North America Track And Trace Solutions Market

市场规模(十亿美元)

CAGR :

%

USD

2.31 Billion

USD

9.84 Billion

2024

2032

USD

2.31 Billion

USD

9.84 Billion

2024

2032

| 2025 –2032 | |

| USD 2.31 Billion | |

| USD 9.84 Billion | |

|

|

|

北美追蹤與追溯解決方案市場,按產品(軟體組件、硬體組件和獨立平台)、解決方案(線路和站點級序列化、雲端企業級可追溯性、配送和倉庫解決方案、供應鏈資料共享網路等)、應用(序列化、印刷、標籤和包裝檢測、聚合、追蹤、追溯和報告)、技術(二維條碼、無線射頻識別 (RFID)和線性/一維條碼)、最終用戶(製藥和生物製藥公司、消費包裝商品、奢侈品、食品和飲料、醫療器材公司、合約製造組織、重新包裝商、化妝品公司等)、分銷管道(直銷和第三方分銷商)劃分 - 行業趨勢和預測(至 2032 年)

北美追蹤與追蹤解決方案市場分析

追蹤和追溯藥物以提高處方供應鏈中產品的可及性並不是一個新鮮現象。事實上,連載的概念已經爭論了15年多。 1999年,美國醫學院的一項研究後,柯林頓總統將病患保護(包括避免配藥環節的錯誤)列入聯邦政府的議程,並在卸任後繼續倡導改革。 2003年,美國食品藥物管理局(FDA)要求在單位層級實施條碼制度;同年,世界衛生組織(WHO)發布了一項研究,強調了假藥問題的嚴重性,聲稱全球10%的藥品都是假藥。 2005 年左右,連載方式發生了重大轉變,各國開始設定採用目標。然而,在採取多項措施保護供應鏈之後,2008 年金融危機後,這項挑戰不再那麼令人擔憂。

隨著世界經濟的變化,焦點也逐漸轉移。土耳其於 2010 年採用了序列化標準,而該規則也適用於中國、韓國和印度等其他市場。隨著歐盟《偽造藥品指令》(FMD)於 2019 年 2 月生效,以及美國於 2017 年 11 月通過《藥品供應鏈安全法案》(DSCSA)的立法,到 2019 年,超過 75% 的北美藥品需要受到某種形式的監控和追蹤法規的保護。追蹤和追蹤解決方案市場對製藥、醫療設備、食品和飲料等各個行業都至關重要。

醫療機構對追蹤和追蹤解決方案的需求不斷增長,這是由於制定了嚴格的序列化和標籤法律,從而導致市場上追蹤和追蹤解決方案的利潤豐厚的增長。龐大的產品組合為食品飲料、化妝品、醫療器材等幾乎所有主要行業提供了豐富的選擇,進一步推動了北美追蹤和追蹤解決方案市場中追蹤和追蹤解決方案的成長。

北美追蹤與追蹤解決方案市場規模

2024 年北美追蹤與追蹤解決方案市場規模為 23.1 億美元,預計到 2032 年將達到 98.4 億美元,在 2025 年至 2032 年的預測期內複合年增長率為 19.9%。除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察外,Data Bridge Market Research 策劃的市場報告還包括進出口分析、生產能力概覽、生產消費分析、價格趨勢分析、氣候變遷情境、供應鏈分析、價值鏈分析、原材料/消耗品概覽、供應商選擇標準、PESTLE 分析、波特分析和監管框架。

北美追蹤與追蹤解決方案市場趨勢

“對供應鏈透明度的需求增加”

由於需要確保病患安全、產品完整性和法規遵循性,對追蹤和追蹤解決方案的需求尤其強烈。追蹤和追蹤技術有助於監控整個供應鏈中藥品、醫療設備和疫苗的流動,最大限度地降低假藥風險,並確保產品在適當的條件下儲存和運輸。此外,隨著個人化醫療需求的不斷增長和醫療保健責任的加強,這些解決方案使醫療保健提供者能夠追蹤產品從生產到最終使用的整個過程,確保它們安全有效地到達正確的患者手中。 FDA 等監管機構要求採取嚴格的可追溯性措施,使得追蹤和追蹤系統成為醫療保健營運的重要組成部分。

報告範圍和北美追蹤和追蹤解決方案市場細分

|

屬性 |

北美追蹤與追蹤解決方案市場市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋區域 |

美國、加拿大和墨西哥 |

|

主要市場參與者 |

SAP SE(德國)、Zebra Technologies Corp.(美國)、Videojet Technologies, Inc.(美國)、梅特勒-托利多(美國)、Tracelink Inc.(美國)、西門子(德國)、Domino Printing Sciences plc(英國)、Laetus GmbH(德國)、Xyntek Incorporated(美國)、IBMWI. GmbH(德國)、3Keys(德國)、ACG(印度)、NJM Packaging Inc.(美國)、OPTEL GROUP(加拿大)、Systech(印度)、Robert Bosch Manufacturing Solutions GmbH(德國)、ANTARES VISION SpA(義大利)、Uhlmann(印度)、SEA VIS SD. Systems(德國)、Grant-Soft Ltd.(土耳其)、PharmaSecure Inc.(美國)、Axyway(法國)、SL Controls Ltd.(美國)等 |

|

市場機會 |

擴大北美貿易 |

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括進出口分析、生產能力概覽、生產消費分析、價格趨勢分析、氣候變遷情景、供應鏈分析、價值鏈分析、原材料/消耗品概覽、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

北美追蹤與追蹤解決方案市場定義

識別特定物體或財產的現在和歷史位置(及其他資訊)的方法涉及幾種物品的儲存和運輸、監控和追蹤或追蹤。根據該定義可以對車輛和貨櫃的位置進行估計和記錄,例如記錄在即時資料庫中。這種方法留下的挑戰是如何制定相應進度記錄的連貫描述。追蹤和追蹤代表著將機器與 IT 連接起來並以各種速率共享數據。這包括強大的硬體套件設備模組或獨立系統。追蹤和追蹤解決方案的主要目標是切斷全球假藥和假冒產品的流通鏈,確保貨物在每個環節的順暢流動和可追溯性。

北美追蹤與追蹤解決方案市場動態

驅動程式

- 序列化實施的嚴格規定和標準

強制序列化的到來徹底改變了醫藥市場。隨著美國《藥品供應鏈安全法案》(DSCSA)和亞太聯盟《偽造藥品指令》(FMD)的實施,藥品供應鏈永遠與序列化產品和資料連結在一起。深入研究後就會發現,成功的序列化程序不僅涉及在包裝上放置序號。各個市場的規定各不相同,而且經常發生變化,這意味著監管專業人員需要準備好調整程序、流程和文件以跟上變化。由於有關藥品標籤和序列化的法律相對較新,因此與其他法規相比,亞太地區的法律更為複雜,變化也更為頻繁。此外,隨著正品藥品供應鏈越來越長,這給造假者在供應鏈的每個環節都創造了機會。因此,為了保護貨物,我們制定了嚴格的規定和標準化。

- 2024年7月,根據食品藥品管理局發表的文章,《藥品供應鏈安全法案》(DSCSA)要求在包裝層面對處方藥進行電子識別和追踪,以防止有害藥物進入美國供應鏈。這項嚴格的法規推動了對先進追蹤和追蹤解決方案的需求,以確保合規性、保護患者並能夠快速應對威脅,從而成為亞太市場的關鍵驅動力

- 2022年2月,根據美國國際開發署亞太衛生供應鏈計畫發表的文章,中國國家食品藥物管理局已要求對基本藥物清單中的502種藥品進行序列化,以確保可追溯性和真實性。這項嚴格的規定增加了對符合序列化要求的追蹤和追蹤解決方案的需求。因此,它成為亞太市場的關鍵驅動力,推動先進追蹤技術的更廣泛應用

幾十年來,藥品和藥品摻假問題一直是亞太地區關注的問題。由於亞太地區不安全的實體和網路供應鏈、網路銷售以及最低限度的處罰,政府和世界各地的各種製藥公司都認為,實施序列化可以減少和製止與假冒有關的問題。這使得實施序列化的嚴格法規和標準成為亞太地區追蹤和追蹤解決方案市場發展的驅動力。

- 假冒偽劣產品日益嚴重

人們對假冒產品的擔憂日益加劇,已成為一個重大問題,特別是在製藥和醫療保健領域,假藥的存在會對患者的健康和安全造成嚴重後果。假藥不僅損害醫療保健系統的完整性,而且增加副作用、抗藥性和治療失敗的風險。為了應對這一日益嚴重的威脅,監管機構和行業利益相關者正在推動更嚴格的可追溯性和序列化措施。這些措施使製造商、分銷商和零售商能夠追蹤整個供應鏈中的貨物流動,有助於確保產品的真實性。 RFID、條碼和區塊鏈等技術越來越多地被用於打擊假冒產品,從而可以在從製造到最終消費者的供應鏈的每個階段對產品進行監控和驗證。隨著全球貿易的擴大和供應鏈的更加複雜,假冒產品進入市場的風險變得更加明顯,進一步推動了加強可追溯系統的需求。隨著企業和政府尋求強大的系統來驗證產品、保持法規遵從性並保護消費者免受潛在有害假冒商品的侵害,對假冒風險的認識不斷提高成為全球追蹤解決方案市場的主要驅動力。

例如,

- 2024年5月,根據美國食品藥物管理局發表的文章,假藥可能含有不正確、不足或有害的成分,在被虛假宣傳為真藥的同時,還會對健康造成嚴重危害。人們對藥品安全性和有效性的日益關注推動了追蹤解決方案的採用,以確保產品的真實性。因此,對假冒產品的日益擔憂成為全球追蹤解決方案市場的重要推動力

- 2024年10月,根據Science Direct發表的文章稱,偽造藥品,尤其是在國際旅行中,對公共衛生構成了嚴重的風險。隨著全球通報案件的增加,人們對假藥蔓延的擔憂也日益加劇。這使得對可追溯系統的需求更大,以確保產品的真實性。因此,對假藥日益增長的擔憂成為全球追蹤解決方案市場的主要驅動力

人們對假冒產品的擔憂,尤其是在製藥和保健行業,已經成為一個主要問題,因為假藥可能會對患者造成傷害。假藥可能導致治療無效和健康風險,從而增加對可追溯性解決方案的需求。透過使用 RFID、條碼和區塊鏈等技術,公司可以在整個供應鏈中追蹤產品以確保真實性。隨著全球供應鏈變得越來越複雜,假冒商品進入市場的風險也隨之增加,從而推動了對更強大的追蹤系統的需求。對安全可靠的可追溯性解決方案的需求成為全球追蹤和追蹤解決方案市場的主要推動力。

機會

- 電子商務領域的成長

由於線上零售業務的複雜性和規模不斷增加,電子商務領域的快速成長為亞太地區追蹤和追蹤解決方案市場帶來了巨大的機會。隨著越來越多的消費者轉向線上購物,企業需要確保其物流和供應鏈流程高效透明。追蹤和追蹤解決方案有助於即時監控庫存水準、裝運狀態和交付流程,使公司能夠向客戶提供有關其訂單的準確資訊。這種更高程度的透明度增強了客戶信心並提高了整體購物體驗,使電子商務公司在擁擠的市場中更具競爭力。

例如,

- 2024 年 7 月,根據市場摘要發表的一篇文章《電子商務對物流的影響:適應需求》,實施先進的追蹤和可視性解決方案可以增強追蹤和可視性解決方案對於滿足電子商務需求至關重要。即時追蹤技術使承運商能夠提供準確的交付估算和更新,從而提高透明度和客戶信任度

- 2023 年 4 月,根據《ScienceDirect》雜誌發表的《識別電子商務行業的優勢、挑戰和途徑:一個綜合的兩階段決策模型》一文,電子商務行業在過去十年中取得了顯著增長,因為它注重便利性和可訪問性,導致網上購物激增,越來越多的消費者選擇網上購物

此外,隨著電子商務的興起,盜竊、詐欺和假冒商品等問題的風險也越來越大,需要強大的追蹤和追蹤系統來緩解這些挑戰。實施 RFID、區塊鏈和自動追蹤系統等先進技術使電子商務企業能夠從倉庫到交付保持產品完整性。這些解決方案進一步使企業能夠遵守與產品責任和安全相關的監管要求和行業標準。隨著電子商務的不斷擴展,對可靠的追蹤和追蹤解決方案的需求將會成長,為此類技術提供者創造巨大的市場機會。

- 全球貿易擴張

全球貿易的擴張為全球追蹤和追蹤解決方案市場創造了重大機遇,這得益於跨境供應鏈的日益複雜化。隨著企業越來越依賴全球網路來採購材料和分銷產品,對有效的追蹤系統的需求變得至關重要。追蹤和追蹤解決方案使公司能夠即時監控貨物,確保整個物流過程的透明度和效率。此功能可提高營運效率並協助組織遵守國際法規和標準,從而增強合作夥伴和客戶之間的信任。隨著全球貿易的不斷擴大,對能夠處理各種監管要求並提供跨多個司法管轄區可見性的複雜追蹤技術的需求可能會激增。

例如,

- 2024 年 5 月,根據世界經濟論壇發表的一篇文章,預計今年全球商品和服務貿易將成長 2.3%,2025 年將成長 3.3%,是 2023 年 1% 增幅的兩倍多

此外,電子商務和線上零售的興起進一步加速了追蹤和追蹤解決方案的需求,因為消費者期望及時交付和訂單透明度。隨著大量貨物在全球範圍內運輸,企業需要強大的系統來準確追蹤其庫存和貨物。這種需求刺激了追蹤市場的創新,促進了區塊鏈、物聯網和人工智慧等先進技術的發展。這些創新增強了追蹤和追蹤解決方案的能力,並提供了在擁擠的市場中脫穎而出的機會。隨著全球貿易的持續成長和發展,追蹤和追蹤解決方案市場準備利用這一趨勢,提供支援企業應對現代供應鏈管理複雜性的重要工具,同時滿足消費者對透明度和責任感的要求。

限制/挑戰

- 樣品污染相關風險

資料安全和隱私問題對亞太追蹤和追蹤解決方案市場來說是一個重大挑戰,因為這些系統通常涉及敏感資訊的收集、儲存和傳輸。這可能包括個人資料、產品詳細資訊和供應鏈信息,如果保護不充分,將對消費者和企業構成風險。資料安全漏洞可能導致財務損失、聲譽損害和法律後果,尤其是在亞太地區 GDPR 和亞太地區各種資料保護法等法規日益嚴格的背景下。當組織實施追蹤和追蹤技術時,他們必須確保強大的安全措施,這可能會增加成本並使部署過程複雜化,從而可能阻止公司採用這些解決方案。

例如,

- 2024 年 8 月,根據 Shriram Veritech Solutions Pvt 發表的一篇文章《在供應鏈管理中實施追蹤和追蹤解決方案的最大挑戰》。有限公司,透過實施追蹤和追蹤解決方案,企業處理大量敏感數據,包括專有資訊、客戶詳細資訊和即時位置追蹤。追蹤和追蹤系統容易受到網路攻擊。

此外,消費者對資料隱私的意識正在增強,導致對處理個人資訊的企業的審查更加嚴格。組織面臨著證明遵守資料保護法規並與客戶建立信任的壓力。如果企業無法自信地向利害關係人保證其保護資料的能力,他們就有可能失去市場份額並面臨消費者的強烈反對。這種擔憂的氣氛可能會限制公司充分投資和採用可能需要大量資料處理的先進追蹤和追蹤解決方案的意願。因此,隨著組織機構應對這些複雜問題,尋求在增強的追蹤能力帶來的好處與維護資料隱私和安全的必要性之間取得平衡,市場可能會出現成長放緩。

- 運送過程中追蹤標籤損壞

運輸過程中追蹤標籤的損壞會嚴重影響全球市場上追蹤和追蹤解決方案的有效性。當追蹤標籤(例如 RFID 標籤或條碼)在運輸過程中損壞時,會導致資料不準確、產品可見度喪失以及追蹤延遲。這會損害供應鏈營運的可靠性,尤其是在依賴精確產品移動和合規性的產業。例如,在製藥業,損壞的標籤會破壞關鍵的可追溯性流程,增加假冒產品和不遵守法規的風險。這些問題導致效率低下、營運成本增加以及客戶信心下降,嚴重限制了全球追蹤和追蹤解決方案市場的發展。

例如,

- 2024年8月,根據encstorge.com發表的文章,RFID標籤在運輸過程中容易損壞,損壞原因包括水、過熱、化學物質、晶片或天線線路的物理斷裂等因素。了解這些風險對於優化不同環境中的 RFID 效能至關重要。這種損害擾亂了追蹤和追蹤系統,導致不準確和低效率,對全球市場的成長造成了重大限制

- 2023年8月,根據Lexicon Tech Solutions發布的文章,條碼在運輸過程中可能會因暴露於濕氣、油或粗糙表面而損壞,從而導致污跡或撕裂等問題。這種損壞會導致條碼無法讀取,從而擾亂追蹤過程。條碼完整性問題可能導致供應鏈出現延遲、不準確和低效,對全球追蹤和追蹤解決方案市場造成重大限制

運輸過程中追蹤標籤的損壞會阻礙全球市場上追蹤和追蹤系統的有效性。損壞的 RFID 標籤或條碼會導致追蹤錯誤、可見性喪失和延遲,從而影響供應鏈的準確性。在製藥等領域,這會破壞合規性和可追溯性,導致效率低下、成本上升和信任度降低,從而限制市場成長。

北美追蹤與追蹤解決方案市場範圍

市場根據產品、解決方案、應用、技術、最終用戶和分銷管道進行細分。這些細分市場之間的成長將幫助您分析行業中成長微弱的細分市場,並為用戶提供有價值的市場概覽和市場洞察,幫助他們做出策略決策,確定核心市場應用。

產品

- 軟體元件

- 工廠經理

- 線路控制器

- 企業和網路經理

- 包裹追蹤

- 案件追蹤

- 倉庫和運輸經理

- 托盤追蹤

- 其他的

- 硬體組件

- 印刷和標記

- 條碼掃描器

- 監測與驗證

- 貼標機

- 檢重秤

- RFID閱讀器

- 其他的

- 獨立平台

解決方案

- 線路和站點級序列化

- 雲端企業級追溯

- 配送和倉儲解決方案

- 供應鏈資料共享網絡

- 其他的

應用

- 序列化

- 紙箱序列化

- 瓶子序列化

- 醫療器材序列化

- 小瓶和安瓿瓶序列化

- 泡罩序列化

- 印刷

- 標籤和包裝檢驗

- 聚合

- 捆綁聚合

- 案例聚合

- 托盤聚合

- 追蹤

- 追蹤

- 報告

科技

- QR 圖條碼

- 射頻識別(Rfid)

- 線性/1d條碼

最終用戶

- 製藥和生物製藥公司

- 消費包裝商品

- 奢侈品

- 食品和飲料

- 醫療器材公司

- 合約製造組織

- 再包裝商

- 化妝品公司

- 其他的

分銷管道

- 直銷

- 第三方經銷商

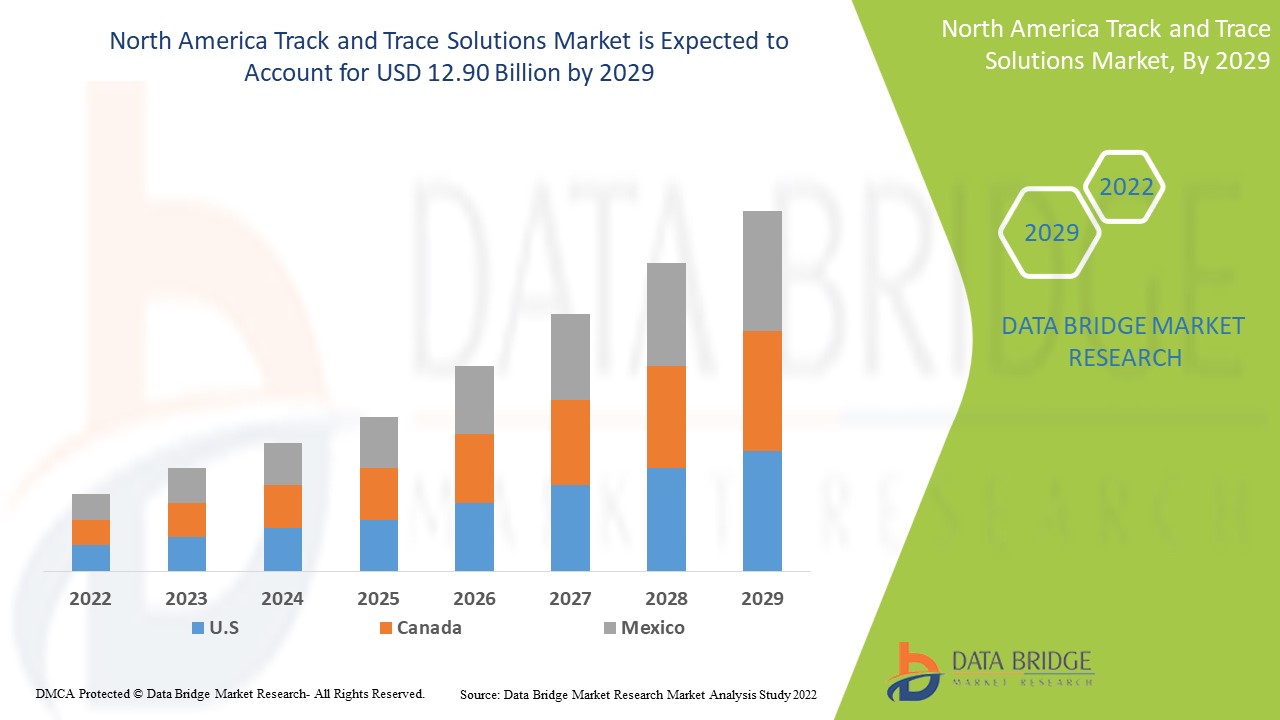

北美追蹤與追蹤解決方案市場區域分析

對市場進行分析,並提供市場規模洞察和趨勢,包括上述國家、產品、解決方案、應用、技術、最終用戶和分銷管道。

市場涵蓋的國家包括美國、加拿大和墨西哥。

由於美國擁有先進的醫療基礎設施、高水準的醫療研發投資以及龐大的老齡人口,預計它將佔據主導地位並成為成長最快的國家。美國醫療保健系統支援廣泛使用尖端眼科治療和技術,包括雷射手術、人工智慧診斷和個人化治療。黃斑部病變、白內障和青光眼等與年齡相關的眼部疾病的盛行率不斷上升,推動了對創新治療的需求。此外,美國擁有一些世界領先的眼科公司,為新療法和新設備的快速發展和應用做出了貢獻。

報告的國家部分還提供了影響個別市場因素以及影響市場當前和未來趨勢的國內市場監管變化。下游和上游價值鏈分析、技術趨勢和波特五力分析、案例研究等數據點是用於預測各國市場情景的一些指標。此外,在對國家數據進行預測分析時,還考慮了北美品牌的存在和可用性以及由於來自本地和國內品牌的大量或稀缺的競爭而面臨的挑戰、國內關稅和貿易路線的影響。

北美追蹤與追蹤解決方案市場份額

市場競爭格局提供了競爭對手的詳細資訊。詳細資訊包括公司概況、公司財務狀況、收入、市場潛力、研發投資、新市場計劃、北美業務、生產基地和設施、生產能力、公司優勢和劣勢、產品發布、產品寬度和廣度、應用優勢。以上提供的數據點僅與公司對市場的關注有關。

北美追蹤與追蹤解決方案市場領導者有:

- SAP SE(德國)

- 斑馬技術公司(美國)

- Videojet Technologies, Inc.(美國)

- 梅特勒-托利多(美國)

- Tracelink Inc.(美國)

- 西門子(德國)

- 多米諾印刷科學有限公司(英國)

- Laetus GmbH(德國)

- Xyntek Incorporated(美國)

- IBM公司(美國)

- WIPOTEC-OCS GmbH(德國)

- 3Keys(德國)

- ACG(印度)

- NJM Packaging Inc.(美國)

- 奧普泰集團(加拿大)

- Systech(印度)

- 羅伯特博世製造解決方案有限公司(德國)

- ANTARES VISION SpA(義大利)

- 烏爾曼(印度)

- SEA VISION Srl(義大利)

- Jackson Vision(印度)

- Kevision Systems(印度)

- Arvato Systems(德國)

- Grant-Soft Ltd.(土耳其)

- PharmaSecure Inc.(美國)

- Axyway(法國)

- SL Controls Ltd.(美國)

北美追蹤解決方案市場的最新發展

- 2024 年 5 月,Videojet 推出了 3350 30 瓦 CO2 雷射器,旨在為各種材料提供高品質的永久標記。這種先進的雷射解決方案憑藉其可靠、高速的性能提高了營運效率並減少了停機時間。它特別適合需要精密標記的行業,如食品、飲料和藥品

- 2019 年 5 月,梅特勒-托利多在巴塞隆納為北美食品和製藥加工商開設了新的產品檢測測試中心。該公司開設的新測試中心提高了其在市場上的信譽,從而增加了未來產品的需求和銷售

- 2020年2月,ACG推出了基於區塊鏈的創新品牌平台。該公司推出的這項新平台將增加其市場需求

- 2019 年 11 月,ACG 推出了面向未來的 NXT 系列機器,將為我們的客戶提供智慧使用者體驗。 NXT系列包括Protab 300 NXT、Protab 700 NXT、BMax NXT、KartonX NXT、Verishield CS18 NXT,將在PMEC 2019上展出。 ACG推出的這些新產品將增加其產品在市場上的需求

- 2020 年 7 月,Axyway 憑藉其在多個行業使用的解決方案獲得了亞馬遜網路服務 (AWS) 頒發的 AWS 醫療保健能力稱號和 AWS 生命科學能力稱號。公司獲得的認可將提高其在市場上的信譽

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCTS LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

5 NORTH AMERICA TRACK & TRACE SOLUTIONS MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 STRINGENT REGULATIONS & STANDARDS FOR THE IMPLEMENTATION OF SERIALIZATION

6.1.2 RISING COUNTERFEIT CONCERNS

6.1.3 TECHNOLOGICAL ADVANCEMENTS IN TRACK AND TRACE SOLUTIONS

6.1.4 COMPLEXITY IN NORTH AMERICA SUPPLY CHAIN

6.2 RESTRAINTS

6.2.1 RESISTANCE FROM SMALL BUSINESSES

6.2.2 DAMAGE TO TRACKING TAGS DURING DELIVERY

6.3 OPPORTUNITIES

6.3.1 GROWTH IN THE E-COMMERCE SECTOR

6.3.2 INCREASING FOCUS ON DATA ANALYTICS

6.3.3 EXPANSION IN NORTH AMERICA TRADE

6.4 CHALLENGES

6.4.1 HIGH IMPLEMENTATION COSTS

6.4.2 DATA SECURITY AND PRIVACY CONCERNS

7 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS

7.1 OVERVIEW

7.2 SOFTWARE COMPONENTS

7.2.1.1 PLANT MANAGER

7.2.1.2 ENTERPRISE & NETWORK MANAGER

7.2.1.3 BUNDLE TRACKING

7.2.1.4 PALLET TRACKING

7.2.1.5 CASE TRACKING

7.2.1.6 WAREHOUSE & SHIPMENT MANAGER

7.2.1.7 LINE CONTROLLER

7.2.1.8 OTHERS

7.3 HARDWARE COMPONENTS

7.3.1.1 PRINTING & MARKING

7.3.1.2 LABELER

7.3.1.3 BARCODE SCANNER

7.3.1.4 RFID READER

7.3.1.5 CHECKWEIGHER

7.3.1.6 MONITORING & VERIFICATION

7.3.1.7 OTHERS

7.4 STANDALONE PLATFORMS

8 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION

8.1 OVERVIEW

8.2 LINE & SITE LEVEL SERIALIZATION

8.3 CLOUD ENTERPRISE-LEVEL TRACEABILITY

8.4 DISTRIBUTION & WAREHOUSE SOLUTION

8.5 SUPPLY CHAIN DATA-SHARING NETWORK

8.6 OTHERS

9 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 2D BARCODES

9.3 RADIOFREQUENCY IDENTIFICATION (RFID)

9.4 LINEAR/1D BARCODESS

10 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 SERIALIZATION

10.3 PRINTING

10.4 LABELING & PACKAGING INSPECTION

10.5 AGGREGATION

10.6 TRACKING

10.7 TRACING

10.8 REPORTING

11 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY END USER

11.1 OVERVIEW

11.2 PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIE

11.3 CONSUMER PACKAGED GOODS

11.4 LUXURY GOODS

11.5 FOOD & BEVERAGE

11.6 MEDICAL DEVICE COMPANIES

11.7 CONTRACT MANUFACTURING ORGANIZATIONS

11.8 REPACKAGERS

11.9 COSMETICS COMPANIES

11.1 OTHERS

12 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT SALES

12.3 THIRD PARTY DISTRIBUTORS

13 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 SAP SE

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 ZEBRA TECHNOLOGIES CORP.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 TRACELINK INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 VIDEOJET TECHNOLOGIES, INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 METTLER TOLEDO

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ACG

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 AXYWAY

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.8 ANTARES VISION S.P.A.

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 ARVATO SYSTEMS

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 DOMINO PRINTING SCIENCES PLC

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 GRANT-SOFT LTD.

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 IBM CORPORATION

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 JEKSON VISION

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 3KEYS

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 KEVISION SYSTEMS

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 LAETUS GMBH

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 NJM PACKAGING INC.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 OPTEL GROUP

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 PHARMADECURE INC.

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 ROBERT BOSCH MANUFACTURING SOLUTIONS GMBH

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 SEA VISION S.R.L.

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 RECENT DEVELOPMENT

16.22 SIEMENS

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENT

16.23 SL CONTROLS LTD

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 SYSTECH

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 UHLMANN

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

16.26 WIPOTEC-OCS GMBH

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENT

16.27 XYNTEK INCORPORATED

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

表格列表

TABLE 1 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 2 NORTH AMERICA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 3 NORTH AMERICA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA STANDALONE PLATFORMS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA LINE & SITE LEVEL SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA CLOUD ENTERPRISE-LEVEL TRACEABILITY IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA DISTRIBUTION & WAREHOUSE SOLUTION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA SUPPLY CHAIN DATA-SHARING NETWORK IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA OTHERS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA 2D BARCODES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032(USD THOUSAND)

TABLE 15 NORTH AMERICA RADIOFREQUENCY IDENTIFICATION (RFID) IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA LINEAR/1D BARCODES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA PRINTING IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA LABELING & PACKAGING INSPECTION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA TRACKING IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA TRACING IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA REPORTING IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIE IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA CONSUMER PACKAGED GOODS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA LUXURY GOODS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA FOOD & BEVERAGE IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA MEDICAL DEVICE COMPANIES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA CONTRACT MANUFACTURING ORGANIZATIONS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA REPACKAGERS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA COSMETICS COMPANIES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA OTHERS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA DIRECT SALES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032(USD THOUSAND)

TABLE 39 NORTH AMERICA THIRD-PARTY DISTRIBUTORS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 51 U.S. TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 52 U.S. SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 53 U.S. HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 54 U.S. TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 55 U.S. TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 56 U.S. SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 57 U.S. AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 58 U.S. TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 59 U.S. TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 60 U.S. TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 61 CANADA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 62 CANADA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 63 CANADA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 64 CANADA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 65 CANADA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 66 CANADA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 67 CANADA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 68 CANADA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 69 CANADA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 70 CANADA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 71 MEXICO TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 72 MEXICO SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 73 MEXICO HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 74 MEXICO TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 75 MEXICO TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 76 MEXICO SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 77 MEXICO AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 78 MEXICO TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 79 MEXICO TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 80 MEXICO TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

图片列表

FIGURE 1 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: SEGMENTATION

FIGURE 11 STRINGENT REGULATIONS & STANDARDS FOR THE IMPLEMENTATION OF SERIALIZATION IS EXPECTED TO DRIVE THE NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 12 SOFTWARE COMPONENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET IN 2025 & 2032

FIGURE 13 DROC ANALYSIS

FIGURE 14 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY PRODUCTS, 2024

FIGURE 15 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY PRODUCTS, 2025-2032 (USD THOUSAND)

FIGURE 16 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY PRODUCTS, CAGR (2025-2032)

FIGURE 17 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY PRODUCTS, LIFELINE CURVE

FIGURE 18 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY SOLUTION, 2024

FIGURE 19 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY SOLUTION, 2025-2032 (USD THOUSAND)

FIGURE 20 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY SOLUTION, CAGR (2025-2032)

FIGURE 21 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY SOLUTION, LIFELINE CURVE

FIGURE 22 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY TECHNOLOGY, 2024

FIGURE 23 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY TECHNOLOGY, 2025-2032 (USD THOUSAND)

FIGURE 24 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY TECHNOLOGY, CAGR (2025-2032)

FIGURE 25 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 26 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY APPLICATION, 2024

FIGURE 27 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY APPLICATION, 2025-2032 (USD THOUSAND)

FIGURE 28 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY APPLICATION, CAGR (2025-2032)

FIGURE 29 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 30 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY END USER, 2024

FIGURE 31 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 32 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY END USER, CAGR (2025-2032)

FIGURE 33 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY END USER, LIFELINE CURVE

FIGURE 34 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 35 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

FIGURE 36 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 37 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET SNAPSHOT

FIGURE 39 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。