North America Plant Based Milk Market, By Type (Almond Milk, Coconut Milk, Cashew Milk, Walnut Milk, Hazelnut Milk, Soy Milk, Oat Milk, Rice Milk, Flax Milk, and Others), Product Type (Refrigerated Milk and Shelf Stable Milk), Category (Organic and Conventional), Formulation (Sweetened and Unsweetened), Flavor (Original/Unflavored, Vanilla, Chocolate, Honey, Coconut Blend, Hazelnut Blend, Caramel, Maple, Coffee, and Others), Fortification (Regular and Fortified), Nature (GMO and Non-GMO), Claim (Regular, Gluten Free, Nut Free, Soy Free, Artificial Preservatives & Colour Free, and Others), Packaging Size (Less than 100 ml, 110 ml, 250 ml, 500 ml, 1000 ml, and More than 1000 ml), Packaging Type (Tetra Packs, Bottles, and Can), and Distribution Channel (Store Based Retailers and Non-Store Based Retailers) - Industry Trends and Forecast to 2030.

North America Plant-Based Milk Market Analysis and Size

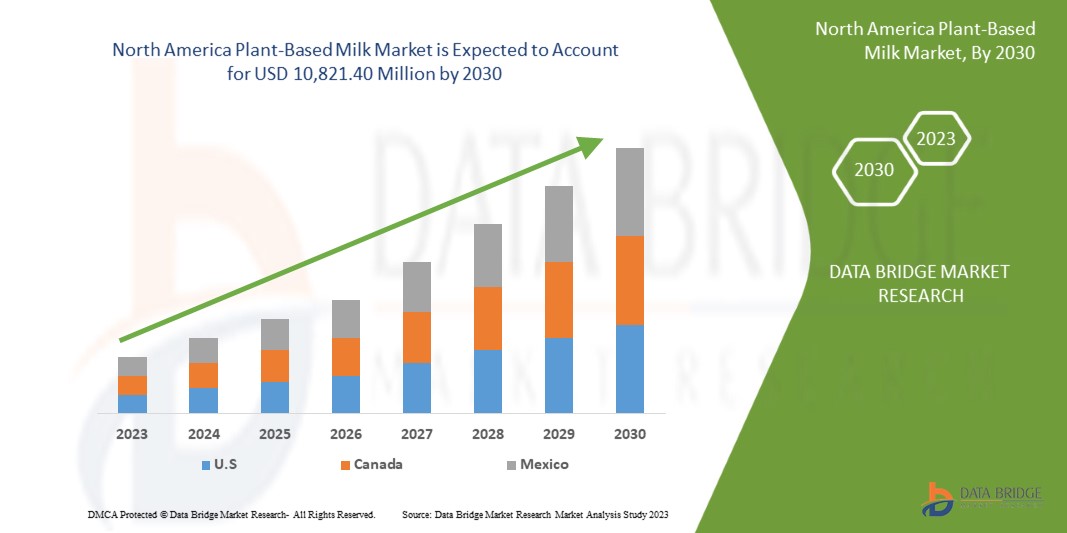

North America plant-based milk market is expected to grow significantly in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 12.0% in the forecast period of 2023 to 2030 and is expected to reach USD 10,821.40 Million by 2030. The increase in the vegan population around the globe is the key factor fueling the expansion of the plant-based milk market.

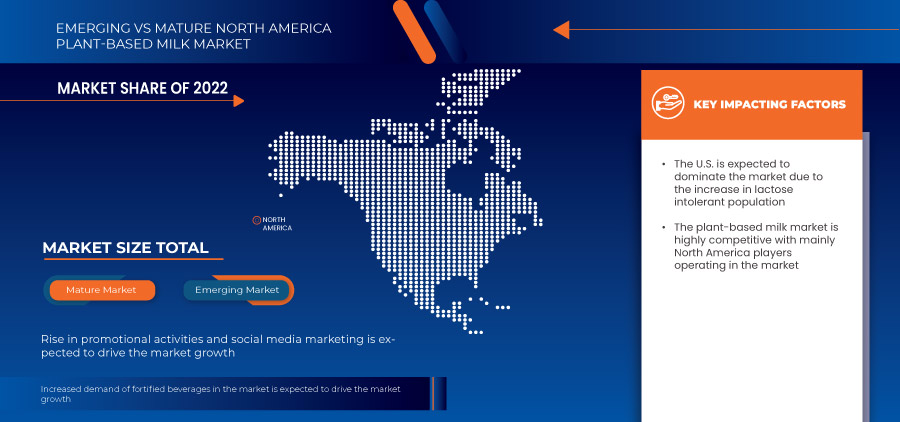

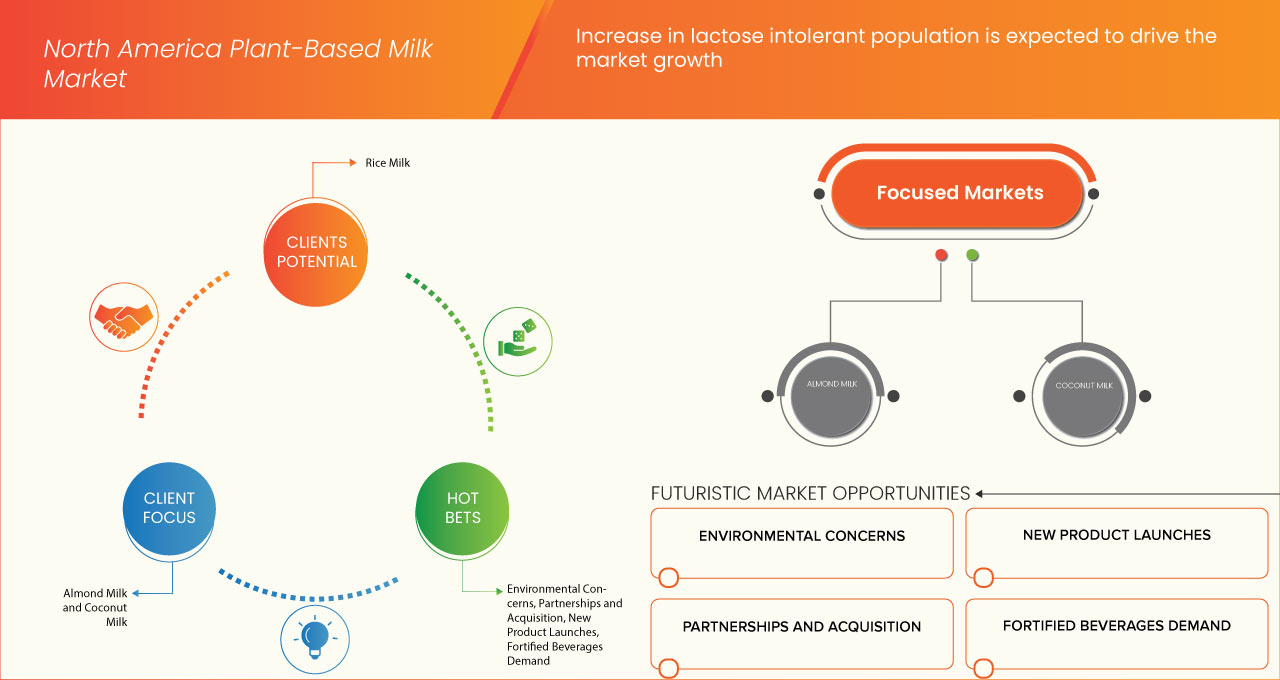

The availability of a wider range of plant-based milk products is driving the market's expansion. Additionally, the market is further influenced by an increase in the lactose-intolerant population. Moreover, the rise in promotional activities and social media marketing for plant-based milk has boosted the market. In addition to the expansions, R&D and the modernization of plant-based product in the market has opened up more business potential for plant-based milk.

North America plant-based milk market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an analyst brief. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2020 - 2015) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

按类型(杏仁奶、椰奶、腰果奶、核桃奶、榛子奶、豆奶、燕麦奶、米奶、亚麻奶等)、产品类型(冷藏牛奶和保质牛奶)、类别(有机和传统)、配方(加糖和不加糖)、口味(原味/无味、香草、巧克力、蜂蜜、椰子混合、榛子混合、焦糖、枫糖、咖啡等)、强化(普通和强化)、性质(转基因和非转基因)、声明(普通、无麸质、无坚果、无大豆、无人工防腐剂和色素等)、包装尺寸(少于 100 毫升、110 毫升、250 毫升、500 毫升、1000 毫升和超过 1000 毫升)、包装类型(利乐包、瓶装和罐装)和分销渠道(基于商店零售商和非店铺零售商) |

|

覆盖国家 |

美国、加拿大和墨西哥 |

|

涵盖的市场参与者 |

Silk、Alpro、THE HAIN CELESTIAL GROUP, INC.、SUNOPTA GRAINS AND FOODS INC.、Califia Farms, LLC、NotCo、YEO HIAP SENG LTD.、natur-a、Oatly Inc.、Elmhurst Milked Direct LLC、Manitoba Milling Company 和 HP Hood LLC. 等 |

市场定义

植物奶是一种由外观类似牛奶的植物制成的饮料。植物奶是一种用水基植物提取物调味和调味的非乳制饮料。植物奶是作为牛奶的素食替代品食用的。与牛奶相比,植物奶具有奶油般的质地。在生产植物奶时,会使用各种植物。全球最受欢迎的植物奶包括杏仁奶、燕麦奶、大豆奶、椰子奶和腰果奶。自古以来,人们就喝植物制成的饮料。

北美植物奶市场动态

司机

- 全球纯素食人口增加

过去十年来,素食市场呈指数级增长,每年都有更多人转向植物性饮食。健康意识的增强增加了对天然和有机食品的需求。这促使大部分人口彻底改变他们的生活方式和饮食。素食社区专注于食用含有植物成分或其他成分的食物。根据美国营养与饮食学会的说法,经过适当规划的素食饮食可以降低患心脏病、2 型糖尿病、高血压、某些类型的癌症和肥胖症等多种疾病的风险。因此,一些素食者或纯素食者开始在日常饮食中关注植物奶

因此,全球素食人口的快速增长以及消费者越来越多地采用纯素食或弹性素食饮食,也将增加植物性食品和饮料的市场。这反过来也将有助于推动北美植物奶市场的增长。

机会

- 新产品发布、新合作伙伴关系和主要参与者的收购不断增加

消费者、食品和饮料制造商正在进行各种开发和战略决策,以扩大业务,应对对植物性食品(如植物奶)日益增长的需求。从新产品发布到投资再到收购,市场顶级参与者正在改进其业务实践并扩大其产品组合。

因此,这样的发展将进一步为北美植物奶市场带来增长机会,并将进一步吸引越来越多的消费者进入坚果奶市场。

克制/挑战

- 消费者坚果过敏率上升

坚果过敏是一种食物过敏,可引起严重且可能危及生命的反应,例如过敏反应。不同的坚果是导致食物过敏的明确原因。由于不同的饮食习惯和烹饪程序,不同国家坚果过敏的发生率似乎存在差异。坚果过敏非常常见,尤其是在儿童和成人中,而且这一人群每天都在增加。由于消费者对健康选择越来越重视,销售增长一直在下降。

此外,坚果和种子是引发危及生命的严重过敏反应的最常见食物之一。在欧洲,坚果过敏很常见,其中榛子过敏是最常见的坚果过敏。腰果是第二大过敏性坚果,也是美国的一个重大健康问题。除了避免食用坚果和含有坚果的食物外,没有其他方法可以治疗坚果过敏。因此,这给坚果行业带来了重大影响,预计这种影响将持续下去。

后疫情时代对北美植物奶市场的影响

然而,北美植物奶市场却呈现增长趋势。杏仁奶、腰果奶和榛子奶等植物奶的使用量在消费者中有所增加。需求增加的原因是消费者的健康意识不断增强,而且在当前危险时期,消费者对环境保护表现出了浓厚的兴趣。

考虑到众多行业的大幅下滑,政府、商界领袖和消费者必须共同努力,战胜 COVID-19。在这种情况下,COVID-19 疫情对北美植物奶市场的影响在一定程度上是有利的。世界各国政府都严格遵守公共卫生措施,包括提高对肥胖和营养增值食品和饮料的认识。在疫情期间,消费者对高免疫力的认识已成为一个合理的担忧。消费者越来越多地购买更健康而不是更美味的食品。在这种情况下,植物奶因其好处而在消费者中的使用率有所提高。疫情期间市场蓬勃发展的另一个原因是其多功能性。例如,市场上有不同类型的口味、来源、配方和强化剂。此外,在疫情后时代,由于消费者需求增加以及转向植物产品而非动物产品,情况有所好转。

最新动态

- 2023 年 1 月,北欧和波罗的海地区的主要零售商 Reitan 和 Oatly Inc. 最近宣布扩大合作关系。Reitan 在瑞典各地拥有并经营着约 300 家 Pressbyrn 和 90 家 7-Eleven 便利店。此次合作将有助于该公司提升业务并吸引新的消费者群体

- 2021 年,Silk 宣布推出新产品 Silk Oat。此次发布使该公司的产品组合更加丰富,吸引了更多的消费者群体

北美植物奶市场范围

北美植物奶市场根据类型、产品类型、类别、配方、风味、强化、性质、声明、包装尺寸、包装类型和分销渠道分为 11 个值得注意的细分市场。这些细分市场之间的增长将帮助您分析行业中的主要增长细分市场,并为用户提供有价值的市场概览和市场洞察,以便做出战略决策以确定核心市场应用。

按类型

根据类型,北美植物奶市场分为杏仁奶、椰奶、腰果奶、核桃奶、榛子奶、豆奶、燕麦奶、米奶、亚麻奶等。

按产品类型

- 冷藏牛奶

- 保质牛奶

根据产品类型,北美植物奶市场分为冷藏牛奶和保质牛奶。

按类别

- 传统的

- 有机的

根据类别,北美植物奶市场分为有机植物奶和传统植物奶。

按配方

- 不加糖

- 加糖

根据配方,北美植物奶市场分为加糖和不加糖。

按口味

- 原味/无味

- 香草

- 巧克力

- 咖啡

- 椰子混合

- 焦糖

- 蜂蜜

- 榛子混合物

- 枫

- 其他的

根据口味,北美植物奶市场分为原味/无味、香草味、巧克力味、蜂蜜味、椰子混合味、榛子混合味、焦糖味、枫糖味、咖啡味等。

通过强化

- 常规的

- 强化

根据强化程度,北美植物奶市场分为普通植物奶和强化植物奶。

天生如此

- 非转基因

- 转基因

根据性质,北美植物奶市场分为转基因和非转基因。

索赔

- 常规的

- 不含麸质

- 不含人工防腐剂和色素

- 不含大豆

- 不含坚果

- 其他的

根据声明,北美植物奶市场分为普通、无麸质、无坚果、无大豆、人工防腐剂、无色素和其他。

按包装尺寸

- 1000 毫升

- 250 毫升

- 500 毫升

- 110 毫升

- 超过1000毫升

- 少于 100 毫升

根据包装尺寸,北美植物奶市场分为少于 100 毫升、110 毫升、250 毫升、500 毫升、1000 毫升和超过 1000 毫升。

按包装类型

- 利乐包装

- 瓶子

- 能

根据包装类型,北美植物奶市场分为利乐包、瓶装和罐装。

按分销渠道

- 无店铺零售商

- 商店零售商

根据分销渠道,北美植物奶市场分为商店零售商和非商店零售商。

北美植物奶市场区域分析/洞察

北美植物奶市场根据类型、产品类型、类别、配方、风味、强化、性质、声明、包装尺寸、包装类型和分销渠道进行细分。

北美植物奶市场的一些国家是美国、加拿大和墨西哥。

由于消费者对植物奶的偏好很高,预计美国将主导北美植物奶市场。

报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和市场监管变化。数据点下游和上游价值链分析、技术趋势波特五力分析和案例研究是用于预测各个国家市场情景的一些指标。此外,在提供国家数据的预测分析时,还考虑了北美品牌的存在和可用性以及由于来自本地和国内品牌的大量或稀缺竞争而面临的挑战、国内关税的影响和贸易路线。

竞争格局和北美植物奶市场份额分析

北美植物奶市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、生产基地和设施、公司优势和劣势、产品发布、产品试验渠道、产品批准、专利、产品宽度和广度、应用优势、技术生命线曲线。以上提供的数据点仅与公司对北美植物奶市场的关注有关。

北美植物奶市场的一些知名参与者包括 Silk、Alpro、THE HAIN CELESTIAL GROUP, INC.、SUNOPTA GRAINS AND FOODS INC.、Califia Farms, LLC、NotCo、YEO HIAP SENG LTD.、natur-a、Oatly Inc.、Elmhurst Milked Direct LLC、Manitoba Milling Company 和 HP Hood LLC 等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA PLANT-BASED MILK MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SHOPPING BEHAVIOR AND DYNAMICS

4.1.1 RECOMMENDATIONS FROM FAMILY AND FRIENDS

4.1.2 RESEARCH

4.1.3 IMPULSIVE

4.1.4 ADVERTISEMENT

4.1.4.1 TELEVISION ADVERTISEMENT

4.1.4.2 ONLINE ADVERTISEMENT

4.1.4.3 IN-STORE ADVERTISEMENT

4.1.4.4 OUTDOOR ADVERTISEMENT

4.2 CONSUMERS' DISPOSABLE INCOME/SPEND DYNAMICS

4.3 CONCLUSION

4.4 FACTORS INFLUENCING PURCHASE DECISION

4.4.1 LARGE PRODUCT RANGE

4.4.2 PRODUCT PRICING

4.4.3 AUTHENTICITY OF PRODUCT

5 NORTH AMERICA PLANT-BASED MILK MARKET, CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

5.1 OVERVIEW

5.2 SOCIAL FACTORS

5.3 CULTURAL FACTORS

5.4 PSYCHOLOGICAL FACTORS

5.5 PERSONAL FACTORS

5.6 ECONOMIC FACTORS

5.7 PRODUCT TRAITS

5.8 MARKET ATTRIBUTES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASE IN VEGAN POPULATION AROUND THE NORTH AMERICA

6.1.2 INCREASE IN LACTOSE INTOLERANT POPULATION

6.1.3 RISE IN PROMOTIONAL ACTIVITIES AND SOCIAL MEDIA MARKETING

6.1.4 AVAILABILITY AND ACCESSIBILITY OF A WIDER RANGE OF PLANT-BASED MILK PRODUCTS

6.2 RESTRAINTS

6.2.1 HIGH PRICE OF PLANT-BASED MILK IN COMPARISON TO DAIRY-BASED MILK

6.2.2 TASTE AND TEXTURE ISSUES ASSOCIATED WITH PLANT-BASED MILK

6.2.3 FLUCTUATING RAW MATERIAL PRICES

6.3 OPPORTUNITIES

6.3.1 RISING AWARENESS REGARDING ENVIRONMENTAL CONCERNS IS FUELING THE MARKET GROWTH

6.3.2 GROWING NEW PRODUCT LAUNCHES AND NEW PARTNERSHIPS, ACQUISITION AMONG KEY PLAYERS

6.3.3 INCREASED DEMAND FOR FORTIFIED BEVERAGES IN THE MARKET

6.4 CHALLENGES

6.4.1 RISE IN NUT ALLERGIES AMONG CONSUMERS

6.4.2 STRINGENT GOVERNMENT REGULATIONS

6.4.3 RISE IN THE NUMBER OF PLANT-BASED MILK PRODUCERS IN THE MARKET

7 NORTH AMERICA PLANT-BASED MILK MARKET, BY FLAVOR

7.1 OVERVIEW

7.2 ORIGINAL/UNFLAVORED

7.2.1 ALMOND MILK

7.2.2 OAT MILK

7.2.3 SOY MILK

7.2.4 COCONUT MILK

7.2.5 RICE MILK

7.2.6 CASHEW NUT MILK

7.2.7 FLAX MILK

7.2.8 WALNUT MILK

7.2.9 HAZELNUT MILK

7.2.10 OTHERS

7.3 VANILLA

7.3.1 ALMOND MILK

7.3.2 OAT MILK

7.3.3 SOY MILK

7.3.4 COCONUT MILK

7.3.5 RICE MILK

7.3.6 CASHEW NUT MILK

7.3.7 FLAX MILK

7.3.8 WALNUT MILK

7.3.9 HAZELNUT MILK

7.3.10 OTHERS

7.4 CHOCOLATE

7.4.1 ALMOND MILK

7.4.2 OAT MILK

7.4.3 SOY MILK

7.4.4 COCONUT MILK

7.4.5 RICE MILK

7.4.6 CASHEW NUT MILK

7.4.7 FLAX MILK

7.4.8 WALNUT MILK

7.4.9 HAZELNUT MILK

7.4.10 OTHERS

7.5 COFFEE

7.5.1 ALMOND MILK

7.5.2 OAT MILK

7.5.3 SOY MILK

7.5.4 COCONUT MILK

7.5.5 RICE MILK

7.5.6 CASHEW NUT MILK

7.5.7 FLAX MILK

7.5.8 WALNUT MILK

7.5.9 HAZELNUT MILK

7.5.10 OTHERS

7.6 COCONUT BLEND

7.6.1 ALMOND MILK

7.6.2 OAT MILK

7.6.3 SOY MILK

7.6.4 COCONUT MILK

7.6.5 RICE MILK

7.6.6 CASHEW NUT MILK

7.6.7 FLAX MILK

7.6.8 WALNUT MILK

7.6.9 HAZELNUT MILK

7.6.10 OTHERS

7.7 CARAMEL

7.7.1 ALMOND MILK

7.7.2 OAT MILK

7.7.3 SOY MILK

7.7.4 COCONUT MILK

7.7.5 RICE MILK

7.7.6 CASHEW NUT MILK

7.7.7 FLAX MILK

7.7.8 WALNUT MILK

7.7.9 HAZELNUT MILK

7.7.10 OTHERS

7.8 HONEY

7.8.1 ALMOND MILK

7.8.2 OAT MILK

7.8.3 SOY MILK

7.8.4 COCONUT MILK

7.8.5 RICE MILK

7.8.6 CASHEW NUT MILK

7.8.7 FLAX MILK

7.8.8 WALNUT MILK

7.8.9 HAZELNUT MILK

7.8.10 OTHERS

7.9 HAZELNUT BLEND

7.9.1 ALMOND MILK

7.9.2 OAT MILK

7.9.3 SOY MILK

7.9.4 COCONUT MILK

7.9.5 RICE MILK

7.9.6 CASHEW NUT MILK

7.9.7 FLAX MILK

7.9.8 WALNUT MILK

7.9.9 HAZELNUT MILK

7.9.10 OTHERS

7.1 MAPLE

7.10.1 ALMOND MILK

7.10.2 OAT MILK

7.10.3 SOY MILK

7.10.4 COCONUT MILK

7.10.5 RICE MILK

7.10.6 CASHEW NUT MILK

7.10.7 FLAX MILK

7.10.8 WALNUT MILK

7.10.9 HAZELNUT MILK

7.10.10 OTHERS

7.11 OTHERS

7.11.1 ALMOND MILK

7.11.2 OAT MILK

7.11.3 SOY MILK

7.11.4 COCONUT MILK

7.11.5 RICE MILK

7.11.6 CASHEW NUT MILK

7.11.7 FLAX MILK

7.11.8 WALNUT MILK

7.11.9 HAZELNUT MILK

7.11.10 OTHERS

8 NORTH AMERICA PLANT-BASED MILK MARKET, BY FORTIFICATION

8.1 OVERVIEW

8.2 REGULAR

8.3 FORTIFIED

9 NORTH AMERICA PLANT-BASED MILK MARKET, BY NATURE

9.1 OVERVIEW

9.2 NON-GMO

9.3 GMO

10 NORTH AMERICA PLANT-BASED MILK MARKET, BY CLAIM

10.1 OVERVIEW

10.2 REGULAR

10.3 GLUTEN FREE

10.4 ARTIFICIAL PRESERVATIVES & COLOR FREE

10.5 SOY FREE

10.6 NUT FREE

10.7 OTHERS

11 NORTH AMERICA PLANT-BASED MILK MARKET, BY PACKAGING SIZE

11.1 OVERVIEW

11.2 1000 ML

11.3 250 ML

11.4 500 ML

11.5 110 ML

11.6 MORE THAN 1000 ML

11.7 LESS THAN 100 ML

12 NORTH AMERICA PLANT-BASED MILK MARKET, BY PRODUCT TYPE

12.1 OVERVIEW

12.2 REFRIGERATED MILK

12.3 SHELF STABLE MILK

13 NORTH AMERICA PLANT-BASED MILK MARKET, BY FORMULATION

13.1 OVERVIEW

13.2 UNSWEETENED

13.3 SWEETENED

14 NORTH AMERICA PLANT-BASED MILK MARKET, BY CATEGORY

14.1 OVERVIEW

14.2 CONVENTIONAL

14.3 ORGANIC

15 NORTH AMERICA PLANT-BASED MILK MARKET, BY TYPE

15.1 OVERVIEW

15.2 ALMOND MILK

15.2.1 UNSWEETENED

15.2.2 SWEETENED

15.3 OAT MILK

15.3.1 UNSWEETENED

15.3.2 SWEETENED

15.4 SOY MILK

15.4.1 UNSWEETENED

15.4.2 SWEETENED

15.5 COCONUT MILK

15.5.1 UNSWEETENED

15.5.2 SWEETENED

15.6 RICE MILK

15.6.1 UNSWEETENED

15.6.2 SWEETENED

15.7 CASHEW NUT MILK

15.7.1 UNSWEETENED

15.7.2 SWEETENED

15.8 FLAX MILK

15.8.1 UNSWEETENED

15.8.2 SWEETENED

15.9 WALNUT MILK

15.9.1 UNSWEETENED

15.9.2 SWEETENED

15.1 HAZELNUT MILK

15.10.1 UNSWEETENED

15.10.2 SWEETENED

15.11 OTHERS

15.11.1 UNSWEETENED

15.11.2 SWEETENED

16 NORTH AMERICA PLANT-BASED MILK MARKET, BY PACKAGING TYPE

16.1 OVERVIEW

16.2 TETRA PACKS

16.3 BOTTLES

16.3.1 GLASS

16.3.2 PLASTICS

16.3.3 OTHERS

16.4 CAN

17 NORTH AMERICA PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL

17.1 OVERVIEW

17.2 NON-STORE RETAILERS

17.2.1 ONLINE RETAILERS

17.2.2 COMPANY WEBSITES

17.2.3 VENDING

17.3 STORE BASED RETAILERS

17.3.1 SUPERMARKETS/HYPERMARKETS

17.3.2 CONVENIENCE STORES

17.3.3 GROCERY STORES

17.3.4 SPECIALTY STORES

17.3.5 OTHERS

18 NORTH AMERICA PLANT-BASED MILK MARKET BY COUNTRY

18.1 NORTH AMERICA

18.1.1 U.S.

18.1.2 CANADA

18.1.3 MEXICO

19 COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

20 SWOT ANALYSIS

21 COMPANY PROFILES

21.1 THE HAIN CELESTIAL GROUP, INC.

21.1.1 COMPANY SNAPSHOT

21.1.2 REVENUE ANALYSIS

21.1.3 PRODUCT PORTFOLIO

21.1.4 RECENT DEVELOPMENT

21.2 ALPRO

21.2.1 COMPANY SNAPSHOT

21.2.2 PRODUCT PORTFOLIO

21.2.3 RECENT DEVELOPMENT

21.3 OATLY AB

21.3.1 COMPANY SNAPSHOT

21.3.2 REVENUE ANALYSIS

21.3.3 PRODUCT PORTFOLIO

21.3.4 RECENT DEVELOPMENTS

21.4 CALIFIA FARMS, LLC

21.4.1 COMPANY SNAPSHOT

21.4.2 PRODUCT PORTFOLIO

21.4.3 RECENT DEVELOPMENTS

21.5 NATURA FOODS

21.5.1 COMPANY SNAPSHOT

21.5.2 PRODUCT PORTFOLIO

21.5.3 RECENT DEVELOPMENTS

21.6 ELMHURST MILKED DIRECT LLC

21.6.1 COMPANY SNAPSHOT

21.6.2 PRODUCT PORTFOLIO

21.6.3 RECENT DEVELOPMENT

21.7 HP HOOD LLC.

21.7.1 COMPANY SNAPSHOT

21.7.2 PRODUCT PORTFOLIO

21.7.3 RECENT DEVELOPMENT

21.8 MANITOBA MILLING COMPANY

21.8.1 COMPANY SNAPSHOT

21.8.2 PRODUCT PORTFOLIO

21.8.3 RECENT DEVELOPMENT

21.9 NOTCO

21.9.1 COMPANY SNAPSHOT

21.9.2 PRODUCT PORTFOLIO

21.9.3 RECENT DEVELOPMENT

21.1 SUNOPTA

21.10.1 COMPANY SNAPSHOT

21.10.2 PRODUCT PORTFOLIO

21.10.3 RECENT DEVELOPMENTS

21.11 WHITEWAVE SERVICES, INC.

21.11.1 COMPANY SNAPSHOT

21.11.2 PRODUCT PORTFOLIO

21.11.3 RECENT DEVELOPMENTS

21.12 YEO HIAP SENG LTD.

21.12.1 COMPANY SNAPSHOT

21.12.2 REVENUE ANALYSIS

21.12.3 PRODUCT PORTFOLIO

21.12.4 RECENT DEVELOPMENT

22 QUESTIONNAIRE

23 RELATED REPORTS

表格列表

TABLE 1 LACTOSE INTOLERANT POPULATION IN THE YEAR 2023

TABLE 2 PRICES FOR PLANT-BASED MILK

TABLE 3 PRICES FOR ANIMAL MILK

TABLE 4 SOYBEAN PRICES OVER THE YEARS (2019-2023)

TABLE 5 OAT PRICES OVER THE YEARS (2019-2023)

TABLE 6 NORTH AMERICA PLANT-BASED MILK MARKET, BY FLAVOR, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA ORIGINAL/UNFLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA VANILLA IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA CHOCOLATE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA COFFEE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA COCONUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA CARAMEL IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA HONEY IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA HAZELNUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA MAPLE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA OTHERS IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA PLANT-BASED MILK MARKET, BY FORTIFICATION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA PLANT-BASED MILK MARKET, BY NATURE, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA PLANT-BASED MILK MARKET, BY CLAIM, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA PLANT-BASED MILK MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA PLANT-BASED MILK MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA ALMOND MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA OAT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA SOY MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA COCONUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA RICE MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA CASHEW NUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA FLAX MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA WALNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA OTHERS IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA BOTTLES PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA NON-STORE RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA STORE BASED RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 41 U.S. PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 U.S. ALMOND MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 43 U.S. OAT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 44 U.S. SOY MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 45 U.S. COCONUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 46 U.S. RICE MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 47 U.S. CASHEW NUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 48 U.S. FLAX MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 49 U.S. WALNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 50 U.S. HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 51 U.S. OTHERS IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 52 U.S. PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 53 U.S. PLANT-BASED MILK MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 54 U.S. PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 55 U.S. PLANT-BASED MILK MARKET, BY FLAVOR, 2021-2030 (USD MILLION)

TABLE 56 U.S. ORIGINAL/UNFLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 57 U.S. VANILLA IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 U.S. CHOCOLATE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 U.S. COFFEE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 U.S. COCONUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 U.S. CARAMEL BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 62 U.S. HONEY IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 63 U.S. HAZELNUT IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 U.S. MAPLE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 U.S. OTHERS IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 U.S. PLANT-BASED MILK MARKET, BY FORTIFICATION, 2021-2030 (USD MILLION)

TABLE 67 U.S. PLANT-BASED MILK MARKET, BY NATURE, 2021-2030 (USD MILLION)

TABLE 68 U.S. PLANT-BASED MILK MARKET, BY CLAIM, 2021-2030 (USD MILLION)

TABLE 69 U.S. PLANT-BASED MILK MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 70 U.S. PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 71 U.S. BOTTLES PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 72 U.S. PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 73 U.S. STORE BASED RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 74 U.S. NON-STORE RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 75 CANADA PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 76 CANADA ALMOND MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 77 CANADA OAT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 78 CANADA SOY MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 79 CANADA COCONUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 80 CANADA RICE MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 81 CANADA CASHEW NUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 82 CANADA FLAX MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 83 CANADA WALNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 84 CANADA HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 85 CANADA OTHERS IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 86 CANADA PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 87 CANADA PLANT-BASED MILK MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 88 CANADA PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 89 CANADA PLANT-BASED MILK MARKET, BY FLAVOR, 2021-2030 (USD MILLION)

TABLE 90 CANADA ORIGINAL/UNFLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 91 CANADA VANILLA IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 92 CANADA CHOCOLATE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 93 CANADA COFFEE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 94 CANADA COCONUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 95 CANADA CARAMEL IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 96 CANADA HONEY IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 CANADA HAZELNUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 CANADA MAPLE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 CANADA OTHERS IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 CANADA PLANT-BASED MILK MARKET, BY FORTIFICATION, 2021-2030 (USD MILLION)

TABLE 101 CANADA PLANT-BASED MILK MARKET, BY NATURE, 2021-2030 (USD MILLION)

TABLE 102 CANADA PLANT-BASED MILK MARKET, BY CLAIM, 2021-2030 (USD MILLION)

TABLE 103 CANADA PLANT-BASED MILK MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 104 CANADA PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 105 CANADA BOTTLES PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 106 CANADA PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 107 CANADA STORE BASED RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 108 CANADA NON-STORE RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 109 MEXICO PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 110 MEXICO ALMOND MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 111 MEXICO OAT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 112 MEXICO SOY MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 113 MEXICO COCONUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 114 MEXICO RICE MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 115 MEXICO CASHEW NUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 116 MEXICO FLAX MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 117 MEXICO WALNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 118 MEXICO HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 119 MEXICO OTHERS IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 120 MEXICO PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 121 MEXICO PLANT-BASED MILK MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 122 MEXICO PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 123 MEXICO PLANT-BASED MILK MARKET, BY FLAVOR, 2021-2030 (USD MILLION)

TABLE 124 MEXICO ORIGINAL/UNFLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 125 MEXICO VANILLA IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 126 MEXICO CHOCOLATE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 127 MEXICO COFFEE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 128 MEXICO COCONUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 129 MEXICO CARAMEL IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 MEXICO HONEY IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 131 MEXICO HAZELNUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 132 MEXICO MAPLE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 133 MEXICO PLANT-BASED MILK MARKET, BY FORTIFICATION, 2021-2030 (USD MILLION)

TABLE 134 MEXICO PLANT-BASED MILK MARKET, BY NATURE, 2021-2030 (USD MILLION)

TABLE 135 MEXICO PLANT-BASED MILK MARKET, BY CLAIM, 2021-2030 (USD MILLION)

TABLE 136 MEXICO PLANT-BASED MILK MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 137 MEXICO PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 138 MEXICO BOTTLES PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 139 MEXICO PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 140 MEXICO STORE BASED RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 141 MEXICO NON-STORE RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

图片列表

FIGURE 1 NORTH AMERICA PLANT-BASED MILK MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PLANT-BASED MILK MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PLANT-BASED MILK MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PLANT-BASED MILK MARKET: NORTH AMERICA VS GLOBAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PLANT-BASED MILK MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PLANT-BASED MILK MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA PLANT-BASED MILK MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA PLANT-BASED MILK MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA PLANT-BASED MILK MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA PLANT-BASED MILK MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA PLANT-BASED MILK MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 NORTH AMERICA PLANT-BASED MILK MARKET: SEGMENTATION

FIGURE 13 INCREASE IN VEGAN POPULATION AROUND THE NORTH AMERICA IS EXPECTED TO DRIVE THE GROWTH OF THE NORTH AMERICA PLANT-BASED MILK MARKET IN THE FORECAST PERIOD

FIGURE 14 ALMOND MILK SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PLANT-BASED MILK MARKET IN 2023 AND 2030

FIGURE 15 NORTH AMERICA PLANT-BASED MILK MARKET: FACTORS AFFECTING DISPOSABLE INCOME OR SPENDING DYNAMICS OF THE CONSUMERS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE NORTH AMERICA PLANT-BASED MILK MARKET

FIGURE 17 NORTH AMERICA PLANT-BASED MILK MARKET: BY FLAVOR, 2022

FIGURE 18 NORTH AMERICA PLANT-BASED MILK MARKET: BY FORTIFICATION, 2022

FIGURE 19 NORTH AMERICA PLANT-BASED MILK MARKET: BY NATURE, 2022

FIGURE 20 NORTH AMERICA PLANT-BASED MILK MARKET: BY CLAIM, 2022

FIGURE 21 NORTH AMERICA PLANT-BASED MILK MARKET: BY PACKAGING SIZE, 2022

FIGURE 22 NORTH AMERICA PLANT-BASED MILK MARKET: BY PRODUCT TYPE, 2022

FIGURE 23 NORTH AMERICA PLANT-BASED MILK MARKET: BY FORMULATION, 2022

FIGURE 24 NORTH AMERICA PLANT-BASED MILK MARKET: BY CATEGORY, 2022

FIGURE 25 NORTH AMERICA PLANT-BASED MILK MARKET: BY TYPE, 2022

FIGURE 26 NORTH AMERICA PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2022

FIGURE 27 NORTH AMERICA PLANT-BASED MILK MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 28 NORTH AMERICA PLANT-BASED MILK MARKET: SNAPSHOT (2022)

FIGURE 29 NORTH AMERICA PLANT-BASED MILK MARKET: COMPANY SHARE 2022 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。