北美锂离子电池回收市场,按组件(活性材料、非活性材料)、化学成分(锂镍锰钴 (Li-NMC)、锂钴氧化物 (LCO)、锂锰氧化物 (LMO)、锂铁磷酸盐(LFP)、锂镍钴铝氧化物 (NCA)、锂钛氧化物 (LTO))、回收工艺(湿法冶金工艺、火法冶金工艺、物理/机械工艺)划分——行业趋势和预测到 2029 年。

市场分析和规模

锂离子电池由锂离子组成,充电时锂离子通过电解质从负极移动到正极,充电时锂离子则向后移动。这些电池是可充电的,常用于消费电子产品和汽车。它由四个组件组成:阴极、阳极、隔膜和电解质。阳极有助于储存和释放阴极中的锂离子,使电流能够通过外部电路。阴极充当锂离子的来源,决定了电池的容量和平均电压。电解质基本上是帮助离子移动的介质。隔膜基本上有助于防止阴极和阳极之间的接触。铝箔用作阴极的集电器,铜箔用作阳极的集电器。所有四个组件的组合构成一个电池,用于为各种应用供电。电池组形成模块,模块组形成电池组。与其他可充电电池相比,锂离子电池具有高能量密度、电压容量和较低的自放电率。这使得它们非常适合广泛的应用。

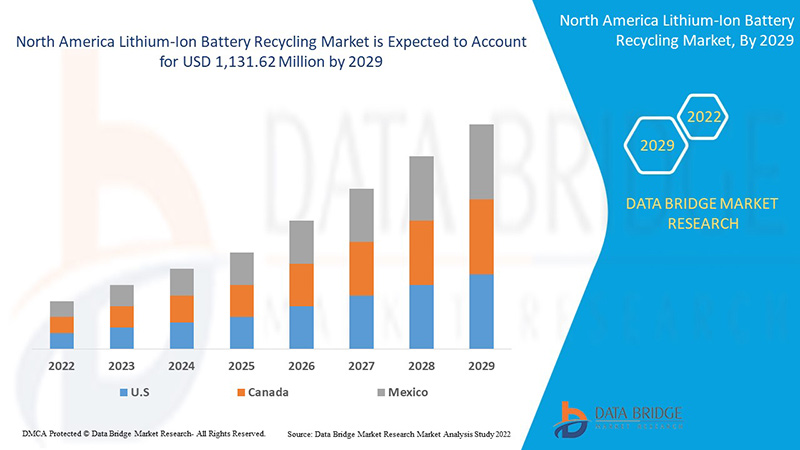

Data Bridge Market Research 分析,北美锂离子电池回收市场预计到 2029 年将达到 11.3162 亿美元的价值,预测期内的复合年增长率为 19.7%。锂离子电池回收市场报告还深入介绍了定价分析、专利分析和技术进步。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020 |

|

定量单位 |

收入(百万美元),定价(美元) |

|

涵盖的领域 |

按成分(活性材料、非活性材料)、化学成分(锂镍锰钴 (Li-NMC)、锂 钴氧化物 (LCO)、锂锰氧化物 (LMO)、锂铁磷酸盐(LFP)、锂镍钴铝氧化物 (NCA)、锂钛氧化物 (LTO))、回收工艺(湿法冶金工艺、火法冶金工艺、物理/机械工艺) |

|

覆盖国家 |

北美的美国、加拿大和墨西哥 |

|

涵盖的市场参与者 |

Glencore、Retriev Technologies、Umicore、American Manganese Inc.、Li-Cycle Corp、TES、宁德时代新能源科技股份有限公司、赣锋锂业股份有限公司、OnTo Technology LLC、Lithion Recycling、ECOBAT、Veolia Environnement SA、Batrec Industrie、Redwood Materials, Inc. |

锂离子电池回收市场动态

本节旨在了解市场驱动因素、优势、机遇、限制和挑战。以下内容将详细讨论所有这些内容:

驱动程序

- 智能手机和消费电子产品的需求不断增长

消费电子产品的需求和要求持续呈指数级增长。锂离子电池在消费电子产品中很常见。它们是便携式电子产品最受欢迎的可充电电池类型之一,具有适当的能量重量比、高开路电压和低自放电率。技术的进步使电子设备的尺寸更小,使其更薄、更轻,这增加了对锂离子电池的需求。锂离子电池使用寿命更长、充电速度更快、功率密度更高,可在更轻的封装中延长电池寿命。

- 低碳发电运输车队的渗透率

公路运输排放占所有运输温室气体 (GHG) 排放的近 75% 和全球温室气体排放的 11%。电气化是公路运输的关键脱碳杠杆。相比之下,电动汽车目前的排放量比内燃机少 30-60%,具体取决于动力结构。如果不采取行动,全球公路运输排放量将继续增长,因为化石燃料提供的运输需求增加。然而,电气化有助于减少二氧化碳排放,并通过避免有毒气体的混合来改善空气质量。为了缓解气候变化和创造无化石燃料的经济,全球社会已同意必须迅速大幅减少温室气体排放。因此,锂离子电池被认为是替代传统化石燃料驱动设备的有前途的清洁技术。与其他高质量可充电电池技术相比,锂离子电池的能量密度是当今所有电池技术中最高的(100-265 Wh/kg 或 250-670 Wh/L)。锂离子电池也用于为一些航空航天应用的电力系统供电,其中环保和重量轻是主要因素。

机会

- 回收研发项目和政府设施不断增多

锂离子电池应用范围广泛,随着研发投入的不断增加,更多先进特性正在被开发出来。各公司正在建设新的生产设施,以满足电动汽车、医疗设备和数据通信领域对锂离子电池日益增长的需求。新设施和不断增长的研发为全球锂离子电池市场的增长创造了新的机会。

限制/挑战

- 废旧电池储存和运输的安全问题

锂离子广泛应用于各种应用,如消费电子产品、工业应用、医疗设备和汽车。锂离子电池重量轻,现在设计为具有柔性和可变形状。然而,如果有缺陷或过度充电、包装不当、误用或处理不当,锂离子电池可能极其危险。锂具有高反应性和易燃性,因此可能对生命和财产造成严重损害。这些特性可能会在锂离子的储存、使用和运输过程中造成危害。

- 锂离子电池过热相关问题

尽管锂离子电池具有技术前景,但仍存在许多缺点,特别是在安全性方面。锂离子电池容易过热,在高电压下容易损坏。在某些情况下,这会导致热失控和燃烧。这些电池需要安全机制来限制电压和内部压力,这在某些情况下会增加重量并限制性能。锂离子电池也容易老化,这意味着它们可能会失去容量,并且在几年后经常出现故障。限制其广泛采用的另一个因素是其成本,比镍镉电池高出约 40%。

新冠肺炎疫情对锂离子电池回收市场的影响

COVID-19 对锂离子电池回收市场产生了重大影响,因为几乎每个国家都选择关闭除生产必需品的工厂以外的所有生产工厂。

疫情过后,锂离子电池回收市场的增长归因于所有地区和国家汽车行业电气化的日益普及。尽管汽车行业在疫情期间面临重大问题,但疫情过后,电动汽车销量跃升至更高水平。此外,消费者对电池供电电子产品的需求也在一段时间内增加,这是该市场增长的驱动力。

制造商正在制定各种战略决策,以在新冠疫情后实现复苏。参与者正在进行多项研发活动,以改进锂离子电池回收技术。借助这些技术,这些公司将把先进的技术推向市场。此外,政府对电动汽车使用的举措也推动了市场的增长

近期发展

- 2022 年 3 月,Li-Cycle Corp 将业务范围扩大到北美地区,并将在金斯敦的 Clogg's Road 商业园区建立一个卓越中心。这将进一步帮助该公司增强其在整个市场的锂离子电池回收服务组合。

- 2021 年 11 月,ECOBAT 宣布将其在北美和欧洲地区的新设施扩建为由摩根大通牵头的新的 5 年期全球融资机构。借助此举,该公司旨在为该地区提供全套锂电池回收服务。

北美锂离子电池回收市场范围

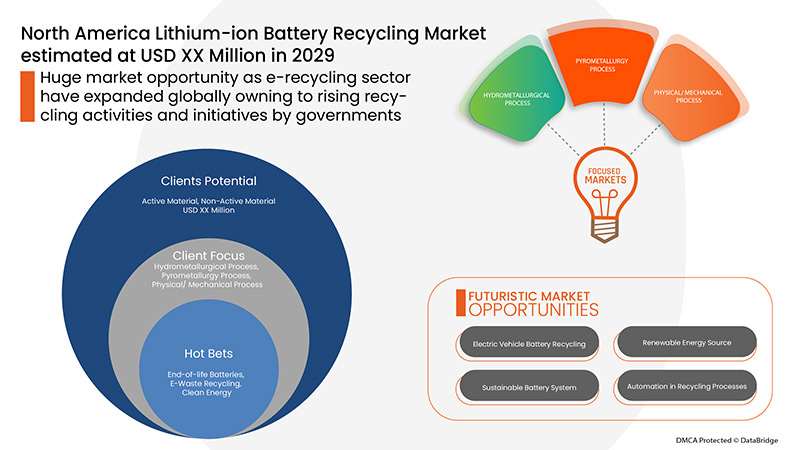

锂离子电池回收市场根据成分、化学成分和回收工艺进行细分。这些细分市场之间的增长情况将帮助您分析行业中增长缓慢的细分市场,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

成分

- 活性材料

- 非活性物质

根据成分,锂离子电池回收市场分为活性材料和非活性材料。

化学

- 锂镍锰钴 (Li-NMC)

- 锂钴氧化物 (LCO)

- 锂锰氧化物 (LMO)

- 磷酸铁锂(LFP)

- 锂镍钴铝氧化物 (NCA)

- 钛酸锂 (LTO)

根据化学基础,锂离子电池回收市场细分为锂镍锰钴(Li-NMC)、锂钴氧化物(LCO)、锂锰氧化物(LMO)、磷酸铁锂(LFP)、锂镍钴铝氧化物(NCA)、锂钛氧化物(LTO)。

回收过程

- 湿法冶金工艺

- 火法冶金工艺

- 物理/机械过程

根据回收工艺,锂离子电池回收市场细分为湿法冶金工艺、火法冶金工艺、物理/机械工艺。

锂离子电池回收市场区域分析/见解

对锂离子电池回收市场进行了分析,并按国家、组件、回收工艺和化学成分提供了上述市场规模见解和趋势。

锂离子电池回收市场报告涵盖的国家包括北美的美国、加拿大和墨西哥。

由于电动汽车、移动设备和智能可穿戴设备对锂离子电池的需求不断增加,美国在北美地区占据主导地位。

报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和市场监管变化。下游和上游价值链分析、技术趋势和波特五力分析、案例研究等数据点是用于预测各个国家市场情景的一些指标。此外,在提供国家数据的预测分析时,还考虑了北美品牌的存在和可用性以及它们因来自本地和国内品牌的大量或稀缺竞争而面临的挑战、国内关税和贸易路线的影响。

竞争格局和锂离子电池回收市场份额分析

锂离子电池回收市场竞争格局按竞争对手提供详细信息。详细信息包括公司概况、公司财务状况、产生的收入、市场潜力、研发投资、新市场计划、北美业务、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度、应用主导地位。以上提供的数据点仅与公司对锂离子电池回收市场的关注有关。

锂离子电池回收市场的一些主要参与者包括 Glencore、Retriev Technologies、Umicore、American Manganese Inc.、Li-Cycle Corp、TES、宁德时代科技股份有限公司、赣锋锂业股份有限公司、OnTo Technology LLC、Lithion Recycling、ECOBAT、Veolia Environnement SA、Batrec Industrie 和 Redwood Materials, Inc.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 COMPONENT TIMELINE CURVE

2.1 MARKET CHALLENGE MATRIX

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 MANUFACTURING OUTLOOK

4.2 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.3 PORTER’S FIVE FORCES

4.4 VENDOR SELECTION CRITERIA

4.5 PESTEL ANALYSIS

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 OVERVIEW

4.6.2 LOGISTIC COST SCENARIO

4.6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.7 CLIMATE CHANGE SCENARIO

4.7.1 ENVIRONMENTAL CONCERNS

4.7.2 INDUSTRY RESPONSE

4.7.3 GOVERNMENT’S ROLE

4.7.4 ANALYST RECOMMENDATION

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND FOR SMART PHONES & CONSUMER ELECTRONICS

6.1.2 PENETRATION OF LOW CARBON GENERATION TRANSPORTATION FLEET

6.1.3 INCREASE IN DEMAND FOR LITHIUM-ION BATTERIES FOR VARIOUS INDUSTRIAL APPLICATIONS

6.1.4 RISE IN THE NUMBER OF ELECTRIC VEHICLES ACROSS THE REGION

6.1.5 INCREASE IN THE ADOPTION OF LITHIUM-ION BATTERIES IN THE DEFENSE SECTOR

6.2 RESTRAINTS

6.2.1 SAFETY ISSUES RELATED TO THE STORAGE AND TRANSPORTATION OF SPENT BATTERIES

6.2.2 STRINGENT GOVERNMENT REGULATIONS AND POLICIES FOR RECYCLING OF LITHIUM-ION BATTERY

6.3 OPPORTUNITIES

6.3.1 GROWING NUMBER OF R&D INITIATIVES AND GOVERNMENT FACILITIES FOR RECYCLING

6.3.2 RISE IN ACQUISITIONS & PARTNERSHIPS AMONG VARIOUS ORGANIZATIONS

6.3.3 INCREASE IN GROWTH OF RENEWABLE ENERGY ACROSS THE REGION

6.3.4 HIGHER ADOPTION OF CORDLESS POWER TOOLS

6.4 CHALLENGES

6.4.1 ISSUES RELATED TO OVERHEATING OF LITHIUM-ION BATTERY

6.4.2 HIGHER DEGRADATION RATE OF LITHIUM-ION BATTERY

7 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 ACTIVE MATERIAL

7.3 NON-ACTIVE MATERIAL

8 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET, BY CHEMISTRY

8.1 OVERVIEW

8.2 LITHIUM-NICKEL MANGANESE COBALT (LI-NMC)

8.3 LITHIUM COBALT OXIDE (LCO)

8.4 LITHIUM-MANGANESE OXIDE (LMO)

8.5 LITHIUM-IRON PHOSPHATE (LFP)

8.6 LITHIUM-NICKEL COBALT ALUMINIUM OXIDE (NCA)

8.7 LITHIUM-TITANATE OXIDE (LTO)

9 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET, BY RECYCLING PROCESS

9.1 OVERVIEW

9.2 HYDROMETALLURGICAL PROCESS

9.3 PYROMETALLURGY PROCESS

9.4 PHYSICAL/ MECHANICAL PROCESS

10 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 GLENCORE

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENT

13.2 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 SOLUTION CATEGORIES

13.2.5 ECENT DEVELOPMENT

13.3 UMICORE

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT POTFOLIO

13.3.5 RECENT DEVELOPMENT

13.4 GEM CO., LTD.

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENT

13.5 VEOLIA

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 ACCUREC-RECYCLING GMBH

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 AKKUSER OY

13.7.1 COMPANY SNAPSHOT

13.7.2 SERVICE PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 AMERICAN MANGANESE INC.

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 ATTERO RECYCLING PVT. LTD.

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 BATREC INDUSTRIE

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 CAWLEYS

13.11.1 COMPANY SNAPSHOT

13.11.2 SERVICE PORTFOLIO

13.11.3 RECENT DEVELOPMENTS

13.12 DUESENFELD GMBH

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 ECOBAT

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 ENVIROSTREAM AUSTRALIA PTY LTD

13.14.1 COMPANY SNAPSHOT

13.14.2 SERVICE PORTFOLIO

13.14.3 RECENT DEVELOPMENTS

13.15 FORTUM

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENT

13.16 GANFENG LITHIUM CO., LTD

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENT

13.17 LI-CYCLE CORP

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 SERVICE PORTFOLIO

13.17.4 RECENT DEVELOPMENT

13.18 LITHION RECYCLING

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 NEOMETALS LTD

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT DEVELOPMENT

13.2 NICKELHÜTTE AUE GMBH

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENTS

13.21 ONTO TECHNOLOGY LLC

13.21.1 COMPANY SNAPSHOT

13.21.2 SERVICE PORTFOLIO

13.21.3 RECENT DEVELOPMENTS

13.22 REDWOOD MATERIALS, INC.,

13.22.1 COMPANY SNAPSHOT

13.22.2 SERVICE PORTFOLIO

13.22.3 RECENT DEVELOPMENT

13.23 RETRIEV TECHNOLOGIES

13.23.1 COMPANY SNAPSHOT

13.23.2 PRODUCT PORTFOLIO

13.23.3 RECENT DEVELOPMENTS

13.24 SAUBERMACHER DIENSTLEISTUNGS AG

13.24.1 COMPANY SNAPSHOT

13.24.2 PRODUCT PORTFOLIO

13.24.3 RECENT DEVELOPMENT

13.25 TATA CHEMICALS LTD.

13.25.1 COMPANY SNAPSHOT

13.25.2 REVENUE ANALYSIS

13.25.3 PRODUCT PORTFOLIO

13.25.4 RECENT DEVELOPMENT

13.26 TES

13.26.1 COMPANY SNAPSHOT

13.26.2 PRODUCT PORTFOLIO

13.26.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

表格列表

TABLE 1 LIST OF THE COMPANIES WITH THEIR RECYCLING PROCESS AND APPROXIMATE CAPACITY

TABLE 2 STANDARDS RELATED TO LITHIUM-ION BATTERIES

TABLE 3 POLICIES RELEVANT TO LIB RECYCLING PUBLISHED IN CHINA

TABLE 4 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA ACTIVE MATERIAL IN LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA NON-ACTIVE MATERIAL IN LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA LITHIUM-NICKEL MANGANESE COBALT (LI-NMC) IN LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA LITHIUM COBALT OXIDE (LCO) IN LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA LITHIUM-MANGANESE OXIDE (LMO) IN LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA LITHIUM-IRON PHOSPHATE (LFP) IN LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA LITHIUM-NICKEL COBALT ALUMINUM OXIDE (NCA) IN LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA LITHIUM-TITANATE OXIDE (LTO) IN LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET, BY RECYCLING PROCESS, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA HYDROMETALLURGICAL PROCESS IN LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA PYROMETALLURGY PROCESS IN LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA PHYSICAL/ MECHANICAL PROCESS IN LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET, BY RECYCLING PROCESS, 2020-2029 (USD MILLION)

TABLE 22 U.S. LITHIUM-ION BATTERY RECYCLING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 23 U.S. LITHIUM-ION BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2029 (USD MILLION)

TABLE 24 U.S. LITHIUM-ION BATTERY RECYCLING MARKET, BY RECYCLING PROCESS, 2020-2029 (USD MILLION)

TABLE 25 CANADA LITHIUM-ION BATTERY RECYCLING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 26 CANADA LITHIUM-ION BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2029 (USD MILLION)

TABLE 27 CANADA LITHIUM-ION BATTERY RECYCLING MARKET, BY RECYCLING PROCESS, 2020-2029 (USD MILLION)

TABLE 28 MEXICO LITHIUM-ION BATTERY RECYCLING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 29 MEXICO LITHIUM-ION BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2029 (USD MILLION)

TABLE 30 MEXICO LITHIUM-ION BATTERY RECYCLING MARKET, BY RECYCLING PROCESS, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: NORTH AMERICA VS. REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: SEGMENTATION

FIGURE 10 INCREASING DEMAND FOR SMARTPHONES AND CONSUMER ELECTRONICS IS EXPECTED TO DRIVE THE NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET IN 2022 & 2029

FIGURE 12 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST GROWING REGION IN THE NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET IN THE FORECAST PERIOD OF 2020 TO 2029

FIGURE 13 HISTORICAL DATA FOR ANNUAL NORTH AMERICA LITHIUM-ION BATTERY DEPLOYMENT FOR ALL MARKETS

FIGURE 14 REGION WITH LITHIUM ION BATTERY RECYCLING CAPACITY FOR ALL APPLICATIONS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET

FIGURE 16 PROJECTION OF STEADY GROWTH FOR DEMAND FOR CONSUMER ELECTRONICS (2015-2025)

FIGURE 17 NUMBER OF PLUG-IN ELECTRIC PASSENGER CAR SALES IN 2020 IN UNITS

FIGURE 18 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: BY COMPONENT, 2021

FIGURE 19 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: BY CHEMISTRY, 2021

FIGURE 20 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: BY RECYCLING PROCESS, 2021

FIGURE 21 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: SNAPSHOT (2021)

FIGURE 22 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: BY COUNTRY (2021)

FIGURE 23 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: BY COMPONENT (2022-2029)

FIGURE 26 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。