North America Food Authenticity Testing Market

市场规模(十亿美元)

CAGR :

%

USD

8.49 Billion

USD

13.45 Billion

2024

2032

USD

8.49 Billion

USD

13.45 Billion

2024

2032

| 2025 –2032 | |

| USD 8.49 Billion | |

| USD 13.45 Billion | |

|

|

|

北美食品真偽檢測市場細分,按測試類型(質譜法、基於 PCR(聚合酶鍊式反應)、DNA 定序/條碼、NMR 技術/分子光譜法、基於免疫測定法/Elisa(酶聯免疫吸附試驗)、同位素方法和下一代測序)、類別(摻假測試、有機、過敏原測試、類型鑑定、GMP 測試種類的保護性肉類鑑定、受質保護、受質保護的原始地理鑑定、GMP 測試種類(PDO)、假標籤等)、應用(食品和飲料)– 產業趨勢與預測到 2032 年

北美食品真偽檢測市場分析

由於消費者對食品安全、品質和透明度的需求不斷增加,北美食品真偽檢測市場正經歷顯著成長。主要驅動因素包括人們對食品詐欺、污染的擔憂日益加劇,以及植物性和有機食品消費的成長趨勢。 DNA條碼、光譜學和色譜法等檢測方法被廣泛用於驗證食品來源、成分和生產過程。嚴格的監管標準和採用先進技術進行更準確、更快速的測試進一步推動了市場的發展。北美和歐洲佔據市場主導地位,但由於人們意識的提高和對食品安全的關注度不斷提高,預計亞太地區將大幅成長。領先的市場參與者正專注於創新,以提高測試的準確性和可靠性。

食品真偽檢測市場規模

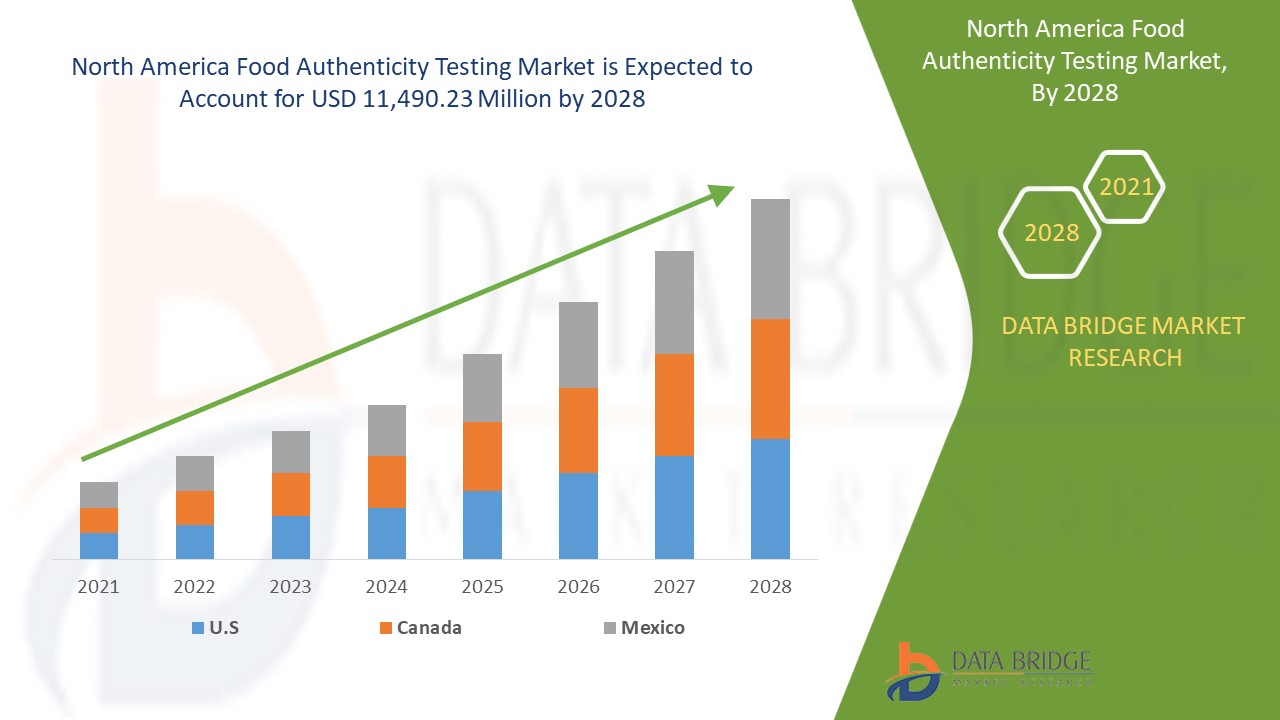

北美食品真偽檢測市場預計將從 2024 年的 84.9 億美元增至 2032 年的 134.5 億美元,在 2025 年至 2032 年的預測期內,複合年增長率將大幅增長 6.1%。除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察外,Data Bridge Market Research 策劃的市場報告還包括進出口分析、生產能力概覽、生產消費分析、價格趨勢分析、氣候變遷情境、供應鏈分析、價值鏈分析、原材料/消耗品概覽、供應商選擇標準、PESTLE 分析、波特分析和監管框架。

食品真偽檢測市場趨勢

“食品安全問題日益嚴重,監管壓力加大”

北美食品真偽檢測市場正經歷由日益增長的食品安全問題和監管壓力所驅動的關鍵趨勢。 DNA條碼、紅外光譜和質譜等技術的進步正在提高檢測的準確性和速度。隨著消費者越來越追求透明度,對有機、清真和非基因改造聲明進行驗證的測試需求也日益增長。電子商務平台的興起也推動了更大程度的真實性驗證,以避免詐欺。此外,肉類、乳製品和橄欖油行業的食品詐欺問題也刺激了成長。隨著消費者食品安全意識的增強,亞太等新興市場的地理擴張引人注目。公司正專注於綜合解決方案和合作夥伴關係以加強其市場地位,而監管機構正在加強食品可追溯性的標準。

報告範圍和市場細分

|

屬性 |

食品真實性檢測原料關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

美國、加拿大和墨西哥 |

|

主要市場參與者 |

Eurofins Scientific(盧森堡)、SGS Société Générale de Surveillance SA。 (瑞士)、Intertek Group plc(英國)、Thermo Fisher Scientific Inc.(美國)、ALS(澳洲)、Mérieux NutriSciences(美國)、TÜV SÜD(德國)、EMSL Analytical, Inc.(美國)、SCIEX(美國)、Cotecna(瑞士)、AnalyatorL Analytical, Inc.(美國)、SCIEX(美國)、Cotecna(瑞士)、Analytiat Jactig(MtiAti)、Falyti Kontig(Atikator)、Falyti KtiA(Atikator)、Palyty KAP(Mr.AtiA)、Palyty KtiA)、Analytipator Kmoo(Atikator) Inc(美國)和 Pathogenia(加拿大)

|

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括進出口分析、生產能力概覽、生產消費分析、價格趨勢分析、氣候變遷情景、供應鏈分析、價值鏈分析、原材料/消耗品概覽、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

食品真實性檢測市場定義

食品真實性測試透過偵測詐欺、摻假和錯誤標籤來確保食品的真實性、品質和安全。食品真實性測試涉及識別摻假(添加未經授權的物質)、替代(以更便宜的替代品取代高價值成分)和錯誤標籤(對產地、有機認證或物種做出虛假聲明)等行為的方法。採用的關鍵技術包括 DNA 分析、光譜學、色譜法和質譜法,供食品製造商、監管機構、零售商和檢測實驗室使用。

食品真偽檢測市場動態

驅動程式

- 食品摻假、偽造和虛假標籤現像日益增多

隨著消費者越來越關注所消費食品的品質、安全性和真實性,對嚴格檢測方法的需求也激增。食品摻假,即故意在食品中添加不合格或有害物質,會帶來嚴重的健康風險。另一方面,假冒和貼錯標籤會欺騙消費者產品的產地、成分或營養價值,破壞對食品供應鏈的信任。食品貿易的全球化帶來了複雜的供應鏈,使得摻假和假冒行為更容易不被發現。同時,消費者意識的提高和監管的嚴格性迫使製造商驗證其產品的真實性。例如,假橄欖油、稀釋蜂蜜和標籤錯誤的海鮮案件不斷增多,引發了公眾的強烈抗議,促使政府和組織實施更嚴格的政策和檢測標準。

例如,

2021年4月,根據ResearchGate GmbH的一篇文章,食品詐欺的一個例子是在中國乳製品中添加三聚氰胺,虛假地提高其氮含量以模仿更高的蛋白質含量。這項詐欺行為造成了廣泛的健康危機,包括人員死亡,凸顯了建立健全的食品真實性體係以保護公眾健康和確保供應鏈完整性的迫切需求。

2023年12月,根據DOAJ報道,全球食品詐欺問題的普遍存在是由於食品需求的增加和法規執行的薄弱所致。常見的目標產品包括有機食品、海鮮、補充品和橄欖油。複雜的供應鏈和不充分的技術工具加劇了偵測挑戰。建議採取協作的全球標準和乾預措施,以有效打擊這些詐欺活動

- 消費者對透明度和清潔標籤產品的需求不斷增長

現今的消費者更重視食品成分,更喜歡成分簡單、天然且加工程度最低的產品。清潔標籤產品不含人工添加劑、防腐劑和色素,尤其受到注重健康的消費者的歡迎,他們尋求符合其永續性和真實性價值的食品。這種對透明度的要求很大程度上是出於對食品安全和誠信的擔憂,特別是在食品詐欺醜聞爆發之後。食品欺詐,即產品虛假陳述、摻假或虛假標籤,導致消費者的不信任感日益增加。例如,肉類產品標籤錯誤、蜂蜜摻假、橄欖油詐欺等各種事件都凸顯了可靠驗證方法的必要性。因此,食品真實性測試已成為確保標籤上的承諾與產品內容相符的重要工具。這些測試方法包括 DNA 測試、同位素分析和化學分析,有助於驗證成分的真實性並確認產品聲明的合法性,例如「有機」、「非基因改造」或「放養」。

例如,

2024年10月,根據食品安全工作社的一篇文章,食品和飲料行業的清潔標籤運動注重透明度和天然成分,消費者青睞不含人工添加劑的產品。這種轉變促使企業重新制定產品配方,通常會強調有機或非基因改造等認證,尤其是在嬰兒食品和植物性食品類別中

機會

- 對道德來源和環保產品的需求不斷增長

隨著消費者越來越意識到購買決策對環境和社會的影響,他們越來越多地尋求符合其價值觀的產品。消費者行為的這種轉變不僅限於有機食品,還擴展到更廣泛的可持續、道德和負責任採購的商品。在食品業,符合道德規範的產品是指採用優先考慮環境永續性、公平勞動實踐和動物福利的方法所生產的產品。因此,消費者要求了解食品的來源和生產過程的透明度,以更加重視食品真實性測試。這項測試確保標有有機、公平貿易或環保的食品確實採用可持續的方式生產,並且其聲明準確且可驗證。

- 便攜式即時測試設備的技術進步和引入

技術進步正在改變市場,便攜式和即時測試設備的推出提供了重大機會。這些創新使得現場測試成為可能,使食品真實性驗證更加方便和高效。手持式光譜儀和便攜式 DNA 分析儀等便攜式設備使食品生產商、零售商和監管機構能夠進行快速可靠的測試,確保符合安全標準和真實性聲明。這些設備減少了昂貴的實驗室測試和漫長的等待時間,從而提高了效率。它們還可以進行即時分析,從而更快地做出決策並降低食品詐欺的風險。隨著對快速、準確測試的需求不斷增長,這些技術進步可滿足小型和大型操作的需求。此外,這些工具越來越便宜,可以在從食品生產到供應鏈管理等各個領域中廣泛應用。

限制/挑戰

- 高昂的測試成本

食品真實性測試對於確保食品安全、品質和法規遵循至關重要,特別是在檢測詐欺方面。然而,各種有效的檢測方法,例如基於 DNA 的檢測、同位素比質譜法 (IRMS) 和色譜法,都需要昂貴的設備和熟練的技術人員,這使得小型公司或發展中國家無法負擔成本。這增加了食品製造商的財務負擔,他們必須在嚴格的測試需求和高昂的營運成本之間取得平衡。此外,食品供應鏈的複雜性,加上需要進行大量測試來驗證各種產品,也增加了這些成本。可能需要對單一產品進行多次測試,以根據產地、成分和加工方法等不同參數確認其真實性。此外,為確保始終符合品質標準而需要進行的頻繁測試可能會增加成本,特別是對於管理大量商品的公司而言。

例如,

2023 年 5 月,根據愛思唯爾出版公司發表的一篇文章,基於 DNA 的技術(PCR、下一代定序)和質譜等肉類真實性檢測方法的高昂檢測成本限制了它們的廣泛應用。這些方法通常需要昂貴的設備、專業知識和漫長的處理時間,因此不適合進行常規或大規模測試。因此,儘管這些方法有效,但其採用卻受到阻礙。

- 食品詐欺趨勢和技術的演變

隨著食品詐欺變得越來越複雜,傳統的檢測方法往往難以跟上。詐欺者採用越來越先進的手段來摻假或歪曲食品,從添加更便宜的成分到偽造有機食品或特色食品等優質產品。另一個例子是,虛假的有機或公平貿易聲明的興起,因為製造商試圖利用消費者對道德、環保產品的需求。這會破壞消費者的信任,也會損害遵守監管標準的合法企業。為了應對這些不斷演變的威脅,食品業越來越多地轉向先進的測試技術,如 DNA 條碼、質譜和基於區塊鏈的可追溯性解決方案。即使在複雜且分散的供應鏈中,這些技術也能更準確地識別食品成分和來源。

原材料短缺和運輸延誤的影響和當前市場情勢

Data Bridge Market Research 提供高水準的市場分析,並透過考慮原材料短缺和運輸延遲的影響和當前市場環境來提供資訊。這意味著評估策略可能性、制定有效的行動計劃並協助企業做出重要決策。

除了標準報告外,我們還提供對採購層面的深入分析,包括預測運輸延遲、按地區劃分的經銷商映射、商品分析、生產分析、價格映射趨勢、採購、類別績效分析、供應鏈風險管理解決方案、高級基準測試以及其他採購和戰略支援服務。

經濟放緩對產品定價和供應的預期影響

當經濟活動放緩時,各行各業就開始受到影響。 DBMR 提供的市場洞察報告和情報服務考慮了經濟衰退對產品定價和可及性的預測影響。透過這種方式,我們的客戶通常可以領先競爭對手一步,預測他們的銷售額和收入,並估算他們的盈虧支出。

北美食品真偽檢測市場範圍

市場根據測試類型、類別和應用進行細分。這些細分市場之間的成長將幫助您分析行業中成長微弱的細分市場,並為用戶提供有價值的市場概覽和市場洞察,幫助他們做出策略決策,確定核心市場應用。

測試類型

- 質譜法

- 基於PCR(聚合酶鍊式反應)

- DNA定序/條碼

- NMR技術/分子光譜法

- 基於免疫測定/Elisa(酵素連結免疫吸附試驗)

- 同位素方法

- 下一代定序

類別

- 摻假測試

- 有機的

- 過敏原檢測

- 肉品形態

- GMP測試

- 清真驗證

- 猶太潔食認證

- 受保護的地理標誌(PGI)

- 原產地保護(PDO)

- 虛假標籤

- 其他的

應用

- 食物

- 飲料

北美食品真偽檢測市場區域分析

對市場進行分析,並按上述國家、測試類型、類別和應用提供市場規模洞察和趨勢。

市場涵蓋的國家包括美國、加拿大和墨西哥。

美國憑藉其先進的研究基礎設施、強大的監管環境、消費者對食品安全的高需求以及對尖端檢測技術和食品可追溯系統的大量投資,在北美食品真實性檢測市場佔據主導地位。

由於消費者對透明度的需求不斷增加、監管標準越來越嚴格、檢測技術越來越進步,以及對食品詐欺的擔憂日益加劇,確保食品的高品質和安全,美國是北美食品真實性檢測市場中成長最快的國家。

報告的國家部分還提供了影響個別市場因素以及影響市場當前和未來趨勢的國內市場監管變化。下游和上游價值鏈分析、技術趨勢和波特五力分析、案例研究等數據點是用於預測各國市場情景的一些指標。此外,在對國家數據進行預測分析時,還考慮了全球品牌的存在和可用性及其因來自本地和國內品牌的大量或稀缺的競爭而面臨的挑戰、國內關稅和貿易路線的影響。

北美食品真偽檢測市場份額

市場競爭格局提供了競爭對手的詳細資訊。詳細資訊包括公司概況、公司財務狀況、收入、市場潛力、研發投資、新市場計劃、全球影響力、生產基地和設施、生產能力、公司優勢和劣勢、產品發布、產品寬度和廣度、應用優勢。以上提供的數據點僅與公司對市場的關注有關。

北美食品真偽檢測市場領導者

- Eurofins Scientific(盧森堡)

- SGS 通用偵測公司 SA。 (瑞士)

- Intertek集團(英國)

- 賽默飛世爾科技公司(美國)

- ALS(澳洲)

- 梅里埃營養科學公司(美國)

- TÜV南德意志集團(德國)

- EMSL Analytical, Inc.(美國)

- SCIEX(美國)

- Cotecna(瑞士)

- 耶拿分析儀器有限公司KG(德國)

- FoodChain ID(美國)

- Microbac Laboratories, Inc(美國)

- Pathogenia(加拿大)

北美食品真偽檢測市場最新發展

- 2024 年 10 月,Intertek Caleb Brett 在西班牙阿爾赫西拉斯開設了一家新的最先進的實驗室,以增強對海事和能源領域的服務。該設施專門從事燃料測試、符合 ISO 8217 和環境監測,加強對國際貿易和法規遵從性的支持

- 2021 年 5 月,賽默飛世爾科技公司宣布,董事長、總裁兼執行長 Marc N. Casper 將在美國銀行證券 2021 年醫療保健會議上進行線上演講。這將有助於公司與各種生物科學和醫療保健專業人士進行互動,並為醫療保健行業做出更好的決議和努力

- 2021 年 4 月,賽默飛世爾科技公司宣布與 PPD 公司達成最終協議,PPD 公司是北美領先的為製藥和生物技術行業提供臨床研究服務的供應商。這將有助於公司為客戶提供重要的臨床研究服務,並以新的方式幫助他們快速將科學概念轉化為核准的藥物

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 COMPARATIVE ANALYSIS OF DIFFERENT TYPES OF FOOD AUTHENTICITY TESTING

4.1.1 PCR (POLYMERASE CHAIN REACTION)-BASED TESTING

4.1.1.1 ADVANTAGES

4.1.1.2 LIMITATIONS

4.1.2 ISOTOPE METHODS

4.1.2.1 ADVANTAGES

4.1.2.2 LIMITATIONS

4.1.3 IMMUNOASSAY-BASED/ELISA (ENZYME-LINKED IMMUNOSORBENT ASSAY)

4.1.3.1 ADVANTAGES

4.1.3.2 LIMITATIONS

4.1.4 DNA SEQUENCING/BARCODING

4.1.4.1 ADVANTAGES

4.1.4.2 LIMITATIONS

4.1.5 NEXT-GENERATION SEQUENCING (NGS)

4.1.5.1 ADVANTAGES

4.1.5.2 LIMITATIONS

4.1.6 NMR (NUCLEAR MAGNETIC RESONANCE) TECHNIQUE

4.1.6.1 ADVANTAGES

4.1.6.2 LIMITATIONS

4.1.7 MASS SPECTROMETRY

4.1.7.1 ADVANTAGES

4.1.7.2 LIMITATIONS

4.1.8 LIQUID CHROMATOGRAPHY (LC) AND GAS CHROMATOGRAPHY (GC)

4.1.8.1 ADVANTAGES

4.1.8.2 LIMITATIONS

4.1.9 CONCLUSION

4.2 CONSUMER TRENDS IN THE NORTH AMERICA FOOD AUTHENTICITY TESTING MARKET

4.2.1 GROWING CONCERN ABOUT FOOD FRAUD

4.2.2 INCREASING FOCUS ON TRANSPARENCY AND SUSTAINABILITY

4.2.3 DEMAND FOR TRACEABILITY AND SUPPLY CHAIN INTEGRITY

4.2.4 RISING POPULARITY OF HEALTH-CONSCIOUS CONSUMERS

4.2.5 EMERGENCE OF DIGITAL TOOLS AND CONSUMER ENGAGEMENT

4.2.6 REGULATORY COMPLIANCE AND GOVERNMENT INITIATIVES

4.2.7 TECHNOLOGICAL INNOVATIONS IN TESTING METHODS

4.2.8 CONCLUSION

4.3 INDUSTRY TRENDS AND FUTURE PERSPECTIVES

4.3.1 DRIVERS OF MARKET GROWTH

4.3.2 KEY TECHNOLOGICAL ADVANCEMENTS

4.3.3 KEY TRENDS AND FUTURE OUTLOOK

4.3.4 GEOGRAPHICAL TRENDS

4.3.5 CONCLUSION

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING INSTANCES OF FOOD ADULTERATION, COUNTERFEITING AND FALSE LABELING

6.1.2 GROWING CONSUMER DEMAND FOR TRANSPARENCY AND CLEAN-LABEL PRODUCTS

6.1.3 STRINGENT REGULATIONS AND STANDARDS FOR FOOD LABELING AND AUTHENTICITY

6.1.4 INCREASED GLOBALIZATION OF FOOD TRADE

6.2 RESTRAINTS

6.2.1 HIGH TESTING COSTS

6.2.2 COMPLEXITY OF TESTING PROCESSES

6.3 OPPORTUNITIES

6.3.1 RISING DEMAND FOR ETHICAL SOURCES AND ENVIRONMENT FRIENDLY PRODUCTS

6.3.2 TECHNOLOGICAL ADVANCEMENTS AND INTRODUCTION OF PORTABLE AND REAL-TIME TESTING DEVICES

6.3.3 INCREASING ONLINE FOOD SALES DEMAND STRICT QUALITY CONTROLS AND TESTING MEASURES

6.4 CHALLENGES

6.4.1 EVOLVING FOOD FRAUD TRENDS AND TECHNIQUES

6.4.2 DATA MANAGEMENT AND INTEGRATION CHALLENGES

7 NORTH AMERICA FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE

7.1 OVERVIEW

7.2 MASS SPECTROMETRY

7.3 PCR (POLYMERASE CHAIN REACTION)-BASED

7.4 DNA SEQUENCING/BARCODING

7.5 NMR TECHNIQUE/MOLECULAR SPECTROMETRY

7.6 IMMUNOASSAY-BASED/ELISA (ENZYME-LINKED IMMUNOSORBENT ASSAY)

7.7 ISOTOPE METHODS

7.8 NEXT-GENERATION SEQUENCING

8 NORTH AMERICA FOOD AUTHENTICITY TESTING MARKET, BY CATEGORY

8.1 OVERVIEW

8.2 ADULTERATION TESTS

8.3 ORGANIC

8.4 ALLERGEN TESTING

8.5 MEAT SPECIATION

8.6 GMO TESTING

8.7 HALAL VERIFICATION

8.8 KOSHER VERIFICATION

8.9 PROTECTED GEOGRAPHICAL INDICATION (PGI)

8.1 PROTECTED DENOMINATION OF ORIGIN (PDO)

8.11 FALSE LABELING

8.12 OTHERS

9 NORTH AMERICA FOOD AUTHENTICITY TESTING MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 FOOD

9.3 BEVERAGES

10 NORTH AMERICA FOOD AUTHENTICITY TESTING MARKET, BY REGION

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA FOOD AUTHENTICITY TESTING MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 EUROFINS SCIENTIFIC

13.1.1 COMPANY SNAPSHOT

13.1.2 PRODUCT PORTFOLIO

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENT

13.2 SGS SOCIÉTÉ GÉNÉRALE DE SURVEILLANCE SA

13.2.1 COMPANY SNAPSHOT

13.2.2 PRODUCT PORTFOLIO

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENT

13.3 INTERTEK GROUP PLC

13.3.1 COMPANY SNAPSHOT

13.3.2 RECENT FINANCIAL

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENT

13.4 THERMO FISHER SCIENTIFIC INC.

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 ALS

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 SERVICE PORTFOLIO

13.5.5 RECENT DEVELOPMENT

13.6 ANALYTIK JENA GMBH

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENTS

13.7 BIA ANALYTICAL LTD.

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 CAMPDEN BRI

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 COTECNA

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 EMSL ANALYTICAL, INC.

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 FOODCHAIN ID

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENTS

13.12 FOOD FORENSICS LIMITED

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 MÉRIEUX NUTRISCIENCES

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 MICROBAC LABORATORIES, INC.

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 PATHOGENIA

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 PREMIER ANALYTICS SERVIES

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENT

13.17 READING SCIENTIFIC SERVICES LTD

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 SCIEX

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENT

13.19 TÜV SÜD

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

表格列表

TABLE 1 REGULATORY COVERAGE

TABLE 2 NORTH AMERICA FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 3 NORTH AMERICA MASS SPECTROMETRY IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA MASS SPECTROMETRY IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA PCR (POLYMERASE CHAIN REACTION)-BASED IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA DNA SEQUENCING/BARCODING IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA NMR TECHNIQUE/MOLECULAR SPECTROMETRY IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA IMMUNOASSAY-BASED/ELISA (ENZYME-LINKED IMMUNOSORBENT ASSAY) IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA ISOTOPE METHODS IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA NEXT-GENERATION SEQUENCING IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA FOOD AUTHENTICITY TESTING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA ADULTERATION TESTS IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA ORGANIC IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA ALLERGEN TESTING IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA MEAT SPECIATION IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA GMO TESTING IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA HALAL VERIFICATION IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA KOSHER VERIFICATION IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA PROTECTED GEOGRAPHICAL INDICATION (PGI) IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA PROTECTED DENOMINATION OF ORIGIN (PDO) IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA FALSE LABELING IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA OTHERS IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA FOOD AUTHENTICITY TESTING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA FOOD IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA FOOD IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA CEREALS & GRAINS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA CEREALS & GRAINS IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA DAIRY PRODUCTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA CHEESE IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA MILK BASED DESSERTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA CHEESE BASED DESSERTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA EDIBLE OILS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA CHOCOLATES & CONFECTIONERY IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA OIL SEEDS & PULSES IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA PEA IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA OIL SEEDS & PULSES IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA MEAT & POULTRY PRODUCTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA CHICKEN IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA PORK IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA BEEF IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA SEAFOOD IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA LAMB IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA OTHERS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA PROCESSED FOOD IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA SYRUPS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA COCOA IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA NUTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA NUTS IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD AUTHENTICITY TESTING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA BEVERAGES IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA BEVERAGE IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA ALCOHOLIC IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA NON-ALCOHOLIC IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA PLANT BASED MILK IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA BEVERAGES IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA FOOD AUTHENTICITY TESTING MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA MASS SPECTROMETRY IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA FOOD AUTHENTICITY TESTING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 61 NORTH AMERICA FOOD AUTHENTICITY TESTING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA FOOD IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA CEREALS & GRAINS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA CEREALS & GRAINS IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 NORTH AMERICA DAIRY PRODUCTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 NORTH AMERICA CHEESE IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 NORTH AMERICA MILK BASED DESSERTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 NORTH AMERICA CHEESE BASED DESSERTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 NORTH AMERICA EDIBLE OILS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 NORTH AMERICA CHOCOLATES & CONFECTIONERY IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 NORTH AMERICA OIL SEEDS & PULSES IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 NORTH AMERICA PEA IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 NORTH AMERICA OIL SEEDS & PULSES IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 NORTH AMERICA MEAT & POULTRY PRODUCTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 NORTH AMERICA CHICKEN IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 NORTH AMERICA PORK IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 NORTH AMERICA BEEF IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 NORTH AMERICA SEAFOOD IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 NORTH AMERICA LAMB IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 NORTH AMERICA OTHERS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 NORTH AMERICA PROCESSED FOOD IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 NORTH AMERICA SYRUPS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 NORTH AMERICA COCOA IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 NORTH AMERICA NUTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 NORTH AMERICA NUTS IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 NORTH AMERICA PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 NORTH AMERICA PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD AUTHENTICITY TESTING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 88 NORTH AMERICA BEVERAGE IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 NORTH AMERICA ALCOHOLIC IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 NORTH AMERICA NON-ALCOHOLIC IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 NORTH AMERICA PLANT BASED MILK IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 NORTH AMERICA BEVERAGES IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 U.S. FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 U.S. MASS SPECTROMETRY IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 U.S. FOOD AUTHENTICITY TESTING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 96 U.S. FOOD AUTHENTICITY TESTING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 97 U.S. FOOD IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 U.S. CEREALS & GRAINS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 U.S. CEREALS & GRAINS IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 U.S. DAIRY PRODUCTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 U.S. CHEESE IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 U.S. MILK BASED DESSERTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 U.S. CHEESE BASED DESSERTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 U.S. EDIBLE OILS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 U.S. CHOCOLATES & CONFECTIONERY IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 U.S. OIL SEEDS & PULSES IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 U.S. PEA IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 U.S. OIL SEEDS & PULSES IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 U.S. MEAT & POULTRY PRODUCTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 U.S. CHICKEN IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 U.S. PORK IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 U.S. BEEF IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 U.S. SEAFOOD IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 U.S. LAMB IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 U.S. OTHERS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 U.S. PROCESSED FOOD IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 U.S. SYRUPS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 U.S. COCOA IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 U.S. NUTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 U.S. NUTS IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 U.S. PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 U.S. PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD AUTHENTICITY TESTING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 123 U.S. BEVERAGE IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 U.S. ALCOHOLIC IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 U.S. NON-ALCOHOLIC IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 U.S. PLANT BASED MILK IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 U.S. BEVERAGES IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 CANADA FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 CANADA MASS SPECTROMETRY IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 CANADA FOOD AUTHENTICITY TESTING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 131 CANADA FOOD AUTHENTICITY TESTING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 132 CANADA FOOD IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 CANADA CEREALS & GRAINS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 CANADA CEREALS & GRAINS IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 CANADA DAIRY PRODUCTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 CANADA CHEESE IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 CANADA MILK BASED DESSERTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 CANADA CHEESE BASED DESSERTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 CANADA EDIBLE OILS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 CANADA CHOCOLATES & CONFECTIONERY IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 CANADA OIL SEEDS & PULSES IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 CANADA PEA IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 CANADA OIL SEEDS & PULSES IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 CANADA MEAT & POULTRY PRODUCTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 CANADA CHICKEN IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 CANADA PORK IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 CANADA BEEF IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 CANADA SEAFOOD IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 CANADA LAMB IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 CANADA OTHERS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 CANADA PROCESSED FOOD IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 CANADA SYRUPS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 CANADA COCOA IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 CANADA NUTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 CANADA NUTS IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 CANADA PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 CANADA PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD AUTHENTICITY TESTING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 158 CANADA BEVERAGE IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 CANADA ALCOHOLIC IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 CANADA NON-ALCOHOLIC IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 CANADA PLANT BASED MILK IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 CANADA BEVERAGES IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 MEXICO FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 MEXICO MASS SPECTROMETRY IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 MEXICO FOOD AUTHENTICITY TESTING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 166 MEXICO FOOD AUTHENTICITY TESTING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 167 MEXICO FOOD IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 MEXICO CEREALS & GRAINS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 MEXICO CEREALS & GRAINS IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 MEXICO DAIRY PRODUCTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 MEXICO CHEESE IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 MEXICO MILK BASED DESSERTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 MEXICO CHEESE BASED DESSERTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 MEXICO EDIBLE OILS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 MEXICO CHOCOLATES & CONFECTIONERY IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 MEXICO OIL SEEDS & PULSES IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 MEXICO PEA IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 MEXICO OIL SEEDS & PULSES IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 MEXICO MEAT & POULTRY PRODUCTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 MEXICO CHICKEN IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 MEXICO PORK IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 MEXICO BEEF IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 MEXICO SEAFOOD IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 MEXICO LAMB IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 MEXICO OTHERS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 MEXICO PROCESSED FOOD IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 MEXICO SYRUPS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 MEXICO COCOA IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 MEXICO NUTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 MEXICO NUTS IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 MEXICO PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 MEXICO PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD AUTHENTICITY TESTING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 193 MEXICO BEVERAGE IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 MEXICO ALCOHOLIC IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 MEXICO NON-ALCOHOLIC IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 MEXICO PLANT BASED MILK IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 MEXICO BEVERAGES IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

图片列表

FIGURE 1 NORTH AMERICA FOOD AUTHENTICITY TESTING MARKET

FIGURE 2 NORTH AMERICA FOOD AUTHENTICITY TESTING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FOOD AUTHENTICITY TESTING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FOOD AUTHENTICITY TESTING MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FOOD AUTHENTICITY TESTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FOOD AUTHENTICITY TESTING MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA FOOD AUTHENTICITY TESTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA FOOD AUTHENTICITY TESTING MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA FOOD AUTHENTICITY TESTING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA FOOD AUTHENTICITY TESTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 NORTH AMERICA FOOD AUTHENTICITY TESTING MARKET: SEGMENTATION

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 SEVEN SEGMENTS COMPRISE THE NORTH AMERICA FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 GROWING CONSUMER DEMAND FOR TRANSPARENCY AND CLEAN-LABEL PRODUCTS IS EXPECTED TO DRIVE THE NORTH AMERICA FOOD AUTHENTICITY TESTING MARKET IN THE FORECAST PERIOD

FIGURE 16 THE MASS SPECTROMETRY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FOOD AUTHENTICITY TESTING MARKET IN 2025 AND 2032

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR NORTH AMERICA FOOD AUTHENTICITY TESTING MARKET

FIGURE 18 NORTH AMERICA FOOD AUTHENTICITY TESTING MARKET: BY TEST TYPE, 2024

FIGURE 19 NORTH AMERICA FOOD AUTHENTICITY TESTING MARKET: BY CATEGORY, 2024

FIGURE 20 NORTH AMERICA FOOD AUTHENTICITY TESTING MARKET: BY APPLICATION, 2024

FIGURE 21 NORTH AMERICA FOOD AUTHENTICITY TESTING MARKET: SNAPSHOT (2024)

FIGURE 22 NORTH AMERICA FOOD AUTHENTICITY TESTING MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。