North America Lymphedema Treatment Market

市场规模(十亿美元)

CAGR :

%

USD

560.25 Million

USD

1,268.05 Million

2024

2032

USD

560.25 Million

USD

1,268.05 Million

2024

2032

| 2025 –2032 | |

| USD 560.25 Million | |

| USD 1,268.05 Million | |

|

|

|

|

北美淋巴水腫治療市場細分,依治療類型(壓迫療法、手術、藥物療法、雷射療法等)、類型(繼發性淋巴水腫和原發性淋巴水腫)、患處(下肢、上肢和生殖器)、年齡組(成人、老年和兒童)、給藥途徑(口服、注射和外用)、最終用戶(醫院、專科診所、經銷手術中心、經銷手術中心。

北美淋巴水腫治療市場規模

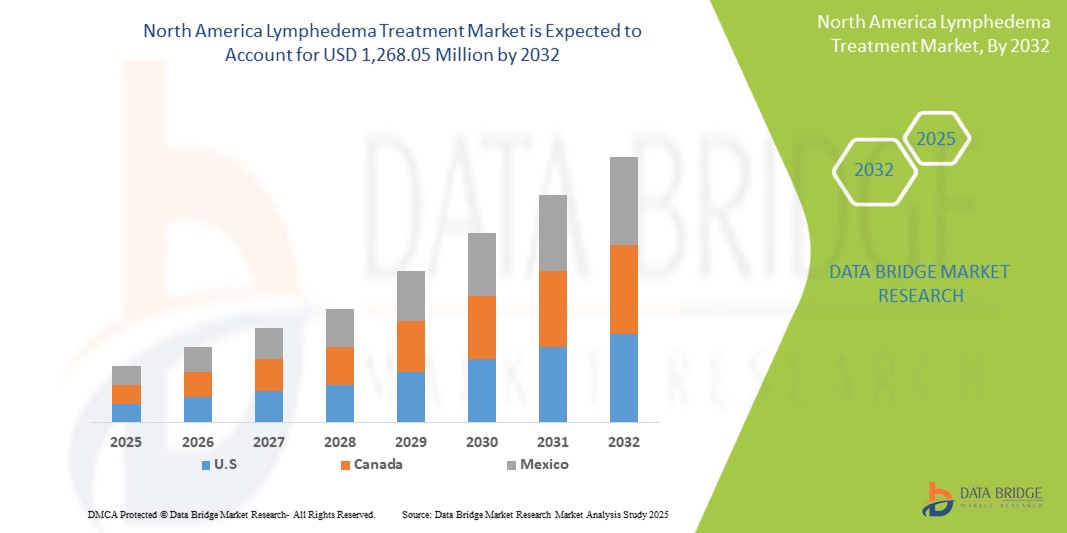

- 2024 年北美淋巴水腫治療市場規模為5.6025 億美元 ,預計 到 2032 年將達到12.6805億美元,預測期內複合年增長率為 11.0%。

- 北美市場的成長主要得益於淋巴水腫和癌症相關淋巴水腫在該區域的患病率上升,加上診斷成像方式和創新治療方法的重大技術進步,從而改善了對該病症的識別和管理。

- 此外,該地區患者和臨床醫生對更有效、更便捷、更全面的慢性腫脹管理解決方案的需求日益增長,並提升了生活質量,這使得先進的壓迫療法、淋巴引流技術和顯微外科幹預成為淋巴水腫治療的現代標準。這些因素共同加速了北美地區淋巴水腫管理解決方案的普及,顯著促進了該行業的區域成長。

北美淋巴水腫治療市場分析

- 淋巴水腫的特徵是淋巴系統功能受損引起的慢性腫脹,由於其對患者生活品質有重大影響,通常是癌症治療或遺傳易感性的併發症,因此成為現代北美醫療保健中越來越重要的關注領域。

- 北美地區淋巴水腫治療需求的不斷增長,主要原因是該地區淋巴水腫和癌症相關淋巴水腫盛行率的上升、醫護人員和患者意識的提高,以及診斷和治療方式的技術不斷進步

- 美國在 2024 年佔據淋巴水腫市場的主導地位,預計在預測期內將出現最高增長率,這得益於淋巴水腫病例的高發病率(特別是癌症相關淋巴水腫)、先進的醫療基礎設施以及強大的消費者意識和對創新療法的早期採用

- 壓力療法預計將主導北美淋巴水腫治療市場,其主要原因是其作為治療腫脹的一線和最常見治療方法的良好聲譽、其非侵入性以及壓力服裝和設備的持續創新,從而提高了舒適度、可及性和臨床療效

報告範圍和北美淋巴水腫治療市場細分

|

屬性 |

淋巴水腫治療關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

北美洲

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括深入的專家分析、定價分析、品牌份額分析、消費者調查、人口統計分析、供應鏈分析、價值鏈分析、原材料/消耗品概述、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

北美淋巴水腫治療市場趨勢

透過人工智慧和數位整合增強患者護理

- 北美淋巴水腫市場一個顯著且加速發展的趨勢是與人工智慧(AI) 和數位健康平台的深度融合,涵蓋遠端監控、個人化治療演算法和遠距醫療解決方案。這種技術融合顯著提高了患者的便利性、治療順從性以及慢性病的整體管理。

- 例如,2014 年 11 月,根據美國癌症協會的數據,美國有超過 400 萬名乳癌倖存者,其中約 20-40% 的人在治療後面臨淋巴水腫的風險——這凸顯出一個關鍵的患者群體推動著該地區對長期淋巴水腫管理解決方案的需求。

- 北美淋巴水腫護理中人工智慧的整合實現了諸多功能,例如分析海量患者數據以預測潛在的病情發作、根據個體反應優化壓力服壓力水平,以及提供更聰明的預警以促進早期幹預。例如,美國和加拿大正在開發新興的人工智慧驅動解決方案,旨在透過影像分析提高早期淋巴水腫檢測的準確性,並指導患者進行個人化的復健訓練。此外,整合通訊功能的數位平台為患者提供了便捷的虛擬問診服務,使他們能夠與護理人員討論症狀並遠端獲得指導。

- 淋巴水腫監測設備和自我管理工具與北美更廣泛的數位健康生態系統無縫集成,有助於集中控制患者護理的各個方面。使用者可以透過單一介面管理肢體測量數據、治療依從性並與護理團隊溝通,從而打造統一且更主動的健康管理體驗。

北美淋巴水腫治療市場動態

司機

由於疾病盛行率上升和診斷能力增強,需求不斷增長

- 北美地區淋巴水腫盛行率不斷上升,尤其是乳癌、攝護腺癌和婦科癌症等癌症治療引起的繼發性淋巴水腫,加之診斷技術的加速進步和人們認識的不斷提高,是該地區對淋巴水腫管理解決方案需求不斷增長的主要驅動力

- 例如,2020年4月,ResearchGate GmbH發表的一篇文章指出,手臂淋巴水腫的總盛行率為27%,且存在相當大的異質性。手臂淋巴水腫的總發生率為21%。證據還表明,較高的體重指數(> 25)——這在美國和加拿大很常見——與手臂淋巴水腫的風險增加有關。

- 隨著北美醫療保健專業人員和患者對未治療淋巴水腫的長期後果的認識日益加深,他們越來越重視早期介入。生物阻抗光譜 (BIS) 和近紅外線螢光成像(例如 ICG 淋巴造影)等先進診斷工具在美國和加拿大的診所中日益普及,與肢體週長測量等傳統方法相比,它們具有更高的準確性和更早的檢測能力。

- 隨著以患者為中心的護理模式的轉變以及慢性病患者生活品質的提高,綜合淋巴水腫管理正在被納入標準的癌症後治療和慢性病護理路徑。這種整合透過協調的復健計劃和支持性療法,支持護理的連續性。

- 數位健康工具的出現,使得早期診斷、個人化治療計劃以及透過先進的壓縮穿戴式裝置和指導性運動程序來支持症狀自我管理成為可能,顯著促進了北美地區臨床和居家護理機構對數位健康工具的採用。主動篩檢的趨勢,加上易於使用、患者友善的淋巴水腫產品日益普及,進一步加速了該地區市場的成長。

克制/挑戰

對診斷不足和高昂治療費用的擔憂

- 北美普遍存在的淋巴水腫漏診和誤診問題,加上長期治療帶來的沉重經濟負擔,對更廣泛的市場滲透和有效的患者護理構成了重大挑戰。許多情況下,淋巴水腫在早期階段症狀隱匿,常常被醫護人員忽視或誤診,導致幹預延誤、病情進展,並加劇患者對長期健康結局的焦慮。

- 雖然北美地區的具體費用數據各不相同,但美國患者經常報告淋巴水腫治療的自付費用高昂,包括與壓力服、手動淋巴引流療法和氣動加壓裝置相關的費用,每年總計可達數千美元,具體取決於疾病嚴重程度和保險覆蓋範圍。儘管諸如《淋巴水腫治療法案》(已於2022年簽署成為美國法律)等立法努力旨在提高聯邦醫療保險對加壓治療項目的報銷,但終身管理的費用仍然是許多患者,尤其是那些沒有綜合保險的患者,的沉重負擔。

- 應對北美診斷不足的挑戰需要加強全科醫生的醫學教育,在腫瘤科和外科術後護理中製定標準化的篩檢方案,並擴大公眾意識宣傳活動。淋巴教育與研究網絡 (LE&RN) 和國家淋巴水腫網絡 (NLN) 等組織的宣傳和教育工作,對於改善患者的早期發現和長期預後至關重要。

- 此外,基本淋巴水腫治療產品相對較高且反覆出現的費用,仍然是許多人堅持治療的障礙,尤其是在低收入或醫療資源匱乏的社區。這種經濟壓力可能會阻礙患者進行積極的治療和常規護理,尤其是在患者缺乏足夠保險或無法前往專業的淋巴水腫診所的情況下。

- 儘管該地區的認知度正在提高,但淋巴水腫的慢性特性以及缺乏根治方法,仍然影響著患者的積極性和持續的就醫行為。透過加強醫療服務提供者培訓、改善報銷機制以及開發更經濟實惠且可擴展的治療方案來克服這些障礙,對於支持長期市場成長並改善北美患者的生活品質至關重要。

北美淋巴水腫治療市場範圍

北美淋巴水腫治療市場根據治療類型、類型、受影響區域、年齡層、給藥途徑、最終用戶和分銷管道分為七個顯著的部分。

按治療類型

根據治療類型,北美淋巴水腫市場細分為壓迫療法、手術、藥物治療、雷射治療和其他療法。壓迫療法預計將佔據該地區最大的市場收入份額(預計到2025年,壓迫療法市場的收入份額將超過70.00%,淋巴水腫是該領域的主要應用),這得益於其作為淋巴水腫管理黃金標準的既定聲譽及其非侵入性。這使得壓迫療法在美國和加拿大廣受歡迎,並受到廣大患者的青睞。北美患者通常優先選擇壓迫療法,因為它在減輕腫脹、改善肢體活動能力和提升日常舒適度方面已被證實有效。此外,市場也受惠於對壓力衣、袖套和氣動幫浦的旺盛需求,這得益於布料技術和穿戴式設計的持續創新,這些創新提高了患者的依從性和舒適度。

預計在預測期內,北美外科手術領域將迎來最快的成長速度,這得益於淋巴靜脈吻合術 (LVA) 和血管化淋巴結移植術 (VLNT) 等顯微外科技術的進步。隨著患者對這些針對晚期或難治性淋巴水腫病例的潛在治癒方案的認識不斷提高,外科治療的接受度也隨之提高。美國各地專業的淋巴水腫手術中心、越來越多的醫生轉診以及對外科手術的保險支持,進一步推動了這些幹預措施的普及。對於那些在保守療法療效有限後尋求長期肢體體積縮小和改善生活品質的患者來說,外科手術尤其具有吸引力。

按類型

根據類型,北美淋巴水腫治療市場分為原發性淋巴水腫和繼發性淋巴水腫。繼發性淋巴水腫預計將佔據該地區最大的市場收入份額,預計到2025年將達到79.26%,這得益於其在美國和加拿大的患病率顯著升高。此類淋巴水腫主要與癌症治療有關,例如淋巴結清除術、乳房切除術和放射治療—這些是乳癌、攝護腺癌和婦科癌症治療的常見手術。

預計原發性淋巴水腫領域將在預測期內實現最快的增長,這得益於人們對這種常伴有遺傳性和早發性疾病的認識和診斷能力的提高,以及基因檢測和兒科淋巴水腫專科護理的進步。對原發性淋巴水腫相關基因突變的深入了解有助於更早診斷。

按受影響區域

根據受影響區域,北美淋巴水腫治療市場細分為下肢、上肢和生殖器。預計下肢淋巴水腫領域將佔據該地區最大的市場收入份額,預計到2025年將達到53.61%,這得益於美國和加拿大腿部淋巴水腫發生率的上升。下肢淋巴水腫通常與慢性靜脈功能不全、肥胖以及前列腺癌和婦科惡性腫瘤等癌症的治療有關。下肢淋巴水腫患者通常活動能力下降,伴隨顯著不適,因此需要儘早醫。

預計北美上肢市場在預測期內將出現顯著增長,這主要得益於乳癌倖存者數量的增加,尤其是在美國,腋窩淋巴結清掃術後和放射相關的手臂淋巴水腫在當地很常見。隨著腫瘤照護人員和患者對淋巴水腫早期徵兆的認識不斷提高,客製化解決方案(例如加壓袖套、手套和先進的氣動加壓裝置)的開發和應用也隨之增加。

按年齡組

亞太地區淋巴水腫治療市場按年齡層細分為成人、老年及兒童。 預計成人市場將繼續佔據亞太地區最大的市場收入份額。這主要是由於與癌症治療相關的繼發性淋巴水腫發生率高,例如乳癌、婦科癌和攝護腺癌的治療。由於生活方式的改變、環境因素以及癌症診斷技術的進步,這些疾病在亞太地區成年人口中日益普遍。此外,各種後天因素,包括創傷、感染(例如某些流行地區的絲蟲病)和其他疾病,都會導致成人淋巴功能障礙。由於亞太地區成人患者群體龐大且對現有治療方案的認識日益加深,因此成為尋求淋巴水腫治療的最大群體。此外,市場還受益於專為成人淋巴水腫管理量身定制的廣泛產品和解決方案。

預計在預測期內,老年醫學領域將見證亞太地區最快的成長速度。這一加速增長的動力源於亞太地區老齡人口的顯著增長,而老齡人口更容易受到與年齡相關的淋巴功能衰退的影響,導致淋巴功能下降。慢性靜脈功能不全、肥胖和其他與年齡相關的慢性疾病等併發症的盛行率不斷上升,也導致老年人淋巴水腫的發生率上升。隨著許多亞太國家預期壽命的持續增長,老年人慢性疾病(包括淋巴水腫)的負擔也不斷加重。

依給藥途徑

根據給藥途徑,亞太淋巴水腫治療市場分為口服、注射和外用。預計到2025年,口服藥物將在亞太地區佔據最大市場份額,達到51.84%。這得益於輔助藥物的便利性,例如用於控制腫脹症狀的利尿劑、用於預防或治療復發性蜂窩性組織炎(淋巴水腫的常見併發症)的抗生素以及各種消炎藥物,均可在家中使用。此外,人們對旨在改善淋巴功能的新興口服療法的興趣和研究也日益增多。亞太地區患者通常更喜歡口服藥物,因為口服藥物易於自行服用,這有助於患者在臨床治療之外更好地遵守治療計劃。

預計注射劑市場將在預測期內成為亞太地區成長最快的領域。這項快速擴張得益於新型生物療法、生長因子(例如刺激淋巴再生的VEGF-C)和基因療法的持續研發。這些先進的治療方法通常需要腸外(注射)給藥,以有效刺激淋巴再生、減輕發炎或調節病情進展。

按最終用戶

根據最終用戶,淋巴水腫治療市場可細分為醫院、專科診所、門診手術中心 (ASC) 和其他類型。預計醫院將佔據最大市場份額。這種優點歸功於醫院能夠提供全方位的淋巴水腫治療方案——從早期保守療法(如手動淋巴引流和壓迫療法)到先進的外科手術(如淋巴靜脈吻合術和帶血管的淋巴結移植)。醫院也是複雜或晚期病例的主要轉診點,這些病例需要多學科護理,包括影像學、診斷和外科幹預。

預計專科診所細分市場將在預測期內實現最快的成長。這一增長主要得益於越來越多專注於淋巴水腫的康復和門診護理中心的出現,這些中心提供非侵入性治療和慢性病管理。這些診所專門服務於需要定期治療的輕度至中度淋巴水腫患者,使其成為經濟實惠且便捷的醫院就診替代方案。日益增加的宣傳活動和政府主導的慢性水腫管理舉措,尤其是在城市地區,進一步推動了專科診所的蓬勃發展。

按分銷管道

根據分銷管道,全球淋巴水腫治療市場可細分為藥局、商店、直接招標和其他管道。預計直接招標管道將佔據市場主導地位。這主要是因為公立醫院、復健中心和政府衛生機構大量採購醫療設備,例如壓力幫浦、防護衣和手術包。直接招標管道確保採購流程精簡、符合監管標準並獲得優惠價格,使其成為大型機構買家的首選。

預計門市細分市場(包括零售和線上通路)將成為預測期內成長最快的細分市場。這種快速擴張歸因於患者行為轉向居家淋巴水腫管理,尤其是在新冠疫情之後。線上購物的便利性、電商滲透率的不斷提升以及壓力袖套和繃帶等自我管理設備的普及,加速了該細分市場的成長。此外,遠距醫療服務的興起使患者能夠在家中管理早期淋巴水腫,從而增加了對非處方藥和電商治療工具的依賴。

北美淋巴水腫治療市場區域分析

- 預計北美將主導北美淋巴水腫治療市場,佔據最大的收入份額,到 2025 年通常將佔據 53.56% 左右,這得益於淋巴水腫病例的高發病率(特別是癌症相關淋巴水腫)、強大的醫療保健基礎設施以及對醫學研發的大量投資

- 該地區的醫療保健提供者和患者高度重視專科診所和醫院提供的現成的先進診斷工具、全面的治療方案以及日益增多的宣傳活動

- 高可支配收入、強大的醫療保險滲透率以及對慢性病管理的積極態度進一步支持了這種廣泛採用,將淋巴水腫護理確立為癌症倖存者和其他淋巴系統疾病患者治療路徑的組成部分

美國淋巴水腫治療市場洞察

美國淋巴水腫市場在北美地區佔據了相當大的收入份額,2024年通常佔比超過92.24%,這得益於先進診斷工具的快速普及以及整合式淋巴水腫護理的日益普及。醫療保健專業人員和患者越來越重視透過綜合治療方案對淋巴水腫進行早期發現和有效管理。臨床醫師對淋巴水腫的認識日益加深,加上對專業壓迫療法、氣動幫浦和數位健康監測的強勁需求,進一步推動了淋巴水腫產業的發展。此外,《淋巴水腫治療法案》等支持性政策的日益整合,以及生物阻抗譜(BIS)和遠端病患監測平台的技術進步,也顯著促進了市場擴張,提高了病患獲得長期照護的管道和依從性。

加拿大淋巴水腫治療市場洞察

加拿大淋巴水腫市場在北美市場佔據了4.53%的顯著收入份額,為2025年的區域增長做出了重大貢獻,這得益於先進診斷工具的逐步普及以及省級醫療體系對綜合淋巴水腫護理的日益重視。加拿大各地的醫護人員和患者越來越重視透過協調一致的治療方案和多學科護理方法對淋巴水腫進行早期發現和綜合管理。臨床醫生對淋巴水腫的認識不斷提高,加上對專用壓力服、氣動壓力裝置和新興數位醫療工具的需求不斷增長,正在穩步推動加拿大淋巴水腫市場的發展。此外,加拿大淋巴水腫框架等國家級倡導組織的支持作用以及促進教育和患者可及性的省級舉措,以及生物阻抗譜 (BIS) 和遠程患者管理平台等診斷方式的技術進步,也促進了市場的擴張。這些努力正在提高及時診斷的可近性,並促進長期照護策略的依從性,最終改善加拿大淋巴水腫患者的預後。

北美淋巴水腫治療市佔率

淋巴水腫治療產業主要由知名公司主導,包括:

- Tactile Medical(美國)

- Essity Aktiebolag (publ)(瑞典)

- 3M(美國)

- 康德樂(美國)

- Lohmann & Rauscher GmbH & Co. KG(德國)

- PAUL HARTMANN AG(德國)

- medi GmbH & Co. KG(德國)

- 康維特公司(英國)

- Juzo(德國)

- Smith + Nephew(英國)

- SIGVARIS集團(瑞士)

- Sanyleg Srl(義大利)

- Avet Pharmaceuticals Inc.(美國)

- ThermoTek Inc.(美國)

- Huntleigh Healthcare Limited(英國)

- KOYA醫療(美國)

- AIROS Medical, Inc.(美國)

- 生物壓縮系統(美國)

- Mego Afek ltd.(以色列)

- 蘇珊(法國)

北美淋巴水腫治療市場的最新發展

- 2025年3月,康維德宣布與傷口、造口和失禁護理師協會 (WOCN) 進行全球合作,以改善造口護理教育。此次合作將啟動兩項免費項目—高級造口護理項目和造口護理助理 (OCA) 項目,為全球超過750名醫療保健專業人員提供培訓。該計畫旨在提高護理標準,並擴大患者獲得專業造口護理的機會。

- 2025年4月,Lohmann & Rauscher (L&R) 集團收購了英國領先的客製化手術包和外科產品供應商Unisurge International Ltd.。此次策略性收購增強了L&R在英國醫院市場的准入。 Unisurge將獨立運營,保留其領導層和員工,同時受益於L&R的全球專業知識和對醫療創新的承諾。

- 2025年2月,Tactile Medical 在美國擴大了其 Nimbl 氣動壓縮裝置的上市範圍,用於治療下肢淋巴水腫,此前該裝置最初用於治療上肢疾病。 Nimbl 是同類產品中尺寸最小、支援藍牙的 PCD,其設計注重舒適性、便攜性和更高的依從性。它與 Kylee 應用程式集成,可提升患者體驗和居家自我照護。

- 2024年10月,Tactile Medical推出了其新一代氣動壓縮裝置Nimbl,用於治療上肢淋巴水腫。 Nimbl已獲得FDA和CMS批准,比之前的型號輕68%,體積縮小40%。它專為家庭使用和日常便利而設計,可與Kylee應用程式集成,增強患者監測。預計下肢版本即將在全國推出。

- 2022年7月,Tactile Medical為其Flexitouch Plus系統推出了ComfortEase系列服裝,該系列服裝經過重新設計,更加貼合、舒適且易於使用。此外,該公司還推出了Kylee行動應用程序,幫助患者追蹤淋巴水腫症狀、記錄治療過程並獲取相關教育資源。這兩項創新旨在提高居家治療的依從性,並提高患者在管理慢性腫脹疾病方面的參與度。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA LYMPHEDEMA TREATMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 INDUSTRY INSIGHTS –

4.3.1 MICRO AND MACROECONOMIC FACTORS

4.3.2 PENETRATION AND GROWTH PROSPECT MAPPING

4.3.3 KEY PRICING STRATEGIES

4.3.4 ANALYSIS AND RECOMMENDATION

4.4 INNOVATION TRACKER & STRATEGIC ANALYSIS

4.4.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.4.1.1 MERGERS & ACQUISITIONS

4.4.1.2 TECHNOLOGY COLLABORATIONS

4.4.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.4.3 STAGE OF DEVELOPMENT

4.4.4 TIMELINES & MILESTONES

4.4.5 INNOVATION STRATEGIES & METHODOLOGIES

4.4.6 RISK ASSESSMENT & MITIGATION

4.4.7 FUTURE OUTLOOK

4.5 PIPELINE ANALYSIS – NORTH AMERICA LYMPHEDEMA TREATMENT MARKET

4.5.1 CLINICAL TRIALS AND PHASE ANALYSIS

4.5.2 DRUG THERAPY PIPELINE

4.5.3 PHASE III CANDIDATES

4.5.4 PHASE II CANDIDATES

4.5.5 PHASE I CANDIDATES

4.5.6 OTHERS (PRE-CLINICAL AND RESEARCH)

4.5.7 CONCLUSION

4.6 EPIDEMIOLOGY–

4.6.1 INCIDENCE OF LYMPHEDEMA (NORTH AMERICA & BY GENDER)

4.6.2 INCIDENCE OF LYMPHEDEMA BY GENDER

4.6.3 TREATMENT RATE

4.6.4 MORTALITY RATE

4.6.5 DRUG ADHERENCE AND THERAPY SWITCH MODEL

4.6.6 PATIENT TREATMENT SUCCESS RATES

4.7 TARIFF

4.7.1 OVERVIEW

4.7.2 TARIFF STRUCTURES

4.7.2.1 North America vs. Regional Tariff Structures

4.7.2.2 United States: Medicare/Medicaid Tariff Policies, CMS Pricing Models

4.7.2.3 European Union: Cross-border Tariff Regulations and Reimbursement Policies

4.7.2.4 Asia-Pacific: Government-imposed Tariffs on Imported Medical Products

4.7.2.5 Emerging Markets: Challenges in Tariff Implementation

4.7.3 PHARMACEUTICAL TARIFFS AND TRADE BARRIERS

4.7.3.1 Import Duties on Prescription Drugs vs. Generics

4.7.3.2 Impact on Drug Affordability and Access

4.7.3.3 Key Trade Agreements Affecting Pharmaceutical Tariffs

4.7.4 IMPACT OF HEALTHCARE TARIFFS ON PROVIDERS AND PATIENTS

4.7.4.1 Cost Burden on Hospitals and Healthcare Facilities

4.7.4.2 Effect on Patient Affordability and Insurance Coverage

4.7.4.3 Tariffs and Their Role in Medical Tourism

4.7.5 TRADE AGREEMENTS AND HEALTHCARE TARIFFS

4.7.5.1 WTO Regulations on Healthcare Tariffs

4.7.5.2 Impact of Trade Wars on the Healthcare Supply Chain

4.7.5.3 Role of Free Trade Agreements (FTAs) in Reducing Tariffs

4.7.6 IMPACT OF TARIFFS ON HEALTHCARE COSTS AND ACCESSIBILITY

4.7.7 IMPORTANCE OF TARIFFS IN THE HEALTHCARE SECTOR

5 REGULATORY FRAMEWORK–

5.1 NORTH AMERICA

5.2 SOUTH AMERICA

5.3 EUROPE

5.4 ASIA-PACIFIC

5.5 MIDDLE EAST & AFRICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN THE NUMBER OF LYMPHEDEMA CASES GLOBALLY

6.1.2 INCREASE IN THE PREVALENCE OF CANCERS

6.1.3 INCREASING NUMBER OF HEALTHCARE FACILITIES

6.1.4 AVAILABILITY AND ADVANCEMENT OF MULTIPLE THERAPEUTIC OPTIONS

6.2 RESTRAINTS

6.2.1 SIGNIFICANT COST BURDEN ASSOCIATED WITH LYMPHEDEMA MANAGEMENT

6.2.2 LACK OF AWARENESS ABOUT THE DISEASE

6.3 OPPORTUNITIES

6.3.1 EXPANDING OPPORTUNITIES FOR DRUG DEVELOPMENT AND REGULATORY APPROVALS

6.3.2 STRATEGIC COLLABORATIONS AND ALLIANCES AMONG INDUSTRY STAKEHOLDERS

6.4 CHALLENGES

6.4.1 ABSENCE OF A DEFINITIVE CURATIVE TREATMENT

6.4.2 RESTRICTIVE AND INCONSISTENT REIMBURSEMENT POLICIES

7 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE

7.1 OVERVIEW

7.2 COMPRESSION THERAPY

7.3 SURGERY

7.4 DRUG THERAPY

7.5 LASER THERAPY

7.6 OTHERS

8 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TYPE

8.1 OVERVIEW

8.2 SECONDARY LYMPHEDEMA

8.3 PRIMARY LYMPHEDEMA

9 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA

9.1 OVERVIEW

9.2 LOWER EXTREMITY

9.3 UPPER EXTREMITY

9.4 GENITALIA

10 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP

10.1 OVERVIEW

10.2 ADULT

10.3 GERIATRIC

10.4 PEDIATRIC

11 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION

11.1 OVERVIEW

11.2 ORAL

11.3 INJECTABLE

11.4 TOPICAL

12 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITAL

12.3 SPECIALTY CLINICS

12.4 AMBULATORY SURGICAL CENTERS

12.5 OTHERS

13 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 PHARMACY STORES

13.3 DIRECT TENDER

13.4 OTHERS

14 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 TACTILE MEDICAL

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 ESSITY AKTIEBOLAG (PUBL)

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 3M

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 CARDINAL HEALTH

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 LOHMANN & RAUSCHER GMBH & CO. KG

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 AIROS MEDICAL, INC.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 ARJO

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 AVET PHARMACEUTICALS INC.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 BAUERFEIND

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 BIOCOMPRESSION SYSTEMS

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 CONVATEC INC.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 ENOVIS CORPORATION

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 HUNTLEIGH HEALTHCARE LIMITED

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 IMPEDIMED LIMITED

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENT/NEWS

17.15 JODAS EXPOIM PVT. LTD.

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 JUZO

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 KOYA MEDICAL

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 LLC BINNOPHARM GROUP

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 MCKESSON MEDICAL-SURGICAL INC.

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT DEVELOPMENT

17.2 MEDI GMBH & CO. KG

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 MEDTRONIC

17.21.1 COMPANY SNAPSHOT

17.21.2 REVENUE ANALYSIS

17.21.3 PRODUCT PORTFOLIO

17.21.4 RECENT DEVELOPMENTS

17.22 MEGO AFEK LTD

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENT

17.23 PAUL HARTMANN AG

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENT

17.24 PERFORMANCE HEALTH

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENTS

17.25 PURETECH HEALTH INC

17.25.1 COMPANY SNAPSHOT

17.25.2 PIPELINE PORTFOLIO

17.25.3 RECENT DEVELOPMENT

17.26 SANYLEG SRL A SOCIO UNICO

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENT

17.27 SIGVARIS GROUP

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENTS

17.28 SMITH+NEPHEW

17.28.1 COMPANY SNAPSHOT

17.28.2 REVENUE ANALYSIS

17.28.3 PRODUCT PORTFOLIO

17.28.4 RECENT DEVELOPMENT

17.29 THERMOTEK

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT DEVELOPMENT

17.3 THUASNE

17.30.1 COMPANY SNAPSHOT

17.30.2 PRODUCT PORTFOLIO

17.30.3 RECENT DEVELOPMENT

17.31 VIATRIS INC.

17.31.1 COMPANY SNAPSHOT

17.31.2 REVENUE ANALYSIS

17.31.3 PRODUCT PORTFOLIO

17.31.4 RECENT DEVELOPMENT

17.32 WHITE SWAN PHARMACEUTICAL

17.32.1 COMPANY SNAPSHOT

17.32.2 PRODUCT PORTFOLIO

17.32.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

表格列表

TABLE 1 PRODUCTS AND THEIR STAGES IN DEVELOPMENT.

TABLE 2 PHASE-WISE DISTRIBUTION: CLINICAL TRIALS

TABLE 3 PHASE 2 CANDIDATES

TABLE 4 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 6 NORTH AMERICA COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY REGION 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA LASER THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA OTHERS IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA SECONDARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA LOWER EXTREMITY IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA UPPER EXTREMITY IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA GENITALIA IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA ADULT IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA GERIATRIC IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA PEDIATRIC IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA ORAL IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA INJECTABLE IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA TOPICAL IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA HOSPITAL IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA SPECIALITY CLINICS IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA OTHERS IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA PHARMACY STORES IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA DIRECT TENDER IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA OTHERS IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 44 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 45 NORTH AMERICA COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 57 U.S. LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 U.S. LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 59 U.S. LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 60 U.S. COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 61 U.S. COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 62 U.S. COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 63 U.S. SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 U.S. DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 U.S. LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 U.S. PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 U.S. LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 68 U.S. LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 69 U.S. LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 70 U.S. LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 71 U.S. LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 72 CANADA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 CANADA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 74 CANADA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 75 CANADA COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 76 CANADA COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 77 CANADA COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 78 CANADA SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 CANADA DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 CANADA LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 CANADA PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 CANADA LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 83 CANADA LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 84 CANADA LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 85 CANADA LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 86 CANADA LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 87 MEXICO LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 MEXICO LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 89 MEXICO LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 90 MEXICO COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 91 MEXICO COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 92 MEXICO COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 93 MEXICO SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 MEXICO DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 MEXICO LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 MEXICO PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 MEXICO LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 98 MEXICO LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 99 MEXICO LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 100 MEXICO LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 101 MEXICO LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

图片列表

FIGURE 1 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 FIVE SEGMENTS COMPRISE THE NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE (2024)

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: SEGMENTATION

FIGURE 14 INCREASE IN THE PREVALENCE OF CANCERS IS EXPECTED TO DRIVE THE NORTH AMERICA LYMPHEDEMA TREATMENT MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 15 THE COMPRESSION THERAPY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA LYMPHEDEMA TREATMENT MARKET IN 2025 AND 2032

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF INDONESIA ZEOLITE MARKET

FIGURE 17 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY TREATMENT TYPE, 2024

FIGURE 18 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY TREATMENT TYPE, 2025-2032 (USD THOUSAND)

FIGURE 19 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY TREATMENT TYPE, CAGR (2025-2032)

FIGURE 20 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY TREATMENT TYPE, LIFELINE CURVE

FIGURE 21 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY TYPE, 2024

FIGURE 22 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY TYPE, 2025-2032 (USD THOUSAND)

FIGURE 23 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY TYPE, CAGR (2025-2032)

FIGURE 24 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY TYPE, LIFELINE CURVE

FIGURE 25 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY AFFECTED AREA, 2024

FIGURE 26 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY AFFECTED AREA, 2025-2032 (USD THOUSAND)

FIGURE 27 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY AFFECTED AREA, CAGR (2025-2032)

FIGURE 28 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY AFFECTED AREA, LIFELINE CURVE

FIGURE 29 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY AGE GROUP, 2024

FIGURE 30 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY AGE GROUP, 2025-2032 (USD THOUSAND)

FIGURE 31 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY AGE GROUP, CAGR (2025-2032)

FIGURE 32 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 33 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY ROUTE OF ADMINISTRATION, 2024

FIGURE 34 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY ROUTE OF ADMINISTRATION, 2025-2032 (USD THOUSAND)

FIGURE 35 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2025-2032)

FIGURE 36 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 37 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY END USER, 2024

FIGURE 38 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 39 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY END USER, CAGR (2025-2032)

FIGURE 40 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY END USER, LIFELINE CURVE

FIGURE 41 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 42 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

FIGURE 43 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 44 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 45 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: SNAPSHOT (2024)

FIGURE 46 North America Lymphedema Treatment Market: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。