北美多元醇市场,按类型(聚醚多元醇和聚酯多元醇)、应用(软质聚氨酯泡沫、硬质聚氨酯泡沫、涂料、粘合剂和密封剂、弹性体等)、最终用户(建筑、家具、运输、包装、地毯背衬等)行业趋势和预测到 2030 年。

北美多元醇市场分析及规模

多元醇是有机化合物。这种有机化合物是一种含有与其他原子共价结合的碳的化合物,尤其是碳-碳和碳-氢。一类称为糖醇的多元醇包括那些来自糖的多元醇。它们可能自然产生或工业生产。对聚氨酯泡沫的需求不断增长、建筑和基础设施部门的需求不断增长以及对节能绝缘材料和可持续产品的日益关注是推动北美多元醇市场的主要因素。然而,环境法规和可持续性问题、与多元醇相关的高成本是制约北美多元醇市场增长的因素。包装材料对多元醇的需求不断增长、多元醇在绝缘应用中的使用以及对生物基的需求不断增长估计为北美多元醇市场的增长提供了机会。然而,原材料价格波动和技术限制以及性能要求为北美多元醇市场的增长创造了一个充满挑战的环境。

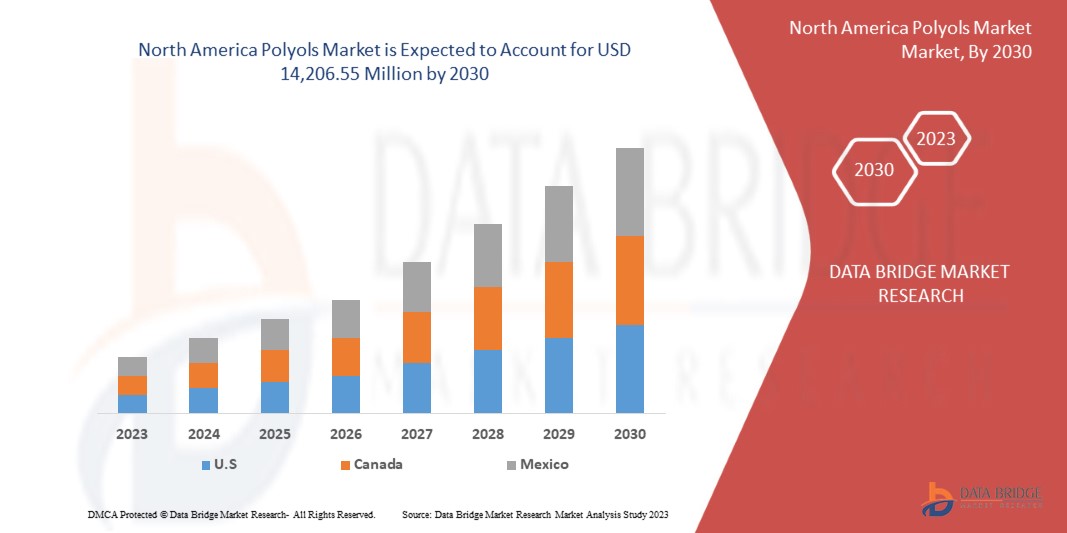

Data Bridge Market Research 分析,预计到 2030 年,北美多元醇市场价值将达到 142.0655 亿美元,预测期内复合年增长率为 5.7%。北美多元醇市场报告还全面涵盖了定价分析、专利分析和技术进步。

|

报告指标 |

细节 |

|

预测期 |

2023 至 2030 年 |

|

基准年 |

2022 |

|

历史岁月 |

2021(可定制为 2015 - 2020) |

|

定量单位 |

收入(百万美元) |

|

涵盖的领域 |

类型(聚醚多元醇和聚酯多元醇)、应用(软质聚氨酯泡沫、硬质聚氨酯泡沫、涂料、粘合剂和密封剂、弹性体等)、最终用户(建筑、家具、运输、包装、地毯背衬等) |

|

覆盖国家 |

美国、加拿大和墨西哥 |

|

涵盖的市场参与者 |

亨斯迈国际有限责任公司、雷普索尔、Bisterfeld AG、DIC CORPORATION、东曹株式会社、阿科玛、巴斯夫欧洲公司、陶氏化学、嘉吉公司、朗盛、壳牌公司、三菱化学株式会社、Vertellus、万华化学、Stepan Company、Gulshan Polyols Ltd、Perstorp Holding AB(马来西亚国家石油化学集团子公司)、Emery Oleochemicals LLC、科思创股份公司、Coim Group 和 Shakun Industries 等 |

市场定义

多元醇是具有多个羟基的醇,是制造聚氨酯的主要原料之一。它们通常用作制造各种产品的关键原料,例如聚氨酯泡沫、涂料、粘合剂、密封剂、弹性体等。多元醇主要来自石化来源或可再生资源,如植物油和糖衍生物。它们可以根据其化学结构分为不同类型,包括聚醚多元醇和聚酯多元醇。每种类型都具有特定的特性,适用于不同的应用。不同类型的多元醇是聚醚多元醇和聚酯多元醇。多元醇以不同的形式用于不同的应用,例如软质聚氨酯泡沫、硬质聚氨酯泡沫、涂料、粘合剂和密封剂、弹性体等。聚氨酯用途广泛、现代且安全。它们具有广泛的应用范围,可用于制造各种工业产品和消费基础产品,使我们的生活更加实用、舒适和环保。聚氨酯由塑料材料制成,有多种形式。它可以以各种形式使用,例如刚性或柔性,并且根据材料的不同,在广泛的应用中是首选。Repsol 就是这样一种多元醇,它提供采用自主技术开发的聚醚多元醇产品组合,并提供多种替代品。

北美多元醇市场动态

本节旨在了解市场驱动因素、优势、机遇、限制和挑战。下面将详细讨论所有这些内容:

驱动程序

- 聚氨酯泡沫的需求不断增长

多元醇是聚氨酯泡沫生产中使用的两种主要成分之一,另一种成分是异氰酸酯。多元醇是含有多个羟基 (-OH) 官能团的聚合物。它们可以来自各种来源,例如石油、植物油或聚酯。在聚氨酯泡沫的制造过程中,多元醇与异氰酸酯发生反应形成聚合物网络。聚氨酯泡沫日益增长的需求预计将推动北美多元醇市场的发展。聚氨酯泡沫是一种用途广泛的材料,由于其出色的绝缘、缓冲和耐用性,可用于建筑、汽车、家具和包装等各个行业。

机会

- 包装材料对多元醇的需求不断增加

包装材料用于封装、保护和容纳产品,以便储存、分发和销售。包装具有多种功能,包括保持产品的质量和完整性、确保运输过程中的安全、向消费者提供信息以及方便搬运和储存。包装材料可以由多种材料制成,包括塑料、纸张和纸板、玻璃、金属和复合材料。包装材料在确保产品的安全、保存和展示方面起着至关重要的作用。它们有助于整体消费者体验,并提供有关产品的基本信息,例如成分、营养价值和使用说明。有效的包装材料有助于保护产品免受损坏、延长保质期并提高其适销性

限制/挑战

- 多元醇成本高

多元醇的成本取决于原材料、制造工艺和市场需求等多种因素。用于生产多元醇的原材料(如环氧丙烷和环氧乙烷)的价格不稳定且波动频繁,导致多元醇的生产成本增加。此外,多元醇的生产工艺复杂,需要专门的设备和专业知识,导致资本和运营成本更高。

- 原材料价格波动

多元醇生产的原材料会根据所生产的多元醇的类型而有所不同,例如聚醚多元醇和聚酯多元醇。

最新动态

- 2022 年 9 月,科思创股份公司宣布推出基于生物循环原料的聚醚多元醇。该公司将能够为各种粘合剂应用及其客户群提供选择性预聚物。聚氨酯的主要成分将基于替代原料。此举有助于公司向各个行业提供替代品,并提升其在市场上的品牌形象。

- 2022 年 9 月,万华宣布推出一种新化学品,该化学品开发了一种生物基多元醇,以减少其碳足迹。推出新的生物产品是为了为可持续环境做出贡献并提高生产效率。这将有助于该公司增强其产品组合。

北美多元醇市场范围

北美多元醇市场根据类型、应用和最终用户分为三个显著的细分市场。这些细分市场之间的增长将帮助您分析行业中增长缓慢的细分市场,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

类型

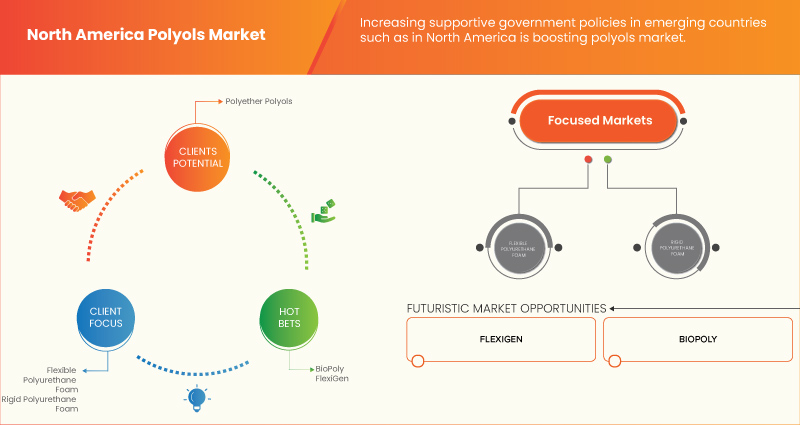

- 聚醚多元醇

- 聚酯多元醇

根据类型,北美多元醇市场分为聚醚多元醇和聚酯多元醇。

应用

- 软质聚氨酯泡沫

- 硬质聚氨酯泡沫

- 涂料

- 粘合剂和密封剂

- 弹性体

- 其他的

根据应用,北美多元醇市场分为软质聚氨酯泡沫、硬质聚氨酯泡沫、涂料、粘合剂和密封剂、弹性体等。

最终用户

- 建造

- 家具

- 运输

- 包装

- 地毯背衬

- 其他的

根据最终用户,北美多元醇市场分为建筑、家具、运输、包装、地毯背衬等。

北美多元醇市场区域分析/见解

对北美多元醇市场进行了分析,并按国家、类型、应用和最终用户提供了市场规模洞察和趋势。

北美多元醇市场涵盖的国家包括美国、加拿大和墨西哥。

美国有望主导北美多元醇市场,因为它拥有强大而先进的制造基础设施,包括最先进的设施和技术。这使得生产过程高效,并确保了多元醇产品的高品质。熟练劳动力和技术专长的可用性进一步增强了美国制造业。

报告的区域部分还提供了影响市场当前和未来趋势的各个市场影响因素和市场监管变化。下游和上游价值链分析、技术趋势和波特五力分析、案例研究等数据点是用于预测各个国家市场情景的一些指标。此外,在提供区域数据的预测分析时,还考虑了北美品牌的存在和可用性以及由于来自本地和国内品牌的大量或稀缺竞争而面临的挑战、国内关税的影响和贸易路线。

竞争格局和北美多元醇市场份额分析

北美多元醇市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、北美业务、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度以及应用主导地位。以上提供的数据点仅与公司对北美多元醇市场的关注有关。

北美多元醇市场的一些主要参与者包括亨斯迈国际有限责任公司、雷普索尔、Bisterfeld AG、DIC CORPORATION、东曹株式会社、阿科玛、巴斯夫 SE、陶氏、嘉吉公司、朗盛、壳牌公司、三菱化学株式会社、Vertellus、万华、Stepan Company、Gulshan Polyols Ltd、Perstorp Holding AB(马来西亚国家石油化学集团子公司)、Emery Oleochemicals LLC、科思创股份公司、Coim Group 和 Shakun Industries 等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA POLYOLS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 TYPE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPORT-EXPORT DATA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR POLYURETHANE FOAMS

5.1.2 INCREASING DEMAND IN THE CONSTRUCTION AND INFRASTRUCTURE SECTOR

5.1.3 ADVANCEMENTS IN POLYOLS TECHNOLOGY

5.1.4 GROWING DEMAND IN THE AUTOMOTIVE INDUSTRY

5.2 RESTRAINTS

5.2.1 ENVIRONMENTAL REGULATIONS AND SUSTAINABILITY CONCERNS

5.2.2 HIGH COST ASSOCIATED WITH POLYOLS

5.3 OPPORTUNITIES

5.3.1 INCREASING DEMAND FOR POLYOLS FOR PACKAGING MATERIALS

5.3.2 USE OF POLYOLS IN INSULATION APPLICATIONS

5.3.3 INCREASING PARTNERSHIP, ACQUISITION, AND COLLABORATION AMONG MARKET PLAYERS

5.3.4 HIGH DEMAND FOR BIO-BASED AND SUSTAINABLE POLYOLS

5.4 CHALLENGES

5.4.1 FLUCTUATION IN RAW MATERIAL PRICES

5.4.2 TECHNOLOGICAL LIMITATIONS AND PERFORMANCE REQUIREMENTS

6 NORTH AMERICA POLYOLS MARKET, BY TYPE

6.1 OVERVIEW

6.2 POLYETHER POLYOLS

6.3 POLYESTER POLYOLS

7 NORTH AMERICA POLYOLS MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 FLEXIBLE POLYURETHANE FOAM

7.3 RIGID POLYURETHANE FOAM

7.4 COATINGS

7.5 ADHESIVES & SEALANTS

7.6 ELASTOMERS

7.7 OTHERS

8 NORTH AMERICA POLYOLS MARKET, BY END USER

8.1 OVERVIEW

8.2 CONSTRUCTION

8.2.1 POLYETHER POLYOLS

8.2.2 POLYESTER POLYOLS

8.3 FURNITURE

8.3.1 POLYETHER POLYOLS

8.3.2 POLYESTER POLYOLS

8.4 TRANSPORT

8.4.1 POLYETHER POLYOLS

8.4.2 POLYESTER POLYOLS

8.5 PACKAGING

8.5.1 POLYETHER POLYOLS

8.5.2 POLYESTER POLYOLS

8.6 CARPET BACKING

8.6.1 POLYETHER POLYOLS

8.6.2 POLYESTER POLYOLS

8.7 OTHERS

8.7.1 POLYETHER POLYOLS

8.7.2 POLYESTER POLYOLS

9 NORTH AMERICA POLYOLS MARKET, BY REGION

9.1 NORTH AMERICA

9.1.1 U.S.

9.1.2 CANADA

9.1.3 MEXICO

10 NORTH AMERICA POLYOLS MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11 SWOT ANALYSIS

12 COMPANY PROFILINGS

12.1 SHELL PLC

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENTS

12.2 COVESTRO AG

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENTS

12.3 WANHUA

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT DEVELOPMENTS

12.4 LANXESS

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT AND SOLUTION PORTFOLIO

12.4.5 RECENT DEVELOPMENTS

12.5 HUNTSMAN INTERNATIONAL LLC

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT DEVELOPMENTS

12.6 ARKEMA

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENT

12.7 BASF SE

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENTS

12.8 BIESTERFELD AG

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENTS

12.9 CARGILL, INCORPORATED.

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT AND SERVICE PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 COIM GROUP

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENTS

12.11 DOW

12.11.1 COMPANY SNAPSHOT

12.11.2 REVENUE ANALYSIS

12.11.3 PRODUCT PORTFOLIO

12.11.4 RECENT DEVELOPMENTS

12.12 DIC CORPORATION

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 PRODUCT PORTFOLIO

12.12.4 RECENT DEVELOPMENTS

12.13 EMERY OLEOCHEMICALS LLC

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENTS

12.14 GULSHAN POLYOLS LTD.

12.14.1 COMPANY SNAPSHOT

12.14.2 REVENUE ANALYSIS

12.14.3 PRODUCT PORTFOLIO

12.14.4 RECENT DEVELOPMENT

12.15 MITSUBISHI CHEMICAL CORPORATION

12.15.1 COMPANY SNAPSHOT

12.15.2 REVENUE ANALYSIS

12.15.3 PRODUCT PORTFOLIO

12.15.4 RECENT DEVELOPMENTS

12.16 PERSTORP HOLDING AB (SUBSIDIARY OF PETRONAS CHEMICALS GROUP)

12.16.1 COMPANY SNAPSHOT

12.16.2 REVENUE ANALYSIS

12.16.3 PRODUCT PORTFOLIO

12.16.4 RECENT DEVELOPMENTS

12.17 REPSOL

12.17.1 COMPANY SNAPSHOT

12.17.2 REVENUE ANALYSIS

12.17.3 PRODUCT PORTFOLIO

12.17.4 RECENT DEVELOPMENTS

12.18 SHAKUN INDUSTRIES

12.18.1 COMPANY SNAPSHOT

12.18.2 PRODUCT PORTFOLIO

12.18.3 RECENT DEVELOPMENT

12.19 STEPAN COMPANY

12.19.1 COMPANY SNAPSHOT

12.19.2 REVENUE ANALYSIS

12.19.3 PRODUCT PORTFOLIO

12.19.4 RECENT DEVELOPMENTS

12.2 TOSOH CORPORATION

12.20.1 COMPANY SNAPSHOT

12.20.2 REVENUE ANALYSIS

12.20.3 PRODUCT PORTFOLIO

12.20.4 RECENT DEVELOPMENT

12.21 VERTELLUS

12.21.1 COMPANY SNAPSHOT

12.21.2 PRODUCT PORTFOLIO

12.21.3 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

表格列表

TABLE 1 NORTH AMERICA POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA POLYOLS MARKET, BY TYPE, 2021-2030 (MT)

TABLE 3 NORTH AMERICA POLYETHER POLYOLS IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA POLYETHER POLYOLS IN POLYOLS MARKET, BY REGION, 2021-2030 (MT)

TABLE 5 NORTH AMERICA POLYESTER POLYOLS IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA POLYESTER POLYOLS IN POLYOLS MARKET, BY REGION, 2021-2030 (MT)

TABLE 7 NORTH AMERICA POLYOLS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA FLEXIBLE POLYURETHANE FOAM IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA RIGID POLYURETHANE FOAM IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA COATINGS IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA ADHESIVES & SEALANTS IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA ELASTOMERS IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA OTHERS IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA POLYOLS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA CONSTRUCTION IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA CONSTRUCTION IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA FURNITURE IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA FURNITURE IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA TRANSPORT IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA TRANSPORT IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA PACKAGING IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA PACKAGING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA CARPET BACKING IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA CARPET BACKING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA OTHERS IN POLYOLS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA OTHERS IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA POLYOLS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA POLYOLS MARKET, BY COUNTRY, 2021-2030 (MT)

TABLE 29 NORTH AMERICA POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA POLYOLS MARKET, BY TYPE, 2021-2030 (MT)

TABLE 31 NORTH AMERICA POLYOLS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA POLYOLS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA CONSTRUCTION IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA FURNITURE IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA TRANSPORT IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA PACKAGING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA CARPET BACKING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA OTHERS IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 U.S. POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 U.S. POLYOLS MARKET, BY TYPE, 2021-2030 (MT)

TABLE 41 U.S. POLYOLS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 42 U.S. POLYOLS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 43 U.S. CONSTRUCTION IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 U.S. FURNITURE IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 U.S. TRANSPORT IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 U.S. PACKAGING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 U.S. CARPET BACKING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 U.S. OTHERS IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 CANADA POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 CANADA POLYOLS MARKET, BY TYPE, 2021-2030 (MT)

TABLE 51 CANADA POLYOLS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 52 CANADA POLYOLS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 53 CANADA CONSTRUCTION IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 CANADA FURNITURE IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 55 CANADA TRANSPORT IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 56 CANADA PACKAGING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 57 CANADA CARPET BACKING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 CANADA OTHERS IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 MEXICO POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 MEXICO POLYOLS MARKET, BY TYPE, 2021-2030 (MT)

TABLE 61 MEXICO POLYOLS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 62 MEXICO POLYOLS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 63 MEXICO CONSTRUCTION IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 MEXICO FURNITURE IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 MEXICO TRANSPORT IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 MEXICO PACKAGING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 MEXICO CARPET BACKING IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 MEXICO OTHERS IN POLYOLS MARKET, BY TYPE, 2021-2030 (USD MILLION)

图片列表

FIGURE 1 NORTH AMERICA POLYOLS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA POLYOLS MARKET: DBMR TRIPOD DATA VALIDATION MODEL

FIGURE 3 NORTH AMERICA POLYOLS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA POLYOLS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA POLYOLS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA POLYOLS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA POLYOLS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA POLYOLS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA POLYOLS MARKET: MULTIVARIATE MODELLING

FIGURE 10 NORTH AMERICA POLYOLS MARKET: TYPE CURVE

FIGURE 11 NORTH AMERICA POLYOLS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 12 NORTH AMERICA POLYOLS MARKET: SEGMENTATION

FIGURE 13 INCREASING DEMAND IN THE CONSTRUCTION AND INFRASTRUCTURE SECTOR IS EXPECTED TO BE A KEY DRIVER FOR NORTH AMERICA POLYOLS MARKET GROWTH IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 POLYETHER POLYOLS ARE EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA POLYOLS MARKET FROM 2023 TO 2030

FIGURE 15 GRAPH 1: EXPORT DATA OF COUNTRIES ACROSS THE GLOBE (FROM JANUARY TO MAY 2023)

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA POLYOLS MARKET

FIGURE 17 NORTH AMERICA POLYOLS MARKET: BY TYPE, 2022

FIGURE 18 NORTH AMERICA POLYOLS MARKET: BY APPLICATION, 2022

FIGURE 19 NORTH AMERICA POLYOLS MARKET: BY END USER, 2022

FIGURE 20 NORTH AMERICA POLYOLS MARKET: SNAPSHOT (2022)

FIGURE 21 NORTH AMERICA POLYOLS MARKET: BY COUNTRY (2022)

FIGURE 22 NORTH AMERICA POLYOLS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 23 NORTH AMERICA POLYOLS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 24 NORTH AMERICA POLYOLS MARKET: BY TYPE (2023-2030)

FIGURE 25 NORTH AMERICA POLYOLS MARKET: COMPANY SHARE 2022(%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。