North America Protective Films Market

市场规模(十亿美元)

CAGR :

%

USD

644.13 million

USD

791.93 million

2022

2030

USD

644.13 million

USD

791.93 million

2022

2030

| 2023 –2030 | |

| USD 644.13 million | |

| USD 791.93 million | |

|

|

|

北美保护膜市场,按类别(粘合剂涂层、自粘)、材料(聚乙烯、聚丙烯、聚对苯二甲酸乙二醇酯、聚氯乙烯、聚氨酯、聚酰胺、聚酯、纸、其他)、厚度(0 - 2 毫米、2 - 4 毫米、4 - 6 毫米、6 - 8 毫米、8 - 10 毫米、其他)、表面(金属、玻璃、纺织品、木材、大理石、模塑塑料、其他)、纹理(不透明、透明、光泽、哑光、其他)、最终用户(建筑和施工、汽车、电子、生命科学、航空航天、包装、工业、海洋、其他)划分 - 行业趋势和预测到 2030 年。

北美保护膜市场分析及规模

保护膜用于保护荧光屏、金属、木材、玻璃等高品质表面免受划痕、痕迹、灰尘颗粒、湿气和其他必须保护的物质的影响。保护膜广泛应用于建筑、汽车、电子、包装等行业。

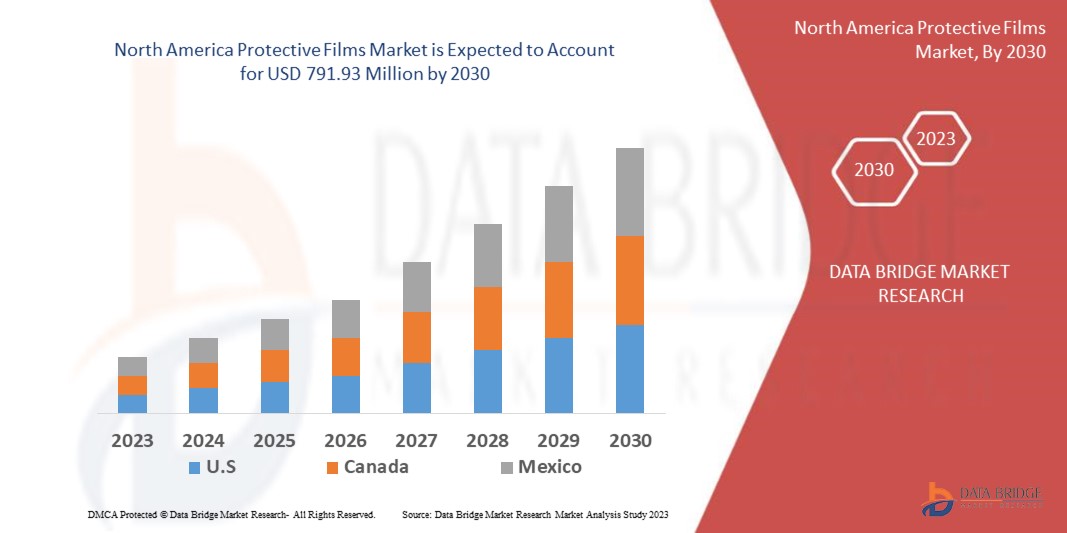

Data Bridge Market Research 分析,北美保护膜市场规模在 2022 年为 6.4413 亿美元,预计到 2030 年将达到 7.9193 亿美元,预计在 2023 年至 2030 年的预测期内复合年增长率为 5.3%。

保护膜具有多种优势,汽车行业对保护膜的需求不断增长,以保护车辆表面免受划痕、痕迹、灰尘和其他颗粒的影响,这是市场增长的驱动因素。除了对市场价值、增长率、细分、地理覆盖范围和主要参与者等市场情景的洞察外,Data Bridge Market Research 策划的市场报告还包括深入的专家分析、按地理代表的公司生产和产能、分销商和合作伙伴的网络布局、详细和最新的价格趋势分析以及供应链和需求的缺口分析。

北美保护膜市场范围和细分

|

报告指标 |

细节 |

|

预测期 |

2023 至 2030 年 |

|

基准年 |

2022 |

|

历史岁月 |

2021 (可定制为 2015-2020) |

|

定量单位 |

收入(百万美元),销量(吨) |

|

涵盖的领域 |

类别(粘合剂涂层、自粘)、材料(聚乙烯、聚丙烯、聚对苯二甲酸乙二醇酯、聚氯乙烯、聚氨酯、聚酰胺、聚酯、纸、其他)、厚度(0 - 2 毫米、2 - 4 毫米、4 - 6 毫米、6 - 8 毫米、8 - 10 毫米、其他)、表面(金属、玻璃、纺织品、木材、大理石、模塑塑料、其他)、纹理(不透明、透明、光泽、哑光、其他)、最终用户(建筑和施工、汽车、电子、生命科学、航空航天、包装、工业、海洋、其他) |

|

覆盖国家 |

美国、加拿大、墨西哥 |

|

涵盖的市场参与者 |

Lamin-x(美国)、Tee Group Films(美国)、Mactac(LINTEC Corporation 的子公司)(美国)、杜邦(美国)、阿科玛(法国)、日立化成株式会社(日本)、圣戈班(法国)和 3M(美国) |

|

市场机会 |

|

市场定义

保护膜用于保护荧光屏、金属、木材、玻璃等高品质表面免受划痕、痕迹、灰尘颗粒、湿气和其他必须保护的物质的影响。保护膜广泛应用于建筑、汽车、电子、包装等行业。

这些薄膜由高质量塑料基原材料制成,例如聚乙烯 (HDPE)、低密度聚乙烯 (LDPE)、线性低密度聚乙烯 (LLPE)、聚丙烯、聚对苯二甲酸乙二醇酯、聚氯乙烯、聚氨酯、聚酰胺、聚酯、纸等。

北美保护膜市场动态

驱动程序

- 电子商务行业对包装薄膜的采用率很高

在当今时代,包装是一种协调的系统,用于准备各种产品或货物以便安全地从一个地方运输到另一个地方。包装在整个供应链管理中起着至关重要的作用。包装保护产品免受损坏、撞击、破裂、划痕等。事实上,各种制造商都在采用新的创新包装技术来打造有效的品牌形象。

根据美国零售联合会 2020 年的一项调查,在消费者的购物行为中,最优先考虑的参数是质量(32%)和价格(30%),只有 13% 的人认为便利性很重要。然而,这并不反映整体的购物习惯,因为每 100 名消费者中就有 97 名表示他们没有购买是因为缺点。

- 与同类产品相比,保护膜成本较低

保护膜是以塑料为原料制成的薄膜。保护膜的生产相当复杂,因为薄膜的顶层必须坚韧,而薄膜中使用的涂层物质必须具有一层薄薄的橡胶或丙烯酸涂层,并且该涂层必须易于去除而不会在产品表面留下任何痕迹或其他痕迹。产品的简单测量,高度监控厚度、反射和形成粘合层、丙烯酸和硅树脂层可以减少产品浪费,从而提高薄膜的整体质量。

保护膜有各种颜色、尺寸和形状,例如透明色、不透明色、哑光色等。保护膜的价格低于油漆和保护性清漆。这些薄膜的安装过程相当复杂,需要经过培训的工人才能获得最佳效果。安装时的小错误或轻微错误可能会导致最终结果发生变化。

- 建筑和运输行业对保护膜的需求很高

众所周知,建筑行业需要在狭小空间内移动材料和重型机械,因此存在较高的安全隐患。需要保护所有物品,例如地毯、台面、电器、窗户和门,防止任何外部磨损,即划痕。涂有粘合剂的薄膜可粘附并保护表面,以防止昂贵的物品维修。保护膜用于保护表面免受损坏和其他大气活动的影响。

定制保护膜在建筑行业的需求量很大,具体取决于所进行的工作类型,例如各种建筑项目,从油漆到改造、装饰或喷漆项目。保护膜由塑料制成,聚乙烯和丙烯等原材料是制造保护膜的常用原材料。这些塑料片材因其高耐热性而被广泛用于建筑行业。使用的其他塑料是 TPU、聚氯乙烯和聚对苯二甲酸乙二醇酯。TPU 薄膜因其更高的耐热性而被广泛用于建筑和施工领域,这些薄膜广泛用于窗玻璃和面板。

机会

- 保护膜在电子领域的高适应性

电子工业已承诺形成下一代电子设备,大多数电子设备在世界各地被广泛用于各种应用领域。电视、空调、冰箱和电话等电子设备正在越来越广泛地成为消费者日常需求的一部分。

表面保护胶带或保护膜广泛应用于电子工业,保护荧光屏、电视屏幕和其他电子设备免受划痕、痕迹、灰尘和其他杂质的影响。

电子市场还包括电阻器、绝缘体、荧光屏、电机、电容器、光刻胶、柔性印刷电路、平板显示器 (FPD)、太阳能屏、太阳能电池等。许多电子产品广泛使用 BOPET 薄膜来保护其表面。在太阳能电池和太阳能电器中,聚酯薄膜用于背玻璃。

-

科技进步提供对环境影响最小的可持续产品

保护膜是以塑料为原料制成的薄膜。保护膜的生产相当复杂,因为薄膜的顶层必须坚韧,而薄膜中使用的涂层物质必须有一层薄薄的橡胶或丙烯酸涂层,厚度要小,并且该层必须容易去除,而不会在产品表面留下任何痕迹或其他痕迹。

轻松测量产品,高度监控厚度、反射和粘合层的形成、丙烯酸和有机硅层,可以通过减少产品的浪费来提高薄膜的整体质量。

保护性包装膜技术的制造已获得广泛发展。消费者越来越喜欢使用保护膜来延长商品的保质期并方便搬运和运输,这增加了对保护膜的需求。

限制/挑战

原材料价格波动

保护膜用于需要保护高质量表面免受外部损害(如污染、灰尘、划痕和其他有损表面整体外观的损害)的地方。

保护膜广泛采用塑料原料制成,例如聚乙烯 (HDPE)、低密度聚乙烯 (LDPE)、线性低密度聚乙烯 (LLPE)、聚丙烯、聚对苯二甲酸乙二醇酯、聚氯乙烯、聚氨酯、聚酰胺、聚酯、纸张等材料。保护膜的加工相当复杂,因为大多数消费者需要薄的保护膜才能获得最佳效果。

原材料价格波动很大,因为塑料价格很大程度上取决于石油价格和其他市场波动。原油是碳氢化合物的混合物,在不同温度下会分离出不同的产品,例如汽油、煤油和石脑油柴油等。

根据《商业标准报》2018年7月的报道,由于全球疫情导致原油价格波动加剧,以及出口型塑料制造商的强劲消费,各种塑料原材料的价格上涨了约13%。原油价格的大幅上涨也导致聚合物价格上涨。

严格的环境和政府法规

包装与消费者保护之间有着密切的联系。包装是安全的载体,旨在为消费者提供安全、健康和营养的食品。国家制定了包装规则和立法,以保障客户和整个社区的需求。大多数国家的政府都禁止使用各种塑料产品,因为这些塑料产品会污染更广泛的环境。

例如,

- 2018年6月,印度总理宣布,印度将在2022年之前消除一次性塑料的使用。另一方面,加拿大和欧盟也将在2021年之前消除一次性塑料的使用。

最新动态

- 2022年5月,圣戈班集团在法国伊索维尔工厂投资新建一条吹制玻璃棉生产线,以满足法国市场对屋顶空间隔热解决方案日益增长的需求

- 2021 年 12 月,圣戈班公司与 Alghamin 集团达成协议,收购其全资子公司 Rockwool India Pvt Ltd,Rockwool India Pvt Ltd 是印度一家主要的岩棉制造商,生产一系列用于隔热、隔音和防火应用的隔热产品。

北美保护膜市场范围

北美保护膜市场根据产品类型、材料类型、温度和应用进行细分。这些细分市场之间的增长将帮助您分析行业中增长微弱的细分市场,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

班级

- 粘合剂涂层

- 丙烯酸纤维

- 橡皮

- 自粘式

材料

- 聚乙烯

- 聚丙烯

- 聚对苯二甲酸乙二醇酯

- 聚氯乙烯

- 聚氨酯

- 聚酰胺

- 聚酯纤维

- 纸

- 其他的

厚度

- 0- 2 毫米

- 2 - 4 毫米

- 4 - 6 毫米

- 6 - 8 毫米

- 8 - 10 毫米

- 其他的

表面

质地

- 不透明

- 透明的

- 光滑

- 哑光的

- 其他的

终端用户

- 建筑和施工

- 汽车

- 电子产品

- 生命科学

- 航天

- 包装

- 工业的

- 海洋

- 其他的

北美保护膜市场区域分析/见解

对北美保护膜市场进行了分析,并按类别、材料、厚度、表面、纹理和最终用户分析了市场规模和趋势,如上所述。

北美保护膜市场报告涵盖的国家包括美国、加拿大和墨西哥。

由于美国在电子商务包装市场拥有庞大的客户群,预计美国将主导北美保护膜市场。

报告的国家部分还提供了影响单个市场因素和国内市场监管变化,这些因素和变化会影响市场的当前和未来趋势。下游和上游价值链分析、技术趋势、波特五力分析、案例研究等数据点是用于预测单个国家市场情景的一些指标。此外,在对国家数据进行预测分析时,还考虑了全球品牌的存在和可用性以及它们因来自本地和国内品牌的激烈或稀缺竞争而面临的挑战、国内关税的影响以及贸易路线。

竞争格局和北美保护膜市场份额分析

The North America Protective Films Market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, application dominance. The above data points provided are only related to the company’s focus related to North America Protective Films Market.

Some of the major players operating in the North America Protective Films Market are:

- Lamin-x (U.S.)

- Tee Group Films (U.S.)

- Mactac (a subsidiary of LINTEC Corporation) (U.S.)

- DuPont (U.S.)

- Arkema (France)

- Hitachi Chemical Co., Ltd., (Japan)

- Saint-Gobain (France

- 3M (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。