMAICA VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 134 JAMAICA VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 135 DOMINICAN REPUBLIC VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 136 DOMINICAN REPUBLIC NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 137 DOMINICAN REPUBLIC NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 138 DOMINICAN REPUBLIC NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 139 DOMINICAN REPUBLIC ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 DOMINICAN REPUBLIC HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 141 DOMINICAN REPUBLIC HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 142 DOMINICAN REPUBLIC HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 143 DOMINICAN REPUBLIC VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 144 DOMINICAN REPUBLIC INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 145 DOMINICAN REPUBLIC HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 146 DOMINICAN REPUBLIC VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 147 DOMINICAN REPUBLIC VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 148 DOMINICAN REPUBLIC VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 149 DOMINICAN REPUBLIC VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE NORTH AMERICA VISCOSUPPLEMENTATION MARKET, AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 THE INCREASING DEMAND FOR NON-SURGICAL TREATMENTS FOR OSTEOARTHRITIS AND ADVANCEMENTS IN THE DEVELOPMENT OF HYALURONIC ACID-BASED THERAPIES IS EXPECTED TO DRIVE THE NORTH AMERICA VISCOSUPPLEMENTATION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 NON-ANIMAL ORIGIN IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA VISCOSUPPLEMENTATION MARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA VISCOSUPPLEMENTATION MARKET

FIGURE 15 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY SOURCE, 2021

FIGURE 16 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY SOURCE, 2022-2029 (USD MILLION)

FIGURE 17 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY SOURCE, CAGR (2022-2029)

FIGURE 18 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY SOURCE, LIFELINE CURVE

FIGURE 19 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY MOLECULAR WEIGHT, 2021

FIGURE 20 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY MOLECULAR WEIGHT, 2022-2029 (USD MILLION)

FIGURE 21 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY MOLECULAR WEIGHT, CAGR (2022-2029)

FIGURE 22 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY MOLECULAR WEIGHT, LIFELINE CURVE

FIGURE 23 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY INJECTION, 2021

FIGURE 24 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY INJECTION, 2022-2029 (USD MILLION)

FIGURE 25 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY INJECTION, CAGR (2022-2029)

FIGURE 26 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY INJECTION, LIFELINE CURVE

FIGURE 27 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY AGE GROUP, 2021

FIGURE 28 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY AGE GROUP, 2022-2029 (USD MILLION)

FIGURE 29 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY AGE GROUP, CAGR (2022-2029)

FIGURE 30 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 31 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY END USER, 2021

FIGURE 32 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 33 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY END USER, CAGR (2022-2029)

FIGURE 34 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY END USER, LIFELINE CURVE

FIGURE 35 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 36 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 37 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 38 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 39 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: SNAPSHOT (2021)

FIGURE 40 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY COUNTRY (2021)

FIGURE 41 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 42 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 43 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY SOURCE (2022-2029)

FIGURE 44 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。