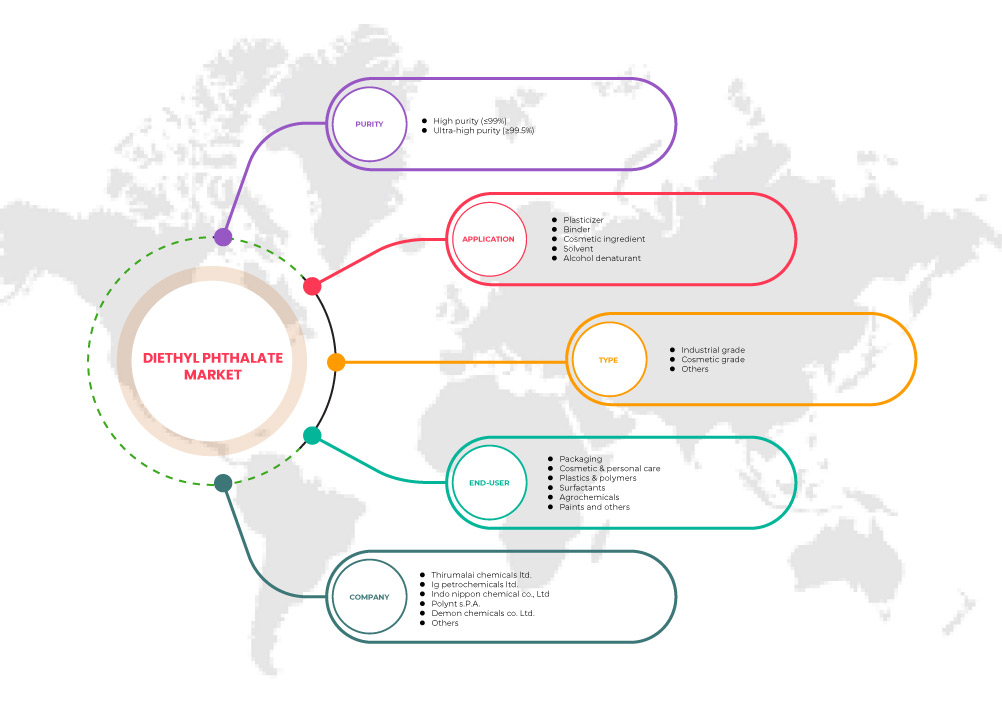

北美邻苯二甲酸二乙酯市场,按纯度(高纯度(≤99%)和超高纯度(≥99.5%))、类型(工业级、化妆品级和其他)、应用(增塑剂、粘合剂、化妆品成分、溶剂和酒精变性剂)、最终用户(包装、化妆品和个人护理、塑料和聚合物、表面活性剂、农用化学品、涂料和其他)划分 - 行业趋势和预测到 2030 年。

北美邻苯二甲酸二乙酯市场分析及规模

预计邻苯二甲酸二乙酯市场将在 2023 年至 2030 年的预测期内实现显着增长。Data Bridge Market Research 分析,在 2023 年至 2030 年的预测期内,该市场将以 3.8% 的复合年增长率增长,预计到 2030 年将达到 126,547.12 万美元。推动邻苯二甲酸二乙酯市场增长的主要因素是化妆品行业对化妆品和个人护理产品的消费量增加以及塑料行业对邻苯二甲酸二乙酯的需求增加。

邻苯二甲酸二乙酯市场报告提供了市场份额、新发展和国内和本地市场参与者影响的详细信息,分析了新兴收入来源、市场法规变化、产品审批、战略决策、产品发布、地域扩张和市场技术创新方面的机会。要了解分析和市场情况,请联系我们获取分析师简报。我们的团队将帮助您创建收入影响解决方案,以实现您的预期目标。

|

报告指标 |

细节 |

|

预测期 |

2023 至 2030 年 |

|

基准年 |

2022 |

|

历史岁月 |

2021 (可定制为 2019-2014) |

|

定量单位 |

收入(千美元) |

|

涵盖的领域 |

按纯度(高纯度(≤99%)和超高纯度(≥99.5%))、类型(工业级、化妆品级等)、应用(增塑剂、粘合剂、化妆品成分、溶剂和酒精变性剂)、最终用户(包装、化妆品和个人护理、塑料和聚合物、表面活性剂、农用化学品、涂料等) |

|

覆盖国家 |

美国、加拿大、墨西哥 |

|

涵盖的市场参与者 |

Thirumalai Chemicals Ltd、IG Petrochemicals Ltd.、TCI Chemicals (India) Pvt. Ltd.、Indo Nippon Chemical Co., Ltd.、Agro Extracts Limited.、Maharashtra Aldehydes & Chemicals Ltd.、MaaS Pharma Chemicals、Nishant Organics Pvt. Ltd.、Spectrum Chemical、LobaChemie Pvt. Ltd.、Polynt SpA、KLJ Group、Demon Chemicals Co., Ltd、PCIPL、West India Chemical International 等。 |

市场定义

邻苯二甲酸二乙酯是一种属于邻苯二甲酸酯家族的化合物,是邻苯二甲酸的二乙酯。邻苯二甲酸二乙酯是一种无色透明液体,密度略大于水。邻苯二甲酸二乙酯不易燃。在工业上,邻苯二甲酸二乙酯也称为溶剂醇。邻苯二甲酸二乙酯通常通过 Ald-Ox 或 Oxo 工艺合成。邻苯二甲酸二乙酯也可以通过在浓硫酸作为催化剂的情况下使邻苯二甲酸酐与乙醇反应来合成。邻苯二甲酸二乙酯的纯度通常在 98% 至 99.5% 之间。

邻苯二甲酸二乙酯市场动态

驱动程序

- 化妆品和个人护理产品消费量增加

由于人们越来越重视皮肤健康和个人卫生,化妆品和个人护理产品的消费量显着增加。年轻一代知道皮肤护理的重要性,并开始大规模使用此类化妆品和个人产品,如指甲油、发胶、须后水、清洁剂和洗发水。抗衰老和防晒产品拥有庞大的用户群,因为消费者开始意识到外表和有害的阳光。此外,经济的增长和生活方式的发展导致个人美容支出增加,尤其是女性。这些化妆品和个人护理产品的发展多年来一直在扩大,未来也是如此。此外,个人产品的技术进步将在未来几年推动北美邻苯二甲酸二乙酯市场的发展。

- 塑料和聚合物行业对邻苯二甲酸二乙酯的需求不断增长

邻苯二甲酸二乙酯用于聚合物和塑料行业,使最终产品更加柔韧。工业化进程加快、收入增加、生活方式改变以及聚合物基产品在日常生活中的应用增多,这些都导致了聚合物行业的蓬勃发展。聚合物用于医疗保健、农业、服装、住房、家具、电子和建筑。增塑剂或软化剂是一种加入材料(通常是塑料或弹性体)以增加其柔韧性、可加工性或可延展性的物质或材料。增塑剂可以降低熔体粘度、降低二级转变温度或降低熔体的弹性模量。

- 邻苯二甲酸二乙酯在现代农业技术中的应用

邻苯二甲酸二乙酯用于农用化学品,以防止昆虫和害虫侵害农作物。由于昆虫对农作物的攻击越来越多,杀虫剂的需求也在增加。诸如邻苯二甲酸二乙酯之类的惰性成分用于杀虫剂,用于动物食品生产。这反过来又有望推动邻苯二甲酸二乙酯在杀虫剂和农药中的使用,这通常会增加农民收入。

此外,这些邻苯二甲酸酯不仅会从包装中渗入肥料和农药中,还会被用作许多农药的溶剂。在现代农业中,PVC 管被广泛用于农业。为了制造这种 PVC 管,邻苯二甲酸二乙酯被用作增塑剂。

机会

- 邻苯二甲酸二乙酯在汽车工业增塑剂生产中的应用日益增多

当今世界,减轻重量和减少燃料消耗的需求十分巨大。因此,邻苯二甲酸二乙酯是汽车塑料的主要材料之一。一辆普通汽车的三分之一由塑料制成,包括仪表板、发动机盖、座椅、内墙板、化油器、把手、电缆绝缘层、卡车车厢衬垫等。聚丙烯、聚氯乙烯、聚苯乙烯、聚碳酸酯和聚乙烯是汽车制造中使用的一些塑料。邻苯二甲酸二乙酯是制造这些塑料和聚合物的广泛使用的增塑剂之一。它们使塑料更加柔韧。此外,DEP 是一种可生物降解的材料,也用于制造汽车零部件和用于医疗和诊断的管道。

- 包装行业的扩张

在包装行业中,气泡膜和塑料薄膜是少数几种使用的包装材料。为了制造此类材料,大量使用增塑剂,例如邻苯二甲酸二乙酯。邻苯二甲酸二乙酯用作纤维素酯塑料薄膜和片材的增塑剂,例如摄影、泡罩包装和胶带应用以及模塑和挤压制品。因此,随着包装行业的扩张,未来几年邻苯二甲酸二乙酯的需求将上升,预计这将为北美邻苯二甲酸二乙酯市场的增长提供有利可图的机会。

限制/挑战

- 市场上邻苯二甲酸二乙酯替代品的供应情况

邻苯二甲酸二乙酯已广泛用于化妆品、消费品、塑料和聚合物以及包装行业。然而,由于法规、环境和健康问题,邻苯二甲酸二乙酯的各种替代品的供应量和使用量有所增加。环氧大豆油 (ESBO) 与邻苯二甲酸二乙酯一起用作增塑剂和相容剂。ESBO 还被用作玻璃罐密封中的增塑剂,也可用作稳定剂以减少聚氯乙烯的紫外线降解。同样,偏苯三酸酯也被用作邻苯二甲酸二乙酯的替代品,用于墙面覆盖物、包装和地板。在化妆品中,乙酰柠檬酸三丁酯用作化妆品和 PVC 应用中的增塑剂。

- 过量长期使用邻苯二甲酸二乙酯的危害

饮食是消费者摄入邻苯二甲酸二乙酯的主要途径之一。食品包装材料(如食品制备过程中使用的手套)以及乙烯基塑料工具和材料可能会将这些化学物质泄漏到食品中。邻苯二甲酸二乙酯释放到水源中会影响海洋生物。因此,鱼类和其他海洋生物中存在的这种有害毒素会在食用这些海鲜时直接危害人类健康。使用个人护理产品、乙烯基地板和墙壁覆盖物往往会释放大量的邻苯二甲酸二乙酯。每天接触这种化学物质不仅会对成人造成有害健康影响,还会对处于早期成长阶段的儿童造成有害健康影响。

最新动态

- 2月,Spectrum Chemical Mfg. Corporation连续第二年荣获GE应用市场杰出合作伙伴奖。该奖项将有助于该公司获得更大范围的认可。

- 12 月,PCIPL 再次获得 ISO 认证。公司以流程为导向的做法在大多数分销公司中并不常见,这为我们带来了优势,不仅对我们业务有帮助,还获得了 TUV SUD 等知名专业机构的认可。

邻苯二甲酸二乙酯市场范围

邻苯二甲酸二乙酯市场根据纯度类型、类型、应用和最终用户进行分类。这些细分市场之间的增长将帮助您分析行业中的主要增长细分市场,并为用户提供有价值的市场概览和市场洞察,以便做出战略决策,确定核心市场应用。

纯度类型

- 高纯度(≤99%)

- 超高纯度(≥99.5%)

根据纯度,邻苯二甲酸二乙酯市场分为高纯度(≤99%)和超高纯度(≥99.5%)。

按类型

- 工业级

- 化妆品级

- 其他的

根据类型,邻苯二甲酸二乙酯市场分为工业级、化妆品级和其他级。

应用

- 增塑剂

- 活页夹

- 化妆品成分

- 溶剂

- 酒精变性剂

根据应用,邻苯二甲酸二乙酯市场分为增塑剂、粘合剂、化妆品成分、溶剂和酒精变性剂。

最终用户

- 包装

- 化妆品和个人护理

- 塑料和聚合物

- 表面活性剂

- 农用化学品

- 油漆

- 其他的

根据最终用户,邻苯二甲酸二乙酯市场分为包装、化妆品和个人护理、塑料和聚合物、表面活性剂、农用化学品、涂料和其他。

邻苯二甲酸二乙酯市场区域分析/见解

邻苯二甲酸二乙酯市场根据纯度类型、类型、应用和最终用户进行细分。

邻苯二甲酸二乙酯市场的国家包括美国、加拿大和墨西哥。

由于汽车工业生产塑料时对邻苯二甲酸二乙酯作为增塑剂的需求不断增长,预计美国将主导邻苯二甲酸二乙酯市场。

报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和市场监管变化。数据点下游和上游价值链分析、技术趋势、波特五力分析和案例研究是用于预测各个国家市场情景的一些指标。此外,在提供国家数据的预测分析时,还考虑了北美品牌的存在和可用性以及由于来自本地和国内品牌的大量或稀缺竞争而面临的挑战、国内关税的影响和贸易路线。

竞争格局和邻苯二甲酸二乙酯市场份额分析

邻苯二甲酸二乙酯市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、生产基地和设施、公司优势和劣势、产品发布、产品试验渠道、产品批准、专利、产品宽度和广度、应用优势、技术生命线曲线。以上提供的数据点仅与公司对邻苯二甲酸二乙酯市场的关注有关。

该市场的一些主要市场参与者包括 Thirumalai Chemicals Ltd、IG Petrochemicals Ltd.、TCI Chemicals (India) Pvt. Ltd.、Indo Nippon Chemical Co., Ltd.、Agro Extracts Limited.、Maharashtra Aldehydes & Chemicals Ltd.、MaaS Pharma Chemicals、Nishant Organics Pvt. Ltd.、Spectrum Chemical、LobaChemie Pvt. Ltd.、Polynt SpA、KLJ Group、Demon Chemicals Co., Ltd、PCIPL、West India Chemical International 等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA DIETHYL PHTHALATE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PURITY LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING CONSUMPTION OF COSMETICS AND PERSONAL CARE PRODUCTS

5.1.2 RISING DEMAND FOR DIETHYL PHTHALATE FROM THE PLASTIC & POLYMER INDUSTRY

5.1.3 ADOPTION OF DIETHYL PHTHALATES IN MODERN AGRICULTURAL TECHNIQUES

5.2 RESTRAINTS

5.2.1 HAZARDS ASSOCIATED WITH EXCESSIVE AND LONG-TERM USE OF DIETHYL PHTHALATE

5.2.2 STRICT REGULATIONS REGARDING THE TOXICITY OF DIETHYL PHTHALATE

5.3 OPPORTUNITIES

5.3.1 INCREASING USE OF DIETHYL PHTHALATE TO PRODUCE PLASTICIZERS FOR THE AUTOMOTIVE INDUSTRY

5.3.2 EXPANSION OF THE PACKAGING INDUSTRY

5.4 CHALLENGE

5.4.1 AVAILABILITY OF ALTERNATIVES TO DIETHYL PHTHALATES IN THE MARKET

6 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY PURITY

6.1 OVERVIEW

6.2 HIGH PURITY (≤99%)

6.3 ULTRA HIGH PURITY (≥99.5%)

7 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY TYPE

7.1 OVERVIEW

7.2 INDUSTRIAL GRADE

7.3 COSMETIC GRADE

7.4 OTHERS

8 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 PLASTICIZER

8.3 BINDER

8.4 COSMETIC INGREDIENT

8.5 SOLVENT

8.6 ALCOHOL DENATURANT

9 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY END-USER

9.1 OVERVIEW

9.2 PACKAGING

9.3 COSMETIC & PERSONAL CARE

9.3.1 COSMETIC & PERSONAL CARE, BY TPE

9.3.1.1 BATH PRODUCTS

9.3.1.2 PERFUMES

9.3.1.3 HAIR CARE

9.3.1.4 NAIL ENAMEL & REMOVERS

9.3.1.5 SKIN CARE PRODUCTS

9.3.1.6 PERSONAL HYGIENE

9.3.1.7 OTHERS

9.4 PLASTICS & POLYMERS

9.5 SURFACTANTS

9.6 AGROCHEMICALS

9.7 PAINTS

9.8 OTHERS

10 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY REGION

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA DIETHYL PHTHALATE MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.2 AWARDS

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 THIRUMALAI CHEMICALS LTD.

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT UPDATES

13.2 I G PETROCHEMICALS LTD.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT UPDATES

13.3 INDO NIPPON CHEMICAL CO., LTD.

13.3.1 COMPANY SNAPSHOT

13.3.2 COMPANY SHARE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT UPDATES

13.4 POLYNT S.P.A.

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT UPDATES

13.5 DEMON CHEMICALS CO. LTD.

13.5.1 COMPANY SNAPSHOT

13.5.2 COMPANY SHARE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT UPDATES

13.6 AGRO EXTRACTS LIMITED.

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT UPDATES

13.7 KLJ GROUP

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT UPDATES

13.8 LOBACHEMIE PVT. LTD.

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT UPDATES

13.9 MAHARASHTRA ALDEHYDES & CHEMICALS LTD.

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT UPDATES

13.1 MAAS PHARMA CHEMICALS

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT UPDATES

13.11 NISHANT ORGANICS PVT. LTD.

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT UPDATES

13.12 PCIPL

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT UPDATES

13.13 SPECTRUM CHEMICAL

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT UPDATE

13.14 TCI CHEMICALS (INDIA) PVT. LTD.

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT UPDATES

13.15 WEST INDIA CHEMICAL INTERNATIONAL

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT UPDATES

14 QUESTIONNAIRE

15 RELATED REPORTS

表格列表

TABLE 1 IMPORT DATA OF ACYCLIC POLYCARBOXYLIC ACIDS, THEIR ANHYDRIDES, HALIDES, PEROXIDES, PEROXYACIDS AND THEIR HALOGENATED; HS CODE – 291719 (USD THOUSAND)

TABLE 2 EXPORT DATA OF ACYCLIC POLYCARBOXYLIC ACIDS, THEIR ANHYDRIDES, HALIDES, PEROXIDES, PEROXYACIDS AND THEIR HALOGENATED; HS CODE – 291719 (USD THOUSAND)

TABLE 3 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 5 NORTH AMERICA HIGH PURITY (≤99%) IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA HIGH PURITY (≤99%) IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (TONS)

TABLE 7 NORTH AMERICA ULTRA HIGH PURITY (≥99.5%) IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA HIGH PURITY (≤99%) IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (TONS)

TABLE 9 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA INDUSTRIAL GRADE IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA COSMETIC GRADEIN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA OTHERS IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA PLASTICIZER IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA BINDER IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA COSMETIC INGREDIENT IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA SOLVENT IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA ALCOHOL DENATURANT IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA PACKAGING IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA PLASTICS & POLYMERS INGREDIENT IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA SURFACTANTS IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA AGROCHEMICALS IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA PAINTS IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA OTHERS IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 30 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 32 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 35 NORTH AMERICA COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 U.S. DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 37 U.S. DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 38 U.S. DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 U.S. DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 40 U.S. DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 41 U.S. COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 42 CANADA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 43 CANADA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 44 CANADA DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 CANADA DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 46 CANADA DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 47 CANADA COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 MEXICO DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 49 MEXICO DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 50 MEXICO DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 MEXICO DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 52 MEXICO DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 53 MEXICO COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

图片列表

FIGURE 1 NORTH AMERICA DIETHYL PHTHALATE MARKET

FIGURE 2 NORTH AMERICA DIETHYL PHTHALATE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA DIETHYL PHTHALATE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA DIETHYL PHTHALATE MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA DIETHYL PHTHALATE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA DIETHYL PHTHALATE MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA DIETHYL PHTHALATE MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA DIETHYL PHTHALATEMARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA DIETHYL PHTHALATE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA DIETHYL PHTHALATE MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 NORTH AMERICA DIETHYL PHTHALATE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA DIETHYL PHTHALATEMARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA DIETHYL PHTHALATE MARKET: SEGMENTATION

FIGURE 14 INCREASING CONSUMPTION OF COSMETICS AND PERSONAL CARE PRODUCTS IS EXPECTED TO DRIVE THE NORTH AMERICA DIETHYL PHTHALATE MARKET IN THE FORECAST PERIOD

FIGURE 15 HIGH PURITY (≤99%) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA DIETHYL PHTHALATE MARKET IN 2022 & 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA DIETHYL PHTHALATE MARKET

FIGURE 17 NORTH AMERICA DIETHYL PHTHALATE MARKET: BY PURITY, 2022

FIGURE 18 NORTH AMERICA DIETHYL PHTHALATE MARKET: BY TYPE, 2022

FIGURE 19 NORTH AMERICA DIETHYL PHTHALATE MARKET: BY APPLICATION, 2022

FIGURE 20 NORTH AMERICA DIETHYL PHTHALATE MARKET: BY END-USER, 2022

FIGURE 21 NORTH AMERICA DIETHYL PHTHALATE MARKET: SNAPSHOT (2022)

FIGURE 22 NORTH AMERICA DIETHYL PHTHALATE MARKET: BY COUNTRY (2022)

FIGURE 23 NORTH AMERICA DIETHYL PHTHALATE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 24 NORTH AMERICA DIETHYL PHTHALATE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 25 NORTH AMERICA DIETHYL PHTHALATE MARKET: BY PURITY (2023-2030)

FIGURE 26 NORTH AMERICA DIETHYL PHTHALATE MARKET: COMPANY SHARE 2022 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。