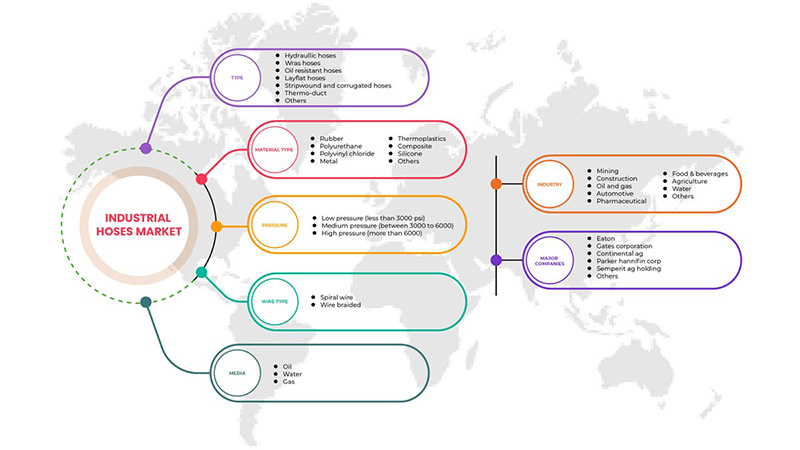

北美工业软管市场,按类型(液压软管、平铺软管、WRAS 软管、耐油软管、带状缠绕软管、波纹软管、热管道及其他)、材料类型(硅胶、聚氨酯、聚氯乙烯、腈、弹性体、金属、热塑性塑料、复合材料及其他)、介质(油、水和气体)、线材类型(编织线和螺旋线)、压力(低压(小于 3000 Psi)、中压(3000 至 6000 之间)和高压(超过 6000))、工业(石油和天然气、水、农业、食品和饮料、制药、汽车、采矿、建筑等)- 行业趋势和预测到 2030 年。

北美工业软管市场分析及规模

工业软管因其广泛的产品范围而被广泛应用于各个垂直行业。这些软管在恶劣的环境中工作,会造成磨损、破裂和过早失效等损害。在这些条件下工作时,正确选择应用所需的软管类型非常重要。对于高压输送,液压软管最适合,可在数百万 Psi 的压力下工作。石油和天然气行业使用软管输送燃料和气体,并需要高质量的软管来满足标准规格和安全性。软管的使用范围很广,因此成为各个垂直行业必不可少的元素。

为此,各市场参与者正在推出新产品并建立合作伙伴关系,以扩大其在北美工业软管市场的业务。

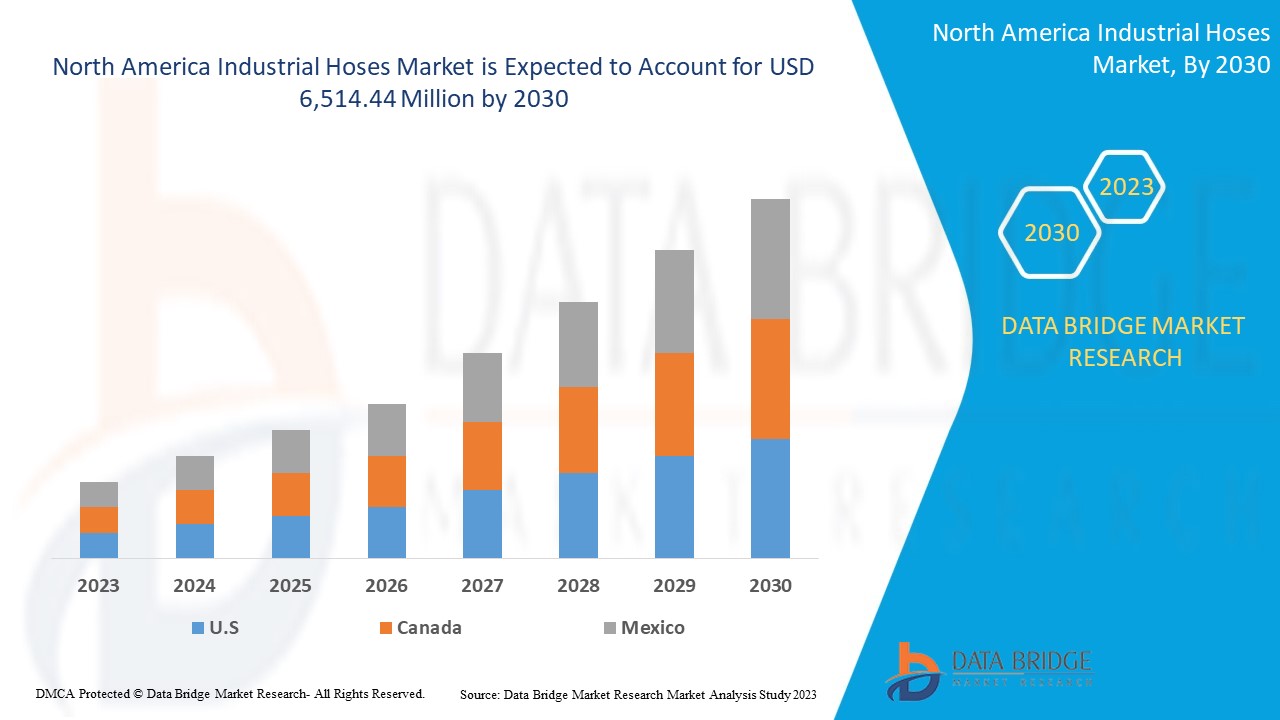

Data Bridge Market Research 分析,北美工业软管市场预计到 2030 年将达到 65.1444 亿美元的价值,预测期内复合年增长率为 6.4%。本市场报告还全面涵盖了定价分析、专利分析和技术进步。

|

报告指标 |

细节 |

|

预测期 |

2023 至 2030 年 |

|

基准年 |

2022 |

|

历史年份 |

2021 (可定制至 2020-2015) |

|

定量单位 |

收入(百万美元)、销量(百万米)、定价(美元) |

|

涵盖的领域 |

按类型(液压软管、平铺软管、WRAS 软管、耐油软管、带状缠绕软管、波纹软管、热风管等)、材料类型(硅胶、聚氨酯、聚氯乙烯、丁腈橡胶、弹性体、金属、热塑性塑料、复合材料等)、介质(油、水和气体)、导线类型(编织线和螺旋线)、压力(低压(小于 3000 Psi)、中压(3000 至 6000 之间)和高压(超过 6000))、行业(石油和天然气、水、农业、食品和饮料、制药、汽车、采矿、建筑等) |

|

覆盖国家 |

美国、加拿大和墨西哥 |

|

涵盖的市场参与者 |

伊顿、派克汉尼芬公司、莱科液压公司、Kurt Manufacturing、NORRES Schlauchtechnik GmbH、Transfer Oil SpA、ContiTech AG(大陆集团子公司)、Kanaflex Corporation Co.,ltd.、Pacific Echo、Colex International Limited、英国、盖茨公司、Semperit AG Holding、Dixon Valve & Coupling Company, LLC 和 Titan Fittings |

市场定义

工业软管是柔性增强管,用于传输不同状态的材料,例如液体和气体。工业软管的工作压力范围很广,因此适用于不同的应用。工业软管有不同的材质,例如聚氨酯、热塑性塑料和聚氯乙烯等。每种材料都提供不同的操作,用于运输各种材料。根据工业应用的需求,工业软管有刚性和柔性两种形式。

北美工业软管市场动态

本节旨在了解市场驱动因素、优势、机遇、限制和挑战。下面将详细讨论所有这些内容:

驱动程序

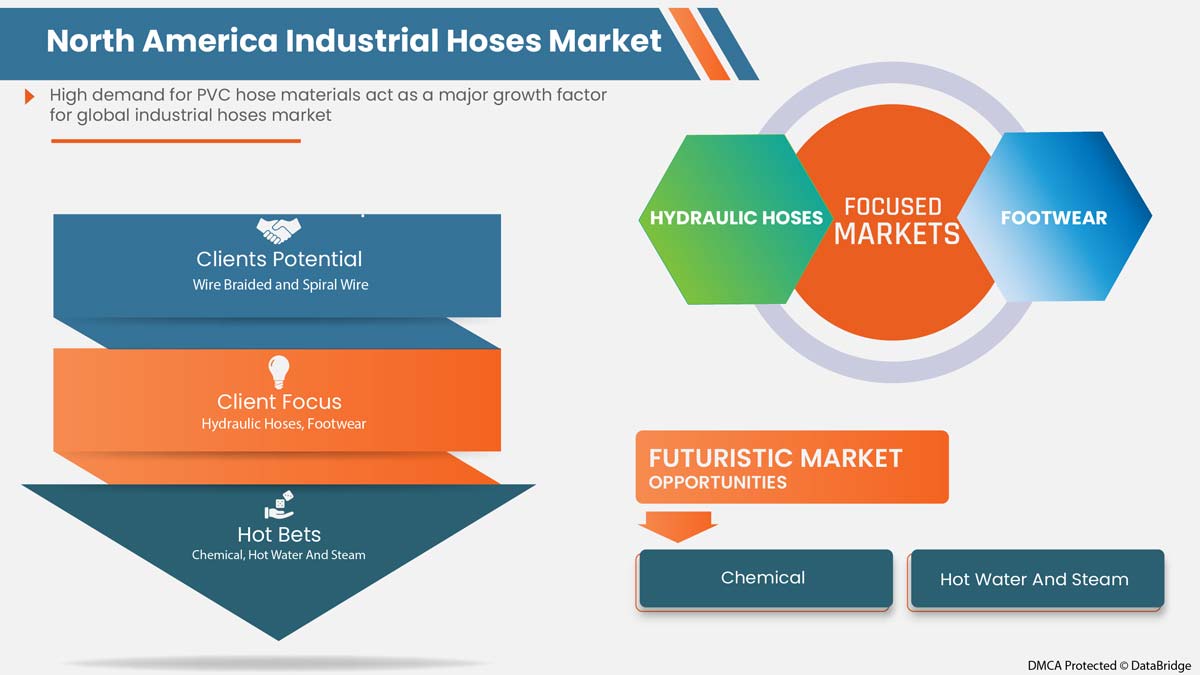

- PVC 软管材料需求旺盛

近年来,PVC 材质的工业软管在汽车、制药、基础设施、石油和天然气、食品和饮料、采矿、水、农业和其他行业中变得越来越重要,用于制造和使用管道从一端到另一端输送空气、水、化学品和流体。

由于其应用范围广泛,如空气、磨料产品、矿物油、水、工业和家用气体、蒸汽、燃料等,其需求量日益增加。技术发展正在帮助工业软管产品促进市场增长。

- 关键应用领域对耐用工业软管的需求日益增加

工业软管的应用包括将流体、化学品、空气、水、油和其他材料从一个地方输送到另一个地方。在高温、高压、化学反应和真空等关键应用中,市场对坚固耐用的工业软管的需求很大。

在选择软管之前,客户必须考虑许多重要标准,包括灾难性故障、渗透性、化学兼容性、温度、外部环境、真空等。市场的主要参与者正在推出用于关键任务用途的尖端产品,这推动了行业对耐用软管的需求。

机会

- 汽车行业对软管的采用日益增多

汽车由复杂的内部结构和系统组成,其中各种部件完好无损。这些系统和部件的集成使汽车能够作为高效的机器运行。在汽车中,软管起着重要作用,因为它用作发动机冷却系统、刹车油载体、燃料载体、空调和车辆的其他部件。在发动机冷却系统的设计中,各种类型的软管用于冷却液循环。这些软管具有不同的材料特性,因为有些软管设计用于承受冷却液的热量,而另一些软管只能承受冷冷却液。这增加了软管在汽车中的重要性,市场增长直接受到汽车行业增长的影响。由于对汽车和电动汽车的需求不断增长,电动汽车行业的汽车部门多年来呈现出巨大的增长,预计这将为市场增长提供有利可图的机会。

克制/挑战

- 工业软管在各种应用中的局限性

工业软管广泛应用于各行各业,以实现最佳运行效率并传输燃料、化学品、散装材料和空气等。尽管工业软管的工业应用不断扩大,但最终用户越来越关注工业软管的效率水平。然而,工业软管在各种系统环境中(例如温度范围)带来各种挑战,从而影响系统的整体性能和效率。工业软管的特性限制预计将阻碍市场增长。由于软管的局限性,许多最终用户和企业倾向于使用软管替代品。

新冠肺炎疫情对北美工业软管市场的影响

由于封锁和 COVID-19 政府法规,制造设施和服务关闭,工业软管行业的需求逐渐下降。此外,该行业还受到供应链中断的影响,尤其是工业软管制造过程中使用的原材料。由于世界各国政府的限制,工业软管生产放缓,2020 年前三个季度的产量无法满足需求。此外,化工、制药和农业领域以及液压应用对工业软管产品的需求很高。石油和天然气行业以及汽车行业的恢复生产进一步刺激了全球对工业软管的需求。因此,这不仅导致需求增加,而且还增加了产品成本。

最新动态

- 2021 年 7 月,柔性软管系统解决方案制造商、开发商和分销商 NORRES Schlauchtechnik GmbH 收购了工业软管、接头和配件制造商和分销商 Baggerman Group(“Baggerman”)。此次收购将有助于该公司扩大其在北美的业务,也有助于扩大市场。

- 2020 年 9 月,KURIYAMA OF AMERICA 公司开发了一款名为 Tigerflex Tiger Aqua 吸排软管的新产品。这款新产品不仅可以改善公司的产品组合,还有助于提高整体销量。

北美工业软管市场范围

北美工业软管市场根据类型、材料类型、介质、线材类型、压力和行业分为六个显著的细分市场。这些细分市场之间的增长情况将帮助您分析行业中增长缓慢的细分市场,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

按类型

- 液压软管

- WRAS 软管

- 耐油软管

- 平铺软管

- 带绕软管和波纹软管

- 热风管

- 其他的

根据类型,市场分为液压软管、WRAS 软管、耐油软管、平放软管、带绕软管和波纹软管、热管道等。

按材料类型

- 硅酮

- 聚氯乙烯

- 聚氨酯

- 丁腈橡胶

- 弹性体

- 热塑性塑料

- 金属

- 合成的

- 其他的

根据材料类型,市场分为硅胶、聚氨酯、聚氯乙烯、丁腈橡胶、弹性体、金属、热塑性塑料、复合材料和其他。

媒体报道

- 油

- 水

- 气体

根据媒体,市场分为石油、水和天然气。

按线材类型

- 螺旋丝

- 钢丝编织

根据电线类型,市场分为螺旋线和编织线。

压力之下

- 低压(低于 3000 Psi)

- 中压(3000 至 6000 之间)

- 高压(6000以上)

根据压力,市场分为低压(低于 3000 psi)、中压(3000 至 6000 之间)和高压(超过 6000)。

按行业

- 汽车

- 药品

- 石油和天然气

- 食品和饮料

- 水

- 矿业

- 农业

- 其他的

根据行业,市场细分为石油和天然气、水、农业、食品和饮料、制药、汽车、采矿等。

北美工业软管市场区域分析/见解

对北美工业软管市场进行了分析,并按国家、类型、材料类型、介质、线材类型、压力和行业提供了市场规模见解和趋势。

本市场报告涵盖的国家包括美国、加拿大和墨西哥。由于对工业软管的需求量很大,美国在北美地区占据主导地位。此外,对 PVC 软管材料的高需求预计将成为市场增长的驱动因素。

报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和市场监管变化。下游和上游价值链分析、技术趋势、波特五力分析和案例研究等数据点是用于预测各个国家市场情景的一些指标。此外,在提供国家数据的预测分析时,还考虑了北美品牌的存在和可用性以及由于来自本地和国内品牌的大量或稀缺竞争而面临的挑战、国内关税的影响和贸易路线。

竞争格局和北美工业软管市场份额分析

北美工业软管市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、北美业务、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度以及应用主导地位。以上提供的数据点仅与公司对市场的关注有关。

北美工业软管市场的一些主要参与者包括伊顿公司、派克汉尼芬公司、莱科液压公司、库尔特制造公司、NORRES Schlauchtechnik GmbH、Transfer Oil SpA、康迪泰克股份公司(大陆集团的子公司)、Kanaflex Corporation Co.,ltd.、Pacific Echo、Colex International Limited、英国、盖茨公司、Semperit AG Holding、Dixon Valve & Coupling Company, LLC 和 Titan Fittings 等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA INDUSTRIAL HOSES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPACT OF UKRAINE WAR ON NORTH AMERICA INDUSTRIAL HOSES MARKET

4.1.1 ANALYSIS OF THE IMPACT OF THE UKRAINE WAR ON THE INDUSTRIAL HOSES MARKET

4.1.2 STRATEGIC DECISIONS FROM COUNTRIES AND THEIR EFFECT ON MARKET

4.1.3 IMPACT ON PRICE AND SUPPLY CHAIN

4.1.4 CONCLUSION

4.2 IMPACT OF COVID-19 ON THE NORTH AMERICA INDUSTRIAL HOSES MARKET

4.2.1 ANALYSIS ON THE IMPACT OF COVID-19 ON THE INDUSTRIAL HOSES MARKET

4.2.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

4.2.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

4.2.4 IMPACT ON PRICE

4.2.5 IMPACT ON DEMAND AND SUPPLY CHAIN

4.2.6 CONCLUSION

4.3 PRICING LIST

4.4 REGULATORY STANDARDS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 HIGH DEMAND FOR PVC HOSE MATERIALS

5.1.2 INCREASING NEED FOR DURABLE INDUSTRIAL HOSES IN CRITICAL APPLICATIONS

5.1.3 GROWING CONCERN ABOUT WORKPLACE SAFETY AND TESTING PROCEDURES

5.1.4 HIGH ADOPTION OF NON-METAL HOSES

5.2 RESTRAINTS

5.2.1 LIMITATIONS OF INDUSTRIAL HOSES IN VARIOUS APPLICATIONS

5.2.2 ENVIRONMENTAL CONCERNS REGARDING HOSES

5.3 OPPORTUNITIES

5.3.1 GROWING ADOPTION OF HOSES IN AUTOMOBILES SECTORS

5.3.2 GROWING USAGE AND DEMAND OF HOSES IN THE CHEMICAL INDUSTRY

5.3.3 INCREASING PARTNERSHIP AND ACQUISITION AMONG MARKET PLAYERS

5.3.4 RAPID PRODUCT DEVELOPMENT AND LAUNCHES OF INDUSTRIAL HOSES

5.4 CHALLENGE

5.4.1 LOW AWARENESS AMONG END USERS REGARDING HOSES

5.4.2 LACK OF SKILLED PROFESSIONALS FOR FITTING HOSES IN INDUSTRIES

6 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY TYPE

6.1 OVERVIEW

6.2 HYDRAULIC HOSES

6.3 LAYFLAT HOSE

6.4 WRAS HOSE

6.5 OIL RESISTANT HOSE

6.6 CORRUGATED HOSE

6.7 STRIPWOUND HOSE

6.8 THERMO-DUCT

6.9 OTHERS

7 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY MATERIAL TYPE

7.1 OVERVIEW

7.2 RUBBER

7.2.1 BY INDUSTRY

7.2.1.1 MINING

7.2.1.2 CONSTRUCTION

7.2.1.3 OIL AND GAS

7.2.1.4 AUTOMOTIVE

7.2.1.5 PHARMACEUTICAL

7.2.1.6 FOOD & BEVERAGES

7.2.1.7 AGRICULTURE

7.2.1.8 WATER

7.2.1.9 OTHERS

7.3 POLYURETHANE

7.3.1 BY WIRE TYPE

7.3.1.1 WIRE BRAIDED

7.3.1.2 SPIRAL WIRE

7.3.2 BY INDUSTRY

7.3.2.1 MINING

7.3.2.2 OIL AND GAS

7.3.2.3 CONSTRUCTION

7.3.2.4 AGRICULTURE

7.3.2.5 PHARMACEUTICAL

7.3.2.6 FOOD & BEVERAGES

7.3.2.7 WATER

7.3.2.8 AUTOMOTIVE

7.3.2.9 OTHERS

7.4 POLYVINYL CHLORIDE

7.4.1 BY WIRE TYPE

7.4.1.1 WIRE BRAIDED

7.4.1.2 SPIRAL WIRE

7.4.2 BY INDUSTRY

7.4.2.1 CONSTRUCTION

7.4.2.2 FOOD & BEVERAGES

7.4.2.3 AGRICULTURE

7.4.2.4 MINING

7.4.2.5 OIL AND GAS

7.4.2.6 PHARMACEUTICAL

7.4.2.7 AUTOMOTIVE

7.4.2.8 WATER

7.4.2.9 OTHERS

7.5 METAL

7.5.1 BY INDUSTRY

7.5.1.1 MINING

7.5.1.2 OIL AND GAS

7.5.1.3 PHARMACEUTICAL

7.5.1.4 CONSTRUCTION

7.5.1.5 FOOD & BEVERAGES

7.5.1.6 WATER

7.5.1.7 AUTOMOTIVE

7.5.1.8 AGRICULTURE

7.5.1.9 OTHERS

7.6 THERMOPLASTICS

7.6.1 BY INDUSTRY

7.6.1.1 OIL AND GAS

7.6.1.2 PHARMACEUTICAL

7.6.1.3 FOOD & BEVERAGES

7.6.1.4 AUTOMOTIVE

7.6.1.5 MINING

7.6.1.6 CONSTRUCTION

7.6.1.7 WATER

7.6.1.8 AGRICULTURE

7.6.1.9 OTHERS

7.7 COMPOSITE

7.7.1 BY INDUSTRY

7.7.1.1 OIL AND GAS

7.7.1.2 WATER

7.7.1.3 PHARMACEUTICAL

7.7.1.4 CONSTRUCTION

7.7.1.5 MINING

7.7.1.6 FOOD & BEVERAGES

7.7.1.7 AGRICULTURE

7.7.1.8 AUTOMOTIVE

7.7.1.9 OTHERS

7.8 SILICONE

7.8.1 BY INDUSTRY

7.8.1.1 AUTOMOTIVE

7.8.1.2 OIL AND GAS

7.8.1.3 MINING

7.8.1.4 CONSTRUCTION

7.8.1.5 FOOD & BEVERAGES

7.8.1.6 PHARMACEUTICAL

7.8.1.7 AGRICULTURE

7.8.1.8 WATER

7.8.1.9 OTHERS

7.9 OTHERS

8 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY MEDIA

8.1 OVERVIEW

8.2 OIL

8.3 WATER

8.4 GAS

9 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY WIRE TYPE

9.1 OVERVIEW

9.2 WIRE BRAIDED

9.3 SPIRAL WIRE

10 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY PRESSURE

10.1 OVERVIEW

10.2 LOW PRESSURE (LESS THAN 3000 PSI)

10.3 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

10.4 HIGH PRESSURE (MORE THAN 6000)

11 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY INDUSTRY

11.1 OVERVIEW

11.2 MINING

11.2.1 LOW PRESSURE (LESS THAN 3000 PSI)

11.2.2 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

11.2.3 HIGH PRESSURE (MORE THAN 6000)

11.3 CONSTRUCTION

11.3.1 LOW PRESSURE (LESS THAN 3000 PSI)

11.3.2 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

11.3.3 HIGH PRESSURE (MORE THAN 6000)

11.4 OIL AND GAS

11.4.1 LOW PRESSURE (LESS THAN 3000 PSI)

11.4.2 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

11.4.3 HIGH PRESSURE (MORE THAN 6000)

11.5 AUTOMOTIVE

11.5.1 LOW PRESSURE (LESS THAN 3000 PSI)

11.5.2 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

11.5.3 HIGH PRESSURE (MORE THAN 6000)

11.6 PHARMACEUTICAL

11.6.1 LOW PRESSURE (LESS THAN 3000 PSI)

11.6.2 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

11.6.3 HIGH PRESSURE (MORE THAN 6000)

11.7 FOOD & BEVERAGES

11.7.1 LOW PRESSURE (LESS THAN 3000 PSI)

11.7.2 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

11.7.3 HIGH PRESSURE (MORE THAN 6000)

11.8 AGRICULTURE

11.8.1 LOW PRESSURE (LESS THAN 3000 PSI)

11.8.2 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

11.8.3 HIGH PRESSURE (MORE THAN 6000)

11.9 WATER

11.9.1 LOW PRESSURE (LESS THAN 3000 PSI)

11.9.2 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

11.9.3 HIGH PRESSURE (MORE THAN 6000)

11.1 OTHERS

12 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA INDUSTRIAL HOSES MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 EATON

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 GATES CORPORATION

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 CONTITECH AG (A SUBSIDIARY OF CONTINENTAL AG)

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 PARKER HANNIFIN CORP

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 SEMPERIT AG HOLDING

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 COLEX INTERNATIONAL LIMITED, UK

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 DIXON VALVE & COUPLING COMPANY, LLC

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 FLEXAUST INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 KANAFLEX CORPORATION

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 KURIYAMA OF AMERICA, INC. (A SUBSIDIARY OF KURIYAMA HOLDINGS CORPORATION)

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 KURT MANUFACTURING

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 NORRES SCHLAUCHTECHNIK GMBH

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 PACIFIC ECHO

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 PIRTEK

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 RYCO HYDRAULICS

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 SALEM-REPUBLIC RUBBER COMPANY

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 TITAN FITTINGS

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 TITEFLEX (A SUBSIDIARY OF SMITHS GROUP PLC)

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.19 TRANSFER OIL S.P.A.

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 TRELLEBORG GROUP (A SUBSIDIARY OF TRELLEBORG AB)

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

表格列表

TABLE 1 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (ASP USD)

TABLE 3 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (MILLION METER)

TABLE 4 NORTH AMERICA HYDRAULIC HOSES IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA LAYFLAT HOSE IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA WRAS HOSE IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA OIL RESISTANT IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA CORRUGATED HOSE IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA STRIPWOUND HOSE IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA THERMO-DUCT IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA OTHERS IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA RUBBER IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA RUBBER IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA POLYURETHANE IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA POLYURETHANE IN INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA POLYURETHANE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA POLYVINYL CHLORIDE IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA POLYVINYL CHLORIDE IN INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA POLYVINYL CHLORIDE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA METAL IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA METAL IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA THERMOPLASTICS IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA THERMOPLASTICS IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA COMPOSITE IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA COMPOSITE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA SILICONE IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA SILICONE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA OTHERS IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY MEDIA, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA OIL IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA WATER IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA GAS IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA WIRE BRAIDED IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA SPIRAL WIRE IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA LOW PRESSURE (LESS THAN 3000 PSI) IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA MEDIUM PRESSURE (BETWEEN 3000 TO 6000) IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA HIGH PRESSURE (MORE THAN 6000) IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA MINING IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA MINING IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA CONSTRUCTION IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA CONSTRUCTION IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA OIL & GAS IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA OIL & GAS IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA AUTOMOTIVE IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA AUTOMOTIVE IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA PHARMACEUTICAL IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA PHARMACEUTICAL IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA FOOD & BEVERAGES IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 53 NORTH AMERICA FOOD & BEVERAGES IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA AGRICULTURE IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA AGRICULTURE IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA WATER IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA WATER IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA OTHERS IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 59 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (ASP USD)

TABLE 62 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (MILLION METER)

TABLE 63 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA POLYURETHANE IN INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 65 NORTH AMERICA POLYVINYL CHLORIDE IN INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 66 NORTH AMERICA RUBBER IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 67 NORTH AMERICA POLYURETHANE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 68 NORTH AMERICA POLYVINYL CHLORIDE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 69 NORTH AMERICA METAL IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA THERMOPLASTIC IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 71 NORTH AMERICA COMPOSITE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 72 NORTH AMERICA SILICONE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 73 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY MEDIA, 2021-2030 (USD MILLION)

TABLE 74 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 75 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 76 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 77 NORTH AMERICA MINING IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 78 NORTH AMERICA CONSTRUCTION IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 79 NORTH AMERICA OIL AND GAS IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 80 NORTH AMERICA AUTOMOTIVE IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 81 NORTH AMERICA PHARMACEUTICAL IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 82 NORTH AMERICA FOOD & BEVERAGES IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 83 NORTH AMERICA AGRICULTURE IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 84 NORTH AMERICA WATER IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 85 U.S. INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 U.S. INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (ASP USD)

TABLE 87 U.S. INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (MILLION METER)

TABLE 88 U.S. INDUSTRIAL HOSES MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 89 U.S. POLYURETHANE IN INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 90 U.S. POLYVINYL CHLORIDE IN INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 91 U.S. RUBBER IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 92 U.S. POLYURETHANE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 93 U.S. POLYVINYL CHLORIDE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 94 U.S. METAL IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 95 U.S. THERMOPLASTIC IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 96 U.S. COMPOSITE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 97 U.S. SILICONE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 98 U.S. INDUSTRIAL HOSES MARKET, BY MEDIA, 2021-2030 (USD MILLION)

TABLE 99 U.S. INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 100 U.S. INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 101 U.S. INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 102 U.S. MINING IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 103 U.S. CONSTRUCTION IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 104 U.S. OIL AND GAS IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 105 U.S. AUTOMOTIVE IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 106 U.S. PHARMACEUTICAL IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 107 U.S. FOOD & BEVERAGES IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 108 U.S. AGRICULTURE IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 109 U.S. WATER IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 110 CANADA INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 111 CANADA INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (ASP USD)

TABLE 112 CANADA INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (MILLION METER)

TABLE 113 CANADA INDUSTRIAL HOSES MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 114 CANADA POLYURETHANE IN INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 115 CANADA POLYVINYL CHLORIDE IN INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 116 CANADA RUBBER IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 117 CANADA POLYURETHANE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 118 CANADA POLYVINYL CHLORIDE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 119 CANADA METAL IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 120 CANADA THERMOPLASTIC IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 121 CANADA COMPOSITE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 122 CANADA SILICONE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 123 CANADA INDUSTRIAL HOSES MARKET, BY MEDIA, 2021-2030 (USD MILLION)

TABLE 124 CANADA INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 125 CANADA INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 126 CANADA INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 127 CANADA MINING IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 128 CANADA CONSTRUCTION IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 129 CANADA OIL AND GAS IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 130 CANADA AUTOMOTIVE IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 131 CANADA PHARMACEUTICAL IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 132 CANADA FOOD & BEVERAGES IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 133 CANADA AGRICULTURE IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 134 CANADA WATER IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 135 MEXICO INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 136 MEXICO INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (ASP USD)

TABLE 137 MEXICO INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (MILLION METER)

TABLE 138 MEXICO INDUSTRIAL HOSES MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 139 MEXICO POLYURETHANE IN INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 140 MEXICO POLYVINYL CHLORIDE IN INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 141 MEXICO RUBBER IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 142 MEXICO POLYURETHANE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 143 MEXICO POLYVINYL CHLORIDE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 144 MEXICO METAL IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 145 MEXICO THERMOPLASTIC IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 146 MEXICO COMPOSITE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 147 MEXICO SILICONE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 148 MEXICO INDUSTRIAL HOSES MARKET, BY MEDIA, 2021-2030 (USD MILLION)

TABLE 149 MEXICO INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 150 MEXICO INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 151 MEXICO INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 152 MEXICO MINING IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 153 MEXICO CONSTRUCTION IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 154 MEXICO OIL AND GAS IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 155 MEXICO AUTOMOTIVE IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 156 MEXICO PHARMACEUTICAL IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 157 MEXICO FOOD & BEVERAGES IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 158 MEXICO AGRICULTURE IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 159 MEXICO WATER IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

图片列表

FIGURE 1 NORTH AMERICA INDUSTRIAL HOSES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA INDUSTRIAL HOSES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA INDUSTRIAL HOSES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA INDUSTRIAL HOSES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA INDUSTRIAL HOSES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA INDUSTRIAL HOSES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA INDUSTRIAL HOSES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA INDUSTRIAL HOSES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA INDUSTRIAL HOSES MARKET: SEGMENTATION

FIGURE 10 INCREASED DEMAND IN FOR ROBUST INDUSTRIAL PROCESSES IN CRITICAL APPLICATIONS IS EXPECTED TO DRIVE THE NORTH AMERICA INDUSTRIAL HOSES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 HYDRAULIC HOSES ARE EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA INDUSTRIAL HOSES MARKET IN 2023 & 2030

FIGURE 12 DRIVERS, RESTRAINT, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA INDUSTRIAL HOSES MARKET

FIGURE 13 NORTH AMERICA INDUSTRIAL HOSES MARKET: BY TYPE, 2022

FIGURE 14 NORTH AMERICA INDUSTRIAL HOSES MARKET: BY MATERIAL TYPE, 2022

FIGURE 15 NORTH AMERICA INDUSTRIAL HOSES MARKET: BY MEDIA, 2022

FIGURE 16 NORTH AMERICA INDUSTRIAL HOSES MARKET: BY WIRE TYPE, 2022

FIGURE 17 NORTH AMERICA INDUSTRIAL HOSES MARKET: BY PRESSURE, 2022

FIGURE 18 NORTH AMERICA INDUSTRIAL HOSES MARKET: BY INDUSTRY, 2022

FIGURE 19 NORTH AMERICA INDUSTRIAL HOSES MARKET: SNAPSHOT (2022)

FIGURE 20 NORTH AMERICA INDUSTRIAL HOSES MARKET: BY COUNTRY (2022)

FIGURE 21 NORTH AMERICA INDUSTRIAL HOSES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 22 NORTH AMERICA INDUSTRIAL HOSES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 23 NORTH AMERICA INDUSTRIAL HOSES MARKET: BY TYPE (2023-2030)

FIGURE 24 NORTH AMERICA INDUSTRIAL HOSES MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。