North America Sports Flooring Market

市场规模(十亿美元)

CAGR :

%

USD

4,869.15 Billion

USD

7,042.96 Billion

2022

2030

USD

4,869.15 Billion

USD

7,042.96 Billion

2022

2030

| 2023 –2030 | |

| USD 4,869.15 Billion | |

| USD 7,042.96 Billion | |

|

|

|

北美运动地板市场,按类型(橡胶地板、PVC 地板、木地板、人造草坪地板、聚氨酯地板和聚丙烯地板)、应用(室内和室外)、运动(健身房、篮球、羽毛球、网球、足球、舞蹈和有氧运动工作室、田径、排球等)、最终用途(商业和住宅)、建筑类型(翻新/维护和新建)、销售渠道(直销和体育用品店)划分——行业趋势和预测到 2030 年。

北美运动地板市场分析及规模

运动地板涉及专门为运动和体育赛事制作的地板解决方案。运动地板有很多种类型,包括橡胶、硬木和合成材料。篮球场经常安装硬木运动地板,因为它可以提供出色的球弹跳力和球员牵引力,并且通常由枫木或橡木制成。PVC 或乙烯基合成运动地板适应性强,可以根据不同的体育活动进行定制。橡胶运动地板因其减震性能而闻名,在室内跑道、举重区和有氧运动工作室中很受欢迎。

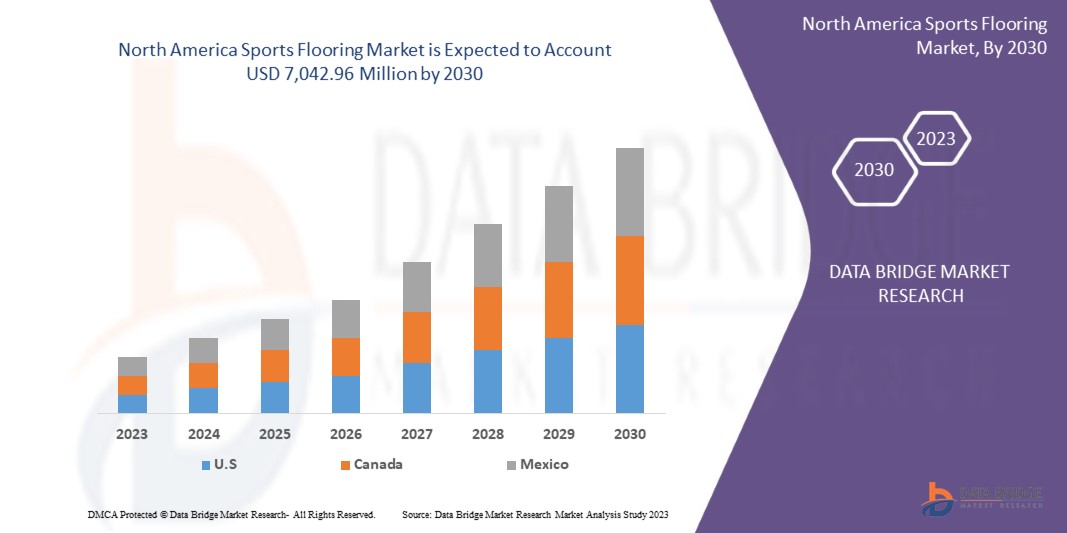

Data Bridge Market Research 分析称,预计到 2030 年,市场规模将从 2022 年的 48.6915 亿美元增至 70.4296 亿美元,在 2023 年至 2030 年的预测期内,复合年增长率为 4.9%。

|

报告指标 |

细节 |

|

预测期 |

2023 至 2030 年 |

|

基准年 |

2022 |

|

历史岁月 |

2021(可定制为 2015 - 2020) |

|

定量单位 |

收入(百万美元) |

|

涵盖的领域 |

类型(橡胶地板、PVC 地板、木地板、人造草皮地板、聚氨酯地板和聚丙烯地板)、应用(室内和室外)、运动(健身房、篮球、羽毛球、网球、足球、舞蹈和有氧运动工作室、田径、排球等)、最终用途(商业和住宅)、建筑类型(翻新/维护和新建)、销售渠道(直销和体育用品店) |

|

覆盖国家 |

美国、加拿大和墨西哥 |

|

涵盖的市场参与者 |

Rephouse Ltd、CONICA AG、Junckers Industrier A/S、FAB FLOORINGS INDIA、FLEXCOURT、Sika AG、Tarkett、Gerflor、Forbo Flooring Systems、Horner Sports Flooring.、Asian Flooring India Private Limited、INDIANA SPORTS INFRA、SnapSports、LX Hausys、Abacus Sports、Hamberger Industriewerke GmbH、KTL SPORTS FLOORING 和 Ecore International 等 |

市场定义

运动地板涉及为运动和体育赛事制作的专用地板解决方案。这些地板选项考虑到减震、牵引力和球弹跳等因素,旨在为运动员提供安全性、性能、耐用性和舒适性。健身房、竞技场、多功能厅和健身中心等室内体育设施经常安装运动地板。

北美运动地板市场动态

本节旨在了解市场驱动因素、优势、机遇、限制和挑战。下面将详细讨论所有这些内容:

驱动程序

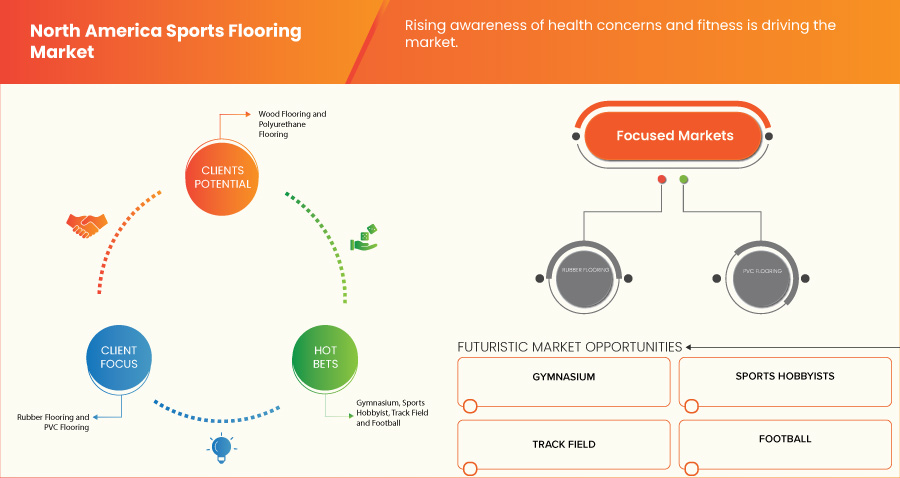

- 人们对健康问题和健身的认识不断提高

总体而言,人们越来越关注健康问题和身体健康。随着人们越来越意识到久坐不动的生活方式的负面影响,他们正在积极寻找改善整体健康状况的方法。由于这种意识的增强,人们优先考虑定期进行体育锻炼并接受更健康的生活方式,这导致了消费者行为的重大变化。人们对健康问题和健身的认识不断提高,极大地推动了北美运动地板市场的发展。随着人们越来越意识到积极生活方式和定期参加体育锻炼的价值,对合适的运动地板选择的需求也日益增加。

与缺乏运动和体质较差相关的慢性病发病率不断上升,进一步增强了个人采取积极措施保持健康的紧迫性。

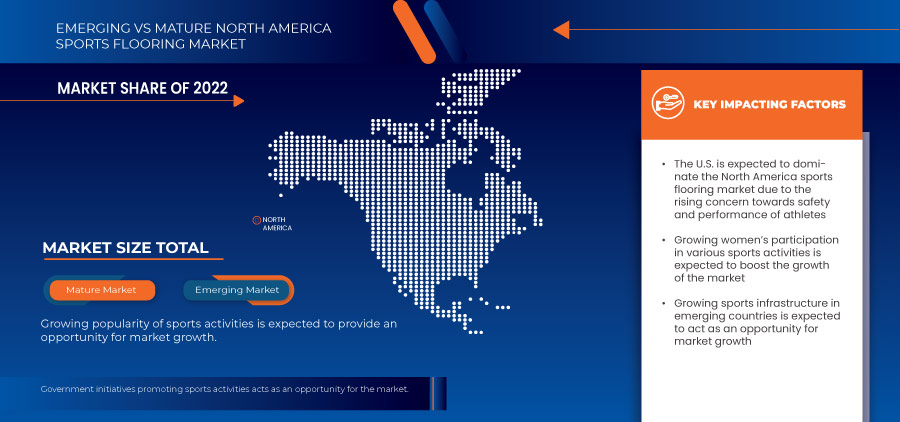

- 女性参与各类体育活动的人数不断增加

随着越来越多的女性参与羽毛球、篮球等各种体育活动,北美运动地板市场正在增长。女性现在比以往任何时候都更加积极地参与体育运动,从业余运动到知名比赛,应有尽有。女性运动参与度的激增催生了对满足她们特定需求和要求的专业运动地板解决方案的需求。

新的联赛和比赛的出现,以及媒体关注和赞助机会的增加,促进了女子体育的发展。由于知名度和认可度的提高,现在各个年龄段的女性都更愿意参与体育运动,并高度重视身体健康。

运动地板行业的企业有机会通过提供根据特定需求定制的高质量地板产品,从女子运动日益增长的普及中获益。

- 对运动员安全和表现的关注度不断上升

人们越来越重视为运动员提供安全且有利的环境,以最大限度地提高他们的表现,同时最大限度地降低受伤风险。由于越来越意识到运动相关伤害对健康的潜在长期影响,运动员、教练和体育设施管理人员正在积极寻找降低这些风险的尖端解决方案。运动地板对于为运动员提供鼓励和保护表面至关重要,有助于转移冲击力、提供牵引力并减少绊倒、滑倒和跌倒的可能性。

负责体育法规和标准的管理机构和组织也认识到运动员的表现和安全的重要性,这导致他们的规则中加入了针对运动地板的具体指导方针。这增加了对合规运动地板解决方案的需求。

机会

- 该地区不断增长的体育基础设施

运动设施的关键要求之一是提供高性能、安全性和耐用性的高品质运动地板。这为北美运动地板市场的增长创造了有利的环境。

此外,新兴国家多功能体育设施的建设也增加了市场机会。这些设施可满足各种体育和娱乐活动,例如篮球、排球、网球和室内足球。对于这些场馆来说,能够适应多种运动的多功能运动地板系统至关重要,从而推动了对适应性强、耐用的运动地板材料的需求。

对体育设施、地区和国际赛事、专业体育联盟、多功能场馆和健康促进的需求不断增长,所有这些都促使对高质量运动地板解决方案的需求不断增加。因此,为北美运动地板市场在不久的将来的增长创造了充足的机会。

- 政府积极推动体育活动

发展中经济体的政府正在采取措施并进行投资,以发展体育基础设施,以促进体育运动和健康的生活方式。这些举措推动了对运动地板解决方案的需求,为市场参与者提供产品和服务创造了机会。

当政府优先考虑并投资体育发展时,它为体育基础设施的发展创造了有利的环境,从而增加了对运动地板解决方案的需求。

因此,政府对体育俱乐部、学院和教育机构的资助和补贴可以促进运动地板市场的发展。财政支持使这些组织能够升级其设施,包括投资优质运动地板。制造商和供应商可以与这些机构合作,提供满足其特定要求的定制地板解决方案,从而增加商机。

限制/挑战

- 依赖熟练劳动力和劳动力供应有限

运动地板安装需要专业技能和知识。必须有训练有素的专业人员,他们了解正确的安装技术、表面准备和粘合剂应用的复杂性。然而,可能缺乏具备运动地板安装专业知识的熟练劳动力,这可能会妨碍及时高效地完成项目。

熟练工人在确保地板正确安装方面起着至关重要的作用,包括适当的平整、线条标记和无缝饰面。熟练工人的有限供应可能导致质量控制受到影响,从而可能导致安装质量差和客户不满意。

- 安装和购买成本高

购买和安装成本是北美运动地板市场的主要障碍。该行业的企业面临着与购买和安装运动地板系统相关的成本的严峻障碍。高品质运动地板材料和设备的前期成本可能很高,而专家安装也可能相当昂贵。

此外,由于运动地板的特殊性,运动地板通常比传统地板更昂贵,必须遵守严格的安全和性能标准。较高的成本是由于需要尖端材料、工程和制造方法来保证理想的减震、牵引力和耐用性。因此,高昂的安装和购买成本是运动地板市场的限制因素。

最新动态

- 2023 年 7 月,Tarkett 推出了 PureGrain,这是一项突破性产品,有望彻底改变运动场的面貌。这款由玉米芯制成的突破性产品不仅代表着向更绿色未来迈出了一大步,而且还为所有技能水平的运动员提供了出色的表现。这种产品的推出帮助该公司拓宽了产品组合并获得了新的消费者群体

- 2023 年 4 月,该公司宣布推出六款全新枫木设计。这些 Taraflex 设计非常逼真,复制了我们的 Connor 枫木条纹,同时模拟了 NBA 最负盛名的地板。此类产品发布将有助于公司在市场上获得竞争优势

- 2021 年 9 月,建筑和室内设计材料制造商 LX Hausys 加入了收购家具公司 Hanssem 股份的竞标。LX Hausys 报告称,计划向 IMM Private Equity (PE) 成立的一家特殊目的公司投资 3000 亿韩元(2.59 亿美元)。Hanssem 生产地板、门窗。通过此次收购,LX Hausys 有望利用两家公司的协同效应,加强其在当地室内设计市场的地位

- 2021 年,国际篮球管理机构国际篮联 (FIBA) 与 Junckers Industier A/s 达成了一项长期协议,根据该协议,Junckers 将在 2024 年前在全球范围内提供木地板。该协议有助于该公司通过提升其品牌形象来创造稳定的营业额并获得新的消费者群体

北美运动地板市场范围

北美运动地板市场根据类型、应用、运动、最终用途、建筑类型和销售渠道分为六个显著的细分市场。这些细分市场之间的增长将帮助您分析行业中的主要增长细分市场,并为用户提供有价值的市场概览和市场洞察,以便做出战略决策以确定核心市场应用。

类型

- 橡胶地板

- PVC地板

- 木地板

- 人造草坪地板

- 聚氨酯地板

- 聚丙烯地板

根据类型,市场分为橡胶地板、PVC地板、木地板、人造草坪地板、聚氨酯地板和聚丙烯地板。

应用

- 室内的

- 户外的

根据应用,市场分为室内和室外。

运动的

- 健身房

- 篮球

- 羽毛球

- 网球

- 足球

- 舞蹈及有氧运动工作室

- 田径

- 排球

- 其他的

根据运动项目,市场分为健身房、篮球、羽毛球、网球、足球、舞蹈和有氧运动工作室、田径、排球等。

最终用途

- 商业的

- 住宅

根据最终用途,市场分为商业和住宅。

建设类型

- 翻新/维护

- 新建筑

根据建筑类型,市场分为翻新/维护和新建。

销售渠道

- 直销

- 体育用品专卖店

根据销售渠道,市场分为直销和体育用品直销。

北美运动地板市场区域分析/见解

对市场进行分析,并按上述国家、类型、应用、运动、最终用途、建筑类型和销售渠道提供市场规模洞察和趋势。

北美运动地板市场的国家包括美国、加拿大和墨西哥。

由于人们对健康和健身的意识日益增强,美国有望主导北美运动地板市场。对运动员安全和表现的日益关注也促进了市场的增长。

报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和市场监管变化。数据点下游和上游价值链分析、技术趋势波特五力分析和案例研究是用于预测各个国家市场情景的一些指标。此外,在提供国家数据的预测分析时,还考虑了区域品牌的存在和可用性以及由于来自本地和国内品牌的大量或稀缺竞争而面临的挑战、国内关税的影响和贸易路线。

竞争格局和北美运动地板市场份额分析

北美运动地板市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、生产基地和设施、公司优势和劣势、产品发布、产品试验渠道、产品批准、专利、产品宽度和广度、应用优势、技术生命线曲线。以上提供的数据点仅与公司对北美运动地板市场的关注有关。

北美运动地板市场的一些知名参与者包括 Rephouse Ltd、CONICA AG、Junckers Industrier A/S、FAB FLOORINGS INDIA、FLEXCOURT、Sika AG、Tarkett、Gerflor、Forbo Flooring Systems、Horner Sports Flooring.、Asian Flooring India Private Limited、INDIANA SPORTS INFRA、SnapSports、LX Hausys、Abacus Sports、Hamberger Industriewerke GmbH、KTL SPORTS FLOORING 和 Ecore International 等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES: NORTH AMERICA SPORTS FLOORING MARKET

4.3 VENDOR SELECTION CRITERIA

4.4 SUPPLY CHAIN ANALYSIS

4.4.1 OVERVIEW

4.4.2 LOGISTICS COST SCENARIO

4.4.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.5 CLIMATE CHANGE SCENARIO

4.5.1 ENVIRONMENTAL CONCERNS

4.5.2 INDUSTRY RESPONSE

4.5.3 GOVERNMENT’S ROLE

4.5.4 ANALYST RECOMMENDATION

4.6 RAW MATERIAL COVERAGE

4.7 TECHNOLOGICAL ADVANCEMENTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING POPULARITY OF SPORTS ACTIVITIES

5.1.2 RISING AWARENESS OF HEALTH CONCERNS AND FITNESS

5.1.3 GROWING WOMEN’S PARTICIPATION IN VARIOUS SPORTS ACTIVITIES

5.1.4 RISING CONCERN TOWARDS SAFETY AND PERFORMANCE OF ATHLETES

5.2 RESTRAINTS

5.2.1 HIGH INSTALLATION AND PURCHASE COSTS

5.2.2 VARIETY IN CONSUMER PREFERENCE

5.3 OPPORTUNITIES

5.3.1 GROWING SPORTS INFRASTRUCTURE IN THE REGION

5.3.2 GOVERNMENT INITIATIVES PROMOTING SPORTS ACTIVITIES

5.4 CHALLENGES

5.4.1 DEPENDENCY ON SKILLED LABOR AND LIMITED AVAILABILITY OF WORKFORCE

5.4.2 STRINGENT REGULATIONS REGARDING INSTALLATION

6 NORTH AMERICA SPORTS FLOORING MARKET, BY TYPE

6.1 OVERVIEW

6.2 RUBBER FLOORING

6.2.1 RECYCLED RUBBER FLOORING

6.2.2 VULCANIZED RUBBER FLOORING

6.3 PVC FLOORING

6.4 WOOD FLOORING

6.4.1 STANDARD

6.4.2 HIGH-END

6.5 ARTIFICIAL TURF FLOORING

6.6 POLYURETHANE FLOORING

6.7 POLYPROPYLENE FLOORING

7 NORTH AMERICA SPORTS FLOORING MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 INDOOR

7.2.1 RUBBER FLOORING

7.2.2 PVC FLOORING

7.2.3 WOOD FLOORING

7.2.4 POLYURETHANE FLOORING

7.2.5 POLYPROPYLENE FLOORING

7.2.6 ARTIFICIAL TURF FLOORING

7.3 OUTDOOR

7.3.1 ARTIFICIAL TURF FLOORING

7.3.2 PVC FLOORING

7.3.3 POLYURETHANE FLOORING

7.3.4 POLYPROPYLENE FLOORING

7.3.5 RUBBER FLOORING

8 NORTH AMERICA SPORTS FLOORING MARKET, BY SPORTS

8.1 OVERVIEW

8.2 GYM

8.3 BASKETBALL

8.4 BADMINTON

8.5 TENNIS

8.6 FOOTBALL

8.7 DANCE AND AEROBIC STUDIO

8.8 TRACK AND FIELD

8.9 VOLLEYBALL

8.1 OTHERS

9 NORTH AMERICA SPORTS FLOORING MARKET, BY END-USE

9.1 OVERVIEW

9.2 COMMERCIAL

9.3 RESIDENTIAL

10 NORTH AMERICA SPORTS FLOORING MARKET, BY CONSTRUCTION TYPE

10.1 OVERVIEW

10.2 RENOVATE/MAINTAINED

10.3 NEW CONSTRUCTION

11 NORTH AMERICA SPORTS FLOORING MARKET, BY SALES CHANNEL

11.1 OVERVIEW

11.2 DIRECT SALES

11.3 SPORTS OUTLET

12 NORTH AMERICA SPORTS FLOORING MARKET, BY COUNTRY

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA SPORTS FLOORING MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 TARKETT

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 GERFLOR

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCT PORTFOLIO

15.2.3 RECENT DEVELOPMENTS

15.3 LX HAUSYS

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 SIKA AG

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 HAMBERGER INDUSTRIEWERKE GMBH

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENTS

15.6 ABACUS SPORTS

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 ASIAN FLOORING INDIA PRIVATE LIMITED

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 CONICA AG

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 ECORE INTERNATIONAL

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 FAB FLOORINGS INDIA

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 FLEXCOURT

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 FORBO GROUP

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.13 HORNER SPORTS FLOORING.

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 INDIANA SPORTS INFRA

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 JUNCKERS INDUSTRIER A/S

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 KTL SPORTS FLOORING

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 REPHOUSE LTD

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 SNAPSPORTS

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

表格列表

TABLE 1 NORTH AMERICA SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (MILLION SQUARE FEET)

TABLE 3 NORTH AMERICA RUBBER FLOORING IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA WOOD FLOORING IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA SPORTS FLOORING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA INDOOR IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA OUTDOOR IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA SPORTS FLOORING MARKET, BY SPORTS, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA SPORTS FLOORING MARKET, BY END-USE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA SPORTS FLOORING MARKET, BY CONSTRUCTION TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA SPORTS FLOORING MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA SPORTS FLOORING MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA SPORTS FLOORING MARKET, BY COUNTRY, 2021-2030 (MILLION SQUARE FEET)

TABLE 14 U.S. SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 U.S. SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (MILLION SQUARE FEET)

TABLE 16 U.S. RUBBER FLOORING IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 U.S. WOOD FLOORING IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 U.S. SPORTS FLOORING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 19 U.S. INDOOR IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 20 U.S. OUTDOOR IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 U.S. SPORTS FLOORING MARKET, BY SPORTS, 2021-2030 (USD MILLION)

TABLE 22 U.S. SPORTS FLOORING MARKET, BY END-USE, 2021-2030 (USD MILLION)

TABLE 23 U.S. SPORTS FLOORING MARKET, BY CONSTRUCTION TYPE, 2021-2030 (USD MILLION)

TABLE 24 U.S. SPORTS FLOORING MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 25 CANADA SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 26 CANADA SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (MILLION SQUARE FEET)

TABLE 27 CANADA RUBBER FLOORING IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 CANADA WOOD FLOORING IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 CANADA SPORTS FLOORING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 30 CANADA INDOOR IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 CANADA OUTDOOR IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 CANADA SPORTS FLOORING MARKET, BY SPORTS, 2021-2030 (USD MILLION)

TABLE 33 CANADA SPORTS FLOORING MARKET, BY END-USE, 2021-2030 (USD MILLION)

TABLE 34 CANADA SPORTS FLOORING MARKET, BY CONSTRUCTION TYPE, 2021-2030 (USD MILLION)

TABLE 35 CANADA SPORTS FLOORING MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 36 MEXICO SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 MEXICO SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (MILLION SQUARE FEET)

TABLE 38 MEXICO RUBBER FLOORING IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 MEXICO WOOD FLOORING IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 MEXICO SPORTS FLOORING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 41 MEXICO INDOOR IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 MEXICO OUTDOOR IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 MEXICO SPORTS FLOORING MARKET, BY SPORTS, 2021-2030 (USD MILLION)

TABLE 44 MEXICO SPORTS FLOORING MARKET, BY END-USE, 2021-2030 (USD MILLION)

TABLE 45 MEXICO SPORTS FLOORING MARKET, BY CONSTRUCTION TYPE, 2021-2030 (USD MILLION)

TABLE 46 MEXICO SPORTS FLOORING MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

图片列表

FIGURE 1 NORTH AMERICA SPORTS FLOORING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SPORTS FLOORING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SPORTS FLOORING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SPORTS FLOORING MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SPORTS FLOORING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SPORTS FLOORING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA SPORTS FLOORING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA SPORTS FLOORING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA SPORTS FLOORING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 10 NORTH AMERICA SPORTS FLOORING MARKET: SEGMENTATION

FIGURE 11 GROWING POPULARITY OF SPORTS ACTIVITIES IS DRIVING THE GROWTH OF THE NORTH AMERICA SPORTS FLOORING MARKET IN THE FORECAST PERIOD FROM 2023 TO 2030

FIGURE 12 RUBBER FLOORING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA SPORTS FLOORING MARKET IN 2023 AND 2030

FIGURE 13 VENDOR SELECTION CRITERIA

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA SPORTS FLOORING MARKET

FIGURE 15 NORTH AMERICA SPORTS FLOORING MARKET: BY TYPE, 2022

FIGURE 16 NORTH AMERICA SPORTS FLOORING MARKET: BY APPLICATION, 2022

FIGURE 17 NORTH AMERICA SPORTS FLOORING MARKET: BY SPORTS, 2022

FIGURE 18 NORTH AMERICA SPORTS FLOORING MARKET: BY END-USE, 2022

FIGURE 19 NORTH AMERICA SPORTS FLOORING MARKET: BY CONSTRUCTION TYPE, 2022

FIGURE 20 NORTH AMERICA SPORTS FLOORING MARKET: BY SALES CHANNEL, 2022

FIGURE 21 NORTH AMERICA SPORTS FLOORING MARKET: SNAPSHOT (2022)

FIGURE 22 NORTH AMERICA SPORTS FLOORING MARKET: COMPANY SHARE 2022 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。