北美网络测试实验室自动化市场,按组件(硬件、软件、服务)、网络类型(物理网络、虚拟网络、混合网络)、测试类型(功能测试、回归测试、性能测试)、部署模式(云、本地、混合)、最终用户(企业垂直、服务提供商)、组织规模(大型企业、中小型企业)、自动化类型(模块化自动化、全实验室自动化)划分 - 行业趋势和预测至 2029 年

市场分析和规模

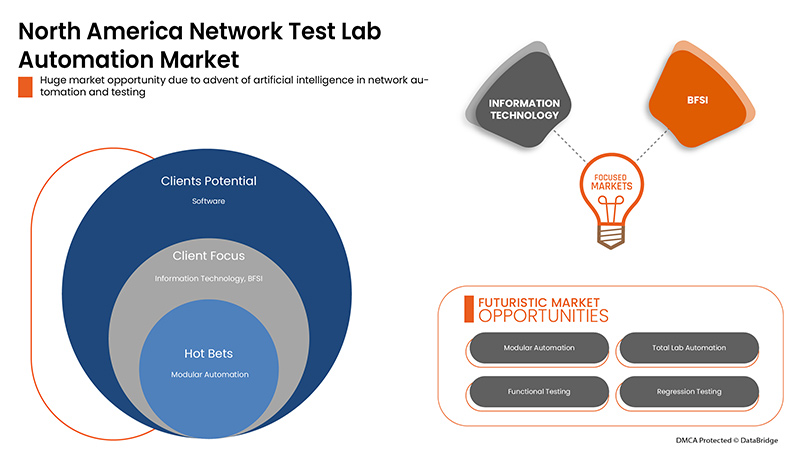

随着行业和企业加速数字化转型计划,新产品和技术的周期越来越短。为了确保在现有运营环境中成功引入新技术,拥有适当的资源来广泛测试和验证设备、产品或解决方案的真实可靠性、性能和互操作性至关重要。由于在模拟环境中进行测试会带来重大的未来风险,大多数企业在建立实验室基础设施和专业知识方面投入了大量资金,或者交由网络测试实验室自动化服务提供商进行测试。由于这些来自行业和企业的新技术和产品比以前更加复杂,企业在网络、测试、监控和自动化方面面临技能差距,因此服务提供商代表企业进行测试。服务提供商可能会对拟议的产品使用功能、性能或回归等测试类型,并在测试中借助各种工具。人工智能的出现及其与物联网和 5G 的融合将提高所有行业数字产品的速度,并且必须在发布前进行测试。这将使北美网络测试实验室自动化市场在未来蓬勃发展。

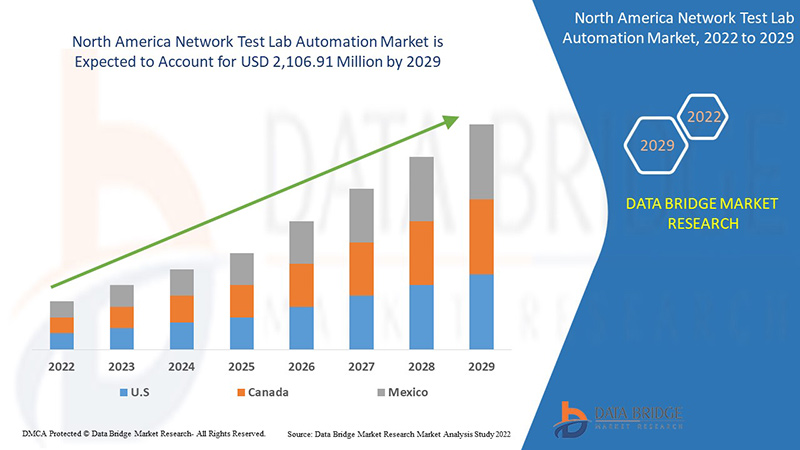

Data Bridge Market Research 分析,北美网络测试实验室自动化市场预计到 2029 年将达到 21.0691 亿美元的价值。网络测试实验室自动化市场报告还深入涵盖了定价分析、专利分析和技术进步。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020 |

|

定量单位 |

收入(百万美元) |

|

涵盖的领域 |

按组件(硬件、软件、服务)、网络类型(物理网络、虚拟网络、混合网络)、测试类型(功能测试、回归测试、性能测试)、部署模式(云、本地、混合)、最终用户(企业垂直、服务提供商)、组织规模(大型企业、中小型企业)、自动化类型(模块化自动化、全实验室自动化) |

|

覆盖国家 |

北美的美国、加拿大和墨西哥 |

|

涵盖的市场参与者 |

Qualisystems Ltd.、Spirent Communications、Lepton、Pluribus Networks、Polatis、Calient Technologies、Fiber Smart Networks、Fiber Mountain、思科、Sedona Systems、Anuta Networks、Versa Networks、Netbrain、Juniper Networks、Netscout、Keysight Technologies、ZPE Systems, Inc.、Bell Integrator、Danaher、Great Software Laboratory、Accuver、Wipro、Appviewx、Kentik、HCL Technologies。 |

市场定义

网络自动化是指网络中虚拟和物理设备的配置、操作、部署、测试和管理自动化的过程。随着日常功能和网络测试以及重复性程序的自动处理和控制,网络服务的可用性将提高。任何网络都可以从网络自动化中受益。企业、服务提供商和数据中心可以使用基于软件和硬件的解决方案来实现网络自动化,从而降低运营成本、减少人为错误并提高生产力。

网络测试实验室自动化市场动态

本节旨在了解市场驱动因素、优势、机遇、限制和挑战。以下内容将详细讨论所有这些内容:

驱动程序

- 对自动化和无缝客户体验解决方案的需求不断增长

如今,研究和病理实验室在过去二十年中经历了重大发展。实验室对技术先进的自动化仪器和实验室系统的需求日益增长。包括实验室自动化在内的多项创新都源于改善诊断、药物研发和研究的愿望。

借助实验室自动化,不同的实验室科学家和专业人员能够在研究和报告生成中实现下一代速度、一致性和精度。此外,实验室自动化的进步带来了流程的标准化,有助于减少错误数量。因此,借助自动化技术对实时结果的评估越来越多,诊断案例也越来越多,导致对先进软件和尖端自动化系统的需求巨大。

- 基于云的存储选项在各种实验室应用中的渗透

据报道,在过去的几十年中,90% 的企业选择了基于云的解决方案,而不是传统的计算和数据存储方法,以获得更好的洞察力、更轻松的协作以及降低组织成本等好处。然而,云使用量的增加意味着企业还需要更有效地管理其云基础设施,以提高运营效率并降低复杂性。云自动化是指使用软件和流程来自动配置和管理云计算工作负载和服务,例如虚拟网络创建、虚拟机部署、负载平衡和性能监控。使用云自动化,IT 管理员可以减少或消除手动流程,以降低管理开销并加快资源交付速度。

机会

- 数字化转型对网络自动化和测试的需求日益增长

数字化转型是利用数字技术改造现有的传统和非数字业务流程和服务,或创建新流程和服务以满足不断变化的市场和客户期望的过程。因此,它彻底改变了企业的管理和运营方式,以及向客户提供价值的方式。数字化转型很重要,因为它使组织能够适应不断变化的行业并不断改进其运营。每个数字化转型计划都有自己的特定目标。任何数字化转型的主要目的都是改进当前流程。但是,组织的数字化转型需要广泛的规划、适当的资源管理、产品和软件的测试和开发,以及巨额的资本投入。如果不这样做,实施软件和业务模型可能需要很长时间,从而导致组织的资本和时间损失。根据贝恩公司的一项研究,全球只有 8% 的公司能够通过对数字技术的投资实现其目标业务成果。这使得网络自动化和测试的集成对于成功的数字化转型至关重要。

限制/挑战

- 实验室自动化系统复杂性增加,从而增加了停机风险

网络实验室自动化流程已在全球范围内实施,以减少对人工的需求,并通过实施自动化机器流程来执行重复性任务。但是,系统越复杂,系统故障对实验室功能造成严重后果的风险就越大。许多关键系统故障,尤其是涉及装配线的故障,需要恢复手动程序来管理样本(即手动分类、离心)。虽然在大多数实验室中,资源是开发和测试的限制因素。管理实验室和协调时间表的传统方法是使用配线架并手动更改连接。但是,这种方法不可扩展,并且在许多情况下效率低下。

- 缺乏熟练劳动力和经验丰富的专业知识

人工智能 (AI)、机器学习 (ML)、物联网 (IoT) 和自动化都是新技术,它们有可能在未来十年内改变网络测试行业。随着 COVID-19 疫情改变技术驱动的格局,这些技术趋势变得更加重要。随着全球疫情改变劳动力动态,对尖端软件、网络和移动应用程序的依赖大幅增加。为了满足这种不断增长的需求,企业转向技术,以增加向最终用户发布功能齐全、功能丰富且完美的产品和软件的需求。因此,测试自动化带来了广泛的测试覆盖范围、科学的测试准确性、简化的测试操作、更低的成本和更高的资源效率。这导致该行业需要大量熟练的劳动力来满足不断增长的需求。熟练工人是指任何拥有特殊技能、培训或知识并将其应用于工作的工人。网络测试行业所需的技能可能包括精通各种编程语言、掌握领先的自动化测试工具(无代码工具也行)、应具有手动测试经验、了解测试管理工具并了解业务需求。这一要求缩小了该行业对熟练劳动力的需求,此外,由于该行业合格劳动力较少,对这一职位的需求正在增加。

COVID-19 后对网络测试实验室自动化市场的影响

由于远程工作和云基础设施的快速采用,COVID-19 对网络测试实验室自动化市场产生了积极影响。

COVID-19 疫情在一定程度上对网络测试实验室自动化市场产生了积极影响。企业越来越多地采用和利用人工智能和机器学习,这有助于市场在疫情期间和疫情后实现增长。此外,在 COVID-19 疫情后市场开放后,增长速度很快,预计由于对工业 4.0 和自动化技术的需求增加,该行业将实现相当大的增长。

解决方案提供商正在制定各种战略决策,以在 COVID-19 后实现复苏。参与者正在进行多项研发活动,以改进网络测试实验室自动化所涉及的技术。借助此,这些公司将把先进的技术推向市场。此外,政府对使用自动化技术的举措也推动了市场的增长

近期发展

- 2022 年 4 月,是德科技公司宣布其自动化现场到实验室设备测试平台解决方案已被小米选中。小米选择了是德科技的测试工具来验证 5G 设备在各种网络信令和无线信道情况下的性能。为了开发先进的 5G 测试解决方案,是德科技有效地结合了实验室和现场测试能力。此次合作将增强客户组合和公司影响力。

- 2022 年 1 月,思博伦收购了 octoScope,以扩展 WiFi 测试能力。octoScope 的测试解决方案包括在模拟真实环境中进行的自动化 Wi-Fi 和 5G 测试,包括最新的 WiFi 6 和 WiFi 6E 技术。此次收购将有助于无线网络测试解决方案公司扩展 WiFi 测试能力,并增强全球服务和品牌重组。

北美网络测试实验室自动化市场范围

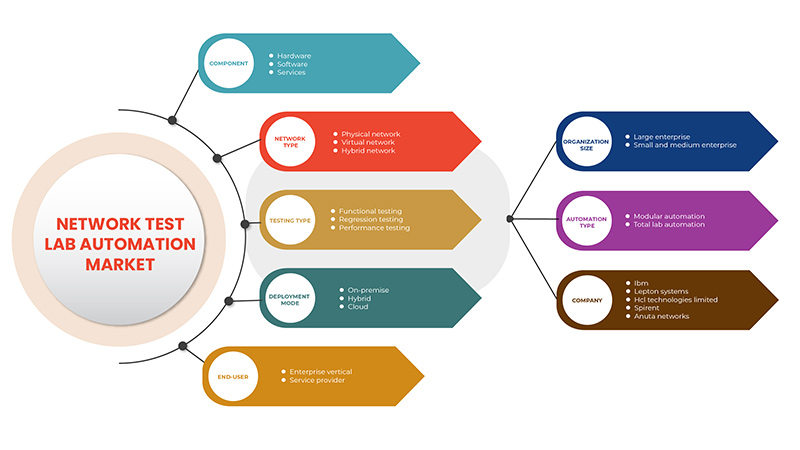

网络测试实验室自动化市场根据组件、网络类型、测试类型、部署模式、最终用户、组织规模、自动化类型进行细分。这些细分市场之间的增长将帮助您分析行业中增长微弱的细分市场,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

成分

- 硬件

- 软件

- 服务

根据组成部分,北美网络测试实验室自动化市场分为硬件、软件、服务。

网络类型

- 物理网络

- 虚拟网络

- 混合网络

根据网络类型,北美网络测试实验室自动化市场细分为物理网络、虚拟网络、混合网络。

测试类型

- 功能测试

- 回归测试

- 性能测试

根据测试类型,北美网络测试实验室自动化市场细分为功能测试、回归测试、性能测试。

部署模式

- 云

- 杂交种

- 本地部署

On the basis of deployment mode, the North America network test lab automation market is segmented into cloud, hybrid, on-premise.

End-User

- Enterprise Vertical

- Service Provider

On the basis of end-user, the North America network test lab automation market has been segmented into enterprise vertical, service provider.

Organization Size

- Large Enterprise

- Small & Medium Enterprise

On the basis of organization size, the North America network test lab automation market is segmented into large enterprise, small & medium enterprise.

Automation Type

- Modular Automation

- Total Lab Automation

On the basis of automation type, the North America network test lab automation market is segmented into modular automation, total lab automation.

Network Test Lab Automation Market Regional Analysis/Insights

The network test lab automation market is analysed and market size insights and trends are provided by country, component, network type, testing type, deployment mode, end-user, organization size and automation type as referenced above.

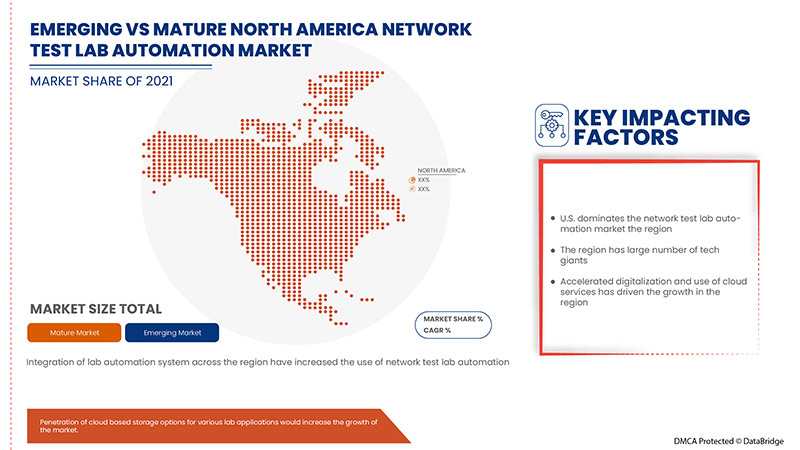

The countries covered in the network test lab automation market report are U.S., Canada and Mexico in North America. U.S. dominates in the North America region as it is home to many tech giants of the world, which are in constant need for testing their systems, applications and updates.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Network Test Lab Automation Market Share Analysis

The network test lab automation market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to network test lab automation market.

网络测试实验室自动化市场的一些主要参与者包括:Qualisystems Ltd.、Spirent Communications、Lepton、Pluribus Networks、Polatis、Calient Technologies、Fiber Smart Networks、Fiber Mountain、Cisco、Sedona Systems、Anuta Networks、Versa Networks、Netbrain、Juniper Networks、Netscout、Keysight Technologies、ZPE Systems, Inc.、Bell Integrator、Danaher、Great Software Laboratory、Accuver、Wipro、Appviewx、Kentik、HCL Technologies。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 COMPONENT CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TECHNOLOGICAL TRENDS

4.2 CASE STUDIES

4.2.1 AUTOMATION OF API TESTING FOR NETWORK APPLICATION

4.2.2 CIRCUIT SWITCHED CORE NETWORK AUTOMATION

4.3 VALUE CHAIN ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN DEMAND FOR AUTOMATION AND SOLUTION FOR SEAMLESS CUSTOMER EXPERIENCE

5.1.2 INTEGRATION OF LAB AUTOMATION SYSTEM ACROSS THE REGION

5.1.3 PENETRATION OF CLOUD BASED STORAGE OPTIONS FOR VARIOUS LAB APPLICATIONS

5.1.4 HIGHER ACCURACY AND QUALITY OF TESTING ASSOCIATED WITH NETWORK TEST LAB AUTOMATION

5.2 RESTRAINTS

5.2.1 HIGHER COST FOR IMPLEMENTATION OF LAB AUTOMATION SYSTEMS

5.2.2 RISE IN COMPLEXITY OF LAB AUTOMATION SYSTEMS AND THEREBY INCREASING THE RISK OF DOWNTIME

5.3 OPPORTUNITIES

5.3.1 GROWING NEED OF NETWORK AUTOMATION & TESTING FOR DIGITAL TRANSFORMATION

5.3.2 INCREASING ADVANCEMENT OF AUTOMATION IN MEDICAL SEGMENT

5.3.3 ADVENT OF ARTIFICIAL INTELLIGENCE IN NETWORK AUTOMATION AND TESTING

5.3.4 INCREASING STRATEGIC PARTNERSHIP AMONG MAJOR MARKET PLAYERS

5.4 CHALLENGES

5.4.1 LACK OF END USER FRIENDLY TOOLS IN TEST LAB AUTOMATION

5.4.2 LACK OF SKILLED WORKFORCE AND EXPERIENCED EXPERTISE

6 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT

6.1 OVERVIEW

6.2 SOFTWARE

6.2.1 TEST AS A SERVICE

6.2.2 NETWORK AUTOMATION TOOLS

6.2.3 TEST LAB AS A SERVICE (LAAS)

6.2.4 INTENT-BASED NETWORKING

6.3 HARDWARE

6.4 SERVICES

6.4.1 PROFESSIONAL SERVICE

6.4.1.1 DEPLOYMENT AND INTEGRATION SERVICES

6.4.1.2 TRAINING AND SUPPORT SERVICES

6.4.1.3 ADVISORY AND CONSULTING SERVICE

6.4.2 MANAGED SERVICE

7 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE

7.1 OVERVIEW

7.2 VIRTUAL NETWORK

7.3 HYBRID NETWORK

7.4 PHYSICAL NETWORK

8 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE

8.1 OVERVIEW

8.2 FUNCTIONAL TESTING

8.3 REGRESSION TESTING

8.4 PERFORMANCE TESTING

9 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE

9.1 OVERVIEW

9.2 CLOUD

9.3 ON-PREMISE

9.4 HYBRID

10 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY END-USER

10.1 OVERVIEW

10.2 ENTERPRISE VERTICAL

10.2.1 INFORMATION TECHNOLOGY

10.2.2 BANKING, FINANCIAL SERVICE AND INSURANCE

10.2.3 MANUFACTURING

10.2.4 HEALTHCARE

10.2.5 EDUCATION

10.2.6 ENERGY AND UTILITIES

10.2.7 OTHERS

10.3 SERVICE PROVIDER

11 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE

11.1 OVERVIEW

11.2 MODULAR AUTOMATION

11.3 TOTAL LAB AUTOMATION

12 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE

12.1 OVERVIEW

12.2 LARGE ENTERPRISE

12.3 SMALL AND MEDIUM ENTERPRISE

13 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 KEYSIGHT TECHNOLOGIES

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 SOLUTION PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 IBM

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 SPIRENT COMMUNICATIONS

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 CISCO SYSTEMS, INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 HCL TECHNOLOGIES LIMITED

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 SOLUTIONS PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ACCUVER

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 ANUTA NETWORKS PVT. LTD.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 APPVIEWX

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 BELL INTEGRATOR

16.9.1 COMPANY SNAPSHOT

16.9.2 SERVICE PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 CALIENT TECHNOLOGIES

16.10.1 COMPANY SNAPSHOT

16.10.2 SOLUTION PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 DANAHER

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 BRAND PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 FIBER MOUNTAIN

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 FIBER SMART NETWORKS INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 GREAT SOFTWARE LABORATORY

16.14.1 COMPANY SNAPHSOT

16.14.2 SOLUTION PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 JUNIPER NETWORKS, INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 KENTIK

16.16.1 COMPANY SNAPSHOT

16.16.2 SOLUTION PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 LEPTON SYSTEMS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 NETBRAIN TECHNOLOGIES, INC.

16.18.1 COMPANY SNAPSHOT

16.18.2 SERVICE PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 NETSCOUT

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

16.2 PHOENIX DATACOM LIMITED

16.20.1 COMPANY SNAPSHOT

16.20.2 SOLUTION PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 PLURIBUS NETWORKS

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 POLATIS, INC.

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

16.23 QUALISYSTEMS LTD

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

16.24 SEGRON AUTOMATION S.R.O

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 VERSA NETWORKS

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

16.26 WIPRO LIMITED

16.26.1 COMPANY SNAPSHOT

16.26.2 REVENUE ANALYSIS

16.26.3 PRODUCT PORTFOLIO

16.26.4 RECENT DEVELOPMENTS

16.27 ZPE SYSTEMS, INC.

16.27.1 COMPANY SNAPSHOT

16.27.2 SOLUTION PORTFOLIO

16.27.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

表格列表

TABLE 1 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 3 NORTH AMERICA SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA HARDWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 6 NORTH AMERICA SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA PROFESSIONAL SERVICE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA VIRTUAL NETWORK IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA HYBRID NETWORK IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA PHYSICAL NETWORK IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA FUNCTIONAL TESTING IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA REGRESSION TESTING IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA PERFORMANCE TESTING IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA CLOUD IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA ON-PREMISE IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA HYBRID IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA SERVICE PROVIDER IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA MODULAR AUTOMATION IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA TOTAL LAB AUTOMATION IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA LARGE ENTERPRISE IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA SMALL AND MEDIUM ENTERPRISE IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA PROFESSIONAL SERVICE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 42 U.S. NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 43 U.S. SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 U.S. SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 U.S. PROFESSIONAL SERVICE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 U.S. NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE, 2020-2029 (USD MILLION)

TABLE 47 U.S. NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 48 U.S. NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 49 U.S. NETWORK TEST LAB AUTOMATION MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 50 U.S. ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 U.S. NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 52 U.S. NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 53 CANADA NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 54 CANADA SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 CANADA SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 CANADA PROFESSIONAL SERVICE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 CANADA NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE, 2020-2029 (USD MILLION)

TABLE 58 CANADA NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 59 CANADA NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 60 CANADA NETWORK TEST LAB AUTOMATION MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 61 CANADA ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 CANADA NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 63 CANADA NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 64 MEXICO NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 65 MEXICO SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 MEXICO SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 MEXICO PROFESSIONAL SERVICE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 MEXICO NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE, 2020-2029 (USD MILLION)

TABLE 69 MEXICO NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 70 MEXICO NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 71 MEXICO NETWORK TEST LAB AUTOMATION MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 72 MEXICO ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 MEXICO NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 74 MEXICO NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET : DATA TRIANGULATION

FIGURE 3 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET:REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: SEGMENTATION

FIGURE 11 INTEGRATION OF LAB AUTOMATION ACROSS THE REGION MAGNET IS EXPECTED TO BE KEY DRIVERS THE MARKET FOR NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET IN THE FORECAST PERIOD OF 2021 TO 2029

FIGURE 12 SOFTWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET IN 2022 TO 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES & CHALLENGES OF NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET

FIGURE 14 TYPE OF CLOUD COMPUTING SERVICE, BY SERVICE MODEL, 2021 (EUROPE)

FIGURE 15 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: BY COMPONENT, 2021

FIGURE 16 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: BY NETWORK TYPE, 2021

FIGURE 17 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: BY TESTING TYPE, 2021

FIGURE 18 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: BY DEPLOYMENT MODE, 2021

FIGURE 19 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: BY END-USER, 2021

FIGURE 20 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: BY AUTOMATION TYPE, 2021

FIGURE 21 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 22 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: SNAPSHOT (2021)

FIGURE 23 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: BY COUNTRY (2021)

FIGURE 24 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: BY COMPONENT (2022-2029)

FIGURE 27 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。