北美浓缩咖啡市场,按类型(纯浓缩咖啡、双份浓缩咖啡、芮斯崔朵、卡布奇诺、拿铁、摩卡玛奇朵、美式咖啡等)、咖啡豆(阿拉比卡咖啡、罗布斯塔咖啡、野生咖啡豆、巴西咖啡豆、利比里亚咖啡、Charrieriana 咖啡、Magnistipula 咖啡等)、烘焙程度(浅、中、深、超深、其他)、分销渠道(电子商务、超市 / 大卖场、便利店、专卖店等)、终端用户(酒店和餐厅、办公室、咖啡厅和酒吧、家庭、教育机构、医院机场等)– 行业趋势和预测至 2029 年

市场分析和规模

浓缩咖啡在世界各地的热饮领域占据着重要地位。每天,数百万人在餐馆、办公室自助餐厅、咖啡店和酒店等场所饮用浓缩咖啡。制造商正在努力将浓缩咖啡与摩卡、卡布奇诺、拿铁等其他饮料混合。

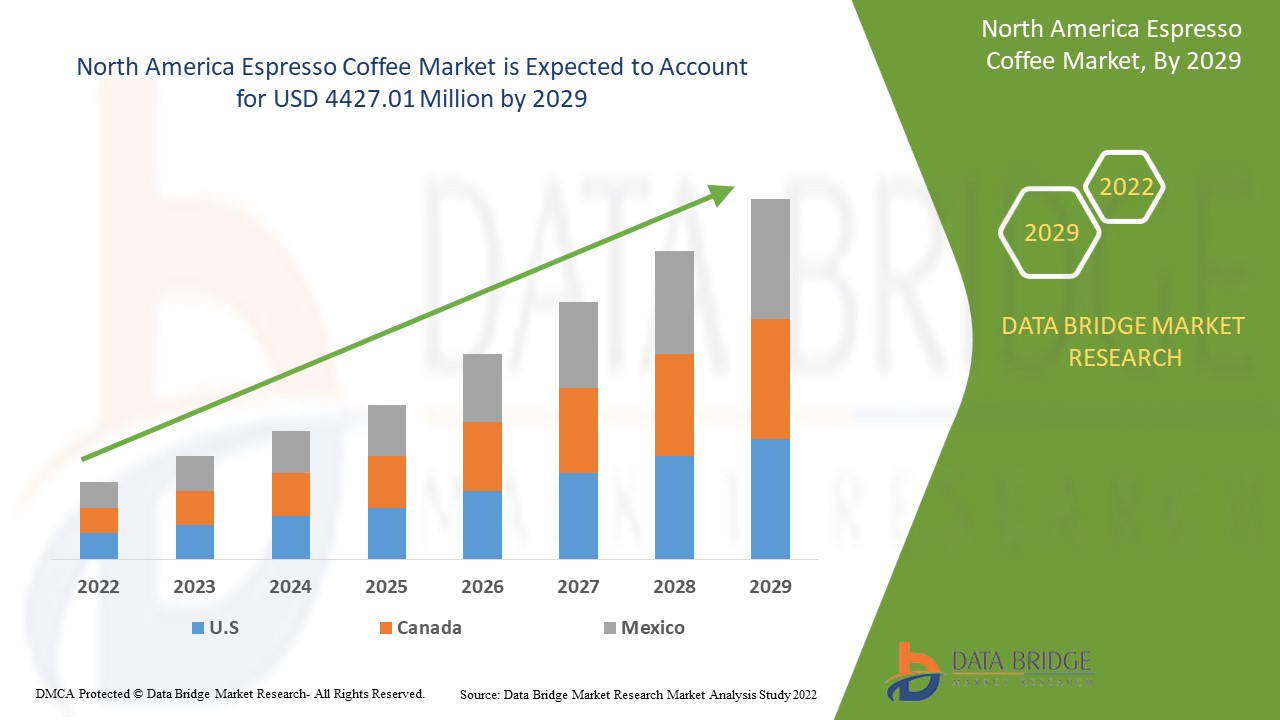

2021 年北美浓缩咖啡市场价值为 31.6182 亿美元,预计到 2029 年将达到 44.2701 亿美元,在 2022-2029 年预测期内的复合年增长率为 3.70%。由于消费者生活方式的变化和对咖啡馆的偏好,咖啡馆和酒吧占据了各自市场中最大的终端使用部分。除了市场价值、增长率、细分市场、地理覆盖范围、市场参与者和市场情景等市场洞察外,Data Bridge 市场研究团队策划的市场报告还包括深入的专家分析、进出口分析、定价分析、生产消费分析、专利分析和消费者行为。

市场定义

浓缩咖啡是一种浓缩形式的咖啡,以小份浓咖啡形式饮用,是多种咖啡饮品的基础。浓缩咖啡由多种类型的咖啡豆制成,例如阿拉比卡咖啡、罗布斯塔咖啡等。阿拉比卡咖啡含有高浓度的咖啡因。但是,由于浓缩咖啡的份量通常比普通咖啡小,因此每份浓缩咖啡的咖啡因含量较低。

报告范围和市场细分

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制至 2019 - 2014) |

|

定量单位 |

收入(百万美元)、销量(单位)、定价(美元) |

|

涵盖的领域 |

类型(纯意式浓缩咖啡、双份意式浓缩咖啡、芮斯崔朵、卡布奇诺、拿铁、摩卡玛奇朵、美式咖啡、其他)、咖啡豆(阿拉比卡咖啡豆、罗布斯塔咖啡豆、野生咖啡豆、巴西咖啡豆、利比里亚咖啡豆、Charrieriana 咖啡豆、Magnistipula 咖啡豆、其他)、烘焙程度(浅、中、深、超深、其他)、分销渠道(电子商务、超市/大卖场、便利店、专卖店、其他)、最终用户(酒店和餐厅、办公室、咖啡馆和酒吧、家庭、教育机构、医院机场、其他) |

|

覆盖国家 |

北美的美国、加拿大、墨西哥 |

|

涵盖的市场参与者 |

星巴克咖啡公司(美国)、雀巢(瑞士)、LUIGI LAVAZZA SPA(意大利)、La Prima 浓缩咖啡公司(美国)、Illycaffè SpA(意大利)、Gloria Jean's Gourmet Coffees、Coffee Beanery、Cafe Coffee Day、麦当劳、Massimo Zanetti Beverage procaffé SpA(意大利)、Caribou Coffee Operating Company, Inc.(美国)、Keurig Dr Pepper Inc.(美国)、ARCO COFFEE COMPANY(美国)、The JM Smucker Company(美国)和卡夫亨氏公司(美国)等 |

|

市场机会 |

|

北美浓缩咖啡市场动态

本节旨在了解市场驱动因素、优势、机遇、限制和挑战。以下内容将详细讨论所有这些内容:

驱动程序

- 茶叶消费

学生和工薪阶层对意式浓缩咖啡的消费量增加是推动珍珠奶茶市场增长的主要因素之一。由于意式浓缩咖啡易于冲泡,因此工作繁忙的人群对意式浓缩咖啡的消费量很高,这有助于市场的增长。

- 浓缩咖啡的兴起

随着制造商将浓缩咖啡与拿铁、卡布奇诺、摩卡等其他饮料混合在一起,浓缩咖啡在整个地区的受欢迎程度不断上升,从而加速了市场的增长。

- 咖啡馆需求增加

发展中国家的酒店、咖啡店、办公室自助餐厅和餐馆对浓缩咖啡的需求增加进一步影响了市场。随着全球人口的增长,浓缩咖啡的消费量也随之增加,这有助于市场的扩张。

此外,生活方式的改变、可支配收入的增加以及对咖啡因益处的认识的提高也对浓缩咖啡市场产生了积极影响。

机会

此外,制造商越来越注重提供先进的咖啡产品,这将在 2022 年至 2029 年的预测期内为市场参与者带来盈利机会。此外,战略营销和推广工作将进一步扩大市场。

限制/挑战

另一方面,过量摄入咖啡因会导致各种心血管问题,预计将阻碍市场增长。此外,预计在 2022-2029 年的预测期内,该产品的高热量水平将对浓缩咖啡市场构成挑战。

本浓缩咖啡市场报告详细介绍了最新发展、贸易法规、进出口分析、生产分析、价值链优化、市场份额、国内和本地市场参与者的影响,分析了新兴收入领域的机会、市场法规的变化、战略市场增长分析、市场规模、类别市场增长、应用领域和主导地位、产品批准、产品发布、地域扩展、市场技术创新。如需了解有关浓缩咖啡市场的更多信息,请联系 Data Bridge Market Research 获取分析师简报,我们的团队将帮助您做出明智的市场决策,实现市场增长。

COVID-19 对北美浓缩咖啡市场的影响

COVID-19 疫情影响了浓缩咖啡市场。有限的投资成本和缺乏员工阻碍了饮料的销售和生产。然而,市场主要参与者采取了新的安全措施来开发产品。在线分销渠道改变了人们的购物习惯,因为它提供了便捷的付款方式、种类繁多的产品、送货上门和大幅折扣等好处,在疫情期间促进了市场的增长,并将在疫情后进一步加速增长。

最新动态

- 2019 年 2 月,雀巢宣布与星巴克合作推出新系列咖啡产品。新系列包括 24 种产品,包括全豆和烘焙研磨咖啡,以及使用 Nespresso 和 Nescafé Dolce Gusto 专有咖啡和系统技术开发的首款星巴克胶囊。所有这些产品均采用 100% 高品质阿拉比卡咖啡制成。借助此产品,该公司将增强其在市场上的供应。

- 2019 年 5 月,Café Coffee Day 宣布推出一系列创新口味的卡布奇诺。这六种口味是异国风味的咖啡,具有豌豆花提取物、喜马拉雅粉红盐、姜黄、生姜和肉桂等创新成分。借助此产品,该公司增强了其在市场上的产品组合。

北美浓缩咖啡市场范围和市场规模

浓缩咖啡市场根据类型、咖啡豆、烘焙、分销渠道和最终用户进行细分。这些细分市场之间的增长情况将帮助您分析行业中增长缓慢的细分市场,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

类型

- 纯正浓缩咖啡

- 双份浓缩咖啡

- 芮斯崔朵

- 卡布奇诺

- 拿铁

- 摩卡玛奇朵

- 美式咖啡

- 其他的

豆子

- 阿拉比卡咖啡

- 咖啡 罗布斯塔 野生咖啡豆 巴西咖啡豆

- 利比里亚咖啡

- 咖啡查里埃里亚纳

- 咖啡大提普拉

- 其他的

烤

- 光

- 中等的

- 黑暗的

- 超暗

- 其他的

分销渠道

- 电子商务

- 超市/大卖场

- 便利店

- 专卖店

- 其他的

终端用户

- 酒店和餐厅

- 辦公室

- 咖啡馆和酒吧

- 家

- 教育机构

- 医院 机场

- 其他的

北美浓缩咖啡市场区域分析/见解

对浓缩咖啡市场进行了分析,并按国家、类型、咖啡豆、烘焙、分销渠道和最终用户提供了市场规模洞察和趋势。

浓缩咖啡市场报告涵盖的国家包括北美的美国、加拿大和墨西哥。

美国在北美浓缩咖啡市场占据主导地位,其次是加拿大和墨西哥。美国浓缩咖啡产品的高消费量是其占据主导地位的主要原因,而加拿大在该地区拥有大量大型公司,推动着该国的增长。由于人们对咖啡的健康益处和美味口感的认识不断提高,墨西哥在市场上占据主导地位。

报告的国家部分还提供了影响单个市场因素和国内市场监管变化,这些因素和变化会影响市场的当前和未来趋势。下游和上游价值链分析、技术趋势和波特五力分析、案例研究等数据点是用于预测单个国家市场情景的一些指标。此外,在提供国家数据的预测分析时,还考虑了全球品牌的存在和可用性以及它们因来自本地和国内品牌的大量或稀缺竞争而面临的挑战、国内关税和贸易路线的影响。

竞争格局和北美浓缩咖啡市场份额分析

浓缩咖啡市场竞争格局按竞争对手提供详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、全球影响力、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度、应用主导地位。以上提供的数据点仅与公司对浓缩咖啡市场的关注有关。

浓缩咖啡市场的一些主要参与者包括

- 星巴克咖啡公司(美国)

- 雀巢(瑞士)

- LUIGI LAVAZZA SPA(意大利)

- La Prima 浓缩咖啡公司(美国)

- Illycaffè SpA(意大利)

- Gloria Jean 的美食咖啡(印度)

- Coffee Beanery(美国)

- 咖啡日(印度)

- 麦当劳 (美国)

- Massimo Zanetti Beverage procaffé SpA(意大利)

- Caribou Coffee Operating Company, Inc.(美国)

- Keurig Dr Pepper Inc.(美国)

- ARCO 咖啡公司(美国)

- JM Smucker 公司(美国)

- 卡夫亨氏公司(美国)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA ESPRESSO COFFEE MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 IMPACT OF COVID-19 PANDEMIC ON THE ESPRESSO COFFEE MARKET

5.1 ANALYSIS ON IMPACT OF COVID-19 ON THE NORTH AMERICA ESPRESSO COFFEE MARKET

5.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE NORTH AMERICA ESPRESSO COFFEE MARKET

5.3 PRICE IMPACT

5.4 IMPACT ON DEMAND

5.5 IMPACT ON SUPPLY CHAIN

5.6 CONCLUSION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 ANTIOXIDANT CONTENTS IN ESPRESSO AIDS IN THE ENHANCEMENT OF HEALTH

6.1.2 INCREASING WORK LOAD AND STRESS AMONG CONSUMERS

6.1.3 INCREASING NUMBER OF LOCAL AND FRANCHISED COFFEE SHOPS

6.1.4 BOOSTS MEMORY CONSOLIDATION

6.1.5 INCREASING GROWTH OF COFFEE-BASED PRODUCTS, FAST FOOD AND RESTAURANT CHAINS

6.2 RESTRAINTS

6.2.1 INCREASING RISK OF CARDIOVASCULAR DISEASE DUE TO CONSUMPTION OF HIGH AMOUNT OF CAFFEINE

6.2.2 HIGHER NUMBER OF ALTERNATIVES AVAILABLE

6.2.3 RISE IN LDL CHOLESTEROL LEVELS DUE TO CAFESTOL AND KAHWEOL

6.3 OPPORTUNITIES

6.3.1 GROWING MANUFACTURERS’ FOCUS TOWARDS DEVELOPMENT OF ADVANCED COFFEE PRODUCTS

6.3.2 ESPRESSO INFUSED WITH FLAVOURS

6.4 CHALLENGES

6.4.1 STRICT FOOD-SAFETY AND HYGIENE GUIDELINES

6.4.2 STIFF COMPLETION IN THE MARKET

6.4.3 IMPACT OF COVID-19 ON FOOD SERVICE INDUSTRY

7 NORTH AMERICA ESPRESSO COFFEE MARKET, BY TYPE

7.1 OVERVIEW

7.2 CAPPUCCINO

7.3 LATTE

7.4 MOCHA

7.5 PURE ESPRESSO

7.6 MACCHIATO

7.6.1 SHORT MACCHIATO

7.6.2 LONG MACCHIATO

7.7 AMERICANO

7.8 DOUBLE ESPRESSO

7.9 RISTRETTO

7.1 OTHERS

8 NORTH AMERICA ESPRESSO COFFEE MARKET, BY END-USER

8.1 OVERVIEW

8.2 CAFES AND RESTAURANTS

8.2.1 CAFES AND RESTAURANTS, BY TYPE

8.2.1.1 CAPPUCCINO

8.2.1.2 LATTE

8.2.1.3 MOCHA

8.2.1.4 PURE ESPRESSO

8.2.1.5 MACCHIATO

8.2.1.6 AMERICANO

8.2.1.7 DOUBLE ESPRESSO

8.2.1.8 RISTRETTO

8.2.1.9 OTHERS

8.3 OFFICES

8.3.1 OFFICES, BY TYPE

8.3.1.1 CAPPUCCINO

8.3.1.2 LATTE

8.3.1.3 MOCHA

8.3.1.4 PURE ESPRESSO

8.3.1.5 MACCHIATO

8.3.1.6 AMERICANO

8.3.1.7 DOUBLE ESPRESSO

8.3.1.8 RISTRETTO

8.3.1.9 OTHERS

8.4 AIRPORTS

8.4.1 AIRPORTS, BY TYPE

8.4.1.1 CAPPUCCINO

8.4.1.2 LATTE

8.4.1.3 MOCHA

8.4.1.4 PURE ESPRESSO

8.4.1.5 MACCHIATO

8.4.1.6 AMERICANO

8.4.1.7 DOUBLE ESPRESSO

8.4.1.8 RISTRETTO

8.4.1.9 OTHERS

8.5 HOMES

8.5.1 HOMES, BY TYPE

8.5.1.1 CAPPUCCINO

8.5.1.2 LATTE

8.5.1.3 MOCHA

8.5.1.4 PURE ESPRESSO

8.5.1.5 MACCHIATO

8.5.1.6 AMERICANO

8.5.1.7 DOUBLE ESPRESSO

8.5.1.8 RISTRETTO

8.5.1.9 OTHERS

8.6 HOTELS AND BARS

8.6.1 HOTELS AND BARS , BY TYPE

8.6.1.1 CAPPUCCINO

8.6.1.2 LATTE

8.6.1.3 MOCHA

8.6.1.4 PURE ESPRESSO

8.6.1.5 MACCHIATO

8.6.1.6 AMERICANO

8.6.1.7 DOUBLE ESPRESSO

8.6.1.8 RISTRETTO

8.6.1.9 OTHERS

8.7 EDUCATIONAL INSTITUTES

8.7.1 EDUCATIONAL INSTITUTES , BY TYPE

8.7.1.1 CAPPUCCINO

8.7.1.2 LATTE

8.7.1.3 MOCHA

8.7.1.4 PURE ESPRESSO

8.7.1.5 MACCHIATO

8.7.1.6 AMERICANO

8.7.1.7 DOUBLE ESPRESSO

8.7.1.8 RISTRETTO

8.7.1.9 OTHERS

8.8 HOSPITALS

8.8.1 HOSPITALS, BY TYPE

8.8.1.1 CAPPUCCINO

8.8.1.2 LATTE

8.8.1.3 MOCHA

8.8.1.4 PURE ESPRESSO

8.8.1.5 MACCHIATO

8.8.1.6 AMERICANO

8.8.1.7 DOUBLE ESPRESSO

8.8.1.8 RISTRETTO

8.8.1.9 OTHERS

8.9 OTHERS

8.9.1 OTHERS, BY TYPE

8.9.1.1 CAPPUCCINO

8.9.1.2 LATTE

8.9.1.3 MOCHA

8.9.1.4 PURE ESPRESSO

8.9.1.5 MACCHIATO

8.9.1.6 AMERICANO

8.9.1.7 DOUBLE ESPRESSO

8.9.1.8 RISTRETTO

8.9.1.9 OTHERS

9 NORTH AMERICA ESPRESSO COFFEE MARKET, BY BEANS

9.1 OVERVIEW

9.2 COFFEE ARABICA

9.3 COFFEE ROBUSTA

9.3.1 KOPI LUWAK

9.3.2 KAPÉNG ALAMID

9.3.3 KAHAWA KUBING

9.4 COFFEE LIBERICA

10 NORTH AMERICA ESPRESSO COFFEE MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 SPECIALTY STORES

10.3 SUPER MARKETS / HYPER MARKETS

10.4 CONVENIENCE STORES

10.5 E-COMMERCE

10.6 OTHERS

11 NORTH AMERICA ESPRESSO COFFEE MARKET, BY ROAST

11.1 OVERVIEW

11.2 MEDIUM ROAST

11.3 DARK ROAST

11.4 LIGHT ROAST

11.5 OTHERS

12 NORTH AMERICA ESPRESSO COFFEE MARKET, BY COUNTRY

12.1 NORTH AMERICA OVERVIEW

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA ESPRESSO COFFEE MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 NESTLÉ

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 MCDONALD'S

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 STARBUCKS COFFEE COMPANY

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 THE J.M. SMUCKER COMPANY

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 BRAND PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 LUIGI LAVAZZA SPA

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 ARCO COFFEE COMPANY

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 CAFE COFFEE DAY

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 CARIBOU COFFEE OPERATING COMPANY, INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 COFFEE BEANERY

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 GLORIA JEAN'S GOURMET COFFEES

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 THE KRAFT HEINZ COMPANY

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 BRAND PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 ILLYCAFFÈ S.P.A.

15.12.1 COMPANY SNAPSHOT

15.12.2 BRAND PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 KEURIG DR PEPPER INC.

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 BRAND PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 LA PRIMA ESPRESSO COMPANY

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 MASSIMO ZANETTI BEVERAGE GROUP

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 BRAND PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 PEET'S COFFEE

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

表格列表

LIST OF TABLES

TABLE 1 IMPORT DATA OF COFFEE, WHETHER OR NOT ROASTED OR DECAFFEINATED; COFFEE HUSKS AND SKINS; COFFEE SUBSTITUTES, HS CODE - 0901 USD (THOUSAND)

TABLE 2 MINERAL CONTENT IN GROUND COFFEE BEANS

TABLE 3 NORTH AMERICA ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION )

TABLE 4 NORTH AMERICA MACCHIATO IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION )

TABLE 5 NORTH AMERICA ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION )

TABLE 6 NORTH AMERICA CAFES AND RESTAURANTS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION )

TABLE 7 NORTH AMERICA OFFICES IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION )

TABLE 8 NORTH AMERICA AIRPORTS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION )

TABLE 9 NORTH AMERICA HOMES IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION )

TABLE 10 NORTH AMERICA HOTELS AND BARS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION )

TABLE 11 NORTH AMERICA EDUCATIONAL INSTITUTES IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION )

TABLE 12 NORTH AMERICA HOSPITALS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION )

TABLE 13 NORTH AMERICA OTHERS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION )

TABLE 14 NORTH AMERICA ESPRESSO COFFEE MARKET, BY BEANS, 2018-2027 (USD MILLION )

TABLE 15 NORTH AMERICA COFFEE ROBUSTA IN ESPRESSO COFFEE MARKET, BY BEANS, 2018-2027 (USD MILLION )

TABLE 16 NORTH AMERICA ESPRESSO COFFEE MARKET, BY DISTRIBUTION CHANNEL, 2018– 2027 (USD MILLION)

TABLE 17 NORTH AMERICA ESPRESSO COFFEE MARKET, BY ROAST, 2018– 2027 (USD MILLION)

TABLE 18 NORTH AMERICA ESPRESSO COFFEE MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 19 NORTH AMERICA ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 20 NORTH AMERICA MACCHIATO IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 21 NORTH AMERICA ESPRESSO COFFEE MARKET, BY BEANS, 2018-2027 (USD MILLION)

TABLE 22 NORTH AMERICA ROBUSTA IN ESPRESSO COFFEE MARKET, BY BEANS, 2018-2027 (USD MILLION)

TABLE 23 NORTH AMERICA ESPRESSO COFFEE MARKET, BY ROAST, 2018-2027 (USD MILLION)

TABLE 24 NORTH AMERICA ESPRESSO COFFEE MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 25 NORTH AMERICA ESPRESSO COFFEE MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 26 NORTH AMERICA CAFES AND RESTAURANTS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 27 NORTH AMERICA OFFICES IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 28 NORTH AMERICA HOTELS AND BARS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 29 NORTH AMERICA HOMES IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 30 NORTH AMERICA EDUCATIONAL INSTITUTES IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 31 NORTH AMERICA HOSPITALS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 32 NORTH AMERICA AIRPORTS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 33 NORTH AMERICA OTHERS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 34 U.S.ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 35 U.S.MACCHIATO IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 36 U.S.ESPRESSO COFFEE MARKET, BY BEANS, 2018-2027 (USD MILLION)

TABLE 37 U.S.ROBUSTA IN ESPRESSO COFFEE MARKET, BY BEANS, 2018-2027 (USD MILLION)

TABLE 38 U.S.ESPRESSO COFFEE MARKET, BY ROAST, 2018-2027 (USD MILLION)

TABLE 39 U.S.ESPRESSO COFFEE MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 40 U.S.ESPRESSO COFFEE MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 41 U.S.CAFES AND RESTAURANTS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 42 U.S.OFFICES IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 43 U.S.HOTELS AND BARS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 44 U.S.HOMES IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 45 U.S.EDUCATIONAL INSTITUTES IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 46 U.S.HOSPITALS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 47 U.S.AIRPORTS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 48 U.S.OTHERS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 49 CANADA ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 50 CANADA MACCHIATO IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 51 CANADA ESPRESSO COFFEE MARKET, BY BEANS, 2018-2027 (USD MILLION)

TABLE 52 CANADA ROBUSTA IN ESPRESSO COFFEE MARKET, BY BEANS, 2018-2027 (USD MILLION)

TABLE 53 CANADA ESPRESSO COFFEE MARKET, BY ROAST, 2018-2027 (USD MILLION)

TABLE 54 CANADA ESPRESSO COFFEE MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 55 CANADA ESPRESSO COFFEE MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 56 CANADA CAFES AND RESTAURANTS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 57 CANADA OFFICES IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 58 CANADA HOTELS AND BARS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 59 CANADA HOMES IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 60 CANADA EDUCATIONAL INSTITUTES IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 61 CANADA HOSPITALS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 62 CANADA AIRPORTS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 63 CANADA OTHERS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 64 MEXICO ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 65 MEXICO MACCHIATO IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 66 MEXICO ESPRESSO COFFEE MARKET, BY BEANS, 2018-2027 (USD MILLION)

TABLE 67 MEXICO ROBUSTA IN ESPRESSO COFFEE MARKET, BY BEANS, 2018-2027 (USD MILLION)

TABLE 68 MEXICO ESPRESSO COFFEE MARKET, BY ROAST, 2018-2027 (USD MILLION)

TABLE 69 MEXICO ESPRESSO COFFEE MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 70 MEXICO ESPRESSO COFFEE MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 71 MEXICO CAFES AND RESTAURANTS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 72 MEXICO OFFICES IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 73 MEXICO HOTELS AND BARS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 74 MEXICO HOMES IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 75 MEXICO EDUCATIONAL INSTITUTES IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 76 MEXICO HOSPITALS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 77 MEXICO AIRPORTS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 78 MEXICO OTHERS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

图片列表

LIST OF FIGURES

FIGURE 1 NORTH AMERICA ESPRESSO COFFEE MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ESPRESSO COFFEE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ESPRESSO COFFEE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ESPRESSO COFFEE MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ESPRESSO COFFEE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ESPRESSO COFFEE MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA ESPRESSO COFFEE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA ESPRESSO COFFEE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA ESPRESSO COFFEE MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA ESPRESSO COFFEE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA ESPRESSO COFFEE MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 NORTH AMERICA ESPRESSO COFFEE MARKET: SEGMENTATION

FIGURE 13 ANTIOXIDANTS CONTENTS IN ESPRESSO AID IN THE ENHANCEMENT OF HEALTH HELPS BOOST THE IMMUNE SYSTEM IS DRIVING THE NORTH AMERICA ESPRESSO COFFEE MARKET IN THE FORECAST PERIOD 2020 TO 2027

FIGURE 14 CAPPUCCINO SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ESPRESSO COFFEE MARKET IN 2020 & 2027

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA ESPRESSO COFFEE MARKET

FIGURE 16 NORTH AMERICA ESPRESSO COFFEE MARKET: BY TYPE, 2019

FIGURE 17 NORTH AMERICA ESPRESSO COFFEE MARKET: BY END-USER, 2019

FIGURE 18 NORTH AMERICA ESPRESSO COFFEE MARKET: BY BEANS, 2019

FIGURE 19 NORTH AMERICA ESPRESSO COFFEE MARKET, BY DISTRIBUTION CHANNEL , 2019

FIGURE 20 NORTH AMERICA ESPRESSO COFFEE MARKET, BY ROAST , 2019

FIGURE 21 NORTH AMERICA ESPRESSO COFFEE MARKET: SNAPSHOT (2019)

FIGURE 22 NORTH AMERICA ESPRESSO COFFEE MARKET: BY COUNTRY (2019)

FIGURE 23 NORTH AMERICA ESPRESSO COFFEE MARKET: BY COUNTRY(2020& 2027)

FIGURE 24 NORTH AMERICA ESPRESSO COFFEE MARKET: BY COUNTRY (2019& 2027)

FIGURE 25 NORTH AMERICA ESPRESSO COFFEE MARKET: BY TYPE(2020-2027)

FIGURE 26 NORTH AMERICA ESPRESSO COFFEE MARKET: COMPANY SHARE 2019 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。