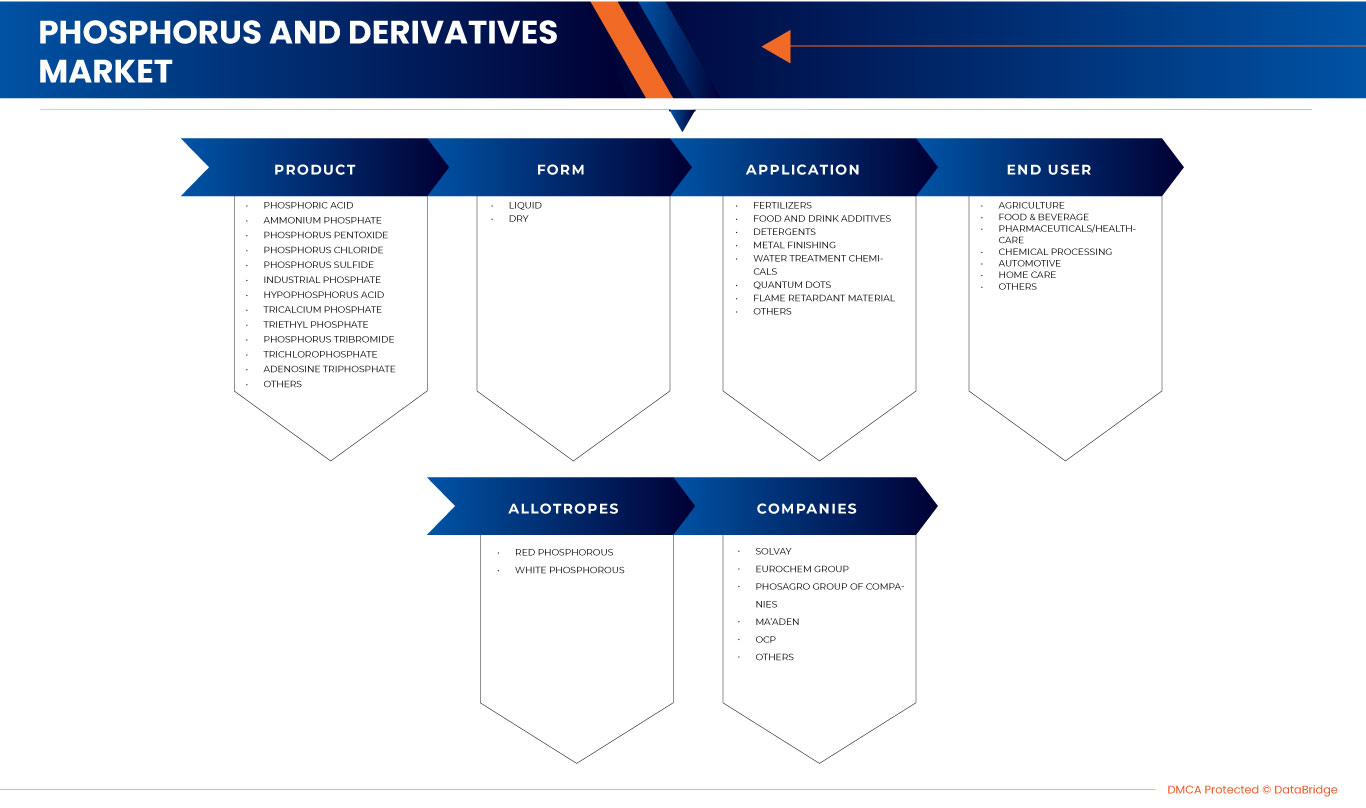

North America Phosphorus and Derivatives Market, By Product (Phosphoric Acid, Ammonium Phosphate, Phosphorus Pentoxide, Phosphorus Chloride, Phosphorus Sulfide, Industrial Phosphate, Hypophosphorus Acid, Tricalcium Phosphate, Triethyl Phosphate, Phosphorus Tribromide, Trichlorophosphate, Adenosine Triphosphate, and Others), Form (Dry and Liquid), Application (Fertilizers, Food and Drink Additives, Detergents, Metal Finishing, Water Treatment Chemicals, Quantum Dots, Flame Retardant Material, and Others), End User (Agriculture, Food & Beverage, Pharmaceuticals/Healthcare, Chemical Processing, Automotive, Home Care, and Others), Allotropes (Red Phosphorous and White Phosphorous) - Industry Trends and Forecast to 2030.

North America Phosphorus and Derivatives Market Analysis and Insights

Phosphorous and phosphoric acid refers to crystalline acid that is generally weak, colorless, and odorless. These inorganic materials are corrosive to the ferrous metal & alloys and possess good solubility in water. These tend to decompose in high temperatures. These may form toxic fumes when combined with alcohol. It gives soft drinks a tangy flavor and prevents the growth of mold and bacteria, which can multiply easily in a sugary solution. Most of the soda's acidity also comes from phosphoric acid.

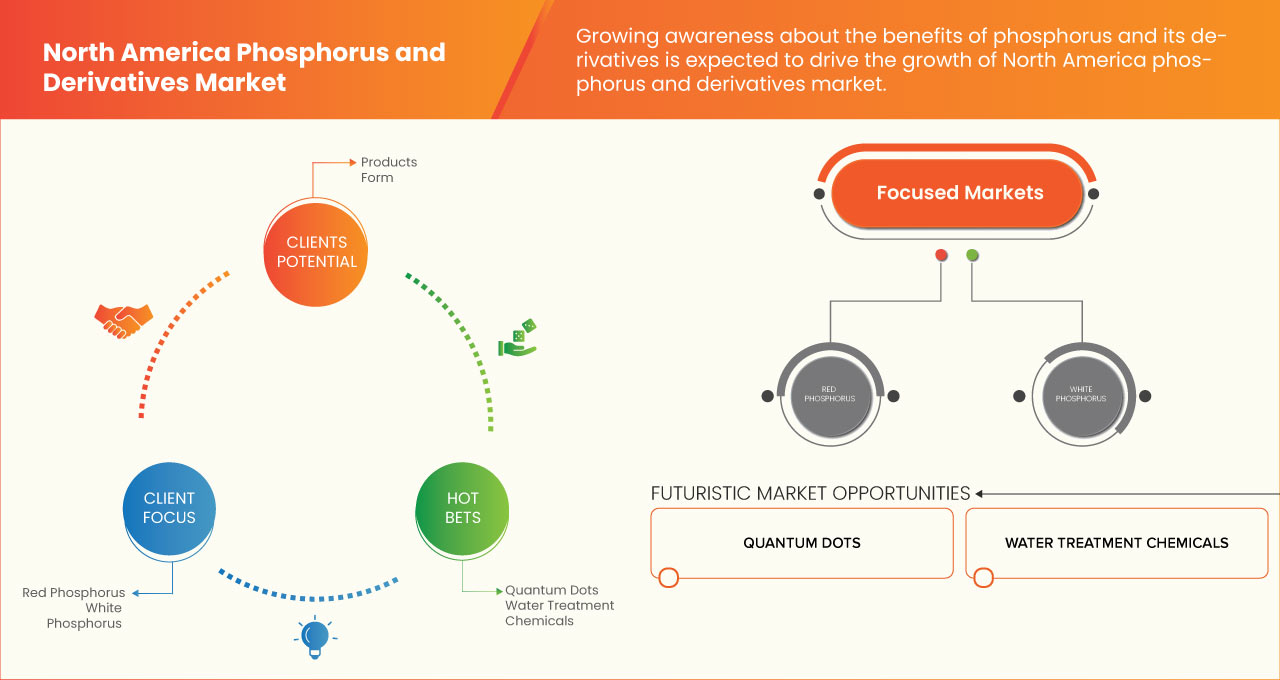

The driving factors that may be responsible for the growth of the North America phosphorus and derivatives market are the rapid growth in the agriculture, food, and food and beverages sector. However, the stringent government regulations on phosphorus and derivatives usage are expected to restrain the market.

On the other hand, strategic initiatives by market players and the rise in the agriculture field and the food and beverages industries may act as an opportunity to grow the North America phosphorus and derivatives market. The risks associated with overusing phosphate-based products may create challenges for the North America phosphorus and derivatives market. There are some recent developments related to the North America phosphorus and derivatives market.

However, the harmful effects of phosphorus and derivatives on the environment are expected to hamper the growth of the North America phosphorus and derivatives market in the forecast period.

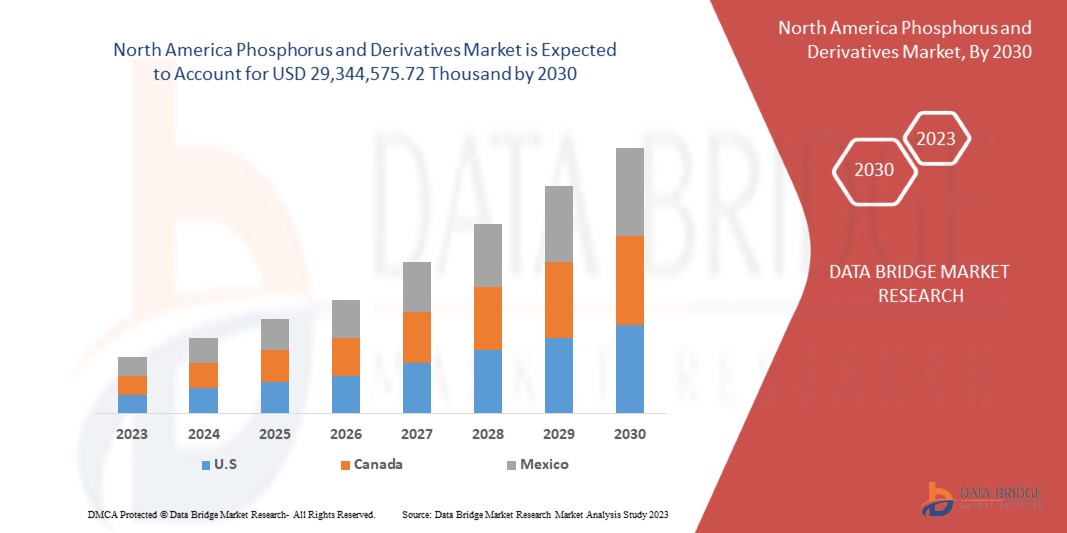

Data Bridge Market Research analyzes that the North America phosphorus and derivatives market is expected to reach the value of USD 29,344,575.72 thousand by 2030, at a CAGR of 4.03% during the forecast period. Phosphoric acid is the largest product segment in the market due to the growing use of phosphorus in North America phosphorus and derivatives market.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (2015 -2020) |

|

Quantitative Units |

Revenue in USD Thousands |

|

Segments Covered |

产品(磷酸、磷酸铵、五氧化二磷、氯化磷、硫化磷、工业磷酸盐、次磷酸、磷酸三钙、磷酸三乙酯、三溴化磷、三氯磷酸、三磷酸腺苷等)、形态(干态和液态)、应用(肥料、食品和饮料添加剂、洗涤剂、金属精加工、水处理化学品、量子点、阻燃材料等)、最终用户(农业、食品和饮料、制药/医疗保健、化学加工、汽车、家庭护理等)、同素异形体(红磷和白磷) |

|

覆盖国家 |

美国、加拿大和墨西哥 |

|

涵盖的市场参与者 |

ANEXIB Chemicals、日本化学工业株式会社、Mosaic Company、朗盛、索尔维、Ma'aden、ICL、徐州建平化工有限公司、Sekisui Diagnostics 等 |

北美磷及衍生物市场定义

磷是一种可燃非金属元素,通常以两种同素异形体存在:白磷和红磷。磷酸、亚磷酸、三氯氧化磷、五氯化磷、三溴化磷、次磷酸钠、磷酸三丁酯和磷酸三乙酯都是磷的衍生物。磷衍生物磷酸是一种结晶酸,通常无色无味。这些无机材料对黑色金属和合金有腐蚀性,在水中具有良好的溶解性。它们在高温下容易分解。它们与酒精混合时可能会形成有毒烟雾。它使软饮料具有浓烈的味道,并防止霉菌和细菌的生长,而霉菌和细菌在含糖溶液中很容易繁殖。苏打水的大部分酸性也来自磷酸。

磷首先通过化学制造过程转化为五氧化二磷,然后再次处理成为磷酸。

北美磷及衍生品市场动态

本节旨在了解市场驱动因素、机遇、限制因素和挑战。下文将详细讨论所有这些内容:

驱动程序

- 农业对肥料的需求不断增加

磷酸可生产多种肥料,包括 DAP、MAP、NPK 和 SSP。

磷酸二铵 (DAP) 因其物理特性而成为最受欢迎的磷肥。DAP 的成分为 N-18% 和 P2O5 -46%。DAP 肥料适用于任何农作物,可在作物生长发育期间提供充分的磷营养,并提供氮和低硫的初始剂量。可在秋季耕作时使用,也可在春季播种和播种前耕作时使用。溶解在土壤中可暂时碱化肥料颗粒周围的土壤溶液的 pH 值,从而刺激酸性土壤更好地从肥料中吸收磷。肥料硫也有助于植物更好地吸收氮和磷。

因此,磷酸的多种用途生产磷肥有望推动北美磷酸市场的增长。

- 制药行业需求不断增长

磷酸主要用于许多医疗用途,例如牙科水泥、制备白蛋白衍生物、酸化尿液、去除坏死(死细胞或组织)碎片、止吐药、牙齿增白剂和漱口液。

牙齿美白中使用的磷酸 磷酸会改变牙齿表面。漂白后使用 37% 的磷酸会显著增加酸对牙釉质表面的脱钙作用,造成不均匀的蚀刻表面。此外,它还会导致牙齿敏感。

因此,磷酸在医疗应用中的使用量不断增长预计将推动北美磷酸市场的增长。

克制

- 政府对磷及其衍生物的使用有严格的规定

不同的政府监管机构对磷酸的使用和生产制定了多项法规。

FDA 通过确保人类和兽医药品、生物制品、化学品等的安全、有效性和保障来保护公众健康。美国食品药品监督管理局制定了一些关于在食品中使用磷酸的规定,以及处理磷酸的规定。以下是 FDA 为保护目的制定的一些参数

因此,由于政府对磷酸的严格监管,磷酸的使用受到限制,这可能会阻碍预测期内的市场增长。

机会

增加创新和新产品发布

领先的市场参与者已经推出了具有改进功能的新产品。制造商已采取必要措施来提高新产品的准确性和整体功能。

市场参与者进一步专注于国内生产磷酸,并通过出口到其他地区来扩大业务。

因此,不断增长的创新和新产品的推出有望为北美磷酸市场提供机会。

挑战

过度使用磷酸盐基产品的风险

在州、临时和国家层面,磷酸供应受到各种政府规则的管制,因为多种风险可能影响肥料的使用,并且在磷酸生产过程中会产生多种环境影响。

磷肥的生产通常使用沉积磷酸盐岩作为原料,其中的铀系放射性核素浓度比未受干扰的土壤高出约 10 至 100 倍。

因此,由于磷酸对空气、水、土壤和人类健康的有害影响,许多政府机构已经牵头实施了多项有关磷酸使用的法规、高标准认证计划和公司注册,这可能对北美磷酸市场构成挑战。

最新动态

- 2023年3月,索尔维宣布其被诺斯罗普·格鲁曼公司北美1万多家供应商网络中评选为2022年60家顶级供应商之一。这将提升该公司的品牌形象等。

- 2023 年 3 月,Airedale 集团宣布公司将通过收购 McCann 化学品继续发展。这将有助于提高公司产品组合的增长和多样化。

北美磷及其衍生物市场范围

北美磷及其衍生物市场分为五个显著的细分市场,例如产品、形式、应用、最终用户和同素异形体。细分市场之间的增长有助于您分析利基增长领域和进入市场的策略,并确定您的核心应用领域和目标市场的差异。

产品

- 磷酸

- 磷酸铵

- 五氧化二磷

- 氯化磷

- 硫化磷

- 工业磷酸盐

- 次磷酸

- 磷酸三钙

- 磷酸三乙酯

- 三溴化磷

- 三氯磷酸盐

- 三磷酸腺苷

- 其他的

根据产品,北美磷和衍生物市场细分为磷酸、磷酸铵、五氧化二磷、氯化磷、硫化磷、工业磷酸盐、次磷酸、磷酸三钙、磷酸三乙酯、三溴化磷、三氯磷酸、三磷酸腺苷等。

形式

- 干燥

- 液体

根据形式,北美磷及其衍生物市场分为干磷和液态磷。

应用

- 肥料

- 食品和饮料添加剂

- 清洁剂

- 金属表面处理

- 水处理化学品

- 量子点

- 阻燃材料

- 其他的

根据应用,北美磷和衍生物市场分为肥料、食品和饮料添加剂、洗涤剂、金属表面处理、水处理化学品、量子点、阻燃材料等。

最终用户

- 农业

- 食品和饮料

- 制药/医疗保健

- 化学加工

- 汽车

- 家庭护理

- 其他的

根据最终用户,北美磷和衍生物市场分为农业、食品和饮料、制药/医疗保健、化学加工、汽车、家庭护理等。

同素异形体

- 红磷

- 白磷

根据同素异形体,北美磷及其衍生物市场分为红磷和白磷。

北美磷及衍生物市场区域分析/见解

The North America phosphorus and derivatives market is segmented into five notable segments such as product, form, application, end user, and allotropes.

The countries covered in this market report North America phosphorus and derivatives market are U.S., Canada, and Mexico.

The country section of the report also provides individual market-impacting factors and domestic regulation changes that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of phosphorus and its derivatives and the challenges faced due to stringent regulations are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Phosphorus and Derivatives Market Share Analysis

North America phosphorus and derivatives market competitive landscape provides details of the competitor. Details include company overview, financials, revenue generated, market potential, business expansion, service facilities, partnership, strategic development, application dominance, and technology lifeline curve. The above data points only relate to the company's focus on the North America phosphorus and derivatives market.

Some of the major players operating in the North America phosphorus and derivatives market are ANEXIB Chemicals, Nippon Chemical Industrial CO., LTD., Mosaic Company, LANXESS, Solvay, Ma'aden, ICL, Xuzhou JianPing Chemical Co., Ltd., and Sekisui Diagnostics.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFELINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 DBMR MARKET CHALLENGE MATRIX

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ENVIRONMENTAL FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ECONOMICAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER'S FIVE FORCES

4.3 RAW MATERIAL COVERAGE

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 IMPORT-EXPORT SCENARIO

4.6 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURES

4.7 VENDOR SELECTION CRITERIA

4.8 PRODUCTION CAPACITY OUTLOOK

5 REGULATION COVERAGE

6 CLIMATE CHANGE SCENARIO

6.1 ENVIRONMENTAL CONCERNS

6.2 INDUSTRY RESPONSE

6.3 GOVERNMENT'S ROLE

6.4 ANALYST RECOMMENDATION

7 PRICING ANALYSIS OF PHOSPHORUS

8 SUPPLY CHAIN ANALYSIS

9 REGIONAL SUMMARIES

10 MARKET OVERVIEW

10.1 DRIVERS

10.1.1 INCREASING DEMAND FOR FERTILIZERS IN THE AGRICULTURE INDUSTRY

10.1.2 GROWING AWARENESS ABOUT THE BENEFITS OF PHOSPHORUS AND DERIVATIVES AMONG CONSUMERS

10.1.3 INCREASING DEMAND IN THE PHARMACEUTICAL SECTOR

10.1.4 RISING APPLICATIONS OF PHOSPHORUS AND DERIVATIVES IN SEVERAL INDUSTRIES

10.2 RESTRAINTS

10.2.1 STRINGENT GOVERNMENT REGULATIONS ON PHOSPHORUS AND DERIVATIVES USAGE

10.2.2 HARMFUL EFFECTS OF PHOSPHORUS AND DERIVATIVES ON THE ENVIRONMENT

10.3 OPPORTUNITIES

10.3.1 INCREASING USE OF PHOSPHORUS AND DERIVATIVES IN THE FOOD & BEVERAGE INDUSTRY

10.3.2 INCREASING INNOVATION AND NEW PRODUCT LAUNCHES

10.3.3 GROWING USE OF PHOSPHORUS AND DERIVATIVES IN FUEL CELLS

10.4 CHALLENGES

10.4.1 RISKS ASSOCIATED WITH OVER USAGE OF PHOSPHATE-BASED PRODUCTS

10.4.2 INCREASING ADOPTION OF GENETICALLY MODIFIED SEEDS

11 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT

11.1 OVERVIEW:

11.2 PHOSPHORIC ACID

11.3 AMMONIUM PHOSPHATE

11.4 PHOSPHORUS PENTOXIDE

11.5 PHOSPHORUS CHLORIDE

11.6 PHOSPHORUS SULPHIDE

11.7 INDUSTRIAL PHOSPHATE

11.8 HYPHOSPHORUS ACID

11.9 TRICALCIUM PHOSPHATE

11.1 TRIETHYL PHOSPHATE

11.11 PHOSPHORUS TRIBROMIDE

11.12 TRICHLOROPHOSPHATE

11.13 ADENOSINE TRIPHOSPHATE

11.14 OTHERS

12 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM

12.1 OVERVIEW

12.2 DRY

12.3 LIQUID

13 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION

13.1 OVERVIEW:

13.2 FERTILIZERS

13.3 FOOD AND DRINK ADDITIVES

13.4 DETERGENTS

13.5 METAL FINISHING

13.6 WATER TREATMENT CHEMICALS

13.7 QUANTUM DOTS

13.8 FLAME RETARDANT MATERIAL

13.9 OTHERS

14 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER

14.1 OVERVIEW:

14.2 AGRICULTURE

14.3 FOOD AND BEVERAGES

14.4 PHARMACEUTICALS/HEALTHCARE

14.5 CHEMICAL PROCESSING

14.6 AUTOMOTIVE

14.7 HOMECARE

14.8 OTHERS

15 NORTH AMERICA PHOSPHOROUS AND DERIVATIVES MARKET, BY ALLOTROPES

15.1 OVERVIEW

15.2 RED PHOSPHOROUS

15.3 WHITE PHOSPHOROUS

16 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY REGION

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 MEXICO

16.1.3 CANADA

17 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17.2 EXPANSIONS

17.3 AGREEMENTS

17.4 RECOGNITIONS

17.5 COLLABORATION

17.6 NEW LAUNCHES/PRODUCTS

17.7 ACQUISITIONS

17.8 PRESENTATION

17.9 NEW PRODUCTION BUILDING

17.1 INVESTMENT

18 COMPANY PROFILE

18.1 SOLVAY

18.1.1 COMPANY SNAPSHOT

18.1.2 PRODUCTION CAPACITY

18.1.3 SWOT

18.1.4 REVENUE ANALYSIS

18.1.5 COMPANY SHARE ANALYSIS

18.1.6 PRODUCT PORTFOLIO

18.1.7 RECENT DEVELOPMENT

18.2 EUROCHEM GROUP

18.2.1 COMPANY SNAPSHOT

18.2.2 PRODUCTION CAPACITY

18.2.3 SWOT

18.2.4 COMPANY SHARE ANALYSIS

18.2.5 PRODUCT PORTFOLIO

18.2.6 RECENT DEVELOPMENT

18.3 PHOSAGRO GROUP OF COMPANIES

18.3.1 COMPANY SNAPSHOT

18.3.2 PRODUCTION CAPACITY

18.3.3 SWOT

18.3.4 REVENUE ANALYSIS

18.3.5 COMPANY SHARE ANALYSIS

18.3.6 PRODUCT PORTFOLIO

18.3.7 RECENT DEVELOPMENT

18.4 MA'ADEN

18.4.1 COMPANY SNAPSHOT

18.4.2 PRODUCTION CAPACITY

18.4.3 SWOT

18.4.4 REVENUE ANALYSIS

18.4.5 COMPANY SHARE ANALYSIS

18.4.6 PRODUCT PORTFOLIO

18.4.7 RECENT DEVELOPMENTS

18.5 OCP

18.5.1 COMPANY SNAPSHOT

18.5.2 PRODUCTION CAPACITY

18.5.3 SWOT

18.5.4 COMPANY SHARE ANALYSIS

18.5.5 PRODUCT PORTFOLIO

18.5.6 RECENT DEVELOPMENT

18.6 ADITYA BIRLA MANAGEMENT CORPORATION PVT. LTD.

18.6.1 COMPANY SNAPSHOT

18.6.2 SWOT

18.6.3 REVENUE ANALYSIS

18.6.4 PRODUCT PORTFOLIO

18.6.5 RECENT DEVELOPMENT

18.7 AIREDALE CHEMICAL COMPANY LIMITED

18.7.1 COMPANY SNAPSHOT

18.7.2 SWOT

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENT

18.8 ANEXIB CHEMICALS

18.8.1 COMPANY SNAPSHOT

18.8.2 SWOT

18.8.3 PRODUCT PORTFOLIO

18.8.4 RECENT DEVELOPMENT

18.9 ANHUI GUANGXIN AGROCHEMICAL CO., LTD.

18.9.1 COMPANY SNAPSHOT

18.9.2 SWOT

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 EXCEL INDUSTRIES LTD. (2022)

18.10.1 COMPANY SNAPSHOT

18.10.2 SWOT

18.10.3 REVENUE ANALYSIS

18.10.4 PRODUCT PORTFOLIO

18.10.5 RECENT DEVELOPMENT

18.11 FUTONG CHEMICAL CO., LTD

18.11.1 COMPANY SNAPSHOT

18.11.2 SWOT

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENT

18.12 ICL

18.12.1 COMPANY SNAPSHOT

18.12.2 SWOT

18.12.3 REVENUE ANALYSIS

18.12.4 PRODUCT PORTFOLIO

18.12.5 RECENT DEVELOPMENTS

18.13 INNOPHOS

18.13.1 COMPANY SNAPSHOT

18.13.2 SWOT

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENT

18.14 JORDAN PHOSPHATE MINES COMPANY (PLC)

18.14.1 COMPANY SNAPSHOT

18.14.2 SWOT

18.14.3 REVENUE ANALYSIS

18.14.4 PRODUCT PORTFOLIO

18.14.5 RECENT DEVELOPMENT

18.15 KAZPHOSPHATE LLC

18.15.1 COMPANY SNAPSHOT

18.15.2 SWOT

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENT

18.16 LANXESS

18.16.1 COMPANY SNAPSHOT

18.16.2 SWOT

18.16.3 REVENUE ANALYSIS

18.16.4 PRODUCT PORTFOLIO

18.16.5 RECENT DEVELOPMENTS

18.17 MOSAIC

18.17.1 COMPANY SNAPSHOT

18.17.2 SWOT

18.17.3 REVENUE ANALYSIS

18.17.4 PRODUCT PORTFOLIO

18.17.5 RECENT DEVELOPMENT

18.18 NIPPON CHEMICAL INDUSTRIAL CO., LTD.

18.18.1 COMPANY SNAPSHOT

18.18.2 SWOT

18.18.3 REVENUE ANALYSIS

18.18.4 PRODUCT PORTFOLIO

18.18.5 RECENT DEVELOPMENTS

18.19 NUTRIEN LTD. (2022)

18.19.1 COMPANY SNAPSHOT

18.19.2 SWOT

18.19.3 REVENUE ANALYSIS

18.19.4 PRODUCT PORTFOLIO

18.19.5 RECENT DEVELOPMENT

18.2 PCC ROKITA SPÓŁKA AKCYJNA. (A SUBSIDIARY OF PCC GROUP)

18.20.1 COMPANY SNAPSHOT

18.20.2 SWOT

18.20.3 REVENUE ANALYSIS

18.20.4 PRODUCT PORTFOLIO

18.20.5 RECENT DEVELOPMENT

18.21 SANDHYA GROUP

18.21.1 COMPANY SNAPSHOT

18.21.2 SWOT

18.21.3 PRODUCT PORTFOLIO

18.21.4 RECENT DEVELOPMENT

18.22 SEKISUI DIAGNOSTICS

18.22.1 COMPANY SNAPSHOT

18.22.2 SWOT

18.22.3 PRODUCT PORTFOLIO

18.22.4 RECENT DEVELOPMENT

18.23 SMC NORTH AMERICA

18.23.1 COMPANY SNAPSHOT

18.23.2 SWOT

18.23.3 PRODUCT PORTFOLIO

18.23.4 RECENT DEVELOPMENT

18.24 STREM (A SUBSIDIARY OF ASCENSUS)

18.24.1 COMPANY SNAPSHOT

18.24.2 SWOT

18.24.3 PRODUCT PORTFOLIO

18.24.4 RECENT DEVELOPMENTS

18.25 XUZHOU JIANPING CHEMICAL CO., LTD.

18.25.1 COMPANY SNAPSHOT

18.25.2 SWOT

18.25.3 PRODUCT PORTFOLIO

18.25.4 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

表格列表

TABLE 1 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY REGION, 2019-2022 (AVERAGE SELLING PRICE (USD) PER KG)

TABLE 2 THE RECOMMENDED DIETARY ALLOWANCE (RDA) FOR PHOSPHORUS IS THE FOLLOWING:

TABLE 3 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY COUNTRY, 2016-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY COUNTRY, 2016-2030 (TONS)

TABLE 5 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 7 NORTH AMERICA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 9 NORTH AMERICA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 11 NORTH AMERICA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 13 NORTH AMERICA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 15 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 17 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 19 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 21 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 23 U.S. PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 24 U.S. PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 25 U.S. PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 26 U.S. PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 27 U.S. AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 28 U.S. AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 29 U.S. PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 30 U.S. PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 31 U.S. PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 32 U.S. PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 33 U.S. PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 34 U.S. PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 35 U.S. PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 36 U.S. PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 37 U.S. PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 38 U.S. PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 39 U.S. PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 40 U.S. PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 41 MEXICO PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 42 MEXICO PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 43 MEXICO PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 44 MEXICO PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 45 MEXICO AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 46 MEXICO AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 47 MEXICO PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 48 MEXICO PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 49 MEXICO PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 50 MEXICO PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 51 MEXICO PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 52 MEXICO PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 53 MEXICO PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 54 MEXICO PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 55 MEXICO PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 56 MEXICO PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 57 MEXICO PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 58 MEXICO PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 59 CANADA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 60 CANADA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 61 CANADA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 62 CANADA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 63 CANADA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 64 CANADA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 65 CANADA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 66 CANADA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 67 CANADA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 68 CANADA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 69 CANADA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 70 CANADA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 71 CANADA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 72 CANADA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 73 CANADA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 74 CANADA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 75 CANADA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 76 CANADA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

图片列表

FIGURE 1 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: PRODUCT LIFELINE CURVE

FIGURE 7 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 12 NORTH AMERICA PHOSPHORUS AND DERIVATIVES: THE MARKET CHALLENGE MATRIX

FIGURE 13 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: SEGMENTATION

FIGURE 14 RISING APPLICATIONS OF PHOSPHORUS AND DERIVATIVES IN SEVERAL INDUSTRIES ARE DRIVING THE GROWTH OF THE NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 THE PHOSPHORIC ACID SEGMENT IN THE PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET IN 2023 & 2030

FIGURE 16 PRODUCTION PROCESS OF PHOSPHORUS AND ITS DERIVATIVES

FIGURE 17 UNITED STATES CONSUMPTION OF PHOSPHATE ROCK (2019 – 2022)

FIGURE 18 IMPORT EXPORT SCENARIO OF PHOSPHORUS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET

FIGURE 20 FERTILIZER CONSUMPTION IN EUROPEAN COUNTRIES (2019) (KILOGRAMS PER HECTARE OF LAND)

FIGURE 21 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2022

FIGURE 22 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2022

FIGURE 23 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2022

FIGURE 24 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2022

FIGURE 25 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2022

FIGURE 26 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: SNAPSHOT (2022)

FIGURE 27 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: BY COUNTRY (2022)

FIGURE 28 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 29 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 30 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: BY PRODUCT (2023 - 2030)

FIGURE 31 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: COMPANY SHARE 2022 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。