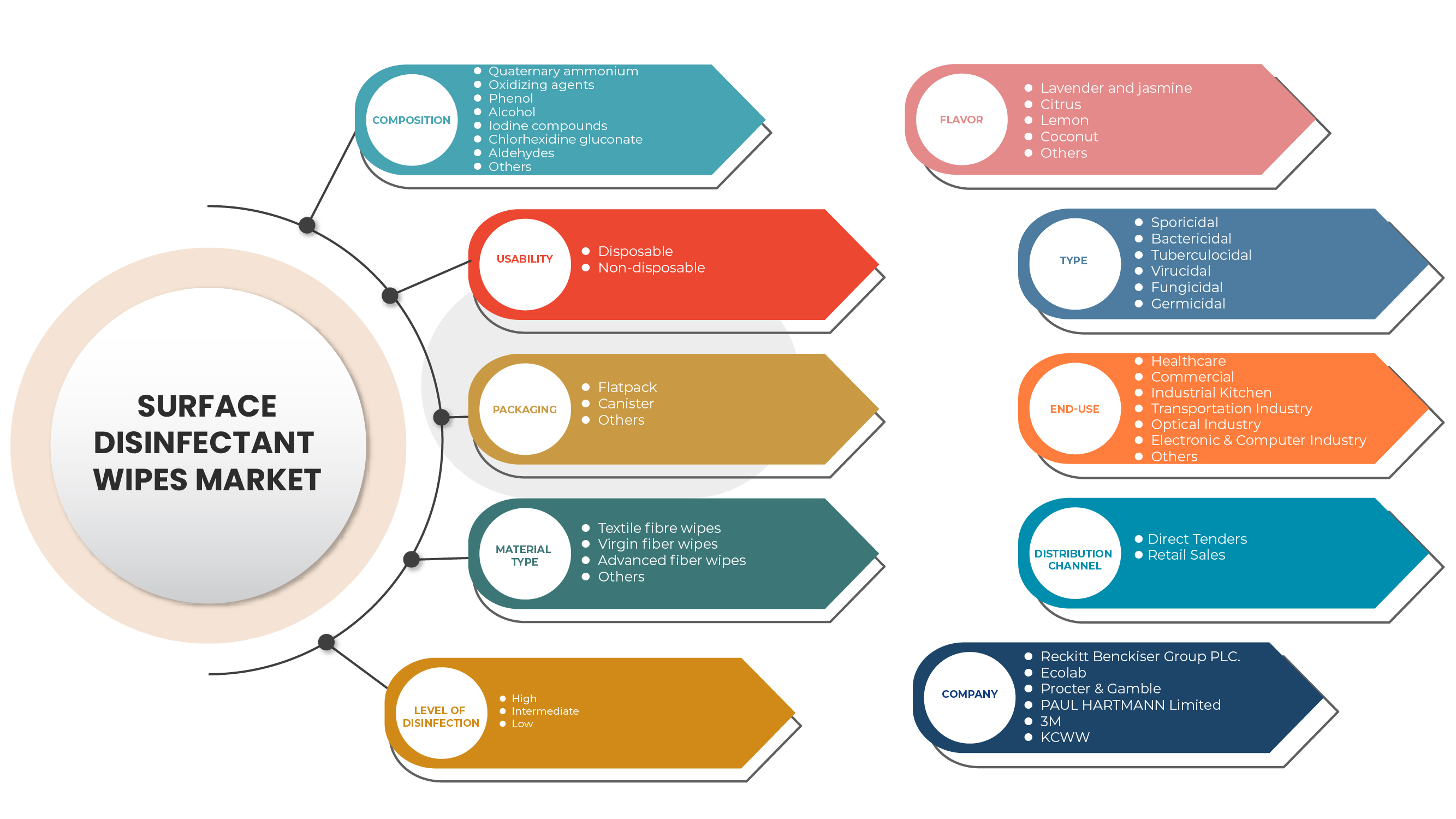

北美表面消毒湿巾市场,按成分(季铵盐、氧化剂、苯酚、酒精、氯化合物、碘化合物、葡萄糖酸氯己定、醛类等)、可用性(一次性和非一次性)、包装(扁平包装、罐装等)、材料类型(纺织纤维湿巾、原生纤维湿巾、高级纤维湿巾等)、消毒等级(高、中、低)、口味(薰衣草和茉莉、柑橘、柠檬、椰子等)、类型(杀孢子、杀菌、杀结核、杀病毒、杀真菌和杀细菌)、最终用途(医疗保健、商业、工业厨房、运输业、光学行业、电子和计算机行业等)、分销渠道(直接招标和零售销售)、行业趋势和预测到 2029 年

市场分析和见解

表面消毒湿巾提供了一种简单的方法,可使几乎任何类型的坚硬、不渗透的表面保持清洁以供使用,消毒并擦拭物品或表面,使被擦洗的区域保持湿润约 30 秒后干燥。壁架、器具、水槽、设施(灯和水)、门把手、门把手、栏杆、瓷砖、石头、陶瓷制品、电话、玩具和控制台是可以使用表面消毒湿巾进行清洁和消毒的常见物品或区域。

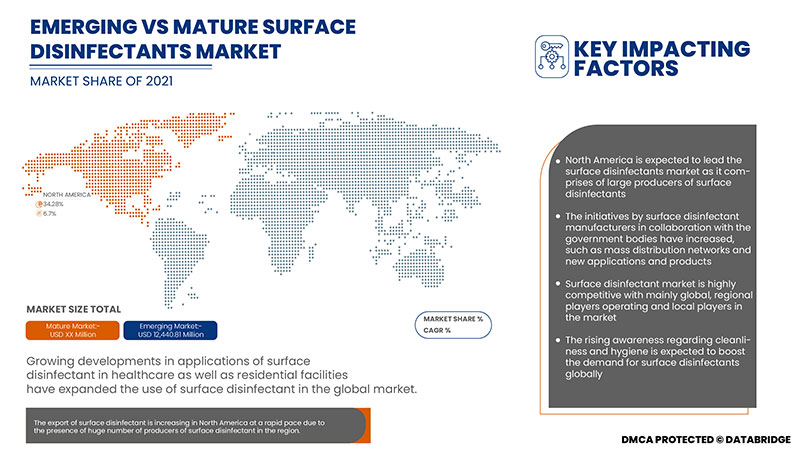

医院、餐饮业、机构和家庭等商业应用对表面消毒湿巾的需求增加是推动表面消毒湿巾市场增长的主要因素。

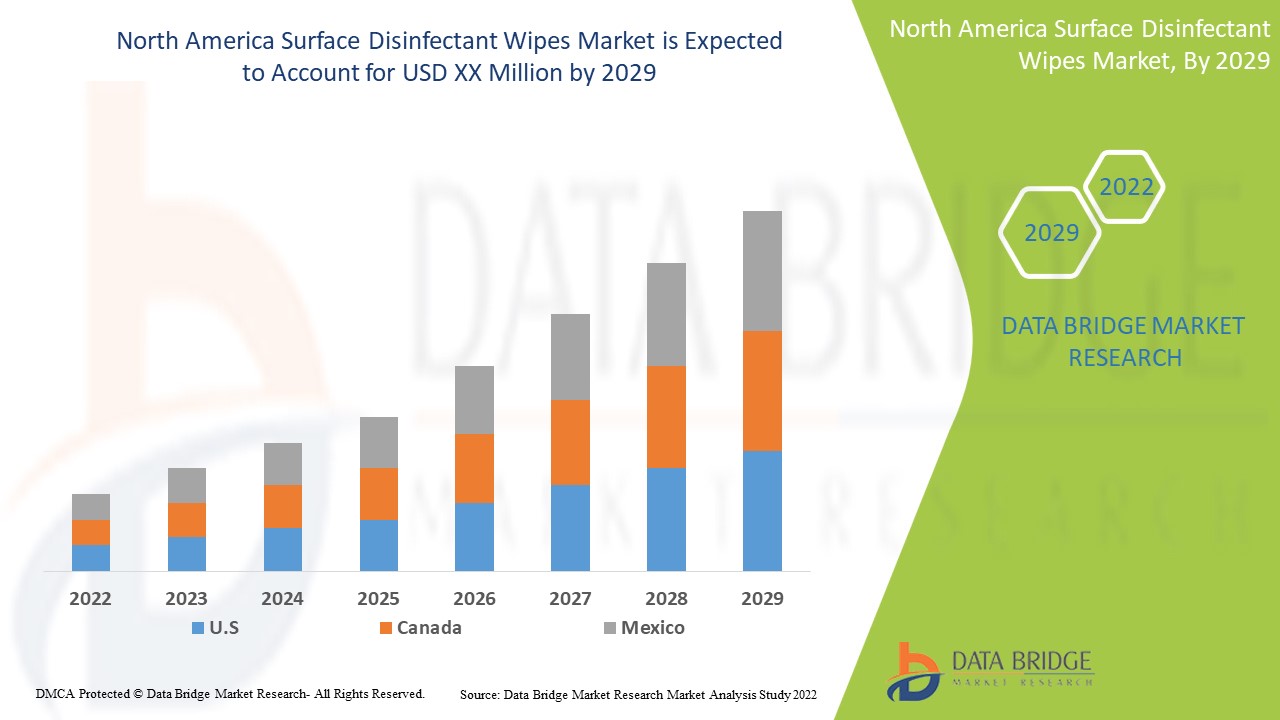

Data Bridge Market Research 分析称,在 2022 年至 2029 年的预测期内,表面消毒湿巾的复合年增长率将达到 6.8%。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史年份 |

2020(可定制为 2020 - 2015) |

|

定量单位 |

收入(百万美元) |

|

涵盖的领域 |

按成分(季铵盐、氧化剂、苯酚、酒精、氯化合物、碘化合物、葡萄糖酸氯己定、醛类等)、可用性(一次性和非一次性)、包装(扁平包装、罐装等)、材料类型(纺织纤维抹布、原生纤维抹布、高级纤维抹布等)、消毒级别(高、中、低)、香味(薰衣草和茉莉、柑橘、柠檬、椰子等)、类型(杀孢子、杀菌、杀结核、杀病毒、杀真菌和杀细菌)、最终用途(医疗保健、商业、工业厨房、运输业、光学行业、电子和计算机行业等)、分销渠道(直接招标和零售销售)、行业趋势和 2029 年预测 |

|

覆盖国家 |

美国、加拿大、墨西哥 |

|

涵盖的市场参与者 |

Zep Inc.、Whiteley、The Claire Manufacturing Company、STERIS、Spartan Chemical Company, Inc.、Seventh Generation Inc.、SC Johnson & Son, Inc.、Reckitt Benckiser Group PLC.、Procter & Gamble、PDI, Inc.、Pal International、Ecolab、3M、Cantel Medical.、Contec, Inc.、Betco、CleanWell、GOJO Industries, Inc.、PDI, Inc、Parker Laboratories, Inc.、Metrex Research, LLC.、Diversey Holdings LTD.、Dreumex USA Inc.、KCWW, Inc 和 Medline Industries, LP. 等等。 |

市场定义

用于清洁表面以去除污垢和细菌(例如葡萄球菌和沙门氏菌)的小块湿巾或小纸巾可能已从食物、人或动物身上被放在受感染的表面上。湿巾通常带有令人愉悦的气味,例如柑橘或松树的气味。

表面消毒湿巾提供了一种简单的方法,可使几乎任何类型的坚硬、不渗透的表面保持清洁以供使用,消毒、擦拭物品或表面,使擦洗区域保持湿润约 30 秒后干燥。壁架、器具、水槽、设施(灯和水)、门把手、入口把手、栏杆、瓷砖、石头、陶器产品、电话、玩具和控制台是可以使用表面消毒湿巾进行清洁和消毒的常见物品或区域。

北美表面消毒湿巾市场动态

驱动程序

-

增加商业用途的表面消毒湿巾的使用

表面消毒剂是一种化学化合物,用于通过消毒过程消灭病原体和其他微生物。表面消毒湿巾有助于抑制细菌、病毒和真菌等病原体的生长,从而防止各种形式的污染和感染。这些表面消毒剂由各种化学化合物组成,例如季铵盐或季铵盐、氯化合物、酚类化合物、氧化剂、酒精、两性化合物,甚至它们的组合。表面消毒湿巾的激增出现在各种商业应用中,即家庭、厨房、食品和农业部门以及酒店业,以防止任何污染。

-

提高消费者对卫生和预防保健的认识

提高公众意识和教育公众是减少全球传染病和其他污染源负担的重要方面。人们的正确认识有助于他们提前了解健康和卫生的重要性,从而减少感染的机会。正如人们所说,预防胜于治疗,各政府和非政府组织都在努力传播有关卫生和预防保健的意识。因此,消费者对卫生和预防保健意识的提高正在推动表面消毒湿巾市场的需求。

-

医院内感染(HAI)患病率高

医院获得性感染 (HAI) 也称为院内感染。这些感染通常是通过就诊医疗机构和医院等而感染的。大多数人从重症监护病房 (ICU) 接触到院内感染。随着医疗保健的增加以及抗生素的使用,院内感染病例的数量有所增加。

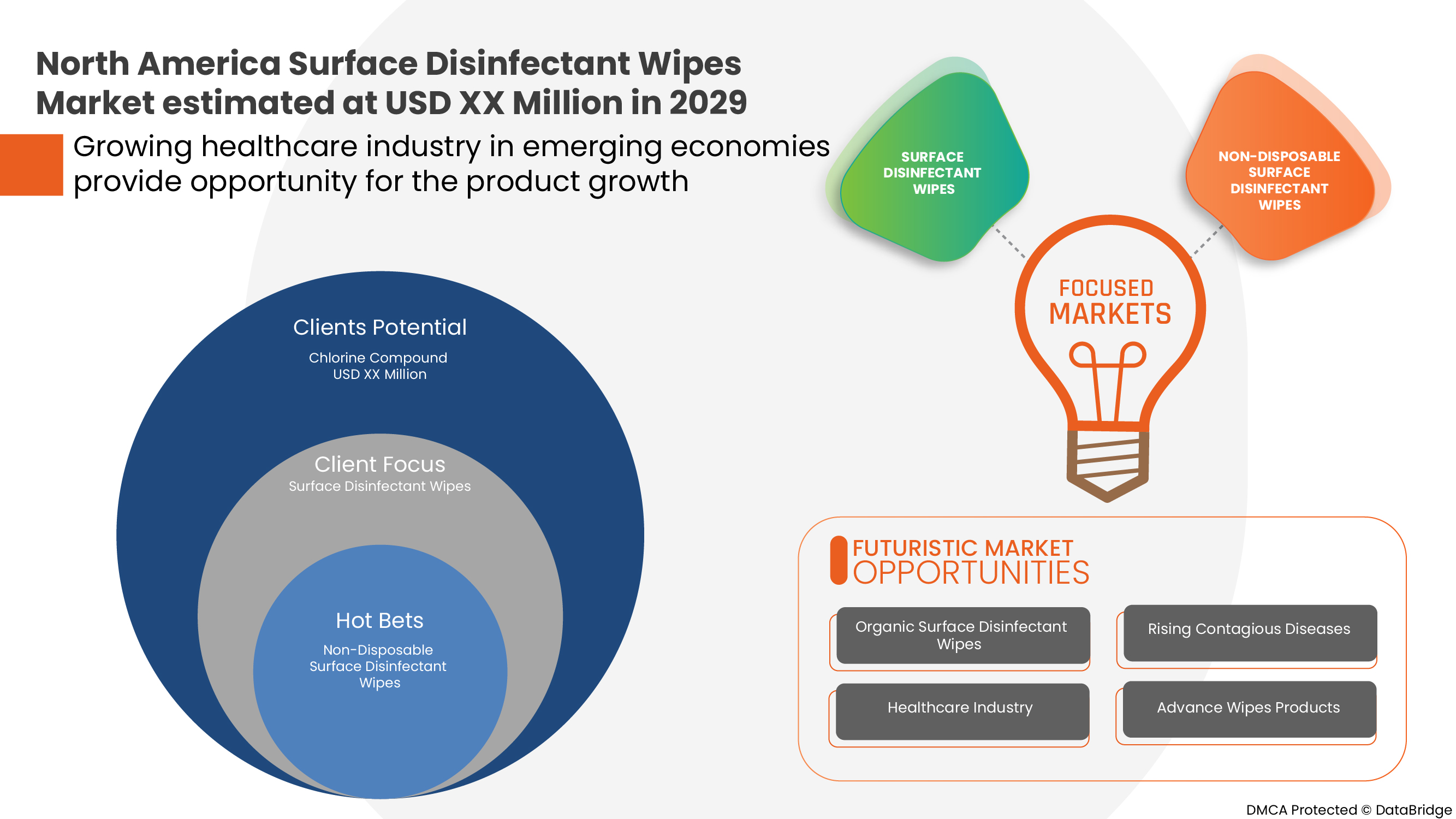

机会

-

主要市场参与者的策略

由于消费者对卫生和预防保健意识的增强,全球对表面消毒湿巾的需求大幅增长。最近,由于 COVID-19 疫情的爆发,全球对表面消毒湿巾的需求激增。此外,全球许多医院对表面消毒湿巾的需求显著增加。这些积极因素增加了对表面消毒湿巾的需求,为了满足市场需求,大大小小的市场参与者都在采用各种策略。

克制/挑战

表面消毒湿巾市场的参与者很难预测原材料成本大幅波动的风险。原材料成本的增加往往会严重影响产品的销售,因为原材料成本的增加会直接阻碍生产。因此,原材料成本的波动及其影响性的价格管理会严重危及产品或公司的成功。竞争性公司采用各种策略来应对原材料价格的波动,包括用任何其他成分替代该成分。

COVID-19 对表面消毒湿巾市场的影响

COVID-19 大流行使清洁和消毒成为人类生活方式的主要必需品。个人卫生变得至关重要,因为它增加了保护人们免受 COVID-19 感染的机会,成为一种生存策略而不是一种好习惯。由于疫苗处于开发阶段,世界各地的科学家和研究人员正在采取各种措施来控制病毒的传播。采用无菌环境、使用表面消毒剂、遵守产品安全等措施来防止病毒传播。因此,COVID-19 极大地推动了对消毒湿巾市场的需求

最新动态

- 2020 年 11 月,高乐氏公司在 2020 财年第一季度业绩中宣布,其由消毒和清洁产品组成的健康和保健部门的销售额增长了 28%。这一增长主要是由于 COVID-19 的出现而导致健康和卫生的重要性提高。

- 2020年10月,利洁时集团公布半年业绩,显示其卫生部门收入大幅增长,表明市场对各种消毒湿巾和用品的需求增加。

- 2020 年 4 月,舒尔克迈尔有限公司宣布在中国上海成立了一家名为舒尔克化工(上海)有限公司的新子公司,专注于个人护理和工业卫生。该公司在新冠疫情爆发期间成立的这家新子公司提高了其在市场上的信誉,从而增加了未来的销售额和收入。

人们快节奏的日常生活和繁忙的日程安排催生了创新。表面消毒湿巾在消毒方面不亚于任何创新。此外,COVID-19 的出现进一步加剧了人们在最紧张时期对便捷消毒的需求。表面消毒剂是用于杀死或消除各种表面上存在的有害细菌、细菌和其他病原体或微生物的抗菌剂,因此,它们最常用于消毒地砖、洗手间、家具和医疗器械等表面。

北美表面消毒湿巾市场范围

北美表面消毒湿巾市场根据成分、可用性、包装、材料类型、消毒程度、风味、类型、最终用途和分销渠道分为九个显著的细分市场。这些细分市场之间的增长将帮助您分析主要的行业增长细分市场,并为用户提供有价值的市场概览和市场洞察,以便做出战略决策,确定核心市场应用。

作品

- 氯化合物

- 季铵盐

- 氧化剂

- 苯酚

- 酒精

- 碘化合物

- 葡萄糖酸氯己定

- 醛类

- 其他的

根据成分,北美表面消毒湿巾市场细分为氯化合物、季铵盐、氧化剂、苯酚、酒精、碘化合物、醛、葡萄糖酸氯己定等

可用性

- 一次性的

- 非一次性

根据可用性,北美表面消毒湿巾市场分为一次性和非一次性。

包装

- 扁平封装

- 罐

- 其他的

根据包装,北美表面消毒湿巾市场分为平板包装、罐装和其他包装。

材质类型

- 纺织纤维抹布

- 原生纤维抹布

- 高级纤维抹布

- 其他的

根据材料类型,北美表面消毒湿巾市场细分为纺织纤维湿巾、原生纤维湿巾、高级纤维湿巾等

消毒程度

- 高的

- 中间的

- 低的

根据消毒水平,北美表面消毒湿巾市场分为高级、中级和低级。

味道

- 薰衣草和茉莉

- 柑橘

- 柠檬

- 椰子

- 其他的

根据口味,北美表面消毒湿巾市场分为薰衣草和茉莉花、柑橘、柠檬、椰子等。

类型

- 杀孢子剂

- 杀菌

- 杀结核菌

- 杀病毒

- 杀菌

- 杀菌

根据类型,北美表面消毒湿巾市场分为杀孢子湿巾、杀细菌湿巾、杀结核湿巾、杀病毒湿巾、杀真菌湿巾和杀细菌湿巾。

最终用途

- 卫生保健

- 商业的

- 工业厨房

- 交通运输业

- 眼镜行业

- 电子及计算机行业

- 其他的

根据最终用途细分,北美表面消毒湿巾市场细分为医疗保健、商业、工业厨房、运输行业、光学行业、电子和计算机行业等

分销渠道

- 直接招标

- 零售

根据分销渠道,北美表面消毒湿巾市场分为直接招标和零售

北美表面消毒湿巾市场区域分析/洞察

对北美表面消毒湿巾 市场进行了分析,并从成分、可用性、包装、材料类型、消毒水平、风味、类型、最终用途和分销渠道提供了市场规模洞察和趋势。

在预测期内,美国将主导北美表面消毒湿巾市场。

报告的国家部分还提供了影响单个市场因素和市场法规变化的信息,这些因素和变化会影响市场的当前和未来趋势。新旧销售、国家人口统计、疾病流行病学和进出口关税等数据点是预测单个国家市场情况的一些主要指标。此外,在对国家数据进行预测分析时,还考虑了全球品牌的存在和可用性以及它们因本土和国内品牌的激烈竞争而面临的挑战以及销售渠道的影响。

竞争格局和表面消毒湿巾市场份额分析

表面消毒湿巾市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、全球影响力、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度以及应用主导地位。以上数据点仅与专注于表面消毒湿巾 市场的公司有关。

北美表面消毒湿巾市场的一些主要参与者包括 Zep Inc.、Whiteley、The Claire Manufacturing Company、STERIS、Spartan Chemical Company, Inc.、Seventh Generation Inc.、SC Johnson & Son, Inc.、Reckitt Benckiser Group PLC.、Procter & Gamble、PDI, Inc.、Pal International、Ecolab、3M、Cantel Medical.、Contec, Inc.、Betco、CleanWell、GOJO Industries, Inc.、PDI, Inc、Parker Laboratories, Inc.、Metrex Research, LLC.、Diversey Holdings LTD.、Dreumex USA Inc.、KCWW, Inc 和 Medline Industries, LP. 等。

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析以及主要(行业专家)验证。除此之外,数据模型还包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、公司市场份额分析、测量标准、北美与地区以及供应商份额分析。如有进一步询问,请要求分析师致电。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 COMPOSITION LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET PRODUCT TYPE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL ANALYSIS

4.1.1 POLITICS:

4.1.2 ECONOMIC:

4.1.3 SOCIAL:

4.1.4 TECHNOLOGY:

4.1.5 ENVIRONMENTAL:

4.1.6 LEGAL:

4.2 PORTER ANALYSIS

4.2.1 THREATS OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREATS OF SUBSTITUTE PRODUCTS

4.2.5 RIVALRY AMONG THE EXISTING COMPETITORS

4.3 INDUSTRIAL INSIGHTS:

4.3.1 KEY PRICING STRATEGIES:

4.3.2 PRICES OF RAW MATERIALS:

4.3.3 FLUCTUATION IN DEMAND AND SUPPLY

4.3.4 LEVELS OF DISINFECTION

4.3.5 QUALITY:

4.3.6 CONCLUSION:

4.4 SURFACE DISINFECTANT WIPES ANALYSIS: BY USABILITY

5 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: REGULATIONS

6 EPIDERMIOLOGY

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING USE OF SURFACE DISINFECTANT WIPES FOR COMMERCIAL APPLICATIONS

7.1.2 INCREASING CONSUMER AWARENESS ABOUT HYGIENE AND PREVENTIVE HEALTHCARE

7.1.3 EMERGENCE OF COVID-19

7.1.4 HIGH PREVALENCE OF HOSPITAL-ACQUIRED INFECTIONS (HAIS)

7.1.5 HIGH DEMAND FOR QUICK AND CONVENIENT DISINFECTION OPTIONS

7.2 RESTRAINTS

7.2.1 SIDE EFFECTS OF USING SURFACE DISINFECTANT WIPES

7.2.2 FLUCTUATION IN THE PRICES OF RAW MATERIAL

7.2.3 EMERGING ALTERNATIVE TECHNOLOGIES

7.3 OPPORTUNITIES

7.3.1 STRATEGIES BY MAJOR MARKET PLAYERS

7.3.2 INCREASING NUMBER OF PRODUCT APPROVAL AND LAUNCHES

7.3.3 GROWING HEALTHCARE EXPENDITURE

7.3.4 INCREASING CHRONIC AND CONTAGIOUS DISEASES

7.4 CHALLENGES

7.4.1 LACK OF ACCESSIBILITY

7.4.2 ESCALATION IN HEALTHCARE WASTE

8 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION

8.1 OVERVIEW

8.2 CHLORINE COMPOUNDS

8.3 QUATERNARY AMMONIUM

8.4 OXIDIZING AGENTS

8.5 PHENOL

8.6 ALCOHOL

8.7 IODINE COMPOUNDS

8.8 CHLORHEXIDINE GLUCONATE

8.9 ALDEHYDES

8.1 OTHERS

9 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY USABILITY

9.1 OVERVIEW

9.2 DISPOSABLE

9.3 NON-DISPOSABLE

10 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING

10.1 OVERVIEW

10.2 FLATPACK

10.3 CANISTER

10.4 OTHERS

11 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE

11.1 OVERVIEW

11.2 TEXTILE FIBER WIPES

11.3 VIRGIN FIBER WIPES

11.4 ADVANCED FIBER WIPES

11.5 OTHERS

12 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY LEVEL OF DISINFECTION

12.1 OVERVIEW

12.2 HIGH

12.3 INTERMEDIATE

12.4 LOW

13 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR

13.1 OVERVIEW

13.2 LAVENDER & JASMINE

13.3 LEMON

13.4 CITRUS

13.5 COCONUT

13.6 OTHERS

14 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY TYPE

14.1 OVERVIEW

14.2 BACTERICIDAL

14.3 VIRUCIDAL

14.4 SPORICIDAL

14.5 TUBERCULOCIDAL

14.6 FUNGICIDAL

14.7 GERMICIDAL

15 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY END USE

15.1 OVERVIEW

15.2 HEALTHCARE

15.3 COMMERCIAL

15.4 INDUSTRIAL KITCHEN

15.5 TRANSPORTATION INDUSTRY

15.6 OPTICAL INDUSTRY

15.7 ELECTRONIC & COMPUTER INDUSTRY

15.8 OTHERS

16 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 DIRECT TENDERS

16.3 RETAIL SALES

17 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY REGION

17.1 NORTH AMERICA

17.1.1 U.S.

17.1.2 CANADA

17.1.3 MEXICO

18 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

19 SWOT ANALYSIS

20 COMPANY PROFILE

20.1 RECKITT BENCKISER GROUP PLC

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 COMPANY SHARE ANALYSIS

20.1.4 PRODUCT PORTFOLIO

20.1.5 RECENT DEVELOPMENTS

20.2 ECOLAB

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 COMPANY SHARE ANALYSIS

20.2.4 PRODUCT PORTFOLIO

20.2.5 RECENT DEVELOPMENT

20.3 PROCTER & GAMBLE

20.3.1 COMPANY SNAPSHOT

20.3.2 REVENUE ANALYSIS

20.3.3 COMPANY SHARE ANALYSIS

20.3.4 PRODUCT PORTFOLIO

20.3.5 RECENT DEVELOPMENT

20.4 PAUL HARTMANN LIMITED

20.4.1 COMPANY SNAPSHOT

20.4.2 COMPANY SHARE ANALYSIS

20.4.3 PRODUCT PORTFOLIO

20.4.4 RECENT DEVELOPMENT

20.5 3M

20.5.1 COMPANY SNAPSHOT

20.5.2 REVENUE ANALYSIS

20.5.3 COMPANY SHARE ANALYSIS

20.5.4 PRODUCT PORTFOLIO

20.5.5 RECENT DEVELOPMENT

20.6 BETCO

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 RECENT DEVELOPMENT

20.7 CANTEL MEDICAL

20.7.1 COMPANY SNAPSHOT

20.7.2 REVENUE ANALYSIS

20.7.3 PRODUCT PORTFOLIO

20.8 CLEANWELL, LLC.

20.8.1 COMPANY SNAPSHOT

20.8.2 PRODUCT PORTFOLIO

20.8.3 RECENT DEVELOPMENT

20.9 COLGATE-PALMOLIVE COMPANY

20.9.1 COMPANY SNAPSHOT

20.9.2 REVENUE ANALYSIS

20.9.3 PRODUCT PORTFOLIO

20.9.4 RECENT DEVELOPMENTS

20.1 CONTEC, INC.

20.10.1 COMPANY SNAPSHOT

20.10.2 PRODUCT PORTFOLIO

20.10.3 RECENT DEVELOPMENT

20.11 DIVERSEY HOLDINGS LTD (2021)

20.11.1 COMPANY SNAPSHOT

20.11.2 REVENUE ANALYSIS

20.11.3 PRODUCT PORTFOLIO

20.11.4 RECENT DEVELOPMENTS

20.12 DREUMEX

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 RECENT DEVELOPMENTS

20.13 GOJO INDUSTRIES, INC.

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVELOPMENT

20.14 KCWW

20.14.1 COMPANY SNAPSHOT

20.14.2 REVENUE ANALYSIS

20.14.3 PRODUCT PORTFOLIO

20.14.4 RECENT DEVELOPMENTS

20.15 MEDLINE INDUSTRIES, LP

20.15.1 COMPANY SNAPSHOT

20.15.2 PRODUCT PORTFOLIO

20.15.3 RECENT DEVELOPMENTS

20.16 METREX RESEARCH, LLC.

20.16.1 COMPANY SNAPSHOT

20.16.2 PRODUCT PORTFOLIO

20.16.3 RECENT DEVELOPMENTS

20.17 PAL INTERNATIONAL

20.17.1 COMPANY SNAPSHOT

20.17.2 PRODUCT PORTFOLIO

20.17.3 RECENT DEVELOPMENTS

20.18 PARKER LABORATORIES, INC

20.18.1 COMPANY SNAPSHOT

20.18.2 PRODUCT PORTFOLIO

20.18.3 1.18.3 RECENT DEVELOPMENT

20.19 PDI, INC.

20.19.1 COMPANY SNAPSHOT

20.19.2 PRODUCT PORTFOLIO

20.19.3 RECENT DEVELOPMENTS

20.2 JOHNSON & SON INC.

20.20.1 COMPANY SNAPSHOT

20.20.2 PRODUCT PORTFOLIO

20.20.3 RECENT DEVELOPMENTS

20.21 SEVENTH GENERATION INC.

20.21.1 COMPANY SNAPSHOT

20.21.2 PRODUCT PORTFOLIO

20.21.3 RECENT DEVELOPMENTS

20.22 SPARTAN CHEMICAL COMPANY, INC.

20.22.1 COMPANY SNAPSHOT

20.22.2 PRODUCT PORTFOLIO

20.22.3 RECENT DEVELOPMENTS

20.23 STERIS

20.23.1 COMPANY SNAPSHOT

20.23.2 REVENUE ANALYSIS

20.23.3 PRODUCT PORTFOLIO

20.23.4 RECENT DEVELOPMENTS

20.24 THE CLAIRE MANUFACTURING COMPANY

20.24.1 COMPANY SNAPSHOT

20.24.2 PRODUCT PORTFOLIO

20.24.3 RECENT UPDATE

20.25 WHITELEY

20.25.1 COMPANY SNAPSHOT

20.25.2 PRODUCT PORTFOLIO

20.25.3 RECENT UPDATE

20.26 WIPESPLUS

20.26.1 COMPANY SNAPSHOT

20.26.2 PRODUCT PORTFOLIO

20.26.3 RECENT DEVELOPMENT

20.27 ZEP INC.

20.27.1 COMPANY SNAPSHOT

20.27.2 PRODUCT PORTFOLIO

20.27.3 RECENT DEVELOPMENT

21 QUESTIONNAIRE

22 RELATED REPORTS

表格列表

TABLE 1 COMPARATIVE TABLE OF THE IDENTIFIED KEY ASPECTS OF SURFACE DISINFECTANTS THROUGHOUT THE REGULATORY FRAMEWORK

TABLE 2 REGULATIONS SET BY THE U.K. GOVERNMENT FOR THE IMPROVEMENT OF DISINFECTANT WIPES

TABLE 3 TESTS ASSOCIATED WITH DISINFECTANT WIPES

TABLE 4 PREVALENCE OF DIABETES

TABLE 5 POVERTY RATES IN ENGLAND, WALES, SCOTLAND, AND NORTHERN IRELAND AFTER HOUSING COSTS (AHC)

TABLE 6 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA CHLORINE COMPOUNDS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA QUATERNARY AMMONIUM IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA OXIDIZING AGENTS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA PHENOL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA ALCOHOL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA IODINE COMPOUNDS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA CHLORHEXIDINE GLUCONATE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA ALDEHYDES IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA OTHERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA DISPOSABLE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA NON-DISPOSABLE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA FLATPACK IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA CANISTER IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA OTHERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA TEXTILE FIBER WIPES IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA VIRGIN FIBER WIPES IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA ADVANCED FIBER WIPES IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA OTHERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA HIGH IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA INTERMEDIATE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA LOW IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA LAVENDER & JASMINE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA LEMON IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA CITRUS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA COCONUT IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA OTHERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA BACTERICIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA VIRUCIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA SPORICIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA TUBERCULOCIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA FUNGICIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA GERMICIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA HEALTHCARE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA COMMERCIAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA INDUSTRIAL KITCHEN IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA TRANSPORTATION INDUSTRY IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA OPTICAL INDUSTRY IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA ELECTRONIC & COMPUTER INDUSTRY IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA OTHERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA DIRECT TENDERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA RETAIL SALES IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 66 U.S. SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 67 U.S. SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 68 U.S. SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 69 U.S. SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 70 U.S. SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 71 U.S. SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 72 U.S. SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 U.S. SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 74 U.S. SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 75 CANADA SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 76 CANADA SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 77 CANADA SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 78 CANADA SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 79 CANADA SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 80 CANADA SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 81 CANADA SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 CANADA SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 83 CANADA SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 84 MEXICO SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 85 MEXICO SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 86 MEXICO SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 87 MEXICO SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 88 MEXICO SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 89 MEXICO SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 90 MEXICO SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 MEXICO SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 92 MEXICO SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: MARKET END USE COVERAGE GRID

FIGURE 10 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 AN INCREASE IN THE PREVALENCE OF HOSPITAL ACQUIRED INFECTIONS (HAIS) LEADS TO INCREASED ADOPTION OF DISINFECTANT WIPES TO DRIVE THE NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 CHLORINE COMPOUNDS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET

FIGURE 15 GOVERNMENT HEALTHCARE EXPENDITURE BY SHARE OF HEALTHCARE PROVIDERS IN THE U.K. IN 2018

FIGURE 16 GOVERNMENT HEALTHCARE EXPENDITURE BY SHARE OF HEALTHCARE FUNCTIONS IN THE U.K. IN 2018

FIGURE 17 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: BY COMPOSITION, 2021

FIGURE 18 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: BY USABILITY, 2021

FIGURE 19 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: BY PACKAGING, 2021

FIGURE 20 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: BY MATERIAL TYPE, 2021

FIGURE 21 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: BY LEVEL OF INDISFECTION, 2021

FIGURE 22 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2021

FIGURE 23 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2021

FIGURE 24 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2021

FIGURE 25 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020

FIGURE 26 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: SNAPSHOT (2021)

FIGURE 27 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: BY COUNTRY (2021)

FIGURE 28 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: BY COMPOSITION (2022 & 2029)

FIGURE 31 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。