North America Fluorspot And Elispot Assay Market

市场规模(十亿美元)

CAGR :

%

USD

188.17 Billion

USD

436.78 Billion

2025

2033

USD

188.17 Billion

USD

436.78 Billion

2025

2033

| 2026 –2033 | |

| USD 188.17 Billion | |

| USD 436.78 Billion | |

|

|

|

|

北美ELISpot和FluoroSpot檢測市場細分,按產品類型(檢測試劑盒、輔助/補充產品和分析儀)、來源(人類、小鼠、猴及其他)、疾病(傳染病、癌症、自體免疫疾病、過敏及其他)、應用(診斷應用和研究應用)、最終用戶(醫院和臨床實驗室、研究機構、生物製藥公司及其他)、零售市場(直接招標及

北美ELISpot與FluoroSpot檢測市場規模

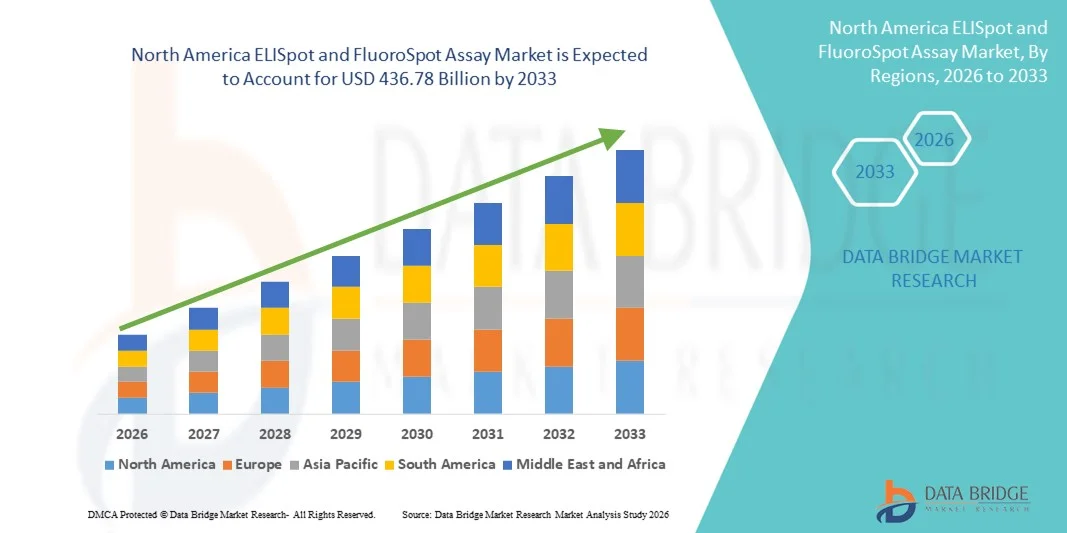

- 2025年北美ELISpot和螢光斑點檢測市場規模為1881.7億美元 ,預計 到2033年將達到4367.8億美元,預測期內 複合年增長率為11.10%。

- 市場成長主要得益於先進免疫學研究技術的日益普及和檢測平台技術的不斷進步,從而提高了學術研究和臨床實驗室的精確度、靈敏度和通量。

- 此外,疫苗研發、傳染病研究、癌症免疫療法和自體免疫疾病研究等領域對準確、可重複且高靈敏度的免疫監測工具的需求不斷增長,使得ELISpot和FluoroSpot檢測成為細胞免疫反應分析的首選解決方案。這些因素共同推動了ELISpot和FluoroSpot檢測解決方案的普及,從而顯著促進了整體市場成長。

北美ELISpot與FluoroSpot檢測市場分析

- ELISpot 和 FluoroSpot 檢測能夠以單細胞層級高度靈敏地檢測細胞激素分泌細胞,由於其高精度、可重複性和同時分析多種免疫標記的能力,已成為免疫學研究、臨床診斷和藥物開發中日益重要的工具。

- 對 ELISpot 和 FluoroSpot 檢測的需求不斷增長,主要受疫苗研發、癌症免疫療法、傳染病研究和自體免疫疾病研究的快速發展以及臨床前和臨床環境中對可靠免疫監測日益增長的需求所驅動。

- 預計到2025年,美國將在ELISpot和FluoroSpot檢測市場佔據主導地位,市佔率約41.3%。這主要得益於聯邦政府對生命科學和免疫學研究的大力投入、眾多領先的生物技術和製藥公司、先進的實驗室和臨床研究基礎設施,以及ELISpot和FluoroSpot檢測在學術機構、醫院和合約研究組織(CRO)的廣泛應用。此外,美國對疫苗研發、癌症免疫療法和傳染病研究的高度重視也進一步鞏固了其市場領導地位。

- 預計在預測期內,加拿大將成為ELISpot和FluoroSpot檢測市場成長最快的地區,複合年增長率預計為9.9 %。這主要得益於生物技術和生命科學領域投資的增加、臨床研究和合約研究組織(CRO)活動的擴展、傳染病和自體免疫疾病盛行率的上升,以及對先進免疫學和診斷研究工具需求的增長。政府的大力支持、學術機構與生物製藥公司之間的合作以及實驗室基礎設施的改善,也進一步加速了加拿大市場的成長。

- 2025年,研究應用領域將佔據主導地位,收入份額達62.1%,這主要得益於免疫學研究領域的廣泛應用。

報告範圍及ELISpot及FluoroSpot檢測市場細分

|

屬性 |

ELISpot 和 FluoroSpot 檢測的關鍵市場洞察 |

|

涵蓋部分 |

|

|

覆蓋國家/地區 |

北美洲

|

|

主要市場參與者 |

|

|

市場機遇 |

|

|

加值資料資訊集 |

除了對市場狀況(如市場價值、成長率、細分、地理覆蓋範圍和主要參與者)的洞察之外,Data Bridge Market Research 精心編制的市場報告還包括深入的專家分析、患者流行病學、產品線分析、定價分析和監管框架。 |

北美ELISpot和FluoroSpot檢測市場趨勢

先進細胞免疫監測技術的應用日益增多

- 全球ELISpot和FluoroSpot檢測市場的一個顯著且加速發展的趨勢是,在傳染病研究、腫瘤學和疫苗開發等領域,先進的細胞免疫反應監測技術正被日益廣泛地採用。這些檢測方法因其在單細胞層級檢測抗原特異性T細胞和B細胞反應的高靈敏度而備受認可。

- 例如,在新冠肺炎疫情期間(2021-2022年),全球研究機構和製藥公司廣泛採用ELISpot和FluoroSpot檢測方法來評估T細胞反應和疫苗效力,從而加速了疫苗研發和免疫反應監測。

- 包括多參數FluoroSpot檢測在內的技術進步,使得同時檢測多種細胞因子成為可能,顯著提高了檢測效率和數據深度。這促進了轉化研究和免疫療法開發中相關技術的應用。

- ELISpot 和 FluoroSpot 檢測方法在疫苗效力測試中的應用日益廣泛,尤其是在 COVID-19、結核病、肝炎和新發病毒感染等傳染病的疫苗效力測試中,這進一步增強了全球學術和臨床研究機構的市場需求。

- 這種向高精度、可重複性和可擴展的免疫監測工具發展的趨勢正在重塑全球免疫學研究實踐,促使檢測試劑生產商擴大其在各地區的生產、分銷網絡和技術支援能力。

- 因此,受全球研究活動增加和免疫療法發展的推動,預計全球ELISpot和FluoroSpot檢測市場在預測期內將以約9.0%–10.5%的複合年增長率成長。

北美ELISpot與FluoroSpot檢測市場動態

司機

免疫學研究的擴展與傳染病和慢性病負擔的加重

- 全球傳染病、癌症和自體免疫疾病的日益流行,是推動ELISpot和FluoroSpot檢測需求成長的主要因素。這些檢測方法廣泛應用於臨床診斷和科研領域,用於研究細胞免疫反應。

- 例如,2021年至2024年間,全球針對新冠肺炎、愛滋病和結核病等傳染病的疫苗研究和臨床試驗顯著增加了北美、歐洲和北美洲對ELISpot和FluoroSpot檢測試劑盒的採購量。

- Government-backed research initiatives and public-private partnerships aimed at strengthening biomedical research and pandemic preparedness are further accelerating assay adoption across academic institutes and biopharmaceutical companies

- The growing number of global clinical trials has directly boosted demand for immune monitoring assays used in safety and efficacy evaluations, especially in oncology and infectious disease vaccine development

- In addition, the expanding presence of global life science companies and contract research organizations (CROs) worldwide is supporting consistent growth in assay consumption across both diagnostic and research applications

Restraint/Challenge

High Assay Costs and Technical Complexity

- One of the key challenges restraining market growth is the relatively high cost of ELISpot and FluoroSpot assay kits, analyzers, and consumables, which can limit adoption among small laboratories and research centers with constrained budgets

- For instance, in many developing countries, limited funding for research and high costs of specialized FluoroSpot analyzers result in continued reliance on conventional ELISA testing, despite the higher sensitivity and data quality offered by ELISpot/FluoroSpot assays

- Variability in assay protocols, sample preparation requirements, and result interpretation can also affect reproducibility, necessitating standardized workflows and skilled technical expertise

- Furthermore, limited awareness and availability of advanced immune monitoring technologies in remote or underdeveloped regions continue to restrict broader market penetration

- Addressing these challenges through cost-effective assay kits, simplified workflows, enhanced training programs, and regional manufacturing expansion will be critical for sustaining long-term growth in the global ELISpot and FluoroSpot Assay market

North America ELISpot and FluoroSpot Assay Market Scope

The market is segmented on the basis of product type, source, disease, application, end user, and distribution channel.

- By Product Type

On the basis of product type, the ELISpot and FluoroSpot Assay market is segmented into assay kits, supplementary/ancillary products, and analyzers. The assay kits segment dominated the market with the largest revenue share of 56.8% in 2025, driven by high repeat consumption in research and clinical settings. Assay kits provide pre-optimized reagents, coated plates, and detection antibodies, ensuring consistent results and high reproducibility. They are extensively used in vaccine development, infectious disease monitoring, and immunotherapy research. Pharmaceutical and biopharma companies prefer assay kits for standardization across multiple labs. The segment benefits from strong demand in emerging markets due to increasing research funding. It also gains from continuous product launches and improved kit sensitivity. Many laboratories prefer kits to reduce assay setup time and operational complexity. Assay kits are widely adopted in both academic and industrial research. The presence of leading global manufacturers further strengthens its dominance. Growth is supported by rising immune profiling and T-cell response studies. The segment is expected to maintain its lead due to ongoing demand for standardized assays.

The analyzers segment is expected to grow fastest, registering a CAGR of 12.9% from 2026 to 2033. Growth is driven by increasing demand for automated spot counting and multiplex analysis. Analyzers improve workflow efficiency and reduce human error in manual counting. They support high-throughput screening needed for large clinical trials and vaccine studies. Advanced imaging systems also enable better data analytics and digital storage. The adoption of FluoroSpot assays, which require sophisticated analyzers, further boosts growth. Rising laboratory automation trends in developed economies accelerate adoption. In addition, growing investments in immuno-oncology research increase demand for precise immune monitoring. Analyzers are increasingly used in centralized labs to support multiple research projects. Their ability to integrate with laboratory information systems (LIMS) enhances operational efficiency. Continuous technological upgrades and AI-based spot recognition contribute to rapid growth.

- By Source

On the basis of source, the market is segmented into human, mouse, monkey, and others. The human source segment dominated with 48.3% revenue share in 2025, supported by extensive clinical usage. Human-based assays are essential for vaccine trials, infectious disease monitoring, and immunotherapy research. Rising prevalence of cancer, autoimmune diseases, and infectious diseases increases demand for human immune response profiling. Pharmaceutical companies prefer human sample assays for better translational relevance in clinical trials. The segment benefits from strong funding for clinical research and increased clinical trial activities. It is further supported by regulatory emphasis on human-relevant data. Human assays are widely used in diagnostic laboratories for immune monitoring. The growth of personalized medicine and immunotherapy strengthens adoption. Moreover, improved access to clinical samples boosts segment growth. The presence of advanced clinical laboratories in developed countries further supports dominance.

The mouse source segment is expected to grow fastest, with a CAGR of 11.7% from 2026 to 2033. Mouse models are widely used in preclinical immunology research and drug discovery. They provide vital data on immune mechanisms before human trials. The growth is supported by rising investments in preclinical studies and animal model research. Academic institutions and CROs rely on mouse assays for early-stage drug evaluation. Increasing focus on translational immunology and vaccine research boosts demand. Mouse assays are used to evaluate novel therapeutics and immune responses. The segment benefits from strong research activity in North America and Europe. Growing adoption of genetically modified mouse models further supports growth.

- By Disease

On the basis of disease, the market is segmented into infectious diseases, cancer, autoimmune diseases, allergy, and others. The infectious diseases segment dominated with 34.9% revenue share in 2025, due to rising global disease burden. ELISpot assays are essential for detecting antigen-specific T-cell responses. They are widely used for TB, HIV, hepatitis, and emerging infectious diseases. Government screening programs and public health initiatives drive adoption. Vaccine development and monitoring also contribute strongly. The segment benefits from increasing research funding for infectious diseases. Rapid outbreak response and pandemic preparedness further strengthen demand. Diagnostic laboratories increasingly use ELISpot for immune monitoring. The segment is supported by growing awareness of immune response analysis. The presence of leading assay manufacturers enhances product availability. Continuous innovation in assay sensitivity improves diagnostic reliability.

The cancer segment is expected to grow fastest, with a CAGR of 13.6% from 2026 to 2033. Growth is driven by rising immunotherapy and personalized cancer treatment. ELISpot and FluoroSpot assays are used to evaluate tumor-specific immune responses. They help monitor patient response to immunotherapy and vaccine-based treatments. Increasing oncology clinical trials and R&D spending supports rapid growth. Biopharma companies use these assays for biomarker discovery and immune profiling. Rising incidence of cancer globally further fuels demand. Growth is also driven by increasing focus on early detection and treatment monitoring.

- By Application

On the basis of application, the market is segmented into diagnostic applications and research applications. The research applications segment dominated with 62.1% revenue share in 2025, driven by extensive use in immunology research. Academic institutions and pharmaceutical companies rely on ELISpot and FluoroSpot assays for vaccine development and immune profiling. The segment benefits from growing research funding globally. It supports preclinical and clinical research in infectious diseases, cancer, and autoimmune disorders. The need for cellular immune response analysis drives strong demand. Research labs prefer standardized assays and kits for consistent results. The segment is supported by collaborations between universities and biotech companies. It also benefits from increasing immunology publications and research output.

The diagnostic applications segment is expected to grow fastest, at a CAGR of 12.4% from 2026 to 2033. Growth is driven by rising use in clinical diagnostics for infectious diseases and immune monitoring. ELISpot assays are increasingly used in diagnostic laboratories for disease screening. Improved validation and regulatory approvals support clinical adoption. The rise of personalized medicine boosts demand for immune monitoring tests. Expansion of clinical laboratories in emerging economies supports growth. Increasing healthcare expenditure and diagnostic infrastructure also contribute.

- By End User

根據最終用戶,市場可細分為醫院和臨床實驗室、研究機構、生物製藥公司和其他機構。由於廣泛的學術研究和雄厚的資金支持,研究機構細分市場在2025年佔據主導地位,收入份額高達41.7%。研究機構是免疫學和疫苗研發的重要中心,推動了對ELISpot和FluoroSpot檢測的需求。他們利用這些檢測方法進行免疫反應分析、疫苗效力研究和轉化研究。政府資助計畫和與生物技術公司的合作為該細分市場提供了支持。研究機構通常進行大規模的臨床前研究,需要大量的檢測試劑盒。不斷增加的論文發表量和對T細胞免疫的科學興趣進一步推動了市場成長。大學的專業免疫學實驗室也為持續的需求做出了貢獻。這些機構傾向於使用標準化試劑盒,以確保結果的可重複性和實驗室間的一致性。批量採購協議也提高了收入份額。長期研究計畫和資助也為該細分市場帶來了益處。免疫學部門的持續擴張也為未來的需求提供了支持。研究機構也率先採用先進的分析儀,從而鞏固了其市場主導地位。

生物製藥公司板塊預計將成為成長最快的領域,2026年至2033年的複合年增長率將達到13.2%,這主要得益於生物製劑和免疫療法投資的不斷增長。生物製藥公司利用ELISpot和FluoroSpot檢測進行藥物發現、生物標記驗證和臨床試驗監測。對腫瘤免疫學和疫苗研發的日益重視推動了市場需求。臨床試驗數量的增加和藥物審批流程的加快也使該板塊受益。生物製藥公司傾向於使用高通量分析儀進行快速篩選並獲得一致的結果。他們通常與合約研究組織(CRO)合作進行大規模免疫原性研究。傳染病和癌症領域在研藥物的不斷湧現也促進了該板塊的快速成長。個人化醫療對可靠的免疫分析的需求推動了相關技術的應用。生物製藥公司優先考慮檢測方法的標準化,以滿足監管要求。檢測技術的持續創新和自動化進一步增強了該板塊的實力。與學術機構合作的增加也進一步加速了成長。

- 透過分銷管道

根據分銷管道,市場可分為直接招標、零售和其他通路。 2025年,直接招標管道佔據市場主導地位,收入份額達52.6%,這主要得益於醫院、研究機構和政府部門的大宗採購。直接招標透過長期合約和具有競爭力的價格提供成本優勢。大型機構傾向於選擇此管道,以確保可靠的供應和穩定的品質。政府資助的研究計畫和公共衛生計畫通常透過招標進行採購。基於招標的採購方式還能確保獲得最新的檢測試劑盒和分析儀。該管道支持大型臨床試驗和全國性的免疫學計畫。主要製造商傾向於選擇招標合同,以獲得可預測的需求和穩定的收入。它降低了分銷成本,並提高了供應鏈效率。醫院和大型實驗室受益於標準化的採購流程。直接招標管道在醫療基礎設施完善的已開發地區佔據主導地位。它也支持大規模的公共衛生篩檢計畫。由於機構需求持續旺盛,預計該細分市場將保持強勁成長動能。

零售銷售領域預計將成為成長最快的領域,2026年至2033年的複合年增長率將達到11.3%,主要驅動力是小型實驗室和合約研究組織(CRO)透過經銷商採購試劑盒的增加。新興經濟體不斷成長的科研基礎設施也支撐了這一成長。線上市場和物流的改進使零售採購更加便捷有效率。零售銷售使小型機構能夠快速獲得先進的檢測試劑盒,無需經歷漫長的採購週期。經銷商提供本地化的支援和培訓,從而提高了試劑盒的普及率。私人研究機構和生物技術新創企業的蓬勃發展也為該領域帶來了益處。零售銷售還支援根據季節性研究需求靈活訂購試劑盒。區域市場檢測試劑盒供應量的增加進一步鞏固了這個管道。零售銷售有助於快速推廣新的檢測技術。即時檢測和分散式研究實驗室需求的成長也推動了該領域的發展。隨著人們對檢測技術的認知度和可及性的提高,該領域預計將持續擴張。

北美ELISpot與FluoroSpot檢測市場區域分析

- 預計到2025年,北美將在ELISpot和FluoroSpot檢測市場佔據主導地位,這得益於生命科學研究領域的強勁投入、先進的實驗室基礎設施以及學術界、臨床和商業研究機構對免疫學檢測的高採用率。

- 該地區受益於完善的生物技術和製藥生態系統、廣泛的臨床試驗活動以及成熟的合約研究組織(CRO)體系。對疫苗研發、癌症免疫療法、自體免疫疾病和傳染病研究的日益重視,持續推動對ELISpot和FluoroSpot檢測的需求。

- 有利的資金框架、檢測靈敏度和多重檢測方面的技術進步,以及先進免疫監測工具的早期應用,進一步增強了區域市場的成長。

美國ELISpot和FluoroSpot檢測市場洞察

2025年,美國ELISpot和FluoroSpot檢測市場將佔據主導地位,收入份額約為41.3%,這主要得益於聯邦政府對生命科學和免疫學研究的大力資助。眾多領先的生物技術和製藥公司以及先進的實驗室和臨床研究基礎設施,顯著鞏固了其市場領先地位。學術機構、醫院和合約研究組織(CRO)對ELISpot和FluoroSpot檢測的廣泛應用,支撐了市場的持續需求。美國對疫苗研發、癌症免疫療法和傳染病研究的高度重視,進一步促進了市場成長。大量的臨床試驗和持續的產品創新加速了檢測方法的應用。研究機構和生物製藥公司之間的策略合作促進了技術發展。高通量和自動化分析儀的早期應用,進一步鞏固了美國市場的領先地位。

加拿大ELISpot和FluoroSpot檢測市場洞察

預計在預測期內,加拿大ELISpot和FluoroSpot檢測市場將成為該市場成長最快的地區,複合年增長率(CAGR)預計為9.9%。成長主要得益於生物技術和生命科學領域投資的增加,以及臨床研究和合約研究組織(CRO)活動的拓展。傳染病和自體免疫疾病的日益流行,推動了對先進免疫學和診斷研究工具的需求。政府資助計畫和國家研究計畫的支持,增強了實驗室的能力。學術機構與生物製藥公司之間的合作,加速了檢測方法的應用。實驗室基礎設施的改善和人們對免疫分析技術的日益了解,進一步促進了市場擴張。加拿大在全球臨床試驗中日益增長的參與度,使其成為北美地區重要的成長貢獻者。

北美ELISpot和FluoroSpot檢測市場份額

ELISpot 和 FluoroSpot 檢測產業主要由一些成熟的公司主導,包括:

- Mabtech(瑞典)

- 蜂窩技術有限公司(美國)

- BD(美國)

- 默克集團(德國)

- 牛津免疫技術公司(英國)

- ImmunoSpot(美國)

- Bio-Rad Laboratories(美國)

- 研發系統(美國)

- Tecan集團(瑞士)

- 安捷倫科技(美國)

- 珀金埃爾默(美國)

- 隆札(瑞士)

- 賽默飛世爾科技(美國)

- 賽多利斯股份公司(德國)

- 貝克頓·迪金森(美國)

- Nexcelom Bioscience(美國)

- ELISpot.com(美國)

- CTL(Cellular Technology Limited)(美國)

- Cytiva(美國)

- AID GmbH(德國)

北美ELISpot與FluoroSpot檢測市場最新動態

- 2023年3月,美敦力推出了一系列符合人體工學的新型拐杖,旨在提高復原和行動輔助過程中的舒適性、穩定性和易用性,滿足使用者對長期輔助設備的需求。

- 2023年6月,醫療器材公司手杖和拐杖(透過新聞稿)宣布推出一款突破性的行動輔助產品,作為全球市場上的新型行動設備,旨在拓寬傳統行動輔助設備的功能,並幫助行動不便的用戶提高獨立性。

- 2023年8月,英國的Cool Crutches & Walking Sticks公司與慈善機構PhysioNet合作,推出了首個助行器回收計劃,旨在翻新和重新分配二手助行器,從而在全球範圍內促進可持續發展和無障礙環境的改善。

- 2024年7月,康德樂公司完成了對一家醫療器材製造商的收購,從而增強了其行動輔助產品組合(包括手杖和拐杖),並鞏固了其在全球治療性行動解決方案市場的地位。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。