North America Mainframe Market

市场规模(十亿美元)

CAGR :

%

USD

11.60 Billion

USD

16.52 Billion

2024

2032

USD

11.60 Billion

USD

16.52 Billion

2024

2032

| 2025 –2032 | |

| USD 11.60 Billion | |

| USD 16.52 Billion | |

|

|

|

|

北美大型主機市場細分,按系統(大型主機和中型系統)、組件(硬體、服務和軟體)、組織規模(大型企業和中小型企業 (SME))、最終用途(金融服務、IT 和電信、醫療保健、公共部門、汽車和製造業、零售和消費包裝商品 (CPG)、旅遊、媒體和娛樂等)– 行業趨勢和預測至 2032 年

大型主機市場規模

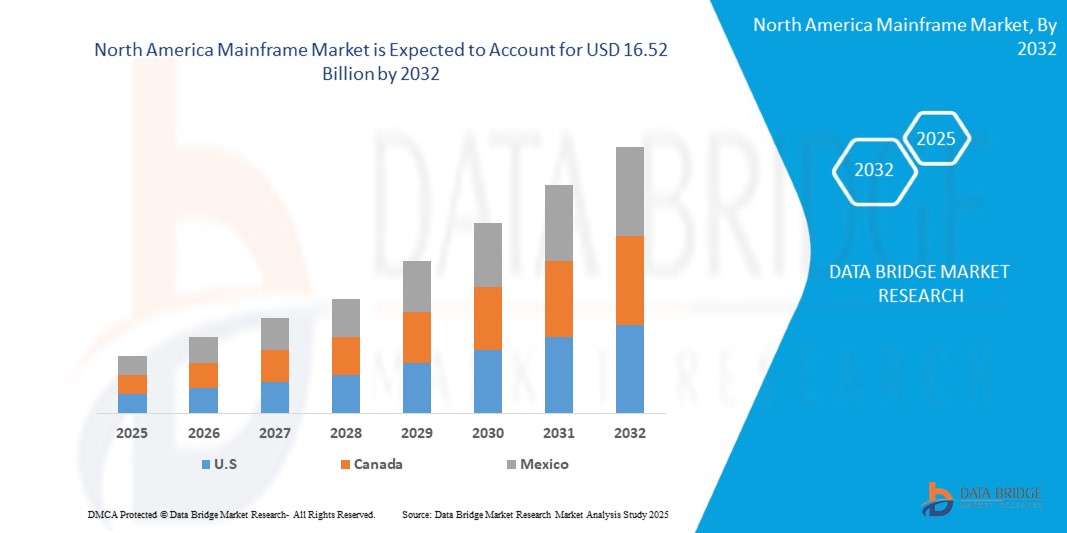

- 2024 年北美大型主機市場價值為116 億美元,預計到 2032 年將達到 165.2 億美元

- 在 2025 年至 2032 年的預測期內,市場可能會以4.5% 的複合年增長率成長,主要原因是各行業數位化進程加快,以及網路安全威脅和資料外洩事件增多

- 這一成長受到資料處理需求成長、雲端整合、網路安全需求、人工智慧採用以及企業數位轉型不斷加強等因素的推動。

北美大型主機市場分析

- 大型主機是各行各業使用的關鍵運算系統,為複雜的操作提供高效能處理、安全性和可靠性。它們廣泛應用於銀行、金融服務和保險 (BFSI)、醫療保健和政府部門。

- 數位化趨勢的不斷增長、日益嚴重的網路安全威脅以及對高速資料處理的需求極大地推動了大型主機的需求。 BFSI 等行業依賴大型主機進行交易處理、核心銀行系統、風險管理和法規遵循。

- 北美地區是大型主機的主要市場之一,這得益於強大的企業 IT 基礎設施、不斷增加的網路安全投資以及金融機構和政府運營的高度採用

- 例如,美國主要銀行和醫療保健提供者嚴重依賴大型主機進行即時交易處理和安全資料存儲,以確保不間斷的營運和法規遵循

- 在北美,大型主機是最重要的運算系統之一,以其卓越的安全功能而聞名,包括加密、存取控制、安全監控和高可用性,使其成為金融、醫療保健和政府部門關鍵任務應用的首選

報告範圍和市場細分

|

屬性 |

北美大型主機關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

北美洲

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括深入的專家分析、定價分析、品牌份額分析、消費者調查、人口統計分析、供應鏈分析、價值鏈分析、原材料/消耗品概述、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

北美大型主機市場趨勢

“對高效能運算的需求不斷增長”

- 數位時代資料的爆炸性成長推動了對強大運算系統的需求不斷增長,需要能夠處理和分析大量複雜資料集的 HPC 解決方案。

- 人工智慧 (AI) 和機器學習 (ML) 的興起極大地促進了對 HPC 的需求不斷增長,因為 AI 和 ML 演算法需要巨大的運算能力來有效地訓練和優化模型。

- 例如,2023年4月,TechDay發表了一篇文章,指出阿聯酋政府已開始將數位轉型目標付諸實踐。其中許多目標被稱為「智慧杜拜」和「智慧阿布達比」。這些活動預計將增加對高效能運算的需求。

- 除了科學應用之外,HPC 正在徹底改變商業分析,使公司能夠處理大量數據以優化供應鏈、預測客戶行為和識別市場趨勢,從而做出更明智的決策並增強競爭優勢。

北美大型主機市場動態

驅動程式

“加速跨行業數位化”

- 由於組織需要安全可靠的運算基礎設施,銀行、金融服務和保險 (BFSI) 以及醫療保健行業的數位化趨勢日益增強,極大地推動了對大型主機的需求。

- 大型主機在大容量交易處理應用中發揮關鍵作用,包括 ATM 交易、信用卡處理和股票交易,其中可擴展性、可靠性和安全性至關重要。

- 在銀行業,大型主機是核心銀行系統的骨幹,支援客戶帳戶管理、貸款處理、支付處理等關鍵功能,確保金融營運的無縫銜接。

- 醫療保健產業越來越依賴大型主機來處理電子病歷 (EMR),為管理大量敏感病患資料提供必要的處理能力、安全性和可用性。

- 隨著金融機構和醫療保健提供者不斷採用數位解決方案,對大型主機等高效能運算系統的需求日益增長,以確保安全、高效和不間斷的運作。

例如,

- 根據 IBM 的一份報告,大型主機用於自動櫃員機 (ATM) 與客戶的銀行帳戶進行互動。企業將大型主機用於依賴可擴展性和可靠性的應用程式。例如,銀行機構可以使用大型主機託管其客戶帳戶資料庫,並且可以從全球數千個 ATM 位置提交交易。報告還提到,在銀行、金融、醫療保健、保險、公用事業、政府以及眾多其他公共和私營企業中,大型電腦仍然是現代商業的基礎。

- 2020年12月,Maintec Technologies 發表了一篇文章,指出在組織內部傳遞病患記錄的需求引發了對標準化病患電子健康記錄 (EHR) 的需求,這需要大型機式的更大儲存空間以及 Linux 式的 Web 標準。文章也提到,大型主機具有很高的安全性和合規性。醫療保健需要最安全的系統來保護這些資料。大型主機享有最安全平台的美譽。大型主機伺服器和軟體現在都具有普遍的資料加密功能。這些安全措施有助於醫療保健組織保護其患者的資料和隱私。

機會

“大型主機現代化日益受到關注”

- 混合雲整合正在改變大型主機市場,使企業能夠將內部部署系統與雲端環境無縫連接,同時保持高效能、安全性和可擴展性。

- 越來越多的組織採用混合雲架構來優化工作負載、管理大量資料並支援關鍵任務應用程序,以確保高效、不間斷的運作。

- 大型主機在即時資料處理和安全交易中發揮著至關重要的作用,對於銀行、保險和零售等資料安全和營運連續性是重中之重的行業來說,大型主機至關重要。

- 混合雲解決方案使組織能夠在內部保留敏感數據,同時利用雲端運算的成本效益和靈活性,增強 IT 基礎架構的現代化。

限制/挑戰

“來自雲端平台的激烈競爭”

- 儘管雲端運算興起,大型主機仍然是 IT 基礎架構的重要組成部分,具有雲端解決方案無法完全取代的獨特優勢。

- 雲端運算比大型主機技術具有更大的靈活性,可讓組織根據需求擴大或縮小資源規模,從而提高效率並降低成本。

- 對於特定的工作負載,雲端運算可能是更具成本效益的選擇,因為按需付費的定價模式使組織只需為其使用的資源付費。

- 雲端運算增強了可訪問性,使北美地區的組織能夠從世界任何地方存取運算資源,從而促進遠端操作。

- 雲端提供者管理基礎設施維護,減輕組織負擔,釋放時間和資源用於核心業務功能

例如,

- 2022 年 9 月,InfoWorld 發表了一篇文章,表示聯邦快遞宣布,到 2024 年,它將關閉其資料中心及其附帶的大型主機,並「全面」轉向雲端(如果延續過去的購買習慣,很可能是微軟 Azure)

- 2022年3月,富士通發表文章稱,該公司將在未來九年內停止生產大型主機解決方案。富士通最近透露,其大型主機將於2031年4月停止銷售,並在五年後停止支援。公司管理層表示,富士通仍然對大型主機市場非常感興趣,其2024年的新機型仍在規劃中,並且正在「將其大型主機和UNIX伺服器遷移到雲端,逐步增強其現有業務系統,以優化最終用戶的體驗」。這一進展表明,企業正在對大型主機解決方案失去信心。

- 2021 年 12 月,Informa USA Inc. 發布了一份關於大型主機的報告。報告中提到,AWS 宣布了一項新的託管服務,使企業能夠將大型主機工作負載遷移到雲端。企業正在設法將大型主機整合到雲端

大型主機市場範圍

市場根據系統、組件、組織規模和最終用途進行細分。

|

分割 |

細分 |

|

按系統 |

|

|

按組件 |

|

|

按組織規模 |

|

|

按最終用途

|

|

大型主機市場區域分析

“美國是大型主機市場的主導地區”

- 美國引領大型主機市場,這得益於主要行業參與者的強大影響力、先進 IT 基礎設施的早期採用以及對數位轉型的大量投資

- 美國佔據了主要份額,這得益於對安全、高效能運算的高需求、雲端整合的不斷增加以及人工智慧和機器學習應用的日益普及

- 由於銀行、金融和政府部門的組織優先考慮安全可靠的運算解決方案,監管合規性和網路安全問題進一步增強了市場

- 此外,對大型主機現代化的投資不斷增加,以及技術的持續進步,促進了該地區關鍵產業對大型主機的採用率不斷提高

“美國預計將實現最高成長率”

- 美國大型主機市場預計將出現顯著成長,這得益於早期採用先進的 IT 基礎設施、數位轉型投資的增加以及對安全運算解決方案的強勁需求

- 美國憑藉其領先的IT公司以及人工智慧和雲端整合領域的持續進步,仍然是大型主機市場的主導者。該國繼續推動高效能運算和資料安全領域的創新。

大型主機市場佔有率

市場競爭格局按競爭對手提供詳細資料。詳細資訊包括公司概況、公司財務狀況、收入、市場潛力、研發投入、新市場計劃、北美業務、生產基地和設施、生產能力、公司優勢和劣勢、產品發布、產品寬度和廣度以及應用主導地位。以上提供的數據點僅與公司在市場中的重點相關。

市場中主要的市場領導者有:

- IBM公司(美國)

- Unisys(美國)

- 富士通(日本)

- NEC公司(日本)

- BMC Software, Inc.(美國)

- Hitachi Vantara LLC(美國)

- 戴爾公司(美國)

- 博通(美國)

- Atos SE(法國)

- Cognizant(美國)

- DXC科技公司(美國)

- HCL Technologies Limited(印度)

- Tieotoevry(芬蘭)

- 印孚瑟斯有限公司(印度)

- 惠普企業開發有限公司(美國)

北美大型主機市場最新動態

- IBM 將於 2024 年 9 月推出全新 IBM DS8000,旨在增強 IBM Z 大型主機架構的企業級儲存。它提供高可靠性,可用性高達 99.999999%,並透過內建安全功能保護關鍵資料免受網路攻擊。 DS8000 支援下一代工作負載,透過降低延遲和提高大容量交易的吞吐量來提升效能。它還透過先進的 FlashCore 模組將儲存容量翻倍,從而提升資料中心效率。這項創新確保企業能夠有效擴展,同時保持資料彈性,並為關鍵任務工作負載提供敏捷且安全的基礎架構。

- 2024年8月,IBM宣布開發Telum II處理器和Spyre加速器,旨在增強IBM Z大型主機的AI能力。這些創新旨在加速AI工作負載,尤其支援大型語言模型(LLM)和生成式AI。它們將改善記憶體管理、資料處理和運算能力,使企業能夠有效率地處理詐欺偵測和財務風險管理等複雜任務。其優勢包括可擴展、安全且高效能的AI解決方案,可協助企業應對資料密集型挑戰、優化決策並促進創新,同時保持大型主機強大的安全性。

- 2023年8月,IBM 發布了 Watson X Code Assistant for Z,這是一款旨在加速大型主機應用程式現代化的生成式 AI 工具。該開發旨在幫助企業重構 COBOL 程式碼並將其轉換為 Java,從而提高開發人員的工作效率。透過利用一個包含 200 億個參數的大型語言模型,該工具可以自動化和優化程式碼轉換,使企業能夠更快地實現關鍵應用程式的現代化,同時保持效能、安全性和彈性。它還能提升開發人員的技能並加快入職速度,從而彌補技能差距。該解決方案預計將顯著縮短現代化時間,並提高整個企業系統的程式碼品質。

- 2025年2月,Unisys與芝加哥量子交易所(CQE)達成合作,共同推動量子技術應用。此次合作使Unisys能夠接觸到頂尖人才,參與量子創新活動,建立策略聯盟,共同開發行業特定的量子解決方案,並在CQE網路內共享專業知識。

- 2025年1月,Unisys 將芬蘭航空貨運納入其貨運入口網站服務 (CPS) 平台,從而擴展了其北美網路。此次合作增強了芬蘭航空貨運的數位化影響力,簡化了營運流程,並拓展了更廣泛的客戶群。 CPS 為北美航空公司提供了一個值得信賴的多承運商航空貨運預訂門戶,從而提高了營運效率。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTE PRODUCTS

4.2.5 INDUSTRY RIVALRY

4.2.6 CONCLUSION

4.3 COMPANY COMPARATIVE ANALYSIS

4.3.1 IBM CORPORATION

4.3.2 FUJITSU

4.3.3 NEC CORPORATION

4.3.4 UNISYS

4.3.5 BMC SOFTWARE, INC.

4.3.6 CONCLUSION

4.4 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.4.1 INDUSTRY OVERVIEW

4.4.2 MARKET TRENDS & DYNAMICS

4.4.3 FUTURISTIC SCENARIO

4.4.4 CONCLUSION

4.5 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

4.5.1 NORTH AMERICA AND SOUTH AMERICA

4.5.1.1 U.S.

4.5.1.2 CANADA

4.5.1.3 MEXICO, BRAZIL, AND ARGENTINA

4.5.2 EUROPE

4.5.2.1 U.K.

4.5.2.2 GERMANY

4.5.2.3 FRANCE & ITALY

4.5.3 ASIA-PACIFIC

4.5.3.1 CHINA

4.5.3.2 JAPAN

4.5.3.3 INDIA

4.5.3.4 SOUTH KOREA & AUSTRALIA

4.5.4 MIDDLE EAST & AFRICA

4.5.4.1 SAUDI ARABIA & U.A.E.

4.5.4.2 ISRAEL

4.5.4.3 SOUTH AFRICA & EGYPT

4.6 TECHNOLOGY ANALYSIS

4.6.1 MARKET GROWTH AND PROJECTIONS

4.6.1.1 KEY DRIVERS OF MAINFRAME MODERNIZATION

4.6.1.1.1 Cost Efficiency

4.6.1.1.2 Scalability and Performance

4.6.1.1.3 Security and Compliance

4.6.1.1.4 Integration with Emerging Technologies

4.6.1.1.5 Digital Transformation Initiatives

4.6.1.2 INDUSTRY TRENDS

4.6.1.2.1 Cloud Adoption

4.6.1.2.2 Hybrid Environments

4.6.1.2.3 AI and ML Integration

4.6.2 KEY BUSINESS OUTCOMES AND INDUSTRY USE CASES

4.6.2.1 FINANCIAL SERVICES

4.6.2.2 HEALTHCARE

4.6.2.3 RETAIL

4.6.2.4 MANUFACTURING

4.6.2.5 GOVERNMENT

4.6.3 CHALLENGES AND CONSIDERATIONS

4.6.3.1 SKILLS SHORTAGE

4.6.3.2 INTEGRATION COMPLEXITY

4.6.3.3 DOWNTIME RISKS

4.6.3.4 SECURITY CONCERNS

4.6.4 CONCLUSION

5 REGULATORY COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 ACCELERATED DIGITALIZATION ACROSS INDUSTRIES

6.1.2 RISING CYBERSECURITY THREATS AND DATA BREACHES

6.1.3 GROWING DEMAND FOR HIGH-PERFORMANCE COMPUTING

6.1.4 EXPANDING NEED FOR LARGE-SCALE TRANSACTION PROCESSING AND REAL-TIME ANALYTICS

6.2 RESTRAINS

6.2.1 INTENSE COMPETITION FROM CLOUD-BASED PLATFORMS

6.2.2 HIGH COSTS ASSOCIATED WITH MAINFRAME INSTALLATION

6.3 OPPORTUNITIES

6.3.1 GROWING FOCUS ON MAINFRAME MODERNIZATION

6.3.2 EXPANDING ADOPTION OF HYBRID CLOUD SOLUTIONS

6.3.3 RISING DEMAND FOR ADVANCED SECURITY SOLUTIONS

6.4 CHALLENGES

6.4.1 ENSURING SECURITY AND COMPLIANCE IN DYNAMIC, INTERCONNECTED HYBRID ECOSYSTEMS AMID EVOLVING NORTH AMERICA REGULATIONS

6.4.2 SHORTAGE OF SKILLED MAINFRAME PROFESSIONALS

7 NORTH AMERICA MAINFRAME MARKET, BY SYSTEMS

7.1 OVERVIEW

7.2 MAINFRAMES

7.3 MIDRANGE SYSTEMS

8 NORTH AMERICA MAINFRAME MARKET, BY COMPONENT

8.1 OVERVIEW

8.2 HARDWARE

8.3 SERVICES

8.4 SOFTWARE

9 NORTH AMERICA MAINFRAME MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISES

9.3 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

10 NORTH AMERICA MAINFRAME MARKET, BY END USE

10.1 OVERVIEW

10.2 FINANCIAL SERVICES

10.3 IT & TELECOMMUNICATIONS

10.4 HEALTHCARE

10.5 PUBLIC SECTOR

10.6 AUTOMOTIVE AND MANUFACTURING

10.7 RETAIL AND CONSUMER PACKAGED GOODS (CPG)

10.8 TRAVEL, MEDIA, AND ENTERTAINMENT

10.9 OTHERS

11 NORTH AMERICA MAINFRAME MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

11.1.4 GUATEMALA

11.1.5 COSTA RICA

11.1.6 PANAMA

11.1.7 HONDURAS

11.1.8 CARIBBEAN

11.1.9 NICARAGUA

11.1.10 EL SALVADOR

11.1.11 BELIZE

11.1.12 REST OF NORTH AMERICA

12 NORTH AMERICA MAINFRAME MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 IBM CORPORATION

14.1.1 COMPANY PROFILES

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT/NEWS

14.2 UNISYS

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 BMC SOFTWARE, INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 COGNIZANT

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT/NEWS

14.5 NEC CORPORATION

14.5.1 COMPANY SNAPSHOTS

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 ATOS SE

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT/NEWS

14.7 BROADCOM

14.7.1 COMPANY PROFILES

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT/NEWS

14.8 DELL INC

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 DXC TECHNOLOGY COMPANY

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT/NEWS

14.1 FUJITSU

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENT/NEWS

14.11 HCL TECHNOLOGIES LIMITED

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT/NEWS

14.12 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENT/NEWS

14.13 HITACHI VANTARA LLC

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT/NEWS

14.14 INFOSYS LIMITED

14.14.1 COMPANY SNAPSHOTS

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENT

14.15 TIEOTOEVRY

14.15.1 COMPANY SNAPSHOTS

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

表格列表

TABLE 1 COMPANY COMPARATIVE ANALYSIS

TABLE 2 REGULATORY COVERAGE

TABLE 3 IMPACT ON UNPLANNED DOWNTIME AND SECURITY

TABLE 4 NORTH AMERICA MAINFRAME MARKET, BY SYSTEMS, 2018-2032 (USD MILLION)

TABLE 5 NORTH AMERICA MAINFRAMES IN MAINFRAME MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 6 NORTH AMERICA MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 7 NORTH AMERICA IBM Z SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 8 NORTH AMERICA FUJITSU GS SERIES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 9 NORTH AMERICA OTHER MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 10 NORTH AMERICA MIDRANGE SYSTEMS IN MAINFRAME MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 11 NORTH AMERICA MIDRANGE IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 12 NORTH AMERICA IBM POWER SYSTEMS (AIX, AS/400) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 13 NORTH AMERICA HPE SERVERS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 14 NORTH AMERICA ORACLE SUN SERVERS (SOLARIS) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 15 NORTH AMERICA MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 16 NORTH AMERICA HARDWARE IN MAINFRAME MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 17 NORTH AMERICA HARDWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 18 NORTH AMERICA SERVICES IN MAINFRAME MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 19 NORTH AMERICA SERVICES IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 20 NORTH AMERICA SOFTWARE IN MAINFRAME MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 21 NORTH AMERICA SOFTWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 22 NORTH AMERICA MAINFRAME MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD MILLION)

TABLE 23 NORTH AMERICA LARGE ENTERPRISES IN MAINFRAME MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 24 NORTH AMERICA SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) IN MAINFRAME MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 25 NORTH AMERICA MAINFRAME MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 26 NORTH AMERICA FINANCIAL SERVICES IN MAINFRAME MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 27 NORTH AMERICA FINANCIAL SERVICES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 28 NORTH AMERICA BANKING AND CAPITAL MARKETS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 29 NORTH AMERICA INSURANCE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 30 NORTH AMERICA PAYMENTS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 31 NORTH AMERICA FINANCIAL SERVICES IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 32 NORTH AMERICA IT & TELECOMMUNICATIONS IN MAINFRAME MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 33 NORTH AMERICA IT & TELECOMMUNICATIONS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 34 NORTH AMERICA HEALTHCARE IN MAINFRAME MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 35 NORTH AMERICA HEALTHCARE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 36 NORTH AMERICA PUBLIC SECTOR IN MAINFRAME MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 37 NORTH AMERICA PUBLIC SECTOR IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 38 NORTH AMERICA AUTOMOTIVE AND MANUFACTURING IN MAINFRAME MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 39 NORTH AMERICA AUTOMOTIVE AND MANUFACTURING IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 40 NORTH AMERICA RETAIL AND CONSUMER PACKAGED GOODS (CPG) IN MAINFRAME MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 41 NORTH AMERICA RETAIL AND CONSUMER PACKAGED GOODS (CPG) IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 42 NORTH AMERICA TRAVEL, MEDIA, AND ENTERTAINMENT IN MAINFRAME MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 43 NORTH AMERICA TRAVEL, MEDIA, AND ENTERTAINMENT IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 44 NORTH AMERICA OTHERS IN MAINFRAME MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 45 NORTH AMERICA OTHERS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 46 NORTH AMERICA MAINFRAME MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 47 NORTH AMERICA MAINFRAME MARKET, BY SYSTEMS, 2018-2032 (USD MILLION)

TABLE 48 NORTH AMERICA MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 49 NORTH AMERICA IBM Z SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 50 NORTH AMERICA FUJITSU GS SERIES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 51 NORTH AMERICA OTHER MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 52 NORTH AMERICA MIDRANGE SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 53 NORTH AMERICA IBM POWER SYSTEMS (AIX, AS/400) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 54 NORTH AMERICA HPE SERVERS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 55 NORTH AMERICA ORACLE SUN SERVERS (SOLARIS) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 56 NORTH AMERICA MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 57 NORTH AMERICA HARDWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 58 NORTH AMERICA SERVICES IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 59 NORTH AMERICA SOFTWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 60 NORTH AMERICA MAINFRAME MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD MILLION)

TABLE 61 NORTH AMERICA MAINFRAME MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 62 NORTH AMERICA FINANCIAL SERVICES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 63 NORTH AMERICA BANKING AND CAPITAL MARKETS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 64 NORTH AMERICA INSURANCE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 65 NORTH AMERICA PAYMENTS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 66 NORTH AMERICA FINANCIAL SERVICES IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 67 NORTH AMERICA IT & TELECOMMUNICATIONS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 68 NORTH AMERICA HEALTHCARE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 69 NORTH AMERICA PUBLIC SECTOR IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 70 NORTH AMERICA AUTOMOTIVE AND MANUFACTURING IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 71 NORTH AMERICA RETAIL AND CONSUMER PACKAGED GOODS (CPG) IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 72 NORTH AMERICA TRAVEL, MEDIA, AND ENTERTAINMENT IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 73 NORTH AMERICA OTHERS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 74 U.S. MAINFRAME MARKET, BY SYSTEMS, 2018-2032 (USD MILLION)

TABLE 75 U.S. MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 76 U.S. IBM Z SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 77 U.S. FUJITSU GS SERIES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 78 U.S. OTHER MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 79 U.S. MIDRANGE SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 80 U.S. IBM POWER SYSTEMS (AIX, AS/400) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 81 U.S. HPE SERVERS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 82 U.S. ORACLE SUN SERVERS (SOLARIS) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 83 U.S. MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 84 U.S. HARDWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 85 U.S. SERVICES IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 86 U.S. SOFTWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 87 U.S. MAINFRAME MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD MILLION)

TABLE 88 U.S. MAINFRAME MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 89 U.S. FINANCIAL SERVICES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 90 U.S. BANKING AND CAPITAL MARKETS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 91 U.S. INSURANCE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 92 U.S. PAYMENTS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 93 U.S. FINANCIAL SERVICES IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 94 U.S. IT & TELECOMMUNICATIONS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 95 U.S. HEALTHCARE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 96 U.S. PUBLIC SECTOR IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 97 U.S. AUTOMOTIVE AND MANUFACTURING IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 98 U.S. RETAIL AND CONSUMER PACKAGED GOODS (CPG) IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 99 U.S. TRAVEL, MEDIA, AND ENTERTAINMENT IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 100 U.S. OTHERS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 101 CANADA MAINFRAME MARKET, BY SYSTEMS, 2018-2032 (USD MILLION)

TABLE 102 CANADA MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 103 CANADA IBM Z SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 104 CANADA FUJITSU GS SERIES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 105 CANADA OTHER MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 106 CANADA MIDRANGE SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 107 CANADA IBM POWER SYSTEMS (AIX, AS/400) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 108 CANADA HPE SERVERS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 109 CANADA ORACLE SUN SERVERS (SOLARIS) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 110 CANADA MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 111 CANADA HARDWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 112 CANADA SERVICES IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 113 CANADA SOFTWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 114 CANADA MAINFRAME MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD MILLION)

TABLE 115 CANADA MAINFRAME MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 116 CANADA FINANCIAL SERVICES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 117 CANADA BANKING AND CAPITAL MARKETS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 118 CANADA INSURANCE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 119 CANADA PAYMENTS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 120 CANADA FINANCIAL SERVICES IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 121 CANADA IT & TELECOMMUNICATIONS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 122 CANADA HEALTHCARE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 123 CANADA PUBLIC SECTOR IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 124 CANADA AUTOMOTIVE AND MANUFACTURING IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 125 CANADA RETAIL AND CONSUMER PACKAGED GOODS (CPG) IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 126 CANADA TRAVEL, MEDIA, AND ENTERTAINMENT IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 127 CANADA OTHERS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 128 MEXICO MAINFRAME MARKET, BY SYSTEMS, 2018-2032 (USD MILLION)

TABLE 129 MEXICO MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 130 MEXICO IBM Z SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 131 MEXICO FUJITSU GS SERIES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 132 MEXICO OTHER MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 133 MEXICO MIDRANGE SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 134 MEXICO IBM POWER SYSTEMS (AIX, AS/400) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 135 MEXICO HPE SERVERS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 136 MEXICO ORACLE SUN SERVERS (SOLARIS) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 137 MEXICO MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 138 MEXICO HARDWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 139 MEXICO SERVICES IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 140 MEXICO SOFTWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 141 MEXICO MAINFRAME MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD MILLION)

TABLE 142 MEXICO MAINFRAME MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 143 MEXICO FINANCIAL SERVICES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 144 MEXICO BANKING AND CAPITAL MARKETS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 145 MEXICO INSURANCE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 146 MEXICO PAYMENTS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 147 MEXICO FINANCIAL SERVICES IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 148 MEXICO IT & TELECOMMUNICATIONS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 149 MEXICO HEALTHCARE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 150 MEXICO PUBLIC SECTOR IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 151 MEXICO AUTOMOTIVE AND MANUFACTURING IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 152 MEXICO RETAIL AND CONSUMER PACKAGED GOODS (CPG) IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 153 MEXICO TRAVEL, MEDIA, AND ENTERTAINMENT IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 154 MEXICO OTHERS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 155 GUATEMALA MAINFRAME MARKET, BY SYSTEMS, 2018-2032 (USD MILLION)

TABLE 156 GUATEMALA MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 157 GUATEMALA IBM Z SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 158 GUATEMALA FUJITSU GS SERIES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 159 GUATEMALA OTHER MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 160 GUATEMALA MIDRANGE SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 161 GUATEMALA IBM POWER SYSTEMS (AIX, AS/400) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 162 GUATEMALA HPE SERVERS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 163 GUATEMALA ORACLE SUN SERVERS (SOLARIS) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 164 GUATEMALA MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 165 GUATEMALA HARDWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 166 GUATEMALA SERVICES IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 167 GUATEMALA SOFTWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 168 GUATEMALA MAINFRAME MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD MILLION)

TABLE 169 GUATEMALA MAINFRAME MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 170 GUATEMALA FINANCIAL SERVICES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 171 GUATEMALA BANKING AND CAPITAL MARKETS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 172 GUATEMALA INSURANCE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 173 GUATEMALA PAYMENTS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 174 GUATEMALA FINANCIAL SERVICES IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 175 GUATEMALA IT & TELECOMMUNICATIONS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 176 GUATEMALA HEALTHCARE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 177 GUATEMALA PUBLIC SECTOR IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 178 GUATEMALA AUTOMOTIVE AND MANUFACTURING IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 179 GUATEMALA RETAIL AND CONSUMER PACKAGED GOODS (CPG) IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 180 GUATEMALA TRAVEL, MEDIA, AND ENTERTAINMENT IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 181 GUATEMALA OTHERS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 182 COSTA RICA MAINFRAME MARKET, BY SYSTEMS, 2018-2032 (USD MILLION)

TABLE 183 COSTA RICA MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 184 COSTA RICA IBM Z SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 185 COSTA RICA FUJITSU GS SERIES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 186 COSTA RICA OTHER MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 187 COSTA RICA MIDRANGE SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 188 COSTA RICA IBM POWER SYSTEMS (AIX, AS/400) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 189 COSTA RICA HPE SERVERS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 190 COSTA RICA ORACLE SUN SERVERS (SOLARIS) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 191 COSTA RICA MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 192 COSTA RICA HARDWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 193 COSTA RICA SERVICES IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 194 COSTA RICA SOFTWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 195 COSTA RICA MAINFRAME MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD MILLION)

TABLE 196 COSTA RICA MAINFRAME MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 197 COSTA RICA FINANCIAL SERVICES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 198 COSTA RICA BANKING AND CAPITAL MARKETS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 199 COSTA RICA INSURANCE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 200 COSTA RICA PAYMENTS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 201 COSTA RICA FINANCIAL SERVICES IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 202 COSTA RICA IT & TELECOMMUNICATIONS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 203 COSTA RICA HEALTHCARE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 204 COSTA RICA PUBLIC SECTOR IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 205 COSTA RICA AUTOMOTIVE AND MANUFACTURING IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 206 COSTA RICA RETAIL AND CONSUMER PACKAGED GOODS (CPG) IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 207 COSTA RICA TRAVEL, MEDIA, AND ENTERTAINMENT IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 208 COSTA RICA OTHERS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 209 PANAMA MAINFRAME MARKET, BY SYSTEMS, 2018-2032 (USD MILLION)

TABLE 210 PANAMA MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 211 PANAMA IBM Z SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 212 PANAMA FUJITSU GS SERIES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 213 PANAMA OTHER MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 214 PANAMA MIDRANGE SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 215 PANAMA IBM POWER SYSTEMS (AIX, AS/400) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 216 PANAMA HPE SERVERS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 217 PANAMA ORACLE SUN SERVERS (SOLARIS) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 218 PANAMA MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 219 PANAMA HARDWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 220 PANAMA SERVICES IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 221 PANAMA SOFTWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 222 PANAMA MAINFRAME MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD MILLION)

TABLE 223 PANAMA MAINFRAME MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 224 PANAMA FINANCIAL SERVICES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 225 PANAMA BANKING AND CAPITAL MARKETS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 226 PANAMA INSURANCE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 227 PANAMA PAYMENTS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 228 PANAMA FINANCIAL SERVICES IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 229 PANAMA IT & TELECOMMUNICATIONS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 230 PANAMA HEALTHCARE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 231 PANAMA PUBLIC SECTOR IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 232 PANAMA AUTOMOTIVE AND MANUFACTURING IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 233 PANAMA RETAIL AND CONSUMER PACKAGED GOODS (CPG) IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 234 PANAMA TRAVEL, MEDIA, AND ENTERTAINMENT IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 235 PANAMA OTHERS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 236 HONDURAS MAINFRAME MARKET, BY SYSTEMS, 2018-2032 (USD MILLION)

TABLE 237 HONDURAS MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 238 HONDURAS IBM Z SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 239 HONDURAS FUJITSU GS SERIES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 240 HONDURAS OTHER MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 241 HONDURAS MIDRANGE SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 242 HONDURAS IBM POWER SYSTEMS (AIX, AS/400) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 243 HONDURAS HPE SERVERS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 244 HONDURAS ORACLE SUN SERVERS (SOLARIS) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 245 HONDURAS MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 246 HONDURAS HARDWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 247 HONDURAS SERVICES IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 248 HONDURAS SOFTWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 249 HONDURAS MAINFRAME MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD MILLION)

TABLE 250 HONDURAS MAINFRAME MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 251 HONDURAS FINANCIAL SERVICES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 252 HONDURAS BANKING AND CAPITAL MARKETS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 253 HONDURAS INSURANCE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 254 HONDURAS PAYMENTS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 255 HONDURAS FINANCIAL SERVICES IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 256 HONDURAS IT & TELECOMMUNICATIONS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 257 HONDURAS HEALTHCARE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 258 HONDURAS PUBLIC SECTOR IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 259 HONDURAS AUTOMOTIVE AND MANUFACTURING IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 260 HONDURAS RETAIL AND CONSUMER PACKAGED GOODS (CPG) IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 261 HONDURAS TRAVEL, MEDIA, AND ENTERTAINMENT IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 262 HONDURAS OTHERS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 263 CARIBBEAN ISLANDS MAINFRAME MARKET, BY SYSTEMS, 2018-2032 (USD MILLION)

TABLE 264 CARIBBEAN ISLANDS MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 265 CARIBBEAN ISLANDS IBM Z SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 266 CARIBBEAN ISLANDS FUJITSU GS SERIES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 267 CARIBBEAN ISLANDS OTHER MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 268 CARIBBEAN ISLANDS MIDRANGE SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 269 CARIBBEAN ISLANDS IBM POWER SYSTEMS (AIX, AS/400) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 270 CARIBBEAN ISLANDS HPE SERVERS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 271 CARIBBEAN ISLANDS ORACLE SUN SERVERS (SOLARIS) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 272 CARIBBEAN ISLANDS MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 273 CARIBBEAN ISLANDS HARDWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 274 CARIBBEAN ISLANDS SERVICES IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 275 CARIBBEAN ISLANDS SOFTWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 276 CARIBBEAN ISLANDS MAINFRAME MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD MILLION)

TABLE 277 CARIBBEAN ISLANDS MAINFRAME MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 278 CARIBBEAN ISLANDS FINANCIAL SERVICES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 279 CARIBBEAN ISLANDS BANKING AND CAPITAL MARKETS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 280 CARIBBEAN ISLANDS INSURANCE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 281 CARIBBEAN ISLANDS PAYMENTS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 282 CARIBBEAN ISLANDS FINANCIAL SERVICES IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 283 CARIBBEAN ISLANDS IT & TELECOMMUNICATIONS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 284 CARIBBEAN ISLANDS HEALTHCARE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 285 CARIBBEAN ISLANDS PUBLIC SECTOR IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 286 CARIBBEAN ISLANDS AUTOMOTIVE AND MANUFACTURING IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 287 CARIBBEAN ISLANDS RETAIL AND CONSUMER PACKAGED GOODS (CPG) IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 288 CARIBBEAN ISLANDS TRAVEL, MEDIA, AND ENTERTAINMENT IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 289 CARIBBEAN ISLANDS OTHERS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 290 NICARAGUA MAINFRAME MARKET, BY SYSTEMS, 2018-2032 (USD MILLION)

TABLE 291 NICARAGUA MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 292 NICARAGUA IBM Z SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 293 NICARAGUA FUJITSU GS SERIES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 294 NICARAGUA OTHER MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 295 NICARAGUA MIDRANGE SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 296 NICARAGUA IBM POWER SYSTEMS (AIX, AS/400) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 297 NICARAGUA HPE SERVERS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 298 NICARAGUA ORACLE SUN SERVERS (SOLARIS) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 299 NICARAGUA MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 300 NICARAGUA HARDWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 301 NICARAGUA SERVICES IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 302 NICARAGUA SOFTWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 303 NICARAGUA MAINFRAME MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD MILLION)

TABLE 304 NICARAGUA MAINFRAME MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 305 NICARAGUA FINANCIAL SERVICES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 306 NICARAGUA BANKING AND CAPITAL MARKETS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 307 NICARAGUA INSURANCE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 308 NICARAGUA PAYMENTS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 309 NICARAGUA FINANCIAL SERVICES IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 310 NICARAGUA IT & TELECOMMUNICATIONS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 311 NICARAGUA HEALTHCARE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 312 NICARAGUA PUBLIC SECTOR IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 313 NICARAGUA AUTOMOTIVE AND MANUFACTURING IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 314 NICARAGUA RETAIL AND CONSUMER PACKAGED GOODS (CPG) IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 315 NICARAGUA TRAVEL, MEDIA, AND ENTERTAINMENT IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 316 NICARAGUA OTHERS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 317 EL SALVADOR MAINFRAME MARKET, BY SYSTEMS, 2018-2032 (USD MILLION)

TABLE 318 EL SALVADOR MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 319 EL SALVADOR IBM Z SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 320 EL SALVADOR FUJITSU GS SERIES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 321 EL SALVADOR OTHER MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 322 EL SALVADOR MIDRANGE SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 323 EL SALVADOR IBM POWER SYSTEMS (AIX, AS/400) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 324 EL SALVADOR HPE SERVERS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 325 EL SALVADOR ORACLE SUN SERVERS (SOLARIS) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 326 EL SALVADOR MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 327 EL SALVADOR HARDWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 328 EL SALVADOR SERVICES IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 329 EL SALVADOR SOFTWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 330 EL SALVADOR MAINFRAME MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD MILLION)

TABLE 331 EL SALVADOR MAINFRAME MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 332 EL SALVADOR FINANCIAL SERVICES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 333 EL SALVADOR BANKING AND CAPITAL MARKETS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 334 EL SALVADOR INSURANCE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 335 EL SALVADOR PAYMENTS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 336 EL SALVADOR FINANCIAL SERVICES IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 337 EL SALVADOR IT & TELECOMMUNICATIONS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 338 EL SALVADOR HEALTHCARE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 339 EL SALVADOR PUBLIC SECTOR IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 340 EL SALVADOR AUTOMOTIVE AND MANUFACTURING IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 341 EL SALVADOR RETAIL AND CONSUMER PACKAGED GOODS (CPG) IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 342 EL SALVADOR TRAVEL, MEDIA, AND ENTERTAINMENT IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 343 EL SALVADOR OTHERS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 344 BELIZE MAINFRAME MARKET, BY SYSTEMS, 2018-2032 (USD MILLION)

TABLE 345 BELIZE MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 346 BELIZE IBM Z SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 347 BELIZE FUJITSU GS SERIES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 348 BELIZE OTHER MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 349 BELIZE MIDRANGE SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 350 BELIZE IBM POWER SYSTEMS (AIX, AS/400) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 351 BELIZE HPE SERVERS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 352 BELIZE ORACLE SUN SERVERS (SOLARIS) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 353 BELIZE MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 354 BELIZE HARDWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 355 BELIZE SERVICES IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 356 BELIZE SOFTWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 357 BELIZE MAINFRAME MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD MILLION)

TABLE 358 BELIZE MAINFRAME MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 359 BELIZE FINANCIAL SERVICES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 360 BELIZE BANKING AND CAPITAL MARKETS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 361 BELIZE INSURANCE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 362 BELIZE PAYMENTS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 363 BELIZE FINANCIAL SERVICES IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 364 BELIZE IT & TELECOMMUNICATIONS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 365 BELIZE HEALTHCARE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 366 BELIZE PUBLIC SECTOR IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 367 BELIZE AUTOMOTIVE AND MANUFACTURING IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 368 BELIZE RETAIL AND CONSUMER PACKAGED GOODS (CPG) IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 369 BELIZE TRAVEL, MEDIA, AND ENTERTAINMENT IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 370 BELIZE OTHERS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 371 REST OF NORTH AMERICA MAINFRAME MARKET, BY SYSTEMS, 2018-2032 (USD MILLION)

图片列表

FIGURE 1 NORTH AMERICA MAINFRAME MARKET

FIGURE 2 NORTH AMERICA MAINFRAME MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA MAINFRAME MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA MAINFRAME MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA MAINFRAME MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA MAINFRAME MARKET: MULTIVARIATE MODELL INC.ING

FIGURE 7 NORTH AMERICA MAINFRAME MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA MAINFRAME MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA MAINFRAME MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA MAINFRAME MARKET: SEGMENTATION

FIGURE 12 NORTH AMERICA MAINFRAME MARKET: EXECUTIVE SUMMARY

FIGURE 13 TWO SEGMENTS COMPRISE THE NORTH AMERICA MAINFRAME MARKET, BY SYSTEMS (2024)

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 ACCELERATED DIGITALIZATION ACROSS INDUSTRIES IS EXPECTED TO DRIVE THE NORTH AMERICA MAINFRAME MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 16 THE MAINFRAMES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF THE NORTH AMERICA MAINFRAME MARKET IN 2025 AND 2032

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA MAINFRAME MARKET

FIGURE 20 BENEFITS OF MAINFRAME MODERNIZATION

FIGURE 21 ADOPTION OF DIFFERENT MODERNIZATION PATH

FIGURE 22 ADOPTION OF DIFFERENT CLOUDS IN VARIOUS INDUSTRIES

FIGURE 23 NORTH AMERICA MAINFRAME MARKET: BY SYSTEMS, 2024

FIGURE 24 NORTH AMERICA MAINFRAME MARKET, BY COMPONENT, 2024

FIGURE 25 NORTH AMERICA MAINFRAME MARKET: BY ORGANIZATION SIZE, 2024

FIGURE 26 NORTH AMERICA MAINFRAME MARKET, BY END USE, 2024

FIGURE 27 NORTH AMERICA MAINFRAME MARKET: SNAPSHOT (2024)

FIGURE 28 NORTH AMERICA MAINFRAME MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。