北美番茄市场,按类型(樱桃番茄、葡萄番茄、罗马番茄、牛排番茄、传家宝番茄、藤番茄、绿番茄等)、产品类型(新鲜、冷冻和干燥)、类别(常规和有机)、最终用户(食品服务业和家庭/零售业)、分销渠道(直接和间接)行业趋势和预测到 2030 年。

北美番茄市场分析与洞察

由于番茄在各种菜肴和加工单位中的使用量增加,北美番茄市场正在获得显着增长。番茄用于生产不同类型的番茄产品,市场需求量巨大。它们不仅味道好,而且还对人类有益。

推动市场增长的因素包括食品加工行业对番茄的需求不断增长,以及市场上新品种番茄的开发和生产。制约市场增长的因素是番茄价格的波动,这取决于降雨、温度和季节等各种因素。市场增长的机会是借助人工智能(AI) 种植番茄。阻碍市场增长的一些因素包括由于缺乏储存设施而导致的收获后损失增加。

市场参与者更加关注新产品开发、合作伙伴关系和其他增加市场份额的策略。因此,制造商必须遵守政府机构制定的不断提高的标准和法规,才能将其产品销售到市场上,并确保消费者的需求将推动市场增长。然而,小型企业缺乏技术专业知识可能会限制该地区的市场增长。

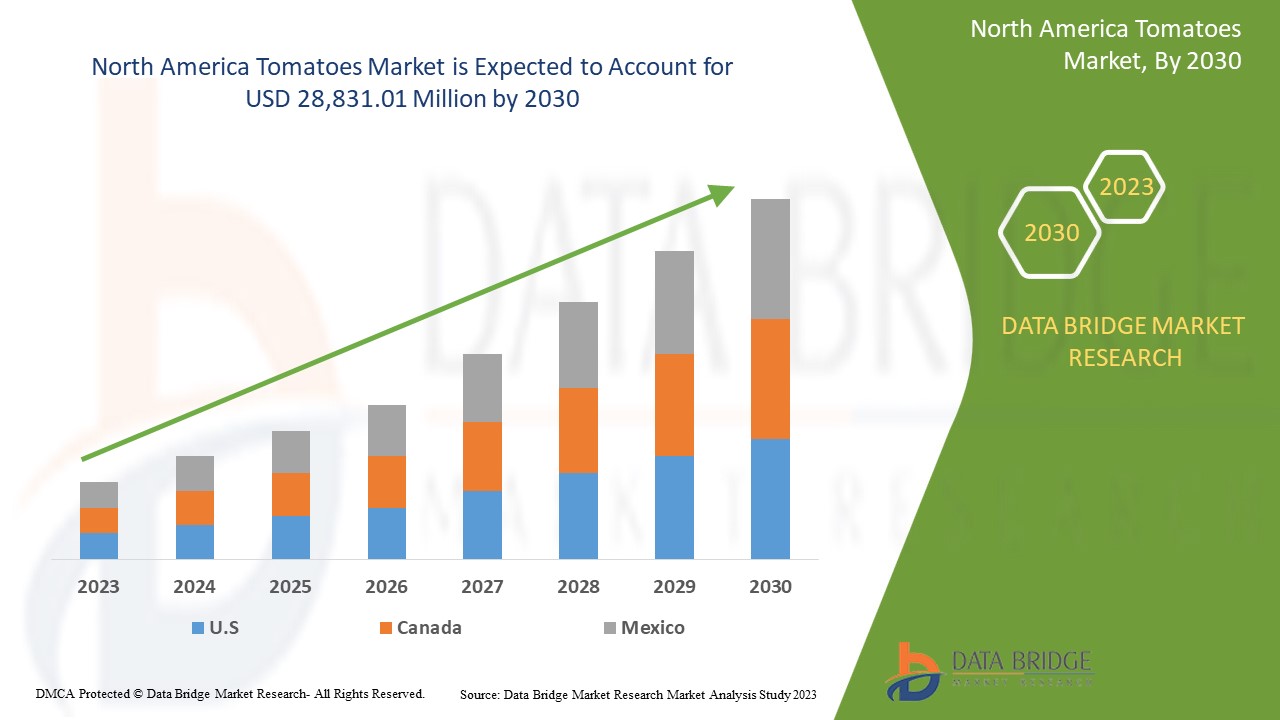

Data Bridge Market Research 分析称,到 2030 年,北美番茄市场价值预计将达到 288.3101 亿美元,预测期内复合年增长率为 3.0%。

|

报告指标 |

细节 |

|

预测期 |

2023 至 2030 年 |

|

基准年 |

2022 |

|

历史年份 |

2021(可定制为 2019 - 2015) |

|

定量单位 |

收入(百万美元),定价(美元) |

|

涵盖的领域 |

按类型(樱桃番茄、葡萄番茄、罗马番茄、牛排番茄、传家宝番茄、藤番茄、绿番茄和其他)、产品类型(新鲜、冷冻和干燥)、类别(常规和有机)、最终用户(食品服务业和家庭/零售业)、分销渠道(直接和间接)。 |

|

覆盖国家 |

美国、加拿大和墨西哥 |

|

涵盖的市场参与者 |

Houwelings、安大略加工蔬菜种植者、Tomato Growers Supply Company、Magic Sun、PACIFIC RIM PRODUCE、Mucci Int'l Mrktg Inc.、West Coast Tomato, LLC、Roalipride、Nature Fresh Farms、RedStar Sales BV、Streef Produce Ltd.、Hnatiuk Gardens、Aylmer Family Farm、Exeter Produce 和 AppHarvest 等等。 |

市场定义

西红柿基本上是圆形的蔬菜,可以熟吃也可以生吃。它们是可食用的番茄属植物的果肉浆果。它们有多种颜色,如红色、黄色、橙色等等。它们有很多种,口味和用途也不同。

西红柿在食品和饮料行业有着广泛的应用。它们用于制作汤、酱汁、果泥、果汁和番茄酱等。它们还用作汉堡、三明治、沙拉、披萨等的生蔬菜。

番茄是食品加工行业的重要来源,用途广泛,还含有对人体有用的必需成分。它们有助于维持血压和健康的皮肤,还具有抗炎作用。

北美番茄市场动态

本节旨在了解市场驱动因素、优势、机遇、限制和挑战。下面将详细讨论所有这些内容:

驱动程序

- 国内外对番茄的需求不断增长

番茄需求的增加是由于种植者和加工者的效率提高。随着消费者对富含水果和蔬菜的饮食的好处的认识不断提高,以及公众为促进其消费而采取的举措,新鲜水果和蔬菜的消费量也在增加。由于人口增加、消费者对营养健康食品的需求不断增加,以及由于冷链基础设施领域的同步发展、通过研究提高生产率和质量以及现代收获后技术,改进技术的潜在使用,番茄需求大幅增加。

- 食品加工行业中番茄的迅猛增长

B2B 市场需要西红柿,因为它们可用作制造其他加工西红柿产品的原材料。西红柿有多种用途,包括果汁、番茄酱、番茄泥、切块/去皮西红柿、番茄酱、泡菜、酱汁和即食咖喱。加工西红柿产品在食品领域有多种用途,例如小吃、烹饪、酒店、餐馆和快餐零售连锁店。它们既可以煮熟也可以生吃,在北美市场需求量很大。由于城市化进程迅速,新兴国家和发达国家的消费者倾向于食用即食食品和西红柿加工产品。为了满足日益增长的需求,加工食品制造商和番茄酱加工商专注于即食产品。

此外,随着各种番茄制品(包括番茄粉制品)的推出,番茄加工食品的范围也在不断扩大。番茄酱和番茄泥是番茄的初级加工产品。番茄的二次加工产品是通过加工初级产品而实现的。番茄酱和番茄泥的主要市场是番茄酱和番茄酱行业。饮料和食品行业是番茄酱和番茄泥的第二大用户。

限制

- 西红柿价格波动

北美市场动荡且不可预测,对工业企业产生了深远的影响。能源成本上涨和原材料价格意外变化等意料之外的障碍正在扰乱供应链,使企业更难保持盈利。制作酱汁、调味品和调味品热灌装瓶包装的原材料价格变化增加了成品价格的额外成本。主要产区的丰收或作物灾害可能会迅速改变番茄价格。

西红柿的价格波动很大,因为它取决于多种因素,例如生产的季节性、反季节降雨和长期干旱。它还取决于地点、偏好、消费者年龄和消费者购买力。由于其季节性,当产品过季时价格上涨,而当产品过季时价格下跌。

- 环境因素和气候条件增加

环境变化通过改变农业生态系统的自然和人为成分,影响农民生计、消费者选择和粮食安全,进而影响粮食系统的可持续性。每年降水和强降雨事件变得越来越常见,尤其是在春季。过多的春雨会减缓作物的生长,中断种植,增加几种真菌和细菌作物疾病的流行,并可能因延误田间作业而导致劳动力问题。温度和降水的变化直接影响番茄作物生产的数量和质量,并间接影响重要农场作业的安排以及害虫、杂草和疾病的经济影响。恶劣的天气条件也会妨碍番茄的供应链和运输。

此外,气温升高会导致作物生长加快,从而缩短作物生长季并降低产量。对流层(或地面)臭氧的增加会导致植物氧化应激增加,从而抑制光合作用并减缓植物生长。极端事件,尤其是洪水和干旱,会损害作物并降低产量,最终影响番茄市场。

机会

- 利用人工智能(AI)种植西红柿

人工智能是计算机科学的一个广泛分支,致力于构建能够执行通常需要人类智能的任务的智能机器。它是日常生活中日益重要的一部分,并用于农业领域。人工智能技术专注于解决各种问题,以增加和优化生产和运营流程。

人工智能使用先进的计算方法来解决许多现实问题。这些方法可用于农业行业进行原创研究,以提高品种、速度、新品种和保护。人工智能可以自动检查作物的质量、产量、pH 值、营养比例、所需水量、湿度和氧气成分。许多国家使用微型机器人来评估农业行业的作物质量和成熟度。微型机器人可以收获成熟的水果和蔬菜,而不会损坏西红柿娇嫩的表皮。

挑战

水资源匮乏和地下水盐化

粮食生产受到水资源短缺的严重影响。没有水,人们就没有办法浇灌庄稼,因此无法养活迅速增长的人口。根据国际水资源管理研究所的数据,农业与家庭、工业和环境应用不断争夺有限的水资源,占北美用水量的 70% 左右。

因此,原材料价格高昂以及这些餐桌的高昂建造成本阻碍了市场的增长。这可能会对北美番茄市场的增长构成挑战。

疫情过后对北美番茄市场的影响

疫情过后,由于封锁期间水果和蔬菜供应有限,蔬菜需求随之增加,西红柿需求随之增加。此外,西红柿具有增强免疫力的特性,在新冠肺炎期间需求旺盛。

最新动态

- 2022年9月,据美国农业部报告,美国自由贸易协定(FTA)伙伴国报告,在签署贸易协定后的五年内,该国农产品出口年增长率从5%(加拿大)到46.2%(新加坡)不等。

- 2022年3月,据鲜食广场刊登的一篇文章称,2022年1月至3月,中国嘉兴水果市场的樱桃番茄销量同比增长12.04%,价值同比增长12.6%。樱桃番茄交易量同比增长23.47%,交易额同比增长35.30%。

北美番茄市场范围

北美番茄市场根据类型、产品类型、类别、最终用户和分销渠道分为五个显著的细分市场。这些细分市场之间的增长将帮助您分析行业中的主要增长细分市场,并为用户提供有价值的市场概览和市场洞察,以便做出战略决策以确定核心市场应用。

类型

- 圣女果

- 葡萄番茄

- 罗马番茄

- 牛排番茄

- 传家宝番茄

- 藤上的西红柿

- 青番茄

- 其他的

根据种类,北美番茄市场分为樱桃番茄、葡萄番茄、罗马番茄、牛排番茄、传家宝番茄、藤番茄、绿番茄等。

产品类型

- 新鲜的

- 冰冻

- 干

根据产品类型,北美番茄市场分为新鲜番茄、冷冻番茄和干番茄。

类别

- 传统的

- 有机的

根据类别,北美番茄市场分为常规番茄和有机番茄。

最终用户

- 食品服务业

- 家居/零售业

根据最终用户,北美番茄市场分为食品服务业和家庭/零售业。

分销渠道

- 直接的

- 间接

根据分销渠道,北美番茄市场分为直接分销和间接分销。

北美番茄市场区域分析/见解

分析了北美番茄市场,并按国家、类型、产品类型、类别、最终用户和分销渠道提供了市场规模洞察和趋势,如上所述

本报告涉及的国家包括美国、加拿大和墨西哥。

就市场份额和收入而言,美国预计将在北美番茄市场占据主导地位。由于对番茄的需求不断增长,预计美国将在预测期内保持主导地位,这是北美地区番茄增长的主要原因。

报告的区域部分还提供了影响单个市场因素和市场法规变化,这些因素和变化会影响市场的当前和未来趋势。新旧销售、国家人口统计、疾病流行病学和进出口关税等数据点是用于预测单个国家市场情景的一些主要指标。此外,在对国家数据进行预测分析时,还考虑了北美品牌的存在和可用性以及它们因来自本地和国内品牌的激烈竞争而面临的挑战以及销售渠道的影响。

竞争格局和北美番茄市场份额分析

竞争激烈的北美番茄市场提供了有关竞争对手的详细信息。详细信息包括公司概况、公司财务状况、产生的收入、市场潜力、研发投资、新市场计划、北美业务、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度以及应用主导地位。以上数据点仅与公司对市场的关注有关。

北美番茄市场的一些主要参与者包括 Houwelings、Ontario Processing Vegetable Growers、Tomato Growers Supply Company、Magic Sun、PACIFIC RIM PRODUCE、Mucci Int'l Mrktg Inc.、West Coast Tomato, LLC、Roalipride、Nature Fresh Farms、REDSTAR Sales BV、Streef Produce Ltd.、Hnatiuk Gardens、Aylmer Family Farm、Exeter Produce 和 AppHarvest 等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA Tomatoes Market

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 CROP TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TOP EXPORTER OF TOMATOES MARKET

4.2 TOP IMPORTER OF TOMATOES MARKET

4.3 NEW PRODUCT LAUNCH STRATEGIES

4.3.1 LAUNCHING OF DISEASE RESISTANT VARIETIES

4.3.2 PROMOTING LAUNCH BY PACKAGING STRATEGIES

4.3.3 AUNCHING ORGANIC PRODUCTS

4.3.4 CONCLUSION

5 REGULATION COVERAGES

6 SUPPLY CHAIN OF THE NORTH AMERICA TOMATOES MARKET

6.1 RAW MATERIAL PROCUREMENT

6.2 PROCESSING

6.3 MARKETING AND DISTRIBUTION

6.4 END USERS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GOVERNMENT INITIATIVES TO BOOST TOMATO PRODUCTION AND THE AGRICULTURAL SECTOR

7.1.2 SURGING GROWTH FOR TOMATOES IN THE FOOD PROCESSING INDUSTRY

7.1.3 INCREASED DEVELOPMENT OF NEW TOMATO VARIETIES

7.1.4 RISING DOMESTIC AND INTERNATIONAL DEMAND FOR TOMATOES

7.2 RESTRAINTS

7.2.1 FLUCTUATIONS IN THE PRICES OF TOMATOES

7.2.2 INCREASING ENVIRONMENTAL ELEMENTS AND CLIMATE CONDITIONS

7.2.3 STRINGENT RULES AND REGULATIONS IN TRADING AND EXPORT OF TOMATOES

7.3 OPPORTUNITY

7.3.1 GROWING TOMATOES USING ARTIFICIAL INTELLIGENCE

7.3.2 WIDE RANGE OF APPLICATIONS IN THE FOOD AND BEVERAGE SECTOR

7.3.3 RISING TECHNOLOGICAL ADVANCEMENTS FOR TOMATO PRODUCTION

7.3.4 HIGH DEMAND FOR ORGANIC AND CHEMICAL-FREE TOMATOES

7.4 CHALLENGES

7.4.1 SCARCITY OF WATER RESOURCES AND SALINITY OF GROUNDWATER

7.4.2 RISING POST HARVESTING LOSSES DUE TO LACK OF STORAGE FACILITY

7.4.3 RISING USAGE OF CROP PROTECTION PRODUCTS

8 NORTH AMERICA TOMATOES MARKET, BY TYPE

8.1 OVERVIEW

8.2 CHERRY TOMATOES

8.3 GRAPE TOMATOES

8.4 ROMA TOMATOES

8.5 TOMATOES ON THE VINE

8.6 BEEFSTEAK TOMATOES

8.7 HEIRLOOM TOMATOES

8.8 GREEN TOMATOES

8.9 OTHERS

9 NORTH AMERICA TOMATOES MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 FRESH

9.3 FROZEN

9.4 DRIED

10 NORTH AMERICA TOMATOES MARKET, BY CATEGORY

10.1 OVERVIEW

10.2 CONVENTIONAL

10.3 ORGANIC

11 NORTH AMERICA TOMATOES MARKET, BY END USER

11.1 OVERVIEW

11.2 FOOD SERVICE INDUSTRY

11.2.1 FOOD SERVICE INDUSTRY, BY TPYE

11.2.1.1 HOTELS

11.2.1.2 RESTAURANTS

11.2.1.3 CAFES

11.2.1.4 OTHERS

11.3 HOUSEHOLD/RETAIL INDUSTRY

12 NORTH AMERICA TOMATOES MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT

12.3 INDIRECT

13 NORTH AMERICA TOMATOES MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 MEXICO

13.1.3 CANADA

14 NORTH AMERICA TOMATOES MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 COMPANY PROFILE

15.1 APPHARVEST

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 MASTRONARDI PRODUCE LTD.

15.2.1 COMPANY SNAPSHOT

15.2.2 COMPANY SHARE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 CASALASCO - SOCIETÀ AGRICOLA S.P.A.

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 HOUWELINGS

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 MUCCI INT’L MRKTG INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 REDSTAR SALES BV

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 AYLMER FAMILY FARM

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 DUIJVESTIJN TOMATEN

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 EXETER PRODUCE

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 HNATIUK GARDENS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 MAGIC SUN

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 NATURE FRESH FARMS

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 ONTARIO PROCESSING VEGETABLE GROWERS

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 PACIFIC RIM PRODUCE

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 R&L HOLT LTD.

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 ROYALPRIDE

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 SAHYADRI FARMS POST HARVEST CARE LTD.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 STREEF PRODUCE LTD

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 TOMATO GROWERS SUPPLY COMPANY

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 WEST COAST TOMATO, LLC

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

表格列表

TABLE 1 TOP EXPORTER OF FRESH AND CHILLED TOMATOES, HS CODE: 0702 2017-2021, VOLUME IN TONS

TABLE 2 TOP IMPORTER OF FRESH AND CHILLED TOMATOES, HS CODE: 0702 2017-2021, VOLUME IN TONS

TABLE 3 IN CASE SIZE CODES ARE APPLIED, THE CODES AND RANGES IN THE FOLLOWING TABLE HAVE TO BE RESPECTED:

TABLE 4 NORTH AMERICA TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA CHERRY TOMATOES IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA GRAPE TOMATOES IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA ROMA TOMATOES IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA TOMATOES ON THE VINE IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA BEEFSTEAK TOMATOES IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA HEIRLOOM TOMATOES IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA GREEN TOMATOES IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA OTHERS IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 14 COMPANIES PROVIDING FRESH TOMATOES

TABLE 15 NORTH AMERICA FRESH IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA FROZEN IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA DRIED IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA CONVENTIONAL IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA ORGANIC IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA HOUSEHOLD/RETAIL INDUSTRY IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA DIRECT IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA INDIRECT IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA TOMATOES MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 35 U.S. TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 36 U.S. TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 37 U.S. TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 38 U.S. TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 39 U.S. FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 U.S. TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 41 MEXICO TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 42 MEXICO TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 43 MEXICO TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 44 MEXICO TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 45 MEXICO FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 MEXICO TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 47 CANADA TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 48 CANADA TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 49 CANADA TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 50 CANADA TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 51 CANADA FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 CANADA TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

图片列表

FIGURE 1 NORTH AMERICA TOMATOES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA TOMATOES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA TOMATOES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA TOMATOES MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA TOMATOES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA TOMATOES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA TOMATOES MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA TOMATOES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA TOMATOES MARKET: SEGMENTATION

FIGURE 10 RISING DEMAND OF TOMATO ON FOOD PROCESSING INDUSTRY IS EXPECTED TO DRIVE THE NORTH AMERICA TOMATOES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 THE CHERRY TOMATO SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA TOMATOES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 SUPPLY CHAIN OF THE NORTH AMERICA TOMATOES MARKET

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA TOMATOES MARKET

FIGURE 14 THE AVERAGE CHANGE IN THE RETAIL PRICE OF TOMATO PER KG COMPARED TO THE LONG-TERM PRICE TREND

FIGURE 15 NORTH AMERICA TOMATOES MARKET, BY TYPE, 2022

FIGURE 16 NORTH AMERICA TOMATOES MARKET, BY PRODUCT TYPE, 2022

FIGURE 17 NORTH AMERICA TOMATOES MARKET, BY CATEGORY, 2022

FIGURE 18 NORTH AMERICA TOMATOES MARKET, BY END USER, 2022

FIGURE 19 NORTH AMERICA TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2022

FIGURE 20 NORTH AMERICA TOMATOES MARKET: SNAPSHOT (2022)

FIGURE 21 NORTH AMERICA TOMATOES MARKET: BY COUNTRY (2022)

FIGURE 22 NORTH AMERICA TOMATOES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 23 NORTH AMERICA TOMATOES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 24 NORTH AMERICA TOMATOES MARKET: BY TYPE (2023 - 2030)

FIGURE 25 NORTH AMERICA TOMATOES MARKET: COMPANY SHARE 2022 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。