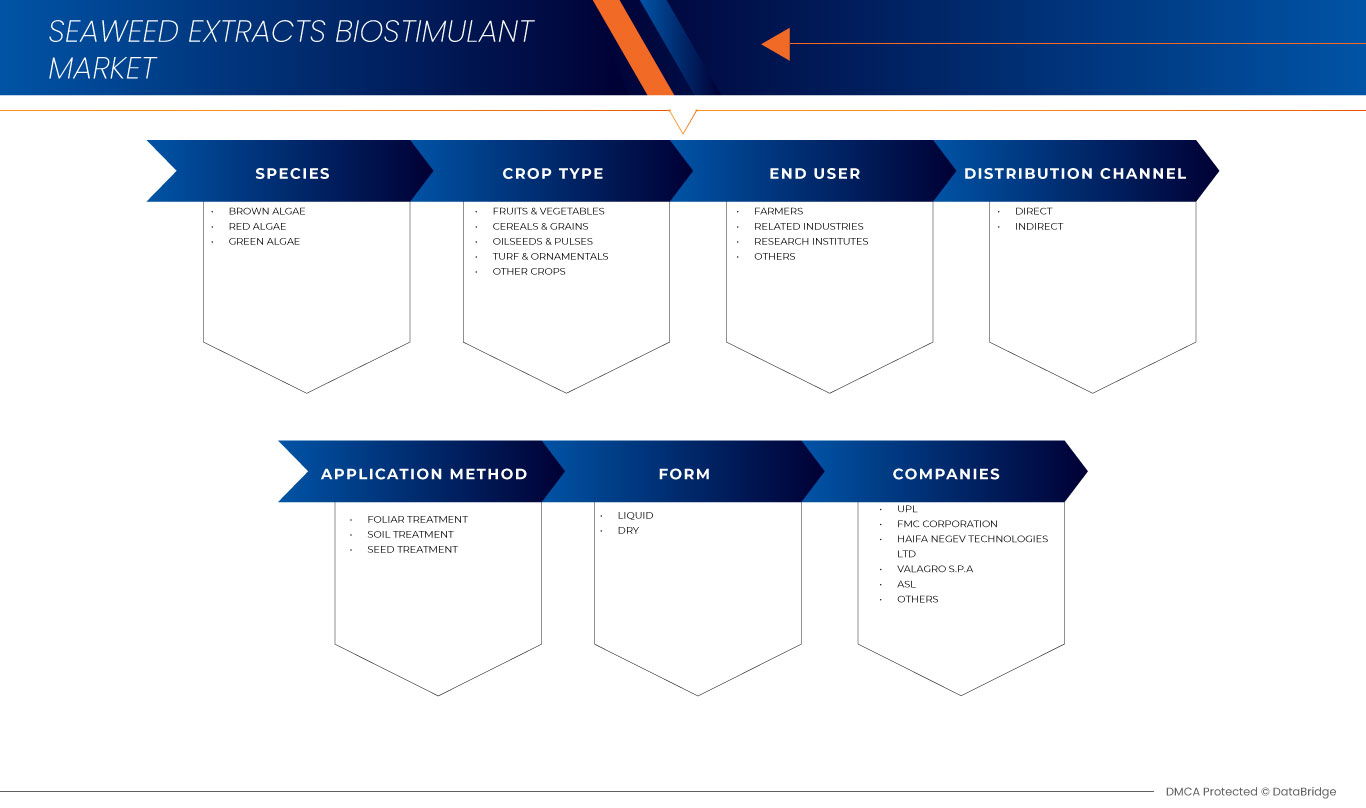

North America Seaweed Extracts Biostimulant Market, By Species (Brown Algae, Red Algae, Green Algae), Crop Type (Fruits & Vegetables, Cereals & Grains, Oilseeds & Pulses, Turf & Ornamentals, and Other Crops), Application Method (Foliar Treatment, Soil Treatment, and Seed Treatment), Form (Liquid and Dry), End User (Farmers, Related Industries, Research Institutes, and Others), and Distribution Channel (Direct and Indirect) - Industry Trends and Forecast to 2030.

North America Seaweed Extracts Biostimulant Market Analysis and Size

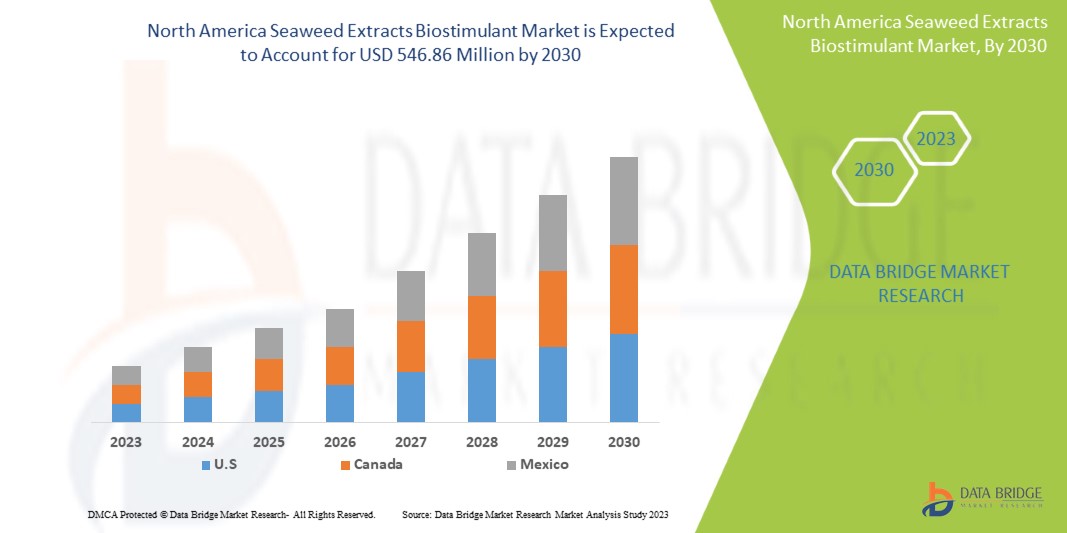

The North America seaweed extracts biostimulant market is expected to grow significantly from 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 12.0% from 2023 to 2030 and is expected to reach USD 546.86 Million by 2030. The rising need for sustainable agriculture is expected to drive the North America seaweed extracts biostimulant market.

The rising preference for organically grown food among consumers is the key factor fueling the expansion of the seaweed extracts biostimulant market. The availability of a wider range of seaweed extracts biostimulant products is driving the market's expansion. Additionally, the market is further influenced by the rising need for sustainable agriculture.

The North America seaweed extracts biostimulant market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an analyst brief. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Species (Brown Algae, Red Algae, Green Algae), Crop Type (Fruits & Vegetables, Cereals & Grains, Oilseeds & Pulses, Turf & Ornamentals, and Other Crops), Application Method (Foliar Treatment, Soil Treatment, and Seed Treatment), Form (Liquid And Dry), End User (Farmers, Related Industries, Research Institutes, and Others), Distribution Channel (Direct and Indirect) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

ASL, BIOVERT S.L., BIOSTADT INDIA LIMITED, FMC Corporation, Valagro S.p.A, OMEX, ATLÁNTICA AGRÍCOLA, BioAtlantis Ltd., Koppert, Trade Corporation International among others. |

Market Definition

Seaweeds are plants that naturally grow in the sea. Seaweeds are also known as marine microalgae, generally attached to hard substrata of coastal areas. These plants comprise various marine algae, such as kelps, dulse, rockweeds, and sea lettuce. Seaweed extract is an organic fertilizer containing vitamins, fatty acids, and macro and micronutrients. It also contains oceanic bioactive ingredients such as polyphenol, mannitol, oligosaccharides betaine, cytokinin, and phycocolloid, considered essential ingredients for root development, resistance to pathogens, and improving germination and leaf quality. The seaweed extracts biostimulant can be used in both horticulture and agriculture crops.

Asia-Pacific Seaweed Extracts Biostimulant Market Dynamics

The section deals with understanding market drivers, opportunities, restraints, and challenges. All of this is discussed in detail below:

Driver

- Rising preference for organically grown food among consumers

Synthetic insecticides, fertilizers, and herbicides produce conventional (non-organic) food. However, organically cultivated food offers the best nutritional benefits and dietary variety, leading to more individuals consuming naturally grown food. As a result, the growing popularity of organically cultivated food ultimately increases the demand for plant inhibitors, biofertilizers, and biopesticides. As it contains vitamins, fatty acids, and other macro- and micronutrients necessary for plant growth, seaweed extract offers the perfect substitute for chemical fertilizers, which are used to boost both the amount and quality of farming production.

Furthermore, consumers are increasingly conscious of food production practices today. The use of fewer chemicals, more biodynamic practices, and better soil management are all part of the organic farming system. Parents are moving towards pesticide-free fresh food because research shows that youngsters are more sensitive to food grown with pesticides. The demand for food farmed organically has surged due to parents' growing concerns. This demand for organically grown food is expected to drive market growth in the forecast period.

For instance,

- In January 2023, according to an article published in MDPI, in the case of emerging nations, due to the significantly smaller price difference between organic products and traditional foods, the health benefits of foods with an eco-label, and the dissemination of information about climate change have a significant impact on the level of consumption of organic foods

Thus, the increasing demand for organic food encourages farmers to avoid using chemical fertilizers to grow plants.

Opportunity

- Growing popularity of horticulture

Seaweed has high nutrient content, including nitrogen, phosphorus, potassium, and trace elements, making it an excellent plant food source. In horticulture, seaweed is often used as a foliar spray, which means it is applied directly to the leaves of plants. This method allows the nutrients to be absorbed by the plant more quickly, resulting in faster growth and improved resistance to pests and diseases. Horticulture crops require more inputs in terms of fertilizers and pesticides to maximize the yield of each acre. Thus the seaweed extract biostimulants can increase crop growth and enhance their yield.

In horticulture practices, abiotic stresses such as water logging in extreme temperatures, drought, and salinity are major factors affecting horticultural crop productivity and quality. Seaweed extracts can counter this problem as they contain bioactive compounds, which enhance the performance of crops under abiotic conditions. The brown seaweed extract is widely used in horticulture crops owing to its plant growth-boosting effect and ameliorating effect on crop tolerance to handle abiotic stresses such as drought, nutrient deficiency, salinity, and extreme temperatures. The seaweed extracts counter the abiotic stress and improve crops' shelf life and yield. Seaweed extracts have also been proven to improve thermal tolerance in plants.

For instance,

- In July 2022, according to a review published in Wiley Open Library, Carrageenans, and oligo-carrageenans, which are polysaccharides commonly found in red seaweeds, have been found to improve the growth and development of various plants by inducing changes in important physiological and biochemical processes

Therefore, the acceptance of seaweed extracts is increasing for horticulture as they provide many beneficial effects such as abiotic and biotic stress tolerance, nutrient uptake, and quality improvement of crops. Hence, the growing popularity of horticulture is creating opportunities for the market shortly due to its effects on horticulture crops, such as improved plant quality, abiotic & biotic stress tolerances, and increased uptake of nutrients.

Restraint/Challenge

- Disproportionality in the supply chain of seaweed extract

The demand for seaweed extract is expected to rise in the coming years due to the growing demand for organic food across the globe. Therefore, the supply chain plays a vital role in producing seaweed from marine sources. The seaweed supply chain majorly includes seaweed suppliers, manufacturers, and customers.

This supply chain mechanism is currently facing the following issues:

- The unpredictability of dried seaweed availability increases the time of delivery as it could not meet the timeline of customers

- Fluctuating prices of seaweed majorly affect the profitability of the end product

- The quality fluctuations of seaweed as it is naturally cultivated in the sea; therefore, humans have no control over the quality of seaweed

- External uncertainties such as natural or artificial disasters and economic disruptions

- The production plant of biostimulant is located nearby the source of seaweed, which further results in the high transportation cost of distribution of processed seaweed extract

As mentioned earlier in the supply chain, the uncertainties affect the cost and profitability of the seaweed manufacturer. Hence, this could be counted as a challenge for the growth of the seaweed extracts biostimulant market.

Recent Developments

- In 2022, Biostadt Group completed the acquisition of all assets and businesses of Biogene Seeds Sciences Pvt. Ltd, thereby expanding its product portfolio to include research rice, hybrid corn, vegetables, and crops such as jowar and bajra. In addition, the company intends to introduce its product, Hyzyme, to the southern states. This strategic move is aimed at achieving the objective of doubling the company's business within two years

- In October 2021, UPL announced a long-term strategic partnership to create microbial-based bio solutions (biostimulants and biopesticides) that will aid growers worldwide in combating pests and diseases and enhance crop quality and yields. Chr. Hansen is a North America bioscience company. This partnership has helped the company to get better brand value, a new consumer base, and a wide range of products and solutions portfolio

North America Seaweed Extracts Biostimulant Market Scope

The North America seaweed extracts biostimulant market is segmented into six notable segments based on species, crop type, application method, form, end user, and distribution channel. The growth amongst these segments will help you analyze major industry growth segments and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

SPECIES

- Brown Algae

- Red Algae

- Green Algae

On the basis of species, the North America seaweed extracts biostimulant market is segmented into brown algae, red algae, and green algae.

CROP TYPE

- Fruits & Vegetables

- Cereals & Grains

- Oilseeds & Pulses

- Turf & Ornamentals

- Other Crops

On the basis of crop type, the North America seaweed extracts biostimulant market is segmented into fruits & vegetables, cereals & grains, oilseeds & pulses, turf & ornamentals, and other crops.

APPLICATION

- Foliar Treatment

- Soil Treatment

- Seed Treatment

On the basis of application method, the North America seaweed extracts biostimulant market is segmented into foliar treatment, soil treatment, and seed treatment.

FORM

- Liquid

- Dry

On the basis of form, the North America seaweed extracts biostimulant market is segmented into liquid and dry.

END USER

- Farmers

- Related Industries

- Research Institutes

- Others

On the basis of end user, the North America seaweed extracts biostimulant market is segmented into farmers, related industries, research institutes, and others.

DISTRIBUTION CHANNEL

- Direct

- Indirect

On the basis of distribution channel, the North America seaweed extracts biostimulant market is segmented into direct and indirect.

North America Seaweed Extracts Biostimulant Market Regional Analysis/Insights

The North America seaweed extracts biostimulant market is segmented based on species, crop type, application method, form, end user, and distribution channel.

The countries in North America seaweed extracts biostimulant market are the U.S., Canada, and Mexico.

U.S. is expected to dominate the North America seaweed extracts biostimulant market due to increased organic farming. Demand for organically grown food is rising, which may drive market demand.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technological trends porter's five forces analysis, and case studies are some pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Seaweed Extracts Biostimulant Based Market Share Analysis

The North America seaweed extracts biostimulant market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points are only related to the companies' focus on the North America seaweed extracts biostimulant market.

Some of the major market players operating in the North America seaweed extracts biostimulant market are ASL, BIOVERT S.L., BIOSTADT INDIA LIMITED, FMC Corporation, Valagro S.p.A, OMEX, ATLÁNTICA AGRÍCOLA, BioAtlantis Ltd., Koppert, and Trade Corporation International among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 SPECIES LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING PREFERENCE FOR ORGANICALLY GROWN FOOD AMONG CONSUMERS

5.1.2 RISING NEED FOR SUSTAINABLE AGRICULTURE

5.1.3 GROWING DEMANDS FOR SEAWEED AS RAW MATERIALS

5.2 RESTRAINTS

5.2.1 DISPROPORTIONALITY IN THE SUPPLY CHAIN OF SEAWEED EXTRACT

5.2.2 LACK OF AWARENESS REGARDING THE SEAWEED EXTRACTS BASED BIOSTIMULANTS

5.3 OPPORTUNITIES

5.3.1 GROWING POPULARITY OF HORTICULTURE

5.3.2 CONTINUOUS CLIMATIC CHANGE

5.4 CHALLENGES

5.4.1 HIGH DEMAND FOR SUBSTITUTE PRODUCTS

5.4.2 UNCERTAINTY IN BIOSTIMULANT REGULATION WORLDWIDE

6 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANTS MARKET, BY SPECIES

6.1 OVERVIEW

6.2 BROWN ALGAE

6.2.1 BROWN ALGAE, BY SPECIES

6.2.1.1 ASCOPHYLLUM NODOSUM

6.2.1.2 SARAGASSUM SPP.

6.2.1.3 ECKLONIA MAXIMA

6.2.1.4 OTHERS

6.3 RED ALGAE

6.3.1 RED ALGAE, BY SPECIES

6.3.1.1 CORRALINA MEDITERRANEA

6.3.1.2 JANIA RUBENS

6.3.1.3 PTEROCLADIA PINNATA

6.3.1.4 GRACILARIA EDULIS

6.3.1.5 OTHERS

6.4 GREEN ALGAE

6.4.1 GREEN ALGAE, BY SPECIES

6.4.1.1 CLADOPHORA DALMATICA

6.4.1.2 ENTEROMORPHA INTESTINALIS

6.4.1.3 ULVA LACTUCA

6.4.1.4 OTHERS

7 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE

7.1 OVERVIEW

7.2 FRUITS & VEGETABLES

7.2.1 POTATO

7.2.2 APPLES

7.2.3 GRAPEFRUITS

7.2.4 ORANGES

7.2.5 TOMATO

7.2.6 CAULIFLOWER

7.2.7 BANANAS

7.2.8 CABBAGE

7.2.9 MANGOES

7.2.10 OTHERS

7.3 CEREALS & GRAINS

7.3.1 CORN

7.3.2 WHEAT

7.3.3 RICE

7.3.4 BARLEY

7.3.5 OTHERS

7.4 OILSEEDS & PULSES

7.4.1 SUNFLOWER

7.4.2 SOYBEANS

7.4.3 GROUNDNUT

7.4.4 RAPESEED

7.4.5 PEA

7.4.6 GRAM

7.4.7 LENTIL

7.4.8 OTHERS

7.5 TURF & ORNAMENTALS

7.6 OTHER CROPS

8 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY APPLICATION METHOD

8.1 OVERVIEW

8.2 FOLIAR TREATMENT

8.3 SOIL TREATMENT

8.4 SEED TREATMENT

9 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY FORM

9.1 OVERVIEW

9.2 LIQUID

9.3 DRY

10 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY END USER

10.1 OVERVIEW

10.2 FARMERS

10.3 RELATED INDUSTRIES

10.4 RESEARCH INSTITUTES

10.5 OTHERS

11 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT

11.3 INDIRECT

12 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 UPL

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 SOLUTION PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 FMC CORPORATION

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 HAIFA NEGEV TECHNOLOGIES LTD

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 VALAGRO S.P.A.

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 ASL

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 ALGEA

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 ATLÁNTICA AGRÍCOLA

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 BIOATLANTIS LTD.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 BIOLCHIM SPA

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 BIOSTADT INDIA LIMITED

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 BIOVERT S.L.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 BRANDT, INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 ILEX ENVIROSCIENCES LTD

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 INDIGROW LTD

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 KOPPERT

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPEMENTS

15.16 L.GOBBI SRL UNIPERSONALE

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 MPH

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 OMEX

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 QINGDAO SEAWIN BIOTECH GROUP CO., LTD.

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 TRADE CORPORATION INTERNATIONAL

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

表格列表

TABLE 1 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA BROWN ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA BROWN ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA RED ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA RED ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA GREEN ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA GREEN ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA FRUITS & VEGETABLES IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA FRUITS & VEGETABLES IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA CEREALS & GRAINS IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA CEREALS & GRAINS IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA OILSEEDS & PULSES IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA TURF & ORNAMENTALS IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA OTHER CROPS IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY APPLICATION METHOD, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA FOLIAR TREATMENT IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA SOIL TREATMENT IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA SEED TREATMENT IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA LIQUID IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA DRY IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA FARMERS IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA RELATED INDUSTRIES IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA RESEARCH INSTITUTES IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA OTHERS IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA DIRECT IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA INDIRECT IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA BROWN ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA RED ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA GREEN ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA FRUITS & VEGETABLES IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA CEREALS & GRAINS IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA OILSEEDS & PULSES IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY APPLICATION METHOD, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 44 U.S. SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 45 U.S. BROWN ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 46 U.S. RED ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 47 U.S. GREEN ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 48 U.S. SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 49 U.S. FRUITS & VEGETABLES IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 50 U.S. CEREALS & GRAINS IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 51 U.S. OILSEEDS & PULSES IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 52 U.S. SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY APPLICATION METHOD, 2021-2030 (USD MILLION)

TABLE 53 U.S. SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 54 U.S. SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 55 U.S. SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 56 CANADA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 57 CANADA BROWN ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 58 CANADA RED ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 59 CANADA GREEN ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 60 CANADA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 61 CANADA FRUITS & VEGETABLES IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 62 CANADA CEREALS & GRAINS IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 63 CANADA OILSEEDS & PULSES IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 64 CANADA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY APPLICATION METHOD, 2021-2030 (USD MILLION)

TABLE 65 CANADA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 66 CANADA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 67 CANADA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 68 MEXICO SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 69 MEXICO BROWN ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 70 MEXICO RED ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 71 MEXICO GREEN ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 72 MEXICO SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 73 MEXICO FRUITS & VEGETABLES IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 74 MEXICO CEREALS & GRAINS IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 75 MEXICO OILSEEDS & PULSES IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 76 MEXICO SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY APPLICATION METHOD, 2021-2030 (USD MILLION)

TABLE 77 MEXICO SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 78 MEXICO SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 79 MEXICO SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

图片列表

FIGURE 1 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET: SEGMENTATION

FIGURE 9 RISING PREFERENCE OF ORGANICALLY GROWN FOOD AMONG CONSUMERS IS EXPECTED TO DRIVE THE GROWTH OF THE NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET IN THE FORECAST PERIOD

FIGURE 10 BROWN ALGAE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET IN 2023 & 2030

FIGURE 11 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET

FIGURE 12 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET: BY SPECIES, 2022

FIGURE 13 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET: BY CROP TYPE, 2022

FIGURE 14 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET: BY APPLICATION METHOD, 2022

FIGURE 15 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET: BY FORM, 2022

FIGURE 16 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET: BY END USER, 2022

FIGURE 17 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 18 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET: SNAPSHOT (2022)

FIGURE 19 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET: BY COUNTRY (2022)

FIGURE 20 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 21 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET: BY COUNTRY (2022 & 2030)

FIGURE 22 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET: BY SPECIES (2023-2030)

FIGURE 23 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET: COMPANY SHARE 2022 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。