北美磷酸市场,按工艺类型(湿法工艺和热法工艺)、形式(固体和液体)、等级(技术级、食品级和饲料级)、应用(食品和饮料、动物饲料、个人护理、化学制造、皮革和纺织品、清洁剂、陶瓷和耐火材料、农业肥料、冶金、水处理、建筑、采矿、半导体、口腔和牙科护理、制药和其他)、国家(美国、加拿大和墨西哥)行业趋势和预测到 2028 年

市场分析与洞察:北美磷酸市场

市场分析与洞察:北美磷酸市场

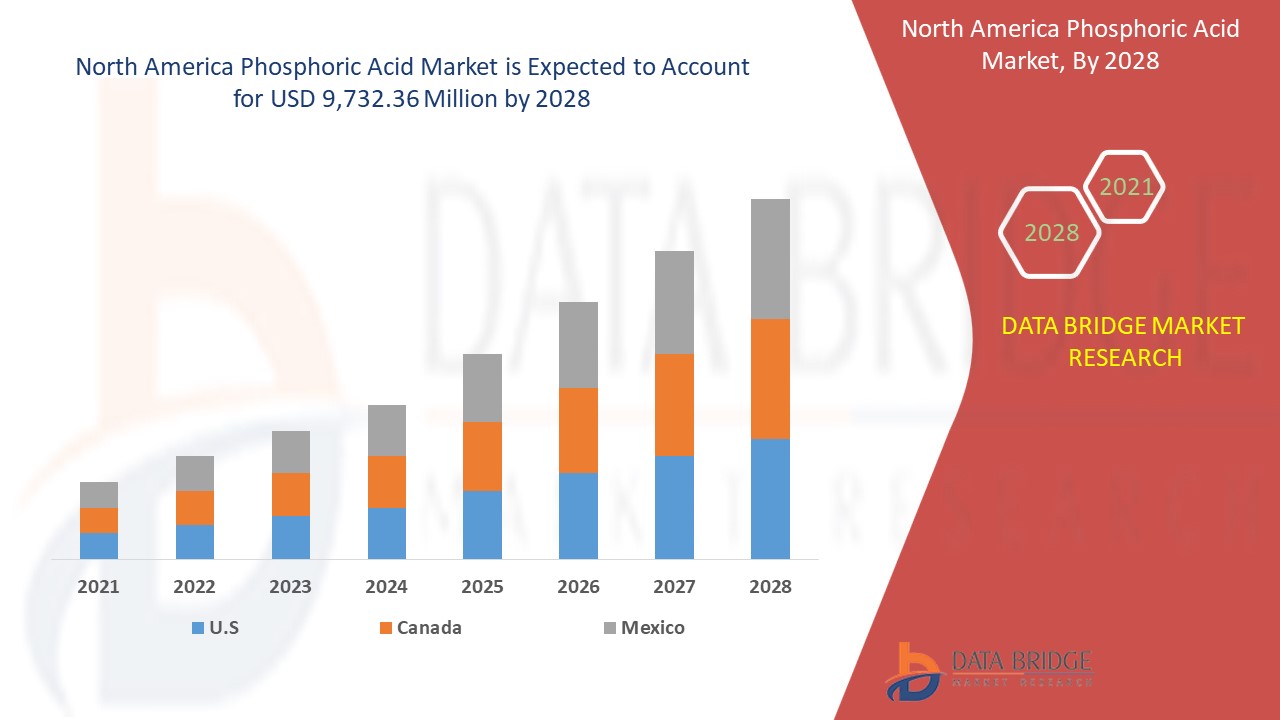

预计北美市场将在 2021 年至 2028 年的预测期内增长。Data Bridge Market Research 分析,在 2021 年至 2028 年的预测期内,该市场以 3.7% 的复合年增长率增长,预计到 2028 年将达到 97.3236 亿美元。食品饮料和制药行业对磷酸的需求增加,从而推动北美磷酸市场的增长。

磷酸是一种结晶酸,通常无色无味,对黑色金属和合金有腐蚀性,在水中具有良好的溶解性。它们在高温下容易分解。与酒精结合时可能会产生有毒烟雾。磷酸的生产采用热法、干窑法和湿法。它使软饮料具有浓郁的味道,并防止霉菌和细菌的生长,而霉菌和细菌在含糖溶液中很容易繁殖。苏打水的大部分酸性也来自磷酸。

磷酸是由矿物质磷制成的,磷在人体中自然存在。它与钙一起形成强健的骨骼和牙齿。它还有助于支持肾脏功能以及身体使用和储存能量的方式。磷有助于肌肉在剧烈运动后恢复。这种矿物质在人体生长中起着重要作用,甚至是产生生物遗传密码 DNA 和 RNA 所必需的。

磷首先通过化学制造过程转化为五氧化二磷。然后再次处理,变成磷酸。

预计在预测期内推动北美磷酸市场增长的主要因素是磷酸在磷肥生产中的大量使用。此外,政府对磷酸的严格监管也进一步推动了北美磷酸市场的发展。另一方面,重大创新和新产品的推出预计将阻碍北美磷酸市场的增长。此外,替代产品的供应可能会在不久的将来进一步阻碍北美磷酸市场的发展。

北美磷酸市场报告提供了市场份额、新发展和产品线分析、国内和本地市场参与者的影响的详细信息,分析了新兴收入来源、市场法规变化、产品审批、战略决策、产品发布、地域扩张和市场技术创新方面的机会。要了解分析和北美磷酸市场情况,请联系 Data Bridge Market Research 获取分析师简报;我们的团队将帮助您创建收入影响解决方案,以实现您的预期目标。

北美磷酸市场范围和市场规模

北美磷酸市场范围和市场规模

北美磷酸市场根据工艺类型、形式、等级和应用分为四个显著的细分市场。细分市场之间的增长有助于您分析利基市场的增长和进入市场的策略,并确定您的核心应用领域和目标市场的差异。

- 根据工艺类型,磷酸市场分为湿法工艺和热法工艺。2021 年,由于磷酸在磷肥生产中的使用量很大,湿法工艺预计将占据最大的市场份额。

- 根据形态,磷酸市场分为液体和固体。2021 年,由于磷酸在食品和饮料领域作为调味剂、酸度调节剂的使用越来越多,市场以液体形式为主。

- 根据等级,磷酸市场分为食品级、饲料级和技术级。2021 年,由于磷酸在医疗保健和商业应用中的使用日益增多,市场以技术级为主。

- 根据应用,磷酸市场细分为食品和饮料、动物饲料、个人护理、化学制造、皮革和纺织品、清洁剂、陶瓷和耐火材料、农业肥料、冶金、水处理、建筑、采矿、半导体、口腔和牙科护理、制药等。2021 年,由于政府与全球各供应商合作扩大磷酸盐开采和磷酸盐生产,农业肥料领域将主导市场。

北美磷酸市场国家级分析

对北美磷酸市场进行了分析,并按国家、工艺类型、形式、等级和应用提供了上述市场规模信息。

北美磷酸市场报告涵盖的国家包括美国、加拿大和墨西哥。

美国引领着北美市场的增长,由于食品和饮料行业对磷酸作为食品添加剂的需求不断增长,湿法工艺领域在美国占据主导地位。

报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和市场监管变化。新销售、替代销售、国家人口统计、监管法案和进出口关税等数据点是用于预测各个国家市场情景的一些主要指标。此外,在对国家数据进行预测分析时,还考虑了北美品牌的存在和可用性以及由于来自本地和国内品牌的激烈或稀缺竞争而面临的挑战、销售渠道的影响。

主要市场参与者不断增加的战略活动提高了人们对磷酸的认识,推动了北美磷酸市场的增长

北美磷酸市场还为您提供了每个国家在特定市场增长的详细市场分析。此外,它还提供有关市场参与者的战略及其地理分布的详细信息。数据适用于 2011 年至 2019 年的历史时期。

竞争格局和北美磷酸市场份额分析

北美磷酸市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、生产基地和设施、公司优势和劣势、产品发布、产品试验渠道、产品批准、专利、产品宽度和广度、应用优势、技术生命线曲线。以上数据点仅与公司对北美磷酸市场的关注有关。

北美磷酸市场的一些主要参与者包括 Nutrien Ltd、OCP、JR Simplot Company.、Brenntag North America, Inc.、Arkema、ICL、Innophos、Spectrum Chemical、Solvay、Merck KGaA、Prayon SA、YPH、Clariant AG、Jordan Phosphate Mines Company (PLC) 和 Quadra Chemicals 等。

DBMR 分析师了解竞争优势并为每个竞争对手分别提供竞争分析。

全球各地的公司也纷纷推出新产品,这也加速了北美磷酸市场的发展。

例如,

- 2020 年 9 月,科莱恩股份公司推出了一种新型创新磷酸酯,在金属加工液配方中具有出色的性能和卓越的可持续性。该产品的推出帮助该公司扩大了其产品组合

- 2020 年 8 月,OCP 通过其子公司 Euro Maroc Phosphore (EMAPHOS) 开始建设一座生产纯化磷酸的新工厂。此次启动有助于该公司提高生产能力

市场参与者的合作、产品发布、业务扩展、奖励和认可、合资企业等策略增强了公司在北美磷酸市场的影响力,也有利于公司的利润增长。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA PHOSPHORIC ACID MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 DBMR MARKET CHALLENGE MATRIX

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 RAW MATERIAL PRICING ANALYSIS

4.2 PRODUCTION AND CONSUMPTION PATTERN

4.2.1 PRODUCTION PATTERN:

4.2.2 CONSUMPTION PATTERN:

4.2.3 CONCLUSION:

4.3 MARKETING STRATEGIES

4.4 LIST OF SUBSTITUTES IN THE MARKET

5 REGULATORY FRAMEWORK

6 PHOSPHORIC ACID MANUFACTURING PROCESS

7 BRAND ANALYSIS

8 COMPARITIVE ANALYSIS WITH PARENT MARKET

9 PRICING ANALYSIS

10 MARKET OVERVIEW

10.1 DRIVERS

10.1.1 CONSIDERABLE USE OF PHOSPHORIC ACID FOR PRODUCTION OF PHOSPHATE FERTILIZERS

10.1.2 GROWING USAGE OF PHOSPHORIC ACID IN MEDICAL APPLICATIONS

10.1.3 INCREASING USE AS A FOOD ADDITIVE IN THE FOOD & BEVERAGE INDUSTRY

10.1.4 RISING USE IN KEY COMMERCIAL APPLICATIONS

10.2 RESTRAINTS

10.2.1 STRINGENT GOVERNMENT REGULATIONS FOR PHOSPHORIC ACID

10.2.2 ISSUES ARISING DUE TO OVER USAGE OF PHOSPHATE BASED PRODUCTS

10.2.3 AVAILABILITY OF SUBSTITUTE PRODUCTS

10.3 OPPORTUNITIES

10.3.1 SIGNIFICANT INNOVATION AND NEW PRODUCT LAUNCHES

10.3.2 GROWING USE OF PHOSPHORIC ACID IN FUEL CELLS

10.4 CHALLENGES

10.4.1 GROWING AWARENESS REGARDING THE ENVIRONMENTAL IMPACT OF PHOSPHORIC ACID

10.4.2 INCREASING ADOPTION OF GENETICALLY MODIFIED SEEDS

11 COVID-19 IMPACT ON THE NORTH AMERICA PHOSPHORIC ACID MARKET

11.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE NORTH AMERICA PHOSPHORIC ACID MARKET

11.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

11.3 IMPACT ON PRICE

11.4 IMPACT ON DEMAND

11.5 IMPACT ON SUPPLY CHAIN

11.6 CONCLUSION

12 NORTH AMERICA PHOSPHORIC ACID MARKET, BY PROCESS TYPE

12.1 OVERVIEW

12.2 WET PROCESS

12.3 THERMAL PROCESS

13 NORTH AMERICA PHOSPHORIC ACID MARKET, BY GRADE

13.1 OVERVIEW

13.2 TECHNICAL GRADE

13.3 FOOD GRADE

13.4 FEED GRADE

14 NORTH AMERICA PHOSPHORIC ACID MARKET, BY FORM

14.1 OVERVIEW

14.2 LIQUID

14.3 SOLID (CRYSTAL SOLID)

15 NORTH AMERICA PHOSPHORIC ACID MARKET, BY APPLICATION

15.1 OVERVIEW

15.2 AGRICULTURE FERTILIZERS

15.3 FOOD & BEVERAGES

15.3.1 BEVERAGES

15.3.1.1 BEVERAGES

15.3.1.2 FRUIT JUICE

15.3.1.3 OTHERS

15.3.2 DAIRY PRODUCTS

15.3.2.1 CHEESE

15.3.2.2 MAYONNAISE

15.3.2.3 OTHERS

15.3.3 BAKERY PRODUCTS

15.3.4 CANNED FOOD

15.3.5 EDIBLE OIL

15.3.6 SAUCES

15.3.7 JAMES, JELLIES

15.3.8 SUGAR

15.3.9 OTHERS

15.4 ANIMAL FEED

15.5 CHEMICAL MANUFACTURING

15.5.1 PHOSPHORIC ACID LINE CLEANERS

15.5.2 METAL PHOSPHATING SOLUTION

15.5.3 ALUMINUM BRIGHT DIP SOLUTION

15.5.4 TRANSITION METAL PHOSPHATE SALT

15.6 PHARMACEUTICAL

15.7 PERSONAL CARE

15.7.1 SOAP

15.7.2 PERFUMES

15.7.3 SHAMPOO

15.7.4 NAIL PAINTS

15.7.5 CLEANERS

15.7.6 CREAMS

15.7.7 OTHERS

15.8 MINING

15.9 CLEANING AGENTS

15.9.1 FOOD PROCESSING CLEANING AGENTS

15.9.2 LAUNDRY CLEANING AGENTS

15.9.3 HOUSEHOLD CLEANING AGENTS

15.9.4 TRANSPORTATION CLEANING AGENTS

15.9.5 OTHERS

15.1 ORAL & DENTAL CARE

15.10.1 ABRASIVE

15.10.2 MOUTHWASHES

15.10.3 WHITENING & SENSITIVE TEETH

15.10.4 TARTAR CONTROL

15.11 WATER TREATMENT

15.12 SEMICONDUCTORS

15.13 LEATHER & TEXTILE

15.14 CONSTRUCTION

15.15 METALLURGY

15.16 CERAMIC & REFRACTORIES

15.17 OTHERS

16 NORTH AMERICA PHOSPHORIC ACID MARKET, BY REGION

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

17 NORTH AMERICA PHOSPHORIC ACID MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17.2 MERGER & ACQUISITION

17.3 EXPANSION

17.4 NEW PRODUCT DEVELOPMENTS

17.5 PRESENTATIONS

17.6 AGREEMENTS

17.7 AWARDS AND CERTIFICATIONS

18 SWOT ANALYSIS

19 COMPANY PROFILES

19.1 OCP

19.1.1 COMPANY SNAPSHOT

19.1.2 COMPANY SHARE ANALYSIS

19.1.3 PRODUCT PORTFOLIO

19.1.4 RECENT DEVELOPMENT

19.2 ICL

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENT

19.3 NUTRIEN LTD.

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUS ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENT

19.4 BRENNTAG SE

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIS

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 MERCK KGAA

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUS ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENT

19.6 JORDAN PHOSPHATE MINES COMPANY (PLC).

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUS ANALYSIS

19.6.3 PRODUCT PORTFOLIO

19.6.4 RECENT DEVELOPMENT

19.7 ARKEMA

19.7.1 COMPANY SNAPSHOT

19.7.2 REVENUE ANALYSIS

19.7.3 PRODUCT PORTFOLIO

19.7.4 RECENT DEVELOPMENT

19.8 CLARIANT AG

19.8.1 COMPANY SNAPSHOT

19.8.2 REVENUS ANALYSIS

19.8.3 PRODUCT PORTFOLIO

19.8.4 RECENT DEVELOPMENT

19.9 INNOPHOS

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENT

19.1 J.R. SIMPLOT COMPANY.

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENT

19.11 PRAYON S.A.

19.11.1 COMPANY SNAPSHOT

19.11.2 PRODUCT PORTFOLIO

19.11.3 RECENT DEVELOPMENT

19.12 QUADRA CHEMICALS

19.12.1 COMPANY SNAPSHOT

19.12.2 PRODUCT PORTFOLIO

19.12.3 RECENT DEVELOPMENT

19.13 SOLVAY

19.13.1 COMPANY SNAPSHOT

19.13.2 REVENUS ANALYSIS

19.13.3 PRODUCT PORTFOLIO

19.13.4 RECENT DEVELOPMENT

19.14 SPECTRUM CHEMICAL

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENT

19.15 YPH

19.15.1 COMPANY SNAPSHOT

19.15.2 PRODUCT PORTFOLIO

19.15.3 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

表格列表

TABLE 1 IMPORT DATA OF PRODUCT: 2809 DIPHOSPHORUS PENTAOXIDE; PHOSPHORIC ACID; POLYPHOSPHORIC ACIDS, WHETHER OR NOT CHEMICALLY DEFINED

TABLE 2 EXPORT DATA OF PRODUCT: 2809 DIPHOSPHORUS PENTAOXIDE; PHOSPHORIC ACID; POLYPHOSPHORIC ACIDS, WHETHER OR NOT CHEMICALLY DEFINED

TABLE 3 WORLD PRODUCTION/SUPPLY OF PHOSPHORIC ACID (2015 – 2020)

TABLE 4 WORLD CONSUMPTION OF PHOSPHORIC ACID (2019 – 2022)

TABLE 5 REGULATORY FRAMEWORK

TABLE 6 AVERAGE PRICE OF PHOSPHORIC ACID (2020-2022)

TABLE 7 NORTH AMERICA PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (USD MILLION)

TABLE 8 NORTH AMERICA PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (TONS)

TABLE 9 NORTH AMERICA WET PROCESS IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 10 NORTH AMERICA THERMAL PROCESS IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 11 NORTH AMERICA PHOSPHORIC ACID MARKET, BY GRADE, 2019-2028 (USD MILLION)

TABLE 12 NORTH AMERICA TECHNICAL GRADE IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 13 NORTH AMERICA FOOD GRADE IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 14 NORTH AMERICA FEED GRADE IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 15 NORTH AMERICA PHOSPHORIC ACID MARKET, BY FORM, 2019-2028 (USD MILLION)

TABLE 16 NORTH AMERICA LIQUID IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 17 NORTH AMERICA SOLID (CRYSTAL SOLID) IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 18 NORTH AMERICA PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 19 NORTH AMERICA AGRICULTURE FERTILIZERS IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 20 NORTH AMERICA FOOD & BEVERAGES IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 21 NORTH AMERICA FOOD & BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 22 NORTH AMERICA BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 23 NORTH AMERICA DAIRY PRODUCT IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 24 NORTH AMERICA ANIMAL FEED IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 25 NORTH AMERICA CHEMICAL MANUFACTURING IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 26 NORTH AMERICA CHEMICAL MANUFACTURING IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 27 NORTH AMERICA PHARMACEUTICAL IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 28 NORTH AMERICA PERSONAL CARE IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 29 NORTH AMERICA PERSONAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 30 NORTH AMERICA MINING IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 31 NORTH AMERICA CLEANING AGENTS IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 32 NORTH AMERICA CLEANING AGENTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 33 NORTH AMERICA ORAL & DENTAL CARE IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 34 NORTH AMERICA ORAL & DENTAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 35 NORTH AMERICA WATER TREATMENT IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 36 NORTH AMERICA SEMICONDUCTORS IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 37 NORTH AMERICA LEATHER & TEXTILE IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 38 NORTH AMERICA CONSTRUCTION IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 39 NORTH AMERICA METALLURGY IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 40 NORTH AMERICA CERAMIC & REFRACTORIES IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 41 NORTH AMERICA OTHERS IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 42 NORTH AMERICA PHOSPHORIC ACID MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 43 NORTH AMERICA PHOSPHORIC ACID MARKET, BY COUNTRY, 2019-2028 (THOUSAND METRIC TONS)

TABLE 44 NORTH AMERICA PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (USD MILLION)

TABLE 45 NORTH AMERICA PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (THOUSAND METRIC TONS)

TABLE 46 NORTH AMERICA PHOSPHORIC ACID MARKET, BY GRADE, 2019-2028 (USD MILLION)

TABLE 47 NORTH AMERICA PHOSPHORIC ACID MARKET, BY FORM, 2019-2028 (USD MILLION)

TABLE 48 NORTH AMERICA PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 49 NORTH AMERICA FOOD & BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 50 NORTH AMERICA DAIRY PRODUCTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 51 NORTH AMERICA BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 52 NORTH AMERICA PERSONAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 53 NORTH AMERICA CHEMICAL MANUFACTURING IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 54 NORTH AMERICA CLEANING AGENTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 55 NORTH AMERICA ORAL & DENTAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 56 U.S. PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (USD MILLION)

TABLE 57 U.S. PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (THOUSAND METRIC TONS)

TABLE 58 U.S. PHOSPHORIC ACID MARKET, BY GRADE, 2019-2028 (USD MILLION)

TABLE 59 U.S. PHOSPHORIC ACID MARKET, BY FORM, 2019-2028 (USD MILLION)

TABLE 60 U.S. PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 61 U.S. FOOD & BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 62 U.S. DAIRY PRODUCTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 63 U.S. BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 64 U.S. PERSONAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 65 U.S. CHEMICAL MANUFACTURING IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 66 U.S. CLEANING AGENTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 67 U.S. ORAL & DENTAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 68 CANADA PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (USD MILLION)

TABLE 69 CANADA PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (THOUSAND METRIC TONS)

TABLE 70 CANADA PHOSPHORIC ACID MARKET, BY GRADE, 2019-2028 (USD MILLION)

TABLE 71 CANADA PHOSPHORIC ACID MARKET, BY FORM, 2019-2028 (USD MILLION)

TABLE 72 CANADA PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 73 CANADA FOOD & BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 74 CANADA DAIRY PRODUCTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 75 CANADA BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 76 CANADA PERSONAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 77 CANADA CHEMICAL MANUFACTURING IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 78 CANADA CLEANING AGENTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 79 CANADA ORAL & DENTAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 80 MEXICO PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (USD MILLION)

TABLE 81 MEXICO PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (THOUSAND METRIC TONS)

TABLE 82 MEXICO PHOSPHORIC ACID MARKET, BY GRADE, 2019-2028 (USD MILLION)

TABLE 83 MEXICO PHOSPHORIC ACID MARKET, BY FORM, 2019-2028 (USD MILLION)

TABLE 84 MEXICO PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 85 MEXICO FOOD & BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 86 MEXICO DAIRY PRODUCTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 87 MEXICO BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 88 MEXICO PERSONAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 89 MEXICO CHEMICAL MANUFACTURING IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 90 MEXICO CLEANING AGENTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 91 MEXICO ORAL & DENTAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

图片列表

FIGURE 1 NORTH AMERICA PHOSPHORIC ACID MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PHOSPHORIC ACID MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PHOSPHORIC ACID MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PHOSPHORIC ACID MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PHOSPHORIC ACID MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PHOSPHORIC ACID MARKET: PRODUCT LIFELINE CURVE

FIGURE 7 NORTH AMERICA PHOSPHORIC ACID MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA PHOSPHORIC ACID MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA PHOSPHORIC ACID MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA PHOSPHORIC ACID MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 NORTH AMERICA PHOSPHORIC ACID MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 12 NORTH AMERICA PHOSPHORIC ACID: THE MARKET CHALLENGE MATRIX

FIGURE 13 NORTH AMERICA PHOSPHORIC ACID MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC REGION IS EXPECTED TO DOMINATE THE NORTH AMERICA PHOSPHORIC ACID MARKET AND GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 15 CONSIDERABLE USE OF PHOSPHORIC ACID FOR THE PRODUCTION OF PHOSPHATE FERTILIZERSIS DRIVING THE GROWTH OF THE NORTH AMERICA PHOSPHORIC ACID MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 16 WET PROCESS SUB-SEGMENT IN PROCESS TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PHOSPHORIC ACID MARKET IN 2021 & 2028

FIGURE 17 FIG: AVERAGE PRICE OF PHOSPHATE ROCK FROM FEB 2021-SEPT-2021 (PER METRIC TON)

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF NORTH AMERICA PHOSPHORIC ACID MARKET

FIGURE 19 NORTH AMERICA PHOSPHORIC ACID MARKET: BY PROCESS TYPE, 2020

FIGURE 20 NORTH AMERICA PHOSPHORIC ACID MARKET: BY GRADE, 2020

FIGURE 21 NORTH AMERICA PHOSPHORIC ACID MARKET: BY FORM, 2020

FIGURE 22 NORTH AMERICA PHOSPHORIC ACID MARKET: BY APPLICATION, 2020

FIGURE 23 NORTH AMERICA PHOSPHORIC ACID MARKET: SNAPSHOT (2020)

FIGURE 24 NORTH AMERICA PHOSPHORIC ACID MARKET: BY COUNTRY (2020)

FIGURE 25 NORTH AMERICA PHOSPHORIC ACID MARKET: BY COUNTRY (2021 & 2028)

FIGURE 26 NORTH AMERICA PHOSPHORIC ACID MARKET: BY COUNTRY (2020 & 2028)

FIGURE 27 NORTH AMERICA PHOSPHORIC ACID MARKET: BY PROCESS TYPE (2021 & 2028)

FIGURE 28 NORTH AMERICA PHOSPHORIC ACID MARKET: COMPANY SHARE 2020 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。