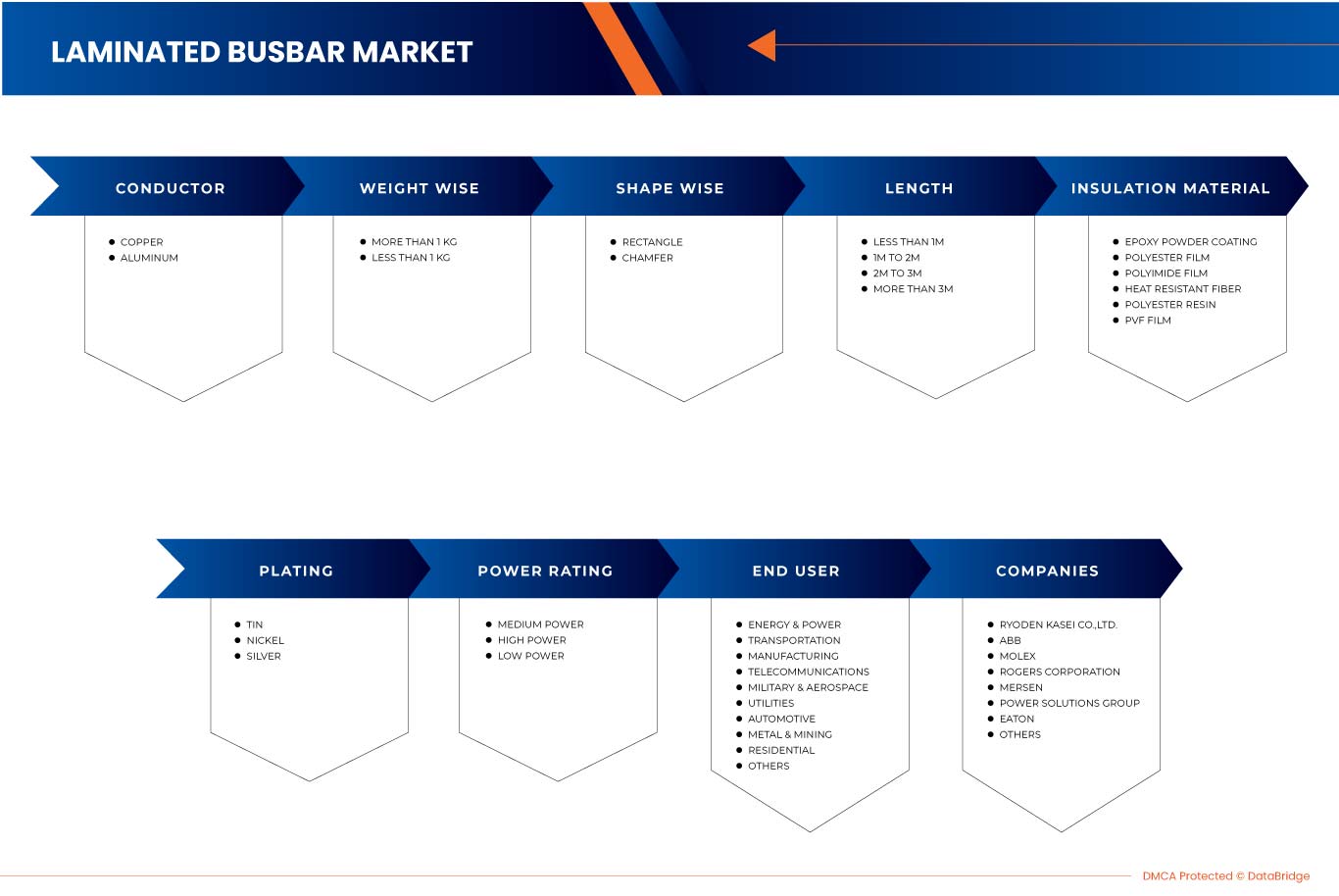

北美层压母线市场,按导体(铜和铝)、重量(大于 1 公斤和小于 1 公斤)、形状(矩形和倒角)、长度(小于 1 米、1 米至 2 米、2 米至 3 米和大于 3 米)、绝缘材料(环氧粉末涂料、聚酯薄膜、聚酰亚胺薄膜、耐热纤维、聚酯树脂和 PVF 薄膜)、电镀(锡、镍和银)、额定功率(中功率、高功率和低功率)、最终用户(能源和电力、运输、制造、电信、军事和航空航天、公用事业、汽车、金属和采矿、住宅等)划分 - 行业趋势和预测到 2030 年。

北美层压母线市场分析和规模

层压母线是一种设计好的部件,由薄介电材料隔开并熔合的金属层组成。这些母线已升级技术,以集成导电服务并降低整体框架费用。同样,各种有益的功能支持对混合动力和电动汽车的需求。此外,这将推动市场的增长率。此外,层压母线市场受到各种因素的驱动,例如电力需求增加和对安全可靠的配电系统的需求增加。除此之外,可再生能源整合的增加将扩大层压母线市场。此外,提高节能和效率意识是影响层压母线市场增长的主要因素。缓冲层压母线市场增长率的重要因素是快速的工业化和技术进步。层压母线的成本效益和运营优势将促进市场的增长率。

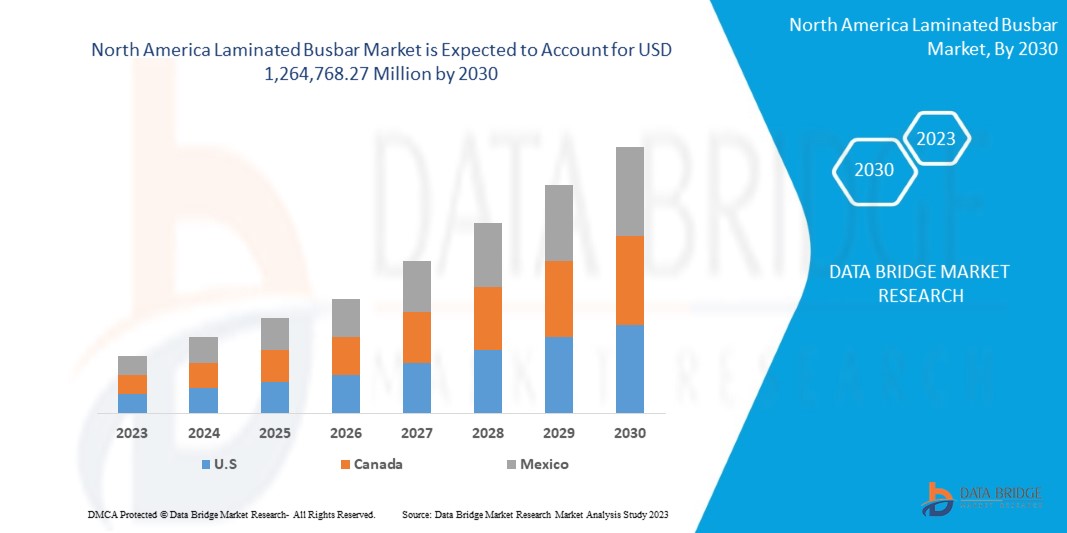

Data Bridge Market Research 分析,北美层压母线市场预计到 2030 年将达到 1,264,768.27 百万美元的价值,预测期内的复合年增长率为 5.8%。北美层压母线市场报告还全面涵盖了定价分析、专利分析和技术进步。

|

报告指标 |

细节 |

|

预测期 |

2023 至 2030 年 |

|

基准年 |

2022 |

|

历史岁月 |

2021 (可定制为 2015-2020) |

|

定量单位 |

收入(百万美元),定价(美元) |

|

涵盖的领域 |

导体(铜和铝)、重量(大于 1 公斤和小于 1 公斤)、形状(矩形和倒角)、长度(小于 1 米、1 米至 2 米、2 米至 3 米和大于 3 米)、绝缘材料(环氧粉末涂料、聚酯薄膜、聚酰亚胺薄膜、耐热纤维、聚酯树脂和 PVF 薄膜)、镀层(锡、镍和银)、额定功率(中功率、高功率和低功率)、最终用户(能源和电力、运输、制造、电信、军事和航空航天、公用事业、汽车、金属和采矿、住宅等) |

|

覆盖国家 |

美国、加拿大和墨西哥 |

|

涵盖的市场参与者 |

RYODEN KASEI CO., LTD.、Rittal GmbH & Co. KG、苏州西迪恩新电源电气有限公司 (WDI)、伊顿、EMS Elektro Metall Schwanenmühle GmbH、Baknor、espbus.com、Jans Copper Private Limited、Power Solutions Group、Segue Electronics, Inc.、上海鹰峰电子科技有限公司、Assemblage Paro Inc.、ABB、Sun.King Technology Group Limited、Storm Power Components、MERSEN PROPERTY、Raychem RPG Private Limited.、罗杰斯公司、浙江 RHI 电气有限公司和 AMPHENOL NORTH AMERICA INTERCONNECT SYSTEMS |

市场定义

母线是一种电气元件,称为电接头,起导体的作用。它可以被认为是一组导体,用于从进线收集电力并将其分配给出线。具有多种导体材料(例如铝和铜)的母线被视为层压母线。这种层压母线由多层导电金属组成,与单层母线和电缆导体相比具有多种性能优势。这种母线是根据形状、长度和用于绝缘母线的材料设计的。尽管这些母线镀有不同类型的镀层,但有助于集成导电服务。虽然层压母线是根据其他工作功率条件设计的,但它们用于各种应用。

北美层压母线市场动态

本节旨在了解市场驱动因素、优势、机遇、限制和挑战。下面将详细讨论所有这些内容:

司机

- 全球对电动汽车的需求不断增加

电动汽车 (EV) 旨在成为一种有前途的可持续交通技术,具有零碳排放、低噪音和高效率的特点。此外,电动汽车在 19 世纪发展起来,但由于缺乏技术进步,内燃机的需求量比电动汽车大得多。在 20 世纪,技术进步逐年提升,从而带来了有助于重塑电动汽车的发展和创新。

- 电信设备需求不断增长

电信行业与提供远距离通信服务有关。该行业包括有线电视、电话、互联网服务和卫星设施。因此,该行业专注于高分辨率音频和视频、数据服务和连接。

机会

- 电气化需求上升

大多数工业制造商越来越关注可持续性,正朝着电气化工业车队、流程和空间的方向发展,以配合整个经济的广泛能源转型。由于多种因素,包括电力消耗增加和二氧化碳排放减少,全球对电气化的需求不断增长,从而实现了经济脱碳并缓解了气候变化。政府还协助在农村地区提供电力或接入智能城市计划。

克制/挑战

- 原材料价格大幅波动

层压母线由导电层和泡沫介电层交替层组成。泡沫介电层可提高局部放电起始和熄灭电压水平。此外,层压结构可用于配电系统和大功率晶体管模块。

- 参与复杂的制造过程

母线是一种金属条,通常由铜或铝制成,用作导体。母线就像一个中心点,在一个位置收集电力,从而实现系统中的无缝分配。在许多行业中,铜制母线因其较高的导电性和电阻而受到企业的青睐,并且是地壳中丰富的矿物。

最新动态

- 2022 年 9 月,Molex 宣布扩建其在越南的制造工厂。此次扩建将有助于满足其用于多种不同应用的产品日益增长的需求,这将帮助该公司提供 200 个新的工作岗位,并通过加速制造产品设施来管理市场上产品的需求和供应。

- 2021 年 3 月,Rittal GmbH & Co. KG 宣布与 Stulz 合作,提供量身定制的数据中心基础设施、咨询、支持和服务。此次合作确保了配电系统业务的增长,从而提高了公司的收入增长。

北美层压母线市场范围

北美层压母线市场根据导体、重量、形状、长度、绝缘材料、镀层、额定功率和最终用户分为八个显著的细分市场。这些细分市场之间的增长将帮助您分析行业中微弱的增长细分市场,并为用户提供有价值的市场概览和见解,帮助他们做出战略决策,以确定核心市场应用。

导体

- 铜

- 铝

根据导体,市场分为铝和铜。

体重明智

- 超过 1 公斤

- 少于 1 公斤

根据重量,市场分为 1 公斤以下和 1 公斤以上。

形状明智

- 长方形

- 倒角

根据形状,市场分为矩形和倒角。

长度

- 少于 1M

- 1M 至 2M

- 2M 至 3M

- 超过 300 万

根据长度,市场细分为小于 1 米、1 米至 2 米、2 米至 3 米和超过 3 米。

绝缘材料

- 环氧粉末涂料

- 聚酯薄膜

- 聚酰亚胺薄膜

- 耐热纤维

- 聚酯树脂

- PVF 薄膜

根据绝缘材料,市场细分为环氧粉末涂料、聚酯薄膜、PVF薄膜、聚酯树脂、耐热纤维和聚酰亚胺薄膜。

电镀

- 锡

- 镍

- 银

根据电镀类型,市场分为锡、镍和银。

额定功率

- 中等功率

- 高功率

- 低功耗

根据功率等级,市场分为低功率、中功率和高功率。

最终用户

- 能源与电力

- 运输

- 制造业

- 电信

- 军事与航空航天

- 实用工具

- 汽车

- 金属与采矿

- 住宅

- 其他的

根据最终用户,市场细分为公用事业、金属和采矿、制造业、住宅、电信、军事和航空航天、运输、能源和电力、汽车等。

北美层压母线市场区域分析/见解

对北美层压母线市场进行了分析,并按上述区域和细分市场提供了市场规模见解和趋势。

北美层压母线市场报告涵盖的国家包括美国、加拿大和墨西哥。

美国在北美地区占据主导地位,因为对可再生能源的需求不断增长,从而带来了对有效、可靠的输电和配电网络的需求。

报告的区域部分还提供了影响市场当前和未来趋势的各个市场影响因素和市场监管变化。下游和上游价值链分析、技术趋势和波特五力分析、案例研究等数据点是用于预测各个国家市场情景的一些指标。此外,在提供区域数据的预测分析时,还考虑了北美品牌的存在和可用性以及由于来自本地和国内品牌的大量或稀缺竞争而面临的挑战、国内关税的影响和贸易路线。

竞争格局和北美层压母线市场份额分析

北美层压母线市场竞争格局提供竞争对手的详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、北美业务、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度、应用主导地位。以上提供的数据点仅与公司对北美层压母线市场的关注有关。

北美层压母线市场的一些主要参与者包括 RYODEN KASEI CO., LTD.、Rittal GmbH & Co. KG、苏州西德恩新电力电气有限公司 (WDI)、伊顿、EMS Elektro Metall Schwanenmühle GmbH、Baknor、espbus.com、Jans Copper Private Limited、Power Solutions Group、Segue Electronics, Inc.、上海鹰峰电子科技有限公司、Assemblage Paro Inc.、ABB、Sun.King Technology Group Limited、Storm Power Components、MERSEN PROPERTY、Raychem RPG Private Limited.、罗杰斯公司、浙江 RHI 电气有限公司和 AMPHENOL NORTH AMERICA INTERCONNECT SYSTEMS 等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA LAMINATED BUSBAR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 CONDUCTOR TIMELINE CURVE

2.1 MARKET END-USE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES

4.2 CASE STUDY

4.3 REGULATORY FRAMEWORK

4.4 PATENT ANALYSIS

4.5 TECHNOLOGICAL TRENDS

4.6 VALUE CHAIN ANALYSIS

4.7 COMPANY COMPARATIVE ANALYSIS

4.8 TOP COMPANY MARKET SHARES BY END-USERS

5 REGIONAL REASONING

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 NCREASING DEMAND FOR ELECTRIC VEHICLES ACROSS THE GLOBE

6.1.2 RISING NEED FOR TELECOMMUNICATION EQUIPMENT

6.1.3 INCREASING NUMBER OF HYPER-SCALE DATA CENTERS

6.1.4 RISING DEMAND FOR SAFE AND SECURE ELECTRICAL DISTRIBUTION SYSTEMS

6.1.5 GROWING IMPORTANCE TOWARDS THE ADOPTION OF INSULATING AND PLATING METHODS

6.2 RESTRAINT

6.2.1 HIGH PRICE VOLATILITY ASSOCIATED WITH RAW MATERIALS

6.3 OPPORTUNITIES

6.3.1 RISE IN THE DEMAND FOR ELECTRIFICATION

6.3.2 INCREASE IN INVESTMENTS IN R&D TO DEVELOP EFFICIENT ELECTRIC COMPONENTS

6.3.3 UPSURGE IN THE ADOPTION OF RENEWABLE ENERGY

6.4 CHALLENGES

6.4.1 INVOLVEMENT IN SOPHISTICATED MANUFACTURING PROCESS

6.4.2 POWER DISTRIBUTION CHALLENGES IN SMALL AND MEDIUM-SIZED PC BOARDS AND CIRCUITS

7 NORTH AMERICA LAMINATED BUSBAR MARKET, BY CONDUCTOR

7.1 OVERVIEW

7.2 COPPER

7.2.1 TRANSFORMERS

7.2.2 RECTIFIERS

7.2.3 GENERATORS

7.2.4 OTHERS

7.3 ALUMINUM

8 NORTH AMERICA LAMINATED BUSBAR MARKET, BY WEIGHT WISE

8.1 OVERVIEW

8.2 MORE THAN 1 KG

8.3 LESS THAN 1 KG

9 NORTH AMERICA LAMINATED BUSBAR MARKET, BY SHAPE WISE

9.1 OVERVIEW

9.2 RECTANGLE

9.3 CHAMFER

10 NORTH AMERICA LAMINATED BUSBAR MARKET, BY END USER

10.1 OVERVIEW

10.2 ENERGY & POWER

10.2.1 POWER TRANSMISSION

10.2.1.1 HVDC CONVERTER STATIONS

10.2.1.2 SUBSTATIONS

10.2.1.3 MAIN STATIONS

10.2.1.4 SWITCHGEARS

10.2.1.5 TRANSFORMER STATIONS

10.2.1.6 OFF-SHORE

10.2.1.7 DISTRIBUTION STATIONS

10.2.1.8 OTHERS

10.2.2 HYDROPOWER

10.2.3 SOLAR POWER

10.2.4 WIND POWER

10.2.5 OTHERS

10.2.6 COPPER

10.2.7 ALUMINUM

10.2.8 EPOXY POWDER COATING

10.2.9 POLYESTER FILM

10.2.10 POLYIMIDE FILM

10.2.11 HEAT RESISTANT FIBER

10.2.12 POLYESTER RESIN

10.2.13 PVF FILM

10.3 TRANSPORTATION

10.3.1 COPPER

10.3.2 ALUMINUM

10.3.3 EPOXY POWDER COATING

10.3.4 POLYESTER FILM

10.3.5 POLYIMIDE FILM

10.3.6 HEAT RESISTANT FIBER

10.3.7 POLYESTER RESIN

10.3.8 PVF FILM

10.4 MANUFACTURING

10.4.1 COPPER

10.4.2 ALUMINUM

10.4.3 EPOXY POWDER COATING

10.4.4 POLYESTER FILM

10.4.5 POLYIMIDE FILM

10.4.6 HEAT RESISTANT FIBER

10.4.7 POLYESTER RESIN

10.4.8 PVF FILM

10.5 TELECOMMUNICATIONS

10.5.1 BASE STATIONS

10.5.2 NETWORK SERVERS

10.5.3 TELEPHONE EXCHANGE SYSTEMS

10.5.4 CELLULAR COMMUNICATIONS

10.5.5 OTHERS

10.5.6 COPPER

10.5.7 ALUMINUM

10.5.8 EPOXY POWDER COATING

10.5.9 POLYESTER FILM

10.5.10 POLYIMIDE FILM

10.5.11 HEAT RESISTANT FIBER

10.5.12 POLYESTER RESIN

10.5.13 PVF FILM

10.6 MILITARY & AEROSPACE

10.6.1 AIRCRAFT CARRIER

10.6.2 UNMANNED AERIAL VEHICLE

10.6.3 DEFENSE EQUIPMENT

10.6.4 OTHERS

10.6.5 COPPER

10.6.6 ALUMINUM

10.6.7 EPOXY POWDER COATING

10.6.8 POLYESTER FILM

10.6.9 POLYIMIDE FILM

10.6.10 HEAT RESISTANT FIBER

10.6.11 POLYESTER RESIN

10.6.12 PVF FILM

10.7 UTILITIES

10.7.1 COPPER

10.7.2 ALUMINUM

10.7.3 EPOXY POWDER COATING

10.7.4 POLYESTER FILM

10.7.5 POLYIMIDE FILM

10.7.6 HEAT RESISTANT FIBER

10.7.7 POLYESTER RESIN

10.7.8 PVF FILM

10.8 AUTOMOTIVE

10.8.1 BATTERY ELECTRIC VEHICLE

10.8.2 HYBRID ELECTRIC VEHICLE

10.8.3 PLUG-IN HYBRID VEHICLE

10.8.4 COPPER

10.8.5 ALUMINUM

10.8.6 EPOXY POWDER COATING

10.8.7 POLYESTER FILM

10.8.8 POLYIMIDE FILM

10.8.9 HEAT RESISTANT FIBER

10.8.10 POLYESTER RESIN

10.8.11 PVF FILM

10.9 METAL & MINING

10.9.1 COPPER

10.9.2 ALUMINUM

10.9.3 EPOXY POWDER COATING

10.9.4 POLYESTER FILM

10.9.5 POLYIMIDE FILM

10.9.6 HEAT RESISTANT FIBER

10.9.7 POLYESTER RESIN

10.9.8 PVF FILM

10.1 RESIDENTIAL

10.10.1 COPPER

10.10.2 ALUMINUM

10.10.3 EPOXY POWDER COATING

10.10.4 POLYESTER FILM

10.10.5 POLYIMIDE FILM

10.10.6 HEAT RESISTANT FIBER

10.10.7 POLYESTER RESIN

10.10.8 PVF FILM

10.11 OTHERS

11 NORTH AMERICA LAMINATED BUSBAR MARKET, BY LENGTH

11.1 OVERVIEW

11.2 LESS THAN 1M

11.3 1M TO 2M

11.4 2M TO 3M

11.5 MORE THAN 3M

12 NORTH AMERICA LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL

12.1 OVERVIEW

12.2 EPOXY POWDER COATING

12.3 POLYESTER FILM

12.4 POLYIMIDE FILM

12.5 HEAT RESISTANT FIBER

12.6 POLYESTER RESIN

12.7 PVF FILM

13 NORTH AMERICA LAMINATED BUSBAR MARKET, BY PLATING

13.1 OVERVIEW

13.2 TIN

13.3 NICKEL

13.4 SILVER

14 NORTH AMERICA LAMINATED BUSBAR MARKET, BY POWER RATING

14.1 OVERVIEW

14.2 MEDIUM POWER

14.2.1 400 AMP TO 800 AMP

14.2.2 200 AMP TO 400 AMP

14.2.3 125 AMP TO 200 AMP

14.3 HIGH POWER

14.3.1 1000 AMP TO 1200 AMP

14.3.2 800 AMP TO 1000 AMP

14.4 LOW POWER

14.4.1 100 AMP TO 125 AMP

14.4.2 60 AMP TO 100 AMP

14.4.3 40 TO 60 AMP

14.4.4 LESS THAN 40 AMP

15 NORTH AMERICA LAMINATED BUSBAR MARKET, BY REGION

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 NORTH AMERICA LAMINATED BUSBAR MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 RYODEN KASEI CO., LTD.

18.1.1 COMPANY SNAPSHOT

18.1.2 COMPANY SHARE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT DEVELOPMENTS

18.2 ABB

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 MOLEX (A SUBSIDIAIRY OF KOCH INDUSTRIES)

18.3.1 COMPANY SNAPSHOT

18.3.2 COMPANY SHARE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT DEVELOPMENTS

18.4 ROGERS CORPORATION

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 MERSEN

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 AMPHENOL NORTH AMERICA INTERCONNECT SYSTEMS (SUBSIDIARY OF AMPHENOL CORPORATION)

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENTS

18.7 ASSEMBLAGE PARO INC.

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENT

18.8 BAKNOR

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 EATON

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 EMS ELEKTRO METALL SCHWANENMÜHLE GMBH

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 ESPBUS.COM

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENT

18.12 JANS COPPER PRIVATE LIMITED

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 POWER SOLUTIONS GROUP

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 COMPANY SHARE ANALYSIS

18.13.4 PRODUCT PORTFOLIO

18.13.5 RECENT DEVELOPMENTS

18.14 RAYCHEM RPG PRIVATE LIMITED

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENTS

18.15 RITTAL GMBH & CO. KG

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENTS

18.16 SEGUE ELECTRONICS, INC.

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.17 SHANGHAI EAGTOP ELECTRONIC TECHNOLOGY CO., LTD.

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.18 STORM POWER COMPONENTS

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENTS

18.19 SUN.KING TECHNOLOGY GROUP LIMITED

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENTS

18.2 SUZHOU WEST DEANE NEW POWER ELECTRIC CO., LTD (WDI)

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 ZHEJIANG RHI ELECTRIC CO., LTD

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

表格列表

TABLE 1 NORTH AMERICA LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 2 NORTH AMERICA COPPER IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 3 NORTH AMERICA COPPER IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA ALUMINUM IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA LAMINATED BUSBAR MARKET, BY WEIGHT WISE, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA MORE THAN 1 KG IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA LESS THAN 1 KG IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA LAMINATED BUSBAR MARKET, BY SHAPE WISE, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA RECTANGLE IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA CHAMFER IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA LAMINATED BUSBAR MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA ENERGY & POWER IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA ENERGY & POWER IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA POWER TRANSMISSION IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA ENERGY & POWER IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA ENERGY & POWER IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA TRANSPORTATION IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA TRANSPORTATION IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA TRANSPORTATION IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA MANUFACTURING IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA MANUFACTURING IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA MANUFACTURING IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA TELECOMMUNICATIONS IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA TELECOMMUNICATION IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA TELECOMMUNICATION IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA TELECOMMUNICATION IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA MILITARY & AEROSPACE IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA MILITARY & AEROSPACE IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA MILITARY & AEROSPACE IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA MILITARY & AEROSPACE IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA UTILITIES IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA UTILITIES IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA UTILITIES IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA AUTOMOTIVE IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 35 NORTH AMERICA AUTOMOTIVE IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA AUTOMOTIVE IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 37 NORTH AMERICA AUTOMOTIVE IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA METAL & MINING IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 39 NORTH AMERICA METAL & MINING IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 40 NORTH AMERICA METAL & MINING IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 41 NORTH AMERICA RESIDENTIAL IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 42 NORTH AMERICA RESIDENTIAL IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 43 NORTH AMERICA RESIDENTIAL IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 44 NORTH AMERICA OTHERS IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 45 NORTH AMERICA LAMINATED BUSBAR MARKET, BY LENGTH, 2021-2030 (USD THOUSAND)

TABLE 46 NORTH AMERICA LESS THAN 1M IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 47 NORTH AMERICA 1M TO 2M IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 48 NORTH AMERICA 2M TO 3M IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 49 NORTH AMERICA MORE THAN 3M IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 50 NORTH AMERICA LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 51 NORTH AMERICA EPOXY POWDER COATING IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 52 NORTH AMERICA POLYESTER FILM IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 53 NORTH AMERICA POLYIMIDE FILM IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 54 NORTH AMERICA HEAT RESISTANT FIBER IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 55 NORTH AMERICA POLYESTER RESIN IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 56 NORTH AMERICA PVF FILM IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 57 NORTH AMERICA LAMINATED BUSBAR MARKET, BY PLATING, 2021-2030 (USD THOUSAND)

TABLE 58 NORTH AMERICA TIN IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 59 NORTH AMERICA NICKEL IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 60 NORTH AMERICA SILVER IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 61 NORTH AMERICA LAMINATED BUSBAR MARKET, BY POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 62 NORTH AMERICA MEDIUM POWER IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 63 NORTH AMERICA MEDIUM POWER IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 NORTH AMERICA HIGH POWER IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 65 NORTH AMERICA HIGH POWER IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 NORTH AMERICA LOW POWER IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 67 NORTH AMERICA HIGH POWER IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 68 NORTH AMERICA LAMINATED BUSBAR MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 69 NORTH AMERICA LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 70 NORTH AMERICA COPPER IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 71 NORTH AMERICA LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 72 NORTH AMERICA LAMINATED BUSBAR MARKET, BY SHAPE WISE, 2021-2030 (USD THOUSAND)

TABLE 73 NORTH AMERICA LAMINATED BUSBAR MARKET, BY LENGTH, 2021-2030 (USD THOUSAND)

TABLE 74 NORTH AMERICA LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 75 NORTH AMERICA LAMINATED BUSBAR MARKET, BY PLATING, 2021-2030 (USD THOUSAND)

TABLE 76 NORTH AMERICA LAMINATED BUSBAR MARKET, BY POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 77 NORTH AMERICA MEDIUM POWER IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 78 NORTH AMERICA HIGH POWER IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 79 NORTH AMERICA LOW POWER IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 80 NORTH AMERICA LAMINATED BUSBAR MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 81 NORTH AMERICA ENERGY & POWER IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 82 NORTH AMERICA POWER TRANSMISSION IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 NORTH AMERICA ENERGY & POWER IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 84 NORTH AMERICA ENERGY & POWER IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 85 NORTH AMERICA TRANSPORTATION IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 86 NORTH AMERICA TRANSPORTATION IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 87 NORTH AMERICA MANUFACTURING IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 88 NORTH AMERICA MANUFACTURING IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 89 NORTH AMERICA TELECOMMUNICATION IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 90 NORTH AMERICA TELECOMMUNICATION IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 91 NORTH AMERICA TELECOMMUNICATION IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 92 NORTH AMERICA MILITARY & AEROSPACE IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 93 NORTH AMERICA MILITARY & AEROSPACE IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 94 NORTH AMERICA MILITARY & AEROSPACE IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 95 NORTH AMERICA UTILITIES IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 96 NORTH AMERICA UTILITIES IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 97 NORTH AMERICA AUTOMOTIVE IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 98 NORTH AMERICA AUTOMOTIVE IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 99 NORTH AMERICA AUTOMOTIVE IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 100 NORTH AMERICA METAL & MINING IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 101 NORTH AMERICA METAL & MINING IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 102 NORTH AMERICA RESIDENTIAL IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 103 NORTH AMERICA RESIDENTIAL IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 104 U.S. LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 105 U.S. COPPER IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 106 U.S. LAMINATED BUSBAR MARKET, BY WEIGHT WISE, 2021-2030 (USD THOUSAND)

TABLE 107 U.S. LAMINATED BUSBAR MARKET, BY SHAPE WISE, 2021-2030 (USD THOUSAND)

TABLE 108 U.S. LAMINATED BUSBAR MARKET, BY LENGTH, 2021-2030 (USD THOUSAND)

TABLE 109 U.S. LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 110 U.S. LAMINATED BUSBAR MARKET, BY PLATING, 2021-2030 (USD THOUSAND)

TABLE 111 U.S. LAMINATED BUSBAR MARKET, BY POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 112 U.S. MEDIUM POWER IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 113 U.S. HIGH POWER IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 114 U.S. LOW POWER IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 115 U.S. LAMINATED BUSBAR MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 116 U.S. ENERGY & POWER IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 117 U.S. POWER TRANSMISSION IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 118 U.S. ENERGY & POWER IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 119 U.S. ENERGY & POWER IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 120 U.S. TRANSPORTATION IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 121 U.S. TRANSPORTATION IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 122 U.S. MANUFACTURING IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 123 U.S. MANUFACTURING IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 124 U.S. TELECOMMUNICATION IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 125 U.S. TELECOMMUNICATION IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 126 U.S. TELECOMMUNICATION IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 127 U.S. MILITARY & AEROSPACE IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 128 U.S. MILITARY & AEROSPACE IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 129 U.S. MILITARY & AEROSPACE IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 130 U.S. UTILITIES IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 131 U.S. UTILITIES IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 132 U.S. AUTOMOTIVE IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 133 U.S. AUTOMOTIVE IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 134 U.S. AUTOMOTIVE IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 135 U.S. METAL & MINING IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 136 U.S. METAL & MINING IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 137 U.S. RESIDENTIAL IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 138 U.S. RESIDENTIAL IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 139 CANADA LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 140 CANADA COPPER IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 141 CANADA LAMINATED BUSBAR MARKET, BY WEIGHT WISE, 2021-2030 (USD THOUSAND)

TABLE 142 CANADA LAMINATED BUSBAR MARKET, BY SHAPE WISE, 2021-2030 (USD THOUSAND)

TABLE 143 CANADA LAMINATED BUSBAR MARKET, BY LENGTH, 2021-2030 (USD THOUSAND)

TABLE 144 CANADA LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 145 CANADA LAMINATED BUSBAR MARKET, BY PLATING, 2021-2030 (USD THOUSAND)

TABLE 146 CANADA LAMINATED BUSBAR MARKET, BY POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 147 CANADA MEDIUM POWER IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 148 CANADA HIGH POWER IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 149 CANADA LOW POWER IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 150 CANADA LAMINATED BUSBAR MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 151 CANADA ENERGY & POWER IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 152 CANADA POWER TRANSMISSION IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 153 CANADA ENERGY & POWER IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 154 CANADA ENERGY & POWER IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 155 CANADA TRANSPORTATION IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 156 CANADA TRANSPORTATION IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 157 CANADA MANUFACTURING IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 158 CANADA MANUFACTURING IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 159 CANADA TELECOMMUNICATION IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 160 CANADA TELECOMMUNICATION IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 161 CANADA TELECOMMUNICATION IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 162 CANADA MILITARY & AEROSPACE IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 163 CANADA MILITARY & AEROSPACE IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 164 CANADA MILITARY & AEROSPACE IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 165 CANADA UTILITIES IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 166 CANADA UTILITIES IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 167 CANADA AUTOMOTIVE IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 168 CANADA AUTOMOTIVE IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 169 CANADA AUTOMOTIVE IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 170 CANADA METAL & MINING IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 171 CANADA METAL & MINING IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 172 CANADA RESIDENTIAL IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 173 CANADA RESIDENTIAL IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 174 MEXICO LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 175 MEXICO COPPER IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 176 MEXICO LAMINATED BUSBAR MARKET, BY WEIGHT WISE, 2021-2030 (USD THOUSAND)

TABLE 177 MEXICO LAMINATED BUSBAR MARKET, BY SHAPE WISE, 2021-2030 (USD THOUSAND)

TABLE 178 MEXICO LAMINATED BUSBAR MARKET, BY LENGTH, 2021-2030 (USD THOUSAND)

TABLE 179 MEXICO LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 180 MEXICO LAMINATED BUSBAR MARKET, BY PLATING, 2021-2030 (USD THOUSAND)

TABLE 181 MEXICO LAMINATED BUSBAR MARKET, BY POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 182 MEXICO MEDIUM POWER IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 183 MEXICO HIGH POWER IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 184 MEXICO LOW POWER IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 185 MEXICO LAMINATED BUSBAR MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 186 MEXICO ENERGY & POWER IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 187 MEXICO POWER TRANSMISSION IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 188 MEXICO ENERGY & POWER IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 189 MEXICO ENERGY & POWER IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 190 MEXICO TRANSPORTATION IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 191 MEXICO TRANSPORTATION IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 192 MEXICO MANUFACTURING IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 193 MEXICO MANUFACTURING IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 194 MEXICO TELECOMMUNICATION IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 195 MEXICO TELECOMMUNICATION IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 196 MEXICO TELECOMMUNICATION IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 197 MEXICO MILITARY & AEROSPACE IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 198 MEXICO MILITARY & AEROSPACE IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 199 MEXICO MILITARY & AEROSPACE IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 200 MEXICO UTILITIES IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 201 MEXICO UTILITIES IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 202 MEXICO AUTOMOTIVE IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 203 MEXICO AUTOMOTIVE IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 204 MEXICO AUTOMOTIVE IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 205 MEXICO METAL & MINING IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 206 MEXICO METAL & MINING IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 207 MEXICO RESIDENTIAL IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 208 MEXICO RESIDENTIAL IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

图片列表

FIGURE 1 NORTH AMERICA LAMINATED BUSBAR MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA LAMINATED BUSBAR MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA LAMINATED BUSBAR MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA LAMINATED BUSBAR MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA LAMINATED BUSBAR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA LAMINATED BUSBAR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA LAMINATED BUSBAR MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA LAMINATED BUSBAR MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA LAMINATED BUSBAR MARKET: MULTIVARIATE MODELING

FIGURE 10 NORTH AMERICA LAMINATED BUSBAR MARKET: TIMELINE CURVE

FIGURE 11 NORTH AMERICA LAMINATED BUSBAR MARKET: MARKET END-USE COVERAGE GRID

FIGURE 12 NORTH AMERICA LAMINATED BUSBAR MARKET: SEGMENTATION

FIGURE 13 RISING DEMAND FOR SAFE AND SECURE ELECTRICAL DISTRIBUTION SYSTEMS IS EXPECTED TO DRIVE THE NORTH AMERICA LAMINATED BUSBAR MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 THE COPPER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA LAMINATED BUSBAR MARKET IN 2023 & 2030

FIGURE 15 COMPANY COMPARISON

FIGURE 16 COMPANY MARKET SHARES BY END-USERS FOR RYODEN KASEI CO., LTD.

FIGURE 17 COMPANY MARKET SHARES BY END-USERS FOR ABB

FIGURE 18 COMPANY MARKET SHARES BY END-USERS FOR MOLEX

FIGURE 19 COMPANY MARKET SHARES BY END-USERS FOR ROGERS CORPORATION

FIGURE 20 COMPANY MARKET SHARES BY END-USERS FOR MERSEN

FIGURE 21 DRIVERS, RESTRAINT, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA LAMINATED BUSBAR MARKET

FIGURE 22 ELECTRIC CAR SALES (2016-2021)

FIGURE 23 INTERNET USERS WORLDWIDE

FIGURE 24 PUBLIC CLOUD ADOPTION FOR BUSINESS OPERATIONS

FIGURE 25 INNOVATIVE METHODOLOGY TO COLLECT THE OPERATING CONDITIONS

FIGURE 26 PRICE FLUCTUATION OF COPPER MATERIAL (JAN 2022 TO MARCH 2023)

FIGURE 27 NORTH AMERICA LAMINATED BUSBAR MARKET: BY CONDUCTOR, 2022

FIGURE 28 NORTH AMERICA LAMINATED BUSBAR MARKET: BY WEIGHT WISE, 2022

FIGURE 29 NORTH AMERICA LAMINATED BUSBAR MARKET: BY SHAPE WISE, 2022

FIGURE 30 NORTH AMERICA LAMINATED BUSBAR MARKET: BY END USER, 2022

FIGURE 31 NORTH AMERICA LAMINATED BUSBAR MARKET: BY LENGTH, 2022

FIGURE 32 NORTH AMERICA LAMINATED BUSBAR MARKET: BY INSULATION MATERIAL, 2022

FIGURE 33 NORTH AMERICA LAMINATED BUSBAR MARKET: BY PLATING, 2022

FIGURE 34 NORTH AMERICA LAMINATED BUSBAR MARKET: BY POWER RATING, 2022

FIGURE 35 NORTH AMERICA LAMINATED BUSBAR MARKET: SNAPSHOT (2022)

FIGURE 36 NORTH AMERICA LAMINATED BUSBAR MARKET: BY COUNTRY (2022)

FIGURE 37 NORTH AMERICA LAMINATED BUSBAR MARKET: BY COUNTRY (2023 & 2030)

FIGURE 38 NORTH AMERICA LAMINATED BUSBAR MARKET: BY COUNTRY (2022 & 2030)

FIGURE 39 NORTH AMERICA LAMINATED BUSBAR MARKET: BY CONDUCTOR (2023-2030)

FIGURE 40 NORTH AMERICA LAMINATED BUSBAR MARKET: COMPANY SHARE 2022 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。