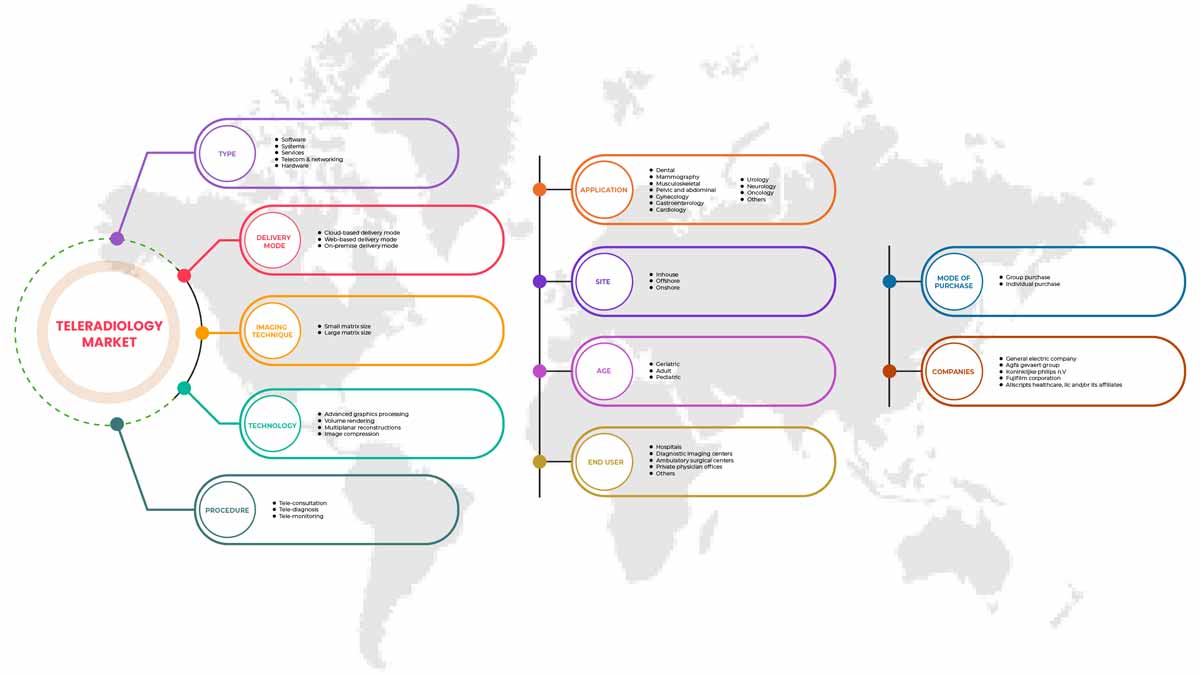

北美远程放射学市场,按类型(硬件、系统、软件、电信和网络服务)、交付模式(基于 Web 的交付模式、基于云的交付模式和本地交付模式)、成像技术(小矩阵大小和大矩阵大小)、技术(高级图形处理、体积渲染、多平面重建和图像压缩)、程序(远程会诊、远程诊断和远程监控)、应用(心脏病学、神经病学、肿瘤学、肌肉骨骼、胃肠病学、盆腔和腹部、妇科、泌尿科、乳房 X 线摄影、牙科和其他)、地点(内部、离岸和陆上)、年龄(儿科、老年科和成人)、购买方式(团购和个人购买)、最终用户(医院、门诊手术中心、私人医生办公室、诊断成像中心和其他)、行业趋势及预测至2029年。

北美远程放射学市场分析和见解

远程放射学是远程医疗的一个分支,其中电信系统用于将放射图像从一个位置传输到另一个位置。快速数字图像处理技术已经发展到可以确保在区域、地方和北美层面有效分发图像。移动技术 (mHealth) 用于可视化和解释图像的出现和接受进一步推动了美国、德国、英国、澳大利亚和日本等发达国家远程放射学市场的增长。智能连接设备和相关解决方案的广泛使用证实了对医学图像的有效解释,从而缩短了治疗时间。因此,数字技术的进步将增强远程患者监测方法和放射科医生解释和咨询的可及性。

此外,根据世界卫生组织的资料,癌症是全球六分之一的死亡原因。此外,大约 70% 的癌症死亡发生在低收入和中等收入国家。联邦政府增加资金以推动这些解决方案的采用,进一步影响了市场。此外,医疗支出的激增、医疗基础设施的进步以及对扩大医疗服务的高需求对远程放射学市场产生了积极影响。

然而,还款和日益增加的监管负担预计将抑制远程放射学市场的增长。另一方面,技术成本的上升预计将抑制市场的增长。

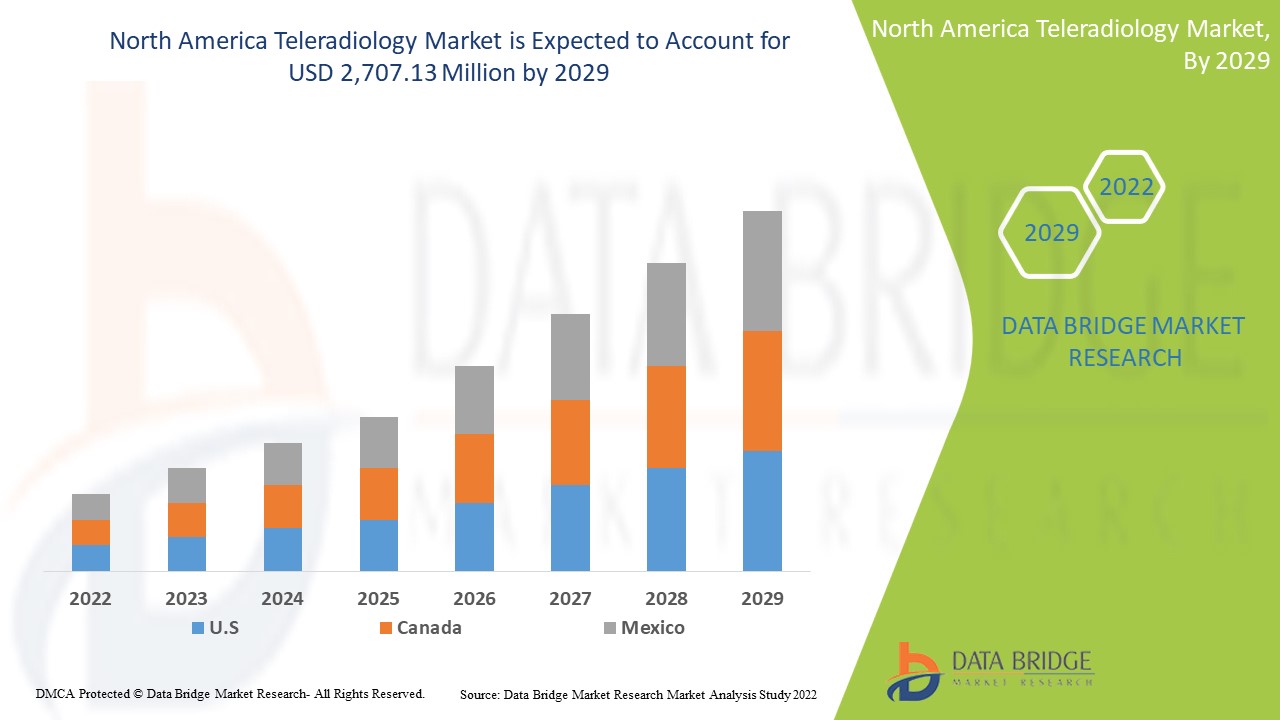

Data Bridge Market Research 分析称,预计到 2029 年,北美远程放射学市场价值将达到 27.0713 亿美元,预测期内复合年增长率为 18.5%。由于北美人口中远程放射学服务的增加,服务占市场最大类型。本市场报告还深入介绍了定价分析、专利分析和技术进步。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制至 2019 - 2014) |

|

定量单位 |

收入(百万美元)、销量(单位)、定价(美元) |

|

涵盖的领域 |

按类型(硬件、系统、软件、电信和网络服务)、交付模式(基于 Web 的交付模式、基于云的交付模式和本地交付模式)、成像技术(小矩阵大小和大矩阵大小)、技术(高级图形处理、体积渲染、多平面重建和图像压缩)、程序(远程会诊、远程诊断和远程监控)、应用(心脏病学、神经病学、肿瘤学、肌肉骨骼、胃肠病学、盆腔和腹部、妇科、泌尿科、乳房 X 线摄影、牙科等)、地点(内部、海上和陆上)、年龄(儿科、老年科和成人)、购买方式(团购和个人购买)、最终用户(医院、门诊手术中心、私人医生办公室、诊断成像中心等) |

|

覆盖国家 |

美国、加拿大和墨西哥 |

|

涵盖的市场参与者 |

远程医疗诊所、Virtual Radiologic、RamSoft, Inc.、Koninklijke Philips NV、Everlight Radiology、Teleradiology Solutions、All-American Teleradiology、Medica Group PLC、Vital Radiology Services、PMG Services, Inc.、General Electric、RadNet, Inc.、FUJIFILM Corporation、Agfa-Gevaert Group、USARAD.COM、TeleDiagnosys Services Pvt Ltd.、ONRAD, Inc.、4ways Healthcare Limited、Allscripts Healthcare, LLC、Redox, Inc.、NightHawk Radiology、NightShift Radiology 和 NucleusHealth 等。 |

北美远程放射学市场定义

远程放射学是一种医疗方法,它捕捉身体内部解剖和功能的视觉效果,有助于医学诊断或治疗过程。可以以这种方式解释所有非侵入性成像研究,例如数字化 x 射线、CT、MRI、超声波和核医学研究。它可以在一个位置捕获医学图像,并在一定范围内传输或传输它们,以便放射科医生可以查看和解释它们以进行诊断或咨询。远程放射学广泛应用于远程监控、远程会诊和远程诊断,使放射科医生能够有效地开展日常工作。远程放射学通过实时解释和北美云网络实现有效的现场解决方案。远程放射学主要帮助医务人员访问患者信息,无论身在何处,从而增强诊断覆盖率。远程放射学服务为放射科医生提供了广泛的应用,使他们能够使用 Web 服务来改善患者的护理和治疗,而无需亲自到现场。

此外,在需要第二意见和紧急情况下,对远程放射学的需求不断增长,这是市场影响力巨大的驱动因素之一。此外,医疗保健专业人员的短缺,尤其是在儿科、神经内科和肌肉骨骼放射学等亚专科领域的短缺,也导致了远程放射学服务的采用。

北美远程放射学市场动态

本节旨在了解市场驱动因素、机遇、限制因素和挑战。下文将详细讨论所有这些内容:

驱动程序

- 先进成像技术日益增多

预计成像程序的增加将推动对可靠性和效率的远程放射学解决方案的需求。先进的诊断成像,包括诊断磁共振成像 (MRI)、计算机断层扫描 (CT) 和核医学成像,如正电子发射断层扫描 (PET),已经吸引了许多新的提供商。包括放射科医生在内的从业人员开出的诊断医学成像服务量激增。

CT 扫描占所有受辐射美国人的四分之一。管理先进而复杂的诊断成像系统需要高水平的工程和专业知识,因此在缺乏适当资源的情况下,病例变得越来越复杂。采用遥感解决方案对缩小许多新兴国家(包括印度和巴西)以及美国、英国和德国等发达经济体的城乡差距做出了重大贡献。这些解决方案更实用、更经济,因为它们消除了旅行,并允许放射科医生在任何地方工作。合格放射科医生的短缺进一步增加了对放射服务的需求。

远程放射学的先进成像程序有望帮助市场快速获得更准确的结果,并推动预测期内北美远程放射学市场的增长。

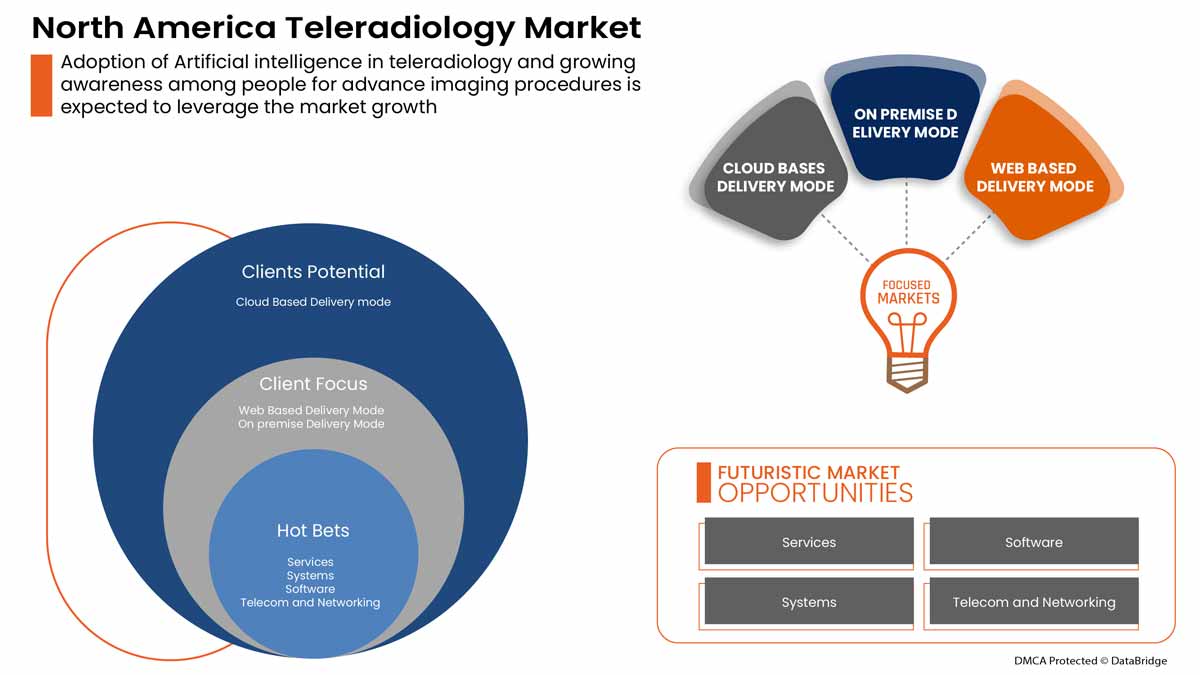

- 人工智能在远程放射学中的应用

人工智能是远程放射学领域最有前景的突破之一。据估计,过去十年间,有关放射学人工智能的出版物数量已从平均每年 100-150 份研究出版物增长到每年 700-800 份。在所有主要成像模式中,CT 和 MRI 系统中对人工智能的接受度较高。根据应用情况,人工智能也主要用于神经放射学。该市场的几家参与者正在扩大其人工智能产品。

AI 已在全球众多医疗机构中得到应用,并已证明自己是放射学领域的宝贵合作伙伴。Integral Diagnostics Group (IDG) 的子公司 North America Diagnostics Australia (GDA) 是首批将 AI 部署到放射学工作流程中的澳大利亚诊断公司之一。该公司将高端算法集成到护理管理路径中,以加速患者护理和头部、颈部和胸部疾病的治疗。AI 在远程放射学中的额外好处是,人工智能可帮助放射科医生快速分析图像和数据注册表,以更好地了解患者状况,增强其临床作用,并成为核心管理团队的一部分。AI 发挥了足够的作用,使放射科医生可以专注于需要他们专业关注的复杂病例。

人工智能 (AI) 可以帮助创建一个内置系统,根据协议要求对病例进行优先排序。例如,创伤和中风病例可以优先处理并分配给放射科医生的工作列表,从而挽救许多生命。

远程放射学中的人工智能有助于利用自动化工具获得更好的结果,并帮助放射科医生正确运用他们的技能,这有望推动市场增长。

克制

- 农村地区缺乏高速互联网接入

远程放射学让农村患者和专业人员无需前往医疗系统更先进的人口稠密的城市地区即可获得高质量的影像咨询。此外,远程工作的放射科医生需要良好的互联网连接。然而,缺乏高速宽带连接影响了农村地区远程放射服务的普及。

高速互联网连接受限会影响放射科医生参与视频咨询、提交医学影像报告和远程监控患者健康状况的能力。当连接速度慢导致图像密集型研究出现瓶颈时,工作流程很快就会变得令人沮丧并影响患者护理。此外,还需要 IT 服务来确保图像符合 HIPAA 的要求。因此,缺乏可靠的互联网连接和农村地区宽带连接不佳是北美市场稳步扩张的主要障碍。

机会

-

提高人们的认识

远程放射学为在北美接受医疗服务提供了替代选择,提高了可及性并降低了因旅行接受服务而产生的费用。然而,由于采用速度缓慢且分散,远程放射学的潜力尚未充分发挥。

意识计划、远程放射学意识的增强以及政府的支持增加了远程放射学和远程医疗在各个领域的使用。

这些针对人们的宣传计划和活动提高了他们对健康的兴趣,使他们更多地了解医疗保健计划以及为他们的健康带来哪些新机会,这最终将促进远程放射学的市场增长并为公司提供成长机会。

挑战

- 误诊几率高

体检可以更好地了解患者的实际健康状况,这是患者治疗的最关键因素。所有治疗方案以及治疗的下一步应该是什么都可以通过快速体检来制定。放射科医生也应采用同样的程序来了解更多有关实际问题和状况的信息,当患者在会诊期间与放射科医生在一起时,可以获得更多的结果。缺乏患者病史和医学影像过程中患者身体检查的其他必要记录是放射科医生无法在远程放射学中做出最佳决策的主要因素。例如,事实证明,医生和放射科医生之间的沟通会导致 50% 的病例临床诊断修改,从而影响治疗方案。如果适当披露患者的病史,解释的准确性将发生变化

因此,误诊和报告检查不当的可能性很高,从而破坏了远程放射学的使用,预计这将对北美远程放射学市场的增长构成挑战。

后新冠疫情对北美远程放射学市场的影响

新冠疫情严重影响了北美的医疗保健,英国是受影响最严重的国家之一。冠状病毒已在全球蔓延,影响了数百万人,并导致数千人死亡。由于北美新冠疫情的爆发,各种规模的医疗机构都承受着巨大的压力。由于选择性手术的取消或推迟,医疗治疗量急剧下降,市场在疫情开始时就受到了影响。另一方面,医疗服务提供商需要依靠远程放射学解决方案来读取诊断报告并治疗患者,这促进了远程放射学行业的发展。远程放射学解决方案通过改进和简化放射学,提供准确的读取和更少的人工错误,从而提高了诊断成像效率。随着抗击新冠疫情的持续,远程放射学方法得到了更广泛的应用。

制造商正在制定各种战略决策,以在新冠疫情后实现复苏。参与者正在进行多项研发活动、产品发布和战略合作,以改善药物基因组学检测市场的技术和检测结果。

最新动态

- 2022 年 4 月,4ways 宣布入围 2022 年健康投资者奖。4ways 正在角逐年度诊断提供商奖。这一认可庆祝了 4ways 的成长,巩固了其作为客户关键合作伙伴的地位。4ways 通过工作流程创新和新技术投资,持续改进其服务产品。这使得 4ways 作为远程放射学平台获得了弹性,并提供了运营安全性

北美远程放射学市场范围

北美的远程放射学市场细分为类型、交付模式、成像技术、技术、程序、应用、地点、年龄、购买方式和最终用户。细分市场之间的增长有助于您分析利基市场的发展和进入市场的策略,并确定您的核心应用领域和目标市场的差异。

按类型

- 硬件

- 系统

- 软件

- 电信和网络

- 服务

根据类型,北美远程放射学市场分为硬件、系统、软件、电信和网络服务。

按交付方式

- 基于网络的交付模式

- 基于云的交付模式

- 现场交付模式

根据交付模式,北美远程放射学市场分为基于网络的交付模式、基于云的交付模式和内部交付模式。

按成像技术

- 矩阵规模小

- 大型矩阵规模

根据成像技术,北美远程放射学市场分为小矩阵规模和大矩阵规模。

按技术分类

- 高级图形处理

- 体积渲染

- 多平面重建

- 图像压缩

On the basis of technology, the North American teleradiology market is segmented into advanced graphics processing, volume rendering, multiplanar reconstructions, and image compression.

By Procedure

- TELE-CONSULTATION

- TELE-DIAGNOSIS

- TELE-MONITORING

On the basis of procedure, the North American teleradiology market is segmented into teleconsultation, telediagnosis, and telemonitoring.

By Application

- CARDIOLOGY

- NEUROLOGY

- ONCOLOGY

- MUSCULOSKELETAL

- GASTROENTEROLOGY

- PELVIC AND ABDOMINAL

- GYNECOLOGY

- UROLOGY

- MAMMOGRAPHY

- DENTAL

- OTHERS

On the basis of application, the North American teleradiology market is segmented into cardiology, neurology, oncology, musculoskeletal, gastroenterology, pelvic and abdominal, gynecology, urology, mammography, dental, and others.

By Site

- INHOUSE

- ONSHORE

- OFFSHORE

On the basis of site, the North American teleradiology market is segmented in-house, offshore, and onshore.

By Age

- PEDIATRIC

- ADULT

- GERIATRIC

On the basis of age, the North American teleradiology market is segmented into pediatric, geriatric, and adult.

By Mode Of Purchase

- GROUP PURCHASE

- INDIVIDUAL PURCHASE

On the basis of mode of purchase, the North American teleradiology market is segmented into group purchases and individual purchases.

By End Users

- HOSPITALS

- AMBULATORY SURGICAL CENTERS

- PRIVATE PHYSICIAN OFFICES

- DIAGNOSTIC IMAGING CENTERS

- OTHERS

On the basis of end-user, the North American teleradiology market is segmented into hospitals, ambulatory surgical centers, private physician offices, diagnostics imaging centers, and others.

North America Teleradiology Market Regional Analysis/Insights

The North American teleradiology market is analyzed, and market size information is provided by type, delivery mode, imaging technique, technology, procedure, application, site, age, mode of purchase, and end-user.

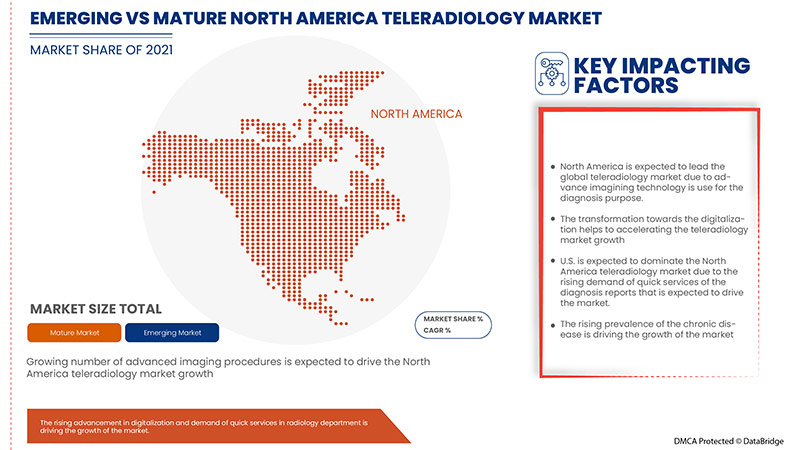

The countries covered in this market report are U.S., Canada, and Mexico.

In 2022, North America will be most dominating due to the presence of key market players in the largest consumer market with high GDP. The U.S is expected to grow due to the rise in technological advancement in teleradiology.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Teleradiology Market Share Analysis

北美远程放射学市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、产生的收入、市场潜力、研发投资、新市场计划、生产基地和设施、公司优势和劣势、产品发布、产品试验渠道、产品批准、专利、产品宽度和广度、应用主导地位、技术生命线曲线。以上提供的数据点仅与公司对北美远程放射学市场的关注有关。

研究方法:北美远程放射学市场

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析以及主要(行业专家)验证。除此之外,数据模型还包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、公司市场份额分析、测量标准、北美与地区以及供应商份额分析。如有进一步询问,请要求分析师致电。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA TELERADIOLOGY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 TYPE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

3.1 PESTEL_ANALYSIS

3.2 PORTER'S FIVE FORCES

3.3 INDUSTRIAL INSIGHTS:

4 REGULATIONS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING NUMBER OF ADVANCED IMAGING PROCEDURES

5.1.2 ADOPTION OF ARTIFICIAL INTELLIGENCE IN TELERADIOLOGY

5.1.3 GOVERNMENT INVESTMENTS FOR HEALTHCARE INTEROPERABILITY

5.2 RESTRAINTS

5.2.1 LACK OF ACCESS TO HIGH-SPEED INTERNET IN RURAL AREAS

5.2.2 LACK OF IMAGING DATA SECURITY

5.3 OPPORTUNITIES

5.3.1 TRANSFORMATION TOWARDS DIGITALIZATION

5.3.2 GROWING PREVALENCE OF CHRONIC DISEASES AND CONDITIONS

5.3.3 INCREASING AWARENESS AMONG PEOPLE

5.4 CHALLENGES

5.4.1 HIGH CHANCES OF MISDIAGNOSIS

5.4.2 RISING HEALTHCARE FRAUDS

5.4.3 STRINGENT REGULATORY

6 NORTH AMERICA TELERADIOLOGY MARKET, BY TYPE

6.1 OVERVIEW

6.2 SERVICES

6.2.1 BY TYPE SERVICES

6.2.1.1 NIGHT RADIOLOGY SERVICES

6.2.1.2 DAYTIME RADIOLOGY SERVICES

6.2.2 BY PROCESS SERVICES

6.2.2.1 CERTIFIED REPORTING SERVICES

6.2.2.2 PRELIMINARY REPORTING

6.3 SOFTWARE

6.3.1 BY DEPLOYMENT

6.3.1.1 INTEGRATED SOFTWARE

6.3.1.2 STANDALONE SOFTWARE

6.3.2 BY TYPE SOFTWARE

6.3.2.1 PICTURE ARCHIVING AND COMMUNICATION

6.3.2.2 RADIOLOGY INFORMATION SYSTEM

6.4 SYSTEMS

6.4.1 DIGITAL IMAGING AND COMMUNICATION IN MEDICINE (DICOM)

6.4.2 ELECTRONIC MEDICAL RECORDS (EMR) SYSTEMS

6.4.3 ELECTRONIC HEALTH RECORD (HER) SYSTEM

6.5 TELECOM & NETWORKING

6.5.1 ENTERPRISE-BASED TELERADIOLOGY SOLUTIONS

6.5.2 CLOUD-BASED TELERADIOLOGY SOLUTIONS

6.5.3 WEB-BASED TELERADIOLOGY SOLUTIONS

6.5.4 VIRTUAL PRIVATE NETWORK (VPN)

6.6 HARDWARE

6.6.1 IMAGE PRINTER

6.6.2 RADIOLOGY VIEWSTATION

6.6.3 SCANNERS

6.6.4 FILM DIGITIZER

6.6.5 MONITORS

6.6.6 IMAGE VIEWERS

6.6.7 OTHERS

7 NORTH AMERICA TELERADIOLOGY MARKET, BY DELIVERY MODE

7.1 OVERVIEW

7.2 CLOUD-BASED DELIVERY MODE

7.3 WEB-BASED DELIVERY MODE

7.4 ON-PREMISE DELIVERY MODE

8 NORTH AMERICA TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE

8.1 OVERVIEW

8.1.1 SMALL MATRIX SIZE

8.1.1.1 MAGNETIC RESONANCE IMAGING

8.1.1.2 NUCLEAR IMAGING (SPECT/PET)

8.1.1.3 COMPUTED TOMOGRAPHY (CT) SCAN

8.1.1.4 TELE-ULTRASOUND

8.1.1.5 DIGITAL FLUOROGRAPHY

8.1.1.6 DIGITAL ANGIOGRAPHY

8.1.1.7 ECHOCARDIOGRAM

8.1.1.8 MAMMOGRAPHY

8.1.1.9 DIGITAL X-RAY IMAGING

8.2 LARGE MATRIX SIZE

8.2.1 DIGITIZED RADIOGRAPHIC FILMS

8.2.2 DIGITAL RADIOGRAPHY

9 NORTH AMERICA TELERADIOLOGY MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 ADVANCED GRAPHICS PROCESSING

9.3 VOLUME RENDERING

9.4 MULTIPLANAR RECONSTRUCTIONS

9.5 IMAGE COMPRESSION

10 NORTH AMERICA TELERADIOLOGY MARKET, BY PROCEDURE

10.1 OVERVIEW

10.2 TELE-CONSULTATION

10.3 TELE-DIAGNOSIS

10.4 TELE-MONITORING

11 NORTH AMERICA TELERADIOLOGY MARKET, BY APPLICATION

11.1 OVERVIEW

11.1.1 CARDIOLOGY

11.1.1.1 SERVICES

11.1.1.2 SOFTWARE

11.1.1.3 SYSTEMS

11.1.1.4 TELECOM & NETWORKING

11.1.1.5 HARDWARE

11.1.2 ONCOLOGY

11.1.2.1 SERVICES

11.1.2.2 SOFTWARE

11.1.2.3 SYSTEMS

11.1.2.4 TELECOM & NETWORKING

11.1.2.5 HARDWARE

11.1.3 NEUROLOGY

11.1.3.1 SERVICES

11.1.3.2 SOFTWARE

11.1.3.3 SYSTEMS

11.1.3.4 TELECOM & NETWORKING

11.1.3.5 HARDWARE

11.1.4 MUSCULOSKELETAL

11.1.4.1 SERVICES

11.1.4.2 SOFTWARE

11.1.4.3 SYSTEMS

11.1.4.4 TELECOM & NETWORKING

11.1.4.5 HARDWARE

11.1.5 GASTROENTEROLOGY

11.1.5.1 SERVICES

11.1.5.2 SOFTWARE

11.1.5.3 SYSTEMS

11.1.5.4 TELECOM & NETWORKING

11.1.5.5 HARDWARE

11.1.6 PELVIC AND ABDOMINAL

11.1.6.1 SERVICES

11.1.6.2 SOFTWARE

11.1.6.3 SYSTEMS

11.1.6.4 TELECOM & NETWORKING

11.1.6.5 HARDWARE

11.1.7 GYNECOLOGY

11.1.7.1 SERVICES

11.1.7.2 SOFTWARE

11.1.7.3 SYSTEMS

11.1.7.4 TELECOM & NETWORKING

11.1.7.5 HARDWARE

11.1.8 UROLOGY

11.1.8.1 SERVICES

11.1.8.2 SOFTWARE

11.1.8.3 SYSTEMS

11.1.8.4 TELECOM & NETWORKING

11.1.8.5 HARDWARE

11.1.9 MAMMOGRAPHY

11.1.9.1 SERVICES

11.1.9.2 SOFTWARE

11.1.9.3 SYSTEMS

11.1.9.4 TELECOM & NETWORKING

11.1.9.5 HARDWARE

11.1.10 DENTAL

11.1.10.1 SERVICES

11.1.10.2 SOFTWARE

11.1.10.3 SYSTEMS

11.1.10.4 TELECOM & NETWORKING

11.1.10.5 HARDWARE

11.1.11 OTHERS

12 NORTH AMERICA TELERADIOLOGY MARKET, BY SITE

12.1 OVERVIEW

12.1.1 INHOUSE

12.1.2 OFFSHORE

12.1.3 ONSHORE

13 NORTH AMERICA TELERADIOLOGY MARKET, BY AGE

13.1 OVERVIEW

13.2 PEDIATRIC

13.3 ADULT

13.4 GERIATRIC

14 NORTH AMERICA TELERADIOLOGY MARKET, BY MODE OF PURCHASE

14.1 OVERVIEW

14.2 GROUP PURCHASE

14.3 INDIVIDUAL PURCHASE

15 NORTH AMERICA TELERADIOLOGY MARKET, BY END USER

15.1 OVERVIEW

15.2 HOSPITALS

15.2.1 PRIVATE

15.2.2 PUBLIC

15.3 DIAGNOSTICS IMAGING CENTRES

15.4 AMBULATORY SURGICAL CENTERS

15.5 PRIVATE PHYSICIAN OFFICES

15.6 OTHERS

16 NORTH AMERICA TELERADIOLOGY MARKET, BY GEOGRAPHY

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

17 NORTH AMERICA TELERADIOLOGY MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 GENERAL ELECTRIC COMPANY (2021)

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENT

19.2 AGFA GEVAERT GROUP

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENTS

19.3 KONINKLIJKE PHILIPS N.V.

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENTS

19.4 FUJIFILM CORPORATION

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIS

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 ALLSCRIPTS HEALTHCARE, LLC AND/OR ITS AFFILIATES.

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENT

19.6 MEDNAX SERVICES, INC

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUE ANALYSIS

19.6.3 PRODUCT PORTFOLIO

19.6.4 RECENT DEVELOPMENT

19.7 VIRTUAL RADIOLOGIC

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENTS

19.8 NUCLEUSHEALTH

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 RECENT DEVELOPMENTS

19.9 TELERADIOLOGY SOLUTIONS

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENTS

19.1 ALL-AMERICAN TELERADIOLOGY

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENT

19.11 EVERLIGHT RADIOLOGY

19.11.1 COMPANY SNAPSHOT

19.11.2 PRODUCT PORTFOLIO

19.11.3 RECENT DEVELOPMENTS

19.12 MEDICA GROUP PLC.

19.12.1 COMPANY SNAPSHOT

19.12.2 REVENUE ANALYSIS

19.12.3 PRODUCT PORTFOLIO

19.12.4 RECENT DEVELOPMENTS

19.13 NIGHTHAWK RADIOLOGY

19.13.1 COMPANY SNAPSHOT

19.13.2 PRODUCT PORTFOLIO

19.13.3 RECENT DEVELOPMENTS

19.14 NIGHTSHIFT RADIOLOGY

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENTS

19.15 ONRAD, INC.

19.15.1 COMPANY SNAPSHOT

19.15.2 PRODUCT PORTFOLIO

19.15.3 RECENT DEVELOPMENTS

19.16 RADNET, INC.

19.16.1 COMPANY SNAPSHOT

19.16.2 REVENUE ANALYSIS

19.16.3 PRODUCT PORTFOLIO

19.16.4 RECENT DEVELOPMENTS

19.17 RAMSOFT, INC.

19.17.1 COMPANY SNAPSHOT

19.17.2 PRODUCT PORTFOLIO

19.17.3 RECENT DEVELOPMENTS

19.18 REAL RADS

19.18.1 COMPANY SNAPSHOT

19.18.2 PRODUCT PORTFOLIO

19.18.3 RECENT DEVELOPMENT

19.19 REDOX, INC

19.19.1 COMPANY SNAPSHOT

19.19.2 PRODUCT PORTFOLIO

19.19.3 RECENT DEVELOPMENTS

19.2 TELEDIAGNOSYS SERVICES PVT LTD.

19.20.1 COMPANY SNAPSHOT

19.20.2 PRODUCT PORTFOLIO

19.20.3 RECENT DEVELOPMENT

19.21 TELEMEDICINE CLINIC

19.21.1 COMPANY SNAPSHOT

19.21.2 PRODUCT PORTFOLIO

19.21.3 RECENT DEVELOPMENTS

19.22 USARAD.COM.

19.22.1 COMPANY SNAPSHOT

19.22.2 PRODUCT PORTFOLIO

19.22.3 RECENT DEVELOPMENTS

19.23 VITAL RADIOLOGY SERVICES

19.23.1 COMPANY SNAPSHOT

19.23.2 PRODUCT PORTFOLIO

19.23.3 RECENT DEVELOPMENTS

19.24 4 WAYS

19.24.1 COMPANY SNAPSHOT

19.24.2 PRODUCT PORTFOLIO

19.24.3 RECENT DEVELOPMENTS

20 QUESTIONNAIRE

21 RELATED REPORTS

表格列表

TABLE 1 NORTH AMERICA TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA SERVICES IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA BY TYPE SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA BY PROCESS SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA SOFTWARE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA BY DEPLOYMENT SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA BY TYPE SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA SYSTEMS IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA SYSTEMS IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA TELECOM & NETWORKING IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA TELECOM & NETWORKING IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA HARDWARE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA HARDWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA TELERADIOLOGY MARKET, BY DELIVERY MODE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA CLOUD-BASED DELIVERY MODE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA WEB-BASED DELIVERY MODE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA ON-PREMISE DELIVERY MODE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA SMALL MATRIX SIZE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA SMALL MATRIX SIZE IN TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA LARGE MATRIX SIZE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA LARGE MATRIX SIZE IN TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA TELERADIOLOGY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA ADVANCE GRAPHICS PROCESSING IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA VOLUME RENDERING IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA MULTIPLANAR RECONSTRUCTIONS IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA IMAGE COMPRESSION IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA TELERADIOLOGY MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA TELE-CONSULTATION IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA TELE-DIAGNOSIS IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA TELE-MONITORING IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA CARDIOLOGY IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA CARDIOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA ONCOLOGY IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA ONCOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA NEUROLOGY IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA NEUROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA MUSCULOSKELETAL IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA MUSCULOSKELETAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA GASTROENTEROLOGY IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA GASTROENTEROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA PELVIC AND ABDOMINAL IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA PELVIC AND ABDOMINAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA GYNECOLOGY IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA GYNECOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA UROLOGY IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA UROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA MAMMOGRAPHY IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA MAMMOGRAPHY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA DENTAL IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA DENTAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA OTHERS IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA TELERADIOLOGY MARKET, BY SITE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA INHOUSE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA OFFSHORE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA ONSHORE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA TELERADIOLOGY MARKET, BY AGE, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA PEDIATRIC IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA ADULT IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA GERIATRIC IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA TELERADIOLOGY MARKET, BY MODE OF PURCHASE, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA GROUP PURCHASE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA INDIVIDUAL PURCHASE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA TELERADIOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA HOSPITALS IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA HOSPITALS IN TELERADIOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA DIAGNOSTICS IMAGINING CENTRES IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA AMBULATORY SURGICAL CENTRES IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA PRIVATE PHYSICIAN OFFICES IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA OTHERS IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA TELERADIOLOGY MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 75 NORTH AMERICA TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 NORTH AMERICA SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 NORTH AMERICA BY TYPE SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 NORTH AMERICA BY PROCESS SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 NORTH AMERICA SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 NORTH AMERICA BY DEPLOYMENT SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 NORTH AMERICA BY TYPE SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 NORTH AMERICA SYSTEMS IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 NORTH AMERICA TELECOM & NETWORKING IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 NORTH AMERICA HARDWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 NORTH AMERICA TELERADIOLOGY MARKET, BY DELIVERY MODE, 2020-2029 (USD MILLION)

TABLE 86 NORTH AMERICA TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 87 NORTH AMERICA SMALL MATRIX SIZE IN TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 88 NORTH AMERICA LARGE MATRIX SIZE IN TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 89 NORTH AMERICA TELERADIOLOGY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 90 NORTH AMERICA TELERADIOLOGY MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 91 NORTH AMERICA TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 NORTH AMERICA CARDIOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 93 NORTH AMERICA ONCOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 94 NORTH AMERICA NEUROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 NORTH AMERICA MUSCULOSKELETAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 NORTH AMERICA GASTROENTEROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 NORTH AMERICA PELVIC AND ABDOMINAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 NORTH AMERICA GYNECOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 99 NORTH AMERICA UROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 100 NORTH AMERICA MAMMOGRAPHY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 101 NORTH AMERICA DENTAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 102 NORTH AMERICA TELERADIOLOGY MARKET, BY SITE, 2020-2029 (USD MILLION)

TABLE 103 NORTH AMERICA TELERADIOLOGY MARKET, BY AGE, 2020-2029 (USD MILLION)

TABLE 104 NORTH AMERICA TELERADIOLOGY MARKET, BY MODE OF PURCHASE, 2020-2029 (USD MILLION)

TABLE 105 NORTH AMERICA TELERADIOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 106 NORTH AMERICA HOSPITALS IN TELERADIOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 107 U.S. TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 U.S. SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 U.S. BY TYPE SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 U.S. BY PROCESS SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 U.S. SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 U.S. BY DEPLOYMENT SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 U.S. BY TYPE SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 U.S. SYSTEMS IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 U.S. TELECOM & NETWORKING IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 U.S. HARDWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 U.S. TELERADIOLOGY MARKET, BY DELIVERY MODE, 2020-2029 (USD MILLION)

TABLE 118 U.S. TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 119 U.S. SMALL MATRIX SIZE IN TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 120 U.S. LARGE MATRIX SIZE IN TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 121 U.S. TELERADIOLOGY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 122 U.S. TELERADIOLOGY MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 123 U.S. TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 124 U.S. CARDIOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 125 U.S. ONCOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 126 U.S. NEUROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 127 U.S. MUSCULOSKELETAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 128 U.S. GASTROENTEROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 129 U.S. PELVIC AND ABDOMINAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 130 U.S. GYNECOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 131 U.S. UROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 132 U.S. MAMMOGRAPHY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 133 U.S. DENTAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 U.S. TELERADIOLOGY MARKET, BY SITE, 2020-2029 (USD MILLION)

TABLE 135 U.S. TELERADIOLOGY MARKET, BY AGE, 2020-2029 (USD MILLION)

TABLE 136 U.S. TELERADIOLOGY MARKET, BY MODE OF PURCHASE, 2020-2029 (USD MILLION)

TABLE 137 U.S. TELERADIOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 138 U.S. HOSPITALS IN TELERADIOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 139 CANADA TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 CANADA SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 CANADA BY TYPE SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 CANADA BY PROCESS SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 CANADA SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 CANADA BY DEPLOYMENT SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 CANADA BY TYPE SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 CANADA SYSTEMS IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 CANADA TELECOM & NETWORKING IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 CANADA HARDWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 CANADA TELERADIOLOGY MARKET, BY DELIVERY MODE, 2020-2029 (USD MILLION)

TABLE 150 CANADA TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 151 CANADA SMALL MATRIX SIZE IN TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 152 CANADA LARGE MATRIX SIZE IN TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 153 CANADA TELERADIOLOGY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 154 CANADA TELERADIOLOGY MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 155 CANADA TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 156 CANADA CARDIOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 157 CANADA ONCOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 158 CANADA NEUROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 159 CANADA MUSCULOSKELETAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 160 CANADA GASTROENTEROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 161 CANADA PELVIC AND ABDOMINAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 162 CANADA GYNECOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 163 CANADA UROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 164 CANADA MAMMOGRAPHY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 165 CANADA DENTAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 166 CANADA TELERADIOLOGY MARKET, BY SITE, 2020-2029 (USD MILLION)

TABLE 167 CANADA TELERADIOLOGY MARKET, BY AGE, 2020-2029 (USD MILLION)

TABLE 168 CANADA TELERADIOLOGY MARKET, BY MODE OF PURCHASE, 2020-2029 (USD MILLION)

TABLE 169 CANADA TELERADIOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 170 CANADA HOSPITALS IN TELERADIOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 171 MEXICO TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 MEXICO SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 173 MEXICO BY TYPE SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 MEXICO BY PROCESS SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 175 MEXICO SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 MEXICO BY DEPLOYMENT SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 MEXICO BY TYPE SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 MEXICO SYSTEMS IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 179 MEXICO TELECOM & NETWORKING IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 MEXICO HARDWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 MEXICO TELERADIOLOGY MARKET, BY DELIVERY MODE, 2020-2029 (USD MILLION)

TABLE 182 MEXICO TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 183 MEXICO SMALL MATRIX SIZE IN TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 184 MEXICO LARGE MATRIX SIZE IN TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 185 MEXICO TELERADIOLOGY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 186 MEXICO TELERADIOLOGY MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 187 MEXICO TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 188 MEXICO CARDIOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 189 MEXICO ONCOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 190 MEXICO NEUROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 191 MEXICO MUSCULOSKELETAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 192 MEXICO GASTROENTEROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 193 MEXICO PELVIC AND ABDOMINAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 194 MEXICO GYNECOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 195 MEXICO UROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 196 MEXICO MAMMOGRAPHY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 197 MEXICO DENTAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 198 MEXICO TELERADIOLOGY MARKET, BY SITE, 2020-2029 (USD MILLION)

TABLE 199 MEXICO TELERADIOLOGY MARKET, BY AGE, 2020-2029 (USD MILLION)

TABLE 200 MEXICO TELERADIOLOGY MARKET, BY MODE OF PURCHASE, 2020-2029 (USD MILLION)

TABLE 201 MEXICO TELERADIOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 202 MEXICO HOSPITALS IN TELERADIOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 NORTH AMERICA TELERADIOLOGY MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA TELERADIOLOGY MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA TELERADIOLOGY MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA TELERADIOLOGY MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA TELERADIOLOGY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA TELERADIOLOGY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA TELERADIOLOGY MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA TELERADIOLOGY MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA TELERADIOLOGY MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA TELERADIOLOGY MARKET: SEGMENTATION

FIGURE 11 THE RISING GERIATRIC POPULATION AND THE SUBSEQUENT INCREASE IN THE PREVALENCE OF ASSOCIATED DISEASES ARE EXPECTED TO DRIVE THE NORTH AMERICA TELERADIOLOGY MARKET IN THE FORECAST PERIOD

FIGURE 12 SERVICES ARE EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA TELERADIOLOGY MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA TELERADIOLOGY MARKET

FIGURE 14 NORTH AMERICA TELERADIOLOGY MARKET: BY TYPE, 2021

FIGURE 15 NORTH AMERICA TELERADIOLOGY MARKET: BY TYPE, 2020-2029 (USD MILLION)

FIGURE 16 NORTH AMERICA TELERADIOLOGY MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 17 NORTH AMERICA TELERADIOLOGY MARKET: BY TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA TELERADIOLOGY MARKET: BY DELIVERY MODE, 2021

FIGURE 19 NORTH AMERICA TELERADIOLOGY MARKET: BY DELIVERY MODE, 2020-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA TELERADIOLOGY MARKET: BY DELIVERY MODE, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA TELERADIOLOGY MARKET: BY DELIVERY MODE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA TELERADIOLOGY MARKET: BY IMAGING TECHNIQUE, 2021

FIGURE 23 NORTH AMERICA TELERADIOLOGY MARKET: BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA TELERADIOLOGY MARKET: BY IMAGING TECHNIQUE, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA TELERADIOLOGY MARKET: BY IMAGING TECHNIQUE, LIFELINE CURVE

FIGURE 26 NORTH AMERICA TELERADIOLOGY MARKET : BY TECHNOLOGY, 2021

FIGURE 27 NORTH AMERICA TELERADIOLOGY MARKET : BY TECHNOLOGY, 2020-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA TELERADIOLOGY MARKET : BY TECHNOLOGY, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA TELERADIOLOGY MARKET : BY TECHNOLOGY, LIFELINE CURVE

FIGURE 30 NORTH AMERICA TELERADIOLOGY MARKET : BY PROCEDURE, 2021

FIGURE 31 NORTH AMERICA TELERADIOLOGY MARKET : BY PROCEDURE, 2020-2029 (USD MILLION)

FIGURE 32 NORTH AMERICA TELERADIOLOGY MARKET : BY PROCEDURE, CAGR (2022-2029)

FIGURE 33 NORTH AMERICA TELERADIOLOGY MARKET : BY PROCEDURE, LIFELINE CURVE

FIGURE 34 NORTH AMERICA TELERADIOLOGY MARKET : BY APPLICATION, 2021

FIGURE 35 NORTH AMERICA TELERADIOLOGY MARKET : BY APPLICATION, 2020-2029 (USD MILLION)

FIGURE 36 NORTH AMERICA TELERADIOLOGY MARKET : BY APPLICATION, CAGR (2022-2029)

FIGURE 37 NORTH AMERICA TELERADIOLOGY MARKET : BY APPLICATION, LIFELINE CURVE

FIGURE 38 NORTH AMERICA TELERADIOLOGY MARKET: BY SITE, 2021

FIGURE 39 NORTH AMERICA TELERADIOLOGY MARKET: BY SITE, 2020-2029 (USD MILLION)

FIGURE 40 NORTH AMERICA TELERADIOLOGY MARKET: BY SITE, CAGR (2022-2029)

FIGURE 41 NORTH AMERICA TELERADIOLOGY MARKET: BY SITE, LIFELINE CURVE

FIGURE 42 NORTH AMERICA TELERADIOLOGY MARKET: BY AGE, 2021

FIGURE 43 NORTH AMERICA TELERADIOLOGY MARKET: BY AGE, 2022-2029 (USD MILLION)

FIGURE 44 NORTH AMERICA TELERADIOLOGY MARKET: BY AGE, CAGR (2022-2029)

FIGURE 45 NORTH AMERICA TELERADIOLOGY MARKET: BY AGE, LIFELINE CURVE

FIGURE 46 NORTH AMERICA TELERADIOLOGY MARKET: BY MODE OF PURCHASE, 2021

FIGURE 47 NORTH AMERICA TELERADIOLOGY MARKET: BY MODE OF PURCHASE, 2020-2029 (USD MILLION)

FIGURE 48 NORTH AMERICA TELERADIOLOGY MARKET: BY MODE OF PURCHASE, CAGR (2022-2029)

FIGURE 49 NORTH AMERICA TELERADIOLOGY MARKET: BY MODE OF PURCHASE, LIFELINE CURVE

FIGURE 50 NORTH AMERICA TELERADIOLOGY MARKET: BY END USER, 2021

FIGURE 51 NORTH AMERICA TELERADIOLOGY MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 52 NORTH AMERICA TELERADIOLOGY MARKET: BY END USER, CAGR (2022-2029)

FIGURE 53 NORTH AMERICA TELERADIOLOGY MARKET: BY END USER, LIFELINE CURVE

FIGURE 54 NORTH AMERICA TELERADIOLOGY MARKET: SNAPSHOT (2021)

FIGURE 55 NORTH AMERICA TELERADIOLOGY MARKET: BY COUNTRY (2021)

FIGURE 56 NORTH AMERICA TELERADIOLOGY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 57 NORTH AMERICA TELERADIOLOGY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 58 NORTH AMERICA TELERADIOLOGY MARKET: BY TYPE (2022-2029)

FIGURE 59 NORTH AMERICA TELERADIOLOGY MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。