North America Solvent Market

市场规模(十亿美元)

CAGR :

%

USD

9,165.03 million

USD

12,504.57 million

2023

2030

USD

9,165.03 million

USD

12,504.57 million

2023

2030

| 2024 –2030 | |

| USD 9,165.03 million | |

| USD 12,504.57 million | |

|

|

|

北美溶剂市场,按类别(含氧溶剂、碳氢化合物溶剂和卤化溶剂源)(传统和生物基)、应用(油漆和涂料、制药、粘合剂、印刷油墨、个人护理、聚合物制造、农用化学品、金属清洗等)划分 - 行业趋势和预测到 2030 年。

北美溶剂市场分析及规模

溶剂作为表面涂层(如油漆、清漆和粘合剂)的载体发挥着重要作用。油漆和涂料中使用的化学品依赖于溶剂,因为它们可以溶解和分散涂料配方中使用的成分。它进一步确保了最终产品的质量和最佳性能。溶剂是建筑行业油漆和涂料配方中必不可少的成分,因为它们可以溶解颜料、添加剂和粘合剂以形成高性能涂层。

根据涂料的要求(例如干燥时间、薄膜质量和与其他成分的兼容性),使用各种类型的溶剂。溶剂的选择(例如烃溶剂、酮、酯、醇和乙二醇醚)取决于溶剂化能力、极性以及与配方中其他成分的兼容性等因素。苯、甲苯和二甲苯是用于搪瓷涂料的芳香烃溶剂,而漆基涂料需要更强的溶剂来加快干燥速度。

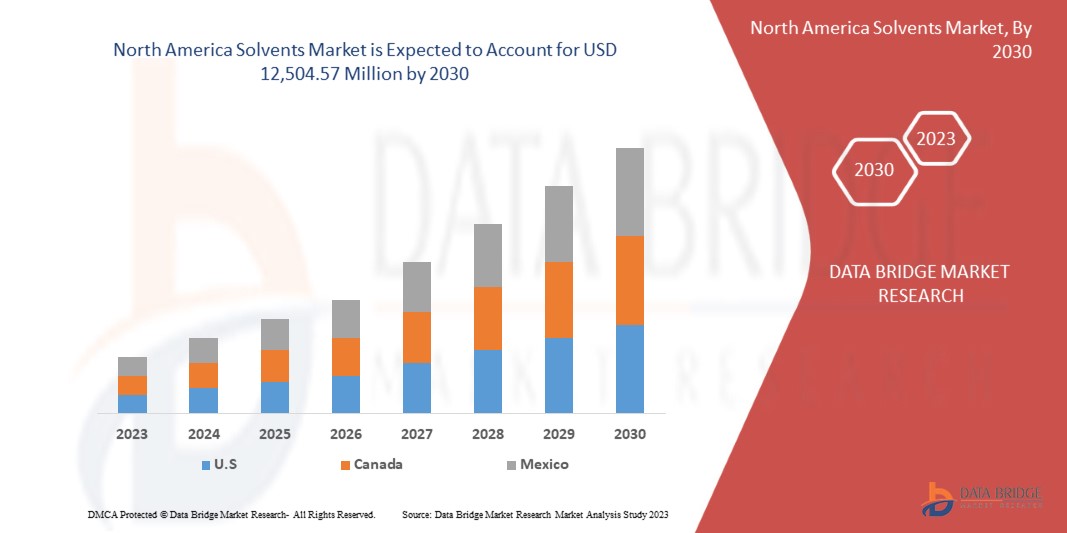

Data Bridge Market Research 分析,北美溶剂市场规模预计将从 2023 年的 91.6503 亿美元增至 2030 年的 125.0457 亿美元,在 2023 年至 2030 年的预测期内,复合年增长率将达到 4.5%。

|

报告指标 |

细节 |

|

预测期 |

2023 至 2030 年 |

|

基准年 |

2022 |

|

历史岁月 |

2021(可定制为 2015 - 2020) |

|

定量单位 |

收入(百万美元) |

|

涵盖的领域 |

类别(含氧溶剂、碳氢化合物溶剂和卤化溶剂)、来源(传统和生物基)、应用(油漆和涂料、药品、粘合剂、印刷油墨、个人护理、聚合物制造、农用化学品和金属清洗) |

|

覆盖国家 |

美国、加拿大和墨西哥 |

|

涵盖的市场参与者 |

阿科玛、英威达(科赫工业集团子公司)、亚什兰、索尔维、ADM、壳牌全球、英国石油公司、伊士曼化工公司、英力士集团控股公司、巴斯夫公司、塞拉尼斯公司、嘉吉公司、信实工业有限公司、霍尼韦尔国际公司、利安德巴塞尔工业控股公司、埃克森美孚公司、Monument Chemical、陶氏化学公司和 Olin Corporation 等 |

市场定义

溶剂通常是液体物质,能够溶解或分散各种化合物,包括固体、液体和气体物质。它们广泛用于各种行业,包括化学品、药品、油漆和涂料、粘合剂、清洁产品等。溶剂市场包括各种溶剂类型,例如碳氢化合物、含氧溶剂、卤化溶剂和其他专用溶剂。

北美溶剂市场动态

本节旨在了解市场驱动因素、优势、限制和挑战。下面将详细讨论所有这些内容:

驱动程序

- 油漆和涂料行业对溶剂的需求不断增长

溶剂作为表面涂层(如油漆、清漆和粘合剂)的载体发挥着重要作用。油漆和涂料中使用的化学品依赖于溶剂,因为它们可以溶解和分散涂料配方中使用的成分。它进一步确保了最终产品的质量和最佳性能。溶剂是建筑行业油漆和涂料配方中必不可少的成分,因为它可以溶解颜料、添加剂和粘合剂以形成高性能涂层。根据涂料的要求(例如干燥时间、薄膜质量和与其他成分的兼容性),使用各种类型的溶剂。

除了油漆和涂料,溶剂还可用于粘合材料。粘合剂有多种类型,例如聚氯丁二烯、聚氨酯、丙烯酸酯和硅基粘合剂。此外,溶剂还用于清洁剂和脱脂剂、除漆剂和清漆。由于城市化、基础设施建设、建筑活动增加和汽车需求增长,全球建筑和汽车行业蓬勃发展。建筑和汽车行业的增长进一步推动了对油漆、涂料和粘合剂的需求,因此对溶剂的需求也随之增加。

- 不同工业用途的印刷油墨使用量不断增加

溶剂在印刷行业中起着至关重要的作用,因为它们为油墨提供溶解能力,将颜料和载体(例如水溶性乙二醇载体)溶解成溶液。这样做是为了将油墨轻松地涂在纸张或任何其他基材上。印刷油墨需要溶剂来实现颜色和一致性的适当分布。具有高溶解能力的溶剂可以产生鲜艳且持久的印刷品。沸点范围窄的溶剂在油墨应用后会迅速蒸发,因此油墨在应用的基材上可以有效且适当地干燥。

印刷油墨中的溶剂广泛应用于印刷、包装、瓶装印刷和塑料印刷等不同领域。包装行业在推动印刷应用对油墨溶剂的需求方面发挥着重要作用。由于软包装具有可定制性、低成本和轻质特性,因此对软包装的需求有所增加。这种软包装用于从消费品到医疗保健等各个领域,从而在预测期内推动了对溶剂的需求。食品和饮料行业的增长也有望增加对包装的需求,这将进一步推动对印刷油墨的需求。油墨溶剂有助于实现食品和饮料行业使用的包装材料所需的印刷质量和耐用性。在未来,食品和饮料、消费品和医疗保健应用等广泛行业的不同应用对高质量印刷油墨的需求将会增加,从而推动北美溶剂市场向前发展。

机会

- 将制造商的重点转向环保溶剂

近年来,终端用户已显著转向使用环保溶剂,这些溶剂也被称为生物溶剂或绿色溶剂。这些溶剂大部分来自农作物加工。由于来自石化产品的溶剂会导致挥发性有机化合物的排放,因此它们对环境有严重的副作用。这些溶剂不致癌、无腐蚀性,因此可以安全处理并降低工人的风险。

乳酸乙酯是一种绿色溶剂,源自玉米加工,与传统溶剂相比具有可生物降解等优势。乳酸乙酯也用于油漆剥离剂以及从各种金属表面去除油脂、油、粘合剂和固体燃料等应用。制造商正在进一步研究和开发环保溶剂的性能和范围。

- 可再生能源领域潜力巨大

随着对清洁和可持续能源的需求不断增加,可再生能源行业近年来经历了显著增长。太阳能电池板系统和风力涡轮机是可再生能源发电的重要组成部分,需要半导体来实现有效的电力转换和控制。

溶剂和溶剂组合在半导体行业中被广泛用于各种目的,例如设备清洗、晶圆干燥以及基板的沉积或去除。半导体级溶剂在半导体制造中起着重要作用。它们是为半导体行业和电子行业设计的,这些行业需要较低的杂质水平。异丙醇和丙酮是半导体行业最受欢迎的清洁溶剂之一。因此,溶剂制造商可以投资于研发活动,以开发新溶剂,包括满足半导体制造要求的环保溶剂。这些措施将有助于可再生能源系统在全球范围内的扩张,从而为市场增长提供广泛的机会。

克制/挑战

- 与使用溶剂有关的健康和安全问题

溶剂用于溶解或稀释成分的各种用途。建筑产品(例如油漆、脱漆剂和稀释剂)中使用的溶剂对接触它的个体构成潜在的健康危害。二氯甲烷、甲苯和乙酸乙酯等溶剂通过皮肤接触、食入、吸入和眼睛接触等不同方式影响人体健康。在使用此类产品时,呼吸会发生,从而导致头痛、恶心以及眼睛、皮肤、肺和皮肤刺激等副作用。此外,长期接触此类溶剂会导致皮炎等健康问题,并对眼睛、肾脏、肺、神经系统和皮肤等身体部位造成损害。高剂量的溶剂甚至会导致昏迷和死亡,尤其是在职业接触的情况下。

与溶剂相关的健康和安全问题将导致对溶剂产品的需求减少。油漆、涂料和粘合剂等行业也可能面临重大挑战,从而抑制市场增长。

近期发展

- 2023年4月,利安德巴赛尔宣布将参加4月17-20日在深圳举办的Chinaplas 2023国际橡塑展。展会期间,利安德巴赛尔还将公布与价值链上下游各方的最新合作成果,包括立邦涂料中国、江苏威格斯和Genox。通过深化本地合作,利安德巴赛尔旨在推动本地创新回收生态系统,与行业合作伙伴共同塑造更可持续的未来

- 2023 年 3 月,壳牌公司发布了《2022 年能源转型进展报告》,报告显示,作为能源转型战略的一部分,壳牌再次实现了气候目标。报告重点介绍了壳牌为推进能源转型战略所采取的重要举措

北美溶剂市场范围

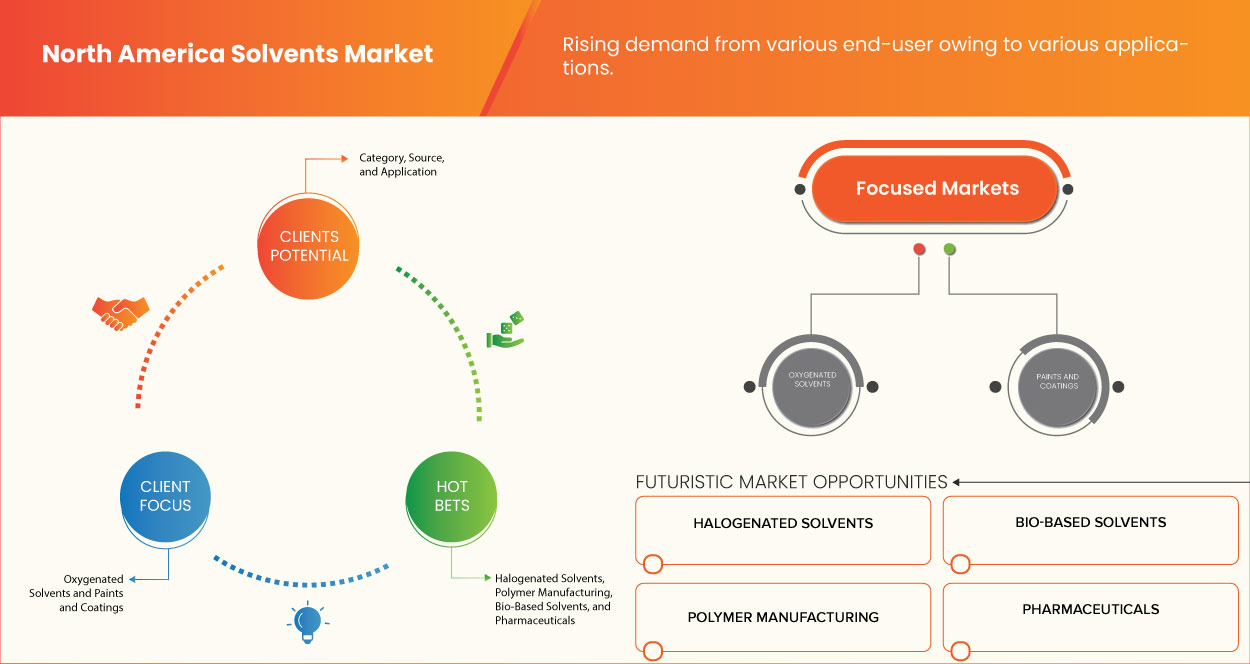

北美溶剂市场根据类别、来源和应用进行细分。这些细分市场之间的增长情况将帮助您分析行业中的主要增长细分市场,并为用户提供有价值的市场概览和市场洞察,以便做出战略决策,确定核心市场应用。

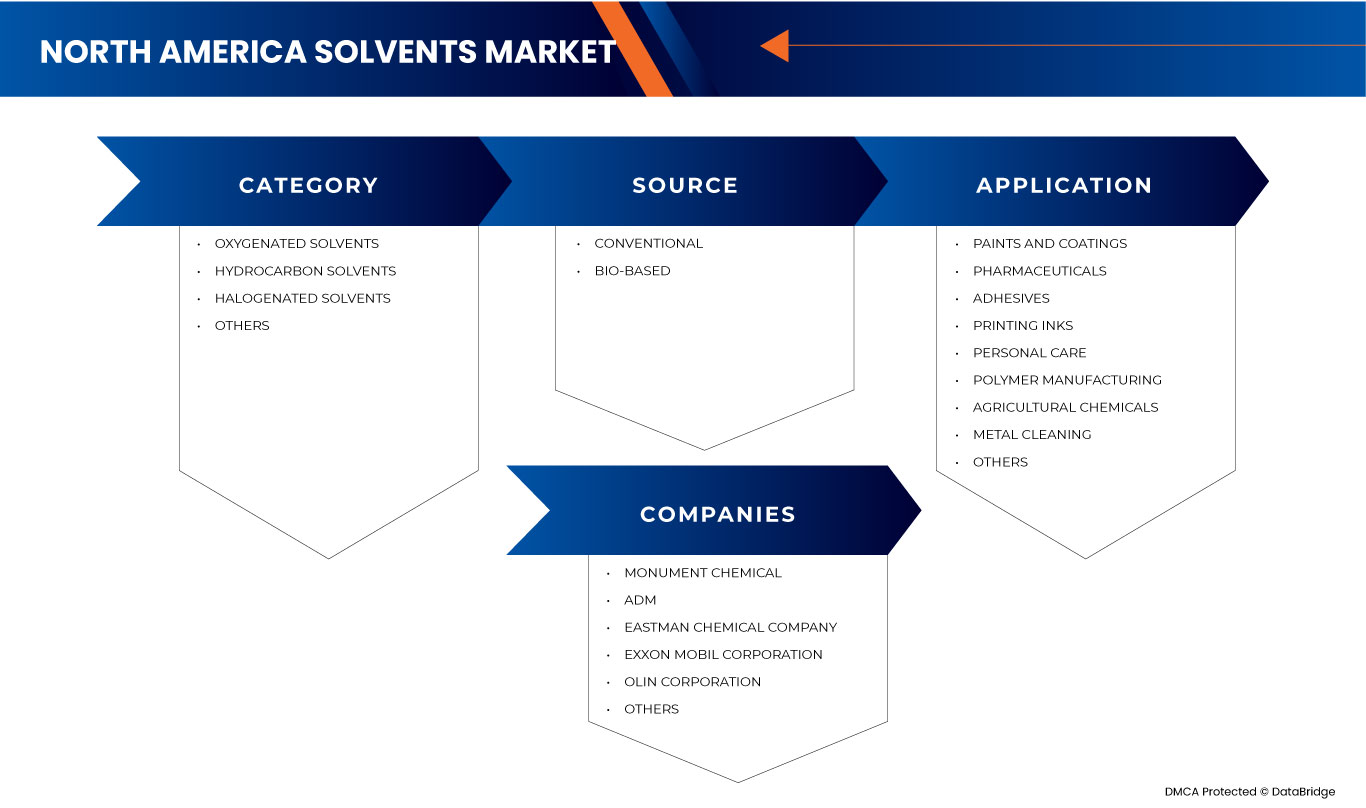

类别

根据类别,市场分为含氧溶剂、碳氢化合物溶剂和卤化溶剂。

来源

- 传统的

- 生物基

根据来源,市场分为传统市场和生物市场。

应用

- 油漆和涂料

- 药品

- 粘合剂

- 印刷油墨

- 个人护理

- 聚合物制造

- 农用化学品

- 金属清洗

- 其他的

根据应用,市场分为油漆和涂料、药品、粘合剂、印刷油墨、个人护理、聚合物制造、农用化学品、金属清洗等。

北美溶剂市场区域分析/见解

北美溶剂市场根据类别、来源和应用进行细分。

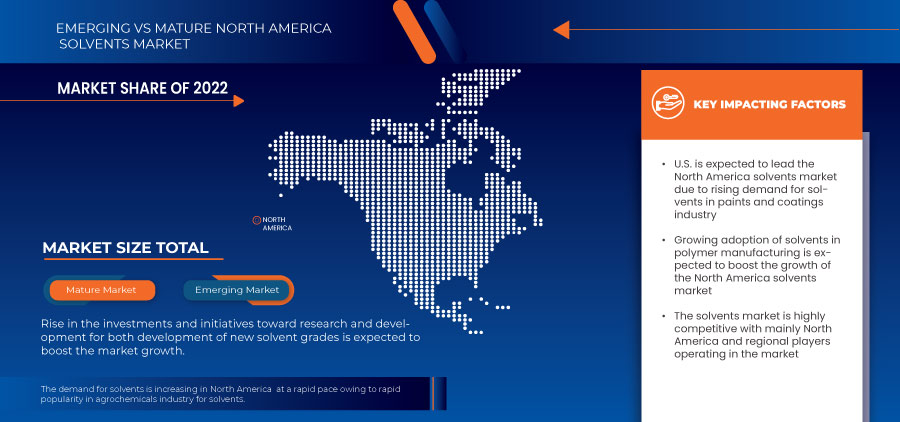

北美溶剂市场报告涵盖的国家包括美国、加拿大和墨西哥。

由于油漆和涂料行业对溶剂的需求不断增长,预计美国将主导北美溶剂市场。

报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和市场监管变化。数据点下游和上游价值链分析、技术趋势波特五力分析和案例研究是用于预测各个国家市场情景的一些指标。此外,在提供国家数据的预测分析时,还考虑了区域品牌的存在和可用性以及由于来自本地和国内品牌的大量或稀缺竞争而面临的挑战、国内关税的影响和贸易路线。

竞争格局和北美溶剂市场份额分析

北美溶剂市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、生产基地和设施、公司优势和劣势、产品发布、产品试验渠道、产品批准、专利、产品宽度和广度、应用优势、技术生命线曲线。以上提供的数据点仅与公司对市场的关注有关。

北美溶剂市场的一些知名市场参与者包括阿科玛、英威达(科赫工业集团的子公司)、亚什兰、索尔维、ADM、壳牌全球、英国石油公司、伊士曼化学公司、英力士集团控股公司、巴斯夫公司、塞拉尼斯公司、嘉吉公司、信实工业有限公司、霍尼韦尔国际公司、利安德巴塞尔工业控股公司、埃克森美孚公司、莫纽曼化学、陶氏和奥林公司等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SUPPLY CHAIN ANALYSIS

4.1.1 OVERVIEW

4.1.2 LOGISTIC COST SCENARIO

4.1.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.2 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.3 VENDOR SELECTION CRITERIA

4.4 LIST OF KEY BUYERS

4.5 RAW MATERIAL COVERAGE

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR SOLVENTS IN THE PAINTS AND COATINGS INDUSTRY

6.1.2 RISING USAGE OF PRINTING INKS FOR DIFFERENT INDUSTRIAL APPLICATIONS

6.1.3 RISING DEMAND FOR BEAUTY AND PERSONAL CARE PRODUCTS INDUSTRY

6.1.4 GROWING ADOPTION OF POLYMERS AND RUBBERS ACROSS VARIOUS SEGMENTS

6.1.5 POSITIVE OUTLOOK TOWARD THE AGROCHEMICALS INDUSTRY

6.1.6 RISING USE OF SOLVENTS IN THE PHARMACEUTICAL SECTOR

6.2 RESTRAINTS

6.2.1 HEALTH AND SAFETY CONCERNS RELATED TO THE USAGE OF SOLVENTS

6.2.2 TECHNICAL COMPLEXITIES IN SOLVENT RECOVERY AND REUSE

6.3 OPPORTUNITIES

6.3.1 SHIFTING THE FOCUS OF MANUFACTURERS TOWARD ECO-FRIENDLY SOLVENTS

6.3.2 IMMENSE POTENTIAL IN THE RENEWABLE ENERGY SECTOR

6.4 CHALLENGES

6.4.1 ISSUES IN TRANSPORTATION AND STORAGE OF SOLVENTS

6.4.2 STRINGENT RULES AND REGULATIONS

7 NORTH AMERICA SOLVENTS MARKET, BY CATGEORY

7.1 OVERVIEW

7.2 OXYGENATED SOLVENTS

7.2.1 OXYGENATED SOLVENTS, BY CATEGORY

7.2.1.1 ALCOHOLS

7.2.1.1.1 ETHANOL

7.2.1.1.2 METHANOL

7.2.1.1.3 PROPANOL

7.2.1.1.4 BUTANOL

7.2.1.2 GLYCOL ETHERS

7.2.1.2.1 E-SERIES GLYCOL ETHERS

7.2.1.2.2 P-SERIES GLYCOL ETHERS

7.2.1.2.3 BUTYL GLYCOL ETHERS

7.2.1.3 KETONES

7.2.1.3.1 ACETONE

7.2.1.3.2 MEK

7.2.1.3.3 MIBK

7.2.1.4 ESTERS

7.2.1.4.1 ETHYL ACETATE

7.2.1.4.2 BUTHYL ACETATE

7.2.1.5 GLYCOLS

7.2.1.5.1 ETHYLENE GLYCOL

7.2.1.5.1.1 MEG

7.2.1.5.1.2 DEG

7.2.1.5.1.3 TEG

7.2.1.5.2 PROPYLENE GLYCOL

7.3 HYDROCARBON SOLVENTS

7.3.1 ALIPHATIC SOLVENTS

7.3.2 AROMATIC SOLVENTS

7.3.2.1 TOLUENE

7.3.2.2 XYLENE

7.3.2.2.1 MIXED-XYLENE

7.3.2.2.2 PARA-XYLENE

7.3.2.3 EHTYLBENZENE

7.4 HALOGENATED SOLVENTS

7.4.1 HALOGENATED SOLVENTS, BY CATEGORY

7.4.1.1 TRICHLOROETHYLENE

7.4.1.2 PERCHLOROETHYLENE

7.4.1.3 METHYLENE CHLORIDE

7.5 OTHERS

8 NORTH AMERICA SOLVENTS MARKET, BY SOURCE

8.1 OVERVIEW

8.2 CONVENTIONAL

8.3 BIO-BASED

9 NORTH AMERICA SOLVENTS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 PAINTS AND COATINGS

9.3 PHARMACEUTICALS

9.4 ADHESIVES

9.5 PRINTING INKS

9.6 PERSONAL CARE

9.7 POLYMER MANUFACTURING

9.8 AGRICULTURAL CHEMICALS

9.9 METAL CLEANING

9.1 OTHERS

10 NORTH AMERICA SOLVENTS MARKET, BY COUNTRY

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA SOLVENTS MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.2 PRODUCT LAUNCH

11.3 ACQUISITION

11.4 COLLABORATION

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 ADM

13.1.1 COMPANY SNAPSHOT

13.1.2 PRODUCT PORTFOLIO

13.1.3 REVENUE ANALYSIS

13.1.4 RECENT DEVELOPMENTS

13.2 RELIANCE INDUSTRIES LIMITED

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENTS

13.3 BP P.L.C.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENTS

13.4 EASTMAN CHEMICAL COMPANY (2022)

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENTS

13.5 OLIN CORPORATION

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENTS

13.6 ARKEMA (2022)

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 ASHLAND.(2022)

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENT

13.8 BASF SE

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENT

13.9 CARGILL, INCORPORATED

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT DEVELOPMENT

13.1 CELANESE CORPORATON(2022)

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENT

13.11 DOW

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENTS

13.12 EXXON MOBIL CORPORATION(2022)

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENTS

13.13 HONEYWELL INTERNATIONAL INC. (2022)

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.14 HUNTSMAN INTERNATIONAL LLC (2022)

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENT

13.15 INEOS GROUP HOLDINGS S.A. (2022)

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENT

13.16 INVISTA (A SUBSIDRIARY OF KOCH INDUSTRIES, INC.)

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENTS

13.17 LYONDELLBASELL INDUSTRIES HOLDING B.V. (2022)

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENT

13.18 MONUMENT CHEMICAL

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 SHELL GLOBAL (2022)

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT DEVELOPMENTS

13.2 SOLVAY (2022)

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

表格列表

TABLE 1 REGULATORY COVERAGE

TABLE 2 NORTH AMERICA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 4 NORTH AMERICA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA HALOGENATED SOLVENTS, BY CATEGORY IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 17 NORTH AMERICA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 19 NORTH AMERICA SOLVENTS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA SOLVENTS MARKET, BY COUNTRY, 2021-2030 (KILO TONS)

TABLE 21 U.S. SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 22 U.S. SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 23 U.S. OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 24 U.S. ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 U.S. GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 26 U.S. KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 U.S. ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 U.S. GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 U.S. ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 30 U.S. HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 31 U.S. AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 U.S. XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 33 U.S. HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 34 U.S. SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 35 U.S. SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 36 U.S. SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 37 U.S. SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 38 CANADA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 39 CANADA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 40 CANADA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 41 CANADA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 CANADA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 CANADA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 CANADA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 CANADA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 CANADA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 CANADA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 48 CANADA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 CANADA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 CANADA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 51 CANADA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 52 CANADA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 53 CANADA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 54 CANADA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 55 MEXICO SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 56 MEXICO SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 57 MEXICO OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 58 MEXICO ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 MEXICO GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 MEXICO KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 MEXICO ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 62 MEXICO GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 63 MEXICO ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 MEXICO HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 65 MEXICO AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 MEXICO XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 MEXICO HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 68 MEXICO SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 69 MEXICO SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 70 MEXICO SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 71 MEXICO SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

图片列表

FIGURE 1 NORTH AMERICA SOLVENTS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SOLVENTS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SOLVENTS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SOLVENTS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SOLVENTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SOLVENTS MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 NORTH AMERICA SOLVENTS MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA SOLVENTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA SOLVENTS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA SOLVENTS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA SOLVENTS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA SOLVENTS MARKET: SEGMENTATION

FIGURE 13 GROWING DEMAND FOR SOLVENTS IN THE PAINTS AND COATINGS INDUSTRY IS EXPECTED TO DRIVE THE NORTH AMERICA SOLVENTS MARKET IN THE FORECAST PERIOD

FIGURE 14 THE OXYGENATED SOLVENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA SOLVENTS MARKET IN 2023 AND 2030

FIGURE 15 VENDOR SELECTION CRITERIA

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA SOLVENTS MARKET

FIGURE 17 NORTH AMERICA SOLVENTS MARKET: BY CATEGORY, 2022

FIGURE 18 NORTH AMERICA SOLVENTS MARKET: BY SOURCE, 2022

FIGURE 19 NORTH AMERICA SOLVENTS MARKET: BY APPLICATION, 2022

FIGURE 20 NORTH AMERICA SOLVENTS MARKET: SNAPSHOT (2022)

FIGURE 21 NORTH AMERICA SOLVENTS MARKET: COMPANY SHARE 2022 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。